Barclays CEO Energy-Power Conference

0September 2017

Exhibit 99.1

1

Cautionary Statement Regarding Forward-Looking Statements

This presentation contains “forward-looking statements.” Forward-looking statements give the Company’s current expectations or forecasts of future

events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,”

“estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements reflect management’s current views with respect

to future events and are subject to risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those

anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements.

Such risks, uncertainties and other important factors include, among others, the Company’s dependence on, and the cyclical and volatile nature of,

offshore oil and gas exploration, development and production activity, and the impact of general economic conditions and fluctuations in worldwide

prices of and demand for oil and natural gas on such activity levels; the Company’s reliance on a small number of customers and the reduction of its

customer base resulting from bankruptcies or consolidation; risks that the Company’s customers reduce or cancel contracted services or tender

processes; cost savings initiatives implemented by the Company’s customers; risks inherent in operating helicopters; the Company’s ability to

maintain an acceptable safety record; the impact of increased United States (“U.S.”) and foreign government regulation and legislation, including

potential government implemented moratoriums on drilling activities; the impact of a grounding of all or a portion of the Company’s fleet for extended

periods of time or indefinitely on the Company’s business, including its operations and ability to service customers, results of operations or financial

condition and/or the market value of the affected helicopter(s); the Company’s ability to successfully expand into other geographic and aviation

service markets; risks associated with political instability, governmental action, war, acts of terrorism and changes in the economic condition in any

foreign country where the Company does business, which may result in expropriation, nationalization, confiscation or deprivation of the Company’s

assets or result in claims of a force majeure situation; the impact of declines in the global economy and financial markets; the impact of fluctuations in

foreign currency exchange rates on the Company’s asset values and cost to purchase helicopters, spare parts and related services; risks related to

investing in new lines of service without realizing the expected benefits; risks of engaging in competitive processes or expending significant resources

for strategic opportunities, with no guaranty of recoupment; the Company’s reliance on a small number of helicopter manufacturers and suppliers; the

Company’s ongoing need to replace aging helicopters; the Company’s reliance on the secondary helicopter market to dispose of older helicopters;

the Company’s reliance on information technology; the impact of allocation of risk between the Company and its customers; the liability, legal fees

and costs in connection with providing emergency response services; adverse weather conditions and seasonality; risks associated with the

Company’s debt structure; the Company’s counterparty credit risk exposure; the impact of operational and financial difficulties of the Company’s joint

ventures and partners and the risks associated with identifying and securing joint venture partners when needed; conflict with the other owners of the

Company’s non-wholly owned subsidiaries and other equity investees; adverse results of legal proceedings; the Company’s ability to obtain

insurance coverage and the adequacy of such coverage; the Company’s ability to remediate the material weakness in its internal controls over

financial reporting described in its Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2017 and in its Annual Report on Form 10-

K for the year ended December 31, 2016; the possibility of labor problems; the attraction and retention of qualified personnel; restrictions on the

amount of foreign ownership of the Company’s common stock; and various other matters and factors, many of which are beyond the Company’s

control. These factors are not exhaustive, and new factors may emerge or changes to the foregoing factors may occur that could impact the

Company’s business. Except to the extent required by law, the Company undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

2

This presentation includes EBITDA and Adjusted EBITDA as supplemental measures of the Company’s operating performance.

EBITDA is defined as Earnings before Interest (includes interest income and interest expense), Taxes, Depreciation and Amortization.

Adjusted EBITDA is defined as EBITDA further adjusted for SEACOR Management Fees and certain other special items that occurred

during the reporting period. Neither EBITDA nor Adjusted EBITDA is a recognized term under generally accepted accounting principles

in the U.S. (“GAAP”). Accordingly, they should not be used as an indicator of, or an alternative to, net income as a measure of

operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for

discretionary use, as they do not take into account certain cash requirements, such as debt service requirements. EBITDA and

Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, nor as a substitute for analysis of

the Company’s results as reported under GAAP. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may

vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. The

Company also presents net debt, which is a non-GAAP measure, defined as total principal balance on borrowings less cash and cash

equivalents, including escrow balances. Each of these non-GAAP measures has limitations and therefore should not be used in

isolation or as a substitute for the amounts reported in accordance with GAAP.

A reconciliation of EBITDA, Adjusted EBITDA, Adjusted EBITDA further adjusted to exclude gains on asset dispositions and net debt is

included in this presentation.

This presentation also includes the Company’s interest coverage ratio and senior secured leverage ratio. The interest coverage ratio is

the ratio for the most recently ended four consecutive fiscal quarters of EBITDA (as defined in the Company’s credit facility) less

dividends and distributions and the amount of any cash proceeds received from the sale of assets included in EBITDA divided by

interest expense. The senior secured leverage ratio is calculated by dividing senior secured debt (as defined in the Company’s credit

facility) by EBITDA. Neither the interest coverage ratio nor the senior secured leverage ratio is a measure of operating performance or

liquidity defined by GAAP and may not be comparable to similarly titled measures presented by other companies. EBITDA is

calculated under the Company’s credit facility (as amended) differently than as presented elsewhere in this presentation.

