First Quarter 2013 Earnings Presentation May 15, 2013 0

I. Introduction Chris Bradshaw, EVP and CFO II. Brief Company Overview Sten Gustafson, Chief Executive Officer III. Q1 Operational Highlights Sten Gustafson, Chief Executive Officer IV. Financial Review Chris Bradshaw, EVP and CFO V. Closing Remarks Sten Gustafson, Chief Executive Officer VI. Questions & Answers First Quarter 2013 Earnings Call Agenda 1

2 This presentation contains “forward-looking statements.” Forward-looking statements give Era Group’s current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements reflect management’s current views with respect to future events and are subject to risks and uncertainties, both known and unknown. Era Group’s actual results may vary materially from those anticipated in forward-looking statements. Era Group cautions investors not to place undue reliance on any forward-looking statements. Such risks, uncertainties and other important factors include, among others, the effect of the spin-off from SEACOR, including the ability of Era Group to recognize the expected benefits from the spin-off and Era Group's dependence on SEACOR's performance under various agreements; decreased demand and loss of revenues resulting from developments that may adversely impact the offshore oil and gas industry, including the issuance of new safety and environmental guidelines and regulations that could increase the costs of exploration and production, reduce the area of operation and result in permitting delays, U.S. government implemented moratoriums directing operators to cease certain drilling activities and any extension of such moratoriums that may result in unplanned customer suspensions, cancellations, rate reductions or non-renewals of aviation equipment contracts or failures to finalize commitments to contract aviation equipment; safety issues experienced by a particular helicopter model that could result in customers refusing to use that helicopter model or a regulatory body grounding that helicopter model, which could also permanently devalue that helicopter model; the cyclical nature of the oil and gas industry; increased U.S. and foreign government legislation and regulation, including environmental and aviation laws and regulations, and Era Group's compliance therewith and the costs thereof; dependence on the activity in the U.S. Gulf of Mexico and Alaska and Era Group's ability to expand into other markets; liability, legal fees and costs in connection with providing emergency response services, including involvement in response to the oil spill that resulted from the sinking of the Deepwater Horizon in April 2010; decreased demand for Era Group's services as a result of declines in the global economy; declines in valuations in the global financial markets and a lack of liquidity in the credit sectors, including, interest rate fluctuations, availability of credit, inflation rates, change in laws, trade barriers, commodity prices and currency exchange fluctuations; activity in foreign countries and changes in foreign political, military and economic conditions; the failure to maintain an acceptable safety record; the dependence on small number of customers; consolidation of the Company's customer base; industry fleet capacity; restrictions imposed by the U.S. federal aviation laws and regulations on the amount of foreign ownership of the Company's common stock; operational risks; risks associated with our debt structure; effects of adverse weather conditions and seasonality; adequacy of insurance coverage; the attraction and retention of qualified personnel; and various other matters and factors included in Era Group's annual report on Form 10-K for the year ended December 31, 2012 and other SEC filings. These factors are not exhaustive, and new factors may emerge or changes to the foregoing factors may occur that could impact Era Group’s business. Except to the extent required by law, Era Group undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Cautionary Statement Regarding Forward Looking Statements

3 This presentation includes EBITDA, Adjusted EBITDA and Adjusted EBITDAR as supplemental measures of Era Group’s operating performance. EBITDA is defined as Earnings before Interest (includes interest income, interest expense and interest expense on advances from SEACOR), Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for SEACOR Management Fees and certain other items that occurred during the reporting period. Adjusted EBITDAR is defined as Adjusted EBITDA further adjusted for rent expense (included as a components of operating expense and general and administrative expense). Neither EBITDA, Adjusted EBITDA nor Adjusted EBITDAR is a recognized term under generally accepted accounting principles in the U.S. (“GAAP”). Accordingly, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA, Adjusted EBITDA and Adjusted EBITDAR are not intended to be a measure of free cash flow available for discretionary use, as they do not consider certain cash requirements, such as debt service requirements. EBITDA, Adjusted EBITDA and Adjusted EBITDAR have limitations as analytical tools, and you should not consider them in isolation, nor as a substitute for analysis of our results as reported under GAAP. Because the definitions of EBITDA, Adjusted EBITDA and Adjusted EBITDAR (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. A reconciliation of EBITDA, Adjusted EBITDA and Adjusted EBITDAR is included in this presentation. Non‐GAAP Financial Measures Reconciliation

Brief Company Overview 4

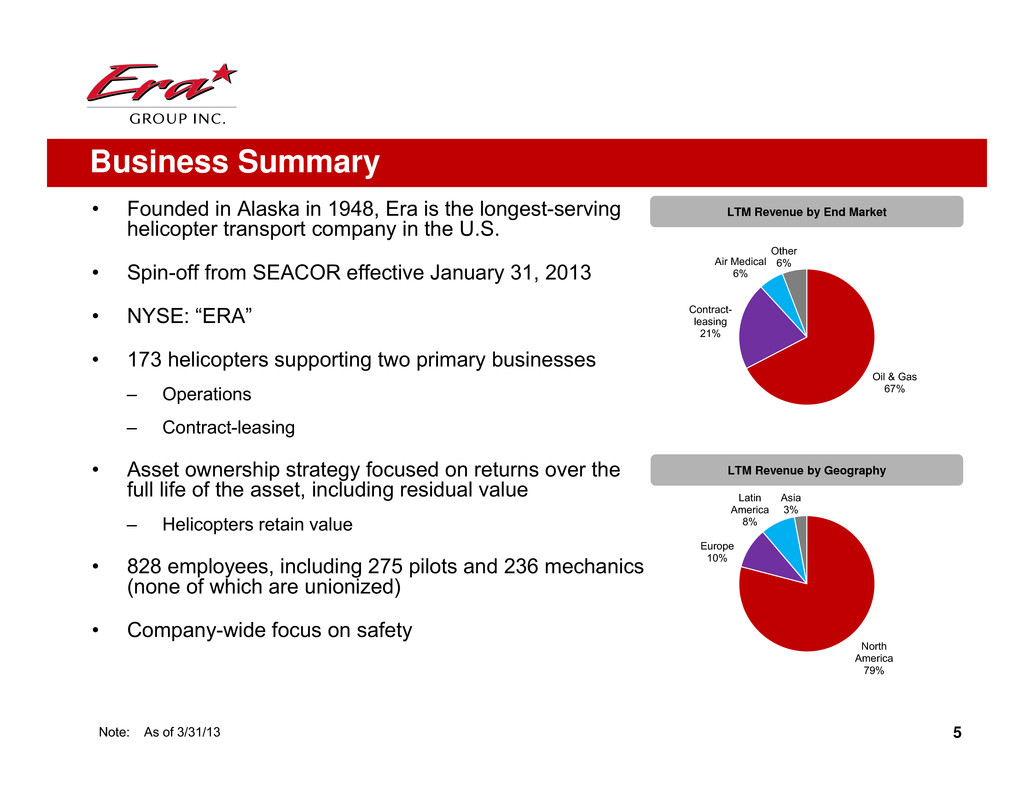

• Founded in Alaska in 1948, Era is the longest-serving helicopter transport company in the U.S. • Spin-off from SEACOR effective January 31, 2013 • NYSE: “ERA” • 173 helicopters supporting two primary businesses – Operations – Contract-leasing • Asset ownership strategy focused on returns over the full life of the asset, including residual value – Helicopters retain value • 828 employees, including 275 pilots and 236 mechanics (none of which are unionized) • Company-wide focus on safety Business Summary LTM Revenue by Geography LTM Revenue by End Market 5Note: As of 3/31/13 Oil & Gas 67% Contract- leasing 21% Air Medical 6% Other 6% North America 79% Europe 10% Latin America 8% Asia 3%

