Bristow Analyst Day December 8, 2021 Exhibit 99.1

2021 Analyst Day Agenda 2 I. Overview / Strategy Chris Bradshaw President and CEO II. ESG Chris Bradshaw President and CEO III. Operational Highlights Samantha Willenbacher SVP Americas IV. Commercial Highlights David Stepanek EVP Sales and Chief Transformation Officer V. Financial Highlights Jennifer Whalen SVP and CFO VI. Concluding Remarks Chris Bradshaw President and CEO VII. Questions & Answers

This presentation contains “forward-looking statements.” Forward-looking statements represent Bristow Group Inc.’s (the “Company”) current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. In particular, this presentation contains forward-looking statements including, without limitation, with respect to: (i) the Company’s efforts to continue and expand certain initiatives to support the Company’s environmental, social and governance vision and strategy; (ii) the capabilities, development, certification, marketing, and future operations of certain (hybrid-) electric short takeoff and landing aircraft (“eSTOL”) and electric vertical takeoff and landing aircraft (“eVTOL”); (iii) the Company’s purchase of eVTOL and eSTOL aircraft from original equipment manufacturers; (iv) the anticipated benefits of the collaboration between the Company and any original equipment manufacturers; and (v) the Company’s ability to diversify into new markets such as offshore wind and advanced air mobility. These statements are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, reflect management’s current views with respect to future events and therefore are subject to significant risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which the forward-looking statement is based that occur after the date hereof. Risks that may affect forward-looking statements include, but are not necessarily limited to, those relating to: public health crises, such as pandemics (COVID-19) and epidemics, and any related government policies and actions; expected cost synergies and other financial or other benefits of the merger (“Merger”) might not be realized within the expected time frames, might be less than projected or may not be realized at all; the ability to successfully integrate the operations, accounting and administrative functions of Era Group Inc (“Era”) and the entity formerly known as Bristow Group Inc. (“Old Bristow“); managing a significantly larger company than before the completion of the Merger; diversion of management time on issues related to integration of the Company; the increase in indebtedness as a result of the Merger; operating costs, customer loss and business disruption following the Merger, including, without limitation, difficulties in maintaining relationships with employees and customers, may be greater than expected; our reliance on a limited number of customers and the reduction of our customer base as a result of bankruptcies or consolidation; the possibility that we may be unable to maintain compliance with covenants in our financing agreements; global and regional changes in the demand, supply, prices or other market conditions affecting oil and gas, including changes resulting from a public health crisis or from the imposition or lifting of crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries (OPEC) and other producing countries; fluctuations in the demand for our services; the possibility that we may impair our long-lived assets and other assets, including inventory, property and equipment and investments in unconsolidated affiliates; our ability to implement operational improvement efficiencies with the objective of rightsizing our global footprint and further reducing our cost structure; the possibility of significant changes in foreign exchange rates and controls, including as a result of the U.K. having exited from the European Union (“E.U.”) (“Brexit”); the impact of continued uncertainty surrounding the effects Brexit will have on the British, EU and global economies and demand for oil and natural gas; potential effects of increased competition and the introduction of energy efficient alternative modes of transportation and solutions; the risk of future material weaknesses we may identify while we work to align policies, principles, and practices of the combined company following the Merger or any other failure by us to maintain effective internal controls; the possibility that we may be unable to re-deploy our aircraft to regions with greater demand; the possibility of changes in tax and other laws and regulations and policies, including, without limitation, actions of the Biden Administration that impact oil and gas operations or favor renewable energy projects in the U.S.; the possibility that we may be unable to dispose of older aircraft through sales into the aftermarket; general economic conditions, including the capital and credit markets; the possibility that segments of our fleet may be grounded for extended periods of time or indefinitely; the existence of operating risks inherent in our business, including the possibility of declining safety performance; the possibility of political instability, war or acts of terrorism in any of the countries where we operate; the possibility that reductions in spending on aviation services by governmental agencies could lead to modifications of our search and rescue (“SAR”) contract terms with the UK government, our contracts with the Bureau of Safety and Environmental Enforcement ("BSEE") or delays in receiving payments under such contracts; and our reliance on a limited number of helicopter manufacturers and suppliers capabilities... You should not place undue reliance on our forward-looking statements because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our forward-looking statements are based on the information currently available to us and speak only as of the date hereof. New risks and uncertainties arise from time to time, and it is impossible for us to predict these matters or how they may affect us. We have included important factors in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2021 (the “Annual Report”) which we believe over time, could cause our actual results, performance or achievements to differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements. You should consider all risks and uncertainties disclosed in the Annual Report and in our filings with the United States Securities and Exchange Commission (the “SEC”), all of which are accessible on the SEC’s website at www.sec.gov. Cautionary Statement Regarding Forward-Looking Statements 3

