Barclays CEO Energy-Power Conference September 2019 0

Cautionary Statement Regarding Forward-Looking Statements This presentation contains “forward-looking statements.” Forward-looking statements give the Company’s current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, and reflect management’s current views with respect to future events and are subject to risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements. Such risks, uncertainties and other important factors include, among others, the Company’s dependence on, and the cyclical and volatile nature of, offshore oil and gas exploration, development and production activity, and the impact of general economic conditions and fluctuations in worldwide prices of and demand for oil and natural gas on such activity levels; the Company’s reliance on a limited number of customers and the reduction of its customer base resulting from bankruptcies or consolidation; risks that the Company’s customers reduce or cancel contracted services or tender processes or obtain comparable services through other forms of transportation; dependence on U.S. government agency contracts that are subject to budget appropriations; cost savings initiatives implemented by the Company’s customers; risks inherent in operating helicopters; the Company’s ability to maintain an acceptable safety record and level of reliability; the impact of increased U.S. and foreign government regulation and legislation, including potential government implemented moratoriums on drilling activities; the impact of a grounding of all or a portion of the Company’s fleet for extended periods of time or indefinitely on the Company’s business, including its operations and ability to service customers, results of operations or financial condition and/or the market value of the affected helicopter(s); the Company’s ability to successfully expand into other geographic and aviation service markets; risks associated with political instability, governmental action, war, acts of terrorism, trade policies and changes in the economic condition in any foreign country where the Company does business, which may result in expropriation, nationalization, confiscation or deprivation of the Company’s assets or result in claims of a force majeure situation; the impact of declines in the global economy and financial markets; the impact of fluctuations in foreign currency exchange rates on the Company’s asset values and cost to purchase helicopters, spare parts and related services; risks related to investing in new lines of aviation service without realizing the expected benefits; risks of engaging in competitive processes or expending significant resources for strategic opportunities, with no guaranty of recoupment; the Company’s reliance on a small number of helicopter manufacturers and suppliers; the Company’s ongoing need to replace aging helicopters; the Company’s reliance on the secondary helicopter market to dispose of used helicopters and parts; the Company’s reliance on information technology and potential harm from cyber-security incidents; the impact of allocation of risk between the Company and its customers; the liability, legal fees and costs in connection with providing emergency response services; adverse weather conditions and seasonality; risks associated with the Company’s debt structure; the Company’s counterparty credit risk exposure; the impact of operational and financial difficulties of the Company’s joint ventures and partners and the risks associated with identifying and securing joint venture partners when needed; conflict with the other owners of the Company’s non-wholly owned subsidiaries and other equity investees; adverse results of legal proceedings, significant increases in costs; the Company’s ability to obtain insurance coverage and the adequacy and availability of such coverage; the possibility of labor problems; the attraction and retention of qualified personnel; restrictions on the amount of foreign ownership of the Company’s common stock; and various other risk factors described from time to time in the Company’s Form 10-K, Form 10-Q, and Form 8-K reports (including all amendments to those reports) filed with the U.S. Securities and Exchange Commission. It is not possible to predict or identify all such factors. Consequently, the foregoing should not be considered a complete discussion of all potential risks or uncertainties. Forward-looking statements speak only as of the date of the document in which they are made. Era Group disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in Era Group's expectations or any change in events, conditions or circumstances on which the forward-looking statement is based. 1

Non-GAAP Financial Measures Reconciliation This presentation includes EBITDA and Adjusted EBITDA as supplemental measures of the Company’s operating performance. EBITDA is defined as Earnings before Interest (includes interest income and interest expense), Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for special items that occurred during the reporting period. Neither EBITDA nor Adjusted EBITDA is a recognized term under generally accepted accounting principles in the U.S. (“GAAP”). Accordingly, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for discretionary use, as they do not take into account certain cash requirements, such as debt service requirements. EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, nor as a substitute for analysis of the Company’s results as reported under GAAP. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. The Company also presents net debt, which is a non-GAAP measure, defined as total principal balance on borrowings less cash and cash equivalents, including escrow balances. Each of these non-GAAP measures has limitations and therefore should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. A reconciliation of EBITDA, Adjusted EBITDA, Adjusted EBITDA further adjusted to exclude gains on asset dispositions, and net debt is included in this presentation. Free Cash Flow represents our net cash provided by operating activities plus proceeds from disposition of property and equipment, less expenditures related to purchases of property and equipment. Adjusted Free Cash Flow is Free Cash Flow adjusted to exclude professional services fees paid in respect of litigation settled in the third quarter of 2018 and the proceeds on settlement of that litigation. Management believes that the use of Adjusted Free Cash Flow is meaningful as it measures the Company’s ability to generate cash from its business after excluding cash payments for special items. Management uses this information as an analytical indicator to assess the Company’s liquidity and performance. However, investors should note numerous methods may exist for calculating a company's free cash flow. As a result, the method used by management to calculate Adjusted Free Cash Flow may differ from the methods used by other companies to calculate their free cash flow. Reconciliations of the foregoing non-GAAP financial measures to the most comparable GAAP financial measures are included in the appendix hereto. 2

