Exhibit 99.2 Q1 FY21 Earnings Presentation August 7, 2020

Q1 FY21 Earnings Call Agenda I. Introduction Crystal Gordon, SVP and General Counsel II. Operational Highlights Chris Bradshaw, President and CEO III. Financial Review Jennifer Whalen, SVP and CFO IV. Concluding Remarks Chris Bradshaw, President and CEO V. Questions & Answers 2

Cautionary Statement Regarding Forward-Looking Statements This presentation contains “forward-looking statements.” Forward-looking statements give Bristow Group Inc.’s (the “Company”) current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, reflect management’s current views with respect to future events and therefore are subject to significant risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which the forward-looking statement is based that occur after the date hereof. Risks that may affect forward-looking statements include, but are not necessarily limited to, those relating to: the COVID-19 pandemic and related economic repercussions have resulted, and may continue to result, in a decrease in the price of and demand for oil, which has caused, and may continue to cause, a decrease in the demand for our services; expected cost synergies and other benefits of the merger (the “Merger”) of the entity formerly known as Bristow Group Inc. (“Old Bristow”) and Era Group Inc.(“Era”) might not be realized within the expected time frames, might be less than projected or may not be realized at all; the ability to successfully integrate the operations, accounting and administrative functions of Era and Old Bristow; managing a significantly larger company than before the completion of the Merger; diversion of management time on issues related to integration of the companies; the increase in indebtedness as a result of the Merger; operating costs, customer loss and business disruption following the Merger, including, without limitation, difficulties in maintaining relationships with employees and customers, may be greater than expected; our reliance on a limited number of customers and the reduction of our customer base as a result of bankruptcies or consolidation; risks inherent in operating helicopters; the Company’s ability to maintain an acceptable safety record and level of reliability; the impact of increased U.S. and foreign government regulation and legislation, including potential government implemented moratoriums on drilling activities; the impact of a grounding of all or a portion of the Company’s fleet for extended periods of time or indefinitely on the Company’s business, including its operations and ability to service customers, results of operations or financial condition and/or the market value of the affected helicopters; the Company’s ability to successfully expand into other geographic and aviation service markets; risks associated with political instability, governmental action, war, acts of terrorism and changes in the economic condition in any foreign country where the Company does business, which may result in expropriation, nationalization, confiscation or deprivation of the Company’s assets or result in claims of a force majeure situation; the impact of declines in the global economy and financial markets; the impact of fluctuations in foreign currency exchange rates on the Company’s asset values and cost to purchase helicopters, spare parts and related services; risks related to investing in new lines of aviation service without realizing the expected benefits; risks of engaging in competitive processes or expending significant resources for strategic opportunities, with no guaranty of recoupment; the Company’s reliance on a limited number of helicopter manufacturers and suppliers; the Company’s ongoing need to replace aging helicopters; the Company’s reliance on the secondary helicopter market to dispose of used helicopters and parts; information technology related risks; the impact of allocation of risk between the Company and its customers; the liability, legal fees and costs in connection with providing emergency response services; adverse weather conditions and seasonality; risks associated with the Company’s debt structure; the Company’s counterparty credit risk exposure; the impact of operational and financial difficulties of the Company’s joint ventures and partners and the risks associated with identifying and securing joint venture partners when needed; conflict with the other owners of the Company’s non-wholly owned subsidiaries and other equity investees; adverse results of legal proceedings; risks associated with significant increases in fuel costs; the Company’s ability to obtain insurance coverage and the adequacy and availability of such coverage; the possibility of labor problems; the attraction and retention of qualified personnel; restrictions on the amount of foreign ownership of the Company’s common stock; and various other matters and factors, many of which are beyond the Company’s control. You should not place undue reliance on our forward-looking statements because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our forward-looking statements are based on the information currently available to us and speak only as of the date hereof. New risks and uncertainties arise from time to time, and it is impossible for us to predict these matters or how they may affect us. We have included important factors in the section entitled “Risk Factors” in the Company’s joint proxy and consent solicitation statement/prospectus (File No. 333-237557), filed with the United States Securities and Exchange Commission (the “SEC”) on May 5, 2020 and the Company’s Quarterly Report on Form 10-Q for the Quarter ended June 30, 2020, which we believe over time, could cause our actual results, performance or achievements to differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements. You should consider all risks and uncertainties disclosed in the Proxy Statement and in our filings with the SEC, all of which are accessible on the SEC’s website at www.sec.gov. 3

