Q3 2016 Earnings Presentation

0November 2, 2016

I. Introduction Shefali Shah, SVP and General Counsel

II. Operational Highlights Chris Bradshaw, President and CEO

III. Financial Review Andy Puhala, SVP and CFO

IV. Concluding Remarks Chris Bradshaw, President and CEO

V. Questions & Answers

Q3 2016 Earnings Call Agenda

1

2

Cautionary Statement Regarding Forward-Looking Statements

This presentation contains “forward-looking statements.” Forward-looking statements give the Company’s current expectations or forecasts of

future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,”

“expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements reflect management’s

current views with respect to future events and are subject to risks and uncertainties, both known and unknown. The Company’s actual

results may vary materially from those anticipated in forward-looking statements. The Company cautions investors not to place undue

reliance on any forward-looking statements.

Such risks, uncertainties and other important factors include, among others, the Company’s dependence on, and the cyclical and volatile

nature of, offshore oil and gas exploration, development and production activity, and the impact of general economic conditions and

fluctuations in worldwide prices of and demand for oil and natural gas on such activity levels; the Company’s reliance on a small number of

customers and reduction of the Company’s customer base resulting from consolidation; cost savings initiatives implemented by the

Company’s customers; risks inherent in operating helicopters; the Company’s ability to maintain an acceptable safety record; the Company’s

ability to successfully expand into other geographic and helicopter service markets; the impact of increased United States (“U.S.”) and foreign

government regulation and legislation, including potential government implemented moratoriums on drilling activities; risks of engaging in

competitive processes or expending significant resources, with no guaranty of recoupment; risks of a grounding of all or a portion of the

Company’s fleet for extended periods of time or indefinitely; risks that the Company’s customers reduce or cancel contracted services or

tender processes; the Company’s reliance on a small number of helicopter manufacturers and suppliers; risks associated with political

instability, governmental action, war, acts of terrorism and changes in the economic condition in any foreign country where the Company

does business, which may result in expropriation, nationalization, confiscation or deprivation of our assets or result in claims of a force

majeure situation; the impact of declines in the global economy and financial markets; the impact of fluctuations in foreign currency exchange

rates on the Company’s cost to purchase helicopters, spare parts and related services and on asset values; the Company’s credit risk

exposure; the Company’s ongoing need to replace aging helicopters; the Company’s reliance on the secondary helicopter market to dispose

of older helicopters; the Company’s reliance on information technology; the impact of allocation of risk between the Company and its

customers; the liability, legal fees and costs in connection with providing emergency response services; risks associated with the Company’s

debt structure; the impact of operational and financial difficulties of the Company’s joint ventures and partners; conflict with the other owners

of the Company’s non-wholly owned subsidiaries and other equity investees; adverse results of legal proceedings; adverse weather

conditions and seasonality; the Company’s ability to obtain insurance coverage and the adequacy and availability of such coverage; the

possibility of labor problems; the attraction and retention of qualified personnel; restrictions on the amount of foreign ownership of the

Company’s common stock; and various other matters and factors, many of which are beyond the Company’s control. These factors are not

exhaustive, and new factors may emerge or changes to the foregoing factors may occur that could impact the Company’s business. Except

to the extent required by law, the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result

of new information, future events or otherwise.

3

This presentation includes EBITDA and Adjusted EBITDA as supplemental measures of the Company’s operating performance.

EBITDA is defined as Earnings before Interest (includes interest income, interest expense and interest expense on advances from

SEACOR), Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for SEACOR Management

Fees and certain other special items that occurred during the reporting period. Neither EBITDA nor Adjusted EBITDA is a recognized

term under generally accepted accounting principles in the U.S. (“GAAP”). Accordingly, they should not be used as an indicator of, or

an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to

be a measure of free cash flow available for discretionary use, as they do not take into account certain cash requirements, such as debt

service requirements. EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation,

nor as a substitute for analysis of the Company’s results as reported under GAAP. Because the definitions of EBITDA and Adjusted

EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled

measures used by other companies. The Company also presents net debt, which is a non-GAAP measure, defined as total debt less

cash and cash equivalents. Each of these non-GAAP measures has limitations and therefore should not be used in isolation or as a

substitute for the amounts reported in accordance with GAAP.

A reconciliation of EBITDA, Adjusted EBITDA, Adjusted EBITDA further adjusted to exclude gains on asset dispositions and net debt is

included in this presentation.

This presentation also includes the Company’s interest coverage ratio and senior secured leverage ratio. The interest coverage ratio is

the ratio for the most recently ended four consecutive fiscal quarters of EBITDA (as defined in the Company’s credit facility) less

dividends and distributions and the amount of any cash proceeds received from the sale of assets included in EBITDA divided by

interest expense. The senior secured leverage ratio is calculated by dividing senior secured debt (as defined in the Company’s credit

facility) by EBITDA. Neither the interest coverage ratio nor the senior secured leverage ratio is a measure of operating performance or

liquidity defined by GAAP and may not be comparable to similarly titled measures presented by other companies. EBITDA is

calculated under the Company’s credit facility (as amended) differently than as presented elsewhere in this presentation.

Non-GAAP Financial Measures Reconciliation

4

Operational Highlights

• Safety is Era’s most important core value and highest operational priority

• Since its founding, HeliOffshore has grown to over 100 members from around the world

− Coordinating information exchange amongst industry participants regarding the operational suspension of H225 (also

known as EC225LP) and AS332 L2 helicopters

• On October 7, 2016, the European Aviation Safety Agency issued an Airworthiness Directive which provides for additional

maintenance and inspection requirements to allow H225 and AS332 L2 model helicopters to return to service

− It is unknown at this time if other jurisdictions such as Norway, the United Kingdom or the United States will allow

these helicopters to return to service

− As of October 28, 2016, we believe there are no H225 or AS332L2 helicopters operating in offshore oil and gas

missions

• Era owns 9 H225 helicopters: 5 located in the U.S., 3 located in Brazil and 1 located in Norway

− As of September 30, 2016, the net book value of these H225 helicopters and related inventory was $162.4 million

− It is too early to estimate the extent and duration of the H225 and AS332 L2 operational suspension, the market

receptivity to these models for future offshore oil and gas operations, the potential impact on asset values, and the

impact a long-term suspension could have on our results of operations or financial condition

• Era has implemented measures to reduce its H225-related expenses as much as possible including placing the helicopters

in long-term storage, reducing and reassigning staff and withdrawing from maintenance programs