Non-GAAP In addition to financial results calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation includes certain non-GAAP measures including EBITDA, Adjusted EBITDA, Net Debt, Free Cash Flow and Adjusted Free Cash Flow. EBITDA and Adjusted EBITDA are presented as supplemental measures of the Company’s operating performance. EBITDA is defined as Earnings before Interest expense, Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for special items that occurred during the reporting period and noted in the applicable reconciliation. Since neither EBITDA nor Adjusted EBITDA is a recognized term under GAAP, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for discretionary use, as they do not take into account certain cash requirements, such as debt service requirements. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. Free Cash Flow represents the Company’s net cash provided by operating activities plus proceeds from disposition of property and equipment, less expenditures related to purchases of property and equipment. Adjusted Free Cash Flow is Free Cash Flow adjusted to exclude professional services fees and other costs paid in relation to the Merger, the implementation of fresh-start accounting and the voluntary petitions filed by Old Bristow and certain of its subsidiaries on May 11, 2019, in the U.S. Bankruptcy Court for the Southern District of Texas, Houston Division seeking relief under Chapter 11 of Title 11 of the U.S. Code. The Company also uses Adjusted Free Cash Flow excluding Net Capex. “Net Capex” is defined as net (proceeds from)/purchases of property and equipment. Management believes that the use of Adjusted Free Cash Flow and Adjusted Free Cash Flow excluding Net Capex is meaningful as it measures the Company’s ability to generate cash from its business after excluding cash payments for special items. Management uses this information as an analytical indicator to assess the Company’s liquidity and performance. However, investors should note numerous methods may exist for calculating a company's free cash flow. As a result, the method used by management to calculate Adjusted Free Cash Flow may differ from the methods used by other companies to calculate their free cash flow. The Company also presents Net Debt, which is a non-GAAP measure, defined as total principal balance on borrowings less unrestricted cash and cash equivalents. Finally, the Company presents Net Leverage ratio and Gross Leverage ratio , which are non-GAAP measures, that management uses to assess the borrowing capacity of the Company. The Company has defined Net Leverage as Net Debt divided by Adjusted EBITDA for the last twelve-month period (“LTM Adjusted EBITDA”) and Gross Leverage as total principal balance on borrowings divided by LTM Adjusted EBITDA. Each of these non-GAAP measures has limitations and therefore should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. A reconciliation of each of EBITDA, Adjusted EBITDA, Adjusted EBITDA excluding gains or losses on asset dispositions, Free Cash Flow, Adjusted Free Cash Flow, and Net debt is included elsewhere in this presentation. Non-GAAP Financial Measures Reconciliation 4

A Highly Experienced Team Our executives have extensive aviation experience with a combined total of more than 200 years Bristow Executive Leadership Team 5 David Stepanek EVP, Sales and Chief Transformation Officer Jennifer Whalen SVP, CFO Alan Corbett SVP, Europe, Africa, Middle East, Asia & Australia & Search and Rescue Samantha Willenbacher SVP, Americas Crystal Gordon SVP, General Counsel, Head of Government Affairs and Corporate Secretary Mary Wersebe SVP, Chief Administrative Officer James Stottlemyer VP, Health, Safety, and Environment Chris Bradshaw President and CEO Stuart Stavley SVP, Global Fleet Management

AppendixOv rview / Strategy

Bristow is a founding member of HeliOffshore, an industry association focused on safety, now with over 110 members from all regions of the world Robust safety management system (SMS) Safety is Bristow’s #1 core value and highest operational priority With third-party accreditation resulting from numerous external audits Bristow’s fleet is configured with the latest safety equipment Safety Note 7

