EXECUTION VERSION L O N D O N Exhibit 10.1 Dated 21 April 2021 (1) BRISTOW GROUP INC. as Parent (2) THE ENTITIES LISTED IN SCHEDULE 1 PART 1 as Borrowers (3) THE ENTITIES LISTED IN SCHEDULE 1, PART 2 as Guarantors (4) THE ENTITIES LISTED IN SCHEDULE 1, PART 3 as Security Obligors (5) BARCLAYS BANK PLC as Agent (6) BARCLAYS BANK PLC as Security Agent DEED OF AMENDMENT AND CONFIRMATION relating to an ABL facilities agreement originally dated 17 April 2018

CONTENTS Clause Page Active 62328571.1 i 1. Definitions and interpretation ....................................................................................... 3 2. Amendment ................................................................................................................... 4 3. Confirmations ............................................................................................................... 7 4. Further assurance .......................................................................................................... 7 5. Representations ............................................................................................................. 8 6. Relationship with other Finance Documents ................................................................ 8 7. Miscellaneous ............................................................................................................... 8 8. Law and jurisdiction ..................................................................................................... 8 Schedule 1. Borrowers, Guarantors and Security Obligors ............................................................ 10 Part 1 Borrowers ........................................................................................................ 10 Part 2 Guarantors ....................................................................................................... 10 Part 3 Security Obligors ............................................................................................ 10 2. Schedule 1 Part 2 (The Original Lenders) .................................................................. 12

Active 62328571.1 2 THIS DEED OF AMENDMENT AND CONFIRMATION is dated 21 April 2021 and made between: (1) BRISTOW GROUP INC. (the "Parent"); (2) THE PERSONS LISTED IN SCHEDULE 1, PART 1 (The Borrowers) (the "Borrowers"); (3) THE PERSONS LISTED IN SCHEDULE 1, PART 2 (The Guarantors) (the "Guarantors"); (4) THE PERSONS LISTED IN SCHEDULE 1, PART 3 (The Security Obligors) (the "Security Obligors"); (5) BARCLAYS BANK PLC as agent of the other Finance Parties (the "Agent"); and (6) BARCLAYS BANK PLC as security trustee for the Secured Parties (the "Security Agent"). BACKGROUND: (A) Certain of the Borrowers and the Agent, amongst others, entered into a facilities agreement dated 17 April 2018 (as amended from time to time up to the date of this Deed, the "Agreement"). (B) Pursuant to an increase confirmation dated on or about the date of this Deed delivered by Deutsche Bank AG, New York Branch to (and accepted by) the Agent, the Security Agent, the Issuing Banks and the Parent, the Revolving Facility Commitments are being increased in accordance with Clause 2.2 (Increase) of the Agreement (the "Increase"). (C) Pursuant to a transfer certificate dated on or about the date of this Deed delivered by Barclays Bank PLC as the existing lender and Deutsche Bank AG, New York Branch as the new lender to (and accepted by) the Agent and the Security Agent, Barclays Bank PLC is transferring part of its US/UK Tranche Commitment to Deutsche Bank AG, New York Branch (the "Transfer"). (D) As a condition to the effectiveness of the Increase and the Transfer, Deutsche Bank AG, New York Branch has requested that an amendment be made to the Agreement. (E) This Deed: (a) puts into effect such amendment to the Agreement, which has been agreed between the Parent, the Borrowers, the Guarantors and the Agent; (b) contains confirmations in relation to guarantees given by the Guarantors; (c) contains confirmations in relation to security interests granted by the Security Obligors; and (d) deals with related matters.

Active 62328571.1 3 THIS DEED WITNESSES that: 1. DEFINITIONS AND INTERPRETATION 1.1 Definitions In this Deed: "Agreement" has the meaning given to it in Recital (A). "Amended Agreement" means the Agreement as amended, or proposed to be amended pursuant to this Deed. "Increase" has the meaning given to it in Recital (B). "Increase and Transfer Effective Date" means the date on which the Increase and the Transfer become effective. "New Finance Documents" means this Deed and any other Finance Document entered into, or to be entered into, on or about the date of this Deed or otherwise in connection with the transactions contemplated by this Deed (including the amendment of the Agreement) and "New Finance Document" means any of them. "Obligor Party" means each Party which is an Obligor. "Parties" means the parties to this Deed. "Security Documents" means: (a) the English law security agreement dated 17 April 2018 made between (1) Bristow Helicopters Limited as the chargor and (2) the Security Agent; (b) the English law charge over bank accounts dated 17 April 2018 made between (1) Bristow Norway AS as the chargor and (2) the Security Agent; (c) the Norwegian law security agreement dated 17 April 2018 made between (1) Bristow Norway AS as the chargor and (2) the Security Agent; (d) the New York law security agreement dated 26 June 2020 made between (1) Bristow U.S. LLC as the grantor and (2) the Security Agent as the collateral agent; (e) the English law charge over receivables dated 26 June 2020 made between (1) Bristow U.S. LLC as the chargor and (2) the Security Agent; (f) the New York law security agreement dated 31 August 2020 made between (1) Era Helicopters, LLC as the grantor and (2) the Security Agent as the collateral agent; and (g) the English law charge over receivables dated 31 August 2020 made between (1) Era Helicopters, LLC as the chargor and (2) the Security Agent.

