Exhibit 99.1 Barclays CEO Energy-Power Conference September 2018 0

Cautionary Statement Regarding Forward-Looking Statements This presentation contains “forward-looking statements.” Forward-looking statements give the Company’s current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements reflect management’s current views with respect to future events and are subject to risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those anticipated in forward- looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements. Such risks, uncertainties and other important factors include, among others, the Company’s dependence on, and the cyclical and volatile nature of, offshore oil and gas exploration, development and production activity, and the impact of general economic conditions and fluctuations in worldwide prices ofand demand for oil and natural gas on such activity levels; the Company’s reliance on a small number of customers and the reduction of its customer base resulting from bankruptcies or consolidation; risks that the Company’s customers reduce or cancel contracted services or tender processes; cost savings initiatives implemented by the Company’s customers; risks inherent in operating helicopters; the Company’s ability to maintain an acceptable safety record; the impact of increased United States (“U.S.”) and foreign government regulation and legislation, including potential government implemented moratoriums on drilling activities; the impact of a grounding of all or a portion of the Company’s fleet for extended periods of time or indefinitely on the Company’s business, including its operations and ability to service customers, results of operations or financial condition and/or the market value of the affected helicopter(s); the Company’s ability to successfully expand into other geographic and aviation service markets; risks associated with political instability, governmental action, war, acts of terrorism and changes in the economic condition in any foreign country where the Company does business, which may result in expropriation, nationalization, confiscation or deprivation of the Company’s assets or result in claims of a force majeure situation; theimpactof declines in the global economy and financial markets; the impact of fluctuations in foreign currency exchange rates on the Company’s asset values andcost to purchase helicopters, spare parts and related services; risks related to investing in new lines of service without realizing the expected benefits; risks of engaging in competitive processes or expending significant resources for strategic opportunities, with no guaranty of recoupment; the Company’s reliance on a small number of helicopter manufacturers and suppliers; the Company’s ongoing need to replace aging helicopters; the Company’s reliance on the secondary helicopter market to dispose of older helicopters; the Company’s reliance on information technology; the impact of allocation of risk between the Company and its customers; the liability, legal fees and costs in connection with providing emergency response services; adverse weather conditions and seasonality; risks associated with the Company’s debt structure; the Company’s counterparty credit risk exposure; the impact of operational and financial difficulties of the Company’s joint ventures and partners and the risks associated with identifying and securing joint venture partners when needed; conflict with the other owners of the Company’s non-wholly owned subsidiaries and other equity investees; adverse results of legal proceedings, the incurrence of significant costs in connection with the Company’s pursuit of legal remedies, the Company’s ability to obtain insurance coverage and the adequacy and availability of such coverage; the Company’s ability to remediate the material weaknesses it has identified in its internal controls over financial reporting described in its Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2018 and in its Annual Report on Form 10-K for the year ended December 31, 2017; the possibility of labor problems; the attraction and retention of qualified personnel; restrictions on the amount of foreign ownership of the Company’s common stock; and various other matters and factors, many of which are beyond the Company’s control. These factors are not exhaustive, and new factors may emerge or changes to the foregoing factors may occur that could impact the Company’s business. Except to the extent required by law, the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. 1

Non-GAAP Financial Measures Reconciliation This presentation includes EBITDA and Adjusted EBITDA as supplemental measures of the Company’s operating performance. EBITDA is defined as Earnings before Interest (includes interest income and interest expense), Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for SEACOR Management Fees and certain other special items that occurred during the reporting period. Neither EBITDA nor Adjusted EBITDA is a recognized term under generally accepted accounting principles in the U.S. (“GAAP”). Accordingly, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for discretionary use, as they do not take into account certain cash requirements, such as debt service requirements. EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, nor as a substitute for analysis of the Company’s results as reported under GAAP. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. The Company also presents net debt, which is a non-GAAP measure, defined as total principal balance on borrowings less cash and cash equivalents, including escrow balances. Each of these non-GAAP measures has limitations and therefore should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. A reconciliation of EBITDA, Adjusted EBITDA, Adjusted EBITDA further adjusted to exclude gains on asset dispositions and net debt is included in this presentation. Illustrative last-twelve month ("LTM") adjusted recurring free cash flow (“LTM Recurring Adjusted Free Cash Flow”) represents our Net Cash Provided by Operating Activities adjusted to exclude professional services fees paid in respect of litigation settled in the third quarter of 2018 and changes in operating assets and liabilities less capital expenditures unrelated to new helicopters. Management believes that the use of LTM Recurring Adjusted Free Cash Flow is meaningful as it measures the Company’s ability to generate cash from its business after excluding cash payments made for what management considers extraordinary matters. Management uses this information as an analytical indicator to assess the Company’s liquidity and performance. However, investors should not assume the measure represents the residual cash flow available for discretionary expenditures due to the fact that the measure does not deduct the payments required for debt service and other contractual obligations. In addition, numerous methods may exist for calculating a company's free cash flow. As a result, the method used by management to calculate LTM Recurring Adjusted Free Cash Flow may differ from the methods used by other companies to calculate their free cash flow. 2