− Era has exited power-by-the-hour “PBH” agreements for its H225 airframes and engines, which resulted in $5.7

million of credits in Q3 2016 and an additional $3.8 million of credits that are expected to be to be realized over the

next 5-6 quarters

5

Safety Update and H225 / AS332 L2 Suspension

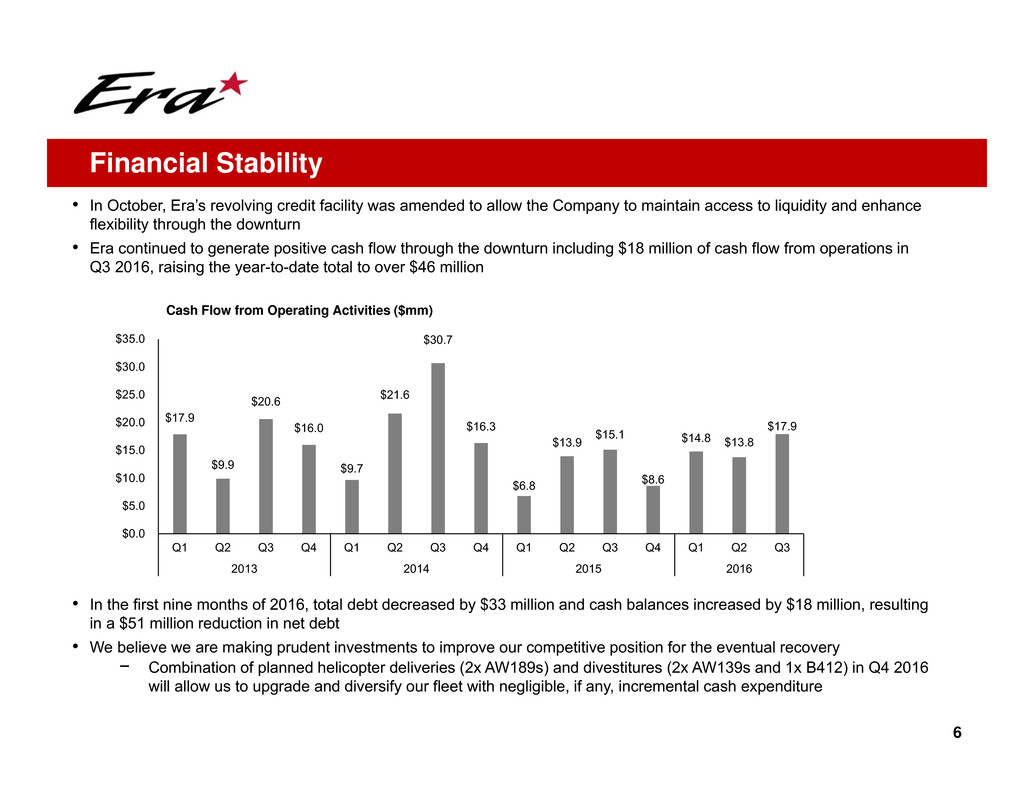

• In October, Era’s revolving credit facility was amended to allow the Company to maintain access to liquidity and enhance

flexibility through the downturn

• Era continued to generate positive cash flow through the downturn including $18 million of cash flow from operations in

Q3 2016, raising the year-to-date total to over $46 million

Cash Flow from Operating Activities ($mm)

• In the first nine months of 2016, total debt decreased by $33 million and cash balances increased by $18 million, resulting

in a $51 million reduction in net debt

• We believe we are making prudent investments to improve our competitive position for the eventual recovery

− Combination of planned helicopter deliveries (2x AW189s) and divestitures (2x AW139s and 1x B412) in Q4 2016

will allow us to upgrade and diversify our fleet with negligible, if any, incremental cash expenditure

$17.9

$9.9

$20.6

$16.0

$9.7

$21.6

$30.7

$16.3

$6.8

$13.9

$15.1

$8.6

$14.8 $13.8

$17.9

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

2013 2014 2015 2016

6

Financial Stability

7

Financial Review

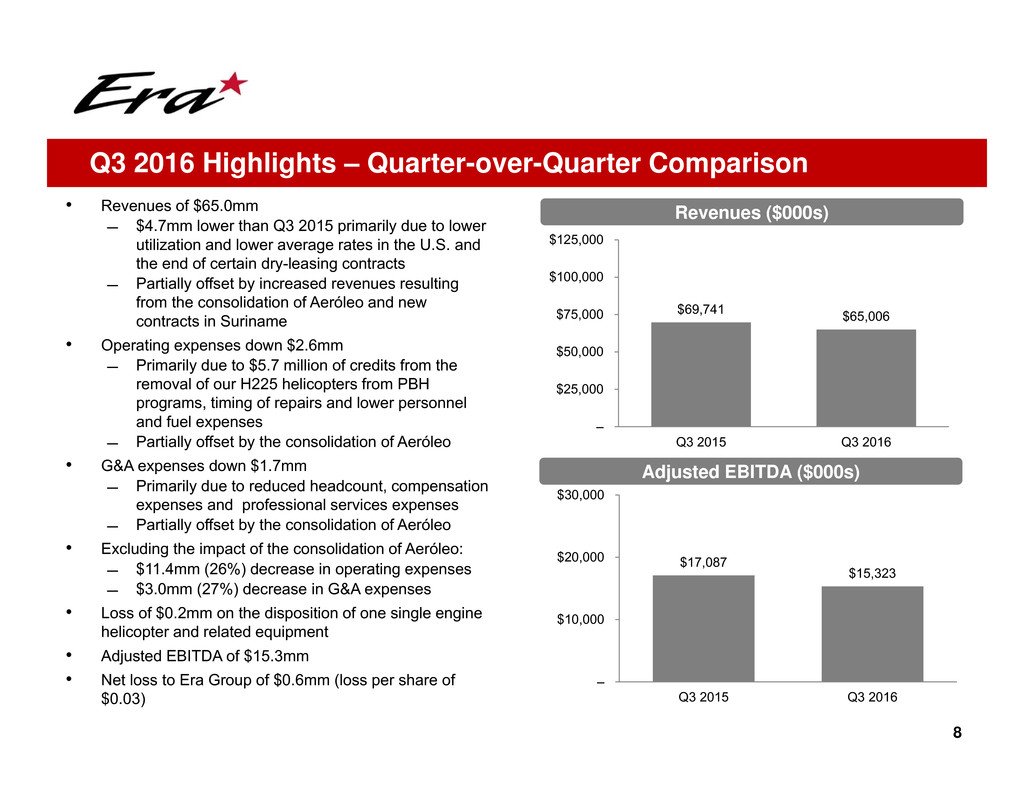

• Revenues of $65.0mm

̶ $4.7mm lower than Q3 2015 primarily due to lower

utilization and lower average rates in the U.S. and

the end of certain dry-leasing contracts

̶ Partially offset by increased revenues resulting

from the consolidation of Aeróleo and new

contracts in Suriname

• Operating expenses down $2.6mm

̶ Primarily due to $5.7 million of credits from the

removal of our H225 helicopters from PBH

programs, timing of repairs and lower personnel

and fuel expenses

̶ Partially offset by the consolidation of Aeróleo

• G&A expenses down $1.7mm

̶ Primarily due to reduced headcount, compensation

expenses and professional services expenses

̶ Partially offset by the consolidation of Aeróleo

• Excluding the impact of the consolidation of Aeróleo:

̶ $11.4mm (26%) decrease in operating expenses

̶ $3.0mm (27%) decrease in G&A expenses

• Loss of $0.2mm on the disposition of one single engine

helicopter and related equipment

• Adjusted EBITDA of $15.3mm

• Net loss to Era Group of $0.6mm (loss per share of

$0.03)

8

Q3 2016 Highlights – Quarter-over-Quarter Comparison

Revenues ($000s)

Adjusted EBITDA ($000s)

$17,087

$15,323

–

$10,000

$20,000

$30,000

Q3 2015 Q3 2016

$69,741 $65,006

–

$25,000

$50,000

$75,000

$100,000

$125,000

Q3 2015 Q3 2016

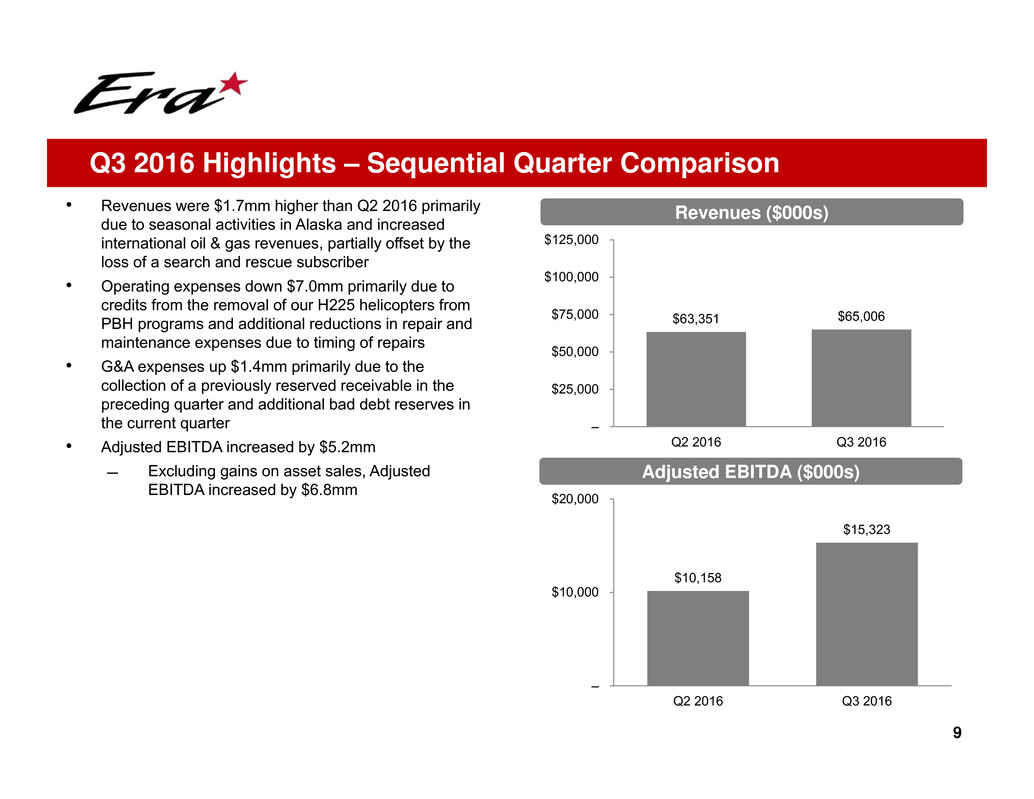

• Revenues were $1.7mm higher than Q2 2016 primarily

due to seasonal activities in Alaska and increased

international oil & gas revenues, partially offset by the

loss of a search and rescue subscriber

• Operating expenses down $7.0mm primarily due to

credits from the removal of our H225 helicopters from

PBH programs and additional reductions in repair and

maintenance expenses due to timing of repairs

• G&A expenses up $1.4mm primarily due to the

collection of a previously reserved receivable in the

preceding quarter and additional bad debt reserves in

the current quarter

• Adjusted EBITDA increased by $5.2mm

̶ Excluding gains on asset sales, Adjusted

EBITDA increased by $6.8mm

9

Q3 2016 Highlights – Sequential Quarter Comparison

Revenues ($000s)

Adjusted EBITDA ($000s)