Safety Note • Safety is Era’s most important core value and our highest operational priority • Achieved our goals of ZERO air accidents and ZERO recordable workplace incidents in FY2018 and YTD 2019 ̶ ZERO air accidents in trailing three year period ̶ Over 700 consecutive days without a recordable workplace incident • Robust safety management system (SMS) ̶ With third-party accreditation resulting from numerous internal and external audits • Era’s fleet is configured with the latest safety equipment • Era is one of the founding members of HeliOffshore, an industry association focused on safety, now with more than 115 members from all regions of the world 3

Why Invest in Era? Diverse and Differentiated Technologically Strategy Advanced Fleet Offshore Recovery Financial Underway Strength Free Cash Flow Generation 4

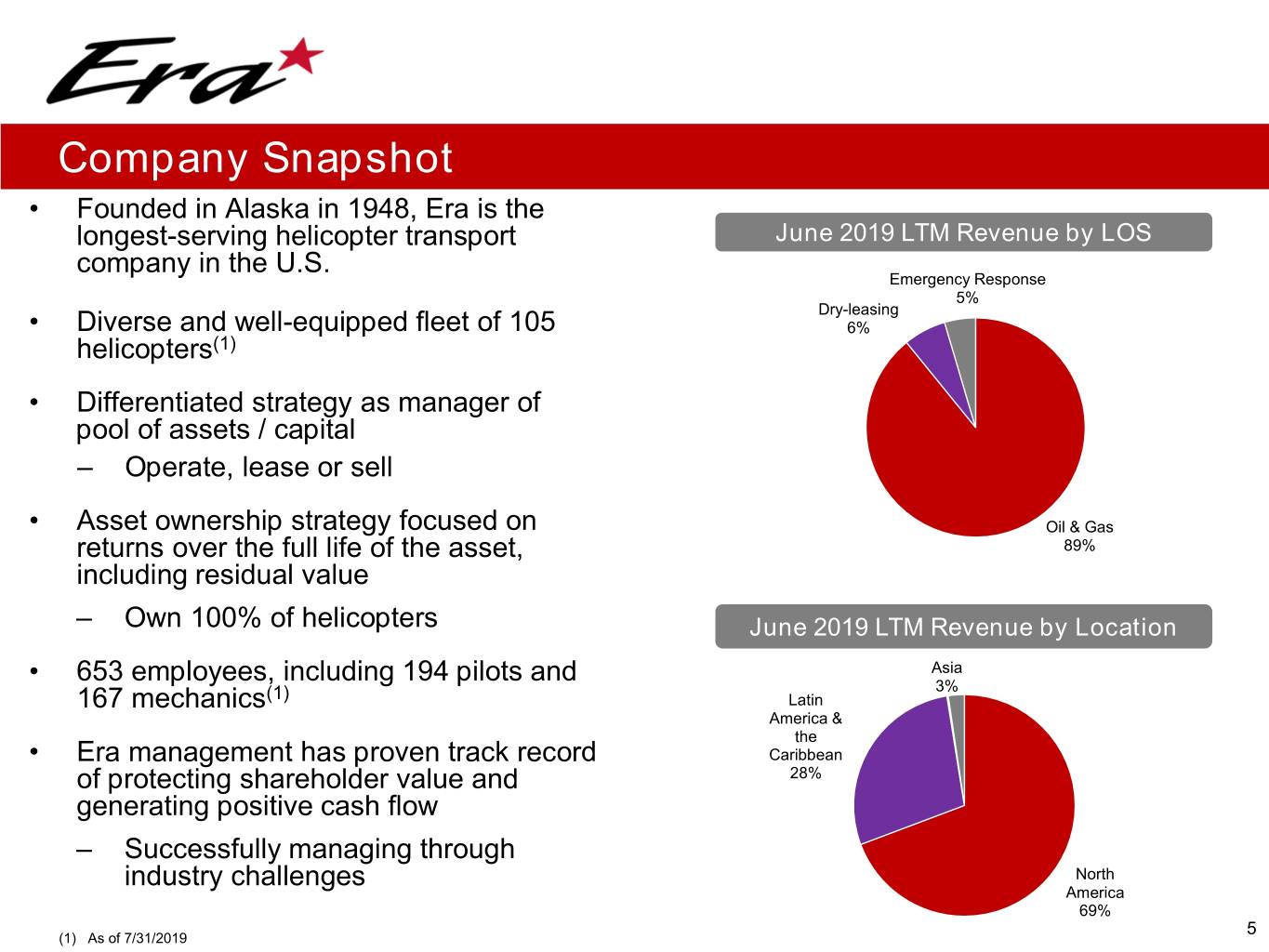

Company Snapshot • Founded in Alaska in 1948, Era is the longest-serving helicopter transport June 2019 LTM Revenue by LOS company in the U.S. Emergency Response 5% Dry-leasing • Diverse and well-equipped fleet of 105 6% helicopters(1) • Differentiated strategy as manager of pool of assets / capital – Operate, lease or sell • Asset ownership strategy focused on Oil & Gas returns over the full life of the asset, 89% including residual value – Own 100% of helicopters June 2019 LTM Revenue by Location Asia • 653 employees, including 194 pilots and 3% 167 mechanics(1) Latin America & the • Era management has proven track record Caribbean of protecting shareholder value and 28% generating positive cash flow – Successfully managing through industry challenges North America 69% 5 (1) As of 7/31/2019

Areas of Operation 1 3 78 3 3 3 2 12 Era Operations Dry Lease Total Aircraft Note: As of July 31, 2019 6

Fleet Snapshot Fleet by Type Fleet by Ownership Light Single, 30 Heavy, 9 9% 28% 100% 44% Medium, 19% 46 Light 96% Owned, Twin, 20 105 • On a dollar-weighted NBV basis: − Heavy and medium helicopters represent 87% of fleet value − Average age of the fleet is 7 years • Own and control 100% of helicopters Note: As of 7/31/19 7