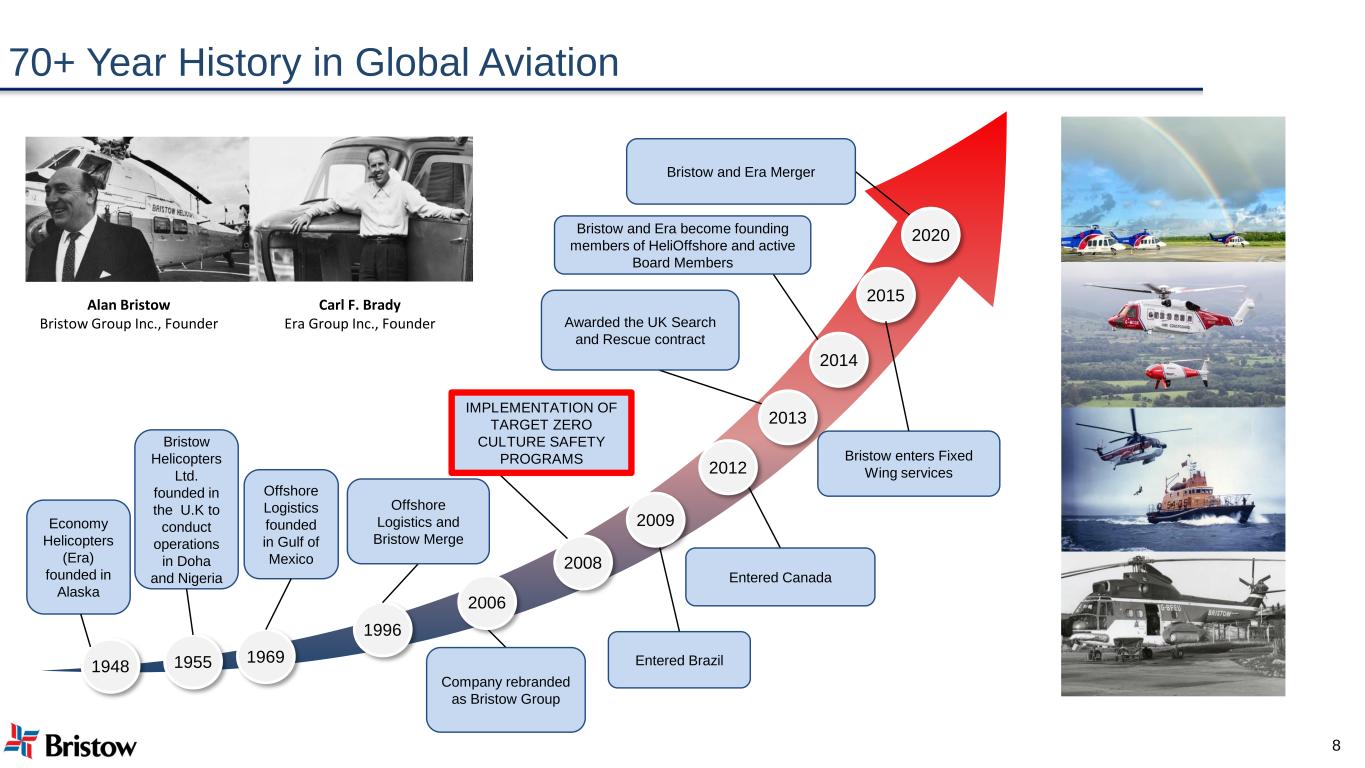

70+ Year History in Global Aviation 8 1955 Bristow Helicopters Ltd. founded in the U.K to conduct operations in Doha and Nigeria 1969 1996 2006 2014 Offshore Logistics founded in Gulf of Mexico Company rebranded as Bristow Group 2009 2012 Entered Canada 2008 IMPLEMENTATION OF TARGET ZERO CULTURE SAFETY PROGRAMS 2015 Entered Brazil Bristow and Era become founding members of HeliOffshore and active Board Members 2020 Offshore Logistics and Bristow Merge Bristow enters Fixed Wing services 2013 Awarded the UK Search and Rescue contract Bristow and Era Merger 1948 Economy Helicopters (Era) founded in Alaska Carl F. Brady Era Group Inc., Founder Alan Bristow Bristow Group Inc., Founder

Why Invest in Bristow Global Leader in Vertical Flight Solutions Well Positioned for Additional Strategic Opportunities Strong Balance Sheet with Robust Free Cash Flow Generation Meaningful Value Enhancement from Achievement of Cost Synergies Diverse Customer Base and End Markets 9