Safety Note • Safety is Era’s most important core value and our highest operational priority • Achieved our goals of ZERO air accidents and ZERO TRIR in YTD 2018 ̶ This follows the Company’s best safety performance year on record in 2017 • Robust safety management system (SMS) • Era’s fleet is configured with the latest safety equipment: ̶ TCAD, TCAS, TCAS II in latest generation ̶ Automatic dependent surveillance – broadcast (ADS–B) ̶ Satellite position tracking ̶ High visibility kits (strobe, pulsating lights and blade paint) ̶ 406Mhz satellite emergency location transmitter ̶ Emergency floatation (water activation) with external rafts ̶ CVR/FDR on CFR part 29 aircraft • Era is one of the founding members of HeliOffshore, an industry association focused on safety, now with more than 110 members from all regions of the world 3

Why Invest in Era? Diverse and Differentiated Technologically Strategy Advanced Fleet Offshore Recovery Financial Underway Strength Cash Flow Generation 4

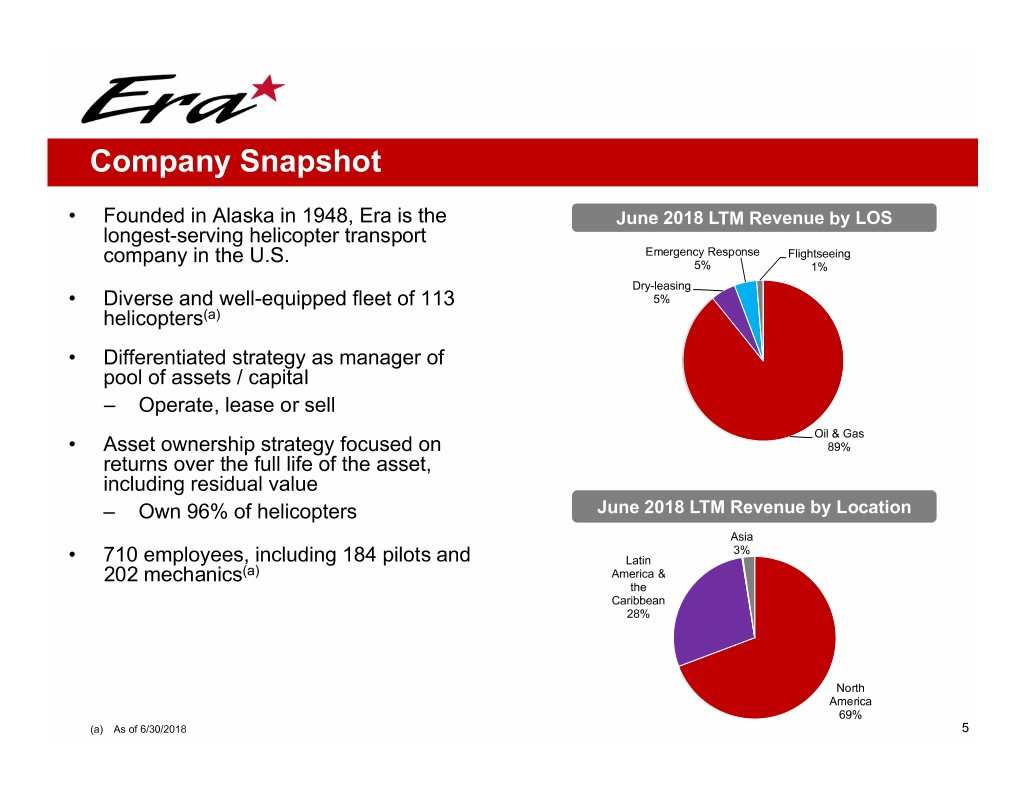

Company Snapshot • Founded in Alaska in 1948, Era is the June 2018 LTM Revenue by LOS longest-serving helicopter transport company in the U.S. Emergency Response Flightseeing 5% 1% Dry-leasing • Diverse and well-equipped fleet of 113 5% helicopters(a) • Differentiated strategy as manager of pool of assets / capital – Operate, lease or sell Oil & Gas • Asset ownership strategy focused on 89% returns over the full life of the asset, including residual value – Own 96% of helicopters June 2018 LTM Revenue by Location Asia 3% • 710 employees, including 184 pilots and Latin 202 mechanics(a) America & the Caribbean 28% North America 69% (a) As of 6/30/2018 5