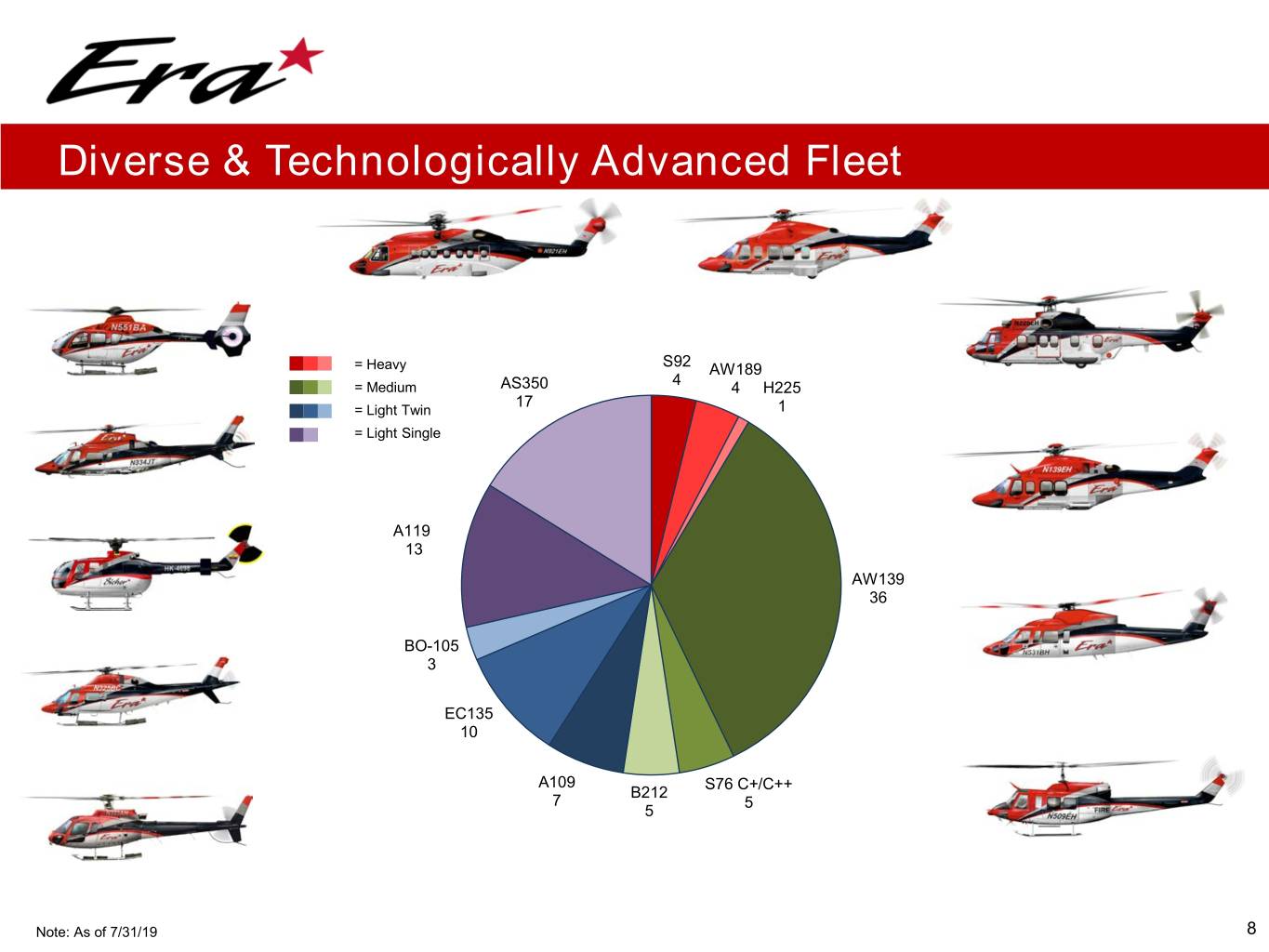

Diverse & Technologically Advanced Fleet S92 = Heavy AW189 4 = Medium AS350 4 H225 17 = Light Twin 1 = Light Single A119 13 AW139 36 BO-105 3 EC135 10 A109 S76 C+/C++ B212 7 5 5 Note: As of 7/31/19 8

