2nd Quarter 2013 Earnings Presentation August 14, 2013 0

I. Introduction Chris Bradshaw, EVP and CFO II. Q2 Operational Highlights Sten Gustafson, Chief Executive Officer III. Financial Review Chris Bradshaw, EVP and CFO IV. Closing Remarks Sten Gustafson, Chief Executive Officer V. Questions & Answers 2nd Quarter 2013 Earnings Call Agenda 1

2 This presentation contains “forward-looking statements.” Forward-looking statements give Era Group’s current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements reflect management’s current views with respect to future events and are subject to risks and uncertainties, both known and unknown. Era Group’s actual results may vary materially from those anticipated in forward-looking statements. Era Group cautions investors not to place undue reliance on any forward-looking statements. Such risks, uncertainties and other important factors include, among others, the effect of the spin-off from SEACOR, including the ability of Era Group to recognize the expected benefits from the spin-off and Era Group's dependence on SEACOR's performance under various agreements; decreased demand and loss of revenues resulting from developments that may adversely impact the offshore oil and gas industry, including the issuance of new safety and environmental guidelines and regulations that could increase the costs of exploration and production, reduce the area of operation and result in permitting delays, U.S. government implemented moratoriums directing operators to cease certain drilling activities and any extension of such moratoriums that may result in unplanned customer suspensions, cancellations, rate reductions or non-renewals of aviation equipment contracts or failures to finalize commitments to contract aviation equipment; safety issues experienced by a particular helicopter model that could result in customers refusing to use that helicopter model or a regulatory body grounding that helicopter model, which could also permanently devalue that helicopter model; the cyclical nature of the oil and gas industry; increased U.S. and foreign government legislation and regulation, including environmental and aviation laws and regulations, and Era Group's compliance therewith and the costs thereof; dependence on the activity in the U.S. Gulf of Mexico and Alaska and Era Group's ability to expand into other markets; liability, legal fees and costs in connection with providing emergency response services, including involvement in response to the oil spill that resulted from the sinking of the Deepwater Horizon in April 2010; decreased demand for Era Group's services as a result of declines in the global economy; declines in valuations in the global financial markets and a lack of liquidity in the credit sectors, including, interest rate fluctuations, availability of credit, inflation rates, change in laws, trade barriers, commodity prices and currency exchange fluctuations; activity in foreign countries and changes in foreign political, military and economic conditions; the failure to maintain an acceptable safety record; the dependence on small number of customers; consolidation of the Company's customer base; industry fleet capacity; restrictions imposed by the U.S. federal aviation laws and regulations on the amount of foreign ownership of the Company's common stock; operational risks; risks associated with our debt structure; operational and financial difficulties of the Company’s joint ventures and partnerships; effects of adverse weather conditions and seasonality; adequacy of insurance coverage; the attraction and retention of qualified personnel; and various other matters and factors included in Era Group's annual reports on Form 10-K, quarterly reports on Form 10-Q and other SEC filings. These factors are not exhaustive, and new factors may emerge or changes to the foregoing factors may occur that could impact Era Group’s business. Except to the extent required by law, Era Group undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Cautionary Statement Regarding Forward Looking Statements