Active 62328571.1 4 "Transfer" has the meaning given to it in Recital (C). 1.2 Terms defined in the Amended Agreement Terms defined in the Amended Agreement but not in this Deed shall have the same meaning in this Deed as in the Amended Agreement. 1.3 Construction Clause 1.2 (Construction) of the Amended Agreement (other than paragraph (n) thereof) shall apply as if set out in full again here, with such changes as are appropriate to fit this context. 2. AMENDMENT 2.1 Amendment (a) The Parent, the Borrowers, the Guarantors and the Agent agree that: (i) with effect from the date of this Deed, the Agreement shall be amended as set out in Clause 2.1(b)(i)-(viii); and (ii) with effect from the Increase and Transfer Effective Date, the Agreement shall be amended as set out in Clause 2.1(b)(ix). (b) The Agreement shall be amended as follows: (i) a new definition of "2021 Amendment Agreement" shall be inserted before the definition of "ABR" in Clause 1.1 (Definitions): ""2021 Amendment Agreement" means the deed of amendment and confirmation designated as such by the Agent and the Parent and made between, Bristow Group Inc., Bristow Helicopters Limited, Bristow Norway AS, Bristow U.S. LLC, Era Helicopters LLC the Agent and the Security Agent in respect of this Agreement;" (ii) a new definition of "Aggregate LILO Borrowing Base" shall be inserted after the definition of "Aggregate LILO Availability" in Clause 1.1 (Definitions): ""Aggregate LILO Borrowing Base" means the aggregate of the LILO Borrowing Bases of the English Borrower, the Norwegian Borrower and the US Borrowers;" (iii) a new definition of "Third Amendment Date" shall be inserted after the definition of "Termination Date" in Clause 1.1 (Definitions): ""Third Amendment Date" has the meaning given to the term "Increase and Transfer Effective Date" in the 2021 Amendment Agreement;"

Active 62328571.1 5 (iv) the reference in Clause 27.11(b) (Acquisitions) to "Clause 27.11(b)" shall be replaced with "Clause 27.11(a)"; (v) the reference in Clause 27.12(b) (Joint ventures) to "Clause 27.12(b)" shall be replaced with "Clause 27.12(a)"; (vi) the reference in Clause 27.18(b) (Arm's length basis) to "Clause 27.17" shall be replaced with "Clause 27.18"; (vii) the first sentence of Clause 28 (Events of Default) shall be deleted in its entirety and replaced with the following: "Subject to Clause 28.20, each of the events or circumstances set out in this Clause 28 is an Event of Default (save for Clauses 28.18, 28.19, 28.20 and 28.21)." (viii) a new Clause 28.21 (Sanctions Provision) will be inserted immediately after Clause 28.20 (Plan of Reorganization) as follows: "28.21 Sanctions Provision (a) In relation to each Lender that notifies the Agent to this effect (each a "Restricted Lender"), any provisions relating to any Sanctioned Person, Sanctioned Country or Sanctions (the "Sanctions Provisions") shall only apply for the benefit of that Restricted Lender to the extent that such Sanctions Provisions would not result in any violation of, conflict with or liability under EU Regulation (EC) 2271/96 or a similar anti-boycott statute. (b) In connection with any amendment, waiver, determination or direction relating to any Sanctions Provision to which a Restricted Lender does not have the benefit pursuant to paragraph (a) above, the relevant Revolving Facility Commitments of that Restricted Lender will be excluded for the purpose of determining whether the consent of the Majority Lenders, the Majority First Out Lenders, the Majority LILO Lenders, Super Majority Lenders, Super Majority First Out Lenders or Super Majority LILO Lenders has been obtained or whether the determination or direction by the Majority Lenders, the Majority First Out Lenders, the Majority LILO Lenders, Super Majority Lenders, Super Majority First Out Lenders or Super Majority LILO Lenders has been made.",

