Exhibit 99.2 Q2 FY21 Earnings Presentation November 5, 2020

Q2 FY21 Earnings Call Agenda Crystal Gordon I. Introduction SVP and General Counsel Chris Bradshaw II. Operational Highlights President and CEO Jennifer Whalen III. Financial Review SVP and CFO Chris Bradshaw IV. Concluding Remarks President and CEO V. Questions & Answers 2

Cautionary Statement Regarding Forward-Looking Statements This presentation contains “forward-looking statements.” Forward-looking statements represent Bristow Group Inc.’s (the “Company”) current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, reflect management’s current views with respect to future events and therefore are subject to significant risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which the forward-looking statement is based that occur after the date hereof. Risks that may affect forward-looking statements include, but are not necessarily limited to, those relating to: the COVID-19 pandemic and related economic repercussions have resulted, and may continue to result, in a decrease in the price of and demand for oil, which has caused, and may continue to cause, a decrease in the demand for our services; expected cost synergies and other benefits of the merger (the “Merger”) of the entity formerly known as Bristow Group Inc. (“Old Bristow”) and Era Group Inc. (“Era”) might not be realized within the expected time frames, might be less than projected or may not be realized at all; the ability to successfully integrate the operations, accounting and administrative functions of Era and Old Bristow; managing a significantly larger company than before the completion of the Merger; diversion of management time on issues related to integration of the companies; the increase in indebtedness as a result of the Merger; operating costs, customer loss and business disruption following the Merger, including, without limitation, difficulties in maintaining relationships with employees and customers, may be greater than expected; our reliance on a limited number of customers and the reduction of our customer base as a result of bankruptcies or consolidation; risks inherent in operating helicopters; the Company’s ability to maintain an acceptable safety record and level of reliability; the impact of increased U.S. and foreign government regulation and legislation, including potential government implemented moratoriums on drilling activities; the impact of a grounding of all or a portion of the Company’s fleet for extended periods of time or indefinitely on the Company’s business, including its operations and ability to service customers, results of operations or financial condition and/or the market value of the affected helicopters; the Company’s ability to successfully expand into other geographic and aviation service markets; risks associated with political instability, governmental action, war, acts of terrorism and changes in the economic condition in any foreign country where the Company does business, which may result in expropriation, nationalization, confiscation or deprivation of the Company’s assets or result in claims of a force majeure situation; the impact of declines in the global economy and financial markets; the impact of fluctuations in foreign currency exchange rates on the Company’s asset values and cost to purchase helicopters, spare parts and related services; risks related to investing in new lines of aviation service without realizing the expected benefits; risks of engaging in competitive processes or expending significant resources for strategic opportunities, with no guaranty of recoupment; the Company’s reliance on a limited number of helicopter manufacturers and suppliers; the Company’s ongoing need to replace aging helicopters; the Company’s reliance on the secondary helicopter market to dispose of used helicopters and parts; information technology related risks; the impact of allocation of risk between the Company and its customers; the liability, legal fees and costs in connection with providing emergency response services; adverse weather conditions and seasonality; risks associated with the Company’s debt structure; the Company’s counterparty credit risk exposure; the impact of operational and financial difficulties of the Company’s joint ventures and partners and the risks associated with identifying and securing joint venture partners when needed; conflict with the other owners of the Company’s non-wholly owned subsidiaries and other equity investees; adverse results of legal proceedings; risks associated with significant increases in fuel costs; the Company’s ability to obtain insurance coverage and the adequacy and availability of such coverage; the possibility of labor problems; the attraction and retention of qualified personnel; restrictions on the amount of foreign ownership of the Company’s common stock; and various other matters and factors, many of which are beyond the Company’s control. You should not place undue reliance on our forward-looking statements because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our forward-looking statements are based on the information currently available to us and speak only as of the date hereof. New risks and uncertainties arise from time to time, and it is impossible for us to predict these matters or how they may affect us. We have included important factors in the section entitled “Risk Factors” in the Company’s joint proxy and consent solicitation statement/prospectus (File No. 333-237557/the “Proxy Statement”), filed with the United States Securities and Exchange Commission (the “SEC”) on May 5, 2020 and the Company’s Quarterly Report on Form 10-Q for the Quarter ended September 30, 2020, which we believe over time, could cause our actual results, performance or achievements to differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements. You should consider all risks and uncertainties disclosed in the Proxy Statement and in our filings with the SEC, all of which are accessible on the SEC’s website at www.sec.gov. 3

Non-GAAP and Pro Forma Financial Measures Non-GAAP In addition to financial results calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation includes certain non-GAAP measures including EBITDA, Adjusted EBITDA, Net Debt, Free Cash Flow and Adjusted Free Cash Flow. EBITDA and Adjusted EBITDA are presented as supplemental measures of the Company’s operating performance. EBITDA is defined as Earnings before Interest expense, Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for special items that occurred during the reporting period and noted in the applicable reconciliation. Since neither EBITDA nor Adjusted EBITDA is a recognized term under GAAP, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for discretionary use, as they do not take into account certain cash requirements, such as debt service requirements. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. Free Cash Flow represents the Company’s net cash provided by operating activities plus proceeds from disposition of property and equipment, less expenditures related to purchases of property and equipment. Adjusted Free Cash Flow is Free Cash Flow adjusted to exclude professional services fees and other costs paid in relation to the Merger, the implementation of fresh-start accounting and the voluntary petitions filed by Old Bristow and certain of its subsidiaries on May 11, 2019 in the U.S. Bankruptcy Court for the Southern District of Texas, Houston Division seeking relief under Chapter 11 of Title 11 of the U.S. Code (the “Chapter 11 Cases”). Management believes that the use of Adjusted Free Cash Flow is meaningful as it measures the Company’s ability to generate cash from its business after excluding cash payments for special items. Management uses this information as an analytical indicator to assess the Company’s liquidity and performance. However, investors should note numerous methods may exist for calculating a company's free cash flow. As a result, the method used by management to calculate Adjusted Free Cash Flow may differ from the methods used by other companies to calculate their free cash flow. The Company also presents net debt, which is a non-GAAP measure, defined as total principal balance on borrowings less cash and cash equivalents, including escrow balances. Each of these non-GAAP measures has limitations and therefore should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. A reconciliation of each of EBITDA, Adjusted EBITDA, Adjusted EBITDA excluding gains or losses on asset dispositions, Free Cash Flow, Adjusted Free Cash Flow. and net debt is included elsewhere in this presentation. Pro Forma This presentation also includes certain financial information provided on a “pro forma” basis to reflect the consummation of the Merger and certain related transactions. The results of operations data was prepared assuming the Merger and related transactions occurred at the beginning of the applicable period. The balance sheet data only gives pro forma effect to the Merger and related transactions and was prepared assuming those transactions occurred on September 30, 2020. Pro forma financial information included in this presentation has been prepared in accordance with guidance set forth in Article 11 of Regulation S-X. As a result, we do not believe our pro forma information are non-GAAP financial measures. Pro forma financial information does not necessarily reflect the actual results that we would have achieved had the pro forma transactions been consummated on the date or dates indicated nor does it reflect our potential future results. 4