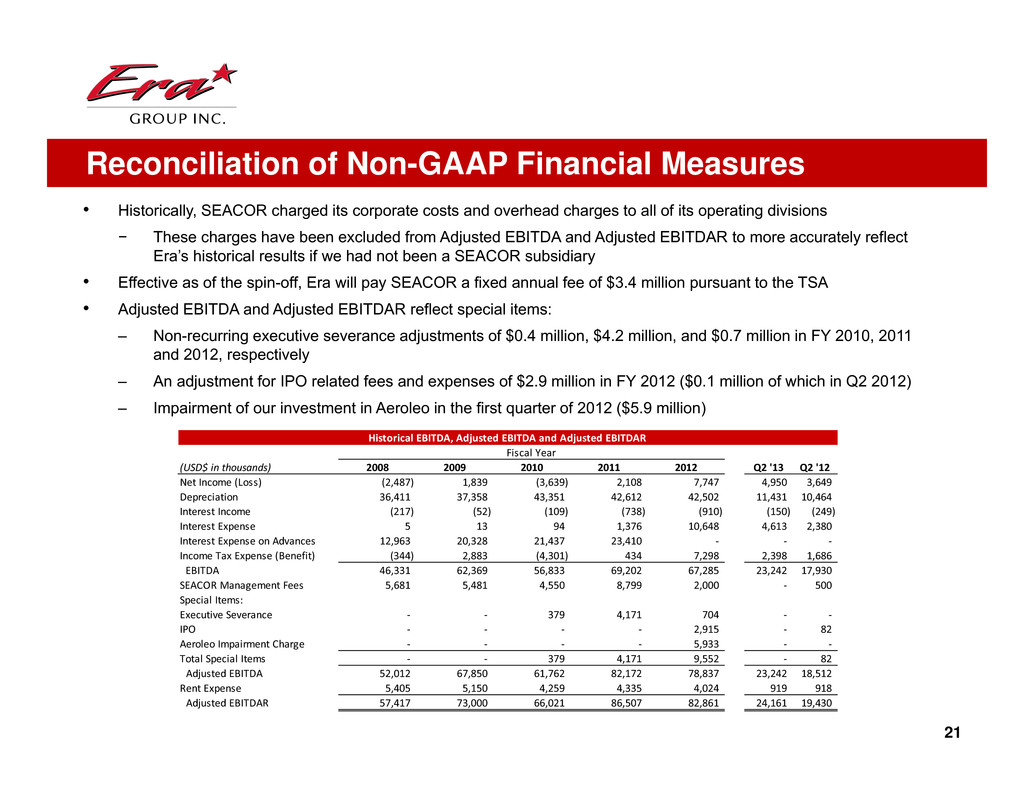

3 This presentation includes EBITDA, Adjusted EBITDA and Adjusted EBITDAR as supplemental measures of Era Group’s operating performance. EBITDA is defined as Earnings before Interest (includes interest income, interest expense and interest expense on advances from SEACOR), Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for SEACOR Management Fees and certain other items that occurred during the reporting period. Adjusted EBITDAR is defined as Adjusted EBITDA further adjusted for rent expense (included as a components of operating expense and general and administrative expense). Neither EBITDA, Adjusted EBITDA nor Adjusted EBITDAR is a recognized term under generally accepted accounting principles in the U.S. (“GAAP”). Accordingly, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA, Adjusted EBITDA and Adjusted EBITDAR are not intended to be a measure of free cash flow available for discretionary use, as they do not consider certain cash requirements, such as debt service requirements. EBITDA, Adjusted EBITDA and Adjusted EBITDAR have limitations as analytical tools, and you should not consider them in isolation, nor as a substitute for analysis of our results as reported under GAAP. Because the definitions of EBITDA, Adjusted EBITDA and Adjusted EBITDAR (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. A reconciliation of EBITDA, Adjusted EBITDA and Adjusted EBITDAR is included in this presentation. Non‐GAAP Financial Measures Reconciliation

Q2 Operational Highlights 4

5 Q2 2013 Highlights • Strong operating performance in Q2 2013 reflected by record Q2 operating revenues of $74.2mm (18% increase from Q2 2012) • Q2 net income attributable to Era Group Inc. of $5.1mm (39% increase from Q2 2012) ̶ Q2 2013 gains on asset dispositions were $3.4mm higher (pre-tax) than prior year period • Q2 Adjusted EBITDA of $23.2mm (26% increase from Q2 2012) ̶ Excluding gains on asset dispositions, Q2 Adjusted EBITDA of $18.8mm (8% increase from Q2 2012) • Q2 operating income of $10.8mm (46% increase from Q2 2012) ̶ Excluding gains on asset dispositions, Q2 operating income of $6.3mm (unchanged from Q2 2012) • Solid results in the face of significant headwinds from the EC225 suspension ̶ Opportunity cost of medium helicopters used to backfill for the EC225s in the U.S. Gulf of Mexico ̶ Increased operating expenses due to acceleration of required maintenance service

EC225 Helicopters Return to Service 6 • On October 22, 2012, following the second ditching of an EC225 in the North Sea, Era and the other large operators suspended operations of the EC225 globally • We continue to earn revenues associated with our two EC225 helicopters under contract-leases in the North Sea • Petrobras announced their intention to “suspend” all of their EC225 contracts in Brazil effective April 1st through the duration of the EC225 suspension − Aeroleo has not received payments for its three EC225 helicopters under contract with Petrobras since April, which has weakened Aeroleo’s financial position and could adversely impact our results of operations • We have not been collecting revenues on the EC225 helicopters we operate in the U.S. Gulf of Mexico since they have not been flying. Instead, we have been earning revenue on the medium helicopters being used to replace the EC225 helicopters in support of these customer contracts • After months of tests, Eurocopter has now identified the root cause of the service failures and implemented engineering solutions, prevention and detection measures to remedy the matters that led to the suspension • In July, the European Aviation Safety Agency (EASA) approved these measures, and the U.K. Civil Aviation Authority and the Civil Aviation Authority of Norway also lifted operational restrictions. These measures and related regulatory approvals are expected to allow the full return to service of the EC225 helicopters on a worldwide basis • Two of our EC225 helicopters in the U.S. Gulf of Mexico have already returned to service, and we plan to resume operations of the two other EC225 helicopters in the U.S. Gulf of Mexico by the end of August

7 Oil and Gas • Q2 operating revenues from oil and gas activities of $52.6mm (20% increase from Q2 2012) • U.S. Gulf of Mexico operating revenues of $41.9mm (11% increase from Q2 2012) ̶ Increased deepwater activity led to more medium helicopters being placed in service • Alaska operating revenue of $9.4mm (55% increase from Q2 2012) ̶ Resumption of services with major oil and gas customer that had been suspended in the prior year period due to permitting delays • International operating revenue of $1.3mm due to start of new contract in Uruguay • Growth in deepwater drilling, completion and production activity is driving increased demand for heavy and medium helicopter services

8 Other Service Lines • Contract-leasing revenues of $13.1mm in Q2 2013 (39% increase from Q2 2012) ̶ Primarily due to the recognition of previously deferred revenues from Aeroleo and a customer in India ̶ Revenues from both of these customers are recognized on a cash receipts basis due to liquidity issues experienced by both customers • Air medical revenues of $3.1mm in Q2 2013 (35% decrease from Q2 2012) ̶ Primarily due to the conclusion of three long-term hospital contracts in effect during the prior year period ̶ Certain hospitals are choosing to attain their own AOC and bring helicopter operations in- house ̶ We have increased the financial return hurdle when bidding new air medical contracts to be more consistent with our oil and gas operations • Operating revenues from flightseeing and FBO activities increased by 7% and 15%, respectively ̶ Better weather conditions resulted in more flying activity