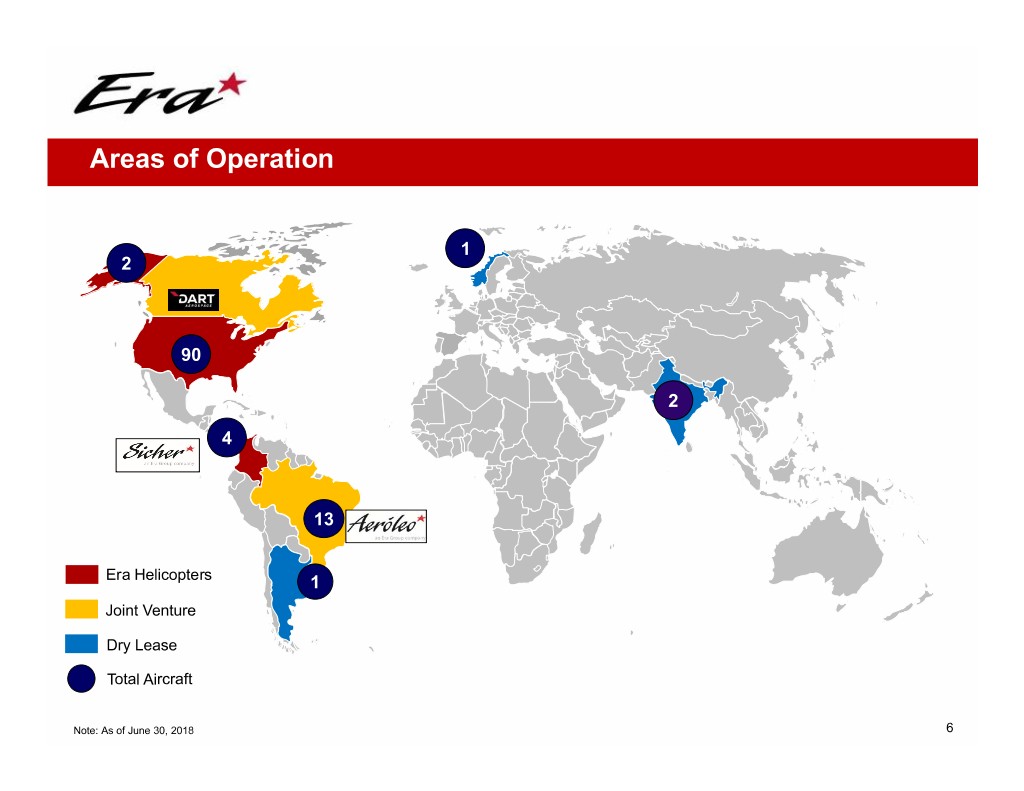

Areas of Operation 1 2 90 2 4 13 Era Helicopters 1 Joint Venture Dry Lease Total Aircraft Note: As of June 30, 2018 6

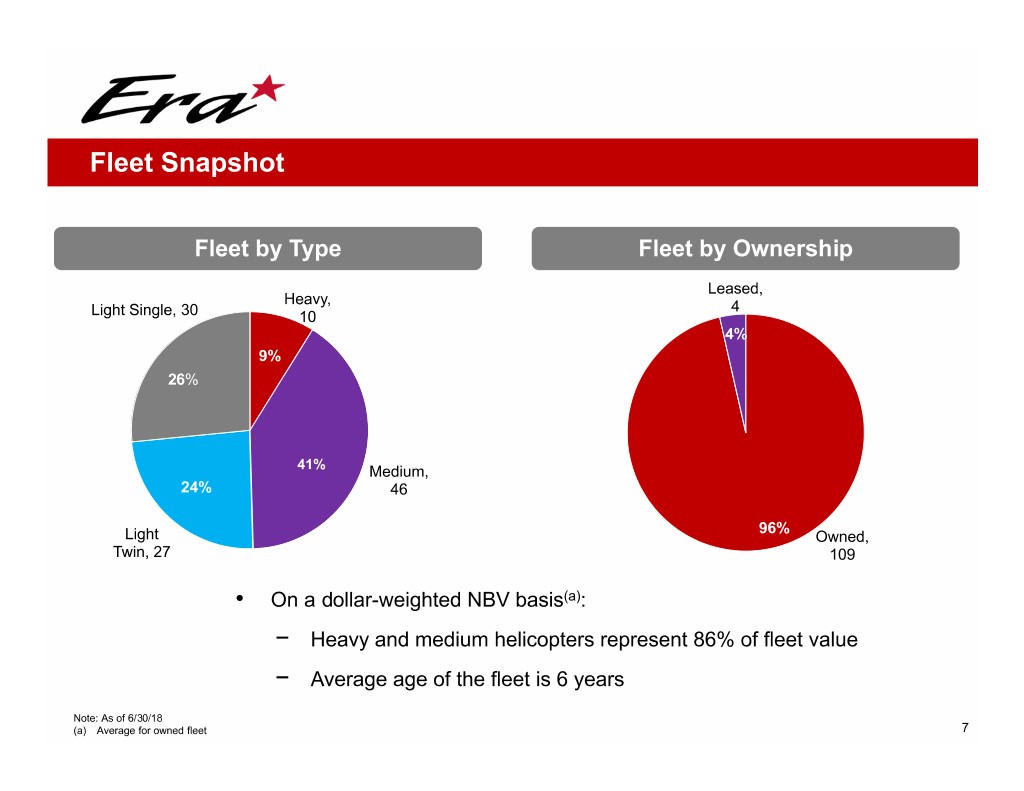

Fleet Snapshot Fleet by Type Fleet by Ownership Leased, Heavy, 4 Light Single, 30 10 4% 9% 26% 41% Medium, 24% 46 96% Light Owned, Twin, 27 109 • On a dollar-weighted NBV basis(a): − Heavy and medium helicopters represent 86% of fleet value − Average age of the fleet is 6 years Note: As of 6/30/18 (a) Average for owned fleet 7

Large, Diverse & Technologically Advanced Fleet = Heavy S92 AW189 4 = Medium AS350 4 EC225 17 = Light Twin 2 = Light Single A119 13 AW139 36 BO-105 / BK- 117 5 EC135 15 S76 C+/C++ A109 B212 5 7 5 Note: As of 6/30/18 8