Oil & Gas 67% of Revenue(b) Contract- Leasing 21% of Revenue(b) Air Medical Services 6% of Revenue(b) Other 6% of Revenue(b) End Market Era Services • Independent, major integrated and national oil & gas companies – primarily serving drilling rigs and platforms • Approximately 800 offshore drilling rigs worldwide(a) • Over 6,000 offshore production installations worldwide, with Gulf of Mexico as the largest market • Deepwater operations – medium/heavy helicopters • Shallow operations – light helicopters • Offshore transport • Operations in key deepwater regions: the U.S. Gulf of Mexico and Brazil • Longest serving helicopter service in Alaska • 56% of revenue in U.S. Gulf of Mexico and 11% in Alaska(b) • Includes search and rescue (SAR) services • Offer flexible lease terms and services for training, maintenance, crew and technical support • Outfitted to fulfill variety of missions • Wholesale pricing • Lessees often require other services from Era (training, PBH, technical support) • Creates multiple uses for helicopters and helps maintain higher utilization • Potential support for corporate development • New markets for older aircraft • Provides access to international markets where Era has none of its own infrastructure • Era offers full emergency medical services (EMS) • Multi-discipline aircrews trained and certified • Helicopter services for medical emergency transport • Mainly services hospitals • Dart Holding Company (JV) • FBO at Ted Stevens Anchorage Int’l Airport • Tours from Denali and Juneau • Era Training Center (JV) • Firefighting • Aircraft fueling, hangaring, tie-down and parking • Alaska helicopter tours • Pilot/operator training (a) IHS Petrodata (b) LTM revenue as of 3/31/13 6

Areas of Operation Australia Continental United States Sweden Aircraft in Region (# of aircraft) Spain Canada India Mexico 2 UK 3 Norway Brazil Training Center Joint Venture 20 2 1 102 3 Joint Ventures 2 Indonesia Australia 12 1 24 Alaska 7 1 Uruguay

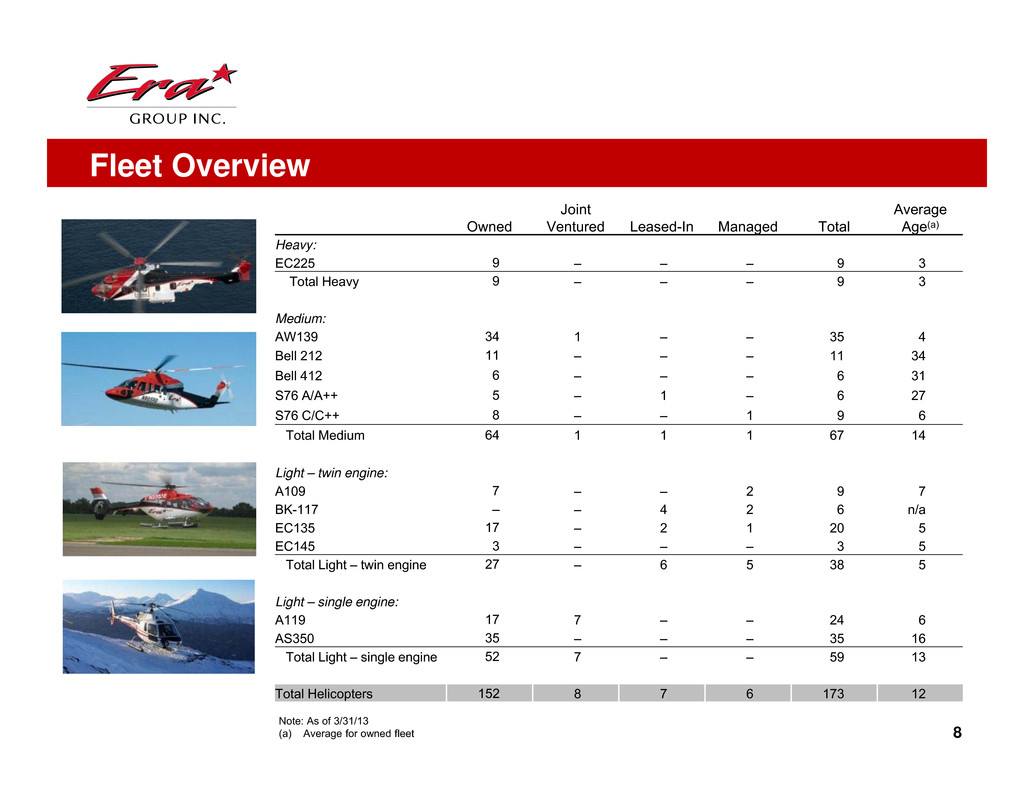

Owned Joint Ventured Leased-In Managed Total Average Age(a) Heavy: EC225 9 – – – 9 3 Total Heavy 9 – – – 9 3 Medium: AW139 34 1 – – 35 4 Bell 212 11 – – – 11 34 Bell 412 6 – – – 6 31 S76 A/A++ 5 – 1 – 6 27 S76 C/C++ 8 – – 1 9 6 Total Medium 64 1 1 1 67 14 Light – twin engine: A109 7 – – 2 9 7 BK-117 – – 4 2 6 n/a EC135 17 – 2 1 20 5 EC145 3 – – – 3 5 Total Light – twin engine 27 – 6 5 38 5 Light – single engine: A119 17 7 – – 24 6 AS350 35 – – – 35 16 Total Light – single engine 52 7 – – 59 13 Total Helicopters 152 8 7 6 173 12 Note: As of 3/31/13 (a) Average for owned fleet Fleet Overview 8