Non-GAAP Financial Measures Reconciliation

3

Safety Note

• Safety is Era’s most important core value and our highest operational priority

• Achieved our goals of ZERO air accidents and ZERO TRIR in YTD 2017

• Robust safety management system (SMS), including proprietary quality assurance

programs

• Era’s fleet is configured with the latest safety equipment:

̶ TCAD, TCAS, TCAS II in latest generation

̶ Automatic dependent surveillance – broadcast (ADS–B)

̶ Satellite position tracking

̶ High visibility kits (strobe, pulsating lights and blade paint)

̶ 406Mhz satellite emergency location transmitter

̶ Emergency floatation (water activation) with external rafts

̶ CVR/FDR on CFR part 29 aircraft

• Era is one of the founding members of HeliOffshore, an industry association focused on

safety, now with more than 100 members from all regions of the world

4

Why Invest in Era?

Company Overview

Large, Diverse and Technologically Advanced Fleet

Differentiated Strategy

Financial Stability

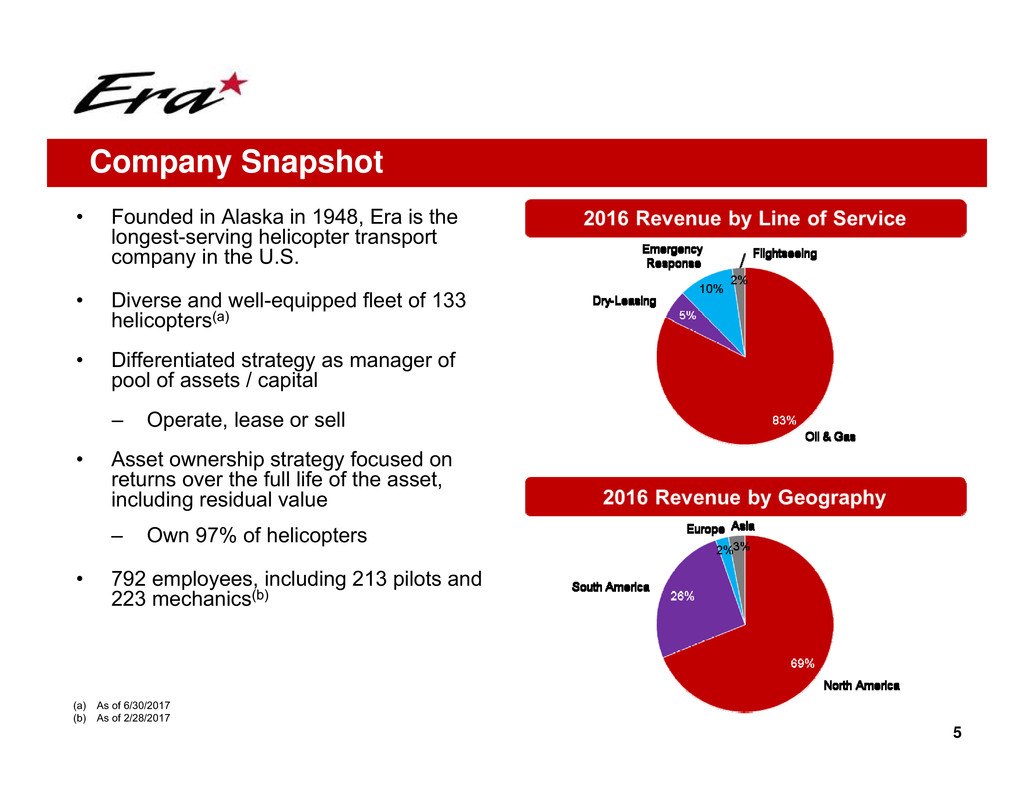

• Founded in Alaska in 1948, Era is the

longest-serving helicopter transport

company in the U.S.

• Diverse and well-equipped fleet of 133

helicopters(a)

• Differentiated strategy as manager of

pool of assets / capital

– Operate, lease or sell

• Asset ownership strategy focused on

returns over the full life of the asset,

including residual value

– Own 97% of helicopters

• 792 employees, including 213 pilots and

223 mechanics(b)

