Q1 2017 Earnings Presentation

0May 3, 2017

Exhibit 99.2

I. Introduction Shefali Shah, SVP and General Counsel

II. Operational Highlights Chris Bradshaw, President and CEO

III. Financial Review Andy Puhala, SVP and CFO

IV. Concluding Remarks Chris Bradshaw, President and CEO

V. Questions & Answers

Q1 2017 Earnings Call Agenda

1

2

Cautionary Statement Regarding Forward-Looking Statements

This presentation contains “forward-looking statements.” Forward-looking statements give the Company’s current expectations or forecasts of future

events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,”

“estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements reflect management’s current views with respect

to future events and are subject to risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those

anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements.

Such risks, uncertainties and other important factors include, among others, the Company’s dependence on, and the cyclical and volatile nature of,

offshore oil and gas exploration, development and production activity, and the impact of general economic conditions and fluctuations in worldwide

prices of and demand for oil and natural gas on such activity levels; the Company’s reliance on a small number of customers and the reduction of its

customer base resulting from bankruptcies or consolidation; risks that the Company’s customers reduce or cancel contracted services or tender

processes; cost savings initiatives implemented by the Company’s customers; risks inherent in operating helicopters; the Company’s ability to

maintain an acceptable safety record; the impact of increased United States (“U.S.”) and foreign government regulation and legislation, including

potential government implemented moratoriums on drilling activities; the impact of a grounding of all or a portion of the Company’s fleet for extended

periods of time or indefinitely on the Company’s business, including its operations and ability to service customers, results of operations or financial

condition and/or the market value of the affected helicopter(s); the Company’s ability to successfully expand into other geographic and aviation

service markets; risks associated with political instability, governmental action, war, acts of terrorism and changes in the economic condition in any

foreign country where the Company does business, which may result in expropriation, nationalization, confiscation or deprivation of the Company’s

assets or result in claims of a force majeure situation; the impact of declines in the global economy and financial markets; the impact of fluctuations in

foreign currency exchange rates on the Company’s asset values and cost to purchase helicopters, spare parts and related services; risks related to

investing in new lines of service without realizing the expected benefits; risks of engaging in competitive processes or expending significant resources

for strategic opportunities, with no guaranty of recoupment; the Company’s reliance on a small number of helicopter manufacturers and suppliers; the

Company’s ongoing need to replace aging helicopters; the Company’s reliance on the secondary helicopter market to dispose of older helicopters;

the Company’s reliance on information technology; the impact of allocation of risk between the Company and its customers; the liability, legal fees

and costs in connection with providing emergency response services; adverse weather conditions and seasonality; risks associated with the

Company’s debt structure; the Company’s counterparty credit risk exposure; the impact of operational and financial difficulties of the Company’s joint

ventures and partners and the risks associated with identifying and securing joint venture partners when needed; conflict with the other owners of the

Company’s non-wholly owned subsidiaries and other equity investees; adverse results of legal proceedings; the Company’s ability to obtain

insurance coverage and the adequacy and availability of such coverage; the Company’s ability to remediate the material weakness in its internal

controls over financial reporting described its Annual Report on Form 10-K for the year ended December 31, 2016; the possibility of labor problems;

the attraction and retention of qualified personnel; restrictions on the amount of foreign ownership of the Company’s common stock; and various other

matters and factors, many of which are beyond the Company’s control. These factors are not exhaustive, and new factors may emerge or changes to

the foregoing factors may occur that could impact the Company’s business. Except to the extent required by law, the Company undertakes no

obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

3

This presentation includes EBITDA and Adjusted EBITDA as supplemental measures of the Company’s operating performance.

EBITDA is defined as Earnings before Interest (includes interest income and interest expense), Taxes, Depreciation and Amortization.

Adjusted EBITDA is defined as EBITDA further adjusted for SEACOR Management Fees and certain other special items that occurred

during the reporting period. Neither EBITDA nor Adjusted EBITDA is a recognized term under generally accepted accounting principles

in the U.S. (“GAAP”). Accordingly, they should not be used as an indicator of, or an alternative to, net income as a measure of

operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for

discretionary use, as they do not take into account certain cash requirements, such as debt service requirements. EBITDA and

Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, nor as a substitute for analysis of

the Company’s results as reported under GAAP. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may

vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. The

Company also presents net debt, which is a non-GAAP measure, defined as total principal balance on borrowings less cash and cash

equivalents, including escrow balances. Each of these non-GAAP measures has limitations and therefore should not be used in

isolation or as a substitute for the amounts reported in accordance with GAAP.

A reconciliation of EBITDA, Adjusted EBITDA, Adjusted EBITDA further adjusted to exclude gains on asset dispositions and net debt is

included in this presentation.

This presentation also includes the Company’s interest coverage ratio and senior secured leverage ratio. The interest coverage ratio is

the ratio for the most recently ended four consecutive fiscal quarters of EBITDA (as defined in the Company’s credit facility) less

dividends and distributions and the amount of any cash proceeds received from the sale of assets included in EBITDA divided by

interest expense. The senior secured leverage ratio is calculated by dividing senior secured debt (as defined in the Company’s credit

facility) by EBITDA. Neither the interest coverage ratio nor the senior secured leverage ratio is a measure of operating performance or

liquidity defined by GAAP and may not be comparable to similarly titled measures presented by other companies. EBITDA is

calculated under the Company’s credit facility (as amended) differently than as presented elsewhere in this presentation.

