Exhibit 99.3 Exhibit ANNUAL REPORT 2018 REPORT ANNUAL ANNUAL REPORT 2018

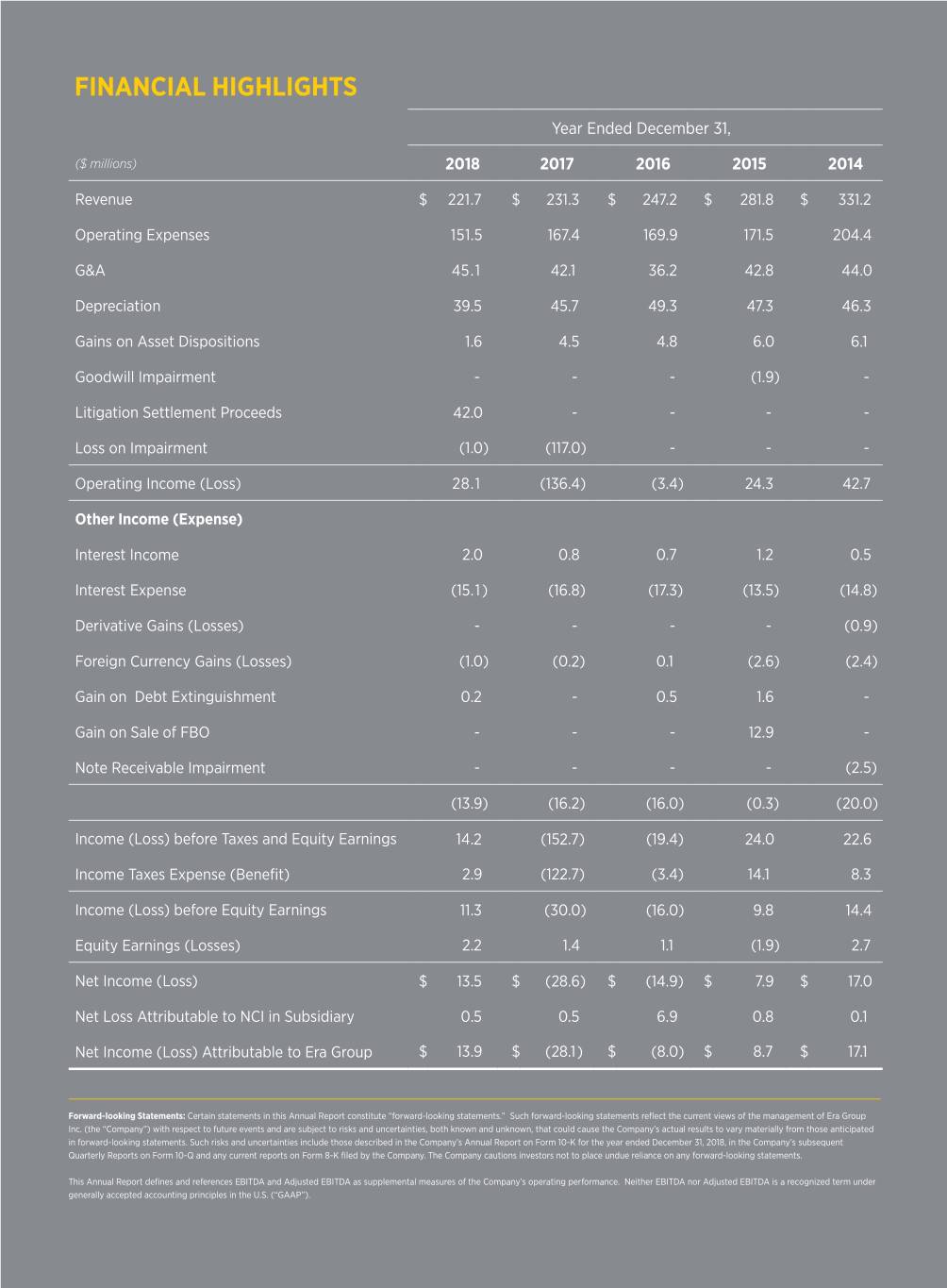

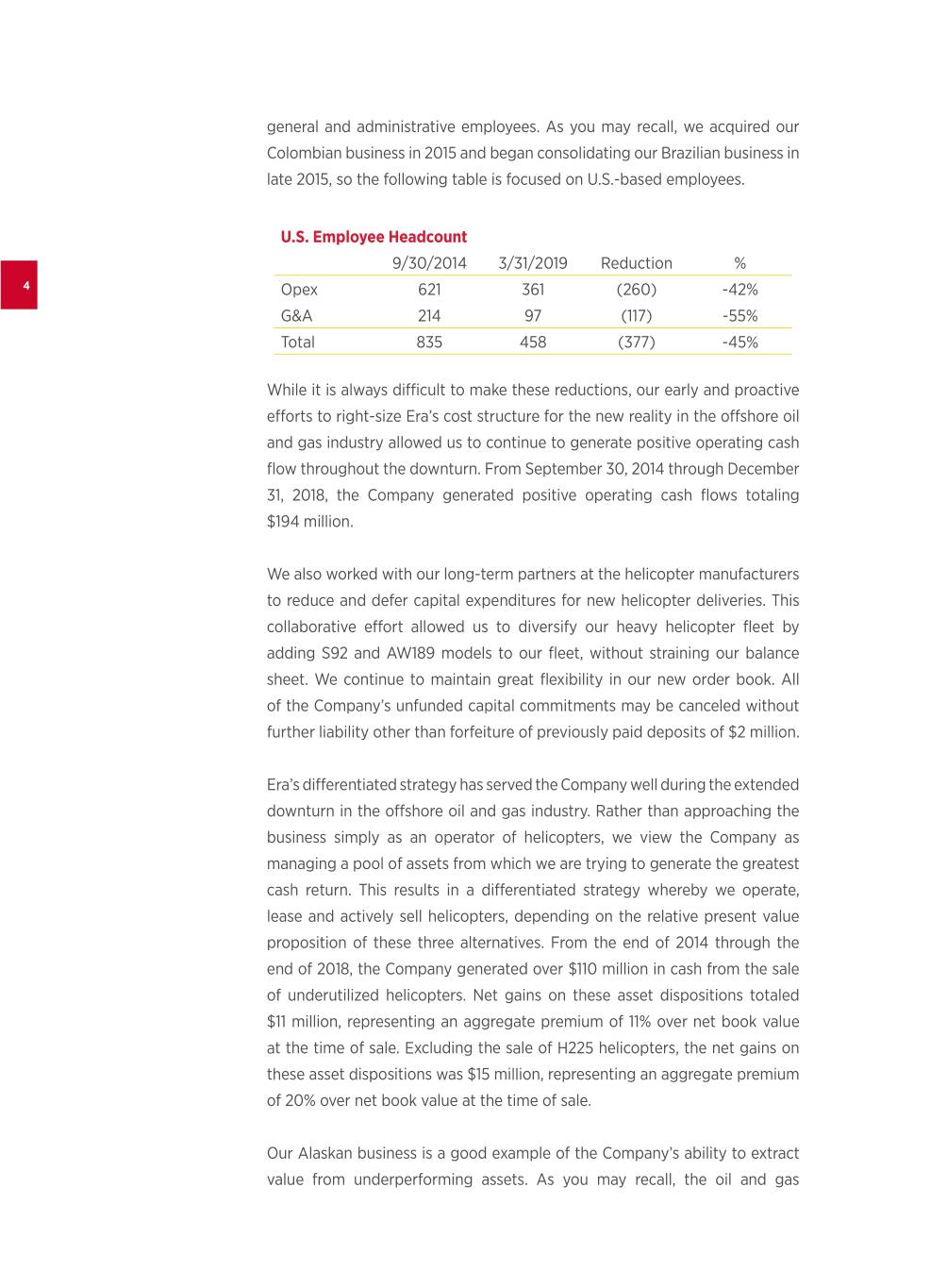

FINANCIAL HIGHLIGHTS Year Ended December 31, ($ millions) 2018 2017 2016 2015 2014 Revenue $ 221.7 $ 231.3 $ 247.2 $ 281.8 $ 331.2 Operating Expenses 151.5 167.4 169.9 171.5 204.4 G&A 45.1 42.1 36.2 42.8 44.0 Depreciation 39.5 45.7 49.3 47.3 46.3 Gains on Asset Dispositions 1.6 4.5 4.8 6.0 6.1 Goodwill Impairment - - - (1.9) - Litigation Settlement Proceeds 42.0 - - - - Loss on Impairment (1.0) (117.0) - - - Operating Income (Loss) 28.1 (136.4) (3.4) 24.3 42.7 Other Income (Expense) Interest Income 2.0 0.8 0.7 1.2 0.5 Interest Expense (15.1) (16.8) (17.3) (13.5) (14.8) Derivative Gains (Losses) - - - - (0.9) Foreign Currency Gains (Losses) (1.0) (0.2) 0.1 (2.6) (2.4) Gain on Debt Extinguishment 0.2 - 0.5 1.6 - Gain on Sale of FBO - - - 12.9 - Note Receivable Impairment - - - - (2.5) (13.9) (16.2) (16.0) (0.3) (20.0) Income (Loss) before Taxes and Equity Earnings 14.2 (152.7) (19.4) 24.0 22.6 Income Taxes Expense (Benefit) 2.9 (122.7) (3.4) 14.1 8.3 Income (Loss) before Equity Earnings 11.3 (30.0) (16.0) 9.8 14.4 Equity Earnings (Losses) 2.2 1.4 1.1 (1.9) 2.7 Net Income (Loss) $ 13.5 $ (28.6) $ (14.9) $ 7.9 $ 17.0 Net Loss Attributable to NCI in Subsidiary 0.5 0.5 6.9 0.8 0.1 Net Income (Loss) Attributable to Era Group $ 13.9 $ (28.1) $ (8.0) $ 8.7 $ 17.1 Forward-looking Statements: Certain statements in this Annual Report constitute “forward-looking statements.” Such forward-looking statements reflect the current views of the management of Era Group Inc. (the “Company”) with respect to future events and are subject to risks and uncertainties, both known and unknown, that could cause the Company’s actual results to vary materially from those anticipated in forward-looking statements. Such risks and uncertainties include those described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018, in the Company’s subsequent Quarterly Reports on Form 10-Q and any current reports on Form 8-K filed by the Company. The Company cautions investors not to place undue reliance on any forward-looking statements. This Annual Report defines and references EBITDA and Adjusted EBITDA as supplemental measures of the Company’s operating performance. Neither EBITDA nor Adjusted EBITDA is a recognized term under generally accepted accounting principles in the U.S. (“GAAP”).