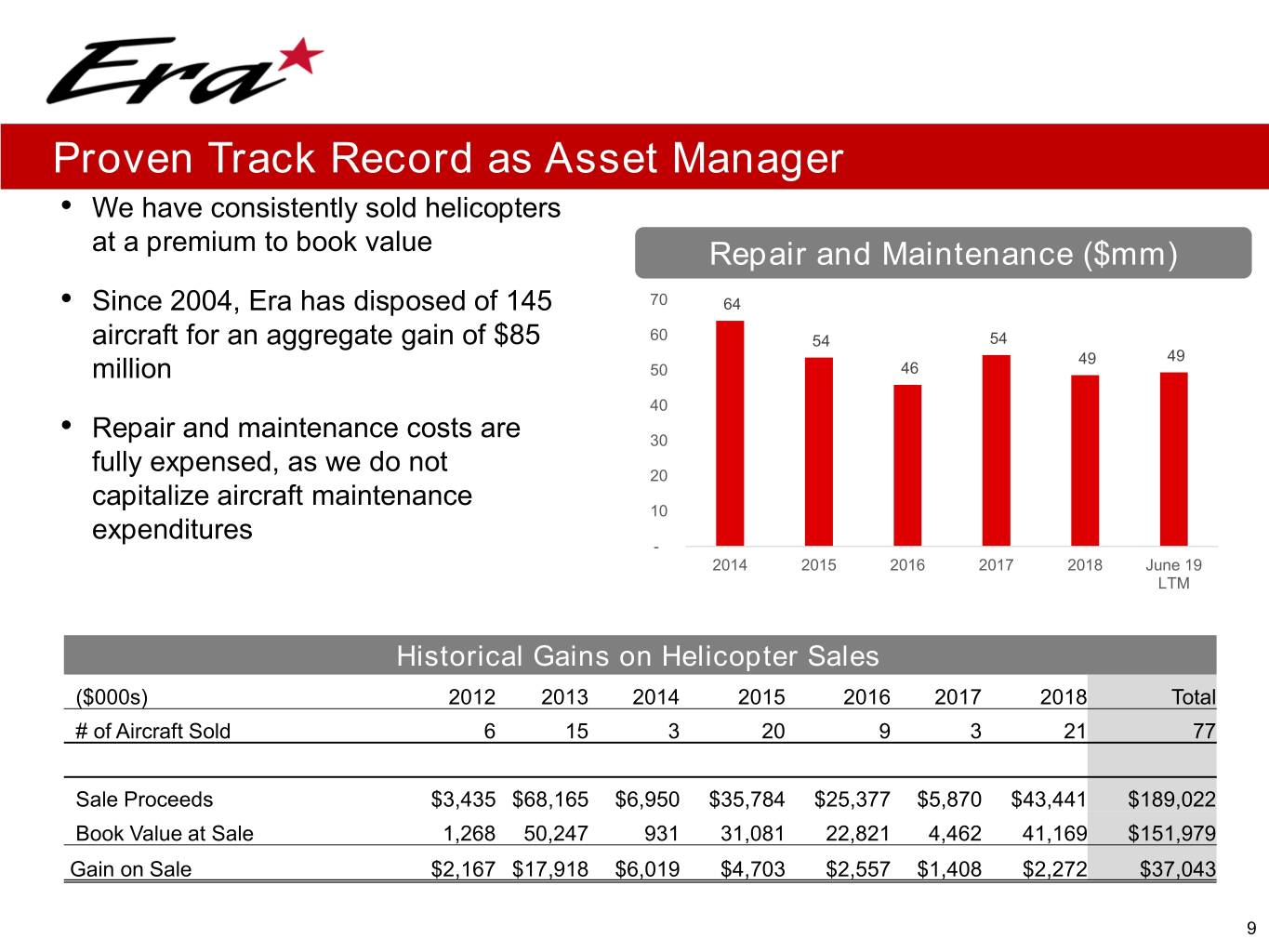

Proven Track Record as Asset Manager • We have consistently sold helicopters at a premium to book value Repair and Maintenance ($mm) • Since 2004, Era has disposed of 145 70 64 aircraft for an aggregate gain of $85 60 54 54 49 49 million 50 46 40 • Repair and maintenance costs are 30 fully expensed, as we do not 20 capitalize aircraft maintenance 10 expenditures - 2014 2015 2016 2017 2018 June 19 LTM Historical Gains on Helicopter Sales ($000s) 2012 2013 2014 2015 2016 2017 2018 Total # of Aircraft Sold 6 15 3 20 9 3 21 77 Sale Proceeds $3,435 $68,165 $6,950 $35,784 $25,377 $5,870 $43,441 $189,022 Book Value at Sale 1,268 50,247 931 31,081 22,821 4,462 41,169 $151,979 Gain on Sale $2,167 $17,918 $6,019 $4,703 $2,557 $1,408 $2,272 $37,043 9

Financial Strength Strong Balance Sheet Limited Debt Maturities Efficient Cost Structure (incl. ~$90 Million Cash) prior to 2022 Manageable Fixed No Firm Capital Charge Obligations Commitments Free Cash Flow LTM Adjusted Free Cash Flow was ~$12 million(1) (1) Non-GAAP metric. Please see calculation on page 15 and disclaimer language on page 2 of the presentation 10