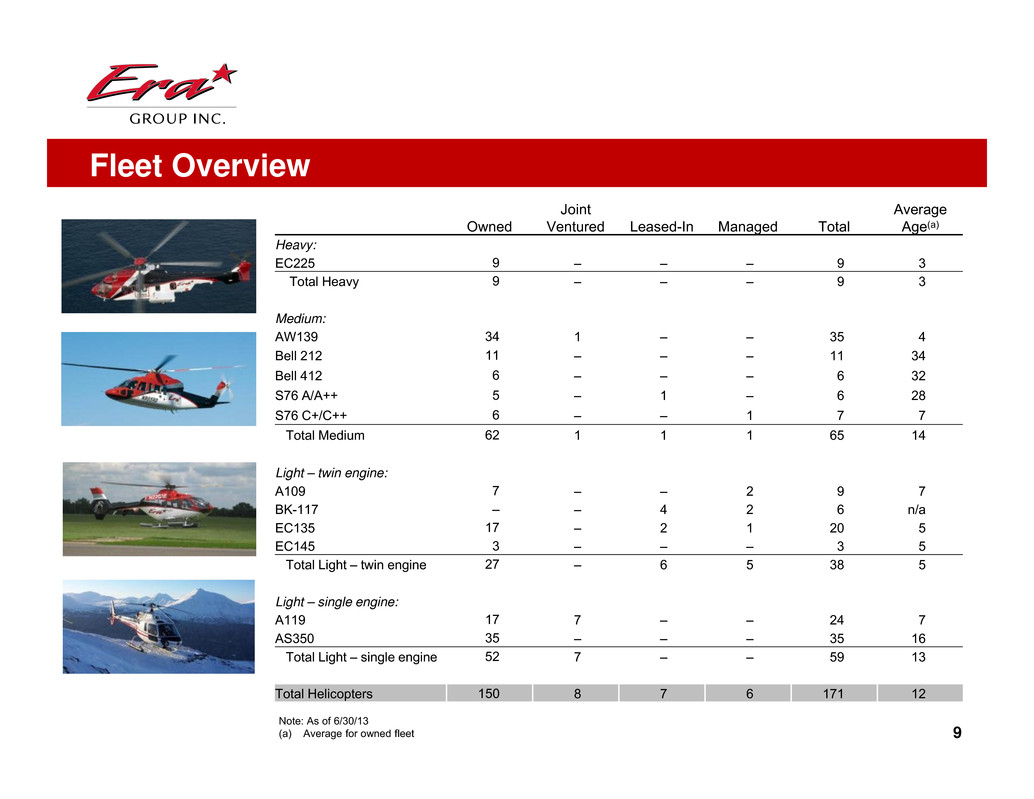

Owned Joint Ventured Leased-In Managed Total Average Age(a) Heavy: EC225 9 – – – 9 3 Total Heavy 9 – – – 9 3 Medium: AW139 34 1 – – 35 4 Bell 212 11 – – – 11 34 Bell 412 6 – – – 6 32 S76 A/A++ 5 – 1 – 6 28 S76 C+/C++ 6 – – 1 7 7 Total Medium 62 1 1 1 65 14 Light – twin engine: A109 7 – – 2 9 7 BK-117 – – 4 2 6 n/a EC135 17 – 2 1 20 5 EC145 3 – – – 3 5 Total Light – twin engine 27 – 6 5 38 5 Light – single engine: A119 17 7 – – 24 7 AS350 35 – – – 35 16 Total Light – single engine 52 7 – – 59 13 Total Helicopters 150 8 7 6 171 12 Note: As of 6/30/13 (a) Average for owned fleet Fleet Overview 9

