Q4 and FY2016 Earnings Presentation

0March 16, 2017

I. Introduction Shefali Shah, SVP and General Counsel

II. Operational Highlights Chris Bradshaw, President and CEO

III. Financial Review Andy Puhala, SVP and CFO

IV. Concluding Remarks Chris Bradshaw, President and CEO

V. Questions & Answers

Q4 and FY2016 Earnings Call Agenda

1

2

Cautionary Statement Regarding Forward-Looking Statements

This presentation contains “forward-looking statements.” Forward-looking statements give the Company’s current expectations or forecasts of future

events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,”

“estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements reflect management’s current views with respect

to future events and are subject to risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those

anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements.

Such risks, uncertainties and other important factors include, among others, the Company’s dependence on, and the cyclical and volatile nature of,

offshore oil and gas exploration, development and production activity, and the impact of general economic conditions and fluctuations in worldwide

prices of and demand for oil and natural gas on such activity levels; the Company’s reliance on a small number of customers and the reduction of its

customer base resulting from bankruptcies or consolidation; risks that the Company’s customers reduce or cancel contracted services or tender

processes; cost savings initiatives implemented by the Company’s customers; risks inherent in operating helicopters; the Company’s ability to

maintain an acceptable safety record; the impact of increased United States (“U.S.”) and foreign government regulation and legislation, including

potential government implemented moratoriums on drilling activities; the impact of a grounding of all or a portion of the Company’s fleet for extended

periods of time or indefinitely on the Company’s business, including its operations and ability to service customers, results of operations or financial

condition and/or the market value of the affected helicopter(s); the Company’s ability to successfully expand into other geographic and aviation

service markets; risks associated with political instability, governmental action, war, acts of terrorism and changes in the economic condition in any

foreign country where the Company does business, which may result in expropriation, nationalization, confiscation or deprivation of the Company’s

assets or result in claims of a force majeure situation; the impact of declines in the global economy and financial markets; the impact of fluctuations in

foreign currency exchange rates on the Company’s asset values and cost to purchase helicopters, spare parts and related services; risks related to

investing in new lines of service without realizing the expected benefits; risks of engaging in competitive processes or expending significant resources

for strategic opportunities, with no guaranty of recoupment; the Company’s reliance on a small number of helicopter manufacturers and suppliers; the

Company’s ongoing need to replace aging helicopters; the Company’s reliance on the secondary helicopter market to dispose of older helicopters;

the Company’s reliance on information technology; the impact of allocation of risk between the Company and its customers; the liability, legal fees

and costs in connection with providing emergency response services; adverse weather conditions and seasonality; risks associated with the

Company’s debt structure; the Company’s counterparty credit risk exposure; the impact of operational and financial difficulties of the Company’s joint

ventures and partners and the risks associated with identifying and securing joint venture partners when needed; conflict with the other owners of the

Company’s non-wholly owned subsidiaries and other equity investees; adverse results of legal proceedings; the Company’s ability to obtain

insurance coverage and the adequacy and availability of such coverage; the Company’s ability to remediate the material weakness in its internal

controls over financial reporting described in “Item 9A. Controls and Procedures” of its Annual Report on Form 10-K for the year ended December 31,

2016; the possibility of labor problems; the attraction and retention of qualified personnel; restrictions on the amount of foreign ownership of the

Company’s common stock; and various other matters and factors, many of which are beyond the Company’s control. These factors are not

exhaustive, and new factors may emerge or changes to the foregoing factors may occur that could impact the Company’s business. Except to the

extent required by law, the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

3

This presentation includes EBITDA and Adjusted EBITDA as supplemental measures of the Company’s operating performance.

EBITDA is defined as Earnings before Interest (includes interest income and interest expense), Taxes, Depreciation and Amortization.

Adjusted EBITDA is defined as EBITDA further adjusted for SEACOR Management Fees and certain other special items that occurred

during the reporting period. Neither EBITDA nor Adjusted EBITDA is a recognized term under generally accepted accounting principles

in the U.S. (“GAAP”). Accordingly, they should not be used as an indicator of, or an alternative to, net income as a measure of

operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be a measure of free cash flow available for

discretionary use, as they do not take into account certain cash requirements, such as debt service requirements. EBITDA and

Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, nor as a substitute for analysis of

the Company’s results as reported under GAAP. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may

vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. The

Company also presents net debt, which is a non-GAAP measure, defined as total principal balance on borrowings less cash and cash

equivalents, including escrow balances. Each of these non-GAAP measures has limitations and therefore should not be used in

isolation or as a substitute for the amounts reported in accordance with GAAP.

A reconciliation of EBITDA, Adjusted EBITDA, Adjusted EBITDA further adjusted to exclude gains on asset dispositions and net debt is

included in this presentation.

This presentation also includes the Company’s interest coverage ratio and senior secured leverage ratio. The interest coverage ratio is

the ratio for the most recently ended four consecutive fiscal quarters of EBITDA (as defined in the Company’s credit facility) less

dividends and distributions and the amount of any cash proceeds received from the sale of assets included in EBITDA divided by

interest expense. The senior secured leverage ratio is calculated by dividing senior secured debt (as defined in the Company’s credit

facility) by EBITDA. Neither the interest coverage ratio nor the senior secured leverage ratio is a measure of operating performance or

liquidity defined by GAAP and may not be comparable to similarly titled measures presented by other companies. EBITDA is

calculated under the Company’s credit facility (as amended) differently than as presented elsewhere in this presentation.

Non-GAAP Financial Measures Reconciliation

4

Operational Highlights

• Safety is Era’s most important core value and highest operational priority

• Following a fatal accident in April 2016 involving an Airbus Helicopters H225 (also known as a EC225LP) model helicopter operated by

another helicopter company, the European Aviation Safety Agency issued an Airworthiness Directive on October 7, 2016 that provides for

additional maintenance and inspection requirements to allow H225 and AS332 L2 model helicopters to return to service, and the Federal

Aviation Administration issued an Alternative Means of Compliance on December 9, 2016 that also provides for additional maintenance

and inspection requirements to allow these helicopters to return to service in the United States

− The Civil Aviation Authorities in Norway and the United Kingdom, the major European markets for the H225, have not allowed

these helicopters to return to service

− Since the accident, H225 helicopters have only returned to service in oil and gas missions in a few countries in Asia

• The Accident Investigation Board Norway (AIBN) published interim reports of the investigation into the accident

− On March 8, 2017, the AIBN announced that the epicyclic gear 2nd stage planet gear carrier had been found and will be subject

to further investigations

− On February 2, 2017, the AIBN noted that the investigation has shown similarities with an earlier 2009 accident in Scotland and

identified certification aspects of the main gearbox and the robustness of past and present design requirements (including

follow-up on safety recommendations issued following the 2009 accident) as the primary focus of the AIBN investigation