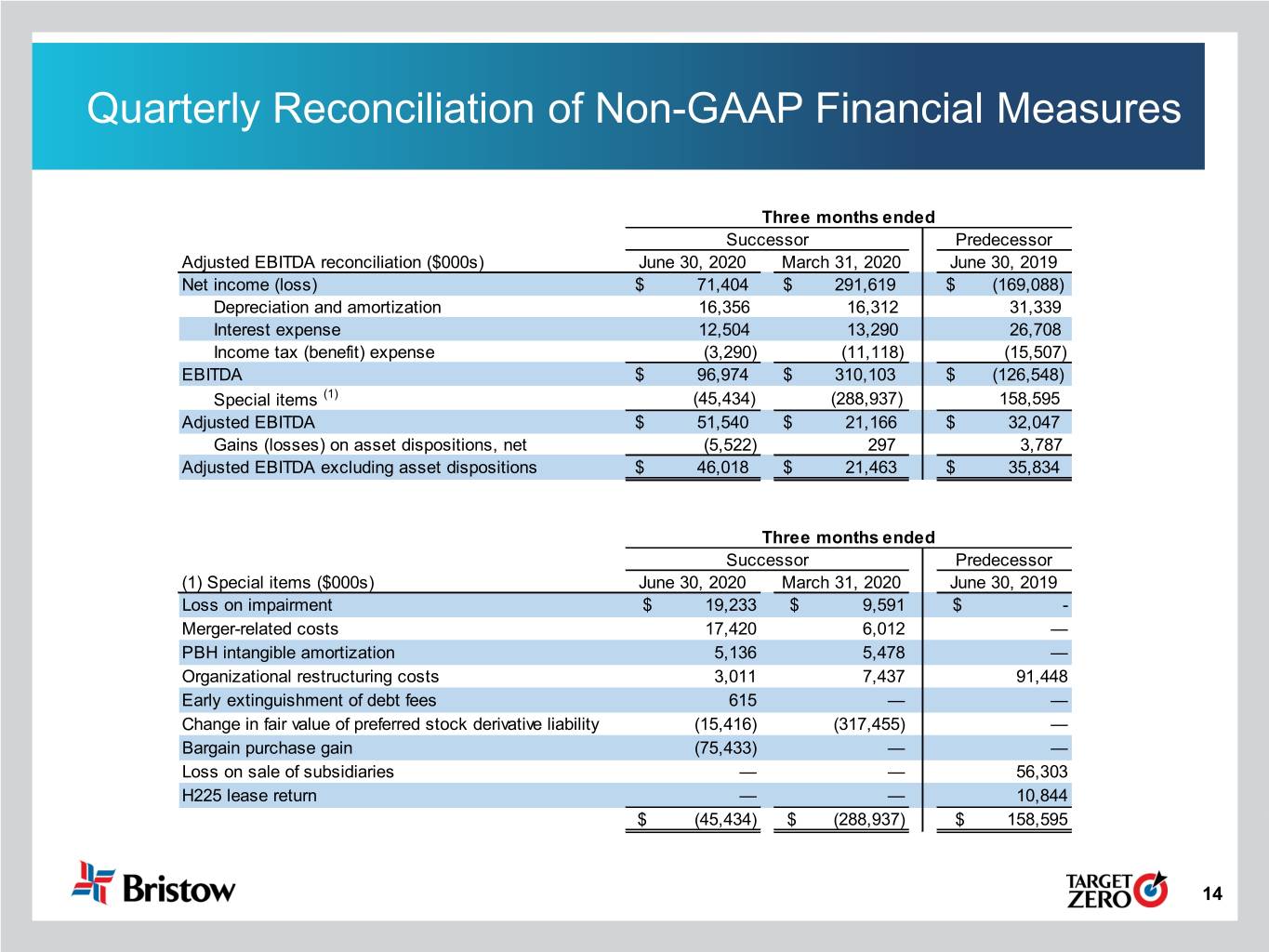

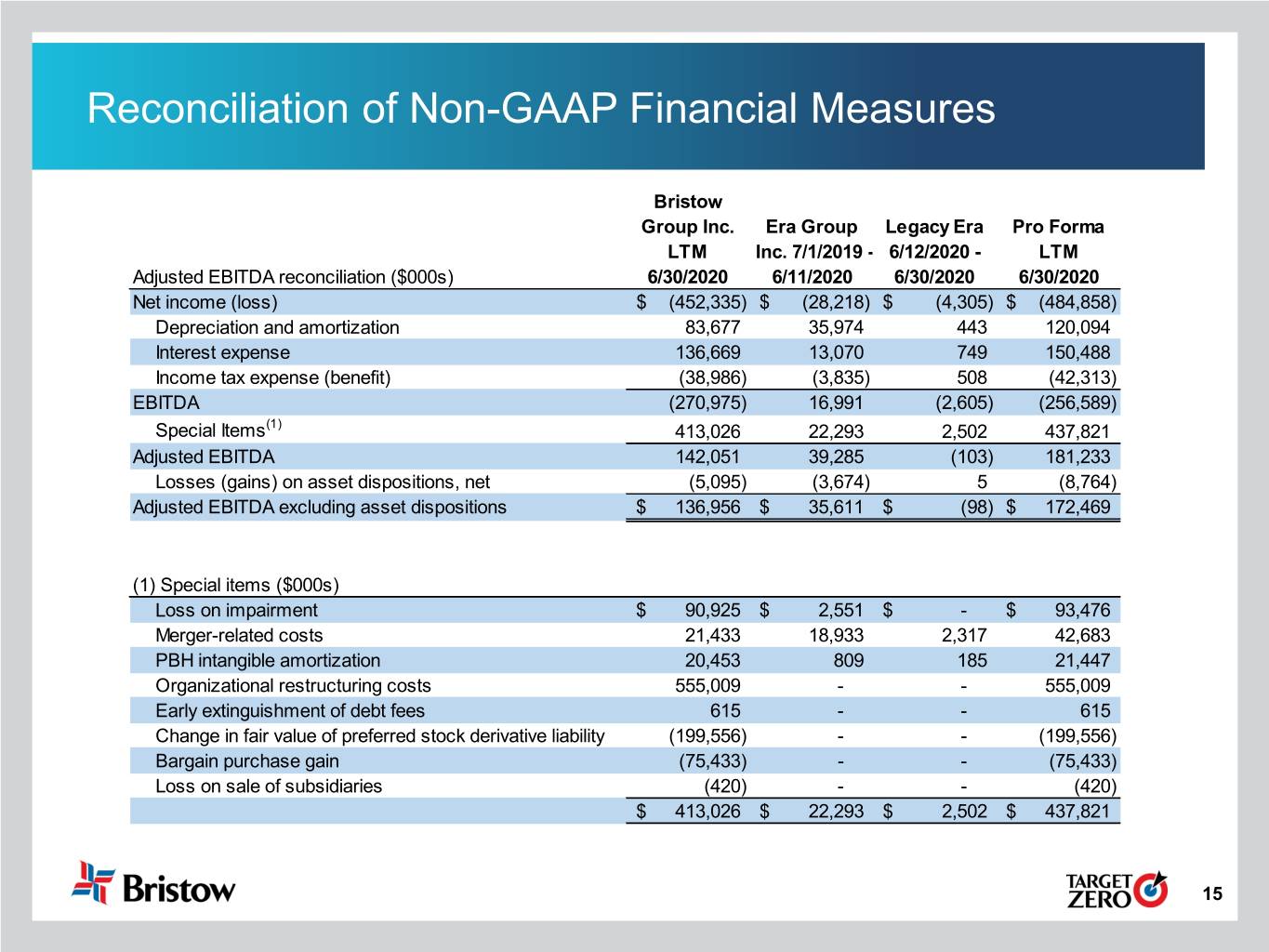

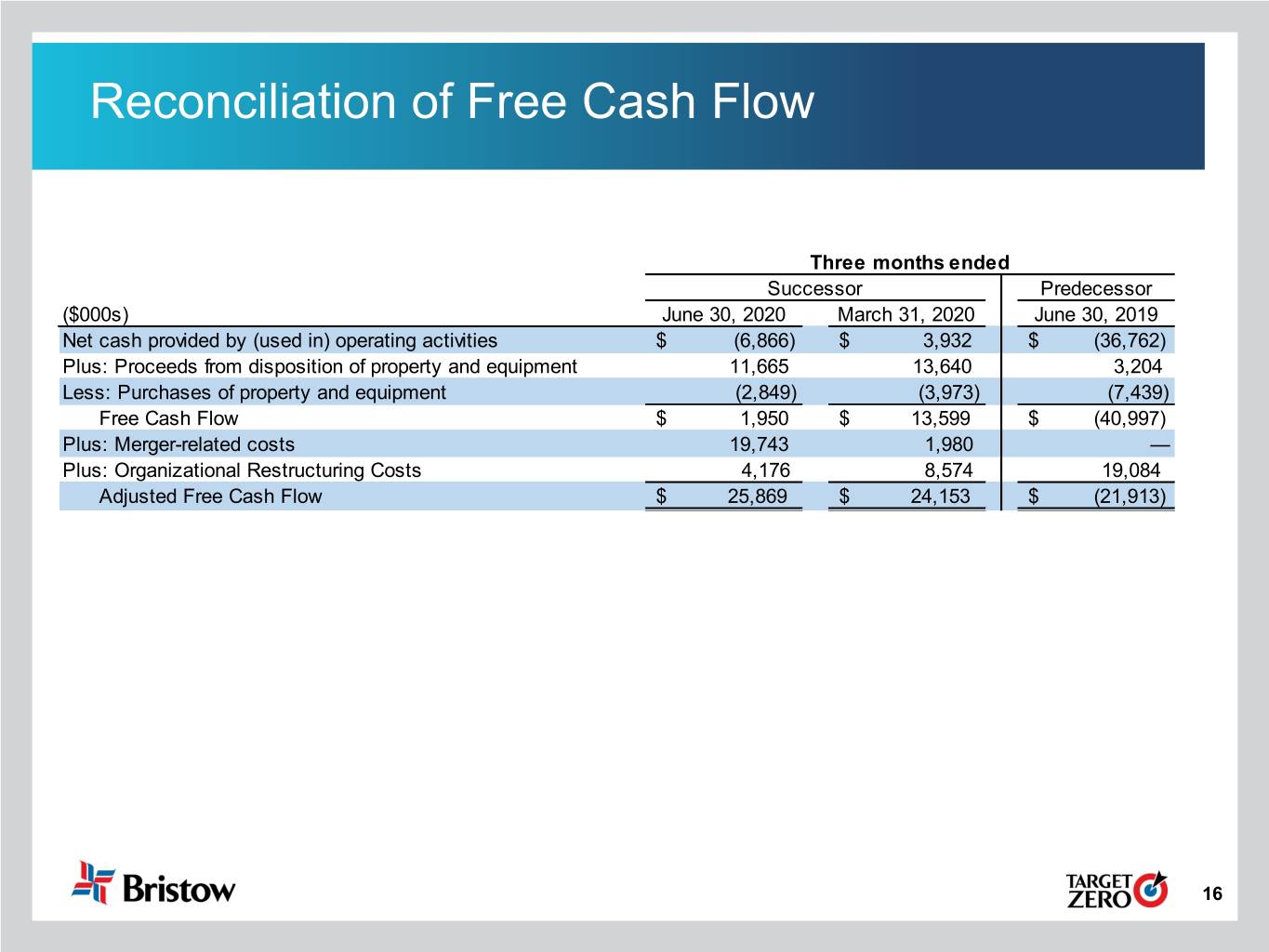

Non-GAAP Financial Measures Reconciliation • This presentation includes EBITDA and Adjusted EBITDA as supplemental measures of the Company’s operating performance. EBITDA is defined as Earnings before Interest expense, Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for special items that occurred during the reporting period and noted in the applicable reconciliation. Neither EBITDA nor Adjusted EBITDA is a recognized term under generally accepted accounting principles in the U.S. (“GAAP”). Accordingly, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for discretionary use, as they do not take into account certain cash requirements, such as debt service requirements. EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, nor as a substitute for analysis of the Company’s results as reported under GAAP. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. The Company also presents net debt, which is a non-GAAP measure, defined as total principal balance on borrowings less cash and cash equivalents, including escrow balances. Each of these non-GAAP measures has limitations and therefore should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. • A reconciliation of each of EBITDA, Adjusted EBITDA, Adjusted EBITDA excluding gains or losses on asset dispositions, and net debt is included in this presentation. • Free Cash Flow represents the Company’s net cash provided by operating activities plus proceeds from disposition of property and equipment, less expenditures related to purchases of property and equipment. Adjusted Free Cash Flow is Free Cash Flow adjusted to exclude professional services fees and other costs paid in relation to the Merger, fresh-start accounting and the