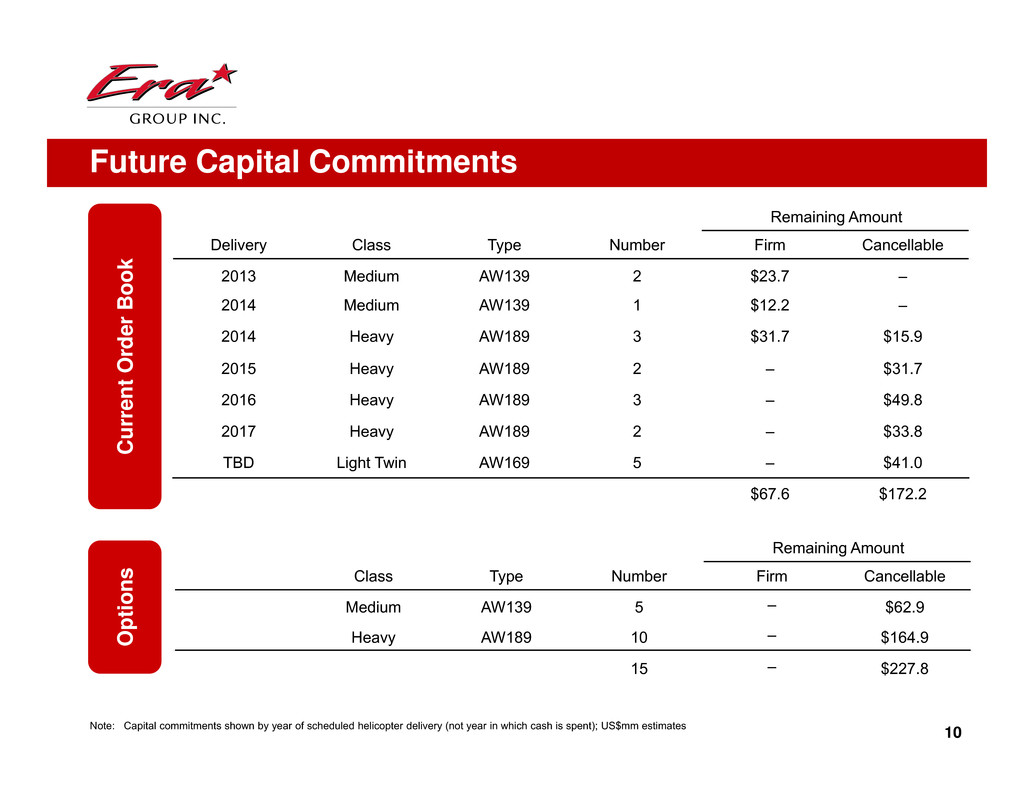

Future Capital Commitments C u r r e n t O r d e r B o o k O p t i o n s Delivery Class Type Number Remaining Amount Firm Cancellable 2013 Medium AW139 2 $23.7 – 2014 Medium AW139 1 $12.2 – 2014 Heavy AW189 3 $31.7 $15.9 2015 Heavy AW189 2 – $31.7 2016 Heavy AW189 3 – $49.8 2017 Heavy AW189 2 – $33.8 TBD Light Twin AW169 5 – $41.0 $67.6 $172.2 10Note: Capital commitments shown by year of scheduled helicopter delivery (not year in which cash is spent); US$mm estimates Class Type Number Remaining Amount Firm Cancellable Medium AW139 5 – $62.9 Heavy AW189 10 – $164.9 15 – $227.8

11 Market Outlook • Continued emphasis on offshore exploration and production services supported by expectations for sustained high commodity prices • Capital and activity increasingly moving to deepwater with global spending in that market expected to increase ~30% by 2015 to ~$150 billion • Gulf of Mexico re-emerging as one of the strongest and most active offshore basins in the world ̶ ~40 deepwater rigs currently operating in the region ̶ Expecting another 10-15 rigs to enter the region over the next two years ̶ Production platforms getting larger and farther offshore • Brazil continues to be the most active offshore basin in the world with more than 70 floater rigs operating at almost 100% utilization ̶ Almost all offshore Brazilian activity requires medium and heavy helicopters due to the distances from shore ̶ Record-breaking Round 11 licensing sale in May 2013 (first held in Brazil since 2008) set stage for the inaugural pre-salt bid round (Round 12) in October • Additional offshore opportunities emerging in South America, Australia, Southeast Asia and Africa • Offshore search and rescue is a growing market segment Source: Industry reports, Street research

Era SAR Update 12 • Following our initial entry into this market in mid-2010, Era SAR has grown to become the premier and largest provider of SAR/Medevac services in the Gulf of Mexico • Partnership with Priority 1 Air Rescue, where Era provides the helicopters and pilots and Priority 1 provides the air ambulance crewmembers (one rescue specialist, one advanced life support paramedic and one hoist operator) • Dedicated full SAR/Medevac operations servicing the entire Gulf of Mexico from two locations − Galveston: 1 x AW139 − Houma/Fourchon: 1 x AW139 − Expecting to add a third AW139 by October 2013 (Houma/Fourchon) • Era provides a subscription-based SAR service to oil & gas operators in the Gulf of Mexico − Anadarko, Apache, Shell, Statoil and Chevron − Also conducts ad hoc missions for other customers − YTD have conducted SAR missions for 60+ oil & gas companies (113 missions) • SAR revenue has grown from $1.3 million in FY 2010 to $6.6 million for the six months ended June 30, 2013 • Recent events, such as the Macondo incident, and the overall growth of POB (people on board) in the Gulf of Mexico have increased demand for SAR services, and we see the potential for adding additional subscription customers and helicopters over the next 6 to 18 months