Active 62328571.1 6 with subsequent Clauses (and cross-references to them) being renumbered accordingly; (ix) Clause 31.5(c) (Resignation of a Guarantor) shall be deleted in its entirety and replaced with the following: "(c) In the case of resignation of a Guarantor pursuant to: (i) Clause 31.5(a)(i), the resignation of that Guarantor shall not be effective until the date of the relevant Third Party Disposal at which time that company shall cease to be a Guarantor and shall have no further rights or obligations under the Finance Documents as a Guarantor; and (ii) Clause 31.5(a)(ii) or Clause 31.5(a)(iii), the resignation of that Guarantor shall not be effective until the date on which the Agent has notified the Parent of its acceptance of the applicable Resignation Letter in accordance with Clause 31.5(b) above at which time that company shall cease to be a Guarantor and shall have no further rights or obligations under the Finance Documents as a Guarantor."; and (x) the table in Schedule 1 Part 2 (The Original Lenders) shall be deleted and replaced with the table set out in Schedule 2 (Schedule 1 Part 2 (The Original Lenders)) of this Deed and the applicable Revolving Facility Commitments (other than LILO Tranche Commitments which shall not be subject to any reallocation by this Deed) of the Lenders (other than Deutsche Bank AG, New York Branch) shall be reallocated as US/UK Tranche Commitments or Norwegian Tranche Commitments, as applicable, such that they shall be as set out in such Schedule 2 (Schedule 1 Part 2 (The Original Lenders)) of this Deed. Such reallocation shall take effect on the Increase and Transfer Effective Date notwithstanding any other provision of the Agreement and shall not be counted as a reallocation of any Revolving Facility Commitments for the purposes of Clause 5.7(c) of the Agreement nor require any separate request. On the date of this Deed any Revolving Facility Commitments of Barclays Bank Ireland PLC that were previously designated as Exclusive US/UK Tranche Commitments shall cease to be so designated. 2.2 Consents The Agent confirms that the consent of the all Lenders has been obtained for the amendment of the Agreement effected by Clause 2.1, as required by Clause 42 (Amendments and waivers) of the Agreement.

Active 62328571.1 7 3. CONFIRMATIONS 3.1 Guarantee confirmations Each of the Guarantors: (a) consents to the amendment of the Agreement effected by Clause 2 (Amendment); (b) confirms for the benefit of the Finance Parties that: (i) its obligations as a Guarantor under Clause 23 (Guarantee and indemnity) of the Agreement (the "Guaranteed Obligations") are not discharged or (except as set out in Clause 3.1(b)(ii)) otherwise affected by those amendments or the other provisions of this Deed and shall accordingly continue in full force and effect; and (ii) the Guaranteed Obligations shall after the Increase and Transfer Effective Date extend to the obligations of each Obligor under the Amended Agreement and under any other Finance Documents, including the New Finance Documents. 3.2 Security Interest confirmations Each of the Security Obligors: (a) consents to the amendment of the Agreement effected by Clause 2 (Amendment); and (b) confirms to the Security Agent for the benefit of the Secured Parties that: (i) its obligations under, and the Security Interests granted by it in and pursuant to, the Security Document(s) to which it is a party are not discharged or (except as set out in Clause 3.2(b)(ii)) otherwise affected by those amendments or the other provisions of this Deed and shall accordingly remain in full force and effect; and (ii) the Secured Obligations, including for the purposes of the Security Documents, shall after the Increase and Transfer Effective Date, extend to the obligations of each Obligor under the Amended Agreement and under any other Finance Documents, including the New Finance Documents. 4. FURTHER ASSURANCE Each Guarantor and Security Obligor shall at the request of the Agent or the Security Agent and at its own expense promptly execute (in such form as the Agent or Security Agent may reasonably require) and do any document, act or thing which the Agent or Security Agent, acting reasonably, considers necessary or appropriate to preserve, perfect, protect or give effect to the consents, confirmations and undertakings provided for in this Deed.

Active 62328571.1 8 5. REPRESENTATIONS (a) Each Obligor Party makes the Repeating Representations on (i) the date of this Deed; and (ii) the Increase and Transfer Effective Date. (b) In addition, each Obligor confirms that: (i) no Default is existing or will occur immediately following the Increase; and (ii) the Increase will not cause any breach of the terms of any documentation evidencing the Material Indebtedness. 6. RELATIONSHIP WITH OTHER FINANCE DOCUMENTS 6.1 Status This Deed is designated by the Agent and the Parent (in its capacity as the Obligors' Agent) as the 2021 Amendment Agreement and as a Finance Document for the purposes of the Amended Agreement. 6.2 Continuing effect Except to the extent of the amendments effected by Clause 2 (Amendment) the Agreement shall continue in full force and effect. 6.3 No waiver This Deed is not to be construed as waiving any right or remedy of any Finance Party. The Agent, on behalf of each Finance Party, reserves any other rights and remedies which any Finance Party may have from time to time under any Finance Document. 7. MISCELLANEOUS The provisions of Clauses 1.4 (Third Party Rights), 38 (Notices), 40 (Partial invalidity), 41 (Remedies and waivers) and 49 (Counterparts) of the Amended Agreement shall apply to this Deed as if set out in full again here, with such changes as are appropriate to fit this context. 8. LAW AND JURISDICTION 8.1 Governing law This Deed and any non-contractual obligations arising out of or in connection with it are governed by, and shall be construed in accordance with, English law.