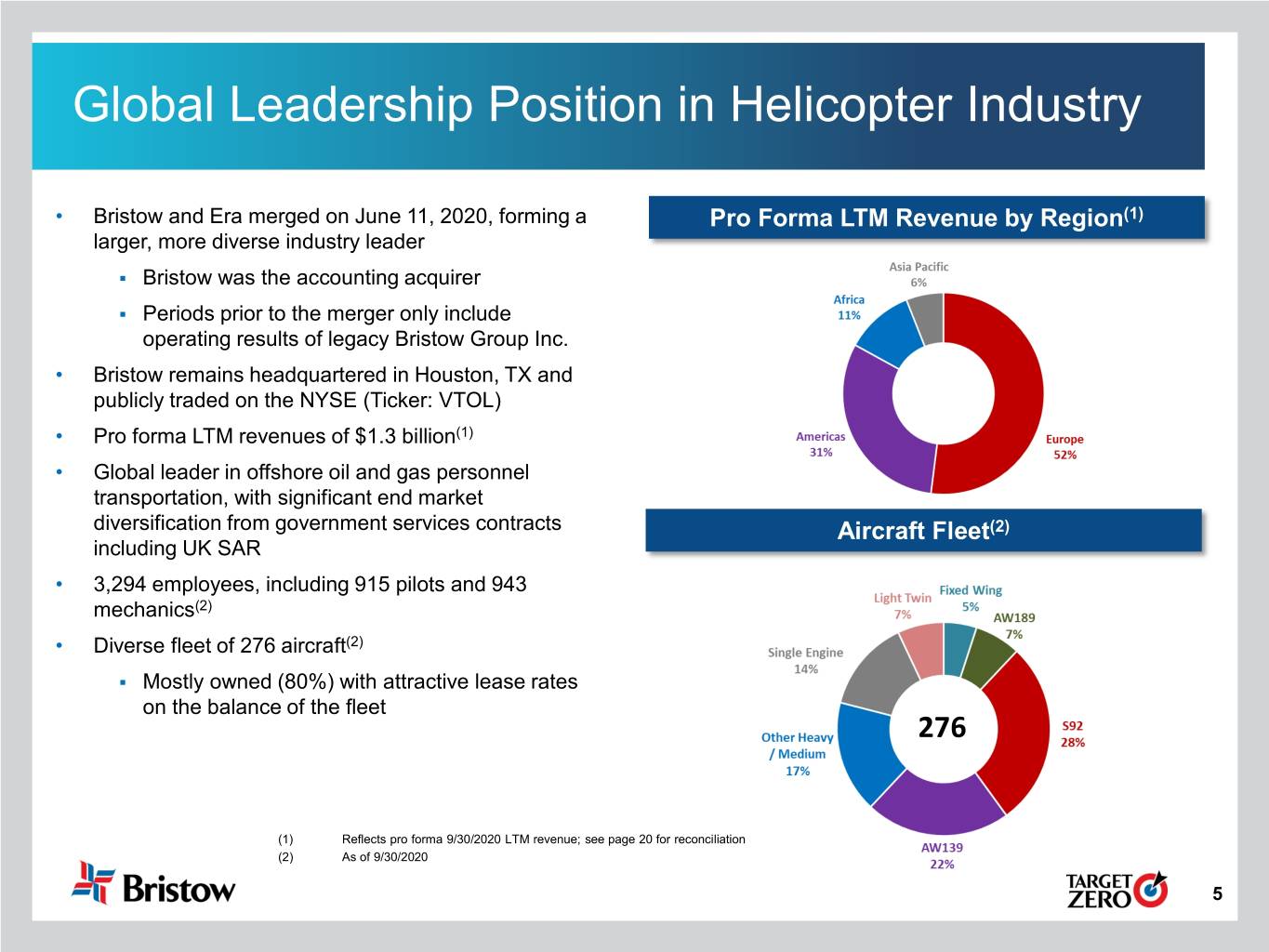

Global Leadership Position in Helicopter Industry • Bristow and Era merged on June 11, 2020, forming a Pro Forma LTM Revenue by Region(1) larger, more diverse industry leader . Bristow was the accounting acquirer . Periods prior to the merger only include operating results of legacy Bristow Group Inc. • Bristow remains headquartered in Houston, TX and publicly traded on the NYSE (Ticker: VTOL) • Pro forma LTM revenues of $1.3 billion(1) • Global leader in offshore oil and gas personnel transportation, with significant end market diversification from government services contracts Aircraft Fleet(2) including UK SAR • 3,294 employees, including 915 pilots and 943 mechanics(2) • Diverse fleet of 276 aircraft(2) . Mostly owned (80%) with attractive lease rates on the balance of the fleet 276 (1) Reflects pro forma 9/30/2020 LTM revenue; see page 20 for reconciliation (2) As of 9/30/2020 5

Why Invest in Bristow 6

Substantial and Highly Achievable Cost Synergies Identified Substantial and Highly Achievable Cost Synergies Identified G&A Savings Elimination of redundant corporate expenses Fleet Cost Savings Realization of operational efficiencies in the U.S. Gulf of Mexico Optimization of aircraft maintenance programs and Other OpEx Savings fleet utilization Synergies expected to be realized in the first ~12 to 24 months following the close of the Merger +$45 Million Annual Run-Rate Savings As of October 30th, synergy projects representing ~$20 million of annualized run-rate savings have been completed 7