1 April 24, 2019 Dear Fellow Stockholder I am pleased to report that Era’s recent safety performance is the best in the history of the Company. In 2018, we achieved our dual goals of ZERO air accidents and ZERO OSHA recordable incidents for the year. It has been three years since the Company’s last air accident, and we have now gone more than 570 consecutive days without an OSHA recordable incident. I want to commend the entire Era team for their hard work and dedication in achieving this world-class safety performance. I am also pleased to report that the National Ocean Industries Association (NOIA) recognized Era as the 2019 winner of the NOIA Safety in Seas Culture of Safety award. Safety is Era’s #1 core value and our highest operational priority. We understand that our safety record must be earned anew each day, and we remain focused on continuous improvement in 2019. For the fiscal year ended December 31, 2018, Era reported operating revenues of $222 million, a $10 million decrease from fiscal year 2017. Earnings before interest, taxes, depreciation and amortization (“EBITDA”)1 was $69 million in 2018 compared to negative $90 million in the prior year. EBITDA adjusted to exclude the impact of special items and gains on asset dispositions was $37 million in 2018 compared to $31 million in 2017. Special items in 2018 consisted of $42 million in litigation settlement proceeds, $11 million in 1 EBITDA and EBITDA adjusted to non-routine professional services fees related to the settled litigation, and exclude the impact of special items and gains on asset dispositions are each $1 million of non-cash charges. Special items in 2017 consisted of a $117 million financial measures not calculated in accordance with U.S. generally accepted impairment charge related to the Company’s H225 helicopters, $6 million in accounting principles (“Non-GAAP Measures”). See the annex to this letter non-routine professional services fees related to the now settled litigation, for a discussion of each of these Non- GAAP Measures and a reconciliation of and $3 million of non-cash charges. Gains on asset dispositions were these Non-GAAP Measures to the most closely comparable GAAP measure. $2 million in 2018 compared to $5 million in 2017.