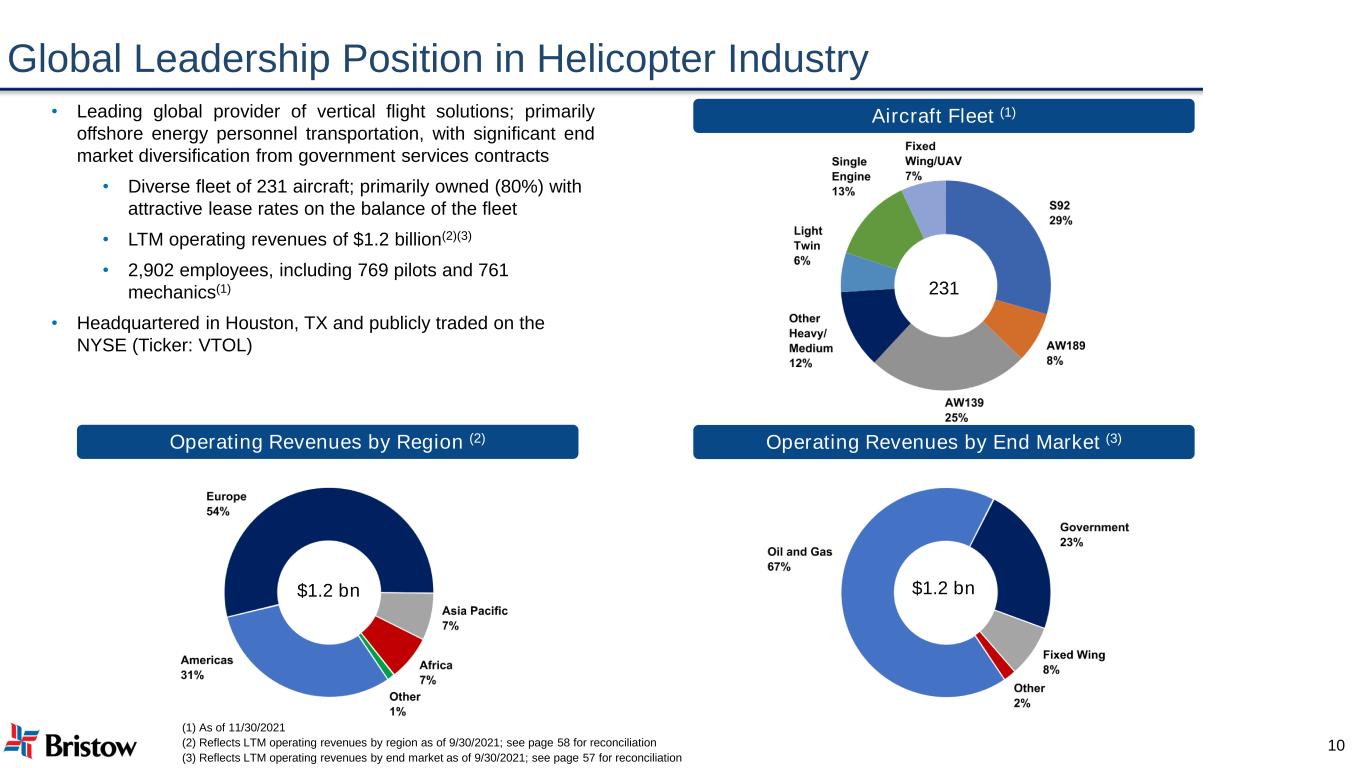

Global Leadership Position in Helicopter Industry Aircraft Fleet (1)• Leading global provider of vertical flight solutions; primarily offshore energy personnel transportation, with significant end market diversification from government services contracts • Diverse fleet of 231 aircraft; primarily owned (80%) with attractive lease rates on the balance of the fleet • LTM operating revenues of $1.2 billion(2)(3) • 2,902 employees, including 769 pilots and 761 mechanics(1) • Headquartered in Houston, TX and publicly traded on the NYSE (Ticker: VTOL) Operating Revenues by End Market (3) (1) As of 11/30/2021 (2) Reflects LTM operating revenues by region as of 9/30/2021; see page 58 for reconciliation (3) Reflects LTM operating revenues by end market as of 9/30/2021; see page 57 for reconciliation $1.2 bn 10 Operating Revenues by Region (2) 231 $1.2 bn