− The AIBN announced its intention to issue a new preliminary report on April 29, 2017

• Era owns 9 H225 helicopters: 5 located in the U.S., 3 located in Brazil and 1 located in Norway

− As of December 31, 2016, the net book value of these H225 helicopters and related inventory was $160.7 million

− It is too early to estimate the extent and duration of the H225 and AS332 L2 operational suspension, the market receptivity to

these models for future offshore oil and gas operations, the potential impact on asset values, and the impact a long-term

suspension could have on our results of operations or financial condition

• In 2016, Era implemented measures to reduce its H225-related expenses as much as possible including placing the helicopters in long-

term storage, reducing and reassigning staff and withdrawing these helicopters from maintenance programs

− Era has exited power-by-the-hour “PBH” agreements for its H225 airframes and engines, which resulted in $6.4 million of credits

in 2016 and an additional $3.1 million of credits that are expected to be to be realized over the next 5-6 quarters

5

Safety Update and H225 / AS332 L2 Suspension

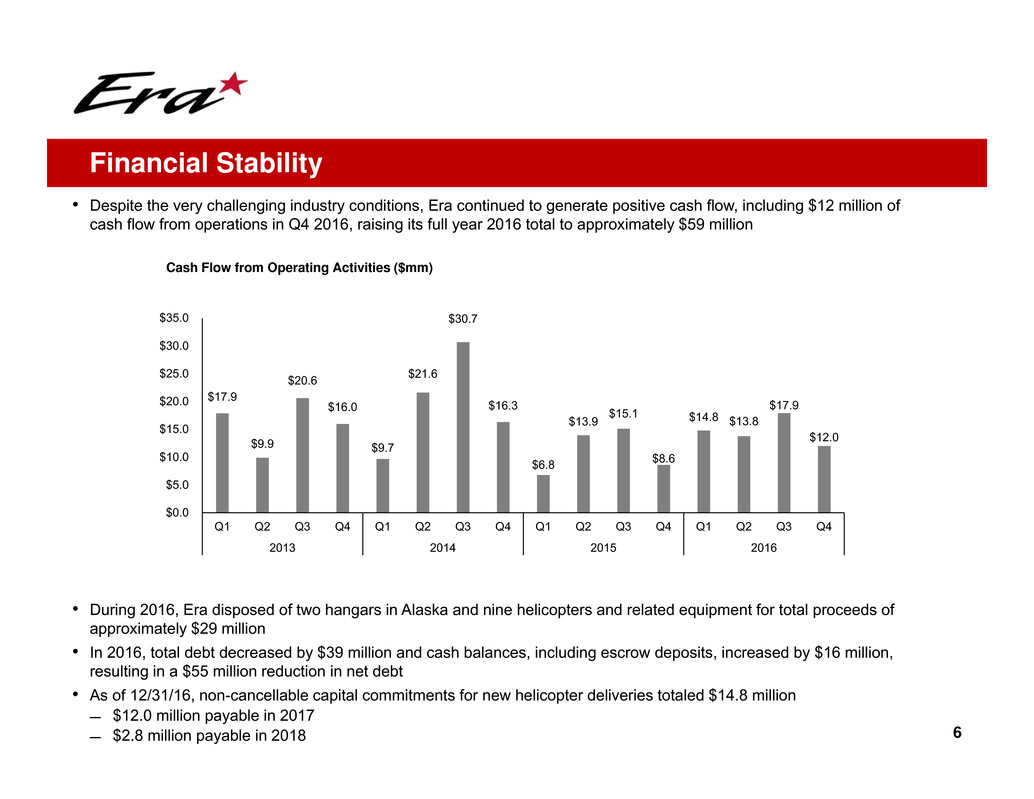

• Despite the very challenging industry conditions, Era continued to generate positive cash flow, including $12 million of

cash flow from operations in Q4 2016, raising its full year 2016 total to approximately $59 million

Cash Flow from Operating Activities ($mm)

• During 2016, Era disposed of two hangars in Alaska and nine helicopters and related equipment for total proceeds of

approximately $29 million

• In 2016, total debt decreased by $39 million and cash balances, including escrow deposits, increased by $16 million,

resulting in a $55 million reduction in net debt

• As of 12/31/16, non-cancellable capital commitments for new helicopter deliveries totaled $14.8 million

̶ $12.0 million payable in 2017

̶ $2.8 million payable in 2018 6

Financial Stability

$17.9

$9.9

$20.6

$16.0

$9.7

$21.6

$30.7

$16.3

$6.8

$13.9

$15.1

$8.6

$14.8 $13.8

$17.9

$12.0

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2013 2014 2015 2016

7

Financial Review

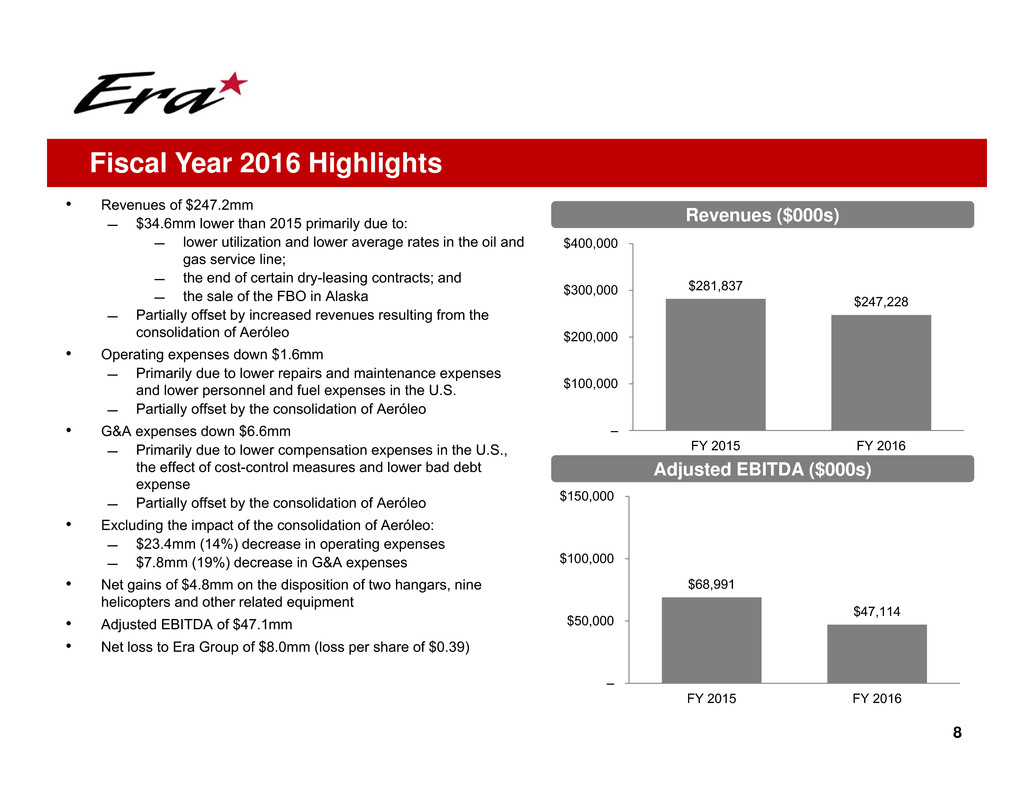

• Revenues of $247.2mm

̶ $34.6mm lower than 2015 primarily due to:

̶ lower utilization and lower average rates in the oil and

gas service line;

̶ the end of certain dry-leasing contracts; and

̶ the sale of the FBO in Alaska

̶ Partially offset by increased revenues resulting from the

consolidation of Aeróleo

• Operating expenses down $1.6mm

̶ Primarily due to lower repairs and maintenance expenses

and lower personnel and fuel expenses in the U.S.

̶ Partially offset by the consolidation of Aeróleo

• G&A expenses down $6.6mm

̶ Primarily due to lower compensation expenses in the U.S.,

the effect of cost-control measures and lower bad debt

expense

̶ Partially offset by the consolidation of Aeróleo

• Excluding the impact of the consolidation of Aeróleo:

̶ $23.4mm (14%) decrease in operating expenses

̶ $7.8mm (19%) decrease in G&A expenses

• Net gains of $4.8mm on the disposition of two hangars, nine

helicopters and other related equipment

• Adjusted EBITDA of $47.1mm

• Net loss to Era Group of $8.0mm (loss per share of $0.39)

8

Fiscal Year 2016 Highlights

Revenues ($000s)

Adjusted EBITDA ($000s)

$281,837

$247,228

–

$100,000

$200,000

$300,000

$400,000

FY 2015 FY 2016

$68,991

$47,114

–

$50,000

$100,000

$150,000

FY 2015 FY 2016

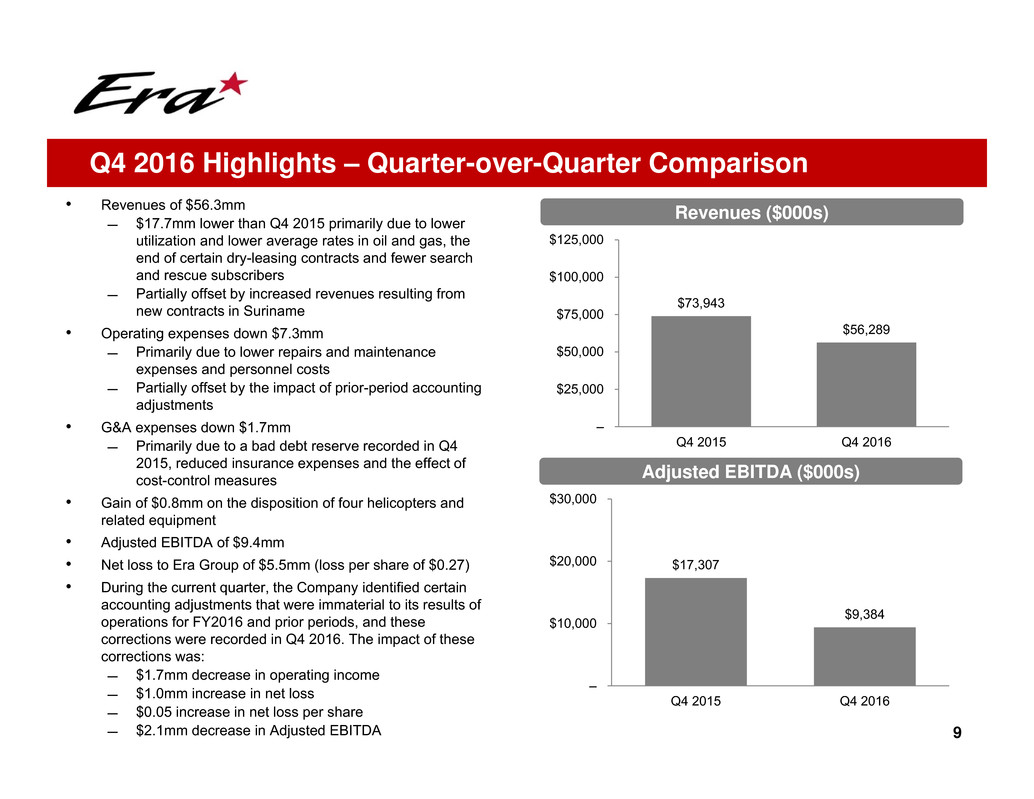

• Revenues of $56.3mm

̶ $17.7mm lower than Q4 2015 primarily due to lower

utilization and lower average rates in oil and gas, the

end of certain dry-leasing contracts and fewer search

and rescue subscribers

̶ Partially offset by increased revenues resulting from

new contracts in Suriname

• Operating expenses down $7.3mm

̶ Primarily due to lower repairs and maintenance

expenses and personnel costs

̶ Partially offset by the impact of prior-period accounting

adjustments

• G&A expenses down $1.7mm

̶ Primarily due to a bad debt reserve recorded in Q4

2015, reduced insurance expenses and the effect of

cost-control measures

• Gain of $0.8mm on the disposition of four helicopters and

related equipment

• Adjusted EBITDA of $9.4mm

• Net loss to Era Group of $5.5mm (loss per share of $0.27)

• During the current quarter, the Company identified certain

accounting adjustments that were immaterial to its results of

operations for FY2016 and prior periods, and these

corrections were recorded in Q4 2016. The impact of these

corrections was:

̶ $1.7mm decrease in operating income

̶ $1.0mm increase in net loss

̶ $0.05 increase in net loss per share

̶ $2.1mm decrease in Adjusted EBITDA 9

Q4 2016 Highlights – Quarter-over-Quarter Comparison

Revenues ($000s)

Adjusted EBITDA ($000s)