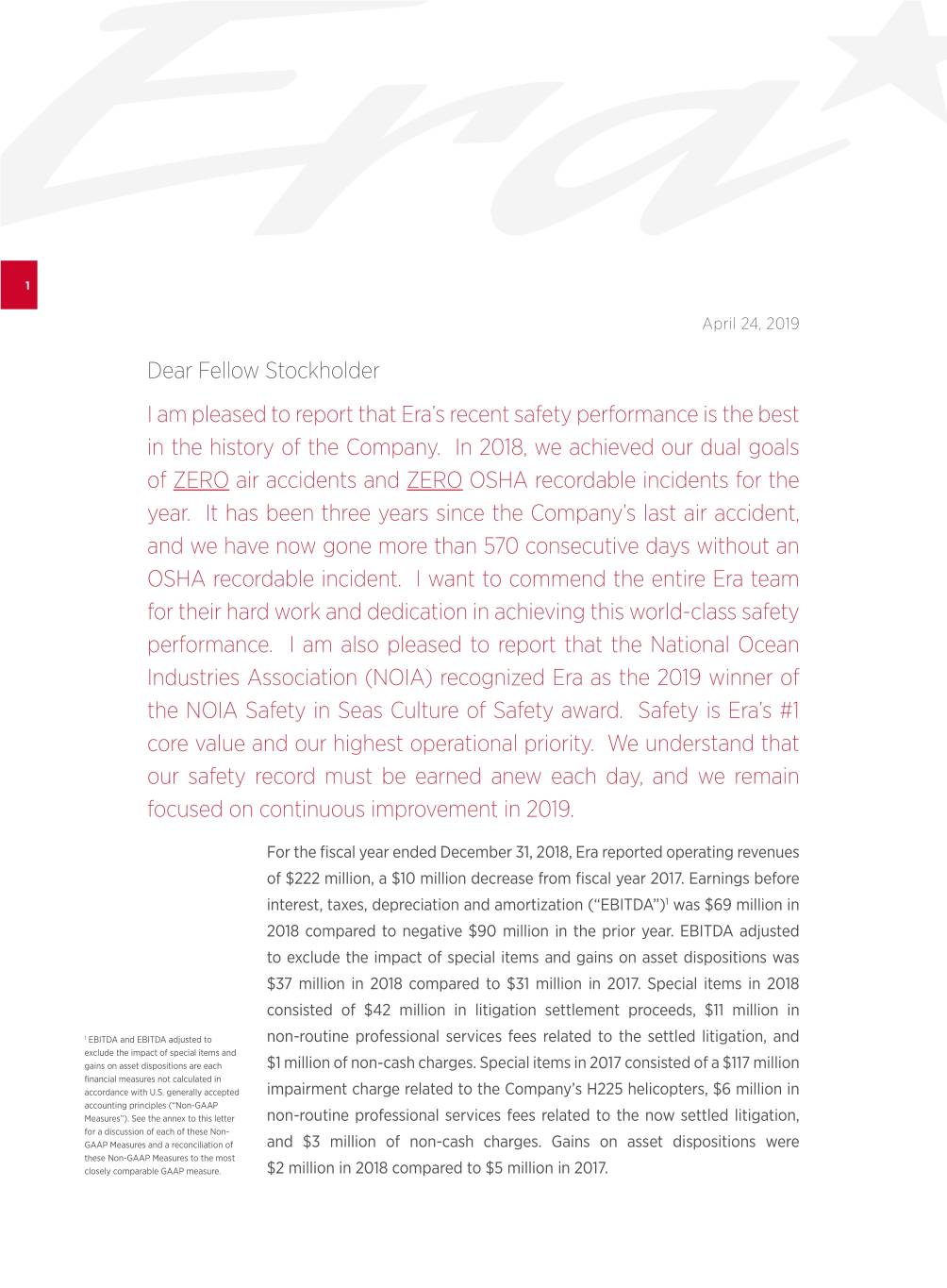

RATHER THAN APPROACHING THE BUSINESS SIMPLY AS AN OPERATOR OF HELICOPTERS, WE VIEW THE 2 COMPANY AS MANAGING A POOL OF ASSETS FROM WHICH WE ARE TRYING TO GENERATE THE GREATEST CASH RETURN.

Despite challenging industry conditions, Era generated positive net cash flows from operating and investing activities of $77 million in 2018. Excluding the impact of non-routine litigation expenses and litigation settlement proceeds noted above, net cash flows from operating and investing activities would have been positive $46 million in 2018. Given the financial distress that other industry participants, both offshore 3 helicopter operators and the specialty helicopter leasing companies, are experiencing, it is worthwhile to review the way Era has executed our strategy during the protracted offshore oil and gas industry downturn. With an uncertain outlook regarding the extent and duration of the downturn, we believed that we needed to design and execute a business plan that would be viable in any commodity price environment. Beginning in late 2014, we adopted strategic priorities based on (i) achieving the highest safety standards, (ii) maximizing the utilization of our helicopter fleet, (iii) realizing efficiencies in our cost structure, and (iv) protecting our balance sheet. Our management team scoured all aspects of the Company’s cost structure, looking for opportunities to reduce costs while maintaining the highest standards for safety and customer service. This effort focused on all line items, from helicopter maintenance expenses to coffee and office supplies. The one metric that is perhaps the most tangible and easiest to illustrate, though certainly the most difficult and painful to implement, is employee headcount reduction. From September 30, 2014 through March 31, 2019, we reduced U.S. employee headcount by 45%, including a 55% reduction in Fleet by Type Fleet by Ownership OWNED—108 8% HEAVY—9 21% LIGHT-TWIN—23 28% LIGHT-SINGLE—30 43% MEDIUM—46 100% As of December 31, 2018.

general and administrative employees. As you may recall, we acquired our Colombian business in 2015 and began consolidating our Brazilian business in late 2015, so the following table is focused on U.S.-based employees. U.S. Employee Headcount 9/30/2014 3/31/2019 Reduction % 4 Opex 621 361 (260) -42% G&A 214 97 (117) -55% Total 835 458 (377) -45% While it is always difficult to make these reductions, our early and proactive efforts to right-size Era’s cost structure for the new reality in the offshore oil and gas industry allowed us to continue to generate positive operating cash flow throughout the downturn. From September 30, 2014 through December 31, 2018, the Company generated positive operating cash flows totaling $194 million. We also worked with our long-term partners at the helicopter manufacturers to reduce and defer capital expenditures for new helicopter deliveries. This collaborative effort allowed us to diversify our heavy helicopter fleet by adding S92 and AW189 models to our fleet, without straining our balance sheet. We continue to maintain great flexibility in our new order book. All of the Company’s unfunded capital commitments may be canceled without further liability other than forfeiture of previously paid deposits of $2 million. Era’s differentiated strategy has served the Company well during the extended downturn in the offshore oil and gas industry. Rather than approaching the business simply as an operator of helicopters, we view the Company as managing a pool of assets from which we are trying to generate the greatest cash return. This results in a differentiated strategy whereby we operate, lease and actively sell helicopters, depending on the relative present value proposition of these three alternatives. From the end of 2014 through the end of 2018, the Company generated over $110 million in cash from the sale of underutilized helicopters. Net gains on these asset dispositions totaled $11 million, representing an aggregate premium of 11% over net book value at the time of sale. Excluding the sale of H225 helicopters, the net gains on these asset dispositions was $15 million, representing an aggregate premium of 20% over net book value at the time of sale. Our Alaskan business is a good example of the Company’s ability to extract value from underperforming assets. As you may recall, the oil and gas