$10,158

$15,323

–

$10,000

$20,000

Q2 2016 Q3 2016

$63,351 $65,006

–

$25,000

$50,000

$75,000

$100,000

$125,000

Q2 2016 Q3 2016

10

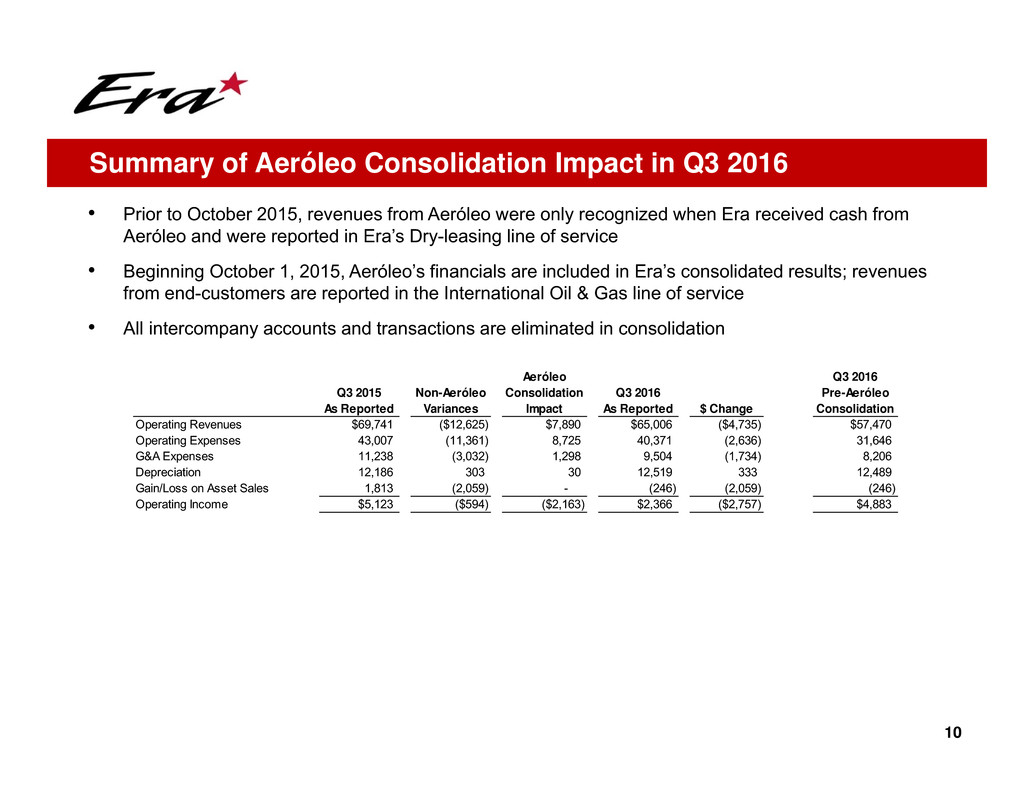

• Prior to October 2015, revenues from Aeróleo were only recognized when Era received cash from

Aeróleo and were reported in Era’s Dry-leasing line of service

• Beginning October 1, 2015, Aeróleo’s financials are included in Era’s consolidated results; revenues

from end-customers are reported in the International Oil & Gas line of service

• All intercompany accounts and transactions are eliminated in consolidation

Summary of Aeróleo Consolidation Impact in Q3 2016

Q3 2015

As Reported

Non-Aeróleo

Variances

Aeróleo

Consolidation

Impact

Q3 2016

As Reported $ Change

Q3 2016

Pre-Aeróleo

Consolidation

Operating Revenues $69,741 ($12,625) $7,890 $65,006 ($4,735) $57,470

Operating Expenses 43,007 (11,361) 8,725 40,371 (2,636) 31,646

G&A Expenses 11,238 (3,032) 1,298 9,504 (1,734) 8,206

Depreciation 12,186 303 30 12,519 333 12,489

Gain/Loss on Asset Sales 1,813 (2,059) - (246) (2,059) (246)

Operating Income $5,123 ($594) ($2,163) $2,366 ($2,757) $4,883

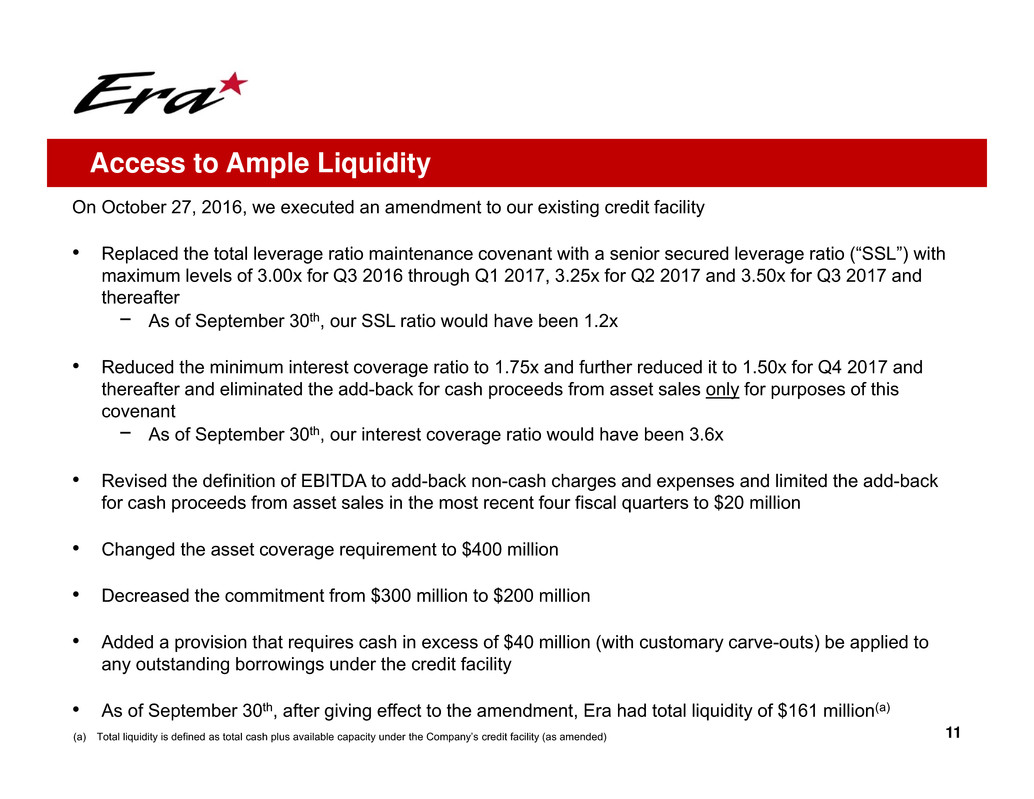

On October 27, 2016, we executed an amendment to our existing credit facility

• Replaced the total leverage ratio maintenance covenant with a senior secured leverage ratio (“SSL”) with

maximum levels of 3.00x for Q3 2016 through Q1 2017, 3.25x for Q2 2017 and 3.50x for Q3 2017 and

thereafter

− As of September 30th, our SSL ratio would have been 1.2x

• Reduced the minimum interest coverage ratio to 1.75x and further reduced it to 1.50x for Q4 2017 and

thereafter and eliminated the add-back for cash proceeds from asset sales only for purposes of this

covenant

− As of September 30th, our interest coverage ratio would have been 3.6x

• Revised the definition of EBITDA to add-back non-cash charges and expenses and limited the add-back

for cash proceeds from asset sales in the most recent four fiscal quarters to $20 million

• Changed the asset coverage requirement to $400 million

• Decreased the commitment from $300 million to $200 million

• Added a provision that requires cash in excess of $40 million (with customary carve-outs) be applied to

any outstanding borrowings under the credit facility

• As of September 30th, after giving effect to the amendment, Era had total liquidity of $161 million(a)

11(a) Total liquidity is defined as total cash plus available capacity under the Company’s credit facility (as amended)