Company Snapshot

5

(a) As of 6/30/2017

(b) As of 2/28/2017

6

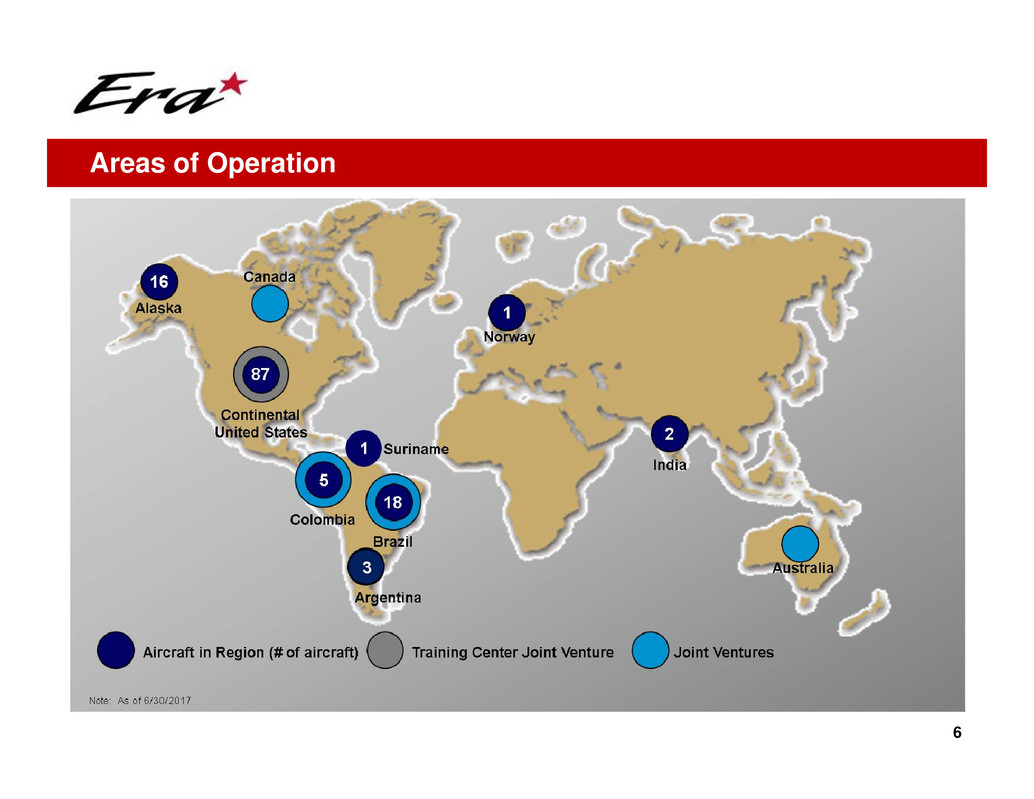

Areas of Operation

7

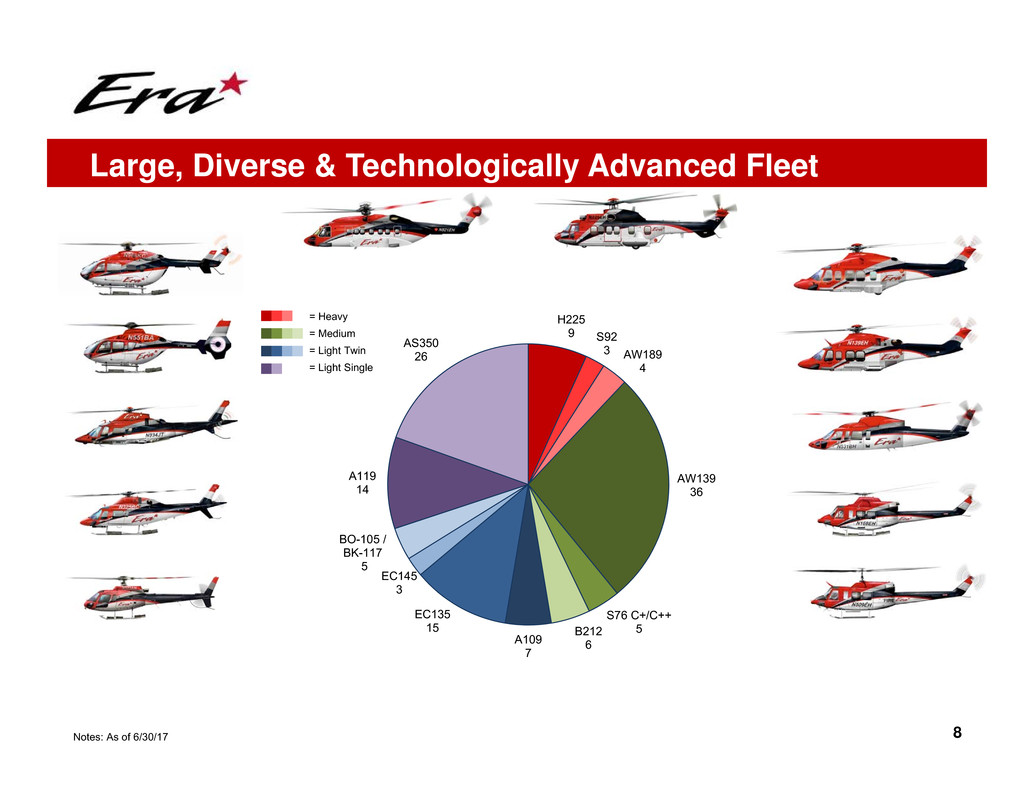

Fleet Snapshot

• On a dollar-weighted NBV basis(a):