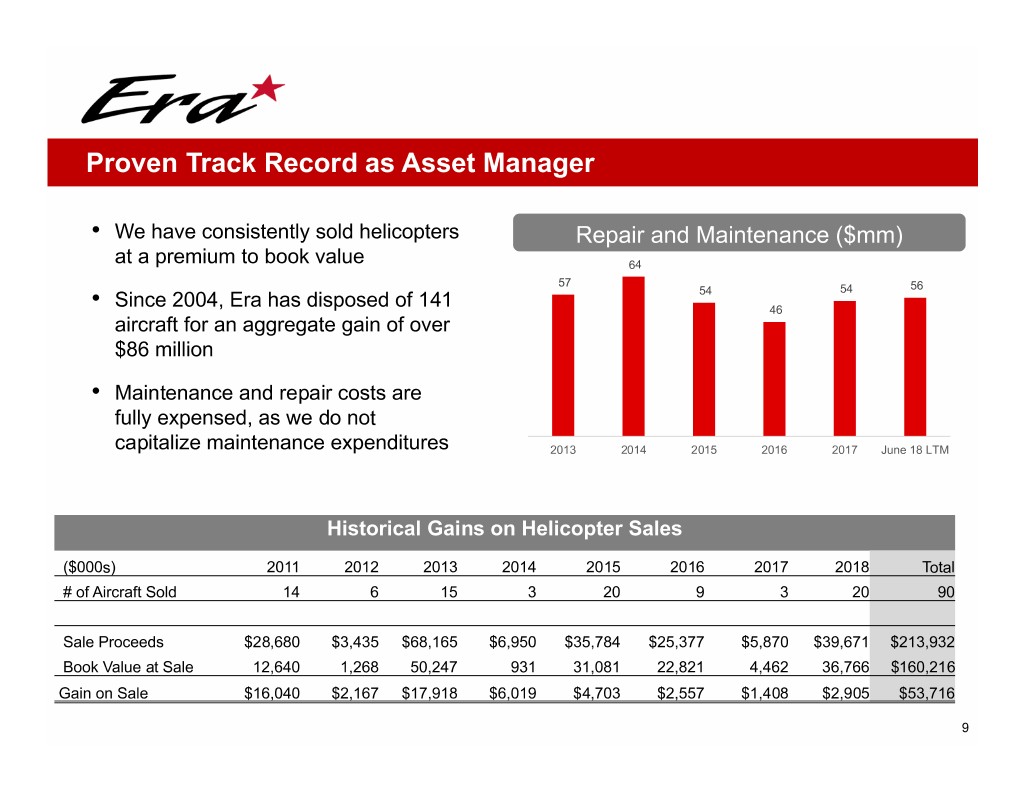

Proven Track Record as Asset Manager • We have consistently sold helicopters Repair and Maintenance ($mm) at a premium to book value 64 57 54 54 56 • Since 2004, Era has disposed of 141 46 aircraft for an aggregate gain of over $86 million • Maintenance and repair costs are fully expensed, as we do not capitalize maintenance expenditures 2013 2014 2015 2016 2017 June 18 LTM Historical Gains on Helicopter Sales ($000s) 2011 2012 2013 2014 2015 2016 2017 2018 Total # of Aircraft Sold 14 6 15 3 20 9 3 20 90 Sale Proceeds $28,680 $3,435 $68,165 $6,950 $35,784 $25,377 $5,870 $39,671 $213,932 Book Value at Sale 12,640 1,268 50,247 931 31,081 22,821 4,462 36,766 $160,216 Gain on Sale $16,040 $2,167 $17,918 $6,019 $4,703 $2,557 $1,408 $2,905 $53,716 9

Financial Strength • Total available liquidity as of August 3, 2018 was approximately $173 million ̶ $49 million in cash balances ̶ $124 million of remaining availability under the Company’s credit facility • Era generated $10 million of cash from asset sales in Q2 2018 ̶ Net cash flows from operating and investing activities were positive $15 million in Q2 • Continue to prioritize the protection of the Company’s strong balance sheet ̶ Limited debt maturities prior to 2021 ̶ Manageable fixed charge obligations ($4 million in Q2; will decrease with the repayment of all outstanding borrowings under the revolving credit facility in July) • All of the Company's unfunded capital commitments may be canceled without further liability other than forfeiture of previously paid deposits of $2 million 10