Financial Review 13

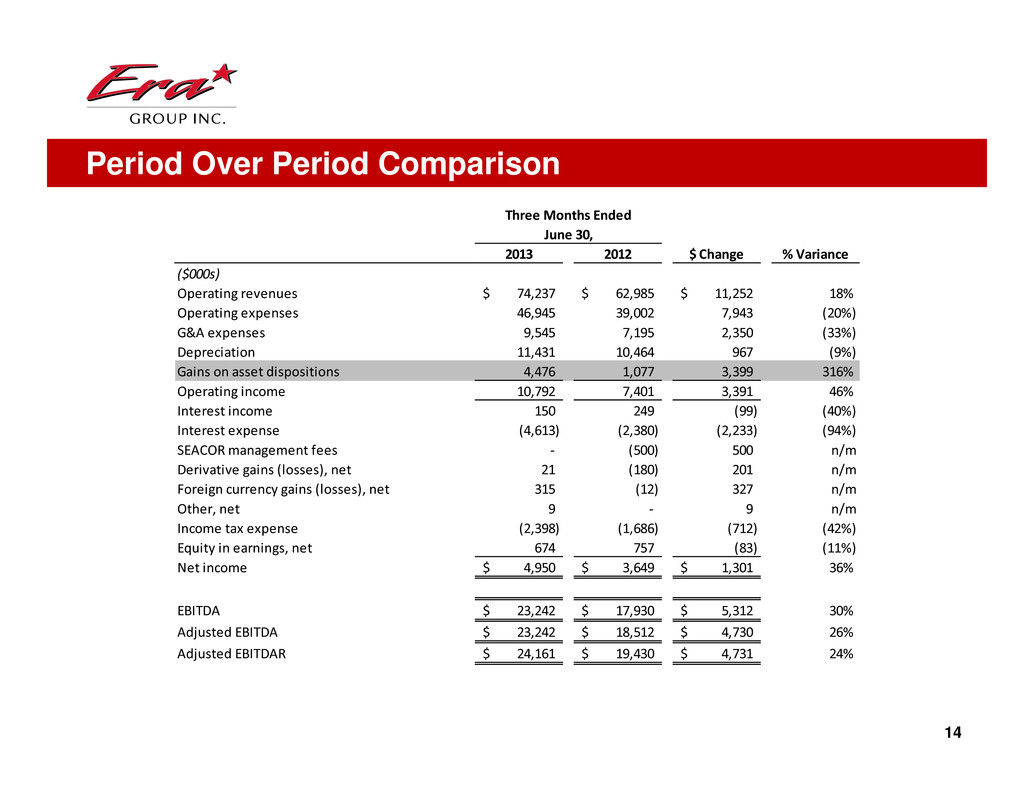

14 Period Over Period Comparison Three Months Ended June 30, 2013 2012 $ Change % Variance ($000s) Operating revenues 74,237$ 62,985$ 11,252$ 18% Operating expenses 46,945 39,002 7,943 (20%) G&A expenses 9,545 7,195 2,350 (33%) Depreciation 11,431 10,464 967 (9%) Gains on asset dispositions 4,476 1,077 3,399 316% Operating income 10,792 7,401 3,391 46% Interest income 150 249 (99) (40%) Interest expense (4,613) (2,380) (2,233) (94%) SEACOR management fees ‐ (500) 500 n/m Derivative gains (losses), net 21 (180) 201 n/m Foreign currency gains (losses), net 315 (12) 327 n/m Other, net 9 ‐ 9 n/m Income tax expense (2,398) (1,686) (712) (42%) Equity in earnings, net 674 757 (83) (11%) Net income 4,950$ 3,649$ 1,301$ 36% EBITDA 23,242$ 17,930$ 5,312$ 30% Adjusted EBITDA 23,242$ 18,512$ 4,730$ 26% Adjusted EBITDAR 24,161$ 19,430$ 4,731$ 24%

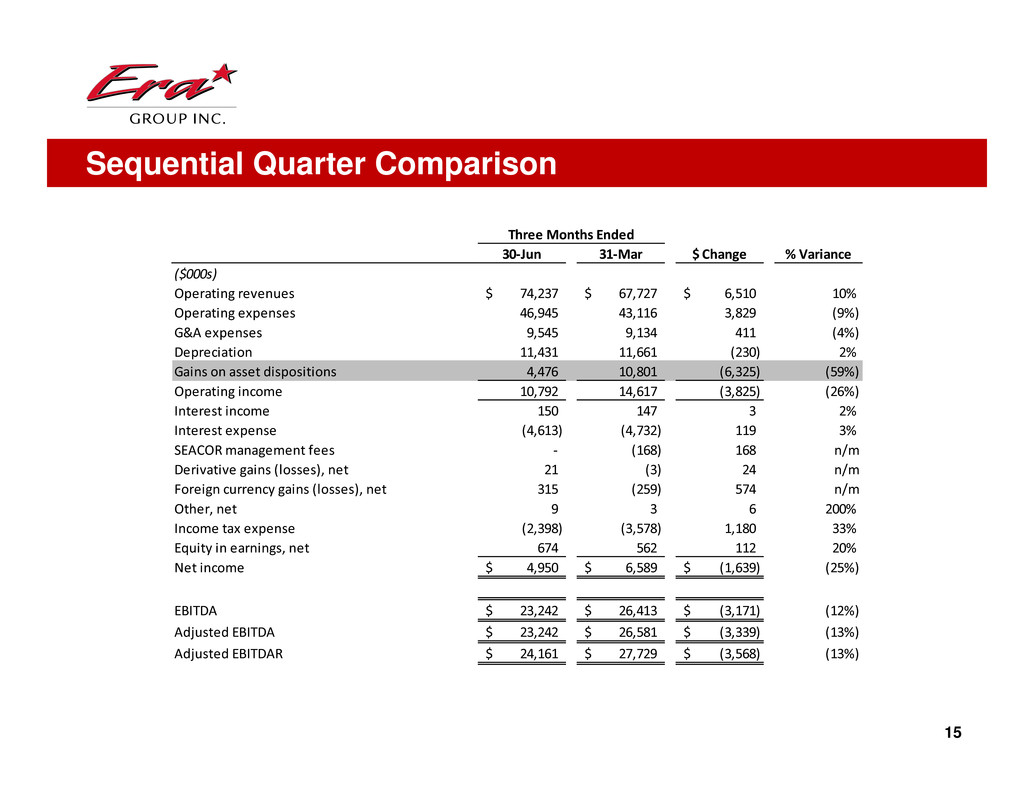

15 Sequential Quarter Comparison Three Months Ended 30‐Jun 31‐Mar $ Change % Variance ($000s) Operating revenues 74,237$ 67,727$ 6,510$ 10% Operating expenses 46,945 43,116 3,829 (9%) G&A expenses 9,545 9,134 411 (4%) Depreciation 11,431 11,661 (230) 2% Gains on asset dispositions 4,476 10,801 (6,325) (59%) Operating income 10,792 14,617 (3,825) (26%) Interest income 150 147 3 2% Interest expense (4,613) (4,732) 119 3% SEACOR management fees ‐ (168) 168 n/m Derivative gains (losses), net 21 (3) 24 n/m Foreign currency gains (losses), net 315 (259) 574 n/m Other, net 9 3 6 200% Income tax expense (2,398) (3,578) 1,180 33% Equity in earnings, net 674 562 112 20% Net income 4,950$ 6,589$ (1,639)$ (25%) EBITDA 23,242$ 26,413$ (3,171)$ (12%) Adjusted EBITDA 23,242$ 26,581$ (3,339)$ (13%) Adjusted EBITDAR 24,161$ 27,729$ (3,568)$ (13%)