− Heavy and medium helicopters represent 86% of fleet value

− Average age of the fleet is 6 years

Note: As of 6/30/17

(a) Average for owned fleet

8

Large, Diverse & Technologically Advanced Fleet

Notes: As of 6/30/17

= Heavy

= Medium

= Light Twin

= Light Single

H225

9 S92

3 AW189

4

AW139

36

S76 C+/C++

5B212

6A109

7

EC135

15

EC145

3

BO-105 /

BK-117

5

A119

14

AS350

26

9

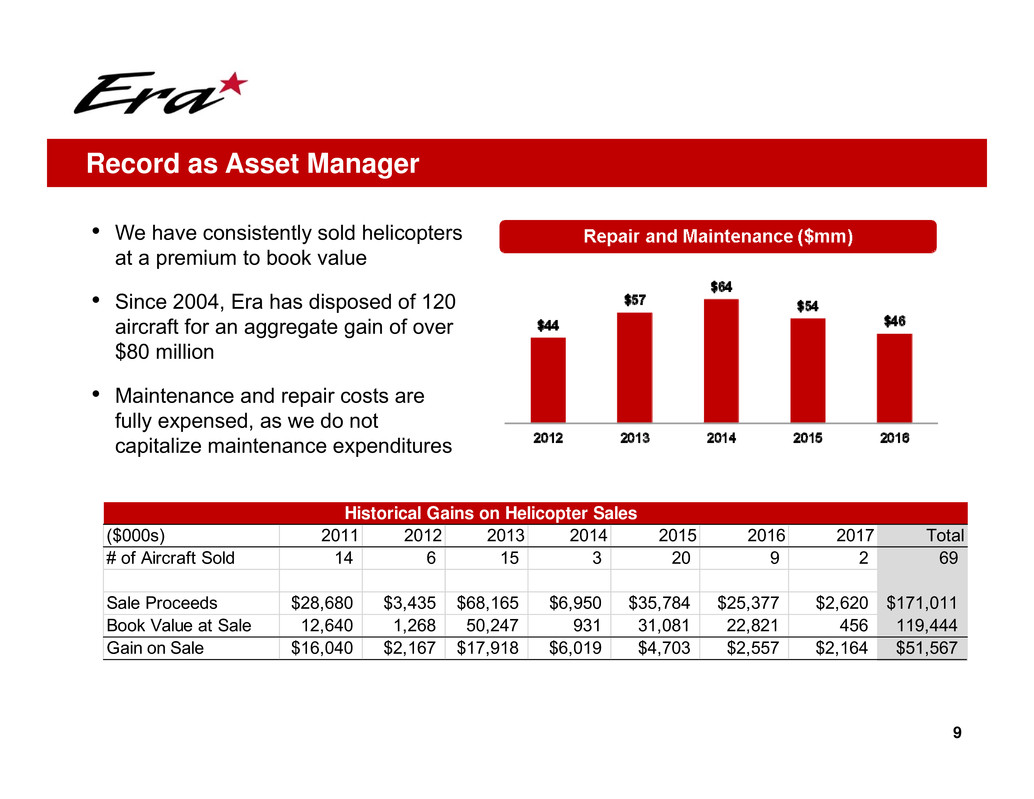

Record as Asset Manager

• We have consistently sold helicopters

at a premium to book value

• Since 2004, Era has disposed of 120

aircraft for an aggregate gain of over

$80 million

• Maintenance and repair costs are

fully expensed, as we do not

capitalize maintenance expenditures

Historical Gains on Helicopter Sales

($000s) 2011 2012 2013 2014 2015 2016 2017 Total

# of Aircraft Sold 14 6 15 3 20 9 2 69

Sale Proceeds $28,680 $3,435 $68,165 $6,950 $35,784 $25,377 $2,620 $171,011

Book Value at Sale 12,640 1,268 50,247 931 31,081 22,821 456 119,444

Gain on Sale $16,040 $2,167 $17,918 $6,019 $4,703 $2,557 $2,164 $51,567

10

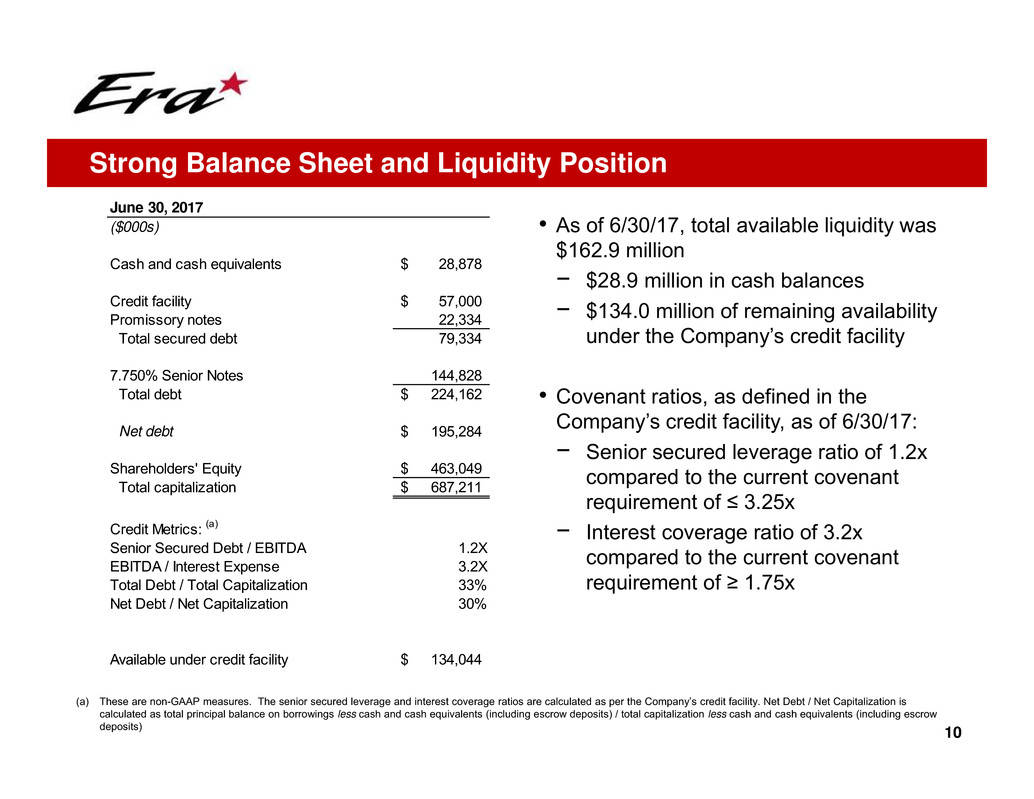

• As of 6/30/17, total available liquidity was

$162.9 million

− $28.9 million in cash balances

− $134.0 million of remaining availability

under the Company’s credit facility

• Covenant ratios, as defined in the

Company’s credit facility, as of 6/30/17:

− Senior secured leverage ratio of 1.2x