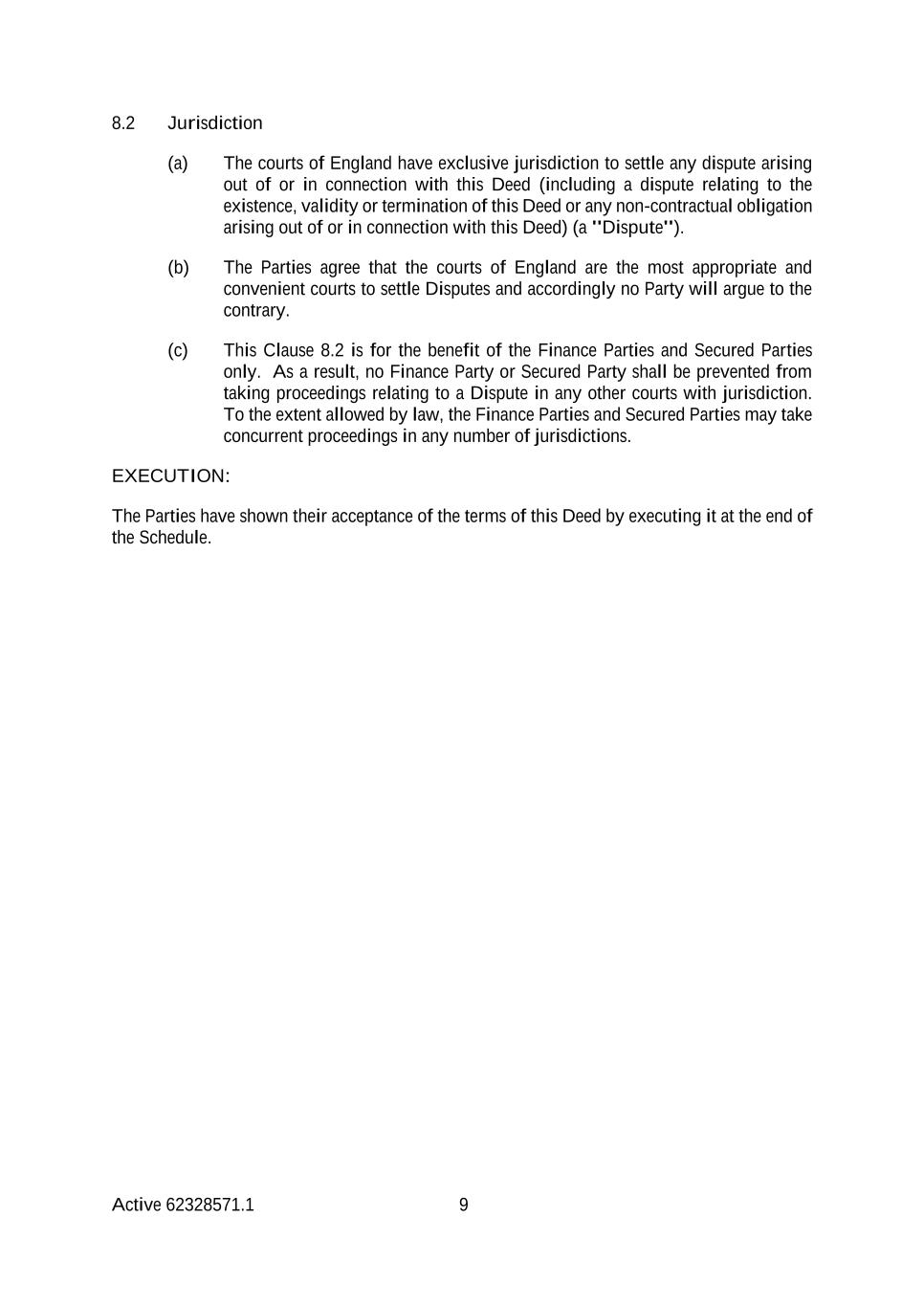

Active 62328571.1 9 8.2 Jurisdiction (a) The courts of England have exclusive jurisdiction to settle any dispute arising out of or in connection with this Deed (including a dispute relating to the existence, validity or termination of this Deed or any non-contractual obligation arising out of or in connection with this Deed) (a "Dispute"). (b) The Parties agree that the courts of England are the most appropriate and convenient courts to settle Disputes and accordingly no Party will argue to the contrary. (c) This Clause 8.2 is for the benefit of the Finance Parties and Secured Parties only. As a result, no Finance Party or Secured Party shall be prevented from taking proceedings relating to a Dispute in any other courts with jurisdiction. To the extent allowed by law, the Finance Parties and Secured Parties may take concurrent proceedings in any number of jurisdictions. EXECUTION: The Parties have shown their acceptance of the terms of this Deed by executing it at the end of the Schedule.