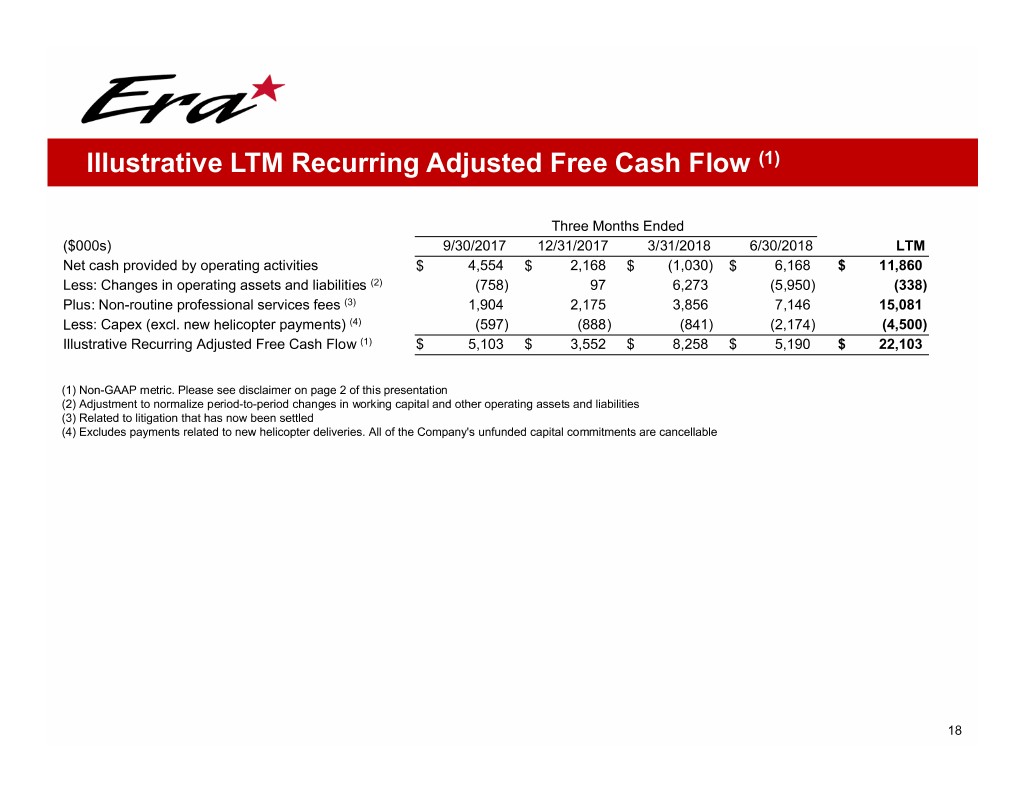

Primed for Free Cash Flow Generation Limited Debt Maturities Strong Balance Sheet Efficient Cost Structure prior to 2021 Manageable Fixed No Significant Firm Charge Obligations Capital Commitments Free Cash Flow Generation Illustrative LTM Recurring Adjusted Free Cash Flow was +$22 million(1) (1) Non-GAAP metric. Please see calculation on page 18 and disclaimer language on page 2 of the presentation 11

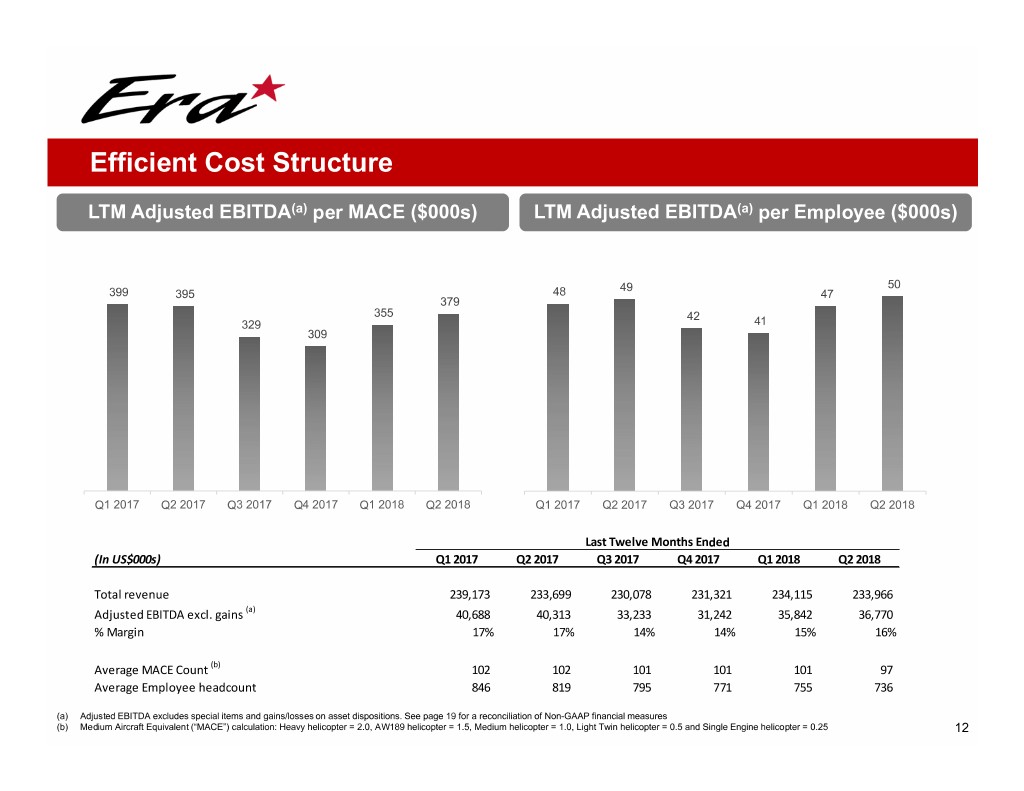

Efficient Cost Structure LTM Adjusted EBITDA(a) per MACE ($000s) LTM Adjusted EBITDA(a) per Employee ($000s) 49 50 399 395 48 47 379 355 42 329 41 309 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Last Twelve Months Ended (In US$000s) Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Total revenue 239,173 233,699 230,078 231,321 234,115 233,966 Adjusted EBITDA excl. gains (a) 40,688 40,313 33,233 31,242 35,842 36,770 % Margin 17% 17% 14% 14% 15% 16% Average MACE Count (b) 102 102 101 101 101 97 Average Employee headcount 846 819 795 771 755 736 (a) Adjusted EBITDA excludes special items and gains/losses on asset dispositions. See page 19 for a reconciliation of Non-GAAP financial measures (b) Medium Aircraft Equivalent (“MACE”) calculation: Heavy helicopter = 2.0, AW189 helicopter = 1.5, Medium helicopter = 1.0, Light Twin helicopter = 0.5 and Single Engine helicopter = 0.25 12