Chapter 11 Cases. Neither Free Cash Flow nor Adjusted Free Cash Flow is a recognized term under GAAP. Management believes that the use of Adjusted Free Cash Flow is meaningful as it measures the Company’s ability to generate cash from its business after excluding cash payments for special items. Management uses this information as an analytical indicator to assess the Company’s liquidity and performance. However, investors should note numerous methods may exist for calculating a company's free cash flow. As a result, the method used by management to calculate Adjusted Free Cash Flow may differ from the methods used by other companies to calculate their free cash flow. 4

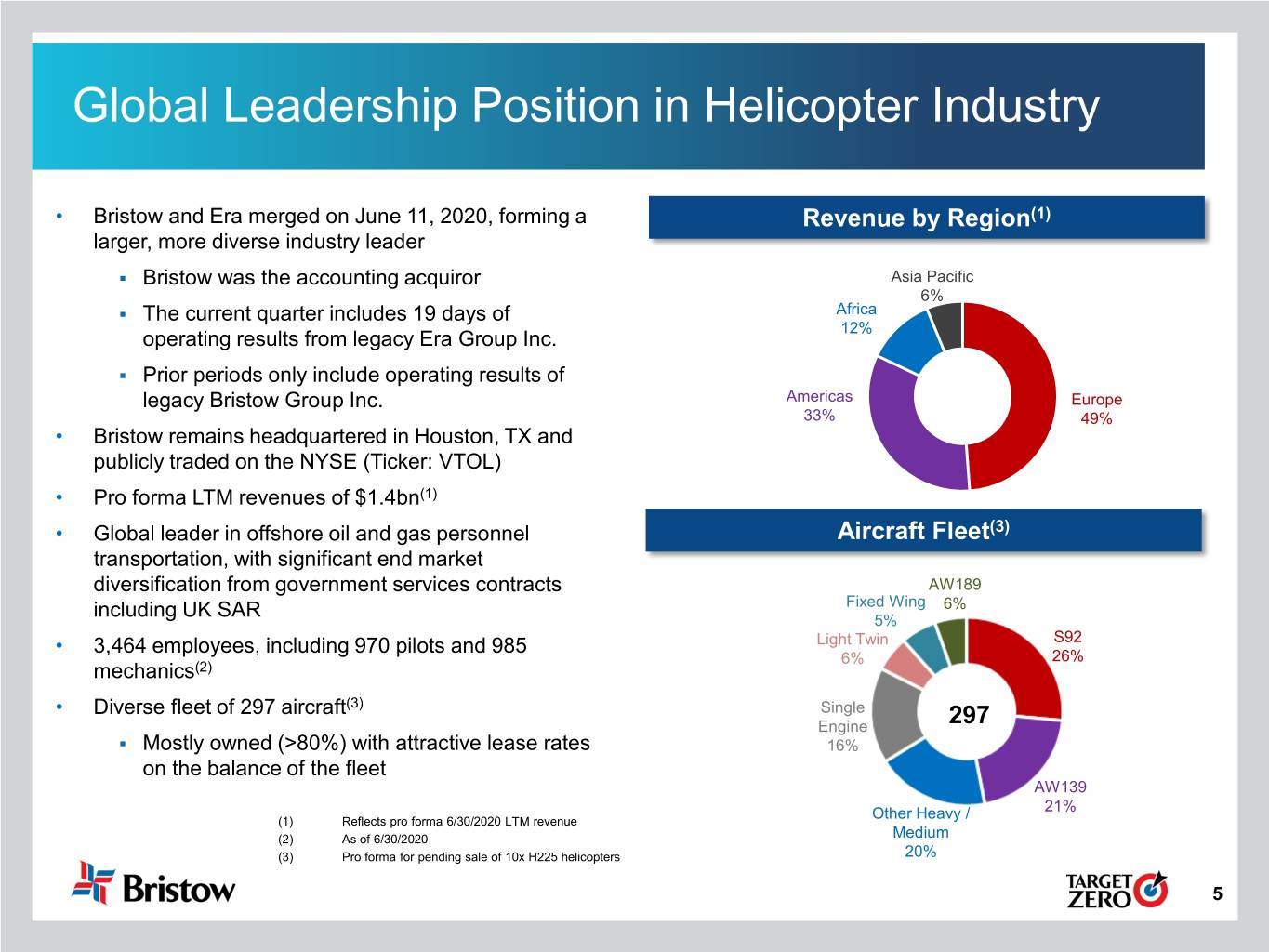

Global Leadership Position in Helicopter Industry • Bristow and Era merged on June 11, 2020, forming a Revenue by Region(1) larger, more diverse industry leader . Bristow was the accounting acquiror Asia Pacific 6% . The current quarter includes 19 days of Africa 12% operating results from legacy Era Group Inc. . Prior periods only include operating results of legacy Bristow Group Inc. Americas Europe 33% 49% • Bristow remains headquartered in Houston, TX and publicly traded on the NYSE (Ticker: VTOL) • Pro forma LTM revenues of $1.4bn(1) • Global leader in offshore oil and gas personnel Aircraft Fleet(3) transportation, with significant end market diversification from government services contracts AW189 Fixed Wing 6% including UK SAR 5% • 3,464 employees, including 970 pilots and 985 Light Twin S92 6% 26% mechanics(2) • Diverse fleet of 297 aircraft(3) Single Engine 297 . Mostly owned (>80%) with attractive lease rates 16% on the balance of the fleet AW139 21% (1) Reflects pro forma 6/30/2020 LTM revenue Other Heavy / (2) As of 6/30/2020 Medium (3) Pro forma for pending sale of 10x H225 helicopters 20% 5