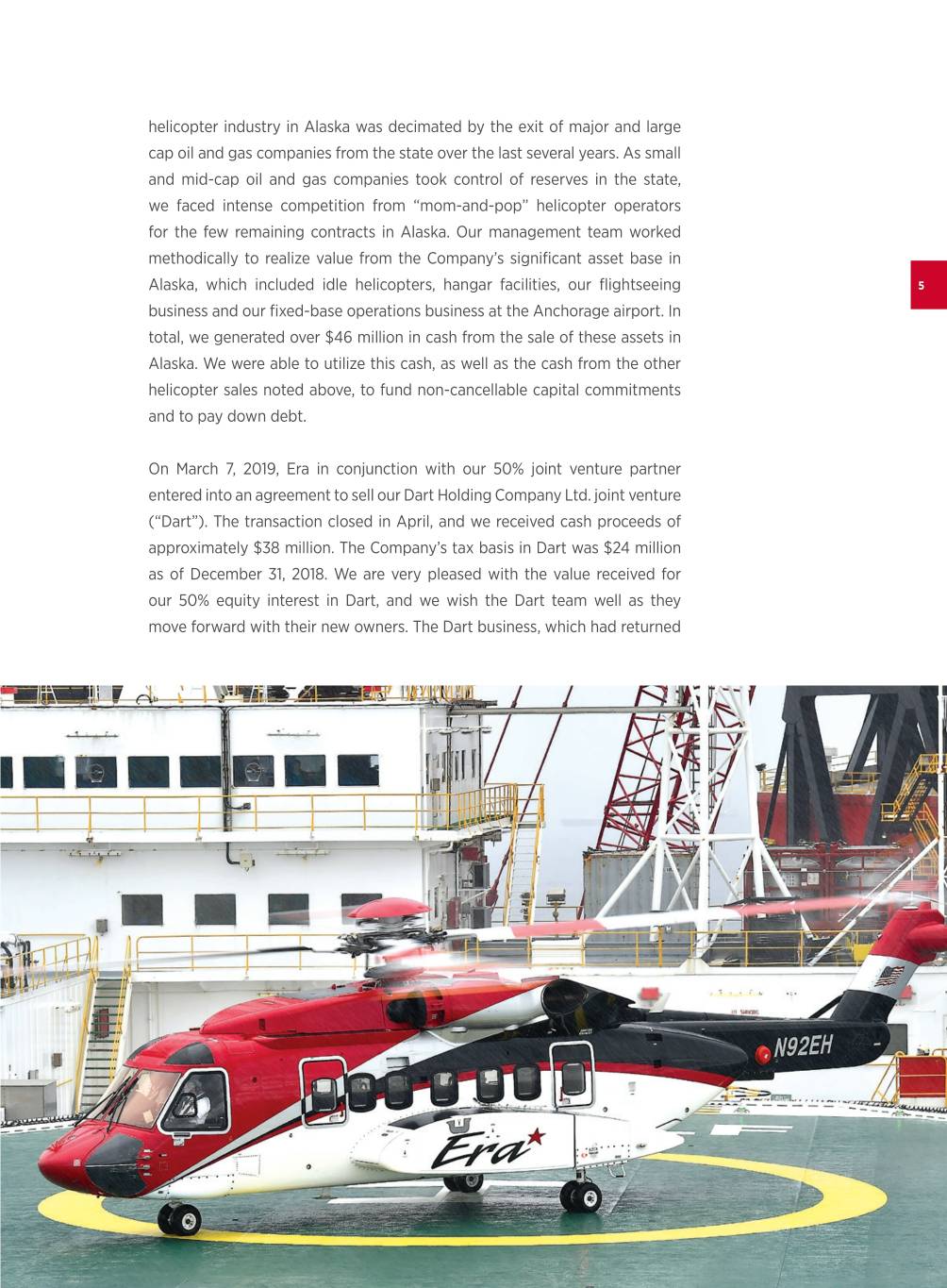

helicopter industry in Alaska was decimated by the exit of major and large cap oil and gas companies from the state over the last several years. As small and mid-cap oil and gas companies took control of reserves in the state, we faced intense competition from “mom-and-pop” helicopter operators for the few remaining contracts in Alaska. Our management team worked methodically to realize value from the Company’s significant asset base in Alaska, which included idle helicopters, hangar facilities, our flightseeing 5 business and our fixed-base operations business at the Anchorage airport. In total, we generated over $46 million in cash from the sale of these assets in Alaska. We were able to utilize this cash, as well as the cash from the other helicopter sales noted above, to fund non-cancellable capital commitments and to pay down debt. On March 7, 2019, Era in conjunction with our 50% joint venture partner entered into an agreement to sell our Dart Holding Company Ltd. joint venture (“Dart”). The transaction closed in April, and we received cash proceeds of approximately $38 million. The Company’s tax basis in Dart was $24 million as of December 31, 2018. We are very pleased with the value received for our 50% equity interest in Dart, and we wish the Dart team well as they move forward with their new owners. The Dart business, which had returned