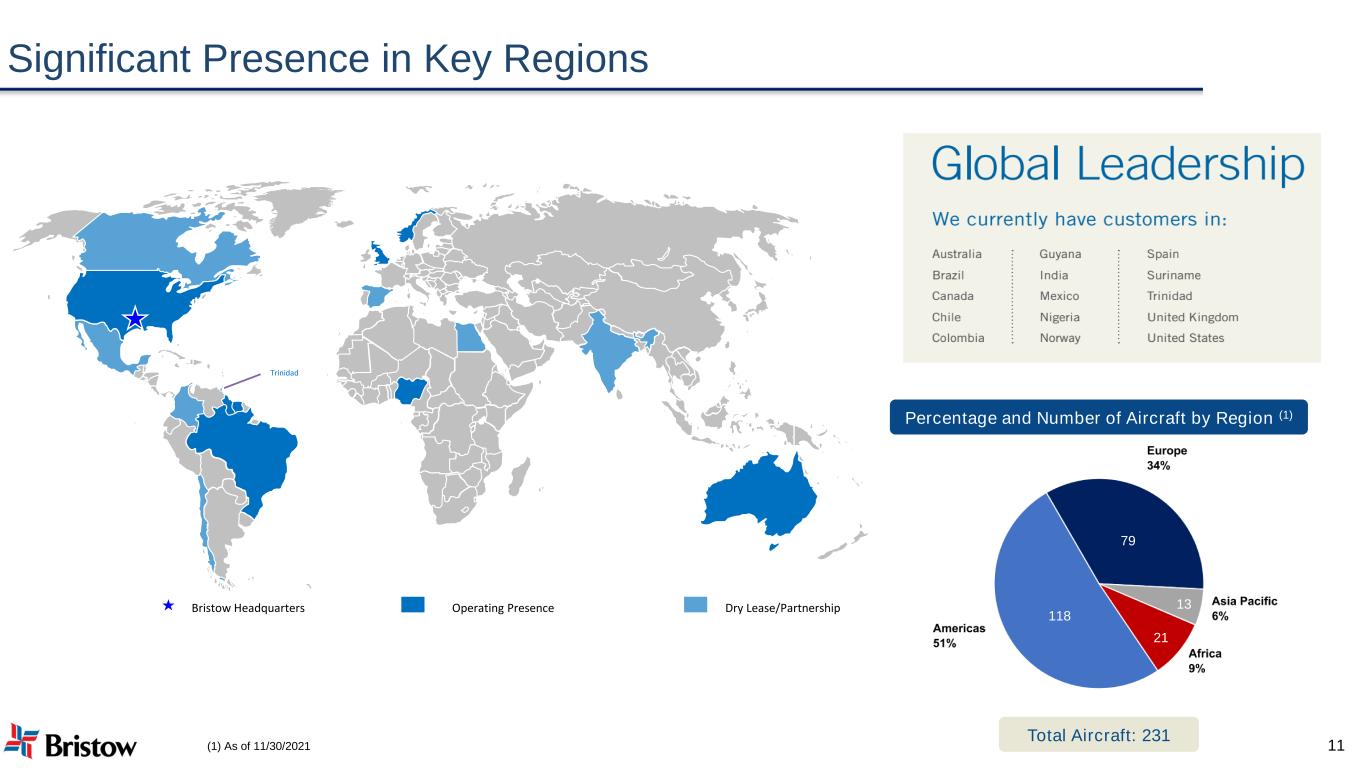

Significant Presence in Key Regions 11 Operating Presence Dry Lease/PartnershipBristow Headquarters Trinidad Percentage and Number of Aircraft by Region (1) (1) As of 11/30/2021 Total Aircraft: 231 79 13 21 118