Non-GAAP Financial Measures Reconciliation

4

Operational Highlights

• Era achieved its goal of ZERO air accidents and ZERO TRIR YTD 2017

• Due to an accident in April 2016 involving an Airbus Helicopters H225 (also known as a EC225LP) model helicopter operated

by another helicopter company, the vast majority of the offshore oil and gas fleet of H225 and AS332 L2 model helicopters

remains on operational suspension

• The Accident Investigation Board Norway (AIBN) issued an updated preliminary report on April 28, 2017(1). The following two

quotes were selected from the report’s summary (not intended to be comprehensive):

− “The observed failure mode in this accident, i.e. crack initiation and propagation with limited spalling, seems to differ

from what was expected or foreseen during the design and certification of the main rotor gearbox. The fracture

propagated in a manner which was unlikely to be detected by the maintenance procedures and the monitoring

systems fitted to LN-OJF at the time of the accident. The certification process and Certification Specifications for

Large Rotorcraft related to catastrophic failure and requirements for safety barriers will be subject to further

investigation.”

− “The AIBN will continue the investigation into how and why two similar catastrophic accidents could happen to near

identical helicopters only seven years apart. Further assessment of the follow-up on the G-REDL safety

recommendations and the continuing airworthiness of the gearbox after 2009 is a relevant issue.”

• Era owns 9 H225 helicopters: 5 located in the U.S., 3 located in Brazil and 1 located in Norway

− As of March 31, 2017, the net book value of these H225 helicopters and related inventory was $158.6 million

− It is too early to estimate the extent and duration of the H225 and AS332 L2 operational suspension, the market

receptivity to these models for future offshore oil and gas operations, the potential impact on asset values, and the

impact a long-term suspension could have on our results of operations or financial condition

5

Safety Update and H225 / AS332 L2 Suspension

(1) The full report is available at https://www.aibn.no/Aviation/Investigations/16-286 and should be read in its entirety for a complete understanding of the findings. The AIBN

issues no safety recommendations at this stage of the investigation. The investigation continues. Only the final report will represent the complete investigation and be the

official document of the AIBN. Neither the AIBN website nor its content or the content of the report is incorporated by reference into this presentation.

• Against the very challenging industry conditions and during what is historically our weakest seasonal

quarter, Era continued to generate positive operating cash flow of $4.3 million in Q1 2017

• As of 3/31/17, total available liquidity was $147.5 million

− $26.3 million in cash balances

− $3.8 million in escrow deposits

− $117.4 million of remaining availability under the Company’s credit facility

• As of 3/31/17, non-cancellable capital commitments for new helicopter deliveries totaled $14.8 million

− $12.0 million payable in 2017

− $2.8 million payable in 2018

• In April 2017, Era took delivery of and placed in service one new S92 helicopter and paid $2.8 million of

the non-cancellable portion of its capital commitments

− Also in April, Era sold one B212 medium helicopter and a hangar in Alaska for aggregate proceeds