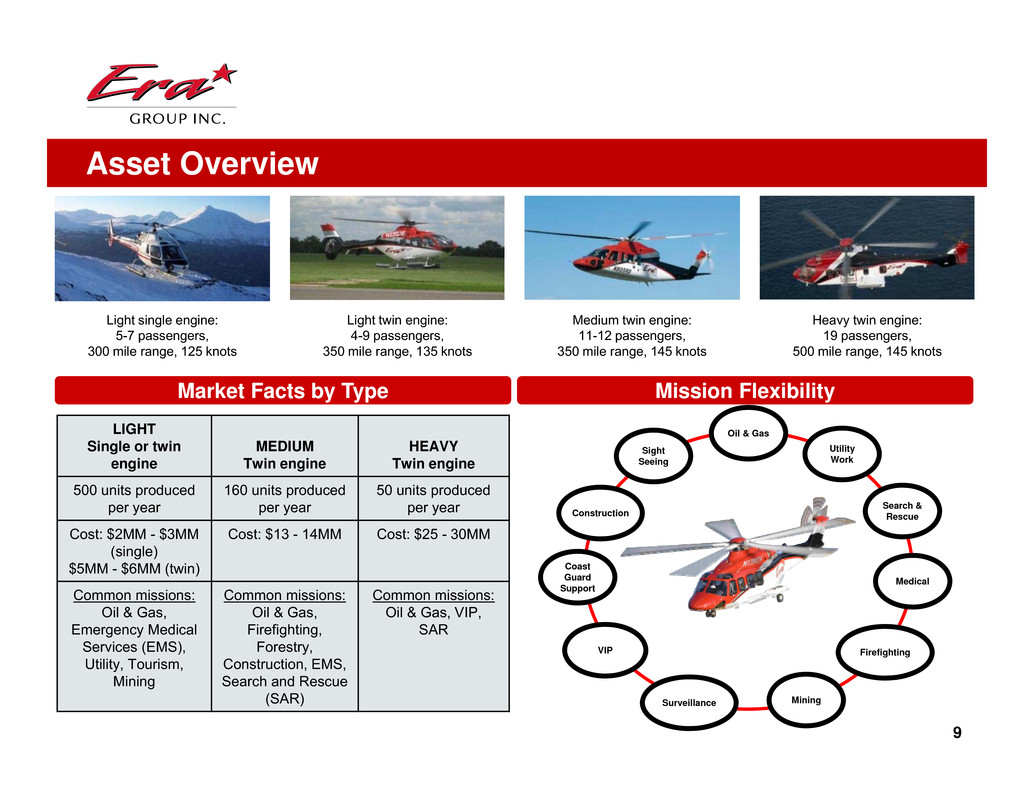

Asset Overview LIGHT Single or twin engine MEDIUM Twin engine HEAVY Twin engine 500 units produced per year 160 units produced per year 50 units produced per year Cost: $2MM - $3MM (single) $5MM - $6MM (twin) Cost: $13 - 14MM Cost: $25 - 30MM Common missions: Oil & Gas, Emergency Medical Services (EMS), Utility, Tourism, Mining Common missions: Oil & Gas, Firefighting, Forestry, Construction, EMS, Search and Rescue (SAR) Common missions: Oil & Gas, VIP, SAR Light single engine: 5-7 passengers, 300 mile range, 125 knots Medium twin engine: 11-12 passengers, 350 mile range, 145 knots Light twin engine: 4-9 passengers, 350 mile range, 135 knots Heavy twin engine: 19 passengers, 500 mile range, 145 knots Market Facts by Type Mission Flexibility Oil & Gas Search & Rescue Firefighting Sight Seeing Mining VIP Construction Coast Guard Support Surveillance Utility Work Medical 9

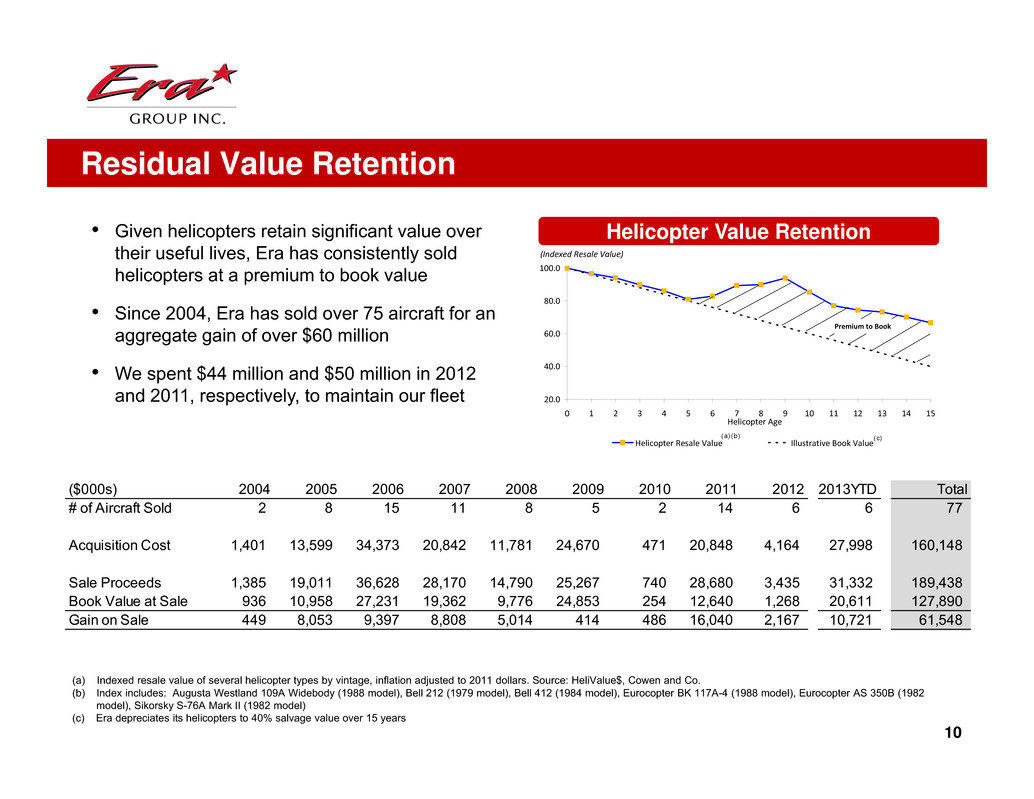

Residual Value Retention (a) Indexed resale value of several helicopter types by vintage, inflation adjusted to 2011 dollars. Source: HeliValue$, Cowen and Co. (b) Index includes: Augusta Westland 109A Widebody (1988 model), Bell 212 (1979 model), Bell 412 (1984 model), Eurocopter BK 117A-4 (1988 model), Eurocopter AS 350B (1982 model), Sikorsky S-76A Mark II (1982 model) (c) Era depreciates its helicopters to 40% salvage value over 15 years • Given helicopters retain significant value over their useful lives, Era has consistently sold helicopters at a premium to book value • Since 2004, Era has sold over 75 aircraft for an aggregate gain of over $60 million • We spent $44 million and $50 million in 2012 and 2011, respectively, to maintain our fleet Helicopter Value Retention 20.0 40.0 60.0 80.0 100.0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Helicopter Resale Value Illustrative Book Value (Indexed Resale Value) (a)(b) (c) Helicopter Age Premium to Book 10 ($000s) 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013YTD Total # of Aircraft Sold 2 8 15 11 8 5 2 14 6 6 77 Acquisition Cost 1,401 13,599 34,373 20,842 11,781 24,670 471 20,848 4,164 27,998 160,148 Sale Proceeds 1,385 19,011 36,628 28,170 14,790 25,267 740 28,680 3,435 31,332 189,438 Book Value at Sale 936 10,958 27,231 19,362 9,776 24,853 254 12,640 1,268 20,611 127,890 Gain on Sale 449 8,053 9,397 8,808 5,014 414 486 16,040 2,167 10,721 61,548

Q1 Operational Highlights 11

12 Q1 2013 Highlights • Strong operating performance in Q1 2013 reflected by record Q1 operating revenues of $67.7mm (11% increase from Q1 2012) • Q1 net income attributable to Era Group Inc. of $6.7mm, compared to Q1 2012 net loss of $4.6mm ̶ Q1 2013 gains on asset dispositions were $9.0mm higher (pre-tax) than prior year period ̶ Q1 2012 included $5.9mm impairment charge (after-tax) on our investment in Aeroleo • Q1 Adjusted EBITDA of $26.6mm (63% increase from Q1 2012) ̶ Excluding gains on asset dispositions, Q1 Adjusted EBITDA of $15.8mm (9% increase from Q1 2012) • Q1 operating income of $14.6mm (281% increase from Q1 2012) ̶ Excluding gains on asset dispositions, Q1 operating income of $3.8mm (84% increase from Q1 2012) • Solid results in the face of significant headwinds from the EC225 suspension

Global Suspension of EC225s 13 • On October 22, 2012, following the second ditching of an EC225 in the North Sea, Era and the other large operators decided to suspend operations of the EC225 globally until a root cause is determined and a solution to address such issue is implemented • After months of tests, Eurocopter has now determined the root cause of the crack initiation and has replicated the failure multiple times. Eurocopter can now move toward a replacement solution for the part (likely 9-12 months) • In the interim, a “safety case” that would enable the EC225 to fly again under a strict set of procedures has been established − It is unclear whether such a case will meet the requirements of certain companies and/or unions − The indicator kit and software update is scheduled to be shipped in the next 3-4 weeks, and installation should only take a few hours • To date, the entire global EC225 fleet (including ours) has been inspected for indications of the same cracking, and no additional cracks have been found − Moreover, some commercial operators in Asia, as well as a number of military fleets, have continued to fly without incident • Although the oil and gas companies in the steering group had originally indicated their willingness to maintain the full monthly payments, some have started to challenge these monthly payments. Petrobras recently announced their intention to “suspend” all of their EC225 contracts in Brazil • If Petrobras holds to this position, Aeroleo would experience significant financial strain, which could require us to infuse more capital before the end of the year and adversely impact our results of operations • In our U.S. Gulf of Mexico operations, we are using our available medium helicopters to support operations in place of the three EC225 helicopters