$73,943

$56,289

–

$25,000

$50,000

$75,000

$100,000

$125,000

Q4 2015 Q4 2016

$17,307

$9,384

–

$10,000

$20,000

$30,000

Q4 2015 Q4 2016

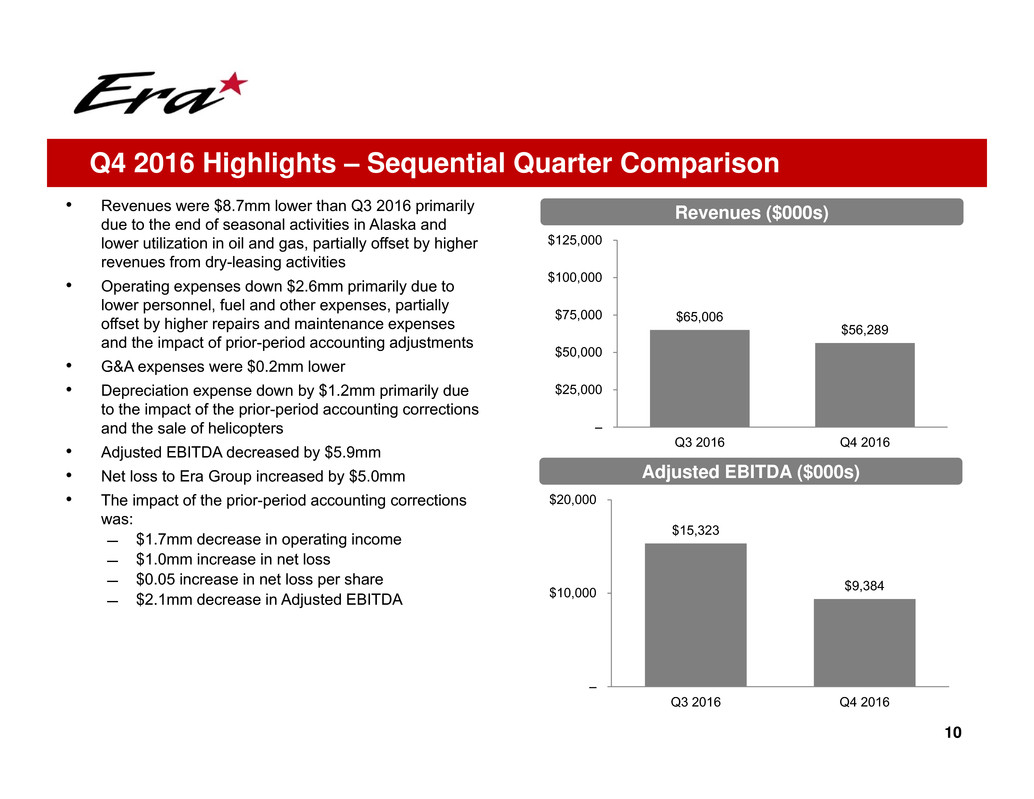

• Revenues were $8.7mm lower than Q3 2016 primarily

due to the end of seasonal activities in Alaska and

lower utilization in oil and gas, partially offset by higher

revenues from dry-leasing activities

• Operating expenses down $2.6mm primarily due to

lower personnel, fuel and other expenses, partially

offset by higher repairs and maintenance expenses

and the impact of prior-period accounting adjustments

• G&A expenses were $0.2mm lower

• Depreciation expense down by $1.2mm primarily due

to the impact of the prior-period accounting corrections

and the sale of helicopters

• Adjusted EBITDA decreased by $5.9mm

• Net loss to Era Group increased by $5.0mm

• The impact of the prior-period accounting corrections

was:

̶ $1.7mm decrease in operating income

̶ $1.0mm increase in net loss

̶ $0.05 increase in net loss per share

̶ $2.1mm decrease in Adjusted EBITDA

10

Q4 2016 Highlights – Sequential Quarter Comparison

Revenues ($000s)

Adjusted EBITDA ($000s)

$65,006

$56,289

–

$25,000

$50,000

$75,000

$100,000

$125,000

Q3 2016 Q4 2016

$15,323

$9,384

–

$10,000

$20,000

Q3 2016 Q4 2016

11

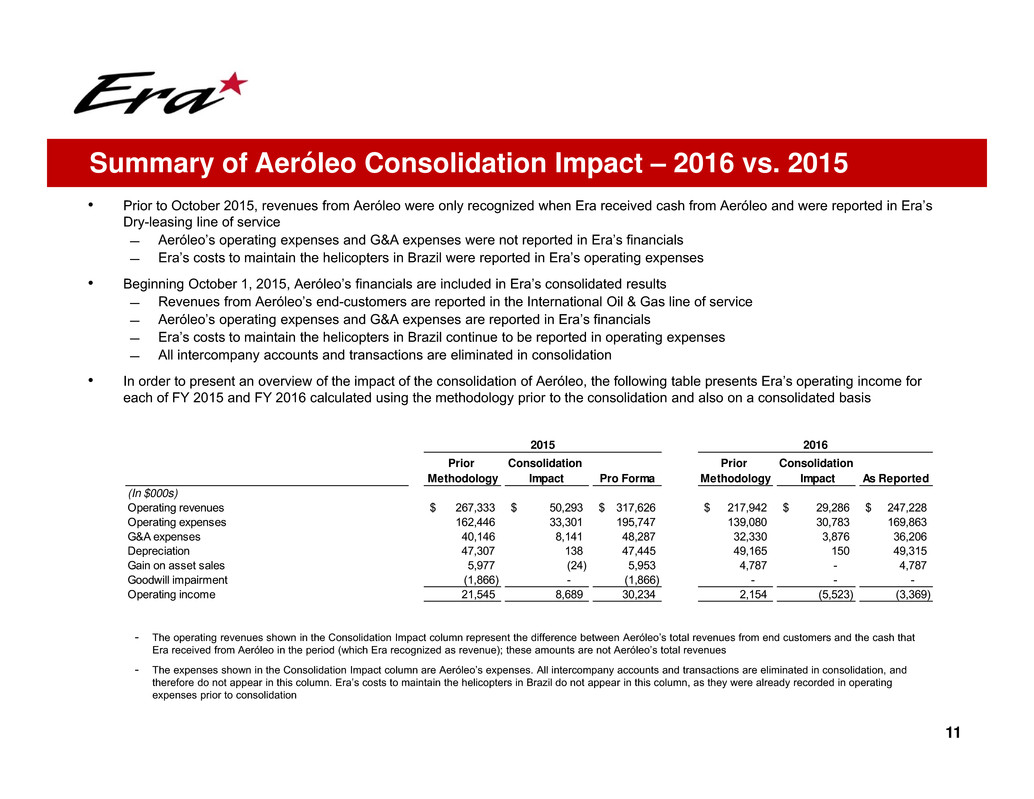

• Prior to October 2015, revenues from Aeróleo were only recognized when Era received cash from Aeróleo and were reported in Era’s

Dry-leasing line of service

̶ Aeróleo’s operating expenses and G&A expenses were not reported in Era’s financials

̶ Era’s costs to maintain the helicopters in Brazil were reported in Era’s operating expenses

• Beginning October 1, 2015, Aeróleo’s financials are included in Era’s consolidated results

̶ Revenues from Aeróleo’s end-customers are reported in the International Oil & Gas line of service

̶ Aeróleo’s operating expenses and G&A expenses are reported in Era’s financials

̶ Era’s costs to maintain the helicopters in Brazil continue to be reported in operating expenses