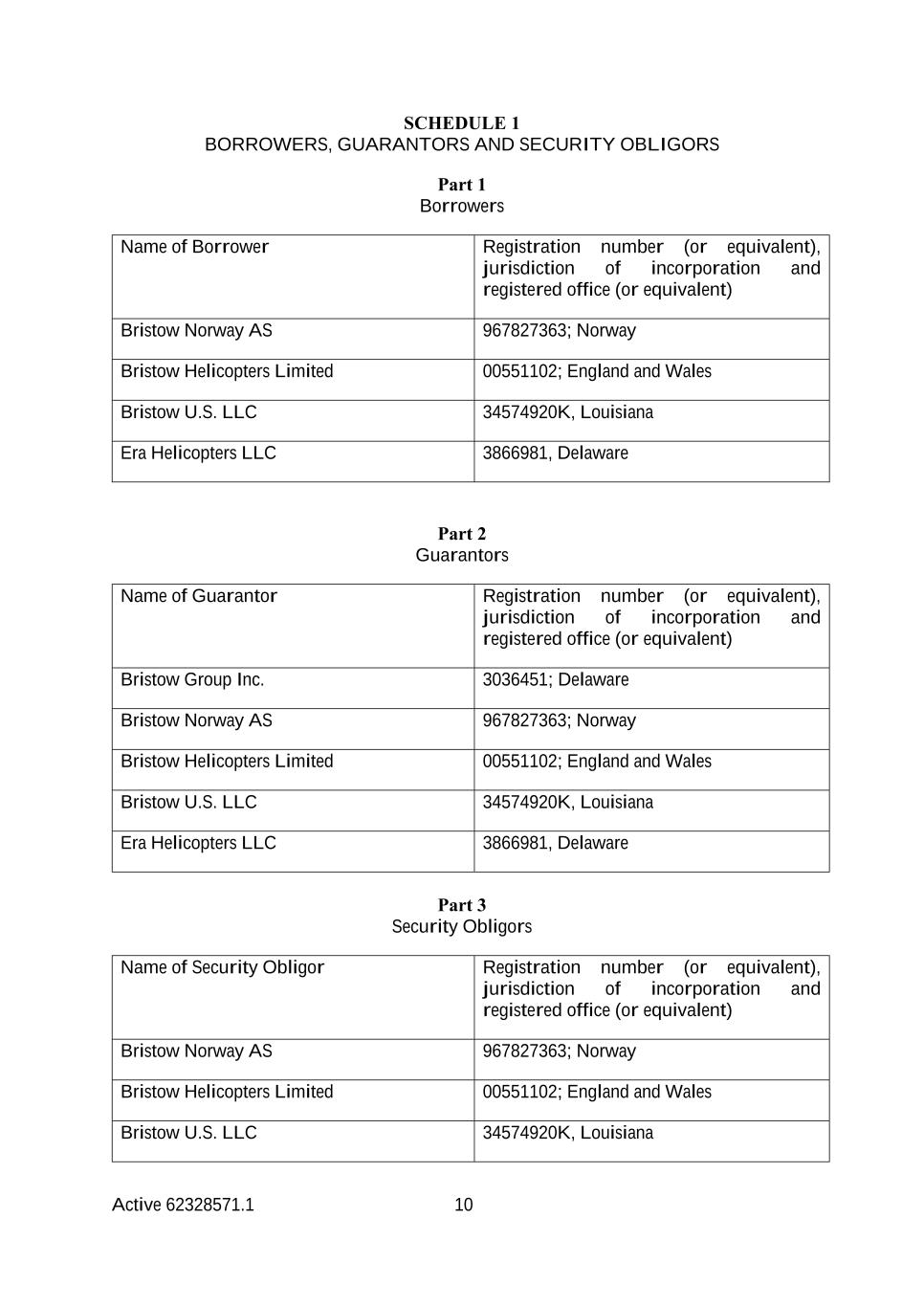

Active 62328571.1 10 SCHEDULE 1 BORROWERS, GUARANTORS AND SECURITY OBLIGORS Part 1 Borrowers Name of Borrower Registration number (or equivalent), jurisdiction of incorporation and registered office (or equivalent) Bristow Norway AS 967827363; Norway Bristow Helicopters Limited 00551102; England and Wales Bristow U.S. LLC 34574920K, Louisiana Era Helicopters LLC 3866981, Delaware Part 2 Guarantors Name of Guarantor Registration number (or equivalent), jurisdiction of incorporation and registered office (or equivalent) Bristow Group Inc. 3036451; Delaware Bristow Norway AS 967827363; Norway Bristow Helicopters Limited 00551102; England and Wales Bristow U.S. LLC 34574920K, Louisiana Era Helicopters LLC 3866981, Delaware Part 3 Security Obligors Name of Security Obligor Registration number (or equivalent), jurisdiction of incorporation and registered office (or equivalent) Bristow Norway AS 967827363; Norway Bristow Helicopters Limited 00551102; England and Wales Bristow U.S. LLC 34574920K, Louisiana