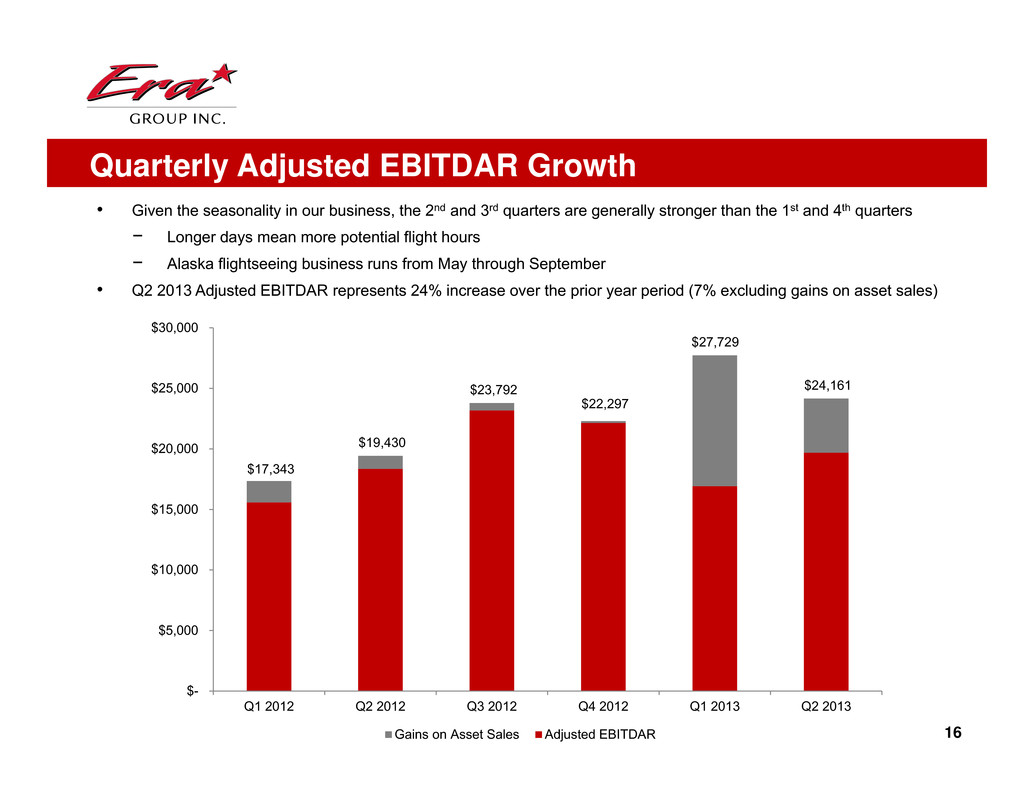

16 Quarterly Adjusted EBITDAR Growth • Given the seasonality in our business, the 2nd and 3rd quarters are generally stronger than the 1st and 4th quarters − Longer days mean more potential flight hours − Alaska flightseeing business runs from May through September • Q2 2013 Adjusted EBITDAR represents 24% increase over the prior year period (7% excluding gains on asset sales) $17,343 $19,430 $23,792 $22,297 $27,729 $24,161 $- $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Gains on Asset Sales Adjusted EBITDAR

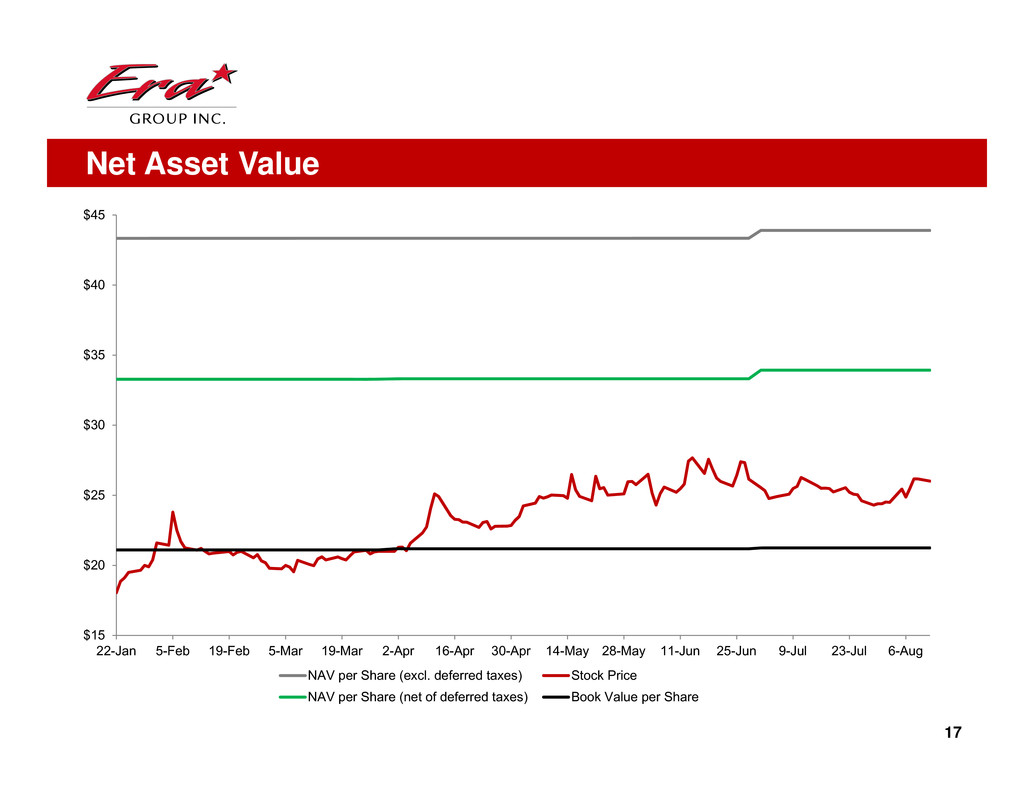

17 Net Asset Value $15 $20 $25 $30 $35 $40 $45 22-Jan 5-Feb 19-Feb 5-Mar 19-Mar 2-Apr 16-Apr 30-Apr 14-May 28-May 11-Jun 25-Jun 9-Jul 23-Jul 6-Aug NAV per Share (excl. deferred taxes) Stock Price NAV per Share (net of deferred taxes) Book Value per Share