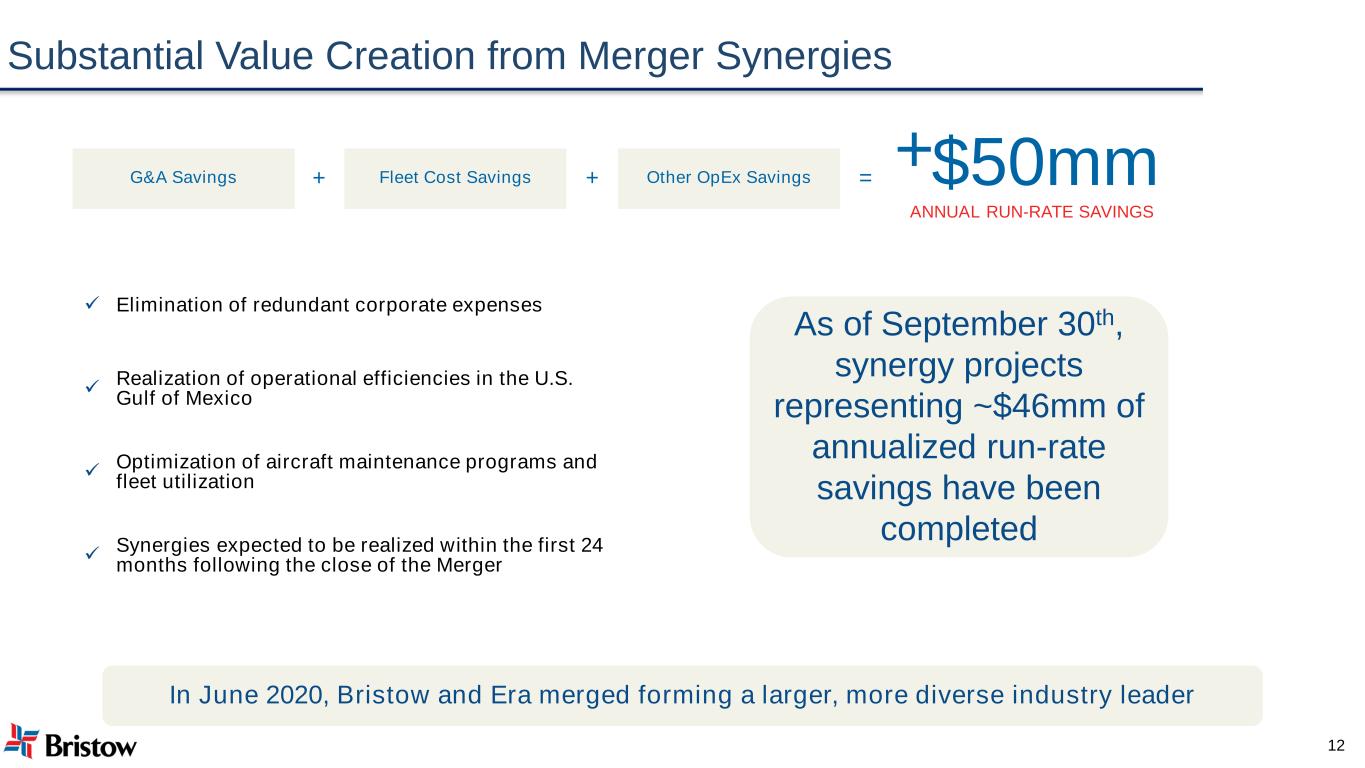

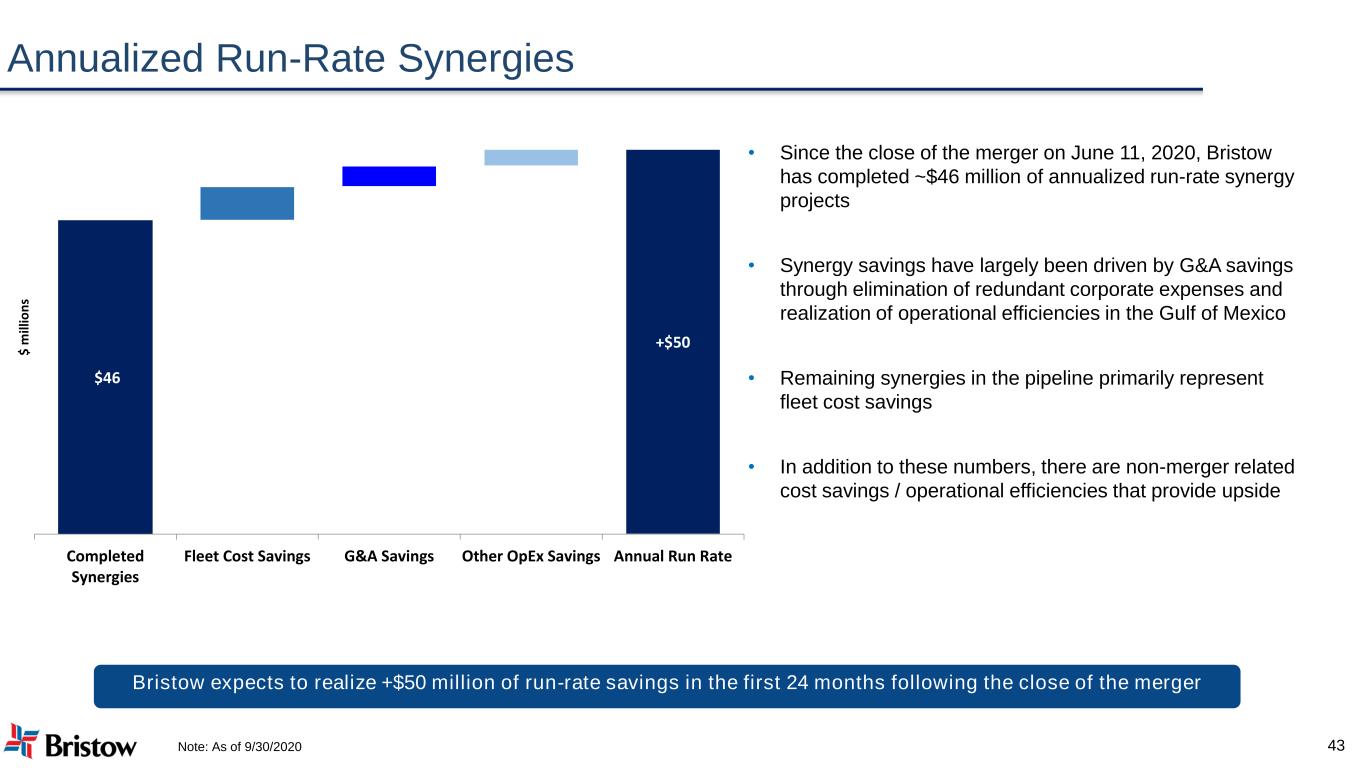

Substantial Value Creation from Merger Synergies As of September 30th, synergy projects representing ~$46mm of annualized run-rate savings have been completed ✓ Elimination of redundant corporate expenses ✓ Realization of operational efficiencies in the U.S. Gulf of Mexico ✓ Optimization of aircraft maintenance programs and fleet utilization ✓ Synergies expected to be realized within the first 24 months following the close of the Merger G&A Savings Fleet Cost Savings Other OpEx Savings 12 + + = +$50mm ANNUAL RUN-RATE SAVINGS In June 2020, Bristow and Era merged forming a larger, more diverse industry leader

Strategic Priorities 13 • Safety is our #1 core value and highest operational priority • We must continue to place safety first, every day, and deliver reliable customer service • We differentiate ourselves by providing great service and being more efficient • Better efficiency drives better results for our customers, and better returns for our shareholders • Focus on EBITDA and other metrics that are connected to actual cash flow • Identify activities that generate cash flow including cost efficiencies • Maintain a strong balance sheet and liquidity position to weather potential volatile cycles • This will best position Bristow to manage industry challenges when they occur • Evaluate new markets to identify and pursue opportunities to leverage our core competencies to expand and diversify our business • Opportunities include additional government services, offshore wind and additional markets arising from advanced air mobility • The merger of Bristow and Era was a first, but we believe there are other compelling strategic combinations • These potential combinations would generate substantial value creation from synergies

Financial Strength 14 Strong Balance Sheet & Liquidity (~$288mm of Total Liquidity) Limited Near-term Debt Maturities Highly Achievable Cost Synergies (+$50mm Annual Savings) Limited Firm Capital Commitments Strong Free Cash Flow Generation