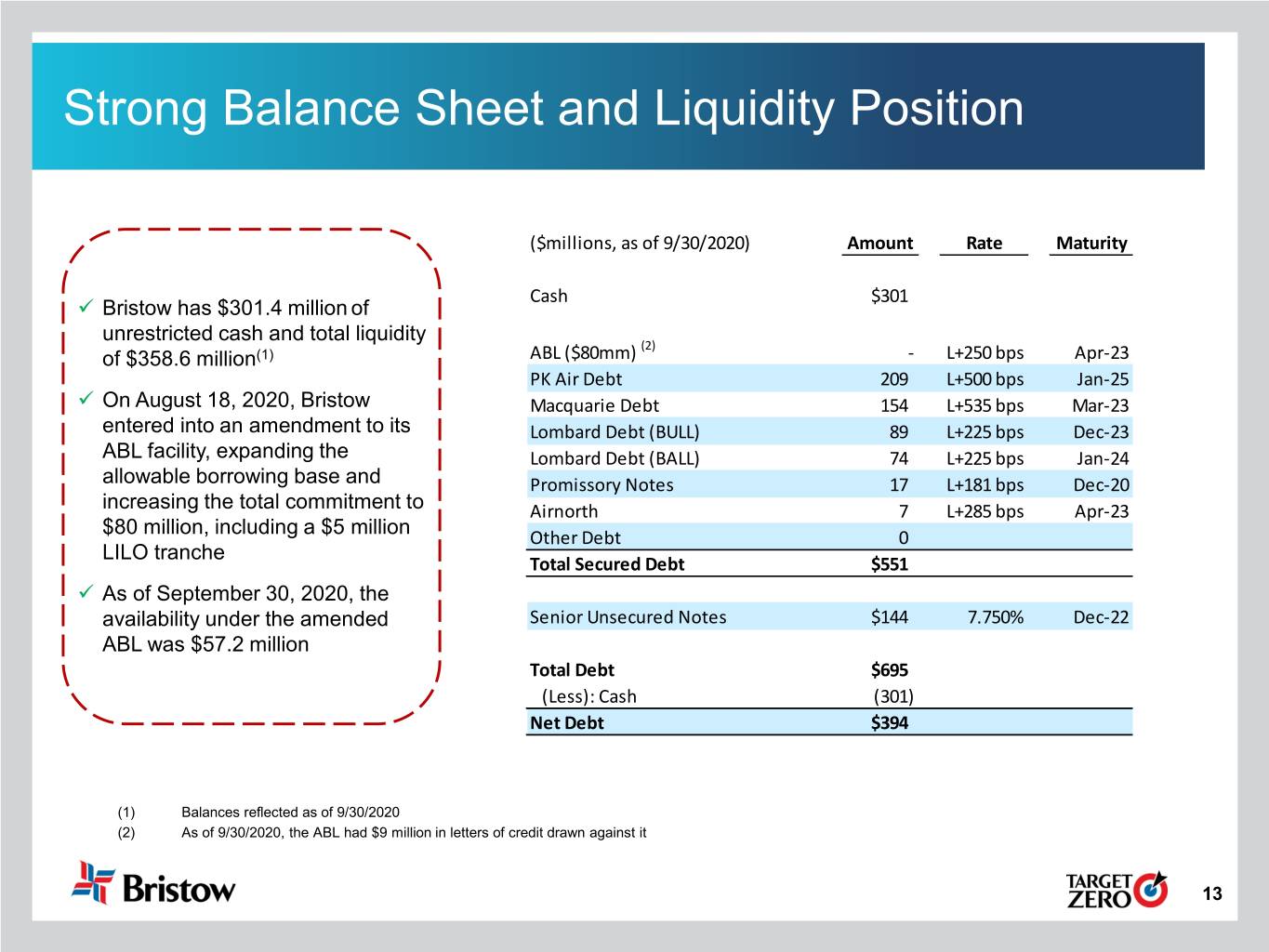

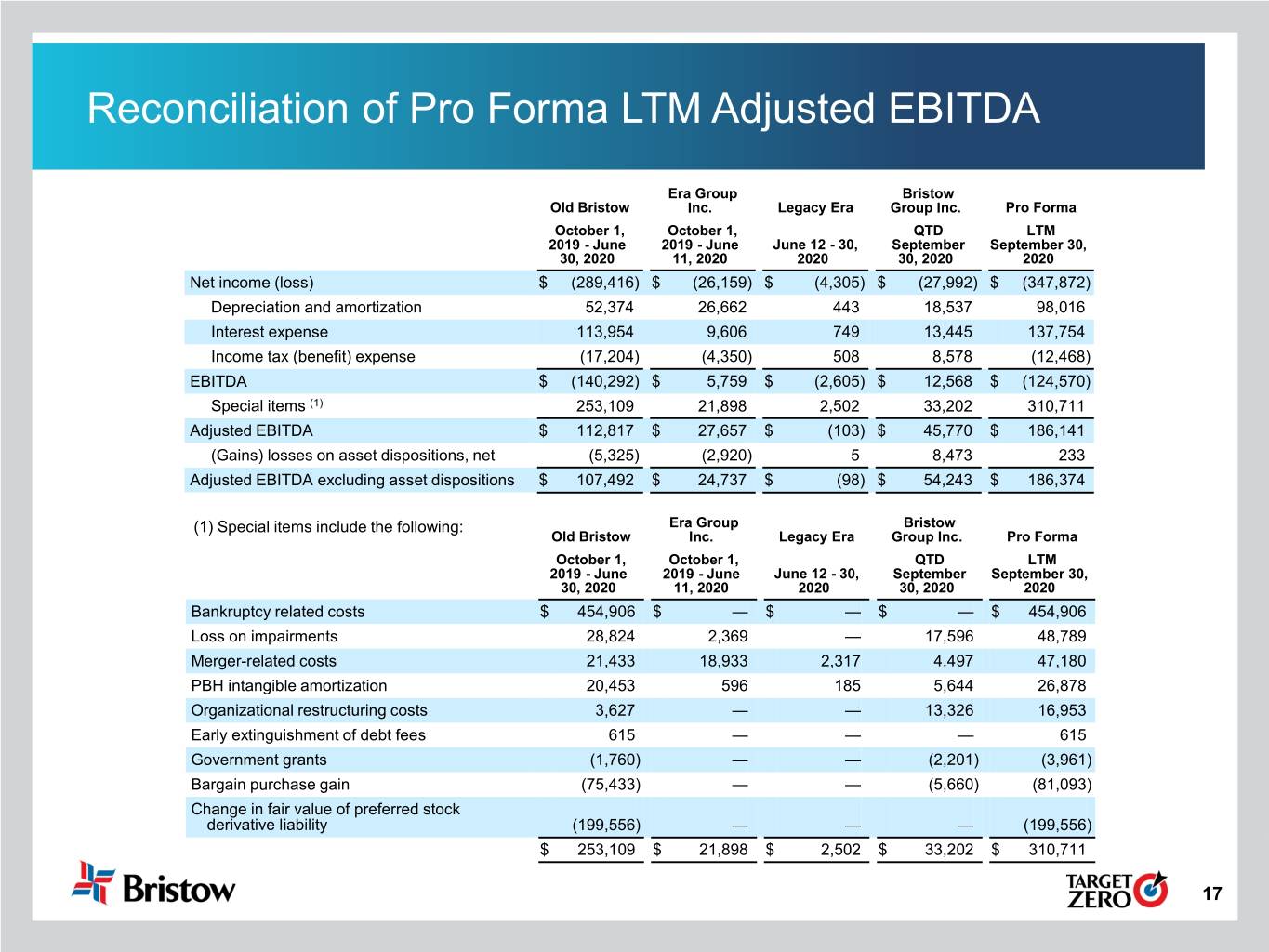

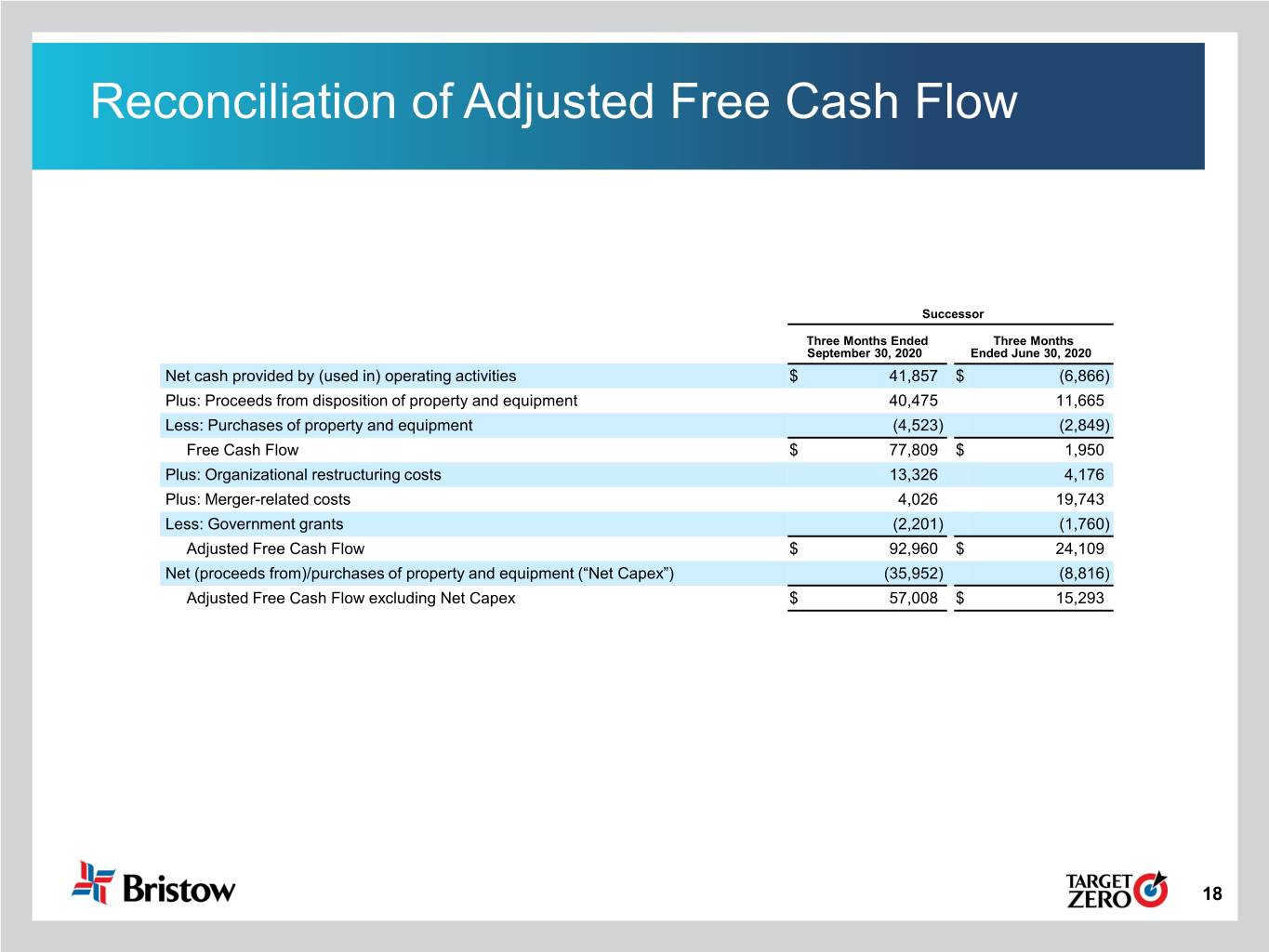

Strong Balance Sheet and Financial Flexibility • Total available liquidity as of September 30, 2020 was $358.6 million . $301.4 million in unrestricted cash balances . $57.2 million of remaining availability under the Company’s ABL facility • Net debt of $394 million as of September 30, 2020 • Pro Forma LTM Adjusted EBITDA of $186 million(1) for the 12 months ended September 30, 2020 • Bristow generated $57 million of Adjusted Free Cash Flow excluding Net Capex(2) in the three months ended September 30, 2020 • All of the Company's unfunded capital commitments may be canceled without further liability other than forfeiture of previously paid deposits of $2.1 million • During the current quarter, the Company repurchased 345,327 shares for consideration of $7.6 million (1) See page 17 for reconciliation of LTM Adjusted EBITDA (2) “Net Capex” is defined as net (proceeds from)/purchases of property and equipment. See page 18 for reconciliation of Adjusted Free Cash Flow 8