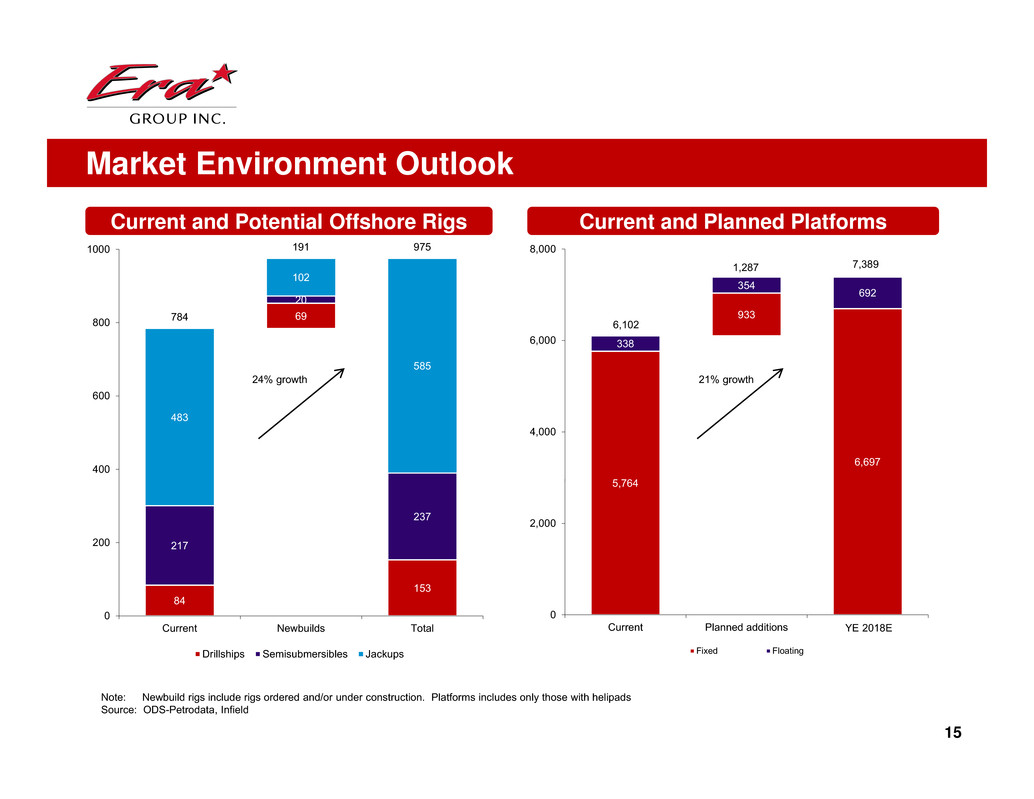

14 Oil and Gas • Q1 operating revenues from oil and gas activities of $48.4mm (29% increase from Q1 2012) • U.S. Gulf of Mexico operating revenue of $39.4mm (15% increase from Q1 2012) ̶ Newly delivered medium helicopters placed in service and associated increase in flight hours ̶ Increase in services provided to government agencies • Alaska operating revenue of $8.0mm (140% increase from Q1 2012) ̶ Short-term work related to drillship running aground ̶ Resumption of services with major oil and gas customer • International operating revenue of $1.0mm due to start of new contract in Uruguay • The number of deepwater drilling rigs and production platforms is increasing, which is driving demand for our helicopter services ̶ Estimated 75% - 80% of our operating fleet is servicing production, pipelines, and government services, the most stable parts of the industry

5,764 933 6,697 338 354 692 0 2,000 4,000 6,000 8,000 Current Planned additions YE 2017E Fixed Floating Market Environment Outlook Current and Potential Offshore Rigs Current and Planned Platforms 84 69 153 217 20 237 483 102 585 784 191 975 0 200 400 600 800 1000 Current Newbuilds Total Drillships Semisubmersibles Jackups Note: Newbuild rigs include rigs ordered and/or under construction. Platforms includes only those with helipads Source: ODS-Petrodata, Infield 15 24% growth 21% growth 6,102 1,287 7,389 8

16 Other Service Lines • Contract-leasing revenues of $13.9mm in Q1 2013 (7% decrease from Q1 2012) ̶ Primarily due to the deferral of revenues from Aeroleo and a customer in India ̶ Partially offset by new contract-leases that commenced after Q1 2012 • Air medial revenues of $3.2mm in Q1 2013 (50% decrease from Q1 2012) ̶ Primarily due to the conclusion of two long-term hospital contracts in Q2 and Q4 2012 ̶ Certain hospitals are choosing to attain their own AOC and bring helicopter operations in- house ̶ We have increased the financial return hurdle when bidding new air medical contracts to be more consistent with our oil and gas operations • FBO revenues of $2.3mm in Q1 2013 were unchanged compared to Q1 2012 • Our flightseeing business in Alaska is seasonal, operating between May and September

Financial Review 17

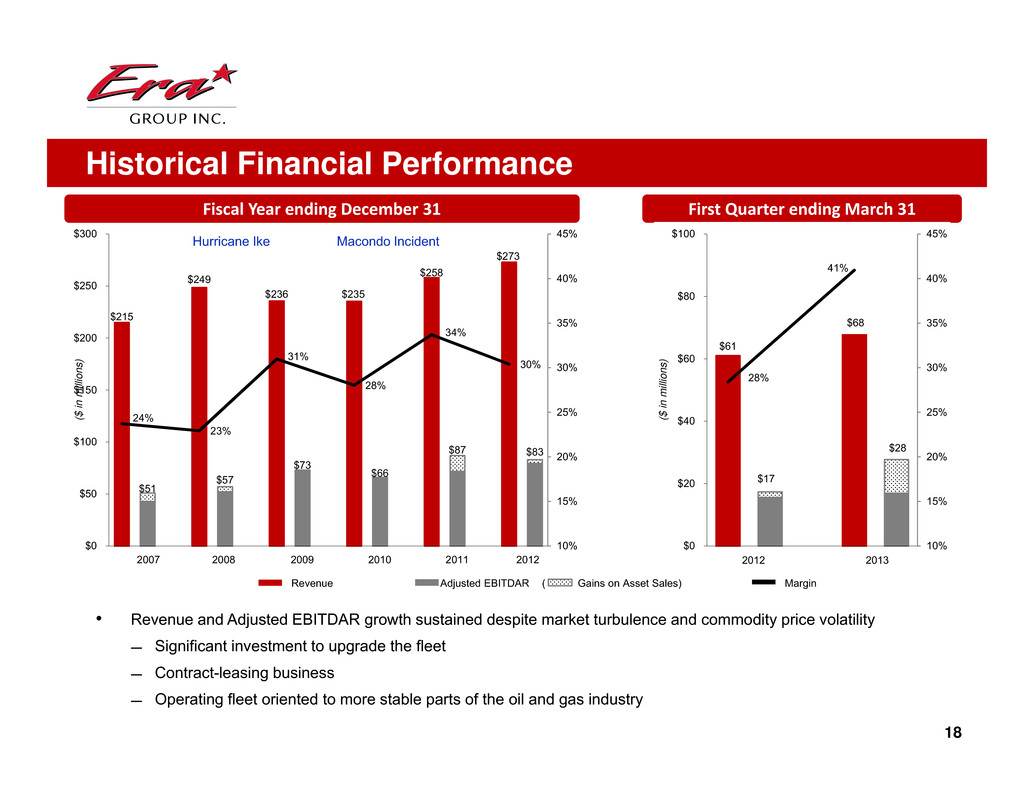

• Revenue and Adjusted EBITDAR growth sustained despite market turbulence and commodity price volatility ̶ Significant investment to upgrade the fleet ̶ Contract-leasing business ̶ Operating fleet oriented to more stable parts of the oil and gas industry Historical Financial Performance 18 Revenue Adjusted EBITDAR ( Gains on Asset Sales) Margin $215 $249 $236 $235 $258 $273 $51 $57 $73 $66 $87 $83 24% 23% 31% 28% 34% 30% 10% 15% 20% 25% 30% 35% 40% 45% $0 $50 $100 $150 $200 $250 $300 ( $ i n m i l l i o n s ) 2007 2008 2009 2010 2011 2012 Hurricane Ike Macondo Incident Fiscal Year ending December 31 First Quarter ending March 31 $61 $68 $17 $28 28% 41% 10% 15% 20% 25% 30% 35% 40% 45% $0 $20 $40 $60 $80 $100 ( $ i n m i l l i o n s ) 2012 2013