Active 62328571.1 11 Era Helicopters LLC 3866981, Delaware

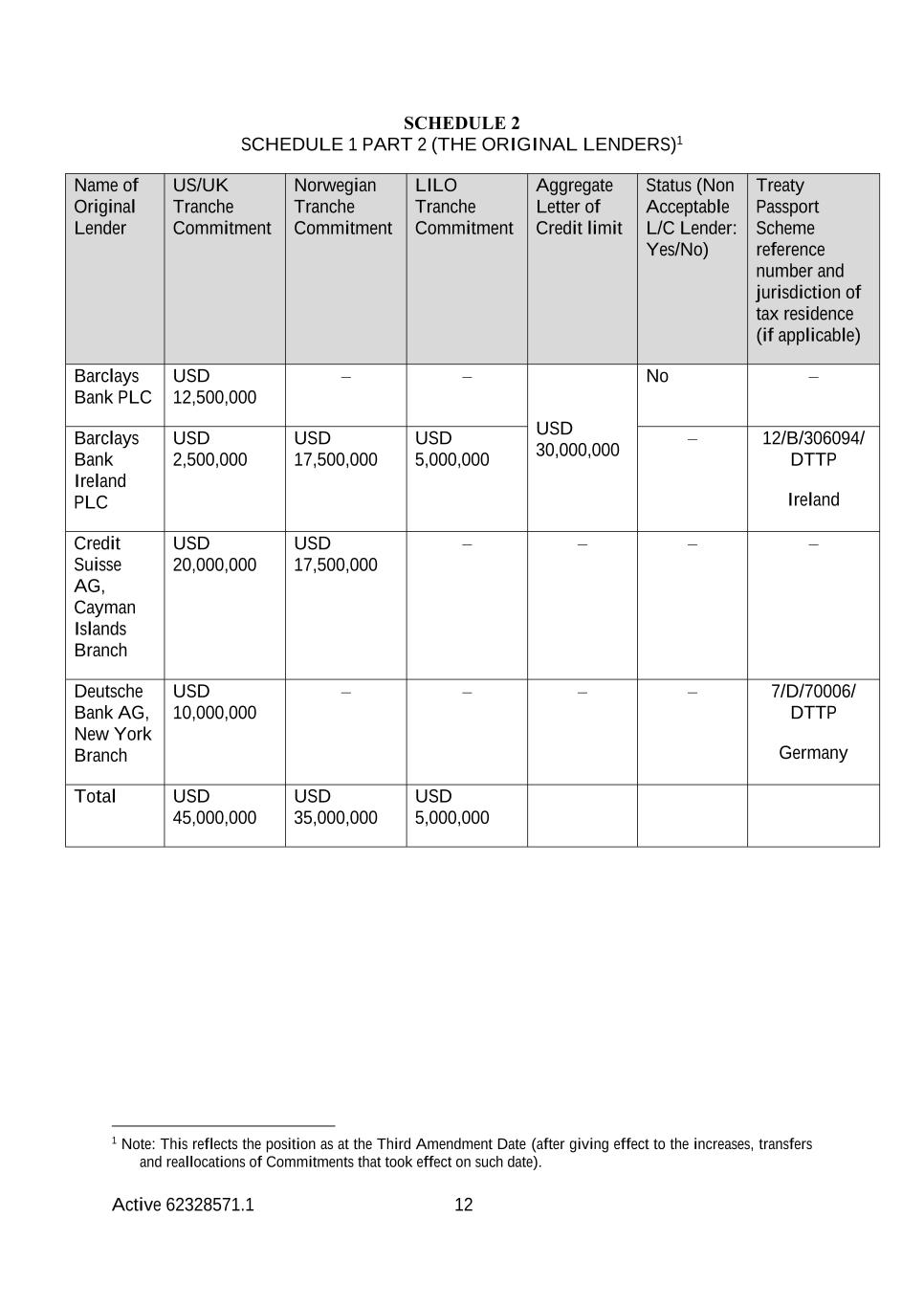

Active 62328571.1 12 SCHEDULE 2 SCHEDULE 1 PART 2 (THE ORIGINAL LENDERS)1 Name of Original Lender US/UK Tranche Commitment Norwegian Tranche Commitment LILO Tranche Commitment Aggregate Letter of Credit limit Status (Non Acceptable L/C Lender: Yes/No) Treaty Passport Scheme reference number and jurisdiction of tax residence (if applicable) Barclays Bank PLC USD 12,500,000 – – USD 30,000,000 No – Barclays Bank Ireland PLC USD 2,500,000 USD 17,500,000 USD 5,000,000 – 12/B/306094/ DTTP Ireland Credit Suisse AG, Cayman Islands Branch USD 20,000,000 USD 17,500,000 – – – – Deutsche Bank AG, New York Branch USD 10,000,000 – – – – 7/D/70006/ DTTP Germany Total USD 45,000,000 USD 35,000,000 USD 5,000,000 1 Note: This reflects the position as at the Third Amendment Date (after giving effect to the increases, transfers and reallocations of Commitments that took effect on such date).