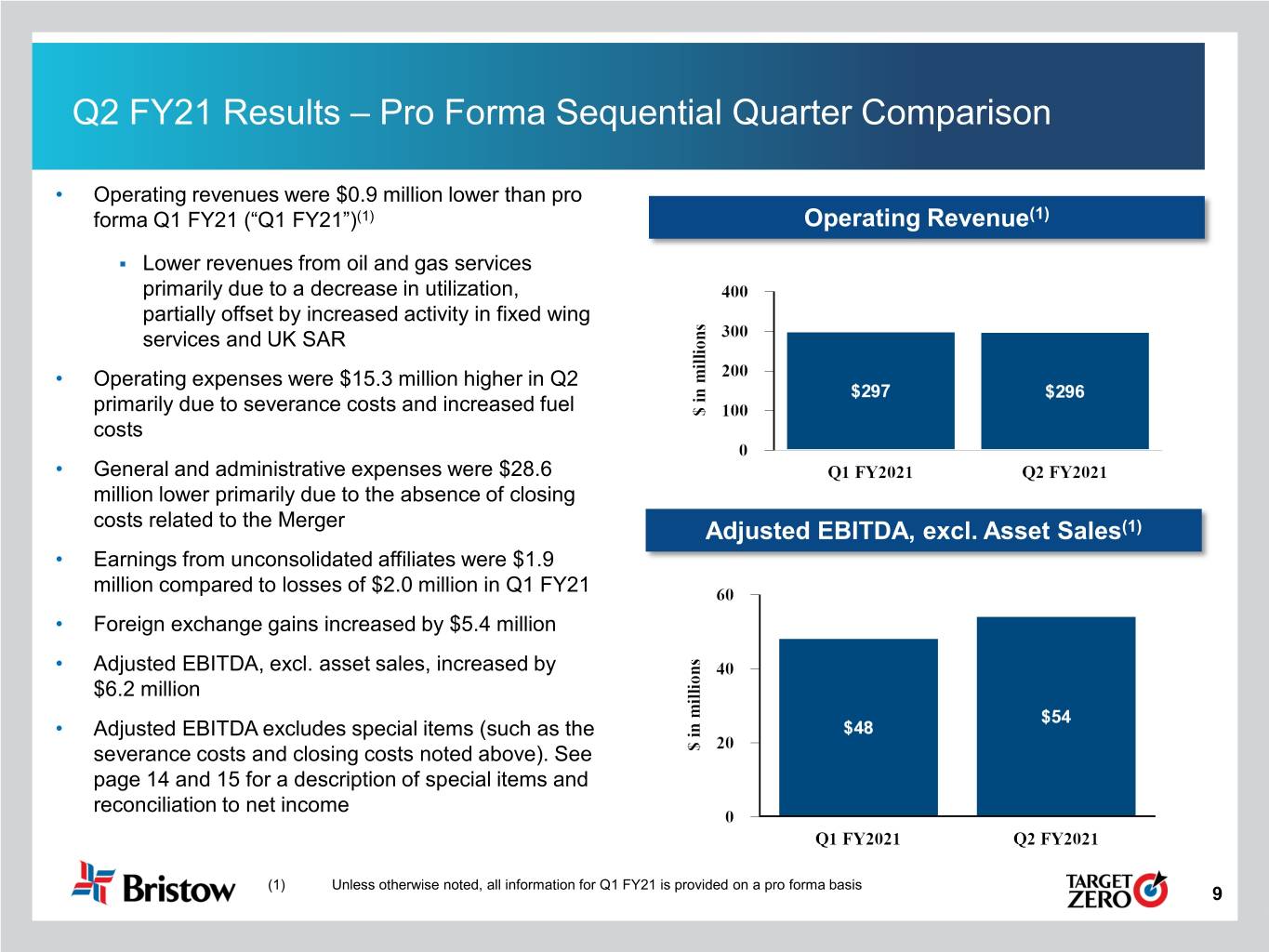

Q2 FY21 Results – Pro Forma Sequential Quarter Comparison • Operating revenues were $0.9 million lower than pro forma Q1 FY21 (“Q1 FY21”)(1) Operating Revenue(1) . Lower revenues from oil and gas services primarily due to a decrease in utilization, partially offset by increased activity in fixed wing services and UK SAR • Operating expenses were $15.3 million higher in Q2 primarily due to severance costs and increased fuel costs • General and administrative expenses were $28.6 million lower primarily due to the absence of closing costs related to the Merger Adjusted EBITDA, excl. Asset Sales(1) • Earnings from unconsolidated affiliates were $1.9 million compared to losses of $2.0 million in Q1 FY21 • Foreign exchange gains increased by $5.4 million • Adjusted EBITDA, excl. asset sales, increased by $6.2 million • Adjusted EBITDA excludes special items (such as the severance costs and closing costs noted above). See page 14 and 15 for a description of special items and reconciliation to net income (1) Unless otherwise noted, all information for Q1 FY21 is provided on a pro forma basis 9

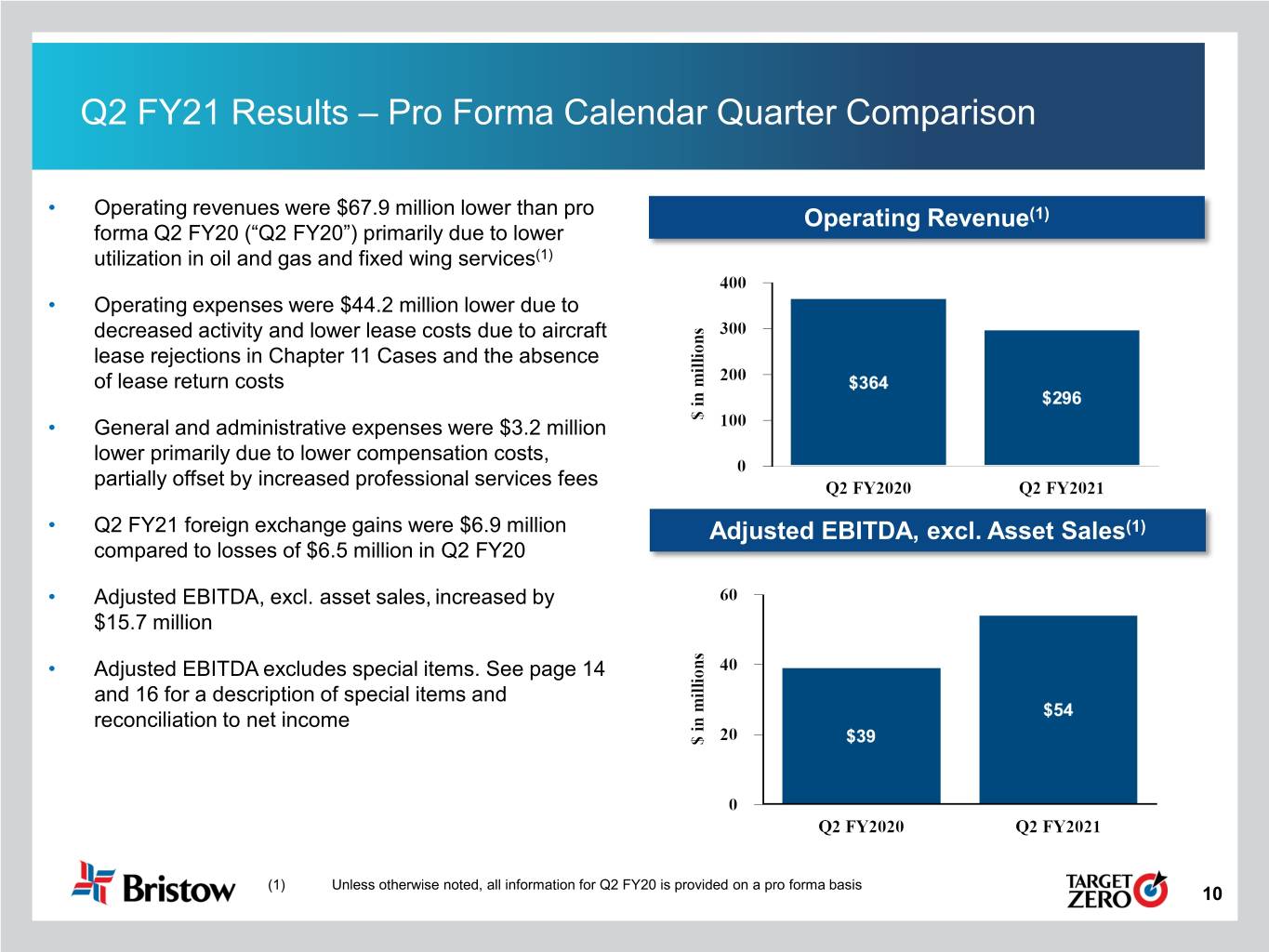

Q2 FY21 Results – Pro Forma Calendar Quarter Comparison • Operating revenues were $67.9 million lower than pro Operating Revenue(1) forma Q2 FY20 (“Q2 FY20”) primarily due to lower utilization in oil and gas and fixed wing services(1) • Operating expenses were $44.2 million lower due to decreased activity and lower lease costs due to aircraft lease rejections in Chapter 11 Cases and the absence of lease return costs • General and administrative expenses were $3.2 million lower primarily due to lower compensation costs, partially offset by increased professional services fees • Q2 FY21 foreign exchange gains were $6.9 million Adjusted EBITDA, excl. Asset Sales(1) compared to losses of $6.5 million in Q2 FY20 • Adjusted EBITDA, excl. asset sales, increased by $15.7 million • Adjusted EBITDA excludes special items. See page 14 and 16 for a description of special items and reconciliation to net income (1) Unless otherwise noted, all information for Q2 FY20 is provided on a pro forma basis 10