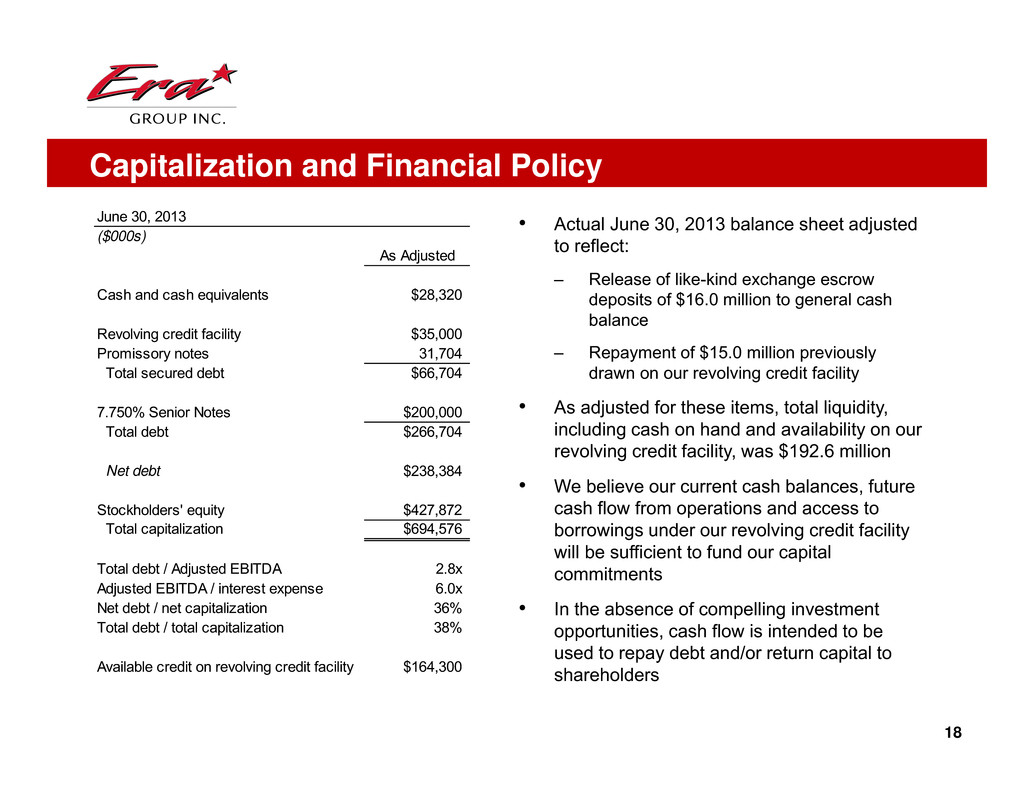

Capitalization and Financial Policy 18 • Actual June 30, 2013 balance sheet adjusted to reflect: – Release of like-kind exchange escrow deposits of $16.0 million to general cash balance – Repayment of $15.0 million previously drawn on our revolving credit facility • As adjusted for these items, total liquidity, including cash on hand and availability on our revolving credit facility, was $192.6 million • We believe our current cash balances, future cash flow from operations and access to borrowings under our revolving credit facility will be sufficient to fund our capital commitments • In the absence of compelling investment opportunities, cash flow is intended to be used to repay debt and/or return capital to shareholders June 30, 2013 ($000s) As Adjusted Cash and cash equivalents $28,320 Revolving credit facility $35,000 Promissory notes 31,704 Total secured debt $66,704 7.750% Senior Notes $200,000 Total debt $266,704 Net debt $238,384 Stockholders' equity $427,872 Total capitalization $694,576 Total debt / Adjusted EBITDA 2.8x Adjusted EBITDA / interest expense 6.0x Net debt / net capitalization 36% Total debt / total capitalization 38% Available credit on revolving credit facility $164,300