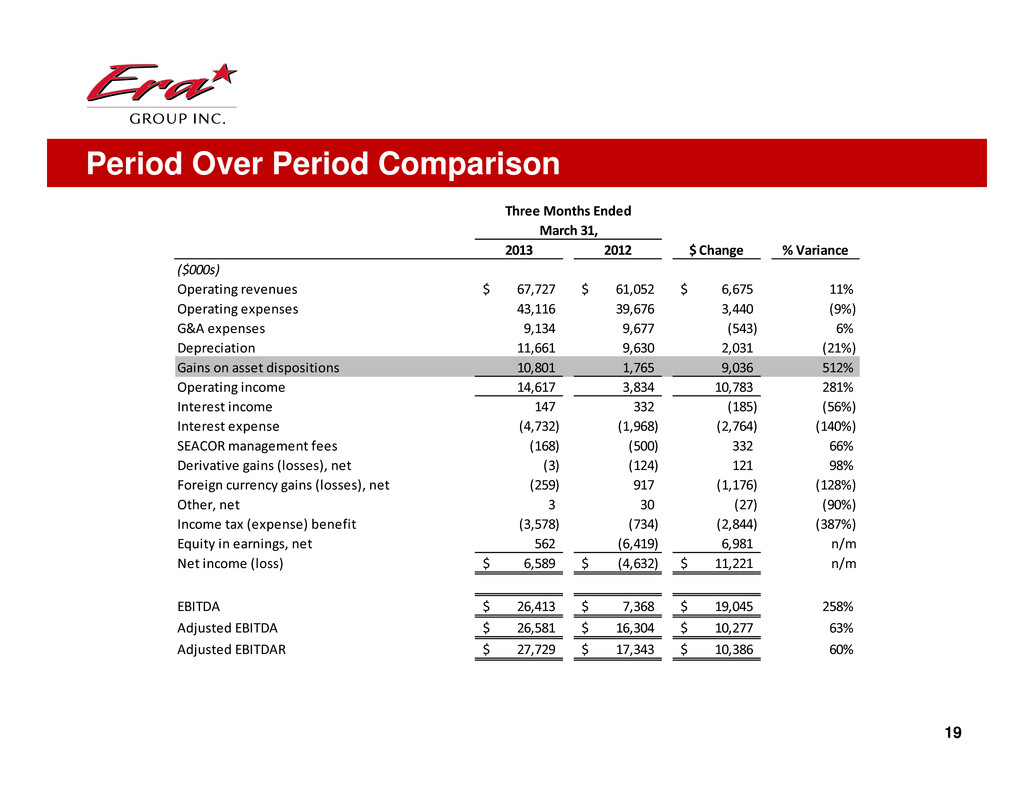

19 Period Over Period Comparison Three Months Ended March 31, 2013 2012 $ Change % Variance ($000s) Operating revenues 67,727$ 61,052$ 6,675$ 11% Operating expenses 43,116 39,676 3,440 (9%) G&A expenses 9,134 9,677 (543) 6% Depreciation 11,661 9,630 2,031 (21%) Gains on asset dispositions 10,801 1,765 9,036 512% Operating income 14,617 3,834 10,783 281% Interest income 147 332 (185) (56%) Interest expense (4,732) (1,968) (2,764) (140%) SEACOR management fees (168) (500) 332 66% Derivative gains (losses), net (3) (124) 121 98% Foreign currency gains (losses), net (259) 917 (1,176) (128%) Other, net 3 30 (27) (90%) Income tax (expense) benefit (3,578) (734) (2,844) (387%) Equity in earnings, net 562 (6,419) 6,981 n/m Net income (loss) 6,589$ (4,632)$ 11,221$ n/m EBITDA 26,413$ 7,368$ 19,045$ 258% Adjusted EBITDA 26,581$ 16,304$ 10,277$ 63% Adjusted EBITDAR 27,729$ 17,343$ 10,386$ 60%

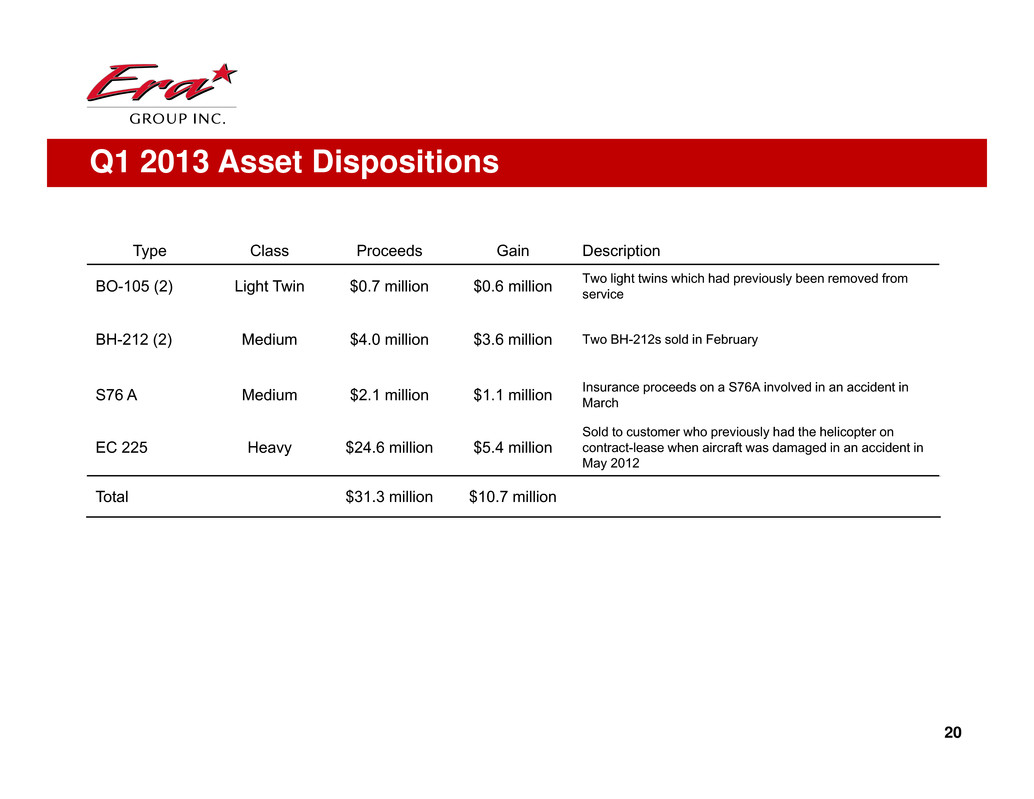

Q1 2013 Asset Dispositions Type Class Proceeds Gain Description BO-105 (2) Light Twin $0.7 million $0.6 million Two light twins which had previously been removed from service BH-212 (2) Medium $4.0 million $3.6 million Two BH-212s sold in February S76 A Medium $2.1 million $1.1 million Insurance proceeds on a S76A involved in an accident in March EC 225 Heavy $24.6 million $5.4 million Sold to customer who previously had the helicopter on contract-lease when aircraft was damaged in an accident in May 2012 Total $31.3 million $10.7 million 20