of $4.6 million

6

Financial Stability

7

Financial Review

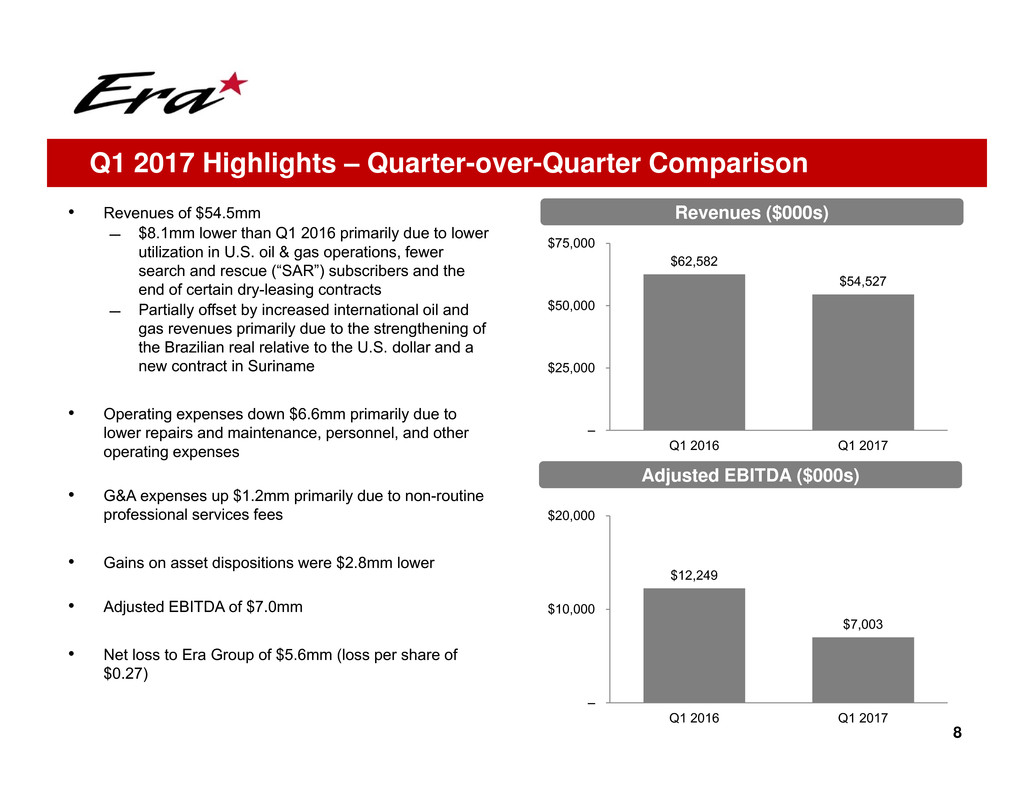

• Revenues of $54.5mm

̶ $8.1mm lower than Q1 2016 primarily due to lower

utilization in U.S. oil & gas operations, fewer

search and rescue (“SAR”) subscribers and the

end of certain dry-leasing contracts

̶ Partially offset by increased international oil and

gas revenues primarily due to the strengthening of

the Brazilian real relative to the U.S. dollar and a

new contract in Suriname

• Operating expenses down $6.6mm primarily due to

lower repairs and maintenance, personnel, and other

operating expenses

• G&A expenses up $1.2mm primarily due to non-routine

professional services fees

• Gains on asset dispositions were $2.8mm lower

• Adjusted EBITDA of $7.0mm

• Net loss to Era Group of $5.6mm (loss per share of

$0.27)

8

Q1 2017 Highlights – Quarter-over-Quarter Comparison

Revenues ($000s)

Adjusted EBITDA ($000s)

$12,249

$7,003

–

$10,000

$20,000

Q1 2016 Q1 2017

$62,582

$54,527

–

$25,000

$50,000

$75,000

Q1 2016 Q1 2017

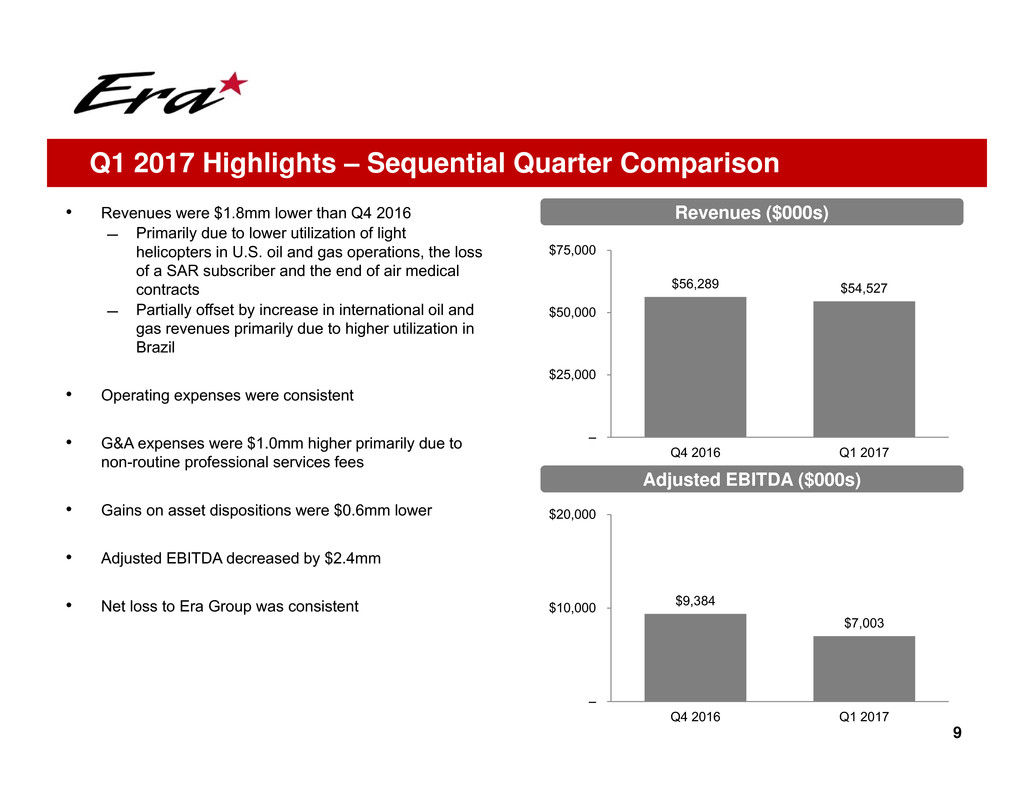

• Revenues were $1.8mm lower than Q4 2016

̶ Primarily due to lower utilization of light

helicopters in U.S. oil and gas operations, the loss

of a SAR subscriber and the end of air medical

contracts

̶ Partially offset by increase in international oil and

gas revenues primarily due to higher utilization in

Brazil

• Operating expenses were consistent

• G&A expenses were $1.0mm higher primarily due to

non-routine professional services fees

• Gains on asset dispositions were $0.6mm lower

• Adjusted EBITDA decreased by $2.4mm

• Net loss to Era Group was consistent

9

Q1 2017 Highlights – Sequential Quarter Comparison

Revenues ($000s)

Adjusted EBITDA ($000s)