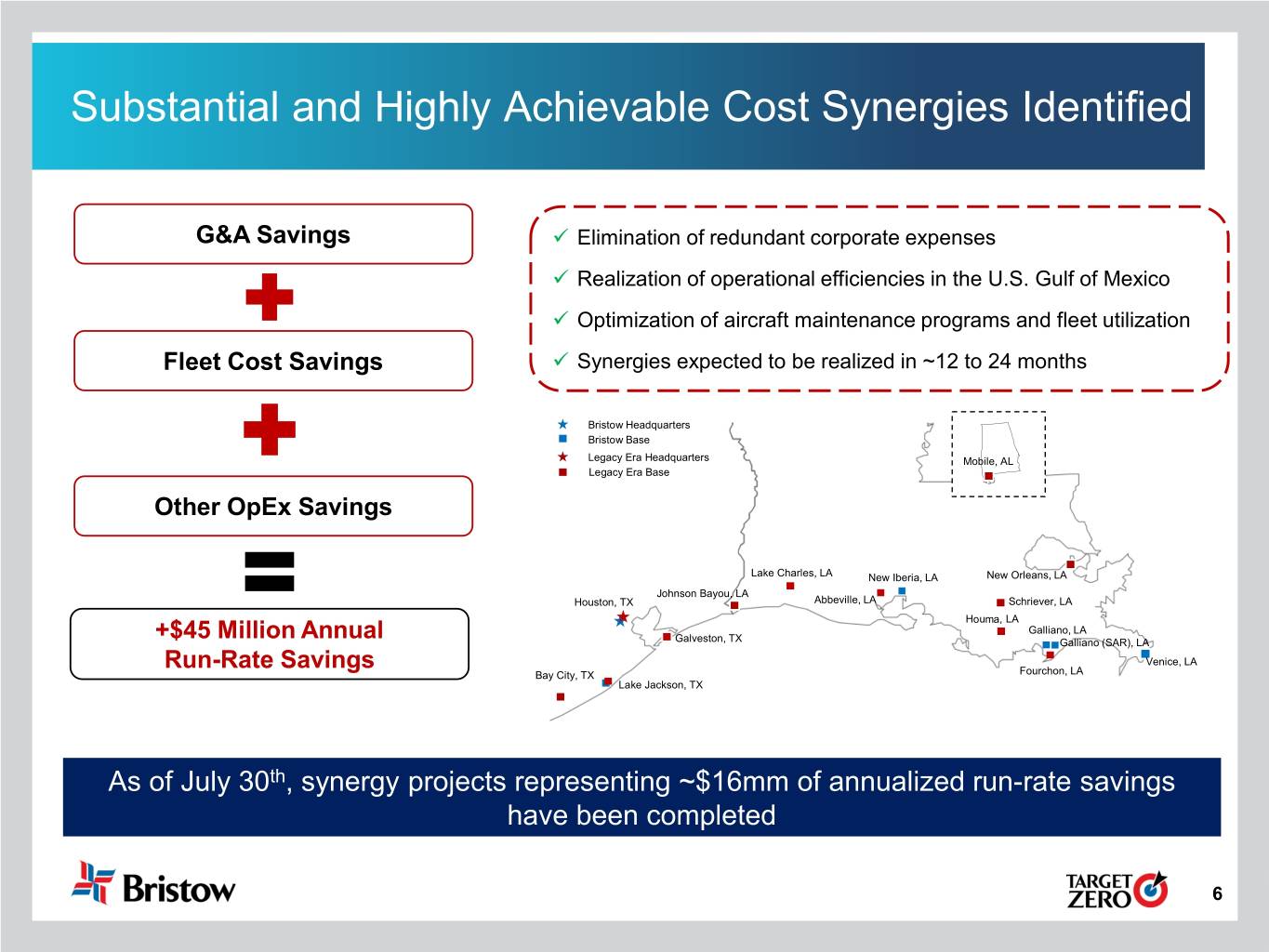

Substantial and Highly Achievable Cost Synergies Identified Substantial and Highly Achievable Cost Synergies Identified G&A Savings Elimination of redundant corporate expenses Realization of operational efficiencies in the U.S. Gulf of Mexico Optimization of aircraft maintenance programs and fleet utilization Fleet Cost Savings Synergies expected to be realized in ~12 to 24 months Bristow Headquarters Bristow Base Legacy Era Headquarters Mobile, AL Legacy Era Base Other OpEx Savings Lake Charles, LA New Iberia, LA New Orleans, LA Johnson Bayou, LA Houston, TX Abbeville, LA Schriever, LA Houma, LA Galliano, LA +$45 Million Annual Galveston, TX Galliano (SAR), LA Venice, LA Run-Rate Savings Bay City, TX Fourchon, LA Lake Jackson, TX As of July 30th, synergy projects representing ~$16mm of annualized run-rate savings have been completed 6