̶ All intercompany accounts and transactions are eliminated in consolidation

• In order to present an overview of the impact of the consolidation of Aeróleo, the following table presents Era’s operating income for

each of FY 2015 and FY 2016 calculated using the methodology prior to the consolidation and also on a consolidated basis

Summary of Aeróleo Consolidation Impact – 2016 vs. 2015

- The operating revenues shown in the Consolidation Impact column represent the difference between Aeróleo’s total revenues from end customers and the cash that

Era received from Aeróleo in the period (which Era recognized as revenue); these amounts are not Aeróleo’s total revenues

- The expenses shown in the Consolidation Impact column are Aeróleo’s expenses. All intercompany accounts and transactions are eliminated in consolidation, and

therefore do not appear in this column. Era’s costs to maintain the helicopters in Brazil do not appear in this column, as they were already recorded in operating

expenses prior to consolidation

Prior

Methodology

Consolidation

Impact Pro Forma

Prior

Methodology

Consolidation

Impact As Reported

(In $000s)

Operating revenues 267,333$ 50,293$ 317,626$ 217,942$ 29,286$ 247,228$

Operating expenses 162,446 33,301 195,747 139,080 30,783 169,863

G&A expenses 40,146 8,141 48,287 32,330 3,876 36,206

Depreciation 47,307 138 47,445 49,165 150 49,315

Gain on asset sales 5,977 (24) 5,953 4,787 - 4,787

Goodwill impairment (1,866) - (1,866) - - -

Operating income 21,545 8,689 30,234 2,154 (5,523) (3,369)

2015 2016

12

Appendix

13

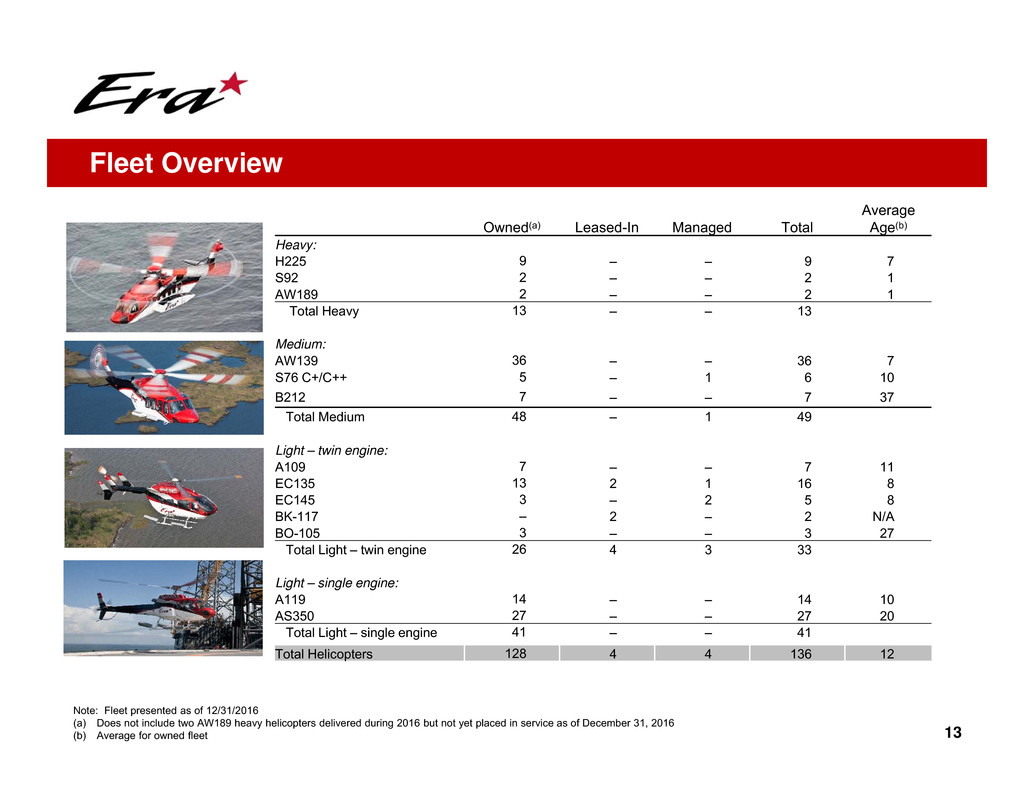

Owned(a) Leased-In Managed Total

Average

Age(b)

Heavy:

H225 9 – – 9 7

S92 2 – – 2 1

AW189 2 – – 2 1

Total Heavy 13 – – 13

Medium:

AW139 36 – – 36 7

S76 C+/C++ 5 – 1 6 10

B212 7 – – 7 37

Total Medium 48 – 1 49

Light – twin engine:

A109 7 – – 7 11

EC135 13 2 1 16 8

EC145 3 – 2 5 8

BK-117 – 2 – 2 N/A

BO-105 3 – – 3 27

Total Light – twin engine 26 4 3 33

Light – single engine:

A119 14 – – 14 10

AS350 27 – – 27 20

Total Light – single engine 41 – – 41

Total Helicopters 128 4 4 136 12

Note: Fleet presented as of 12/31/2016

(a) Does not include two AW189 heavy helicopters delivered during 2016 but not yet placed in service as of December 31, 2016