$56,289 $54,527

–

$25,000

$50,000

$75,000

Q4 2016 Q1 2017

$9,384

$7,003

–

$10,000

$20,000

Q4 2016 Q1 2017

10

Appendix

11

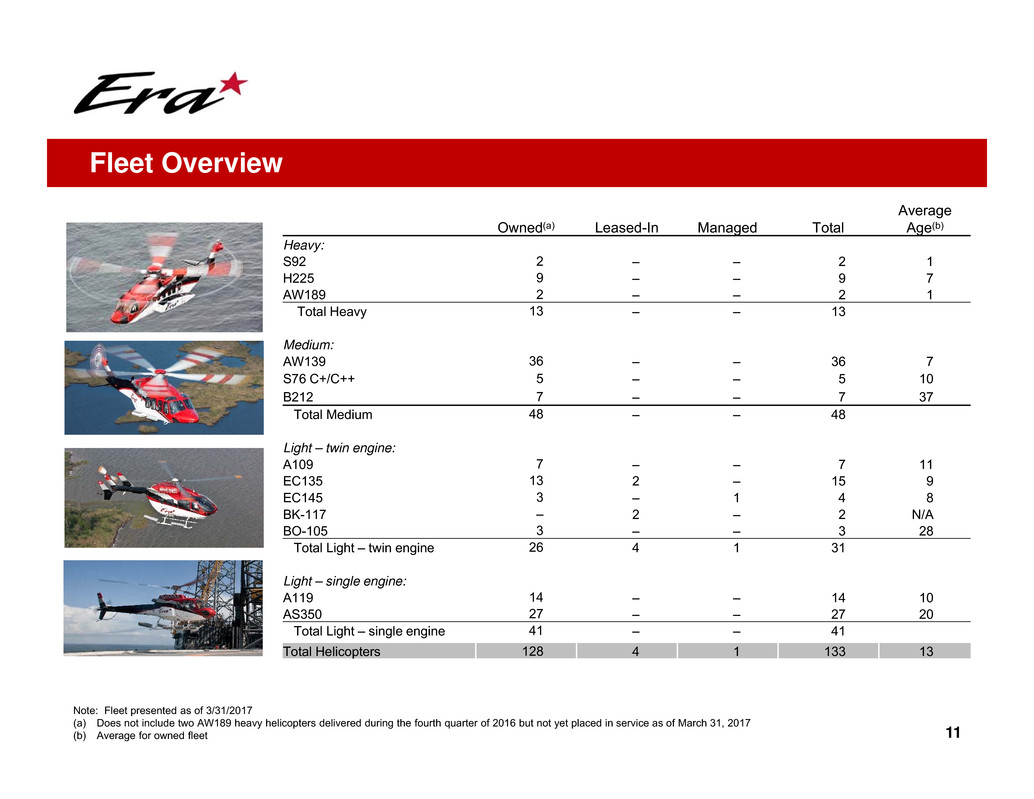

Owned(a) Leased-In Managed Total

Average

Age(b)

Heavy:

S92 2 – – 2 1

H225 9 – – 9 7

AW189 2 – – 2 1

Total Heavy 13 – – 13

Medium:

AW139 36 – – 36 7

S76 C+/C++ 5 – – 5 10

B212 7 – – 7 37

Total Medium 48 – – 48

Light – twin engine:

A109 7 – – 7 11

EC135 13 2 – 15 9

EC145 3 – 1 4 8

BK-117 – 2 – 2 N/A

BO-105 3 – – 3 28

Total Light – twin engine 26 4 1 31

Light – single engine:

A119 14 – – 14 10

AS350 27 – – 27 20

Total Light – single engine 41 – – 41

Total Helicopters 128 4 1 133 13

Note: Fleet presented as of 3/31/2017

(a) Does not include two AW189 heavy helicopters delivered during the fourth quarter of 2016 but not yet placed in service as of March 31, 2017