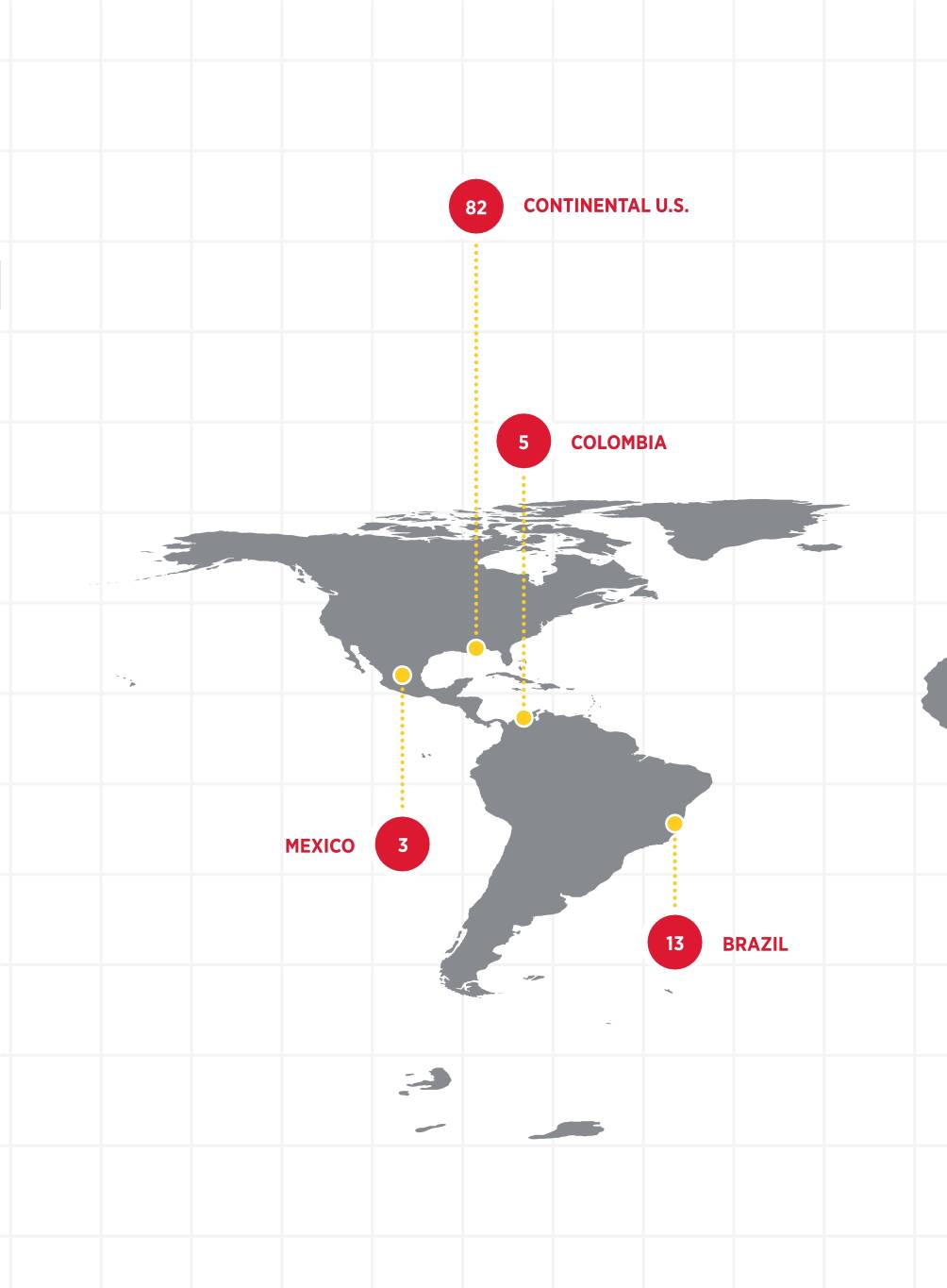

82 CONTINENTAL U.S. 6 5 COLOMBIA MEXICO 3 13 BRAZIL

Areas of Operation 108 Helicopters 7 1 NORWAY 2 SPAIN 2 INDIA As of December 31, 2018

THESE EFFORTS HAVE HELPED TO MAINTAIN THE COMPANY’S 8 FINANCIAL FLEXIBILITY, WHICH HAS INCREASINGLY BECOME A COMPETITIVE ADVANTAGE IN OUR INDUSTRY.

de minimus amounts of cash to Era since our initial investment, had recently come of age from a scale and independent management standpoint, and the time had come to realize value from this investment for Era shareholders. We have continued to prioritize the protection of our strong balance sheet and liquidity position. From September 30, 2014 to December 31, 2018, we reduced net debt2 by $128 million. Pro forma for the sale of Dart noted above, 9 the total reduction in net debt was over $165 million during this period. These efforts have helped to maintain the Company’s financial flexibility, which has increasingly become a competitive advantage in our industry. As of December 31, 2018, Era’s Net Debt to FY2018 Adjusted EBITDA ratio was less than 3x. Pro forma for the sale of Dart, this metric would have been less than 2x. Despite the very difficult conditions experienced during the prolonged downturn in the offshore oil and gas industry, we have protected the equity value of your Company. Era’s book value of equity was $463 million as of December 31, 2018, which compares favorably to the Company’s equity book value of $457 million as of September 30, 2014. This preservation of equity value is more dramatic when compared to our closest peers. The following chart shows relative equity market capitalization levels for our closest publicly traded offshore helicopter operator peers over the course of the downturn. 905 719 476 355 260 282 229 229 251 183 190 Equity Market 87 30 40 Capitalization 9 (in millions) 2015 2016 2017 2018 Q1 2019* Company A Company B ERA *Q1 2019, as of March 31, 2019. All other years as of December 31st of that respective year. We have experienced many rainy days over the last four-and-a-half years, but our business and balance sheet remain strong. We are not out of the 2 Net debt is a Non-GAAP Measure. See the annex to this letter for a proverbial woods yet. Conditions in the offshore helicopter industry remain discussion of this Non-GAAP Measure and a reconciliation to its most closely challenging, with limited visibility on future market activity. In addition, comparable GAAP measure.