Strategic Opportunities 15 • Offshore wind is a significant global opportunity over the next decade+ • Market expected to increase by ~100 aircraft by 2030 (currently serviced by an estimated 40 helicopters) • New class of aircraft could lower carbon emissions and operating costs • New potential end markets include moving time-sensitive cargo and passengers regionally • Over ~$3 billion of potential Government SAR contracts up for competition over the next few years • Includes contracts in the Dutch Antilles, Ireland, and Falkland Islands, with more countries expected to follow GOVERNMENT SERVICES ADVANCED AIR MOBILITYWINDOFFSHORE OIL & GAS • Multi-year recovery in offshore oil and gas expected in the coming years • Potential opportunities to consolidate in certain geographic regions

AppendixESG Overview

Environmental Environmental Obtained ISO14001 certification in the UK and Brazil; we are working on obtaining ISO14001 certification for other operating bases globally, beginning in fiscal year 2022 Undertaking proactive measures to reduce aircraft emissions and reduce the environmental impact of our operations using a modern fleet with the latest technologies, such as flight planning software for payload management, to ensure aircraft engines perform efficiently and are regularly maintained by an experienced engineering team In partnership with engine manufacturers, aircraft manufacturers, fuel system suppliers, our customers and other stakeholders, we intend to be early and leading adopters of Sustainable Aviation Fuels Avoiding adverse noise impacts to our communities, including by establishing hush houses for engine runs, installing noise walls around our bases, limiting engine runs and establishing aircraft operations “quiet hours” in the evening Transitioning to electric ground support vehicles at our Norway operations and expanding this initiative to other bases Partnered with several Advanced Air Mobility OEMs in the certification and development of Electric vertical takeoff and landing (eVTOL) and short take-off and landing (eSTOL) 17