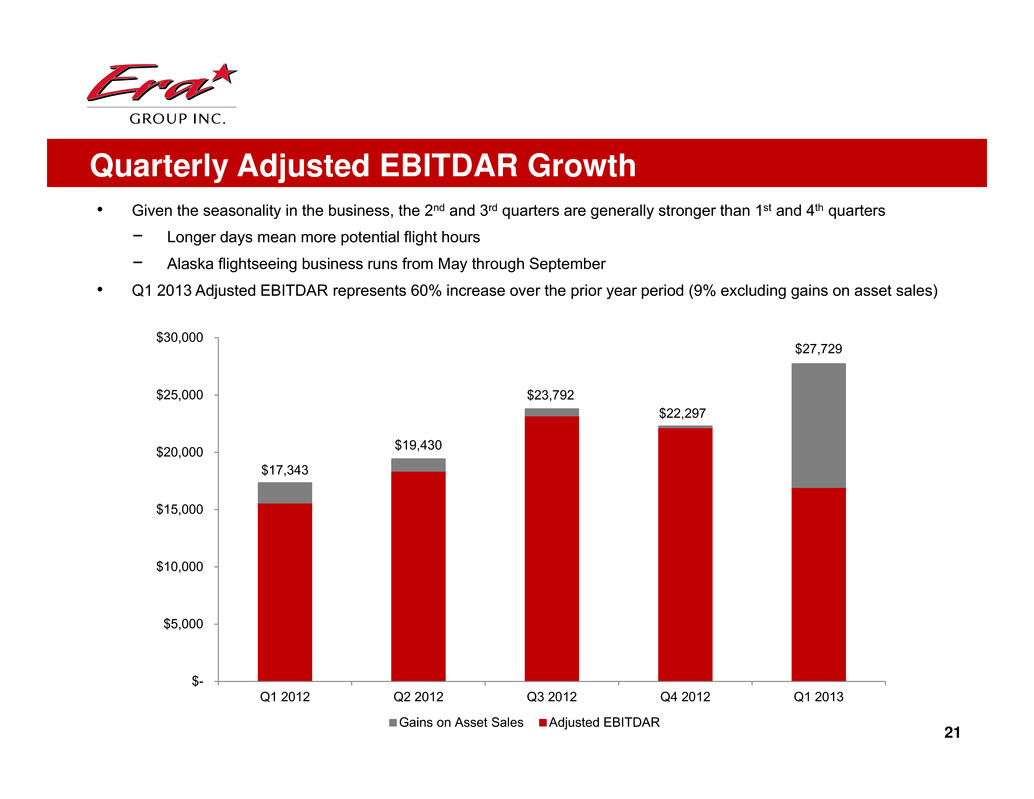

21 Quarterly Adjusted EBITDAR Growth • Given the seasonality in the business, the 2nd and 3rd quarters are generally stronger than 1st and 4th quarters − Longer days mean more potential flight hours − Alaska flightseeing business runs from May through September • Q1 2013 Adjusted EBITDAR represents 60% increase over the prior year period (9% excluding gains on asset sales) $17,343 $19,430 $23,792 $22,297 $27,729 $- $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Gains on Asset Sales Adjusted EBITDAR

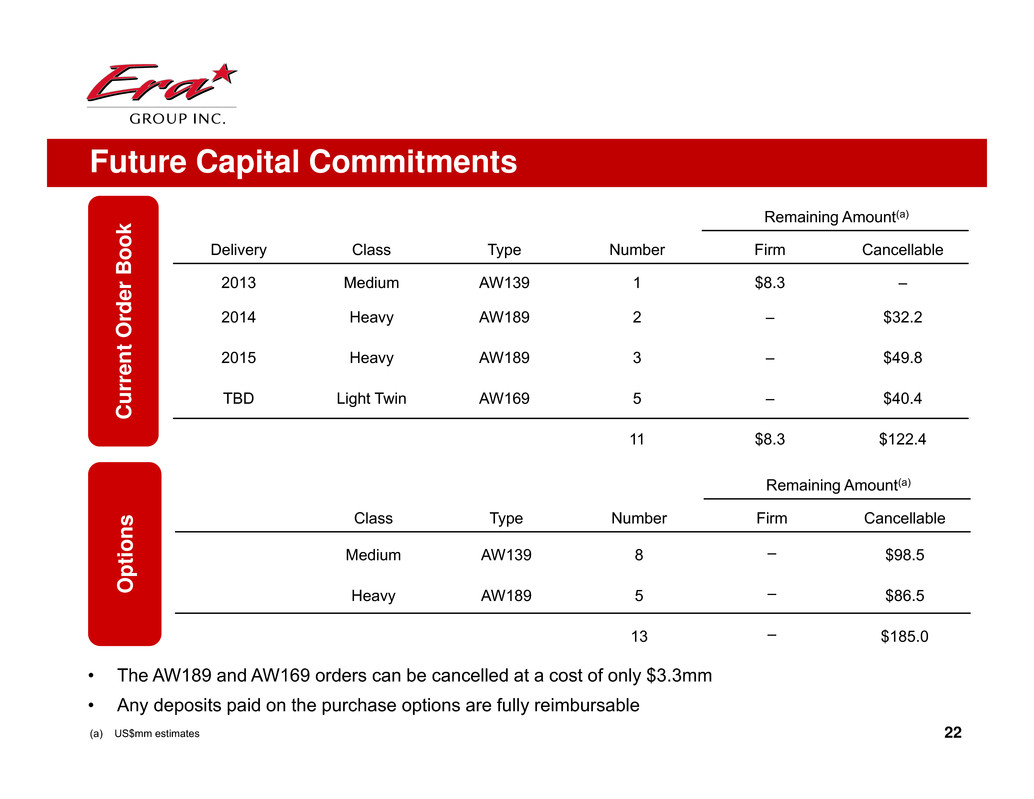

Future Capital Commitments C u r r e n t O r d e r B o o k O p t i o n s Delivery Class Type Number Remaining Amount(a) Firm Cancellable 2013 Medium AW139 1 $8.3 – 2014 Heavy AW189 2 – $32.2 2015 Heavy AW189 3 – $49.8 TBD Light Twin AW169 5 – $40.4 11 $8.3 $122.4 22(a) US$mm estimates • The AW189 and AW169 orders can be cancelled at a cost of only $3.3mm • Any deposits paid on the purchase options are fully reimbursable Class Type Number Remaining Amount(a) Firm Cancellable Medium AW139 8 – $98.5 Heavy AW189 5 – $86.5 13 – $185.0