the recent announcement of Chevron Corporation’s agreement to acquire Anadarko Petroleum Corporation introduces uncertainty as Anadarko is our largest customer, accounting for approximately 30% of Era’s 2018 revenues. As of the date of this letter, Occidental Petroleum has submitted a competing offer to acquire Anadarko. If a sale of Anadarko proceeds, it is likely that the transaction will take a while to complete, regardless of the identity of 10 the counterparty. Furthermore, we believe the implications for the combined company’s helicopter transport needs will not be known until later in the integration process. At this time, it is too early for us to speculate on whether a transaction will have a positive, negative or neutral impact on our business. We believe Era is well-positioned to deal with challenges, should more arise. In the meantime, our priorities are unchanged. We remain laser-focused on delivering safe, efficient and reliable helicopter operations to all of our customers, every day. 27% 24% 19% 18% 15% $39 Historical $91 Financial $69 $47 Performance $36 (in millions) $331 $282 $247 $231 $222 2014 2015 2016 2017 2018 Revenue Adjusted EBITDA Margin Adjusted EBITDA includes Gains on Asset Sales. Those who follow the offshore helicopter business understand that the current industry structure is not sustainable, with multiple helicopter operators and leasing companies having already filed for bankruptcy protection and others expected to follow suit shortly. A simple, stand-alone equitization of these distressed balance sheets is unlikely to address the fundamental issues at play and may only lead to subsequent rounds of restructuring. In our view, the offshore helicopter industry is in dire need of consolidation, amongst both the operators and the lessors. Consolidation will not only address the excess capacity in the industry, but will also facilitate better absorption of the significant fixed costs required to run an air carrier. By way of illustration, a combination of any two of the three large deepwater Gulf of Mexico (“GOM”) helicopter operators is likely to result in synergies that are equivalent to or

greater than either stand-alone company’s GOM oil and gas EBITDA levels. The magnitude of these cost savings is such that a combination could create significant value for both companies’ stakeholders. We have positioned Era such that the Company is secure in a stand-alone scenario, despite the challenging industry conditions, and also well-positioned to participate in value-accretive consolidation opportunities, should they 11 become actionable. We continue to believe that our strong balance sheet and cash flow profile present multiple opportunities to create value for Era shareholders. Thank you for your support. Sincerely, Christopher S. Bradshaw President and Chief Executive Officer