compared to the current covenant

requirement of ≤ 3.25x

− Interest coverage ratio of 3.2x

compared to the current covenant

requirement of ≥ 1.75x

Strong Balance Sheet and Liquidity Position

(a) These are non-GAAP measures. The senior secured leverage and interest coverage ratios are calculated as per the Company’s credit facility. Net Debt / Net Capitalization is

calculated as total principal balance on borrowings less cash and cash equivalents (including escrow deposits) / total capitalization less cash and cash equivalents (including escrow

deposits)

June 30, 2017

($000s)

Cash and cash equivalents 28,878$

Credit facility 57,000$

Promissory notes 22,334

Total secured debt 79,334

7.750% Senior Notes 144,828

Total debt 224,162$

Net debt 195,284$

Shareholders' Equity 463,049$

Total capitalization 687,211$

Credit Metrics: (a)

Senior Secured Debt / EBITDA 1.2X

EBITDA / Interest Expense 3.2X

Total Debt / Total Capitalization 33%

Net Debt / Net Capitalization 30%

Available under credit facility 134,044$

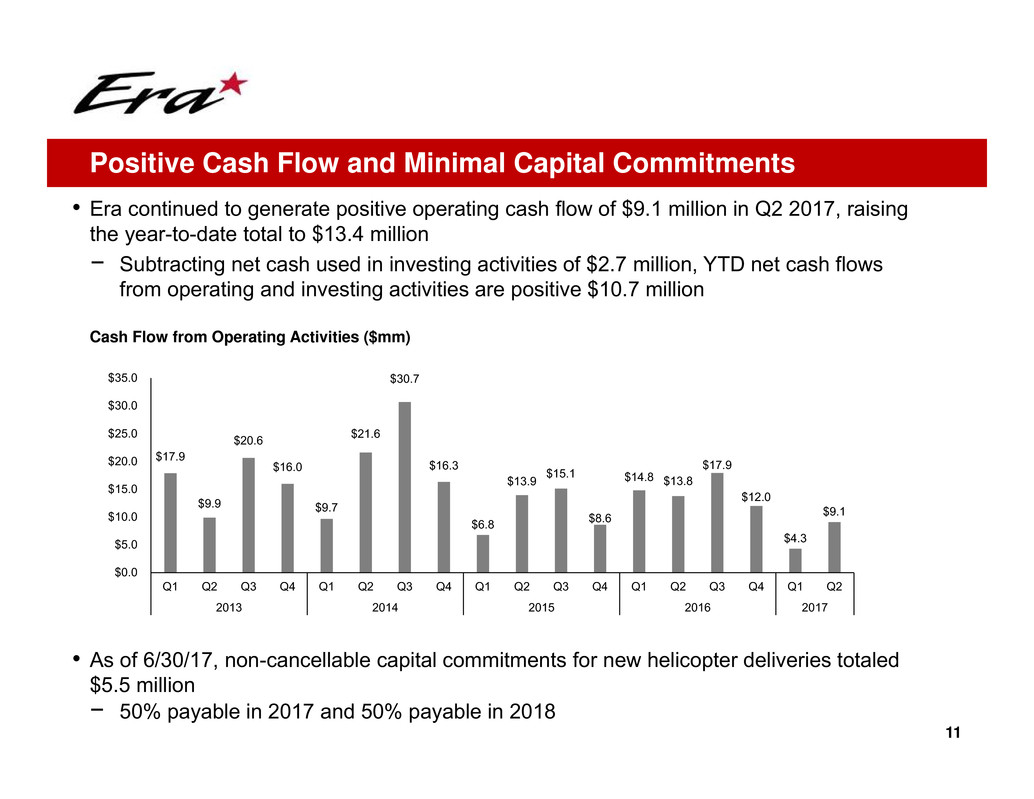

• Era continued to generate positive operating cash flow of $9.1 million in Q2 2017, raising

the year-to-date total to $13.4 million

− Subtracting net cash used in investing activities of $2.7 million, YTD net cash flows

from operating and investing activities are positive $10.7 million

Cash Flow from Operating Activities ($mm)