Appendix 19

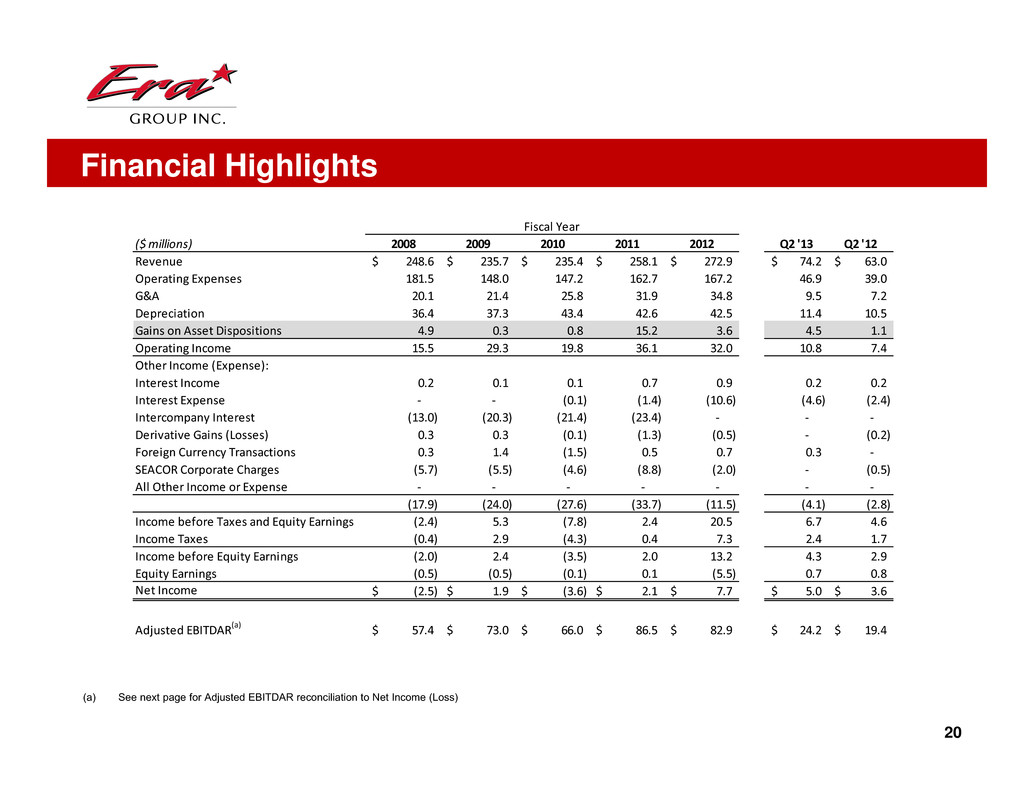

Financial Highlights 20 (a) See next page for Adjusted EBITDAR reconciliation to Net Income (Loss) ($ millions) 2008 2009 2010 2011 2012 Q2 '13 Q2 '12 Revenue 248.6$ 235.7$ 235.4$ 258.1$ 272.9$ 74.2$ 63.0$ Operating Expenses 181.5 148.0 147.2 162.7 167.2 46.9 39.0 G&A 20.1 21.4 25.8 31.9 34.8 9.5 7.2 Depreciation 36.4 37.3 43.4 42.6 42.5 11.4 10.5 Gains on Asset Dispositions 4.9 0.3 0.8 15.2 3.6 4.5 1.1 Operating Income 15.5 29.3 19.8 36.1 32.0 10.8 7.4 Other Income (Expense): Interest Income 0.2 0.1 0.1 0.7 0.9 0.2 0.2 Interest Expense ‐ ‐ (0.1) (1.4) (10.6) (4.6) (2.4) Intercompany Interest (13.0) (20.3) (21.4) (23.4) ‐ ‐ ‐ Derivative Gains (Losses) 0.3 0.3 (0.1) (1.3) (0.5) ‐ (0.2) Foreign Currency Transactions 0.3 1.4 (1.5) 0.5 0.7 0.3 ‐ SEACOR Corporate Charges (5.7) (5.5) (4.6) (8.8) (2.0) ‐ (0.5) All Other Income or Expense ‐ ‐ ‐ ‐ ‐ ‐ ‐ (17.9) (24.0) (27.6) (33.7) (11.5) (4.1) (2.8) Income before Taxes and Equity Earnings (2.4) 5.3 (7.8) 2.4 20.5 6.7 4.6 Income Taxes (0.4) 2.9 (4.3) 0.4 7.3 2.4 1.7 Income before Equity Earnings (2.0) 2.4 (3.5) 2.0 13.2 4.3 2.9 Equity Earnings (0.5) (0.5) (0.1) 0.1 (5.5) 0.7 0.8 Net Income (2.5)$ 1.9$ (3.6)$ 2.1$ 7.7$ 5.0$ 3.6$ Adjusted EBITDAR(a) 57.4$ 73.0$ 66.0$ 86.5$ 82.9$ 24.2$ 19.4$ Fiscal Year

Reconciliation of Non-GAAP Financial Measures • Historically, SEACOR charged its corporate costs and overhead charges to all of its operating divisions − These charges have been excluded from Adjusted EBITDA and Adjusted EBITDAR to more accurately reflect Era’s historical results if we had not been a SEACOR subsidiary • Effective as of the spin-off, Era will pay SEACOR a fixed annual fee of $3.4 million pursuant to the TSA • Adjusted EBITDA and Adjusted EBITDAR reflect special items: – Non-recurring executive severance adjustments of $0.4 million, $4.2 million, and $0.7 million in FY 2010, 2011 and 2012, respectively – An adjustment for IPO related fees and expenses of $2.9 million in FY 2012 ($0.1 million of which in Q2 2012) – Impairment of our investment in Aeroleo in the first quarter of 2012 ($5.9 million) 21 (USD$ in thousands) 2008 2009 2010 2011 2012 Q2 '13 Q2 '12 Net Income (Loss) (2,487) 1,839 (3,639) 2,108 7,747 4,950 3,649 Depreciation 36,411 37,358 43,351 42,612 42,502 11,431 10,464 Interest Income (217) (52) (109) (738) (910) (150) (249) Interest Expense 5 13 94 1,376 10,648 4,613 2,380 Interest Expense on Advances 12,963 20,328 21,437 23,410 ‐ ‐ ‐ Income Tax Expense (Benefit) (344) 2,883 (4,301) 434 7,298 2,398 1,686 EBITDA 46,331 62,369 56,833 69,202 67,285 23,242 17,930 SEACOR Management Fees 5,681 5,481 4,550 8,799 2,000 ‐ 500 Special Items: Executive Severance ‐ ‐ 379 4,171 704 ‐ ‐ IPO ‐ ‐ ‐ ‐ 2,915 ‐ 82 Aeroleo Impairment Charge ‐ ‐ ‐ ‐ 5,933 ‐ ‐ Total Special Items ‐ ‐ 379 4,171 9,552 ‐ 82 Adjusted EBITDA 52,012 67,850 61,762 82,172 78,837 23,242 18,512 Rent Expense 5,405 5,150 4,259 4,335 4,024 919 918 Adjusted EBITDAR 57,417 73,000 66,021 86,507 82,861 24,161 19,430 Fiscal Year Historical EBITDA, Adjusted EBITDA and Adjusted EBITDAR