(b) Average for owned fleet

Fleet Overview

12

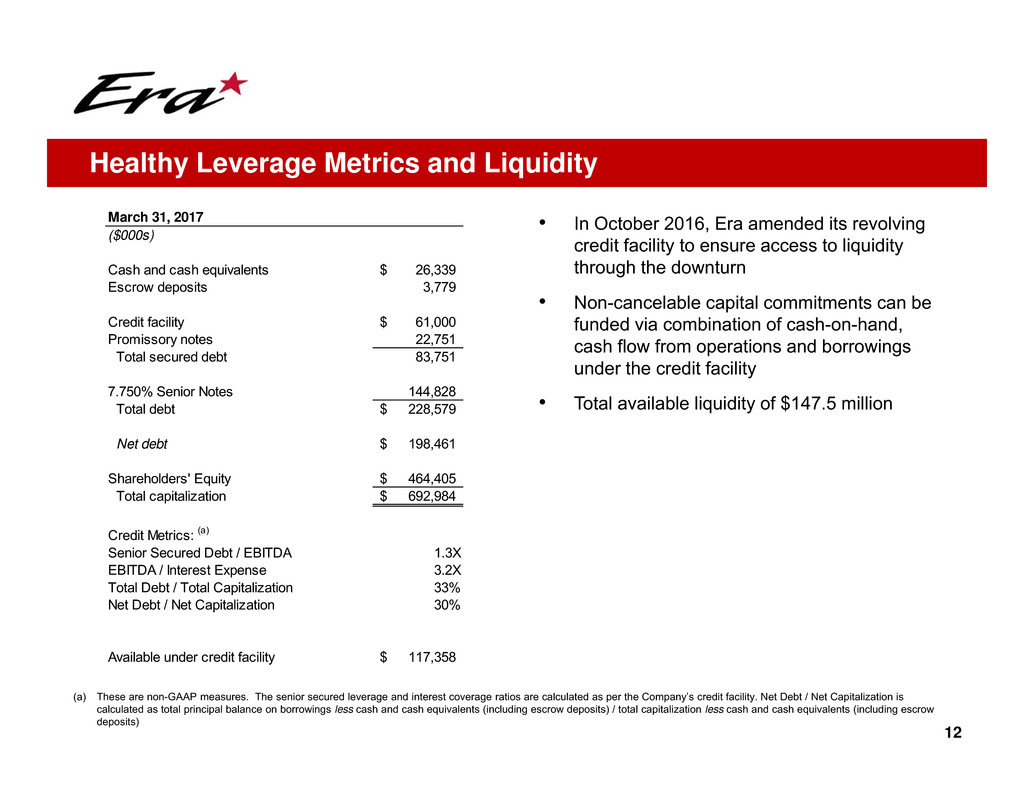

• In October 2016, Era amended its revolving

credit facility to ensure access to liquidity

through the downturn

• Non-cancelable capital commitments can be

funded via combination of cash-on-hand,

cash flow from operations and borrowings

under the credit facility

• Total available liquidity of $147.5 million

Healthy Leverage Metrics and Liquidity

(a) These are non-GAAP measures. The senior secured leverage and interest coverage ratios are calculated as per the Company’s credit facility. Net Debt / Net Capitalization is

calculated as total principal balance on borrowings less cash and cash equivalents (including escrow deposits) / total capitalization less cash and cash equivalents (including escrow

deposits)

March 31, 2017

($000s)

Cash and cash equivalents 26,339$

Escrow deposits 3,779

Credit facility 61,000$

Promissory notes 22,751

Total secured debt 83,751

7.750% Senior Notes 144,828

Total debt 228,579$

Net debt 198,461$

Shareholders' Equity 464,405$

Total capitalization 692,984$

Credit Metrics: (a)

Senior Secured Debt / EBITDA 1.3X

EBITDA / Interest Expense 3.2X

Total Debt / Total Capitalization 33%

Net Debt / Net Capitalization 30%

Available under credit facility 117,358$

13

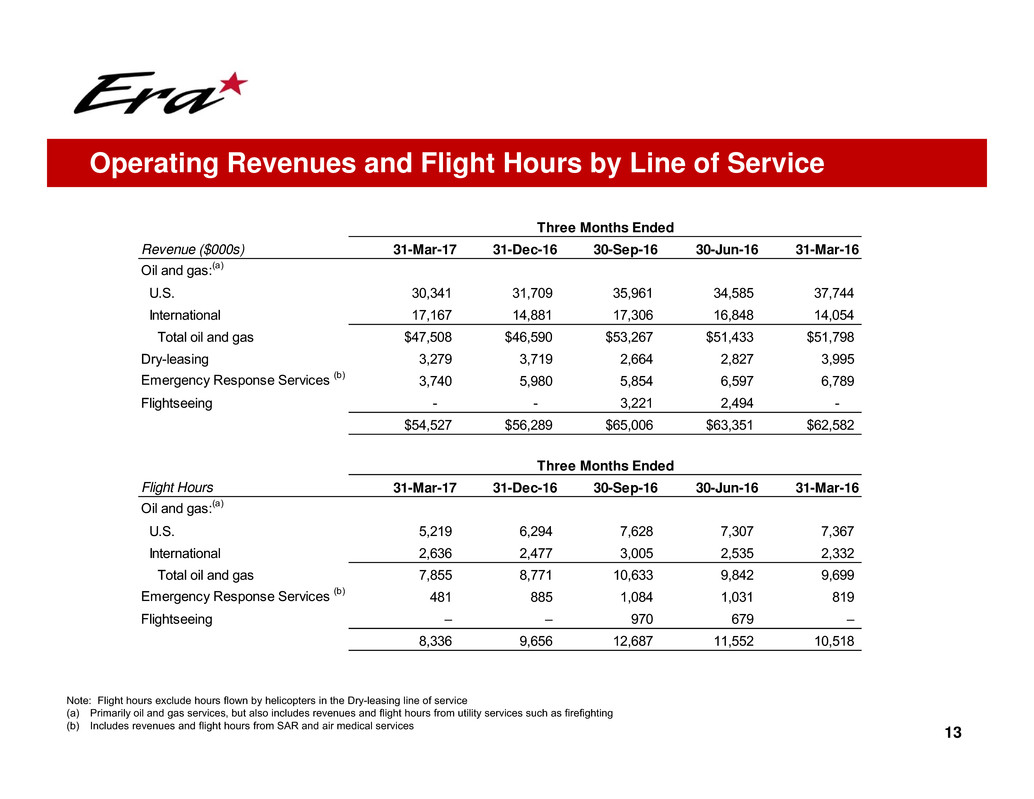

Operating Revenues and Flight Hours by Line of Service

Note: Flight hours exclude hours flown by helicopters in the Dry-leasing line of service