Efficient Supply Chain Management • For a helicopter operator, significant money can be lost, or value gained, depending on how efficiently a company manages its supply chain • We believe Era has outperformed our competition in this area Inventory as % of Net PP&E Inventory as % of Total Tangible Assets 3.4% 3.3% 3.1% 3.1% 3.1% 2.8% 2.8% 2.6% 2.7% 2.7% FY2014 FY2015 FY2016 FY2017 6/30/2018 FY2014 FY2015 FY2016 FY2017 6/30/2018 13

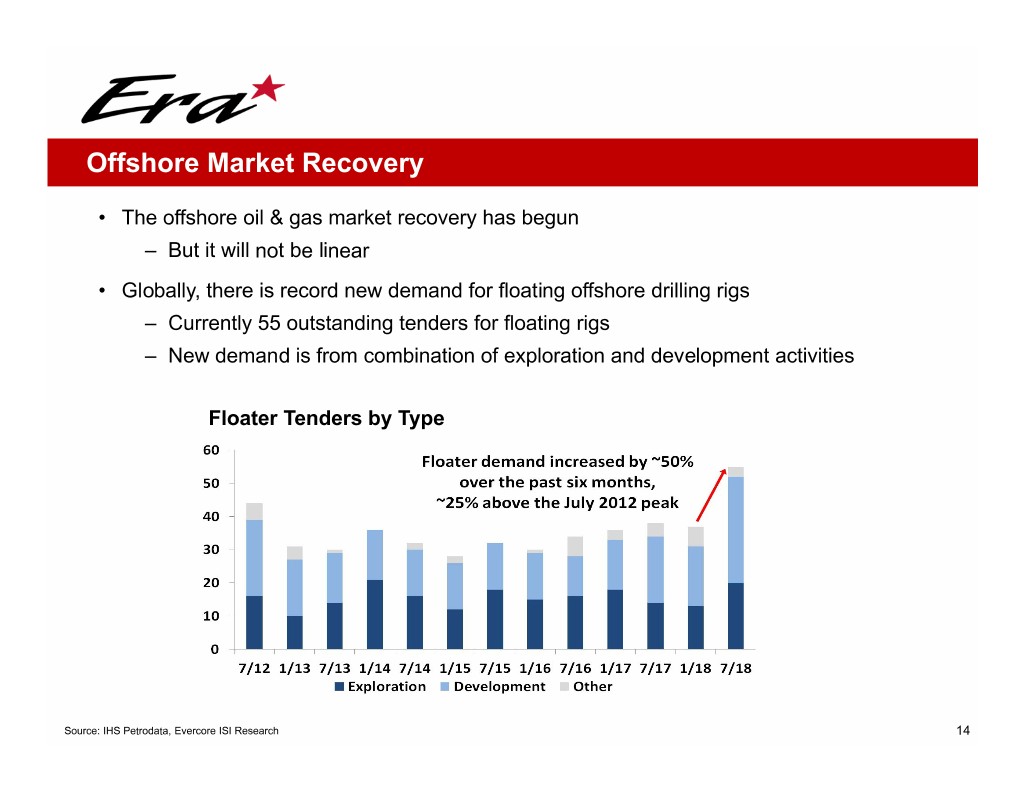

Offshore Market Recovery • The offshore oil & gas market recovery has begun – But it will not be linear • Globally, there is record new demand for floating offshore drilling rigs – Currently 55 outstanding tenders for floating rigs – New demand is from combination of exploration and development activities Floater Tenders by Type Source: IHS Petrodata, Evercore ISI Research 14