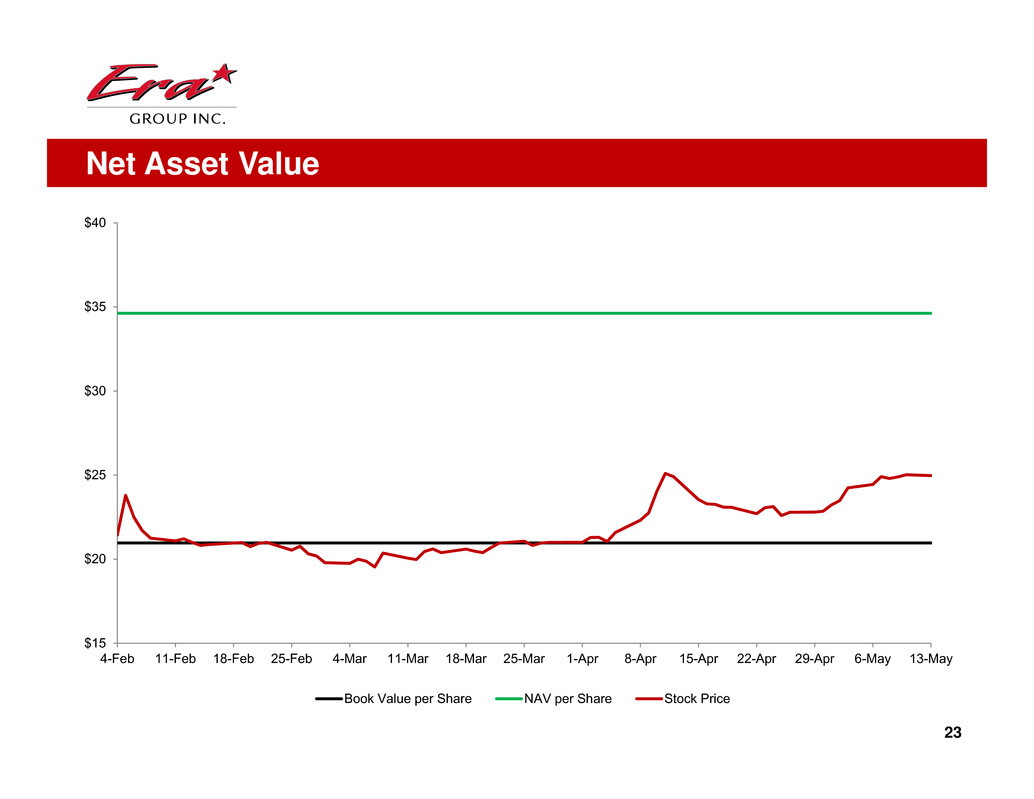

23 Net Asset Value $15 $20 $25 $30 $35 $40 4-Feb 11-Feb 18-Feb 25-Feb 4-Mar 11-Mar 18-Mar 25-Mar 1-Apr 8-Apr 15-Apr 22-Apr 29-Apr 6-May 13-May Book Value per Share NAV per Share Stock Price

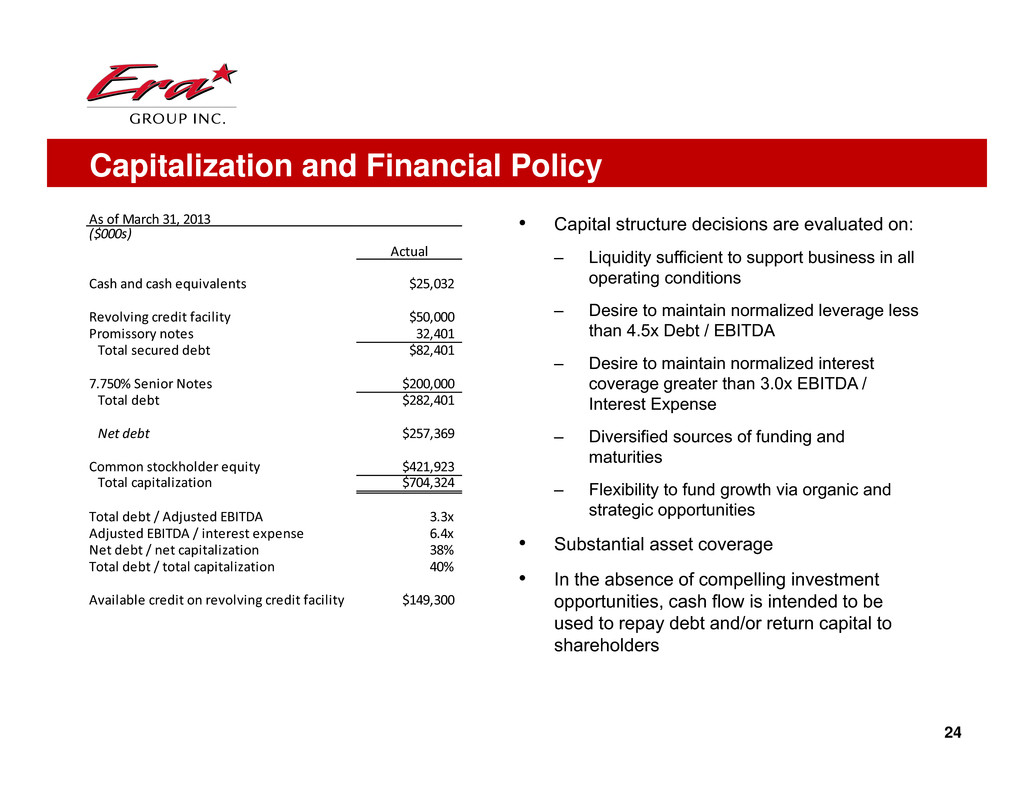

Capitalization and Financial Policy 24 • Capital structure decisions are evaluated on: – Liquidity sufficient to support business in all operating conditions – Desire to maintain normalized leverage less than 4.5x Debt / EBITDA – Desire to maintain normalized interest coverage greater than 3.0x EBITDA / Interest Expense – Diversified sources of funding and maturities – Flexibility to fund growth via organic and strategic opportunities • Substantial asset coverage • In the absence of compelling investment opportunities, cash flow is intended to be used to repay debt and/or return capital to shareholders As of March 31, 2013 ($000s) Actual Cash and cash equivalents $25,032 Revolving credit facility $50,000 Promissory notes 32,401 Total secured debt $82,401 7.750% Senior Notes $200,000 Total debt $282,401 Net debt $257,369 Common stockholder equity $421,923 Total capitalization $704,324 Total debt / Adjusted EBITDA 3.3x Adjusted EBITDA / interest expense 6.4x Net debt / net capitalization 38% Total debt / total capitalization 40% Available credit on revolving credit facility $149,300