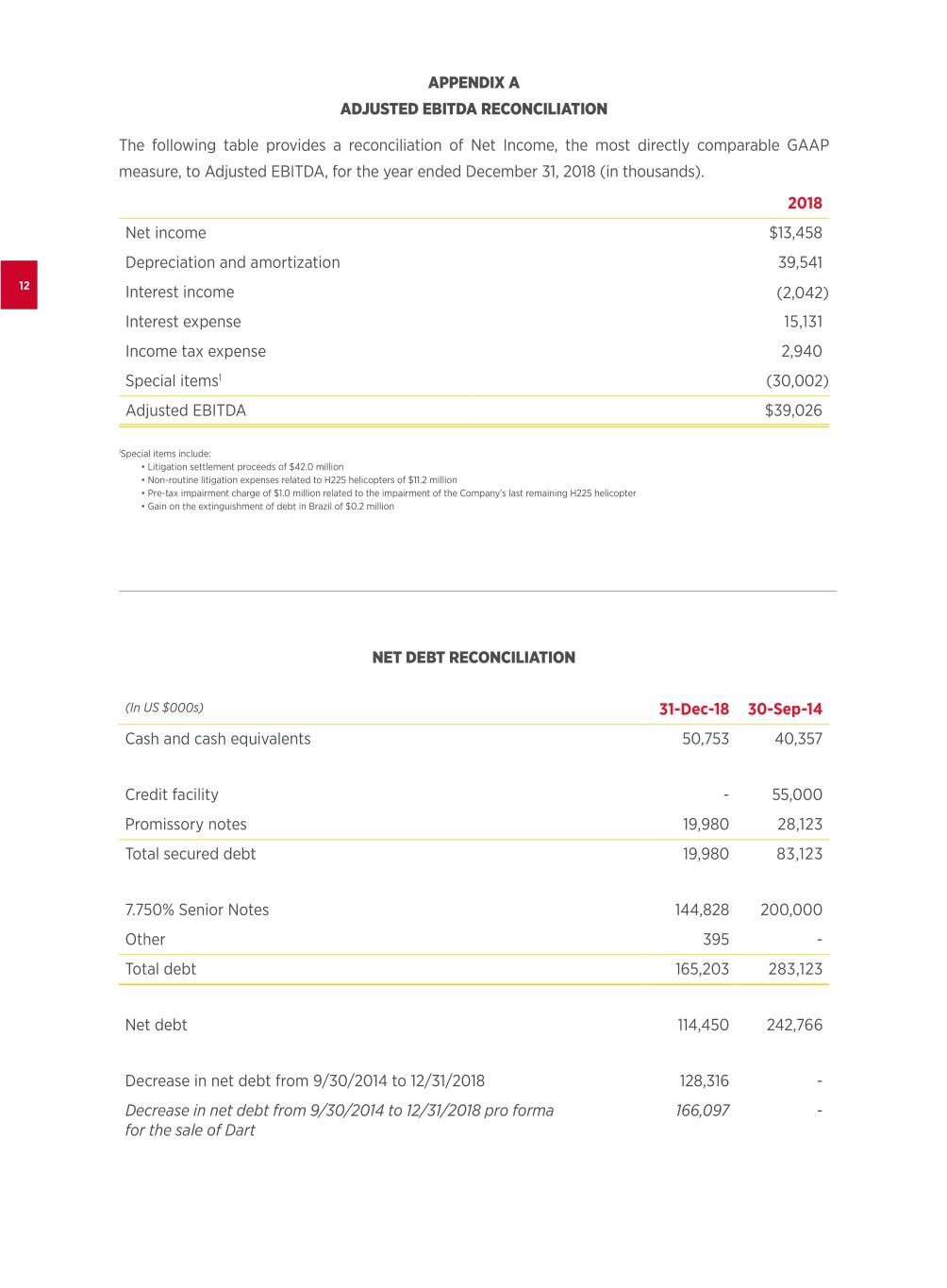

APPENDIX A ADJUSTED EBITDA RECONCILIATION The following table provides a reconciliation of Net Income, the most directly comparable GAAP measure, to Adjusted EBITDA, for the year ended December 31, 2018 (in thousands). 2018 Net income $13,458 Depreciation and amortization 39,541 12 Interest income (2,042) Interest expense 15,131 Income tax expense 2,940 Special items1 (30,002) Adjusted EBITDA $39,026 1Special items include: • Litigation settlement proceeds of $42.0 million • Non-routine litigation expenses related to H225 helicopters of $11.2 million • Pre-tax impairment charge of $1.0 million related to the impairment of the Company’s last remaining H225 helicopter • Gain on the extinguishment of debt in Brazil of $0.2 million NET DEBT RECONCILIATION (In US $000s) 31-Dec-18 30-Sep-14 Cash and cash equivalents 50,753 40,357 Credit facility - 55,000 Promissory notes 19,980 28,123 Total secured debt 19,980 83,123 7.750% Senior Notes 144,828 200,000 Other 395 - Total debt 165,203 283,123 Net debt 114,450 242,766 Decrease in net debt from 9/30/2014 to 12/31/2018 128,316 - Decrease in net debt from 9/30/2014 to 12/31/2018 pro forma 166,097 - for the sale of Dart

BOARD OF DIRECTORS SENIOR MANAGEMENT CHARLES FABRIKANT CHRISTOPHER BRADSHAW Non-Executive Chairman of the Board President and Chief Executive Officer CHRISTOPHER BRADSHAW President and CRYSTAL GORDON Chief Executive Officer Senior Vice President Era Group Inc. General Counsel and Chief Administrative Officer ANN FAIRBANKS Founder and Chairman JENNIFER WHALEN The Fairbanks Investment Fund Senior Vice President Chief Financial Officer BLAINE (“FIN”) V. FOGG Of Counsel STUART STAVLEY Skadden, Arps, Slate, Senior Vice President Meagher & Flom LLP Operations and Fleet Management CHRISTOPHER PAPOURAS PAUL WHITE Former President of Senior Vice President Nabors Drilling Solutions Commercial YUEPING SUN GRANT NEWMAN Of Counsel Senior Vice President Yetter Coleman LLP Strategy and Corporate Development STEVEN WEBSTER DAVID ZAWORSKI Managing Partner Director AEC Partners LP Safety and Compliance MICHAEL MAY Chief Technology Officer SHAREHOLDER INFORMATION PRINCIPAL EXECUTIVE OFFICE INDEPENDENT REGISTERED CERTIFIED Era Group Inc. PUBLIC ACCOUNTING FIRM CityCentre Two Grant Thornton LLP 818 Town and Country Blvd., Suite 200 700 Milam Street, Suite 300 Houston, Texas 77024 Houston, TX 77002 Phone: +1 713 369 4700 www.grantthornton.com www.erahelicopters.com ANNUAL MEETING MARKET INFORMATION The Annual Meeting of Shareholders will be Era Group Inc.’s stock is listed on the New York held at 10:00 a.m. Central Time on June 6, 2019, Stock Exchange (NYSE) under the symbol ERA. at the Company’s principal executive office. TRANSFER AGENT AND REGISTRAR ADDITIONAL INFORMATION American Stock Transfer and Trust Company The Era Group Inc. Annual Report on Form 10-K 6201 15th Avenue and other Company SEC filings can be accessed on Brooklyn, NY 11219 the Era Group Inc. website, www.erahelicopters.com, Phone: +1 800 937 5449 or +1 718 921 8124 in the “Investors” section. www.astfinancial.com ©2019 Era Group Inc.

ANNUAL REPORT 2018 Era Group Inc. Group Era CityCentre Two CityCentre Houston, Texas 77024 Texas Houston, Phone: +1 713 369 4700 Phone: +1 713 369 www.erahelicopters.com 818 Town & Country Blvd., Suite 200 Suite Blvd., & Country 818 Town