Access to Ample Liquidity

12

Appendix

13

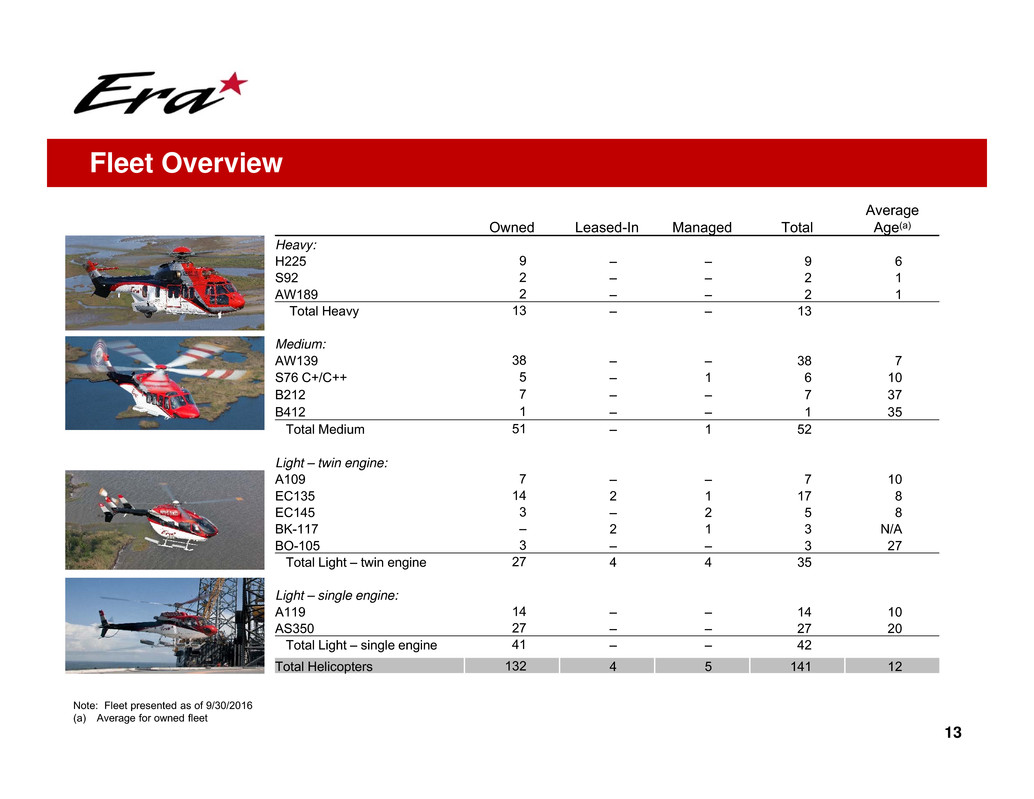

Owned Leased-In Managed Total

Average

Age(a)

Heavy:

H225 9 – – 9 6

S92 2 – – 2 1

AW189 2 – – 2 1

Total Heavy 13 – – 13

Medium:

AW139 38 – – 38 7

S76 C+/C++ 5 – 1 6 10

B212 7 – – 7 37

B412 1 – – 1 35

Total Medium 51 – 1 52

Light – twin engine:

A109 7 – – 7 10

EC135 14 2 1 17 8

EC145 3 – 2 5 8

BK-117 – 2 1 3 N/A

BO-105 3 – – 3 27

Total Light – twin engine 27 4 4 35

Light – single engine:

A119 14 – – 14 10

AS350 27 – – 27 20

Total Light – single engine 41 – – 42

Total Helicopters 132 4 5 141 12

Note: Fleet presented as of 9/30/2016

(a) Average for owned fleet

Fleet Overview

14

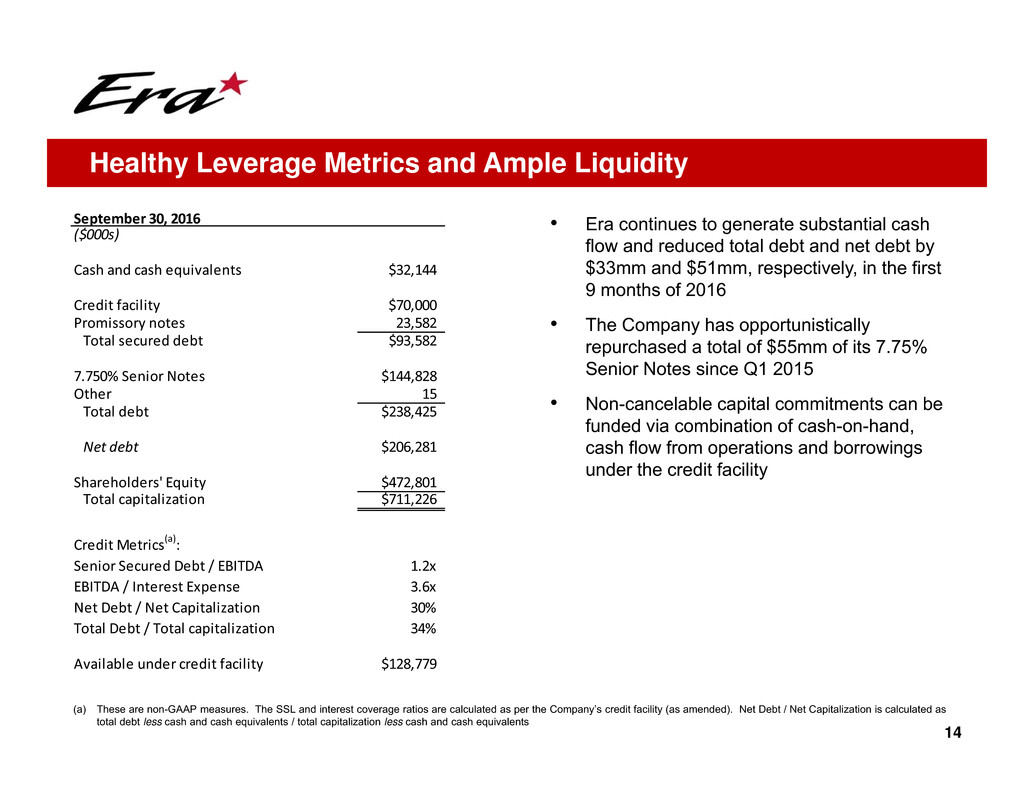

• Era continues to generate substantial cash

flow and reduced total debt and net debt by

$33mm and $51mm, respectively, in the first

9 months of 2016

• The Company has opportunistically

repurchased a total of $55mm of its 7.75%

Senior Notes since Q1 2015

• Non-cancelable capital commitments can be

funded via combination of cash-on-hand,

cash flow from operations and borrowings

under the credit facility

Healthy Leverage Metrics and Ample Liquidity

(a) These are non-GAAP measures. The SSL and interest coverage ratios are calculated as per the Company’s credit facility (as amended). Net Debt / Net Capitalization is calculated as

total debt less cash and cash equivalents / total capitalization less cash and cash equivalents