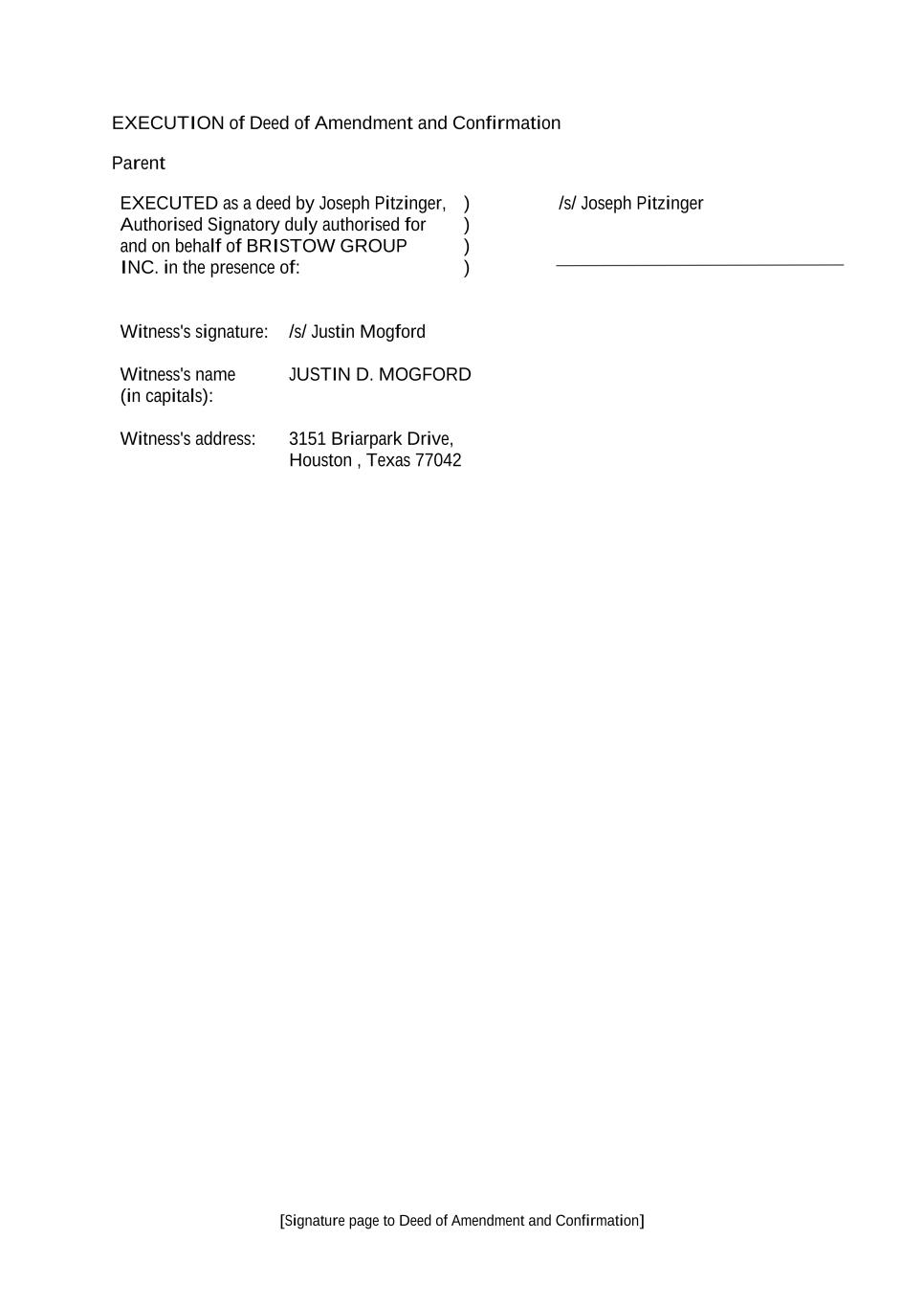

[Signature page to Deed of Amendment and Confirmation] EXECUTION of Deed of Amendment and Confirmation Parent /s/ Joseph Pitzinger Witness's signature: /s/ Justin Mogford Witness's name (in capitals): JUSTIN D. MOGFORD Witness's address: 3151 Briarpark Drive, Houston , Texas 77042 EXECUTED as a deed by Joseph Pitzinger, Authorised Signatory duly authorised for and on behalf of BRISTOW GROUP INC. in the presence of: ) ) ) )

[Signature page to Deed of Amendment and Confirmation] Borrowers /s/ Alan Corbett Alan Corbett Chairman of Board EXECUTED as a deed by Alan Corbett, Authorised Signatory, duly authorised for and on behalf of BRISTOW NORWAY AS: ) ) ) ) Witness's signature: /s/ Audrey Smith Witness's name (in capitals): AUDREY SMITH Witness's address: c/o Bristow Helicopters Dyce AB21 0LQ

[Signature page to Deed of Amendment and Confirmation] EXECUTED as a deed by Alan Corbett, Authorised Signatory, duly authorised for and on behalf of BRISTOW HELICOPTERS LIMITED: ) ) ) ) /s/ Alan Corbett Witness's signature: /s/ Audrey Smith Witness's name (in capitals): AUDREY SMITH Witness's address: c/o Bristow Helicopters Dyce AB21 0LQ

[Signature page to Deed of Amendment and Confirmation] EXECUTED as a deed by Joseph Pitzinger, Authorised Signatory duly authorised for and on behalf of BRISTOW U.S. LLC in the presence of: ) ) /s/ Joseph Pitzinger ) ) Witness's signature: /s/ Justin Mogford Witness's name (in capitals): JUSTIN D. MOGFORD Witness's address: 3151 Briarpark Drive, Houston, Texas 77042