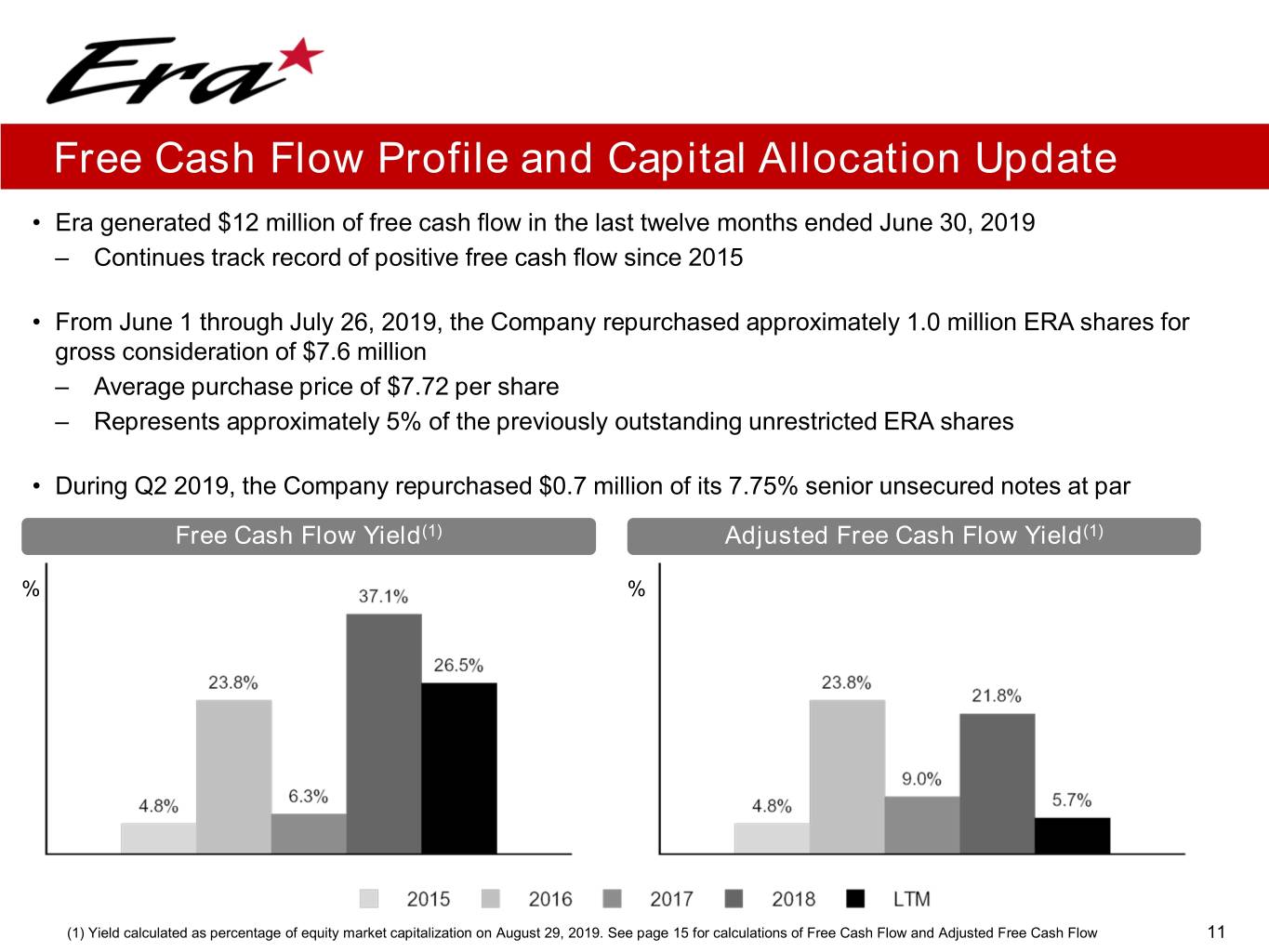

Free Cash Flow Profile and Capital Allocation Update • Era generated $12 million of free cash flow in the last twelve months ended June 30, 2019 – Continues track record of positive free cash flow since 2015 • From June 1 through July 26, 2019, the Company repurchased approximately 1.0 million ERA shares for gross consideration of $7.6 million – Average purchase price of $7.72 per share – Represents approximately 5% of the previously outstanding unrestricted ERA shares • During Q2 2019, the Company repurchased $0.7 million of its 7.75% senior unsecured notes at par Free Cash Flow Yield(1) Adjusted Free Cash Flow Yield(1) % % (1) Yield calculated as percentage of equity market capitalization on August 29, 2019. See page 15 for calculations of Free Cash Flow and Adjusted Free Cash Flow 11