(a) Primarily oil and gas services, but also includes revenues and flight hours from utility services such as firefighting

(b) Includes revenues and flight hours from SAR and air medical services

Revenue ($000s) 31-Mar-17 31-Dec-16 30-Sep-16 30-Jun-16 31-Mar-16

Oil and gas:(a)

U.S. 30,341 31,709 35,961 34,585 37,744

International 17,167 14,881 17,306 16,848 14,054

Total oil and gas $47,508 $46,590 $53,267 $51,433 $51,798

Dry-leasing 3,279 3,719 2,664 2,827 3,995

Emergency Response Services (b) 3,740 5,980 5,854 6,597 6,789

Flightseeing - - 3,221 2,494 -

$54,527 $56,289 $65,006 $63,351 $62,582

Flight Hours 31-Mar-17 31-Dec-16 30-Sep-16 30-Jun-16 31-Mar-16

Oil and gas:(a)

U.S. 5,219 6,294 7,628 7,307 7,367

International 2,636 2,477 3,005 2,535 2,332

Total oil and gas 7,855 8,771 10,633 9,842 9,699

Emergency Response Services (b) 481 885 1,084 1,031 819

Flightseeing – – 970 679 –

8,336 9,656 12,687 11,552 10,518

Three Months Ended

Three Months Ended

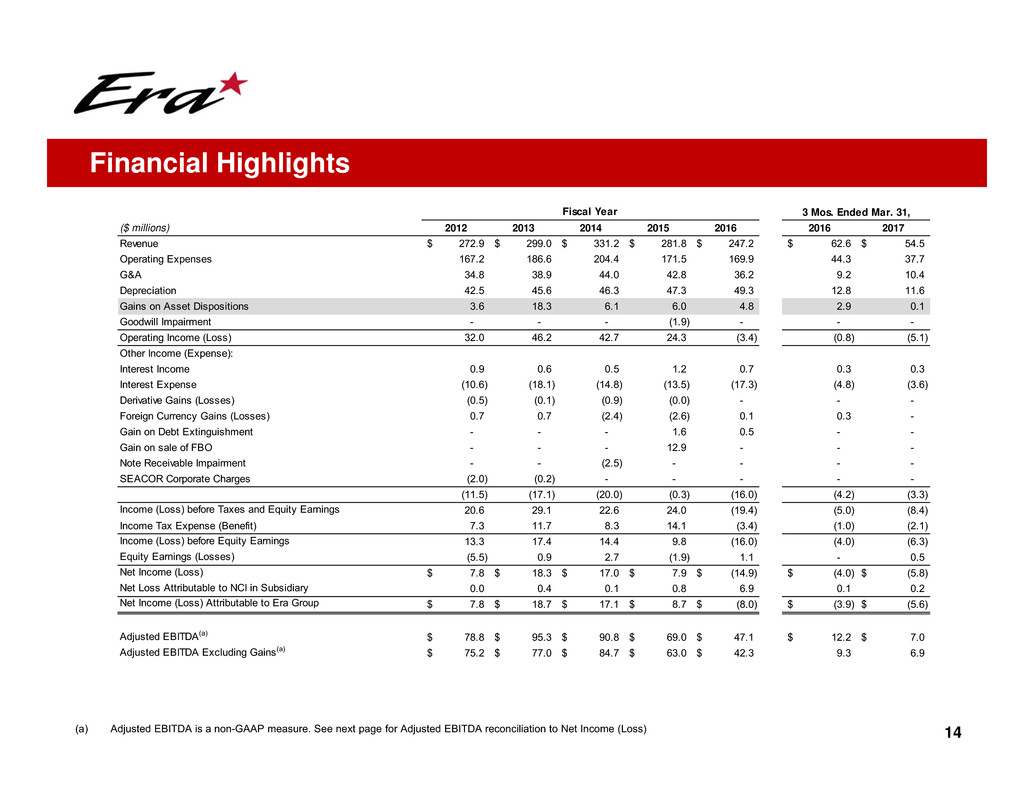

14(a) Adjusted EBITDA is a non-GAAP measure. See next page for Adjusted EBITDA reconciliation to Net Income (Loss)

Financial Highlights

Fiscal Year

($ millions) 2012 2013 2014 2015 2016 2016 2017

Revenue 272.9$ 299.0$ 331.2$ 281.8$ 247.2$ 62.6$ 54.5$

Operating Expenses 167.2 186.6 204.4 171.5 169.9 44.3 37.7

G&A 34.8 38.9 44.0 42.8 36.2 9.2 10.4

Depreciation 42.5 45.6 46.3 47.3 49.3 12.8 11.6

Gains on Asset Dispositions 3.6 18.3 6.1 6.0 4.8 2.9 0.1

Goodwill Impairment - - - (1.9) - - -

Operating Income (Loss) 32.0 46.2 42.7 24.3 (3.4) (0.8) (5.1)

Other Income (Expense):

Interest Income 0.9 0.6 0.5 1.2 0.7 0.3 0.3

Interest Expense (10.6) (18.1) (14.8) (13.5) (17.3) (4.8) (3.6)