[Signature page to Deed of Amendment and Confirmation] EXECUTED as a deed by Justin D. Mogford, Authorised Signatory duly authorised for and on behalf of ERA HELICOPTERS, LLC in the presence of: ) /s/ Justin D. Mogford ) ) Witness's signature: /s/ Lisa Newburn Witness's name (in capitals): LISA NEWBURN Witness's address: 3151 Briarpark Drive, Houston, Texas, 77042

[Signature page to Deed of Amendment and Confirmation] Guarantors EXECUTED as a deed by Joseph Pitzinger, Authorised Signatory, duly authorised for and on behalf of BRISTOW GROUP INC. ) /s/ Joseph Pitzinger ) ) Witness's signature: /s/ Justin Mogford Witness's name (in capitals): JUSTIN D. MOGFORD Witness's address: 3151 Briarpark Drive, Houston, Texas 77042

[Signature page to Deed of Amendment and Confirmation] EXECUTED as a deed by Alan Corbett, Authorised Signatory, duly authorised for and on behalf of BRISTOW NORWAY AS: ) /s/ Alan Corbett ) ) ) Alan Corbett Chairman of the Board Witness's signature: /s/ Audrey Smith Witness's name (in capitals): AUDREY SMITH Witness's address: c/o Bristow Helicopters, Dyce, AB21 0LQ

[Signature page to Deed of Amendment and Confirmation] EXECUTED as a deed by Alan Corbett, Authorised Signatory, duly authorised for and on behalf of BRISTOW HELICOPTERS LIMITED: ) /s/ Alan Corbett ) ) ) Witness's signature: /s/ Audrey Smith Witness's name (in capitals): AUDREY SMITH Witness's address: c/o Bristow Helicopters, Dyce, AB21 0LQ

[Signature page to Deed of Amendment and Confirmation] EXECUTED as a deed by Joseph Pitzinger, Authorised Signatory duly authorised for and on behalf of BRISTOW U.S. LLC in the presence of: ) /s/ Joseph Pitzinger ) ) Witness's signature: /s/ Justin Mogford Witness's name (in capitals): JUSTIN D. MOGFORD Witness's address: 3151 Briarpark Drive, Houston, Texas 77042

[Signature page to Deed of Amendment and Confirmation] EXECUTED as a deed by Justin D. Mogford, Authorised Signatory duly authorised for and on behalf of ERA HELICOPTERS, LLC in the presence of: ) /s/ Justin Mogford ) ) Witness's signature: /s/ Lisa Newburn Witness's name (in capitals): LISA NEWBURN Witness's address: 3151 Briarpark Drive, Houston, Texas 77042

[Signature page to Deed of Amendment and Confirmation] Security Obligors EXECUTED as a deed by Alan Corbett, Authorised Signatory, duly authorised for and on behalf of BRISTOW NORWAY AS: ) /s/ Alan Corbett ) ) ) Alan Corbett Chairman of the Board Witness's signature: /s/ Audrey Smith Witness's name (in capitals): AUDREY SMITH Witness's address: c/o Bristow Helicopters, Dyce, AB21 0LQ

[Signature page to Deed of Amendment and Confirmation] EXECUTED as a deed by Alan Corbett, Authorised Signatory, duly authorised for and on behalf of BRISTOW HELICOPTERS LIMITED: ) /s/ Alan Corbett ) ) ) Witness's signature: /s/ Audrey Smith Witness's name (in capitals): AUDREY SMITH Witness's address: c/o Bristow Helicopters, Dyce, AB21 0LQ

[Signature page to Deed of Amendment and Confirmation] EXECUTED as a deed by Joseph Pitzinger, Authorised Signatory duly authorised for and on behalf of BRISTOW U.S. LLC in the presence of: ) /s/ Joseph Pitzinger ) ) Witness's signature: /s/ Justin Mogford Witness's name (in capitals): JUSTIN D. MOGFORD Witness's address: 3151 Briarpark Drive, Houston, Texas 77042

[Signature page to Deed of Amendment and Confirmation] EXECUTED as a deed by Justin D. Mogford, Authorised Signatory duly authorised for and on behalf of ERA HELICOPTERS, LLC in the presence of: ) /s/ Justin Mogford ) ) Witness's signature: /s/ Lisa Newburn Witness's name (in capitals): LISA NEWBURN Witness's address: 3151 Briarpark Drive, Houston, Texas 77042

[Signature page to Deed of Amendment and Confirmation] Agent EXECUTED as a deed by Joseph Jordan, Managing Director, duly authorised for and on behalf of BARCLAYS BANK PLC in the presence of: ) /s/ Joseph Jordan ) ) ) Witness's signature: /s/ Gursahib Anand Witness's name GURSAHIB ANAND (in capitals): Witness's address: 910 Thompson Drive, Bay Shore, NY 11706

[Signature page to Deed of Amendment and Confirmation] Security Agent EXECUTED as a deed by Joseph Jordan, Managing Director, duly authorised for and on behalf of BARCLAYS BANK PLC in the presence of: ) /s/ Joseph Jordan ) ) ) Witness's signature: /s/ Gursahib Anand Witness's name GURSAHIB ANAND (in capitals): Witness's address: 910 Thompson Drive, Bay Shore, NY 11706