September 30, 2016

($000s)

Cash and cash equivalents $32,144

Credit facility $70,000

Promissory notes 23,582

Total secured debt $93,582

7.750% Senior Notes $144,828

Other 15

Total debt $238,425

Net debt $206,281

Shareholders' Equity $472,801

Total capitalization $711,226

Credit Metrics(a):

Senior Secured Debt / EBITDA 1.2x

EBITDA / Interest Expense 3.6x

Net Debt / Net Capitalization 30%

Total Debt / Total capitalization 34%

Available under credit facility $128,779

15

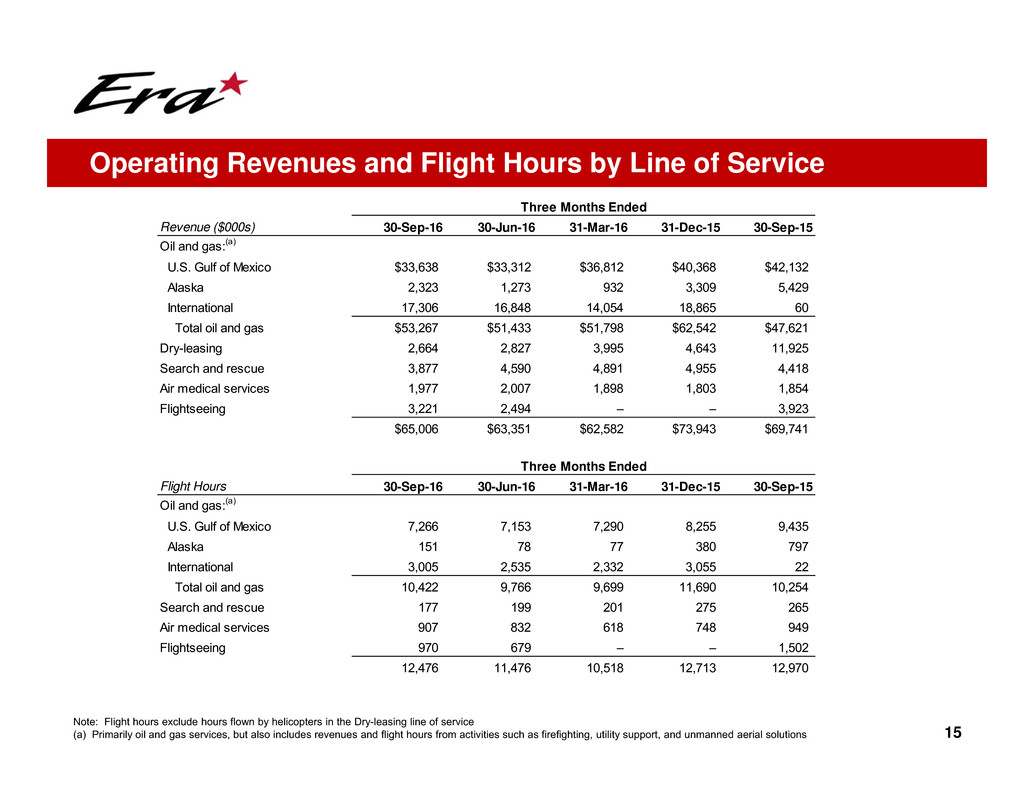

Operating Revenues and Flight Hours by Line of Service

Note: Flight hours exclude hours flown by helicopters in the Dry-leasing line of service

(a) Primarily oil and gas services, but also includes revenues and flight hours from activities such as firefighting, utility support, and unmanned aerial solutions

Three Months Ended

Revenue ($000s) 30-Sep-16 30-Jun-16 31-Mar-16 31-Dec-15 30-Sep-15

Oil and gas:(a)

U.S. Gulf of Mexico $33,638 $33,312 $36,812 $40,368 $42,132

Alaska 2,323 1,273 932 3,309 5,429

International 17,306 16,848 14,054 18,865 60

Total oil and gas $53,267 $51,433 $51,798 $62,542 $47,621

Dry-leasing 2,664 2,827 3,995 4,643 11,925

Search and rescue 3,877 4,590 4,891 4,955 4,418

Air medical services 1,977 2,007 1,898 1,803 1,854

Flightseeing 3,221 2,494 – – 3,923

$65,006 $63,351 $62,582 $73,943 $69,741

Three Months Ended

Flight Hours 30-Sep-16 30-Jun-16 31-Mar-16 31-Dec-15 30-Sep-15

Oil and gas:(a)