Derivative Gains (Losses) (0.5) (0.1) (0.9) (0.0) - - -

Foreign Currency Gains (Losses) 0.7 0.7 (2.4) (2.6) 0.1 0.3 -

Gain on Debt Extinguishment - - - 1.6 0.5 - -

Gain on sale of FBO - - - 12.9 - - -

Note Receivable Impairment - - (2.5) - - - -

SEACOR Corporate Charges (2.0) (0.2) - - - - -

(11.5) (17.1) (20.0) (0.3) (16.0) (4.2) (3.3)

Income (Loss) before Taxes and Equity Earnings 20.6 29.1 22.6 24.0 (19.4) (5.0) (8.4)

Income Tax Expense (Benefit) 7.3 11.7 8.3 14.1 (3.4) (1.0) (2.1)

Income (Loss) before Equity Earnings 13.3 17.4 14.4 9.8 (16.0) (4.0) (6.3)

Equity Earnings (Losses) (5.5) 0.9 2.7 (1.9) 1.1 - 0.5

Net Income (Loss) 7.8$ 18.3$ 17.0$ 7.9$ (14.9)$ (4.0)$ (5.8)$

Net Loss Attributable to NCI in Subsidiary 0.0 0.4 0.1 0.8 6.9 0.1 0.2

Net Income (Loss) Attributable to Era Group 7.8$ 18.7$ 17.1$ 8.7$ (8.0)$ (3.9)$ (5.6)$

Adjusted EBITDA(a) 78.8$ 95.3$ 90.8$ 69.0$ 47.1$ 12.2$ 7.0$

Adjusted EBITDA Excluding Gains(a) 75.2$ 77.0$ 84.7$ 63.0$ 42.3$ 9.3 6.9

3 Mos. Ended Mar. 31,

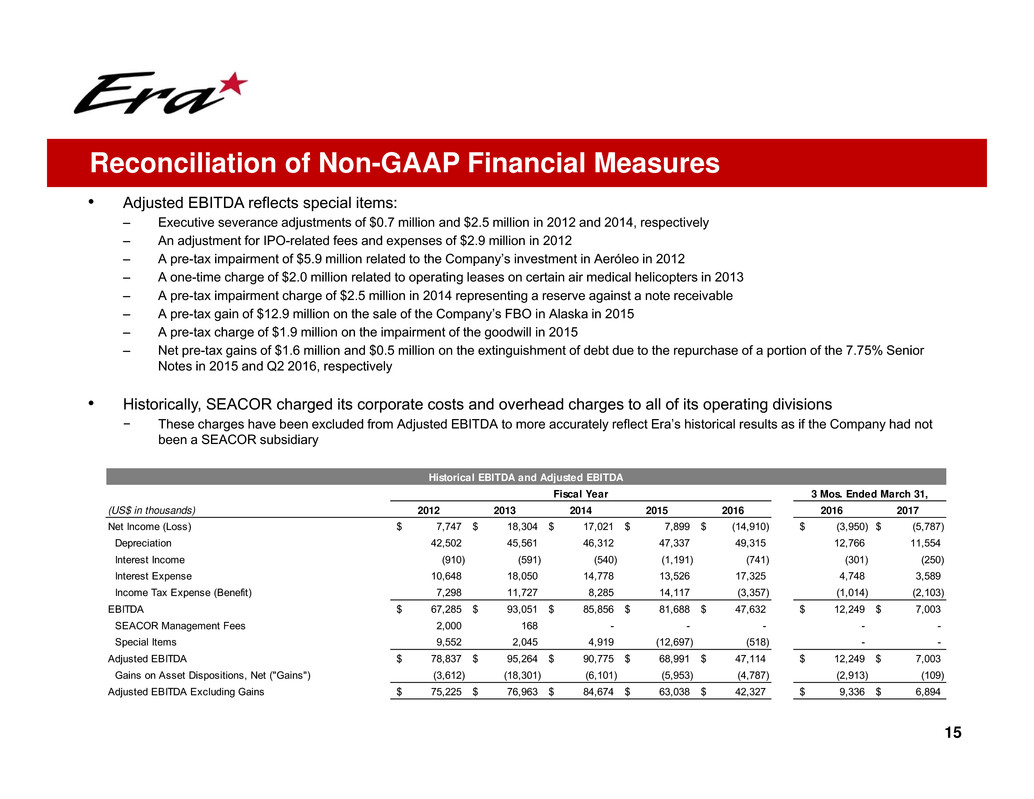

• Adjusted EBITDA reflects special items:

– Executive severance adjustments of $0.7 million and $2.5 million in 2012 and 2014, respectively

– An adjustment for IPO-related fees and expenses of $2.9 million in 2012

– A pre-tax impairment of $5.9 million related to the Company’s investment in Aeróleo in 2012

– A one-time charge of $2.0 million related to operating leases on certain air medical helicopters in 2013

– A pre-tax impairment charge of $2.5 million in 2014 representing a reserve against a note receivable

– A pre-tax gain of $12.9 million on the sale of the Company’s FBO in Alaska in 2015

– A pre-tax charge of $1.9 million on the impairment of the goodwill in 2015

– Net pre-tax gains of $1.6 million and $0.5 million on the extinguishment of debt due to the repurchase of a portion of the 7.75% Senior

Notes in 2015 and Q2 2016, respectively

• Historically, SEACOR charged its corporate costs and overhead charges to all of its operating divisions