• As of 6/30/17, non-cancellable capital commitments for new helicopter deliveries totaled

$5.5 million

− 50% payable in 2017 and 50% payable in 2018

11

Positive Cash Flow and Minimal Capital Commitments

$17.9

$9.9

$20.6

$16.0

$9.7

$21.6

$30.7

$16.3

$6.8

$13.9

$15.1

$8.6

$14.8 $13.8

$17.9

$12.0

$4.3

$9.1

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2013 2014 2015 2016 2017

12

Appendix

13

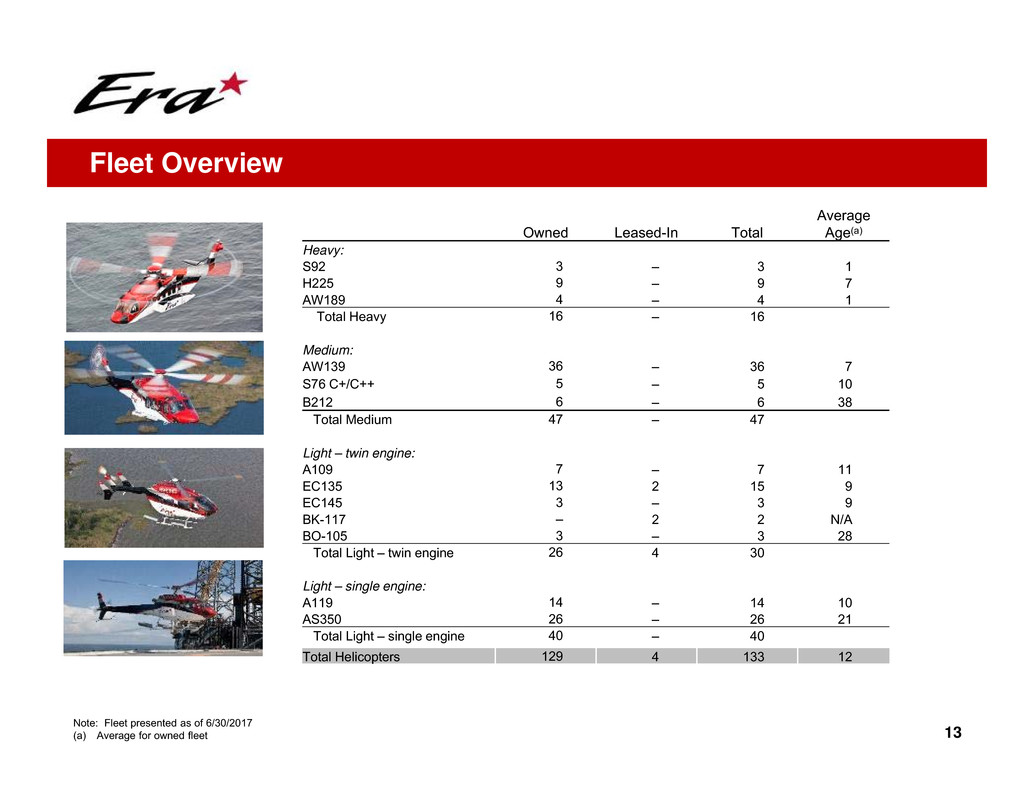

Owned Leased-In Total

Average

Age(a)

Heavy:

S92 3 – 3 1

H225 9 – 9 7

AW189 4 – 4 1

Total Heavy 16 – 16

Medium:

AW139 36 – 36 7

S76 C+/C++ 5 – 5 10

B212 6 – 6 38

Total Medium 47 – 47

Light – twin engine:

A109 7 – 7 11

EC135 13 2 15 9

EC145 3 – 3 9

BK-117 – 2 2 N/A

BO-105 3 – 3 28

Total Light – twin engine 26 4 30

Light – single engine:

A119 14 – 14 10

AS350 26 – 26 21

Total Light – single engine 40 – 40

Total Helicopters 129 4 133 12

Note: Fleet presented as of 6/30/2017

(a) Average for owned fleet

Fleet Overview

14(a) Adjusted EBITDA is a non-GAAP measure. See next page for Adjusted EBITDA reconciliation to Net Income (Loss)