U.S. Gulf of Mexico 7,266 7,153 7,290 8,255 9,435

Alaska 151 78 77 380 797

International 3,005 2,535 2,332 3,055 22

Total oil and gas 10,422 9,766 9,699 11,690 10,254

Search and rescue 177 199 201 275 265

Air medical services 907 832 618 748 949

Flightseeing 970 679 – – 1,502

12,476 11,476 10,518 12,713 12,970

16

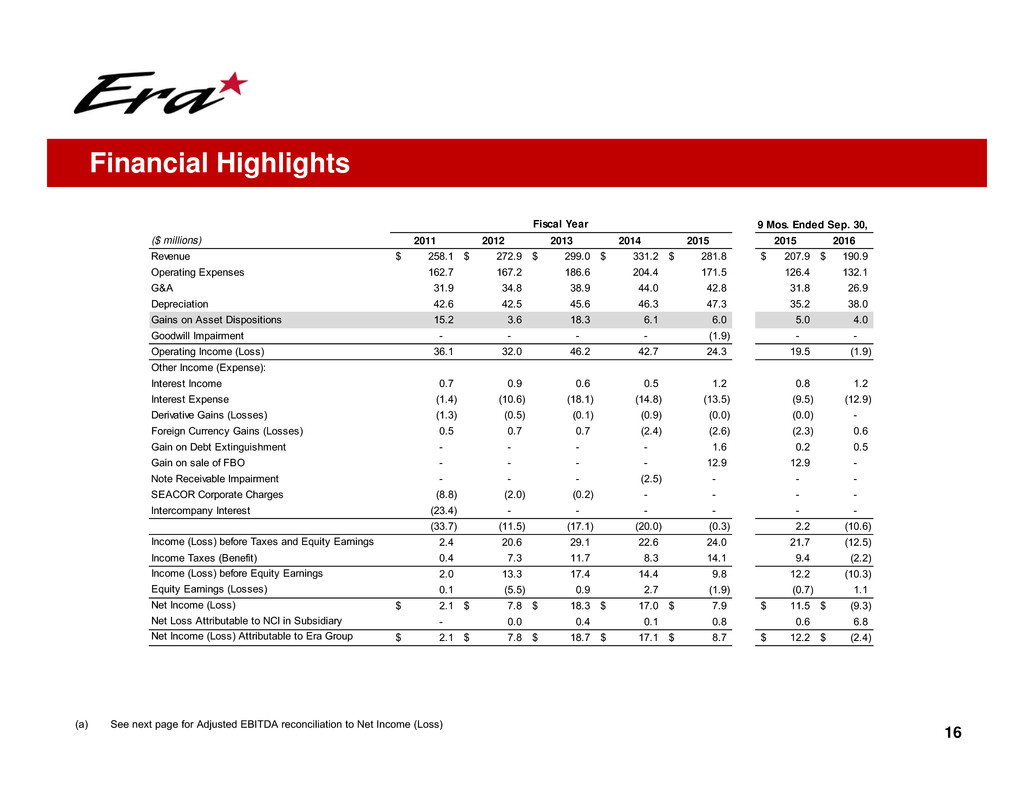

(a) See next page for Adjusted EBITDA reconciliation to Net Income (Loss)

Financial Highlights

Fiscal Year 9 Mos. Ended Sep. 30,

($ millions) 2011 2012 2013 2014 2015 2015 2016

Revenue 258.1$ 272.9$ 299.0$ 331.2$ 281.8$ 207.9$ 190.9$

Operating Expenses 162.7 167.2 186.6 204.4 171.5 126.4 132.1

G&A 31.9 34.8 38.9 44.0 42.8 31.8 26.9

Depreciation 42.6 42.5 45.6 46.3 47.3 35.2 38.0

Gains on Asset Dispositions 15.2 3.6 18.3 6.1 6.0 5.0 4.0

Goodwill Impairment - - - - (1.9) - -

Operating Income (Loss) 36.1 32.0 46.2 42.7 24.3 19.5 (1.9)

Other Income (Expense):

Interest Income 0.7 0.9 0.6 0.5 1.2 0.8 1.2

Interest Expense (1.4) (10.6) (18.1) (14.8) (13.5) (9.5) (12.9)

Derivative Gains (Losses) (1.3) (0.5) (0.1) (0.9) (0.0) (0.0) -

Foreign Currency Gains (Losses) 0.5 0.7 0.7 (2.4) (2.6) (2.3) 0.6

Gain on Debt Extinguishment - - - - 1.6 0.2 0.5

Gain on sale of FBO - - - - 12.9 12.9 -

Note Receivable Impairment - - - (2.5) - - -

SEACOR Corporate Charges (8.8) (2.0) (0.2) - - - -

Intercompany Interest (23.4) - - - - - -

(33.7) (11.5) (17.1) (20.0) (0.3) 2.2 (10.6)

Income (Loss) before Taxes and Equity Earnings 2.4 20.6 29.1 22.6 24.0 21.7 (12.5)

Income Taxes (Benefit) 0.4 7.3 11.7 8.3 14.1 9.4 (2.2)

Income (Loss) before Equity Earnings 2.0 13.3 17.4 14.4 9.8 12.2 (10.3)

Equity Earnings (Losses) 0.1 (5.5) 0.9 2.7 (1.9) (0.7) 1.1

Net Income (Loss) 2.1$ 7.8$ 18.3$ 17.0$ 7.9$ 11.5$ (9.3)$

Net Loss Attributable to NCI in Subsidiary - 0.0 0.4 0.1 0.8 0.6 6.8

Net Income (Loss) Attributable to Era Group 2.1$ 7.8$ 18.7$ 17.1$ 8.7$ 12.2$ (2.4)$

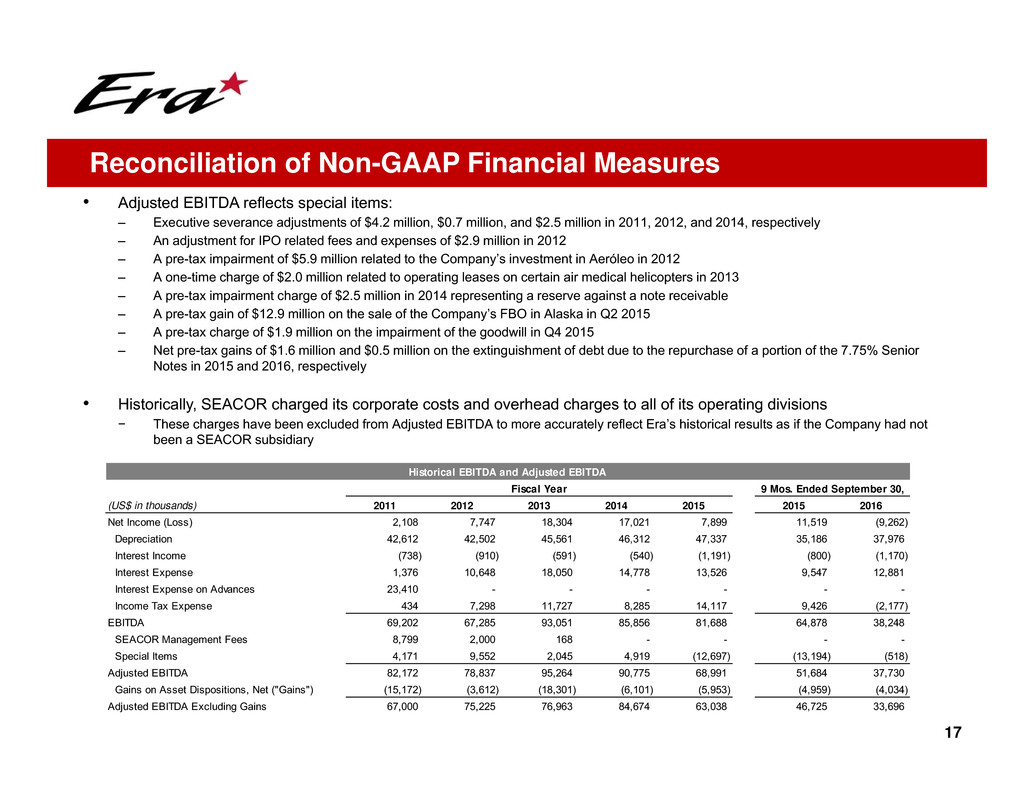

• Adjusted EBITDA reflects special items:

– Executive severance adjustments of $4.2 million, $0.7 million, and $2.5 million in 2011, 2012, and 2014, respectively

– An adjustment for IPO related fees and expenses of $2.9 million in 2012

– A pre-tax impairment of $5.9 million related to the Company’s investment in Aeróleo in 2012

– A one-time charge of $2.0 million related to operating leases on certain air medical helicopters in 2013

– A pre-tax impairment charge of $2.5 million in 2014 representing a reserve against a note receivable

– A pre-tax gain of $12.9 million on the sale of the Company’s FBO in Alaska in Q2 2015

– A pre-tax charge of $1.9 million on the impairment of the goodwill in Q4 2015

– Net pre-tax gains of $1.6 million and $0.5 million on the extinguishment of debt due to the repurchase of a portion of the 7.75% Senior

Notes in 2015 and 2016, respectively

• Historically, SEACOR charged its corporate costs and overhead charges to all of its operating divisions

− These charges have been excluded from Adjusted EBITDA to more accurately reflect Era’s historical results as if the Company had not

been a SEACOR subsidiary

17

Reconciliation of Non-GAAP Financial Measures

Historical EBITDA and Adjusted EBITDA

Fiscal Year 9 Mos. Ended September 30,

(US$ in thousands) 2011 2012 2013 2014 2015 2015 2016

Net Income (Loss) 2,108 7,747 18,304 17,021 7,899 11,519 (9,262)

Depreciation 42,612 42,502 45,561 46,312 47,337 35,186 37,976

Interest Income (738) (910) (591) (540) (1,191) (800) (1,170)

Interest Expense 1,376 10,648 18,050 14,778 13,526 9,547 12,881

Interest Expense on Advances 23,410 - - - - - -

Income Tax Expense 434 7,298 11,727 8,285 14,117 9,426 (2,177)

EBITDA 69,202 67,285 93,051 85,856 81,688 64,878 38,248

SEACOR Management Fees 8,799 2,000 168 - - - -

Special Items 4,171 9,552 2,045 4,919 (12,697) (13,194) (518)

Adjusted EBITDA 82,172 78,837 95,264 90,775 68,991 51,684 37,730

Gains on Asset Dispositions, Net ("Gains") (15,172) (3,612) (18,301) (6,101) (5,953) (4,959) (4,034)

Adjusted EBITDA Excluding Gains 67,000 75,225 76,963 84,674 63,038 46,725 33,696

18

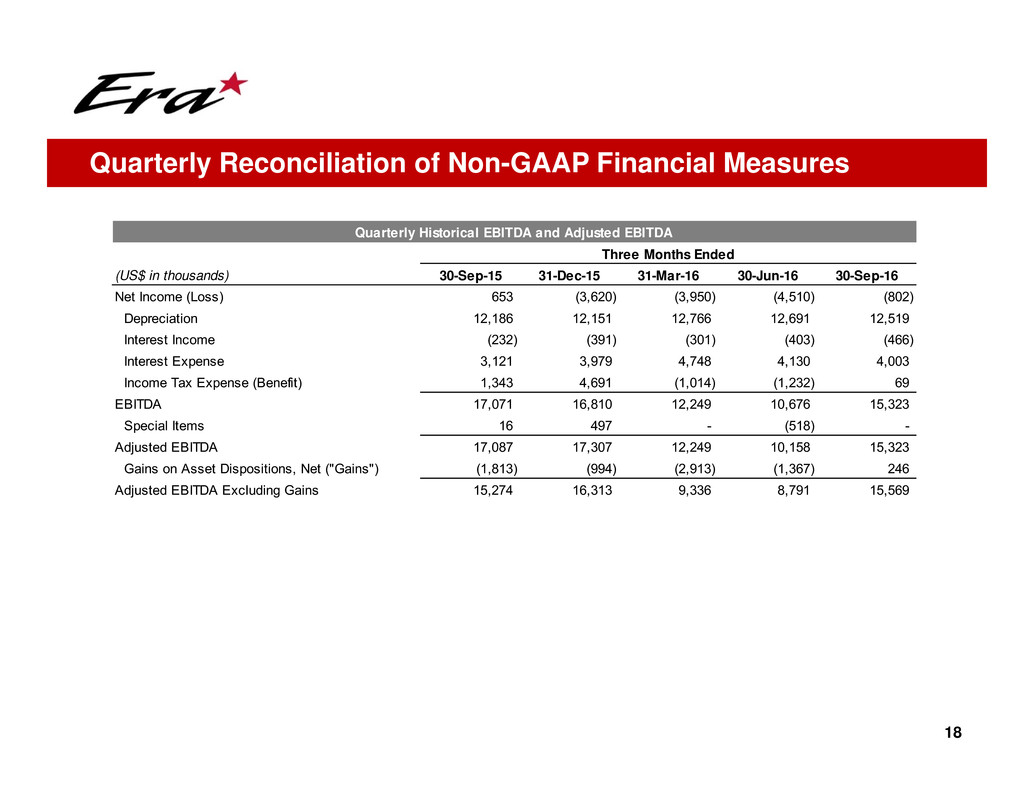

Quarterly Reconciliation of Non-GAAP Financial Measures

Quarterly Historical EBITDA and Adjusted EBITDA

Three Months Ended

(US$ in thousands) 30-Sep-15 31-Dec-15 31-Mar-16 30-Jun-16 30-Sep-16

Net Income (Loss) 653 (3,620) (3,950) (4,510) (802)

Depreciation 12,186 12,151 12,766 12,691 12,519

Interest Income (232) (391) (301) (403) (466)

Interest Expense 3,121 3,979 4,748 4,130 4,003

Income Tax Expense (Benefit) 1,343 4,691 (1,014) (1,232) 69

EBITDA 17,071 16,810 12,249 10,676 15,323

Special Items 16 497 - (518) -

Adjusted EBITDA 17,087 17,307 12,249 10,158 15,323

Gains on Asset Dispositions, Net ("Gains") (1,813) (994) (2,913) (1,367) 246

Adjusted EBITDA Excluding Gains 15,274 16,313 9,336 8,791 15,569