− These charges have been excluded from Adjusted EBITDA to more accurately reflect Era’s historical results as if the Company had not

been a SEACOR subsidiary

15

Reconciliation of Non-GAAP Financial Measures

Historical EBITDA and Adjusted EBITDA

3 Mos. Ended March 31,

(US$ in thousands) 2012 2013 2014 2015 2016 2016 2017

Net Income (Loss) 7,747$ 18,304$ 17,021$ 7,899$ (14,910)$ (3,950)$ (5,787)$

Depreciation 42,502 45,561 46,312 47,337 49,315 12,766 11,554

Interest Income (910) (591) (540) (1,191) (741) (301) (250)

Interest Expense 10,648 18,050 14,778 13,526 17,325 4,748 3,589

Income Tax Expense (Benefit) 7,298 11,727 8,285 14,117 (3,357) (1,014) (2,103)

EBITDA 67,285$ 93,051$ 85,856$ 81,688$ 47,632$ 12,249$ 7,003$

SEACOR Management Fees 2,000 168 - - - - -

Special Items 9,552 2,045 4,919 (12,697) (518) - -

Adjusted EBITDA 78,837$ 95,264$ 90,775$ 68,991$ 47,114$ 12,249$ 7,003$

Gains on Asset Dispositions, Net ("Gains") (3,612) (18,301) (6,101) (5,953) (4,787) (2,913) (109)

Adjusted EBITDA Excluding Gains 75,225$ 76,963$ 84,674$ 63,038$ 42,327$ 9,336$ 6,894$

Fiscal Year

16

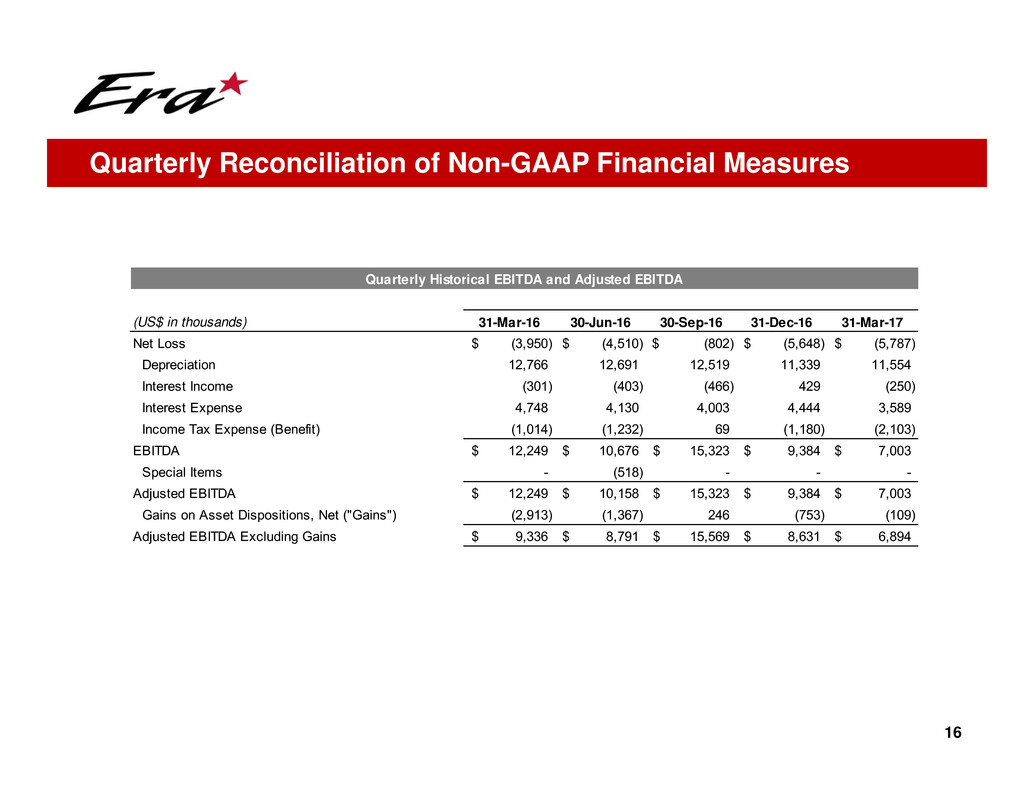

Quarterly Reconciliation of Non-GAAP Financial Measures

(US$ in thousands) 31-Mar-16 30-Jun-16 30-Sep-16 31-Dec-16 31-Mar-17

Net Loss (3,950)$ (4,510)$ (802)$ (5,648)$ (5,787)$

Depreciation 12,766 12,691 12,519 11,339 11,554

Interest Income (301) (403) (466) 429 (250)

Interest Expense 4,748 4,130 4,003 4,444 3,589

Income Tax Expense (Benefit) (1,014) (1,232) 69 (1,180) (2,103)

EBITDA 12,249$ 10,676$ 15,323$ 9,384$ 7,003$

Special Items - (518) - - -

Adjusted EBITDA 12,249$ 10,158$ 15,323$ 9,384$ 7,003$

Gains on Asset Dispositions, Net ("Gains") (2,913) (1,367) 246 (753) (109)

Adjusted EBITDA Excluding Gains 9,336$ 8,791$ 15,569$ 8,631$ 6,894$

Quarterly Historical EBITDA and Adjusted EBITDA