Demonstrated Track Record During a time in which Era’s closest competitors witnessed significant negative cash flows and resulting financial distress, the Era management team aggressively managed its cost structure, maintained financial discipline and generated positive cash flow throughout the industry downturn – all while improving the Company’s safety performance and delivering the efficient and reliable service that customers value Equity Market Capitalization(1) ($mm) Company A Company B ERA $1,000 $905 $800 $719 $600 $476 $355 $400 $282 $260 $229 $229 $183 $190 $201 $200 $87 $30 $2 $1 $0 2015 2016 2017 2018 2019 (1) 2015 2016 2017 2018 2019 (1) 2015 2016 2017 2018 2019 (1) Free Cash Flow Generation(2) ($mm) $200 $145 $87 $112 $48 $75 $10 $13 $0 ($11) ($47) ($70) ($75) ($69) ($200) ($113) ($270) ($400) ($319) 2015 2016 2017 2018 Total 2015 2016 2017 2018 Total 2015 2016 2017 2018 Total Notes: (1) 2019 data as of August 29, 2019. All other years as of December 31st of the respective year 12 (2) Free Cash Flow defined as cash flow from operating activities less capital expenditures, net of proceeds from asset dispositions

Appendix 13

Fleet Overview Average Helicopters Age Heavy: S92 4 3 H225 1 11 AW189 4 3 Total Heavy 9 Medium: AW139 36 9 S76 C+/C++ 5 13 B212 5 40 Total Medium 46 Light – twin engine: A109 7 13 EC135 10 11 BO-105 3 30 Total Light – twin engine 20 Light – single engine: A119 13 13 AS350 17 21 Total Light – single engine 30 Total Helicopters 105 14 Note: Fleet presented as of 7/31/2019. Era owns and controls all 105 of its helicopters 14

Reconciliation of Free Cash Flow and Free Cash Flow Yields ($000s) 2015 2016 2017 2018 LTM Net cash provided by operating activities $ 44,456 $ 58,504 $ 20,096 $ 54,354 $ 59,066 Plus: Proceeds from disposition of property and equipment 25,328 28,609 9,392 29,590 93 Less: Purchases of property and equipment (60,050) (39,200) (16,770) (9,216) (5,838) Free cash flow $ 9,734 $ 47,913 $ 12,718 $ 74,728 $ 53,321 Plus: Non-routine litigation expenses - - 5,473 11,182 180 Less: Litigation settlement proceeds - - - (42,000) (42,000) Adjusted free cash flow $ 9,734 $ 47,913 $ 18,191 $ 43,910 $ 11,501 Free cash flow yield 4.8% 23.8% 6.3% 37.1% 26.5% Adjusted free cash flow yield 4.8% 23.8% 9.0% 21.8% 5.7% ERA equity market capitalization (in $mm; as of 8/29/2019) $ 201 Note: Yield calculated as percentage of equity market capitalization on August 29, 2019 15