Appendix 11

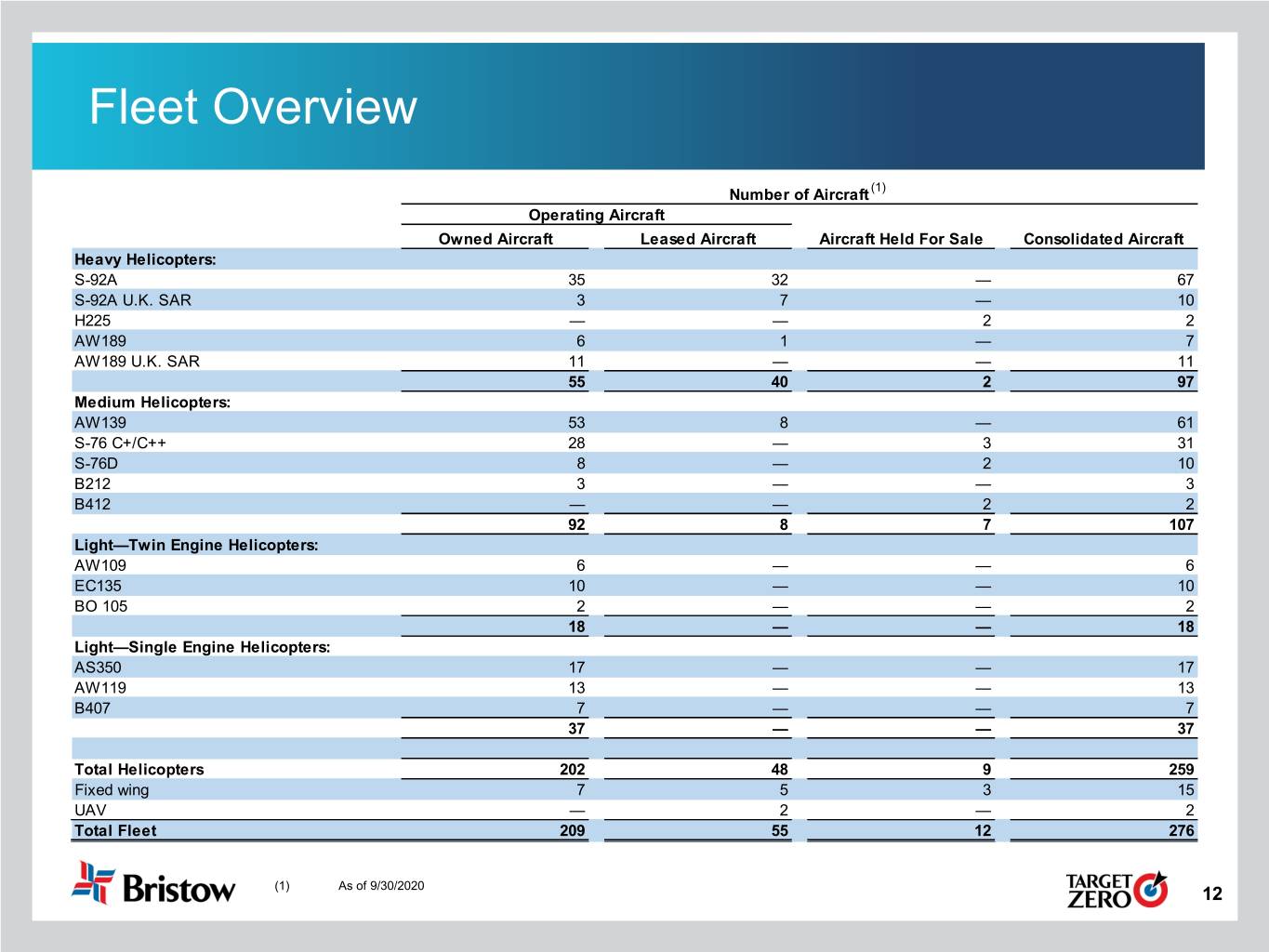

Fleet Overview (1) Number of Aircraft Operating Aircraft Owned Aircraft Leased Aircraft Aircraft Held For Sale Consolidated Aircraft Heavy Helicopters: S-92A 35 32 — 67 S-92A U.K. SAR 3 7 — 10 H225 — — 2 2 AW189 6 1 — 7 AW189 U.K. SAR 11 — — 11 55 40 2 97 Medium Helicopters: AW139 53 8 — 61 S-76 C+/C++ 28 — 3 31 S-76D 8 — 2 10 B212 3 — — 3 B412 — — 2 2 92 8 7 107 Light—Twin Engine Helicopters: AW109 6 — — 6 EC135 10 — — 10 BO 105 2 — — 2 18 — — 18 Light—Single Engine Helicopters: AS350 17 — — 17 AW119 13 — — 13 B407 7 — — 7 37 — — 37 Total Helicopters 202 48 9 259 Fixed wing 7 5 3 15 UAV — 2 — 2 Total Fleet 209 55 12 276 (1) As of 9/30/2020 12

Strong Balance Sheet and Liquidity Position ($millions, as of 9/30/2020) Amount Rate Maturity Cash $301 Bristow has $301.4 million of unrestricted cash and total liquidity (2) of $358.6 million(1) ABL ($80mm) - L+250 bps Apr-23 PK Air Debt 209 L+500 bps Jan-25 On August 18, 2020, Bristow Macquarie Debt 154 L+535 bps Mar-23 entered into an amendment to its Lombard Debt (BULL) 89 L+225 bps Dec-23 ABL facility, expanding the Lombard Debt (BALL) 74 L+225 bps Jan-24 allowable borrowing base and Promissory Notes 17 L+181 bps Dec-20 increasing the total commitment to Airnorth 7 L+285 bps Apr-23 $80 million, including a $5 million Other Debt 0 LILO tranche Total Secured Debt $551 As of September 30, 2020, the availability under the amended Senior Unsecured Notes $144 7.750% Dec-22 ABL was $57.2 million Total Debt $695 (Less): Cash (301) Net Debt $394 (1) Balances reflected as of 9/30/2020 (2) As of 9/30/2020, the ABL had $9 million in letters of credit drawn against it 13