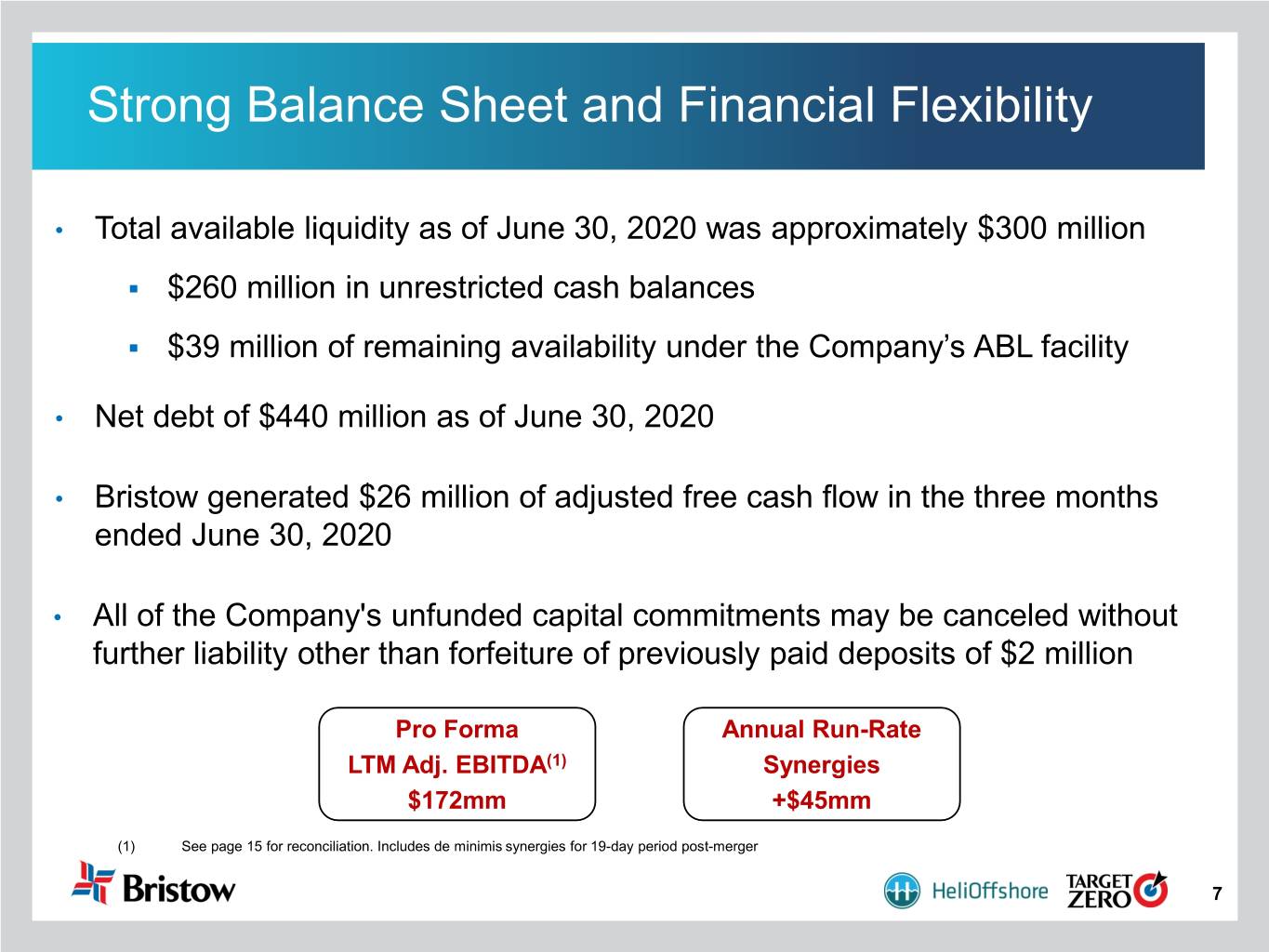

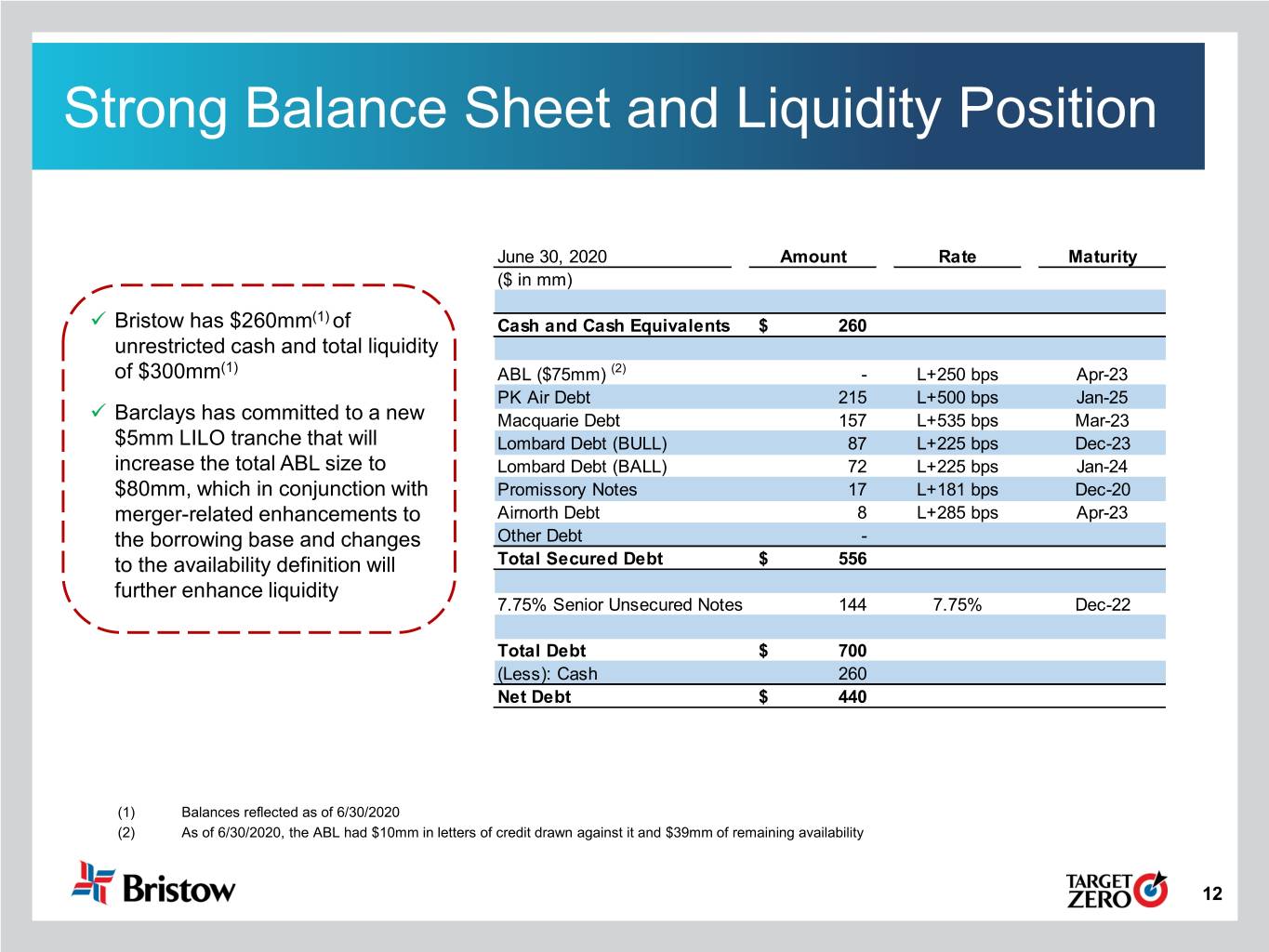

Strong Balance Sheet and Financial Flexibility • Total available liquidity as of June 30, 2020 was approximately $300 million . $260 million in unrestricted cash balances . $39 million of remaining availability under the Company’s ABL facility • Net debt of $440 million as of June 30, 2020 • Bristow generated $26 million of adjusted free cash flow in the three months ended June 30, 2020 • All of the Company's unfunded capital commitments may be canceled without further liability other than forfeiture of previously paid deposits of $2 million Pro Forma Annual Run-Rate LTM Adj. EBITDA(1) Synergies $172mm +$45mm (1) See page 15 for reconciliation. Includes de minimis synergies for 19-day period post-merger 7