Appendix 25

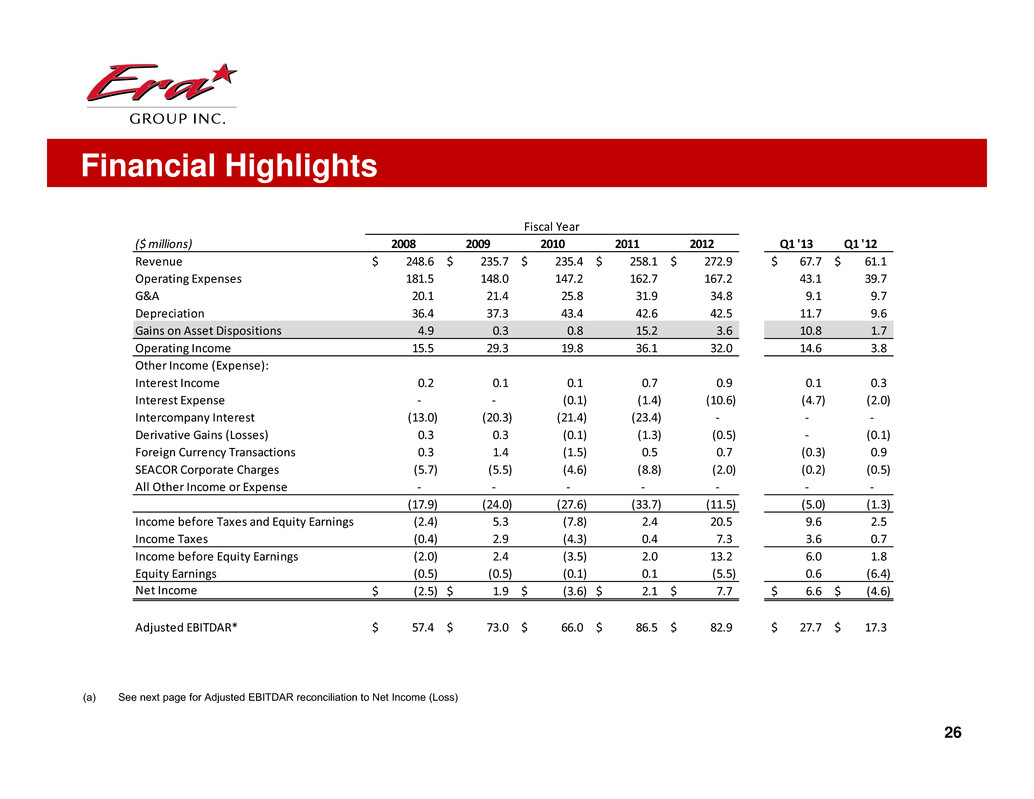

Financial Highlights 26 (a) See next page for Adjusted EBITDAR reconciliation to Net Income (Loss) ($ millions) 2008 2009 2010 2011 2012 Q1 '13 Q1 '12 Revenue 248.6$ 235.7$ 235.4$ 258.1$ 272.9$ 67.7$ 61.1$ Operating Expenses 181.5 148.0 147.2 162.7 167.2 43.1 39.7 G&A 20.1 21.4 25.8 31.9 34.8 9.1 9.7 Depreciation 36.4 37.3 43.4 42.6 42.5 11.7 9.6 Gains on Asset Dispositions 4.9 0.3 0.8 15.2 3.6 10.8 1.7 Operating Income 15.5 29.3 19.8 36.1 32.0 14.6 3.8 Other Income (Expense): Interest Income 0.2 0.1 0.1 0.7 0.9 0.1 0.3 Interest Expense ‐ ‐ (0.1) (1.4) (10.6) (4.7) (2.0) Intercompany Interest (13.0) (20.3) (21.4) (23.4) ‐ ‐ ‐ Derivative Gains (Losses) 0.3 0.3 (0.1) (1.3) (0.5) ‐ (0.1) Foreign Currency Transactions 0.3 1.4 (1.5) 0.5 0.7 (0.3) 0.9 SEACOR Corporate Charges (5.7) (5.5) (4.6) (8.8) (2.0) (0.2) (0.5) All Other Income or Expense ‐ ‐ ‐ ‐ ‐ ‐ ‐ (17.9) (24.0) (27.6) (33.7) (11.5) (5.0) (1.3) Income before Taxes and Equity Earnings (2.4) 5.3 (7.8) 2.4 20.5 9.6 2.5 Income Taxes (0.4) 2.9 (4.3) 0.4 7.3 3.6 0.7 Income before Equity Earnings (2.0) 2.4 (3.5) 2.0 13.2 6.0 1.8 Equity Earnings (0.5) (0.5) (0.1) 0.1 (5.5) 0.6 (6.4) Net Income (2.5)$ 1.9$ (3.6)$ 2.1$ 7.7$ 6.6$ (4.6)$ Adjusted EBITDAR* 57.4$ 73.0$ 66.0$ 86.5$ 82.9$ 27.7$ 17.3$ Fiscal Year

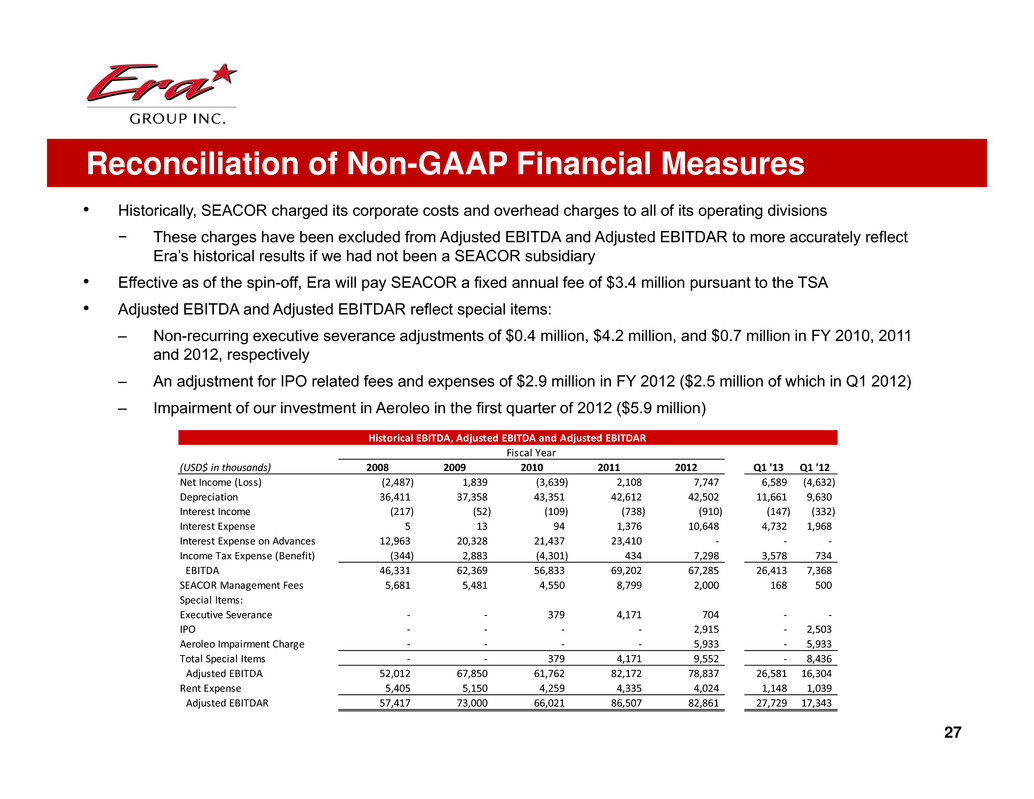

Reconciliation of Non-GAAP Financial Measures • Historically, SEACOR charged its corporate costs and overhead charges to all of its operating divisions − These charges have been excluded from Adjusted EBITDA and Adjusted EBITDAR to more accurately reflect Era’s historical results if we had not been a SEACOR subsidiary • Effective as of the spin-off, Era will pay SEACOR a fixed annual fee of $3.4 million pursuant to the TSA • Adjusted EBITDA and Adjusted EBITDAR reflect special items: – Non-recurring executive severance adjustments of $0.4 million, $4.2 million, and $0.7 million in FY 2010, 2011 and 2012, respectively – An adjustment for IPO related fees and expenses of $2.9 million in FY 2012 ($2.5 million of which in Q1 2012) – Impairment of our investment in Aeroleo in the first quarter of 2012 ($5.9 million) 27 (USD$ in thousands) 2008 2009 2010 2011 2012 Q1 '13 Q1 '12 Net Income (Loss) (2,487) 1,839 (3,639) 2,108 7,747 6,589 (4,632) Depreciation 36,411 37,358 43,351 42,612 42,502 11,661 9,630 Interest Income (217) (52) (109) (738) (910) (147) (332) Interest Expense 5 13 94 1,376 10,648 4,732 1,968 Interest Expense on Advances 12,963 20,328 21,437 23,410 ‐ ‐ ‐ Income Tax Expense (Benefit) (344) 2,883 (4,301) 434 7,298 3,578 734 EBITDA 46,331 62,369 56,833 69,202 67,285 26,413 7,368 SEACOR Management Fees 5,681 5,481 4,550 8,799 2,000 168 500 Special Items: Executive Severance ‐ ‐ 379 4,171 704 ‐ ‐ IPO ‐ ‐ ‐ ‐ 2,915 ‐ 2,503 Aeroleo Impairment Charge ‐ ‐ ‐ ‐ 5,933 ‐ 5,933 Total Special Items ‐ ‐ 379 4,171 9,552 ‐ 8,436 Adjusted EBITDA 52,012 67,850 61,762 82,172 78,837 26,581 16,304 Rent Expense 5,405 5,150 4,259 4,335 4,024 1,148 1,039 Adjusted EBITDAR 57,417 73,000 66,021 86,507 82,861 27,729 17,343 Fiscal Year Historical EBITDA, Adjusted EBITDA and Adjusted EBITDAR