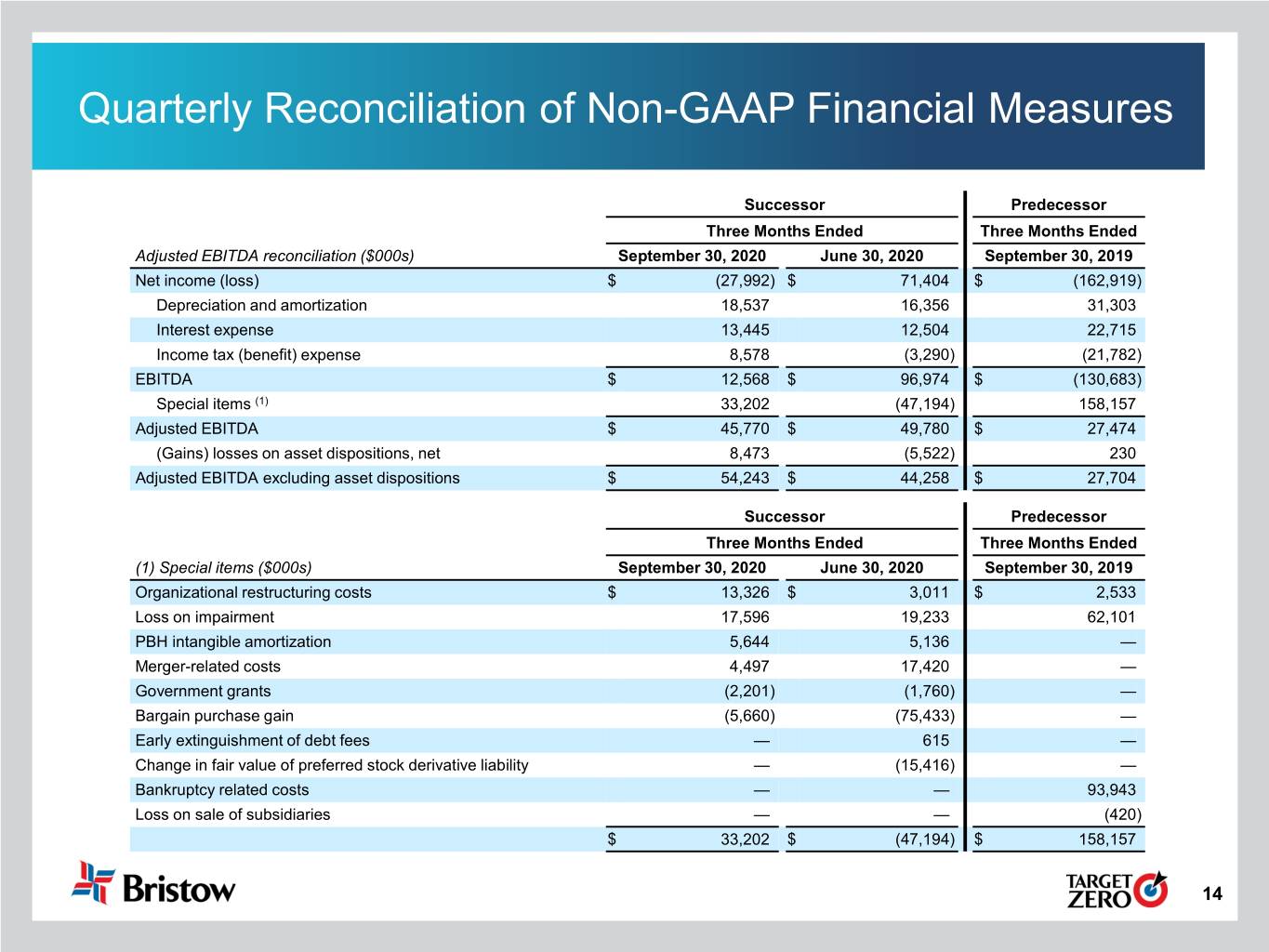

Quarterly Reconciliation of Non-GAAP Financial Measures Successor Predecessor Three Months Ended Three Months Ended Adjusted EBITDA reconciliation ($000s) September 30, 2020 June 30, 2020 September 30, 2019 Net income (loss) $ (27,992) $ 71,404 $ (162,919) Depreciation and amortization 18,537 16,356 31,303 Interest expense 13,445 12,504 22,715 Income tax (benefit) expense 8,578 (3,290) (21,782) EBITDA $ 12,568 $ 96,974 $ (130,683) Special items (1) 33,202 (47,194) 158,157 Adjusted EBITDA $ 45,770 $ 49,780 $ 27,474 (Gains) losses on asset dispositions, net 8,473 (5,522) 230 Adjusted EBITDA excluding asset dispositions $ 54,243 $ 44,258 $ 27,704 Successor Predecessor Three Months Ended Three Months Ended (1) Special items ($000s) September 30, 2020 June 30, 2020 September 30, 2019 Organizational restructuring costs $ 13,326 $ 3,011 $ 2,533 Loss on impairment 17,596 19,233 62,101 PBH intangible amortization 5,644 5,136 — Merger-related costs 4,497 17,420 — Government grants (2,201) (1,760) — Bargain purchase gain (5,660) (75,433) — Early extinguishment of debt fees — 615 — Change in fair value of preferred stock derivative liability — (15,416) — Bankruptcy related costs — — 93,943 Loss on sale of subsidiaries — — (420) $ 33,202 $ (47,194) $ 158,157 14

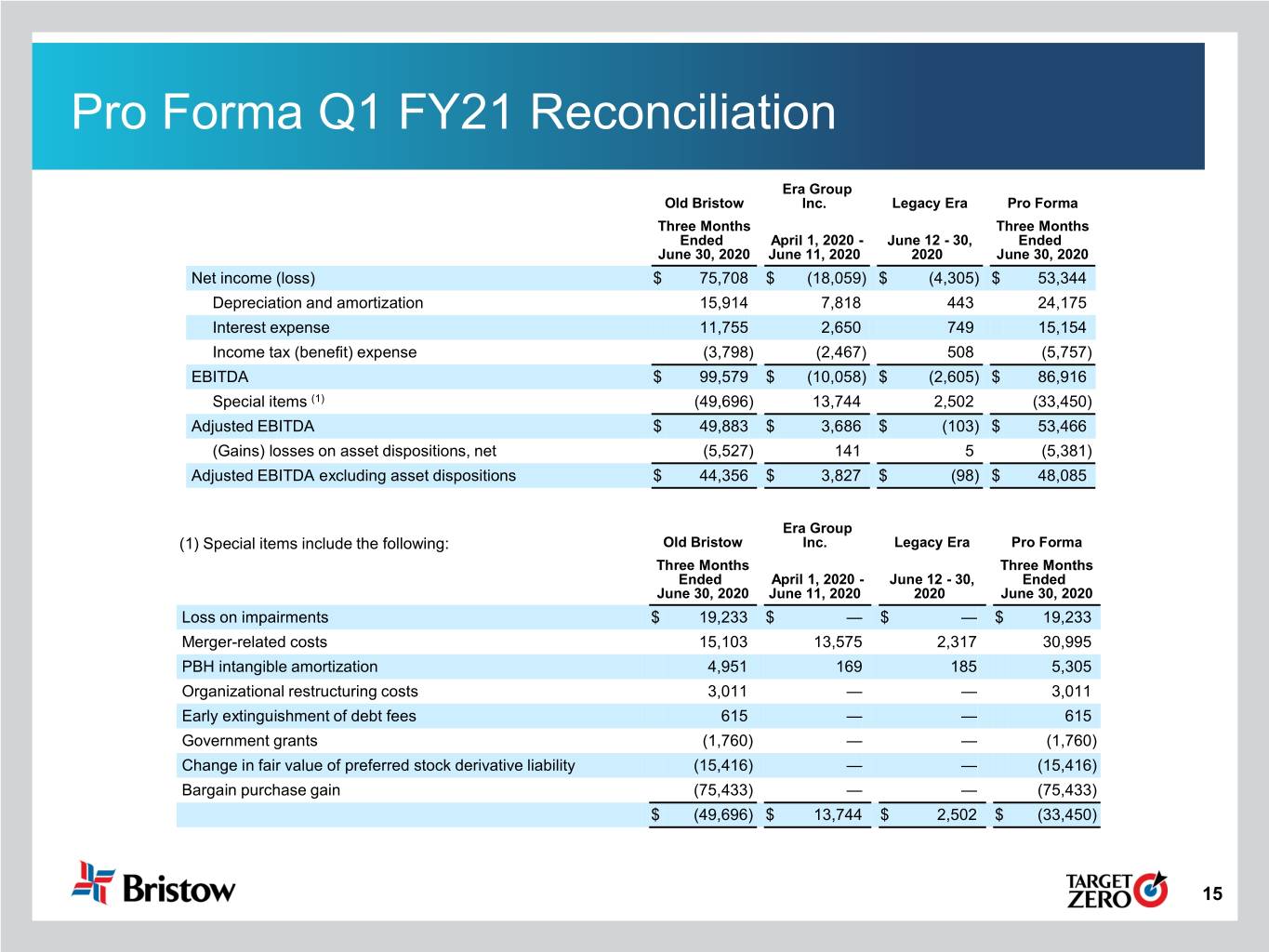

Pro Forma Q1 FY21 Reconciliation Era Group Old Bristow Inc. Legacy Era Pro Forma Three Months Three Months Ended April 1, 2020 - June 12 - 30, Ended June 30, 2020 June 11, 2020 2020 June 30, 2020 Net income (loss) $ 75,708 $ (18,059) $ (4,305) $ 53,344 Depreciation and amortization 15,914 7,818 443 24,175 Interest expense 11,755 2,650 749 15,154 Income tax (benefit) expense (3,798) (2,467) 508 (5,757) EBITDA $ 99,579 $ (10,058) $ (2,605) $ 86,916 Special items (1) (49,696) 13,744 2,502 (33,450) Adjusted EBITDA $ 49,883 $ 3,686 $ (103) $ 53,466 (Gains) losses on asset dispositions, net (5,527) 141 5 (5,381) Adjusted EBITDA excluding asset dispositions $ 44,356 $ 3,827 $ (98) $ 48,085 Era Group (1) Special items include the following: Old Bristow Inc. Legacy Era Pro Forma Three Months Three Months Ended April 1, 2020 - June 12 - 30, Ended June 30, 2020 June 11, 2020 2020 June 30, 2020 Loss on impairments $ 19,233 $ — $ — $ 19,233 Merger-related costs 15,103 13,575 2,317 30,995 PBH intangible amortization 4,951 169 185 5,305 Organizational restructuring costs 3,011 — — 3,011 Early extinguishment of debt fees 615 — — 615 Government grants (1,760) — — (1,760) Change in fair value of preferred stock derivative liability (15,416) — — (15,416) Bargain purchase gain (75,433) — — (75,433) $ (49,696) $ 13,744 $ 2,502 $ (33,450) 15