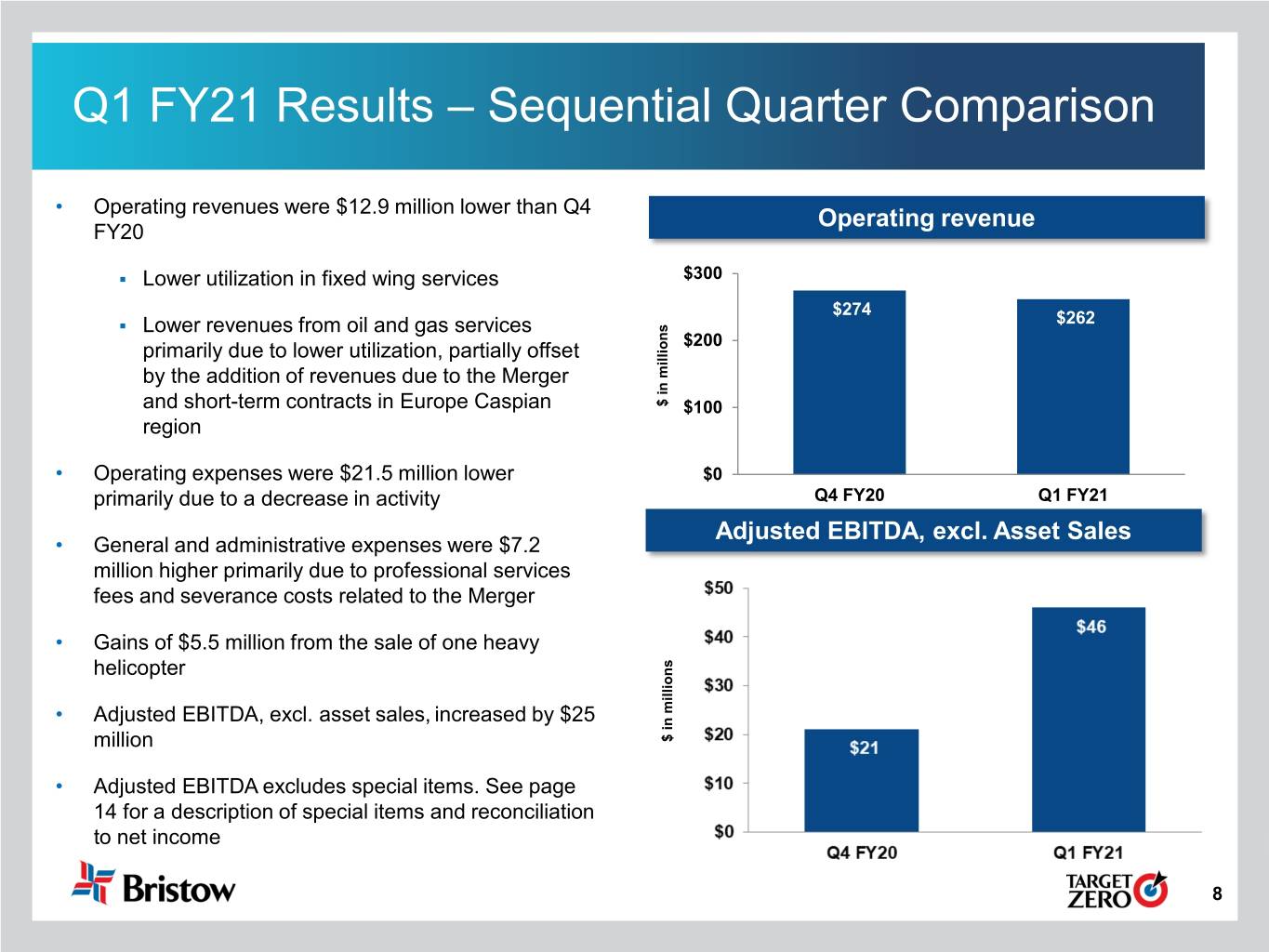

Q1 FY21 Results – Sequential Quarter Comparison • Operating revenues were $12.9 million lower than Q4 FY20 Operating revenue . Lower utilization in fixed wing services $300 $274 . Lower revenues from oil and gas services $262 primarily due to lower utilization, partially offset $200 by the addition of revenues due to the Merger and short-term contracts in Europe Caspian millions $ in $100 region • Operating expenses were $21.5 million lower $0 primarily due to a decrease in activity Q4 FY20 Q1 FY21 • General and administrative expenses were $7.2 Adjusted EBITDA, excl. Asset Sales million higher primarily due to professional services fees and severance costs related to the Merger • Gains of $5.5 million from the sale of one heavy helicopter • Adjusted EBITDA, excl. asset sales, increased by $25 million millions $ in • Adjusted EBITDA excludes special items. See page 14 for a description of special items and reconciliation to net income 8

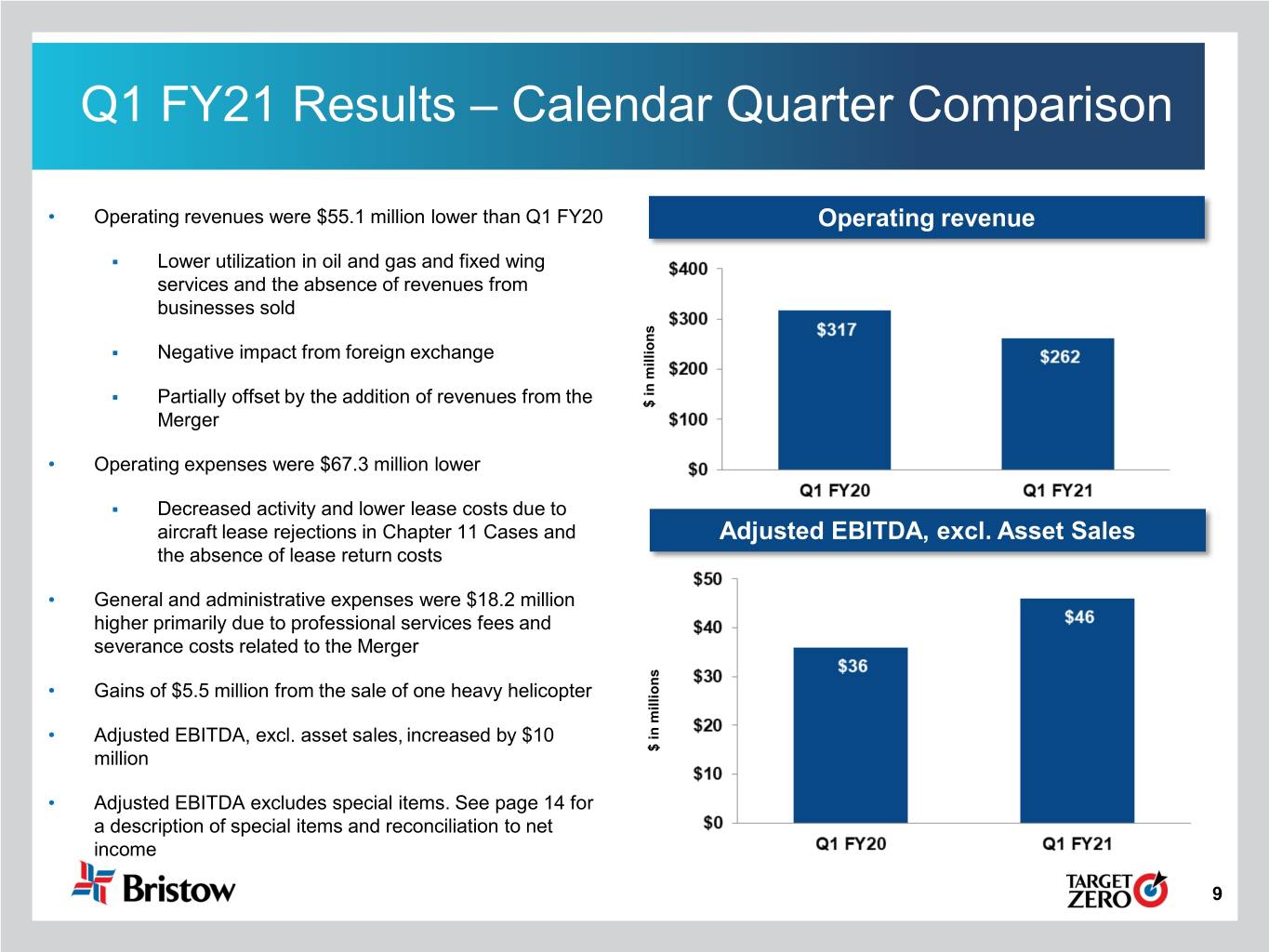

Q1 FY21 Results – Calendar Quarter Comparison • Operating revenues were $55.1 million lower than Q1 FY20 Operating revenue . Lower utilization in oil and gas and fixed wing services and the absence of revenues from businesses sold . Negative impact from foreign exchange . Partially offset by the addition of revenues from the millions $ in Merger • Operating expenses were $67.3 million lower . Decreased activity and lower lease costs due to aircraft lease rejections in Chapter 11 Cases and Adjusted EBITDA, excl. Asset Sales the absence of lease return costs • General and administrative expenses were $18.2 million higher primarily due to professional services fees and severance costs related to the Merger • Gains of $5.5 million from the sale of one heavy helicopter • Adjusted EBITDA, excl. asset sales, increased by $10 $ millions $ in million • Adjusted EBITDA excludes special items. See page 14 for a description of special items and reconciliation to net income 9