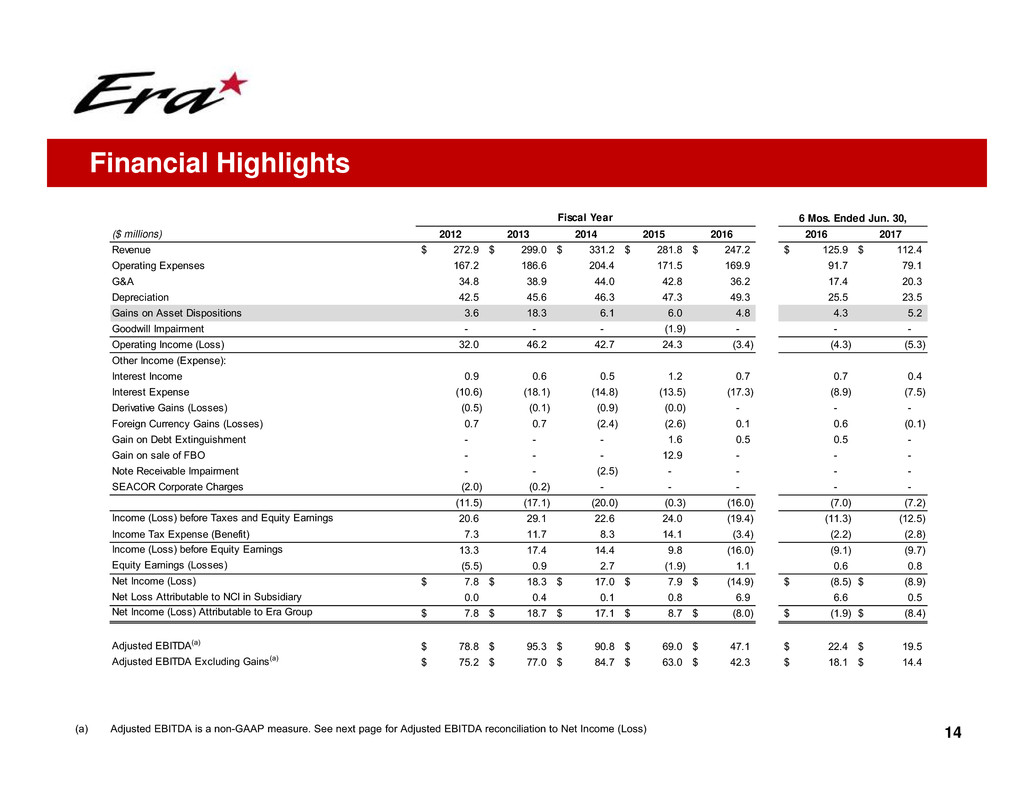

Financial Highlights

Fiscal Year

($ millions) 2012 2013 2014 2015 2016 2016 2017

Revenue 272.9$ 299.0$ 331.2$ 281.8$ 247.2$ 125.9$ 112.4$

Operating Expenses 167.2 186.6 204.4 171.5 169.9 91.7 79.1

G&A 34.8 38.9 44.0 42.8 36.2 17.4 20.3

Depreciation 42.5 45.6 46.3 47.3 49.3 25.5 23.5

Gains on Asset Dispositions 3.6 18.3 6.1 6.0 4.8 4.3 5.2

Goodwill Impairment - - - (1.9) - - -

Operating Income (Loss) 32.0 46.2 42.7 24.3 (3.4) (4.3) (5.3)

Other Income (Expense):

Interest Income 0.9 0.6 0.5 1.2 0.7 0.7 0.4

Interest Expense (10.6) (18.1) (14.8) (13.5) (17.3) (8.9) (7.5)

Derivative Gains (Losses) (0.5) (0.1) (0.9) (0.0) - - -

Foreign Currency Gains (Losses) 0.7 0.7 (2.4) (2.6) 0.1 0.6 (0.1)

Gain on Debt Extinguishment - - - 1.6 0.5 0.5 -

Gain on sale of FBO - - - 12.9 - - -

Note Receivable Impairment - - (2.5) - - - -

SEACOR Corporate Charges (2.0) (0.2) - - - - -

(11.5) (17.1) (20.0) (0.3) (16.0) (7.0) (7.2)

Income (Loss) before Taxes and Equity Earnings 20.6 29.1 22.6 24.0 (19.4) (11.3) (12.5)

Income Tax Expense (Benefit) 7.3 11.7 8.3 14.1 (3.4) (2.2) (2.8)

Income (Loss) before Equity Earnings 13.3 17.4 14.4 9.8 (16.0) (9.1) (9.7)

Equity Earnings (Losses) (5.5) 0.9 2.7 (1.9) 1.1 0.6 0.8

Net Income (Loss) 7.8$ 18.3$ 17.0$ 7.9$ (14.9)$ (8.5)$ (8.9)$

Net Loss Attributable to NCI in Subsidiary 0.0 0.4 0.1 0.8 6.9 6.6 0.5

Net Income (Loss) Attributable to Era Group 7.8$ 18.7$ 17.1$ 8.7$ (8.0)$ (1.9)$ (8.4)$