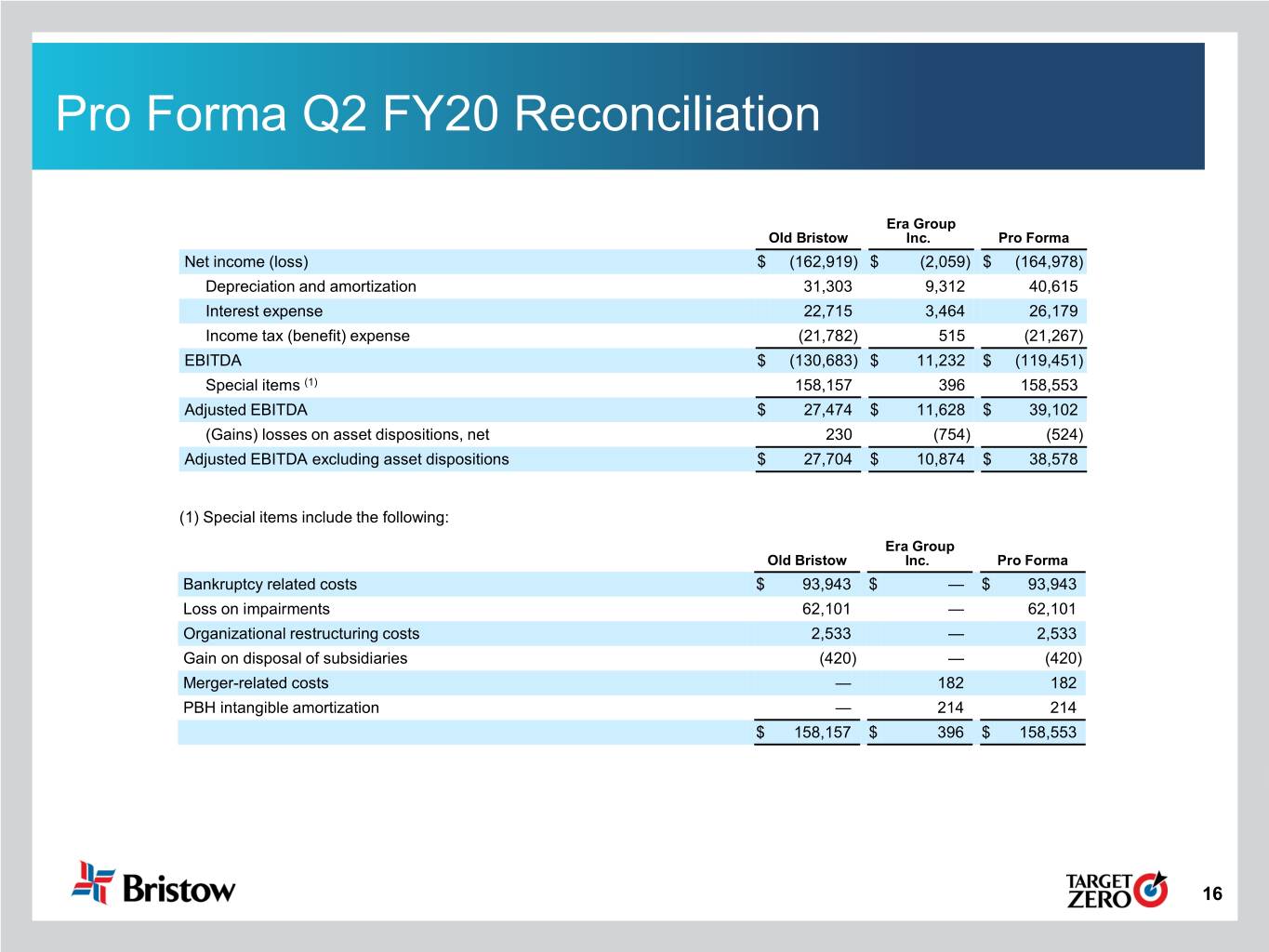

Pro Forma Q2 FY20 Reconciliation Era Group Old Bristow Inc. Pro Forma Net income (loss) $ (162,919) $ (2,059) $ (164,978) Depreciation and amortization 31,303 9,312 40,615 Interest expense 22,715 3,464 26,179 Income tax (benefit) expense (21,782) 515 (21,267) EBITDA $ (130,683) $ 11,232 $ (119,451) Special items (1) 158,157 396 158,553 Adjusted EBITDA $ 27,474 $ 11,628 $ 39,102 (Gains) losses on asset dispositions, net 230 (754) (524) Adjusted EBITDA excluding asset dispositions $ 27,704 $ 10,874 $ 38,578 (1) Special items include the following: Era Group Old Bristow Inc. Pro Forma Bankruptcy related costs $ 93,943 $ — $ 93,943 Loss on impairments 62,101 — 62,101 Organizational restructuring costs 2,533 — 2,533 Gain on disposal of subsidiaries (420) — (420) Merger-related costs — 182 182 PBH intangible amortization — 214 214 $ 158,157 $ 396 $ 158,553 16

Reconciliation of Pro Forma LTM Adjusted EBITDA Era Group Bristow Old Bristow Inc. Legacy Era Group Inc. Pro Forma October 1, October 1, QTD LTM 2019 - June 2019 - June June 12 - 30, September September 30, 30, 2020 11, 2020 2020 30, 2020 2020 Net income (loss) $ (289,416) $ (26,159) $ (4,305) $ (27,992) $ (347,872) Depreciation and amortization 52,374 26,662 443 18,537 98,016 Interest expense 113,954 9,606 749 13,445 137,754 Income tax (benefit) expense (17,204) (4,350) 508 8,578 (12,468) EBITDA $ (140,292) $ 5,759 $ (2,605) $ 12,568 $ (124,570) Special items (1) 253,109 21,898 2,502 33,202 310,711 Adjusted EBITDA $ 112,817 $ 27,657 $ (103) $ 45,770 $ 186,141 (Gains) losses on asset dispositions, net (5,325) (2,920) 5 8,473 233 Adjusted EBITDA excluding asset dispositions $ 107,492 $ 24,737 $ (98) $ 54,243 $ 186,374 (1) Special items include the following: Era Group Bristow Old Bristow Inc. Legacy Era Group Inc. Pro Forma October 1, October 1, QTD LTM 2019 - June 2019 - June June 12 - 30, September September 30, 30, 2020 11, 2020 2020 30, 2020 2020 Bankruptcy related costs $ 454,906 $ — $ — $ — $ 454,906 Loss on impairments 28,824 2,369 — 17,596 48,789 Merger-related costs 21,433 18,933 2,317 4,497 47,180 PBH intangible amortization 20,453 596 185 5,644 26,878 Organizational restructuring costs 3,627 — — 13,326 16,953 Early extinguishment of debt fees 615 — — — 615 Government grants (1,760) — — (2,201) (3,961) Bargain purchase gain (75,433) — — (5,660) (81,093) Change in fair value of preferred stock derivative liability (199,556) — — — (199,556) $ 253,109 $ 21,898 $ 2,502 $ 33,202 $ 310,711 17