Appendix 10

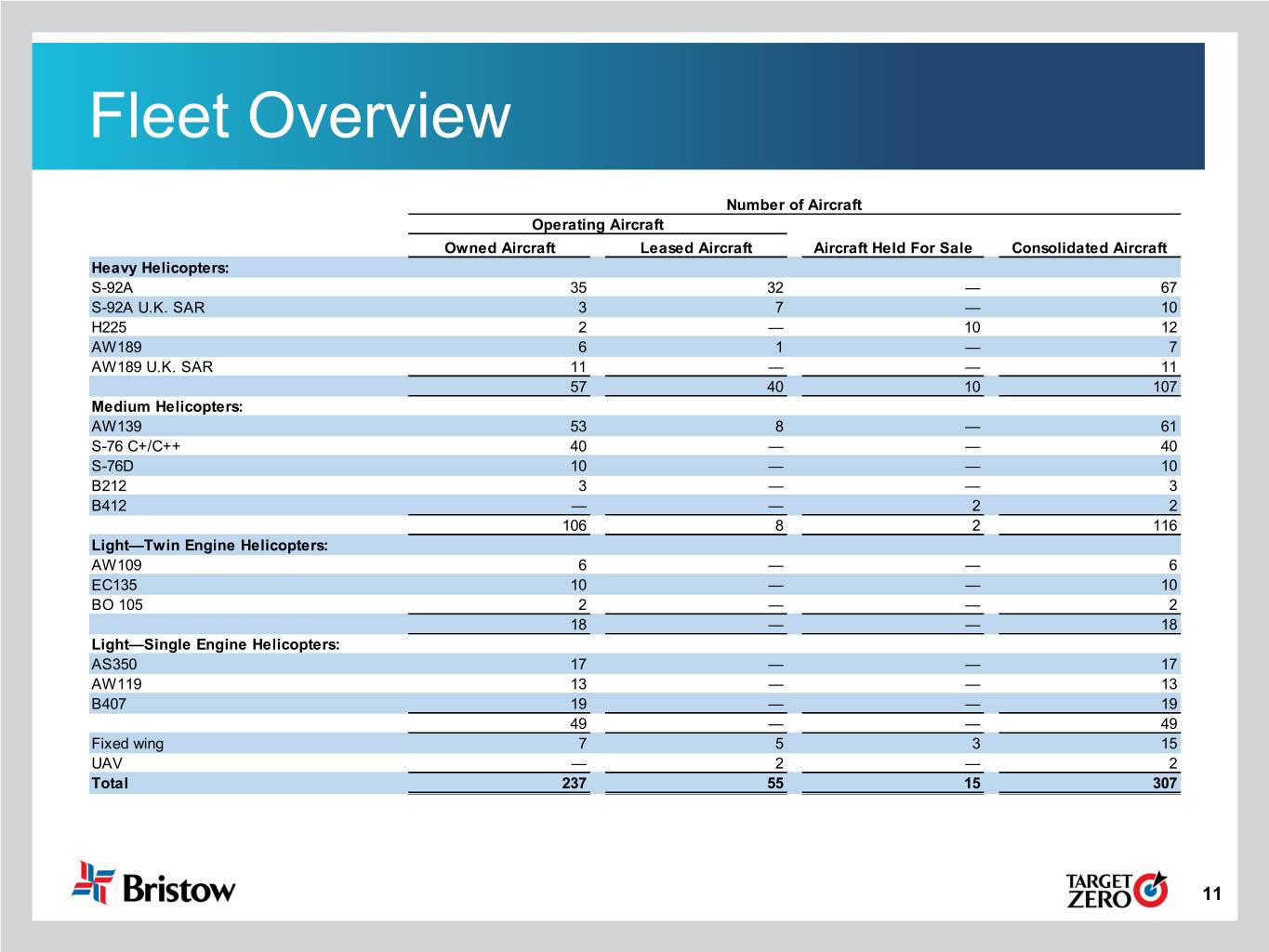

Fleet Overview Number of Aircraft Operating Aircraft Owned Aircraft Leased Aircraft Aircraft Held For Sale Consolidated Aircraft Heavy Helicopters: S-92A 35 32 — 67 S-92A U.K. SAR 3 7 — 10 H225 2 — 10 12 AW189 6 1 — 7 AW189 U.K. SAR 11 — — 11 57 40 10 107 Medium Helicopters: AW139 53 8 — 61 S-76 C+/C++ 40 — — 40 S-76D 10 — — 10 B212 3 — — 3 B412 — — 2 2 106 8 2 116 Light—Twin Engine Helicopters: AW109 6 — — 6 EC135 10 — — 10 BO 105 2 — — 2 18 — — 18 Light—Single Engine Helicopters: AS350 17 — — 17 AW119 13 — — 13 B407 19 — — 19 49 — — 49 Fixed wing 7 5 3 15 UAV — 2 — 2 Total 237 55 15 307 11

Strong Balance Sheet and Liquidity Position June 30, 2020 Amount Rate Maturity ($ in mm) (1) Bristow has $260mm of Cash and Cash Equivalents $ 260 unrestricted cash and total liquidity of $300mm(1) ABL ($75mm) (2) - L+250 bps Apr-23 PK Air Debt 215 L+500 bps Jan-25 Barclays has committed to a new Macquarie Debt 157 L+535 bps Mar-23 $5mm LILO tranche that will Lombard Debt (BULL) 87 L+225 bps Dec-23 increase the total ABL size to Lombard Debt (BALL) 72 L+225 bps Jan-24 $80mm, which in conjunction with Promissory Notes 17 L+181 bps Dec-20 merger-related enhancements to Airnorth Debt 8 L+285 bps Apr-23 the borrowing base and changes Other Debt - to the availability definition will Total Secured Debt $ 556 further enhance liquidity 7.75% Senior Unsecured Notes 144 7.75% Dec-22 Total Debt $ 700 (Less): Cash 260 Net Debt $ 440 (1) Balances reflected as of 6/30/2020 (2) As of 6/30/2020, the ABL had $10mm in letters of credit drawn against it and $39mm of remaining availability 12