(b) Average for owned fleet

Fleet Overview

14

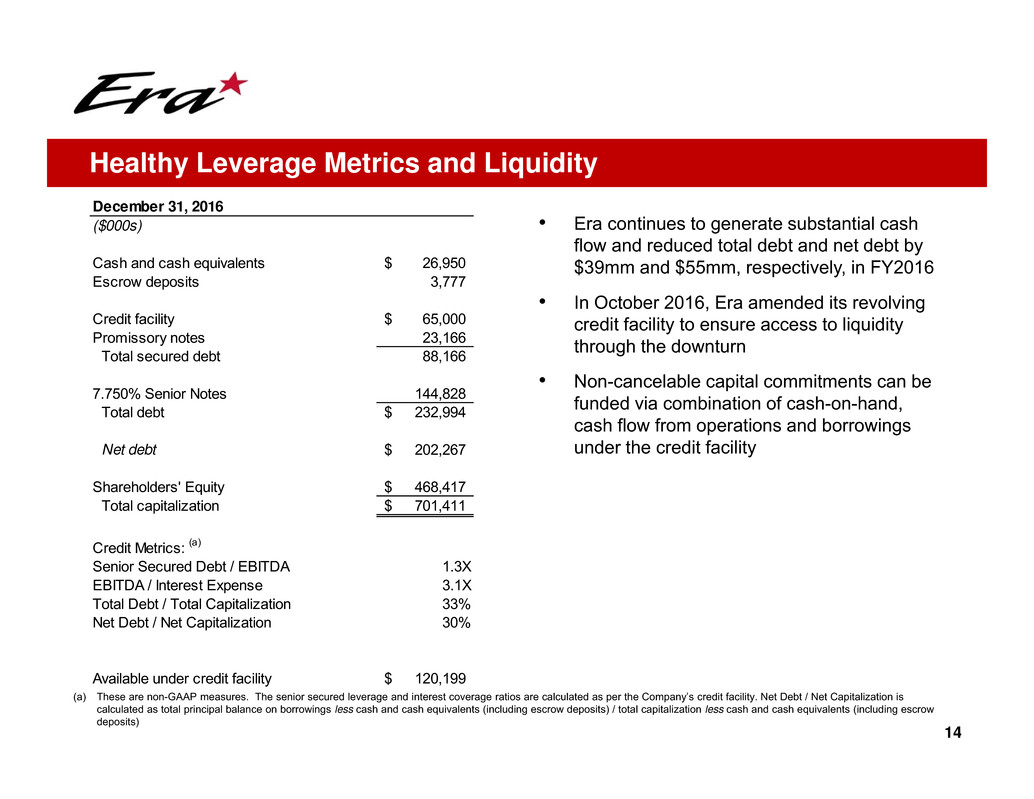

• Era continues to generate substantial cash

flow and reduced total debt and net debt by

$39mm and $55mm, respectively, in FY2016

• In October 2016, Era amended its revolving

credit facility to ensure access to liquidity

through the downturn

• Non-cancelable capital commitments can be

funded via combination of cash-on-hand,

cash flow from operations and borrowings

under the credit facility

Healthy Leverage Metrics and Liquidity

(a) These are non-GAAP measures. The senior secured leverage and interest coverage ratios are calculated as per the Company’s credit facility. Net Debt / Net Capitalization is

calculated as total principal balance on borrowings less cash and cash equivalents (including escrow deposits) / total capitalization less cash and cash equivalents (including escrow

deposits)

December 31, 2016

($000s)

Cash and cash equivalents 26,950$

Escrow deposits 3,777

Credit facility 65,000$

Promissory notes 23,166

Total secured debt 88,166

7.750% Senior Notes 144,828

Total debt 232,994$

Net debt 202,267$

Shareholders' Equity 468,417$

Total capitalization 701,411$

Credit Metrics: (a)

Senior Secured Debt / EBITDA 1.3X

EBITDA / Interest Expense 3.1X

Total Debt / Total Capitalization 33%

Net Debt / Net Capitalization 30%

Available under credit facility 120,199$

15

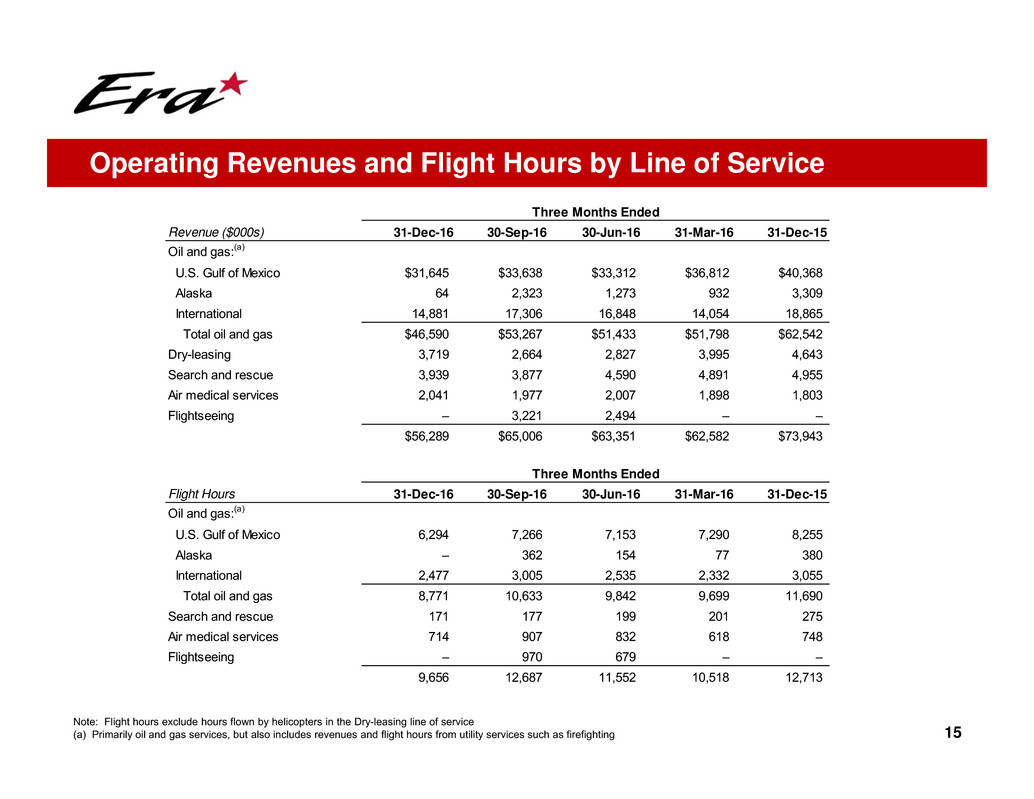

Operating Revenues and Flight Hours by Line of Service

Note: Flight hours exclude hours flown by helicopters in the Dry-leasing line of service

(a) Primarily oil and gas services, but also includes revenues and flight hours from utility services such as firefighting

Revenue ($000s) 31-Dec-16 30-Sep-16 30-Jun-16 31-Mar-16 31-Dec-15

Oil and gas:(a)

U.S. Gulf of Mexico $31,645 $33,638 $33,312 $36,812 $40,368

Alaska 64 2,323 1,273 932 3,309

International 14,881 17,306 16,848 14,054 18,865

Total oil and gas $46,590 $53,267 $51,433 $51,798 $62,542

Dry-leasing 3,719 2,664 2,827 3,995 4,643

Search and rescue 3,939 3,877 4,590 4,891 4,955

Air medical services 2,041 1,977 2,007 1,898 1,803

Flightseeing – 3,221 2,494 – –

$56,289 $65,006 $63,351 $62,582 $73,943

Flight Hours 31-Dec-16 30-Sep-16 30-Jun-16 31-Mar-16 31-Dec-15

Oil and gas:(a)

U.S. Gulf of Mexico 6,294 7,266 7,153 7,290 8,255

Alaska – 362 154 77 380

International 2,477 3,005 2,535 2,332 3,055

Total oil and gas 8,771 10,633 9,842 9,699 11,690

Search and rescue 171 177 199 201 275

Air medical services 714 907 832 618 748

Flightseeing – 970 679 – –

9,656 12,687 11,552 10,518 12,713

Three Months Ended

Three Months Ended

16(a) Adjusted EBITDA is a non-GAAP measure. See next page for Adjusted EBITDA reconciliation to Net Income (Loss)