Reconciliation of Adjusted Free Cash Flow Successor Three Months Ended Three Months September 30, 2020 Ended June 30, 2020 Net cash provided by (used in) operating activities $ 41,857 $ (6,866) Plus: Proceeds from disposition of property and equipment 40,475 11,665 Less: Purchases of property and equipment (4,523) (2,849) Free Cash Flow $ 77,809 $ 1,950 Plus: Organizational restructuring costs 13,326 4,176 Plus: Merger-related costs 4,026 19,743 Less: Government grants (2,201) (1,760) Adjusted Free Cash Flow $ 92,960 $ 24,109 Net (proceeds from)/purchases of property and equipment (“Net Capex”) (35,952) (8,816) Adjusted Free Cash Flow excluding Net Capex $ 57,008 $ 15,293 18

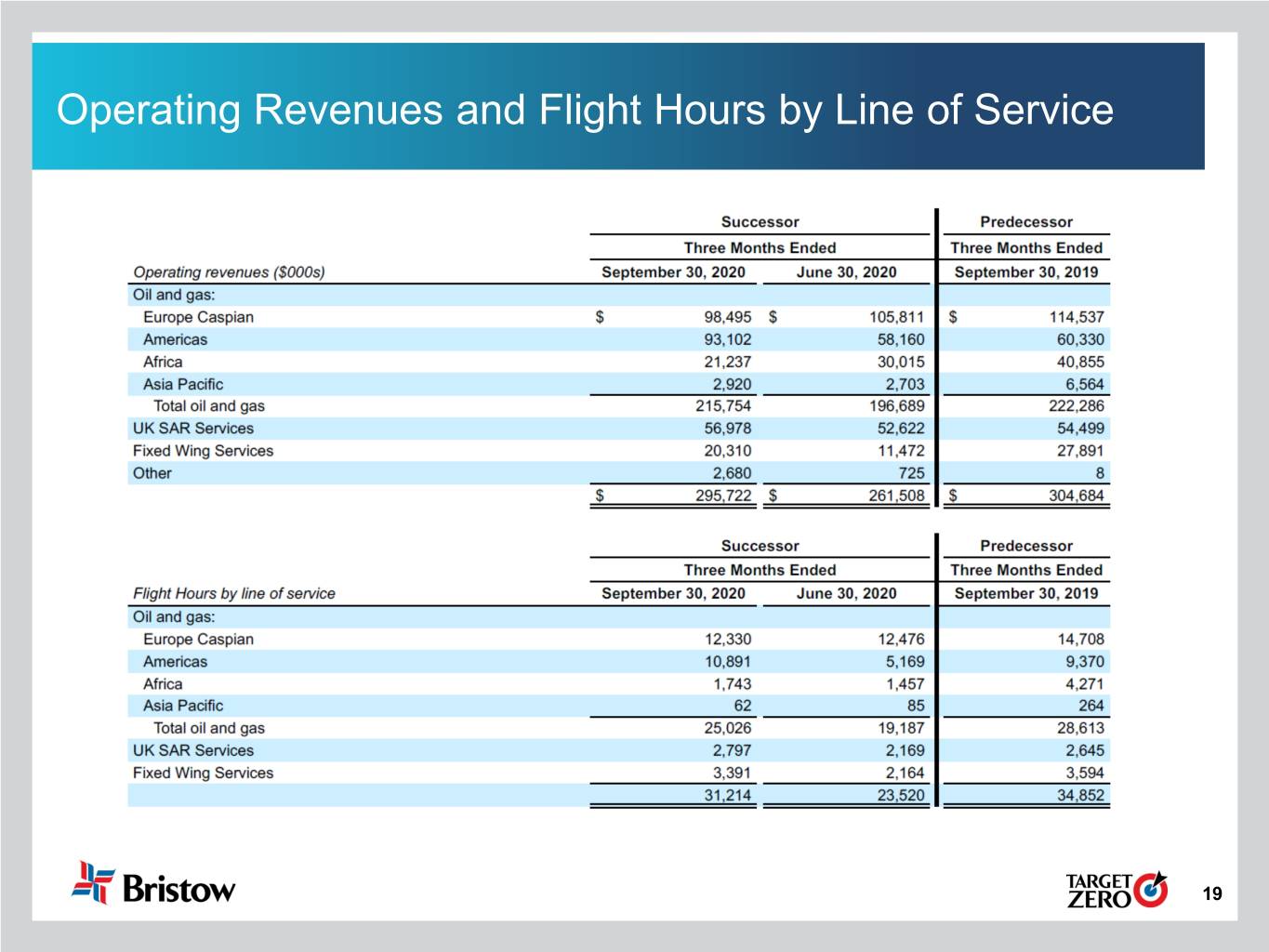

Operating Revenues and Flight Hours by Line of Service 19

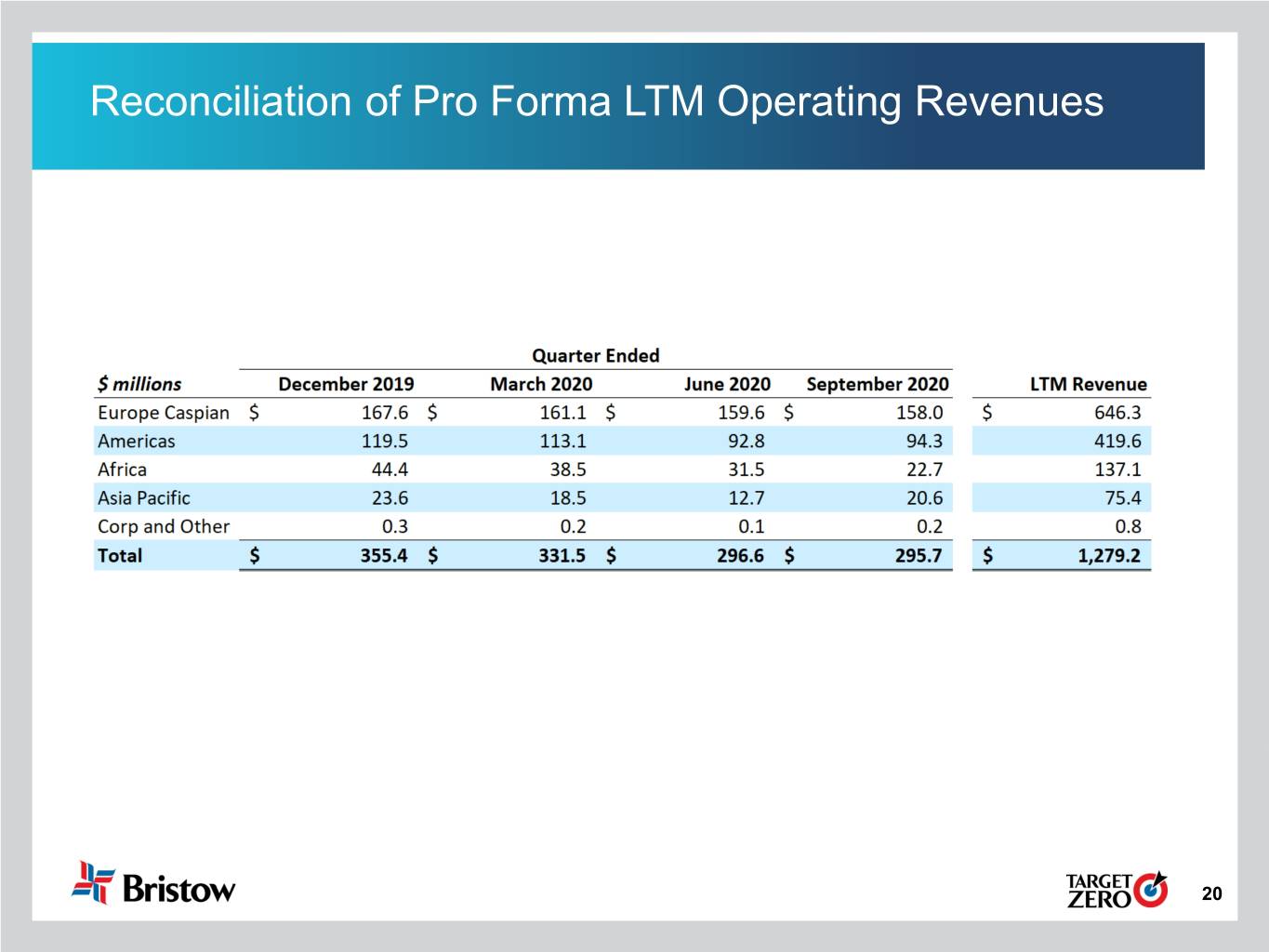

Reconciliation of Pro Forma LTM Operating Revenues 20