Adjusted EBITDA(a) 78.8$ 95.3$ 90.8$ 69.0$ 47.1$ 22.4$ 19.5$

Adjusted EBITDA Excluding Gains(a) 75.2$ 77.0$ 84.7$ 63.0$ 42.3$ 18.1$ 14.4$

6 Mos. Ended Jun. 30,

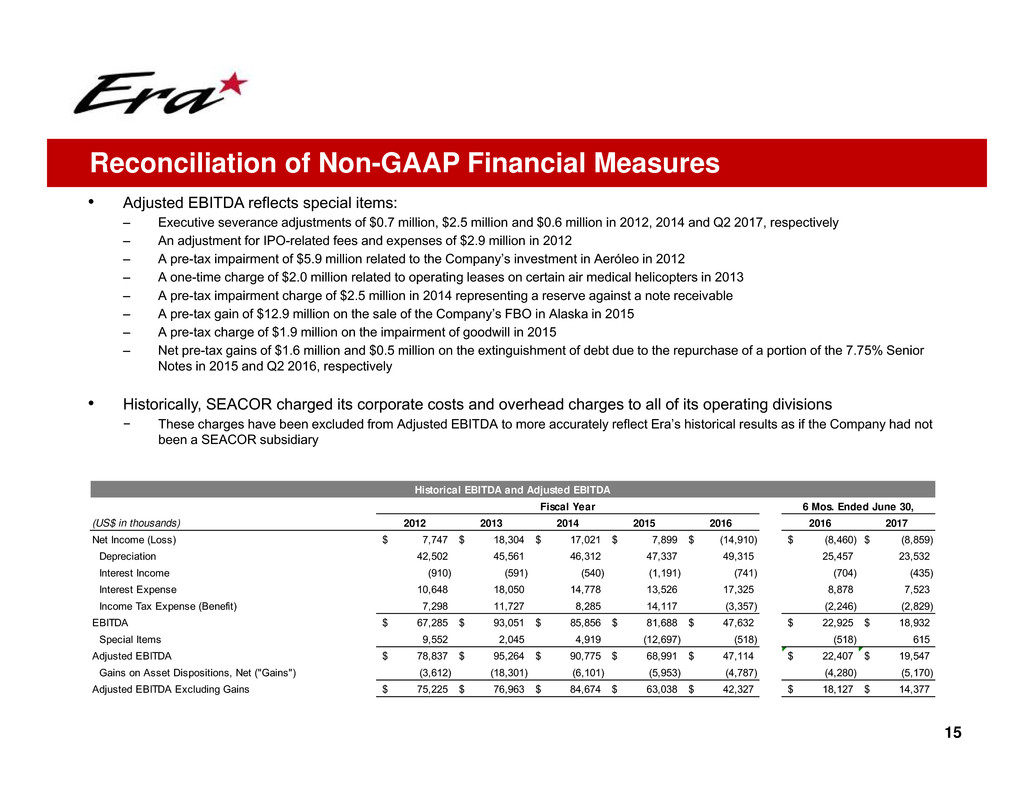

• Adjusted EBITDA reflects special items:

– Executive severance adjustments of $0.7 million, $2.5 million and $0.6 million in 2012, 2014 and Q2 2017, respectively

– An adjustment for IPO-related fees and expenses of $2.9 million in 2012

– A pre-tax impairment of $5.9 million related to the Company’s investment in Aeróleo in 2012

– A one-time charge of $2.0 million related to operating leases on certain air medical helicopters in 2013

– A pre-tax impairment charge of $2.5 million in 2014 representing a reserve against a note receivable

– A pre-tax gain of $12.9 million on the sale of the Company’s FBO in Alaska in 2015

– A pre-tax charge of $1.9 million on the impairment of goodwill in 2015

– Net pre-tax gains of $1.6 million and $0.5 million on the extinguishment of debt due to the repurchase of a portion of the 7.75% Senior

Notes in 2015 and Q2 2016, respectively

• Historically, SEACOR charged its corporate costs and overhead charges to all of its operating divisions

− These charges have been excluded from Adjusted EBITDA to more accurately reflect Era’s historical results as if the Company had not

been a SEACOR subsidiary

15

Reconciliation of Non-GAAP Financial Measures

Historical EBITDA and Adjusted EBITDA

6 Mos. Ended June 30,

(US$ in thousands) 2012 2013 2014 2015 2016 2016 2017

Net Income (Loss) 7,747$ 18,304$ 17,021$ 7,899$ (14,910)$ (8,460)$ (8,859)$

Depreciation 42,502 45,561 46,312 47,337 49,315 25,457 23,532

Interest Income (910) (591) (540) (1,191) (741) (704) (435)

Interest Expense 10,648 18,050 14,778 13,526 17,325 8,878 7,523

Income Tax Expense (Benefit) 7,298 11,727 8,285 14,117 (3,357) (2,246) (2,829)

EBITDA 67,285$ 93,051$ 85,856$ 81,688$ 47,632$ 22,925$ 18,932$

Special Items 9,552 2,045 4,919 (12,697) (518) (518) 615

Adjusted EBITDA 78,837$ 95,264$ 90,775$ 68,991$ 47,114$ 22,407$ 19,547$

Gains on Asset Dispositions, Net ("Gains") (3,612) (18,301) (6,101) (5,953) (4,787) (4,280) (5,170)

Adjusted EBITDA Excluding Gains 75,225$ 76,963$ 84,674$ 63,038$ 42,327$ 18,127$ 14,377$

Fiscal Year