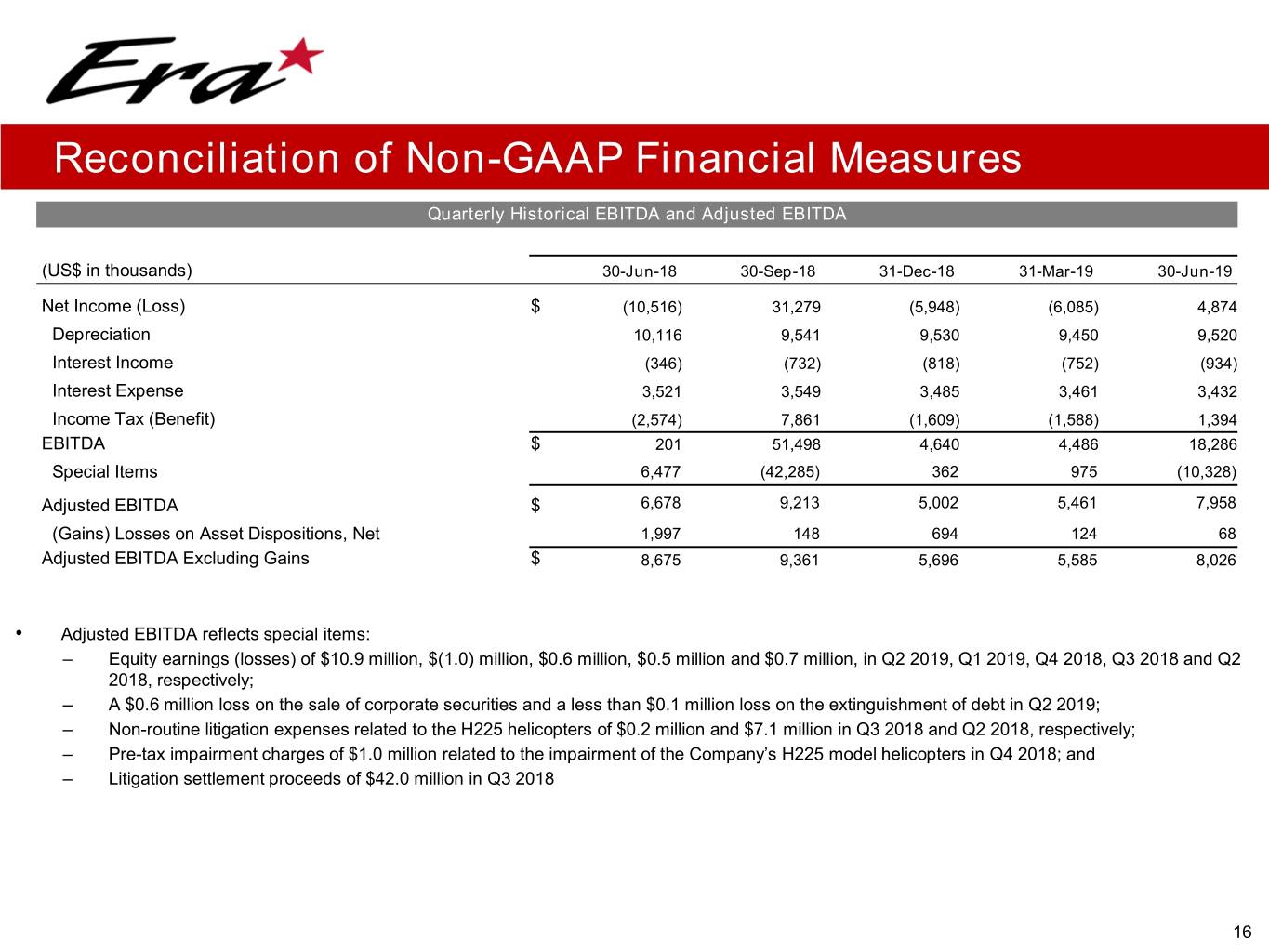

Reconciliation of Non-GAAP Financial Measures Quarterly Historical EBITDA and Adjusted EBITDA (US$ in thousands) 30-Jun-18 30-Sep-18 31-Dec-18 31-Mar-19 30-Jun-19 Net Income (Loss) $ (10,516) 31,279 (5,948) (6,085) 4,874 Depreciation 10,116 9,541 9,530 9,450 9,520 Interest Income (346) (732) (818) (752) (934) Interest Expense 3,521 3,549 3,485 3,461 3,432 Income Tax (Benefit) (2,574) 7,861 (1,609) (1,588) 1,394 EBITDA $ 201 51,498 4,640 4,486 18,286 Special Items 6,477 (42,285) 362 975 (10,328) Adjusted EBITDA $ 6,678 9,213 5,002 5,461 7,958 (Gains) Losses on Asset Dispositions, Net 1,997 148 694 124 68 Adjusted EBITDA Excluding Gains $ 8,675 9,361 5,696 5,585 8,026 • Adjusted EBITDA reflects special items: – Equity earnings (losses) of $10.9 million, $(1.0) million, $0.6 million, $0.5 million and $0.7 million, in Q2 2019, Q1 2019, Q4 2018, Q3 2018 and Q2 2018, respectively; – A $0.6 million loss on the sale of corporate securities and a less than $0.1 million loss on the extinguishment of debt in Q2 2019; – Non-routine litigation expenses related to the H225 helicopters of $0.2 million and $7.1 million in Q3 2018 and Q2 2018, respectively; – Pre-tax impairment charges of $1.0 million related to the impairment of the Company’s H225 model helicopters in Q4 2018; and – Litigation settlement proceeds of $42.0 million in Q3 2018 16