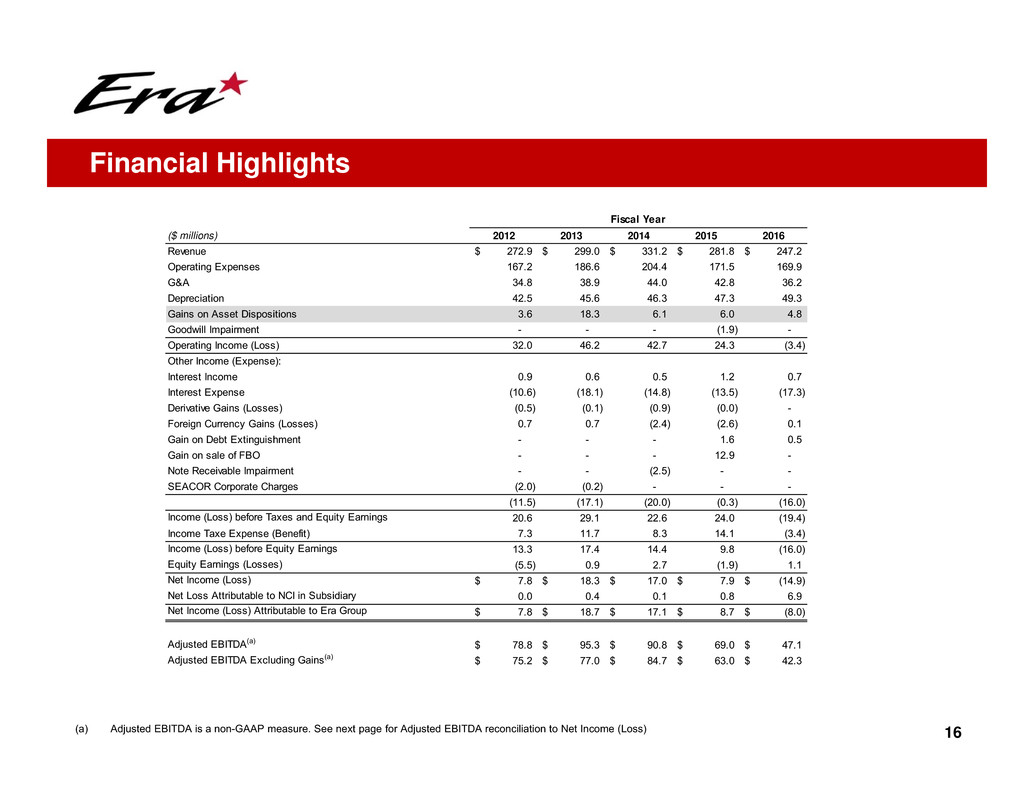

Financial Highlights

Fiscal Year

($ millions) 2012 2013 2014 2015 2016

Revenue 272.9$ 299.0$ 331.2$ 281.8$ 247.2$

Operating Expenses 167.2 186.6 204.4 171.5 169.9

G&A 34.8 38.9 44.0 42.8 36.2

Depreciation 42.5 45.6 46.3 47.3 49.3

Gains on Asset Dispositions 3.6 18.3 6.1 6.0 4.8

Goodwill Impairment - - - (1.9) -

Operating Income (Loss) 32.0 46.2 42.7 24.3 (3.4)

Other Income (Expense):

Interest Income 0.9 0.6 0.5 1.2 0.7

Interest Expense (10.6) (18.1) (14.8) (13.5) (17.3)

Derivative Gains (Losses) (0.5) (0.1) (0.9) (0.0) -

Foreign Currency Gains (Losses) 0.7 0.7 (2.4) (2.6) 0.1

Gain on Debt Extinguishment - - - 1.6 0.5

Gain on sale of FBO - - - 12.9 -

Note Receivable Impairment - - (2.5) - -

SEACOR Corporate Charges (2.0) (0.2) - - -

(11.5) (17.1) (20.0) (0.3) (16.0)

Income (Loss) before Taxes and Equity Earnings 20.6 29.1 22.6 24.0 (19.4)

Income Taxe Expense (Benefit) 7.3 11.7 8.3 14.1 (3.4)

Income (Loss) before Equity Earnings 13.3 17.4 14.4 9.8 (16.0)

Equity Earnings (Losses) (5.5) 0.9 2.7 (1.9) 1.1

Net Income (Loss) 7.8$ 18.3$ 17.0$ 7.9$ (14.9)$

Net Loss Attributable to NCI in Subsidiary 0.0 0.4 0.1 0.8 6.9

Net Income (Loss) Attributable to Era Group 7.8$ 18.7$ 17.1$ 8.7$ (8.0)$

Adjusted EBITDA(a) 78.8$ 95.3$ 90.8$ 69.0$ 47.1$

Adjusted EBITDA Excluding Gains(a) 75.2$ 77.0$ 84.7$ 63.0$ 42.3$

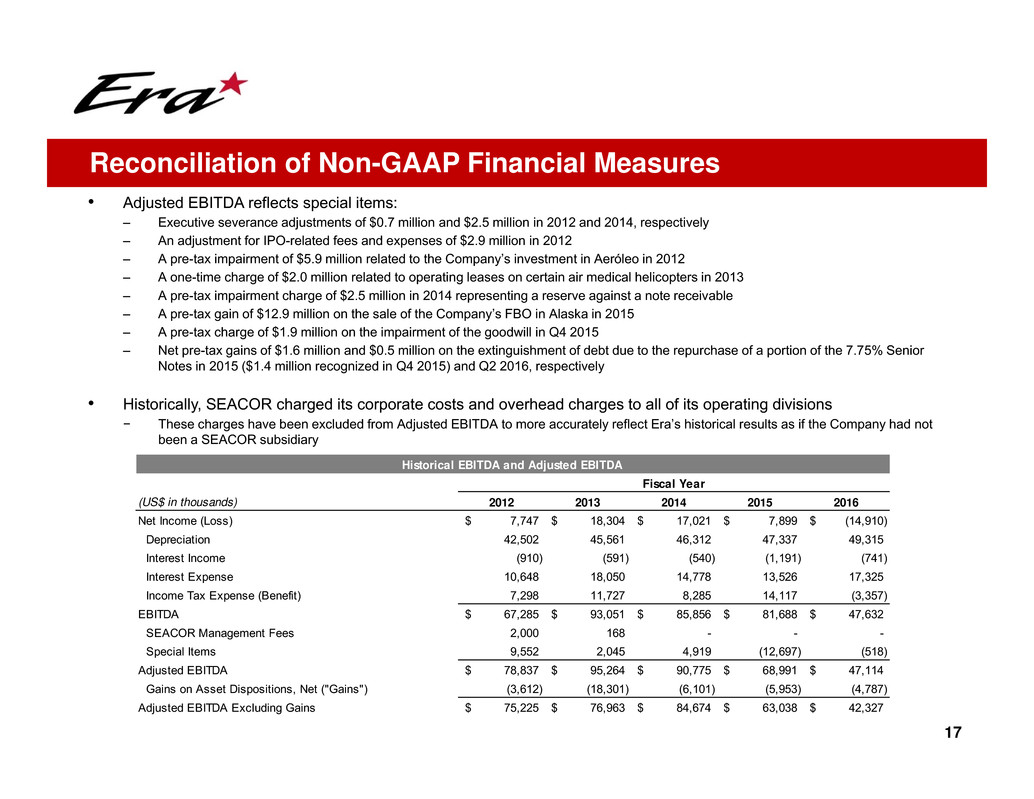

• Adjusted EBITDA reflects special items:

– Executive severance adjustments of $0.7 million and $2.5 million in 2012 and 2014, respectively

– An adjustment for IPO-related fees and expenses of $2.9 million in 2012

– A pre-tax impairment of $5.9 million related to the Company’s investment in Aeróleo in 2012

– A one-time charge of $2.0 million related to operating leases on certain air medical helicopters in 2013

– A pre-tax impairment charge of $2.5 million in 2014 representing a reserve against a note receivable

– A pre-tax gain of $12.9 million on the sale of the Company’s FBO in Alaska in 2015

– A pre-tax charge of $1.9 million on the impairment of the goodwill in Q4 2015

– Net pre-tax gains of $1.6 million and $0.5 million on the extinguishment of debt due to the repurchase of a portion of the 7.75% Senior

Notes in 2015 ($1.4 million recognized in Q4 2015) and Q2 2016, respectively

• Historically, SEACOR charged its corporate costs and overhead charges to all of its operating divisions

− These charges have been excluded from Adjusted EBITDA to more accurately reflect Era’s historical results as if the Company had not

been a SEACOR subsidiary

17

Reconciliation of Non-GAAP Financial Measures

Historical EBITDA and Adjusted EBITDA

(US$ in thousands) 2012 2013 2014 2015 2016

Net Income (Loss) 7,747$ 18,304$ 17,021$ 7,899$ (14,910)$

Depreciation 42,502 45,561 46,312 47,337 49,315

Interest Income (910) (591) (540) (1,191) (741)

Interest Expense 10,648 18,050 14,778 13,526 17,325

Income Tax Expense (Benefit) 7,298 11,727 8,285 14,117 (3,357)

EBITDA 67,285$ 93,051$ 85,856$ 81,688$ 47,632$

SEACOR Management Fees 2,000 168 - - -

Special Items 9,552 2,045 4,919 (12,697) (518)

Adjusted EBITDA 78,837$ 95,264$ 90,775$ 68,991$ 47,114$

Gains on Asset Dispositions, Net ("Gains") (3,612) (18,301) (6,101) (5,953) (4,787)

Adjusted EBITDA Excluding Gains 75,225$ 76,963$ 84,674$ 63,038$ 42,327$

Fiscal Year

18

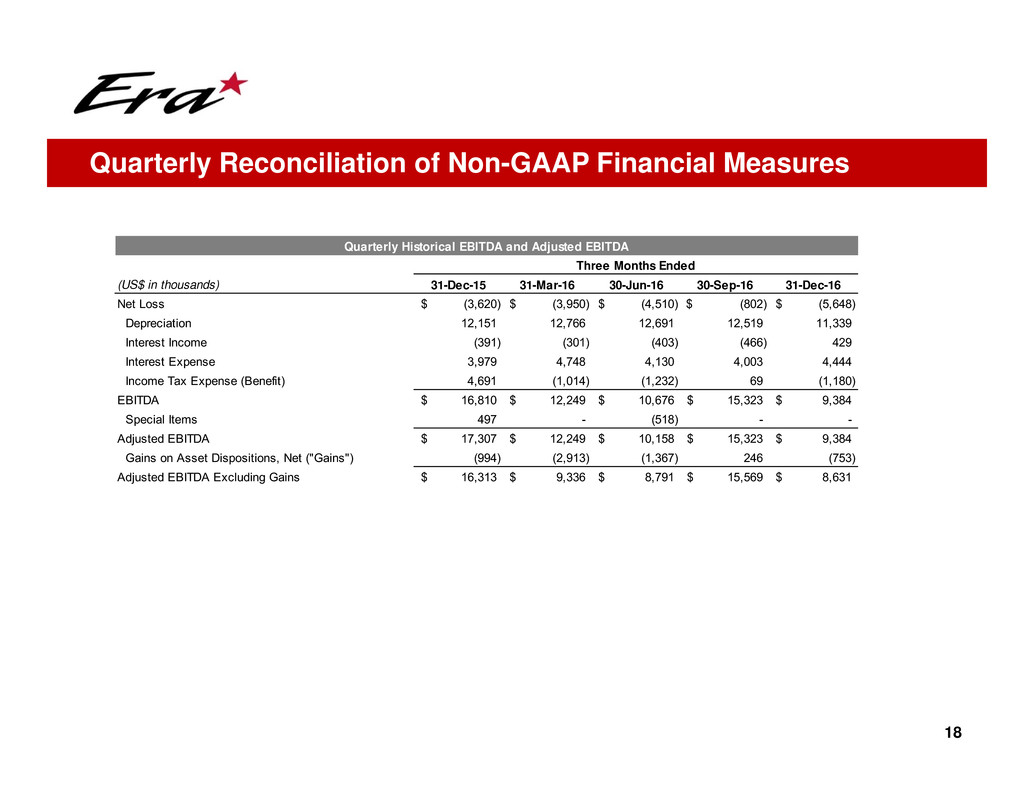

Quarterly Reconciliation of Non-GAAP Financial Measures

Three Months Ended

(US$ in thousands) 31-Dec-15 31-Mar-16 30-Jun-16 30-Sep-16 31-Dec-16

Net Loss (3,620)$ (3,950)$ (4,510)$ (802)$ (5,648)$

Depreciation 12,151 12,766 12,691 12,519 11,339

Interest Income (391) (301) (403) (466) 429

Interest Expense 3,979 4,748 4,130 4,003 4,444

Income Tax Expense (Benefit) 4,691 (1,014) (1,232) 69 (1,180)

EBITDA 16,810$ 12,249$ 10,676$ 15,323$ 9,384$

Special Items 497 - (518) - -

Adjusted EBITDA 17,307$ 12,249$ 10,158$ 15,323$ 9,384$

Gains on Asset Dispositions, Net ("Gains") (994) (2,913) (1,367) 246 (753)

Adjusted EBITDA Excluding Gains 16,313$ 9,336$ 8,791$ 15,569$ 8,631$

Quarterly Historical EBITDA and Adjusted EBITDA