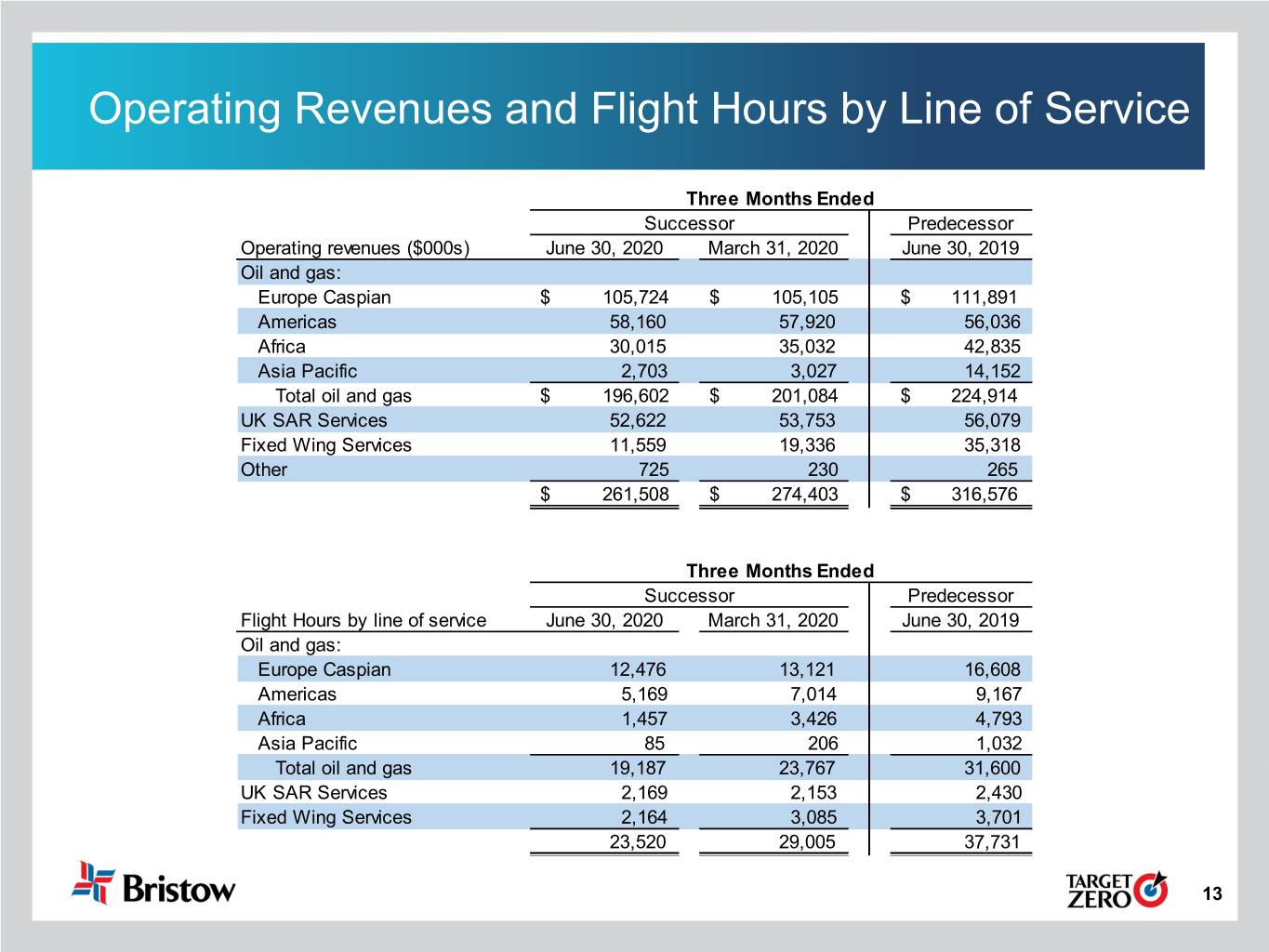

Operating Revenues and Flight Hours by Line of Service Three Months Ended Successor Predecessor Operating revenues ($000s) June 30, 2020 March 31, 2020 June 30, 2019 Oil and gas: Europe Caspian $ 105,724 $ 105,105 $ 111,891 Americas 58,160 57,920 56,036 Africa 30,015 35,032 42,835 Asia Pacific 2,703 3,027 14,152 Total oil and gas $ 196,602 $ 201,084 $ 224,914 UK SAR Services 52,622 53,753 56,079 Fixed Wing Services 11,559 19,336 35,318 Other 725 230 265 $ 261,508 $ 274,403 $ 316,576 Three Months Ended Successor Predecessor Flight Hours by line of service June 30, 2020 March 31, 2020 June 30, 2019 Oil and gas: Europe Caspian 12,476 13,121 16,608 Americas 5,169 7,014 9,167 Africa 1,457 3,426 4,793 Asia Pacific 85 206 1,032 Total oil and gas 19,187 23,767 31,600 UK SAR Services 2,169 2,153 2,430 Fixed Wing Services 2,164 3,085 3,701 23,520 29,005 37,731 13

Quarterly Reconciliation of Non-GAAP Financial Measures Three months ended Successor Predecessor Adjusted EBITDA reconciliation ($000s) June 30, 2020 March 31, 2020 June 30, 2019 Net income (loss) $ 71,404 $ 291,619 $ (169,088) Depreciation and amortization 16,356 16,312 31,339 Interest expense 12,504 13,290 26,708 Income tax (benefit) expense (3,290) (11,118) (15,507) EBITDA $ 96,974 $ 310,103 $ (126,548) Special items (1) (45,434) (288,937) 158,595 Adjusted EBITDA $ 51,540 $ 21,166 $ 32,047 Gains (losses) on asset dispositions, net (5,522) 297 3,787 Adjusted EBITDA excluding asset dispositions $ 46,018 $ 21,463 $ 35,834 Three months ended Successor Predecessor (1) Special items ($000s) June 30, 2020 March 31, 2020 June 30, 2019 Loss on impairment $ 19,233 $ 9,591 $ - Merger-related costs 17,420 6,012 — PBH intangible amortization 5,136 5,478 — Organizational restructuring costs 3,011 7,437 91,448 Early extinguishment of debt fees 615 — — Change in fair value of preferred stock derivative liability (15,416) (317,455) — Bargain purchase gain (75,433) — — Loss on sale of subsidiaries — — 56,303 H225 lease return — — 10,844 $ (45,434) $ (288,937) $ 158,595 14

Reconciliation of Non-GAAP Financial Measures Bristow Group Inc. Era Group Legacy Era Pro Forma LTM Inc. 7/1/2019 - 6/12/2020 - LTM Adjusted EBITDA reconciliation ($000s) 6/30/2020 6/11/2020 6/30/2020 6/30/2020 Net income (loss) $ (452,335) $ (28,218) $ (4,305) $ (484,858) Depreciation and amortization 83,677 35,974 443 120,094 Interest expense 136,669 13,070 749 150,488 Income tax expense (benefit) (38,986) (3,835) 508 (42,313) EBITDA (270,975) 16,991 (2,605) (256,589) Special Items(1) 413,026 22,293 2,502 437,821 Adjusted EBITDA 142,051 39,285 (103) 181,233 Losses (gains) on asset dispositions, net (5,095) (3,674) 5 (8,764) Adjusted EBITDA excluding asset dispositions $ 136,956 $ 35,611 $ (98) $ 172,469 (1) Special items ($000s) Loss on impairment $ 90,925 $ 2,551 $ - $ 93,476 Merger-related costs 21,433 18,933 2,317 42,683 PBH intangible amortization 20,453 809 185 21,447 Organizational restructuring costs 555,009 - - 555,009 Early extinguishment of debt fees 615 - - 615 Change in fair value of preferred stock derivative liability (199,556) - - (199,556) Bargain purchase gain (75,433) - - (75,433) Loss on sale of subsidiaries (420) - - (420) $ 413,026 $ 22,293 $ 2,502 $ 437,821 15

Reconciliation of Free Cash Flow Three months ended Successor Predecessor ($000s) June 30, 2020 March 31, 2020 June 30, 2019 Net cash provided by (used in) operating activities $ (6,866) $ 3,932 $ (36,762) Plus: Proceeds from disposition of property and equipment 11,665 13,640 3,204 Less: Purchases of property and equipment (2,849) (3,973) (7,439) Free Cash Flow $ 1,950 $ 13,599 $ (40,997) Plus: Merger-related costs 19,743 1,980 — Plus: Organizational Restructuring Costs 4,176 8,574 19,084 Adjusted Free Cash Flow $ 25,869 $ 24,153 $ (21,913) 16