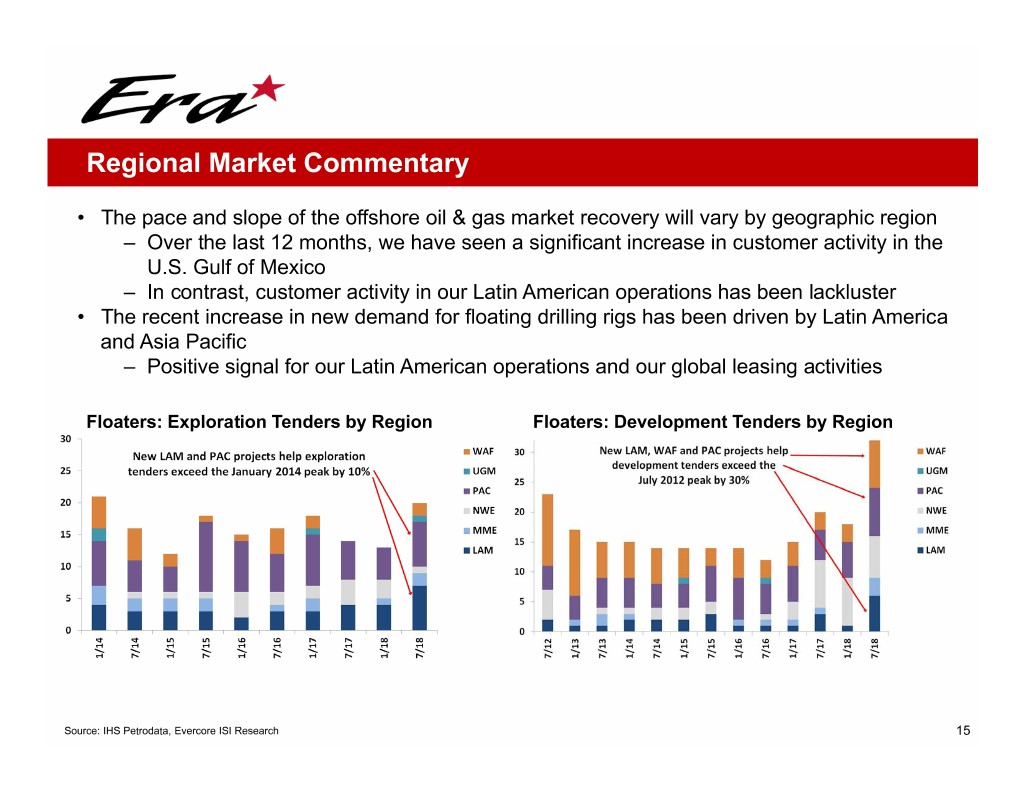

Regional Market Commentary • The pace and slope of the offshore oil & gas market recovery will vary by geographic region – Over the last 12 months, we have seen a significant increase in customer activity in the U.S. Gulf of Mexico – In contrast, customer activity in our Latin American operations has been lackluster • The recent increase in new demand for floating drilling rigs has been driven by Latin America and Asia Pacific – Positive signal for our Latin American operations and our global leasing activities Floaters: Exploration Tenders by Region Floaters: Development Tenders by Region Source: IHS Petrodata, Evercore ISI Research 15

Appendix 16

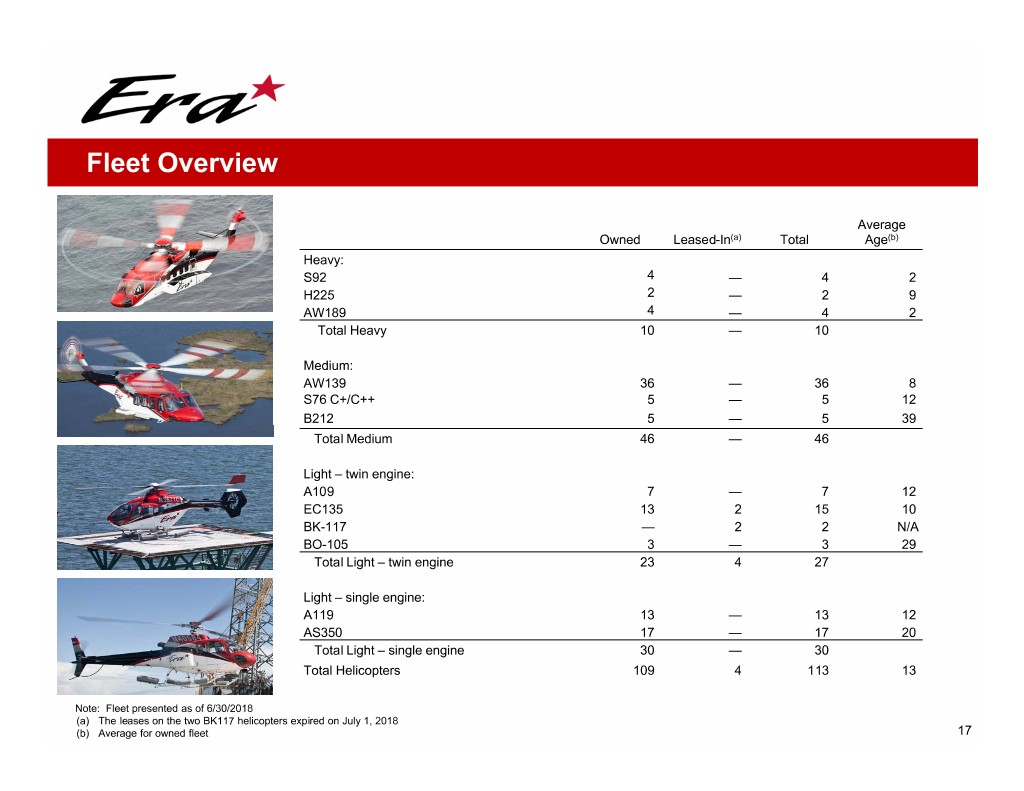

Fleet Overview Average Owned Leased-In(a) Total Age(b) Heavy: S92 4 —42 H225 2 —29 AW189 4 —42 Total Heavy 10 — 10 Medium: AW139 36 — 36 8 S76 C+/C++ 5 —512 B212 5 — 5 39 Total Medium 46 — 46 Light – twin engine: A109 7 — 7 12 EC135 13 2 15 10 BK-117 — 2 2 N/A BO-105 3 — 3 29 Total Light – twin engine 23 4 27 Light – single engine: A119 13 — 13 12 AS350 17 — 17 20 Total Light – single engine 30 — 30 Total Helicopters 109 4 113 13 Note: Fleet presented as of 6/30/2018 (a) The leases on the two BK117 helicopters expired on July 1, 2018 (b) Average for owned fleet 17

Illustrative LTM Recurring Adjusted Free Cash Flow (1) Three Months Ended ($000s) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 LTM Net cash provided by operating activities $ 4,554 $ 2,168 $ (1,030) $ 6,168 $ 11,860 Less: Changes in operating assets and liabilities (2) (758) 97 6,273 (5,950) (338) Plus: Non-routine professional services fees (3) 1,904 2,175 3,856 7,146 15,081 Less: Capex (excl. new helicopter payments) (4) (597) (888) (841) (2,174) (4,500) Illustrative Recurring Adjusted Free Cash Flow (1) $ 5,103 $ 3,552 $ 8,258 $ 5,190 $ 22,103 (1) Non-GAAP metric. Please see disclaimer on page 2 of this presentation (2) Adjustment to normalize period-to-period changes in working capital and other operating assets and liabilities (3) Related to litigation that has now been settled (4) Excludes payments related to new helicopter deliveries. All of the Company's unfunded capital commitments are cancellable 18

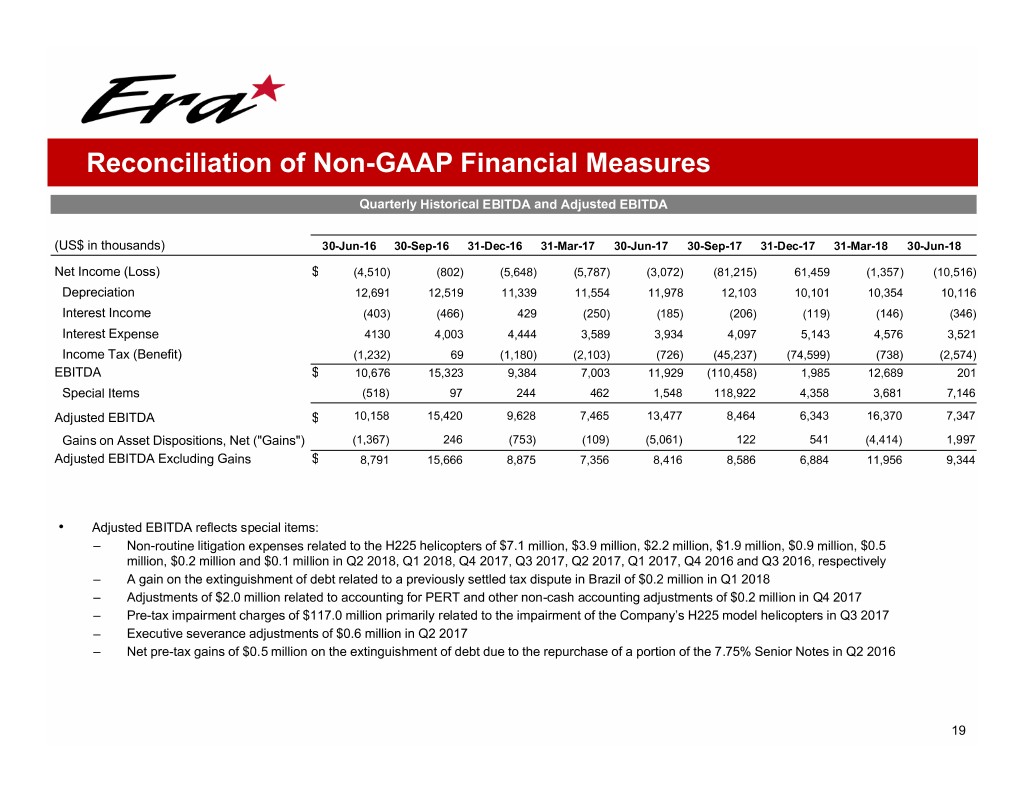

Reconciliation of Non-GAAP Financial Measures Quarterly Historical EBITDA and Adjusted EBITDA (US$ in thousands) 30-Jun-16 30-Sep-16 31-Dec-16 31-Mar-17 30-Jun-17 30-Sep-17 31-Dec-17 31-Mar-18 30-Jun-18 Net Income (Loss) $ (4,510) (802) (5,648) (5,787) (3,072) (81,215) 61,459 (1,357) (10,516) Depreciation 12,691 12,519 11,339 11,554 11,978 12,103 10,101 10,354 10,116 Interest Income (403) (466) 429 (250) (185) (206) (119) (146) (346) Interest Expense 4130 4,003 4,444 3,589 3,934 4,097 5,143 4,576 3,521 Income Tax (Benefit) (1,232) 69 (1,180) (2,103) (726) (45,237) (74,599) (738) (2,574) EBITDA $ 10,676 15,323 9,384 7,003 11,929 (110,458) 1,985 12,689 201 Special Items (518) 97 244 462 1,548 118,922 4,358 3,681 7,146 Adjusted EBITDA $ 10,158 15,420 9,628 7,465 13,477 8,464 6,343 16,370 7,347 Gains on Asset Dispositions, Net ("Gains") (1,367) 246 (753) (109) (5,061) 122 541 (4,414) 1,997 Adjusted EBITDA Excluding Gains $ 8,791 15,666 8,875 7,356 8,416 8,586 6,884 11,956 9,344 • Adjusted EBITDA reflects special items: – Non-routine litigation expenses related to the H225 helicopters of $7.1 million, $3.9 million, $2.2 million, $1.9 million, $0.9 million, $0.5 million, $0.2 million and $0.1 million in Q2 2018, Q1 2018, Q4 2017, Q3 2017, Q2 2017, Q1 2017, Q4 2016 and Q3 2016, respectively – A gain on the extinguishment of debt related to a previously settled tax dispute in Brazil of $0.2 million in Q1 2018 – Adjustments of $2.0 million related to accounting for PERT and other non-cash accounting adjustments of $0.2 million in Q4 2017 – Pre-tax impairment charges of $117.0 million primarily related to the impairment of the Company’s H225 model helicopters in Q3 2017 – Executive severance adjustments of $0.6 million in Q2 2017 – Net pre-tax gains of $0.5 million on the extinguishment of debt due to the repurchase of a portion of the 7.75% Senior Notes in Q2 2016 19