Social Women represent half of our executive management team We are focused on creating career pathways for those who serve in the military, with ~25% of our U.S. employees having previously served We provide opportunities for all employees to improve their skills and advance their careers. We are committed to developing a robust, equitable culture through DE&I training, learning resources and professional development resources Through Bristow Uplift, we invest resources and partner with local communities, charities and non-profit organizations to develop, support and implement targeted and sustainable social responsibility initiatives Social 18 We believe in keeping everyone safe and well, which includes doing our part to safeguard physical and mental well-being using robust safety monitoring and reporting programs and offering access to counseling and mental health professionals to our employees globally Through our UK SAR service, we have rescued over 6,000 people

Governance Recently refreshed Board – seven new directors in last two years In May 2021, we welcomed our newest director, General Maryanne Miller, Ret. Board is led by our independent Non-Executive Chairman Anonymous, non-retaliatory whistleblower program Governance 19 Annual enterprise risk assessment In line with our global Code of Business Integrity, we conduct business according to the highest legal and ethical standards

AppendixO rational Overview

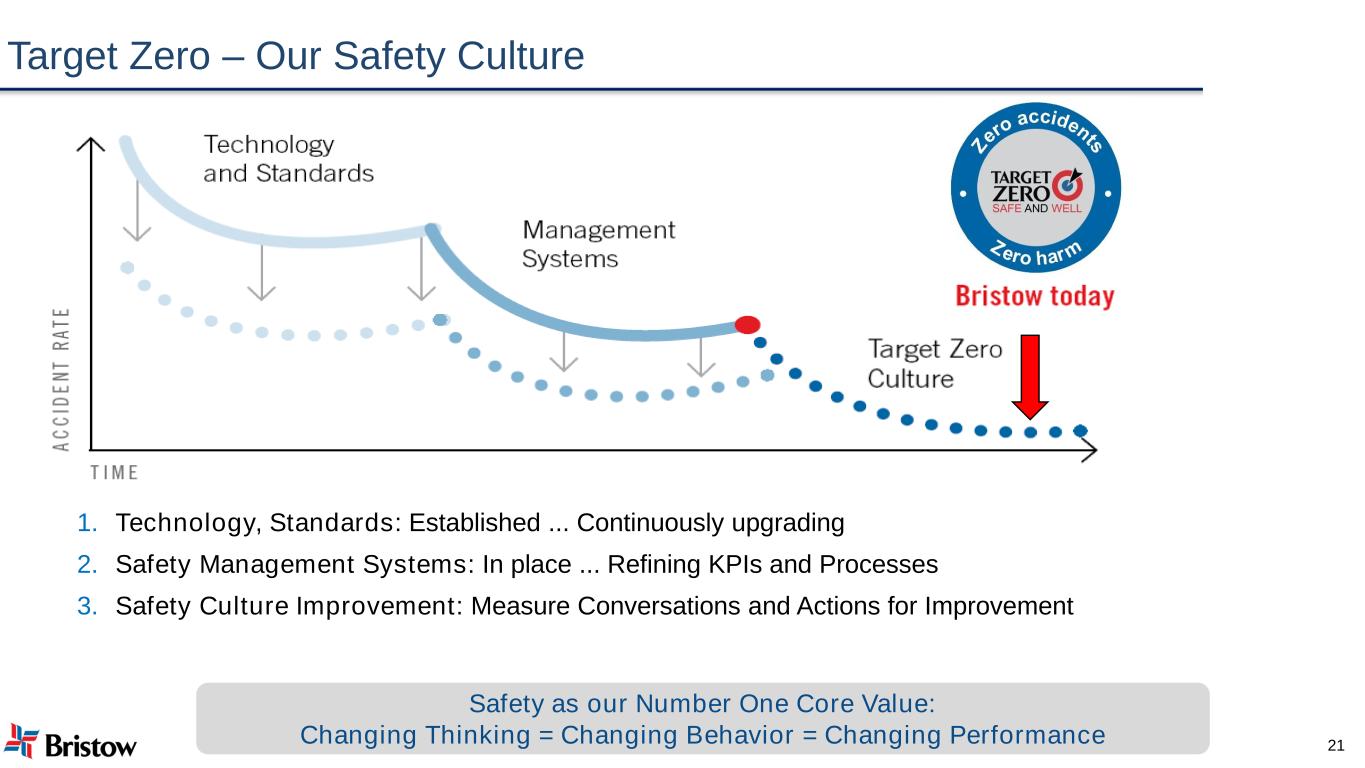

Target Zero – Our Safety Culture 21 1. Technology, Standards: Established ... Continuously upgrading 2. Safety Management Systems: In place ... Refining KPIs and Processes 3. Safety Culture Improvement: Measure Conversations and Actions for Improvement Safety as our Number One Core Value: Changing Thinking = Changing Behavior = Changing Performance

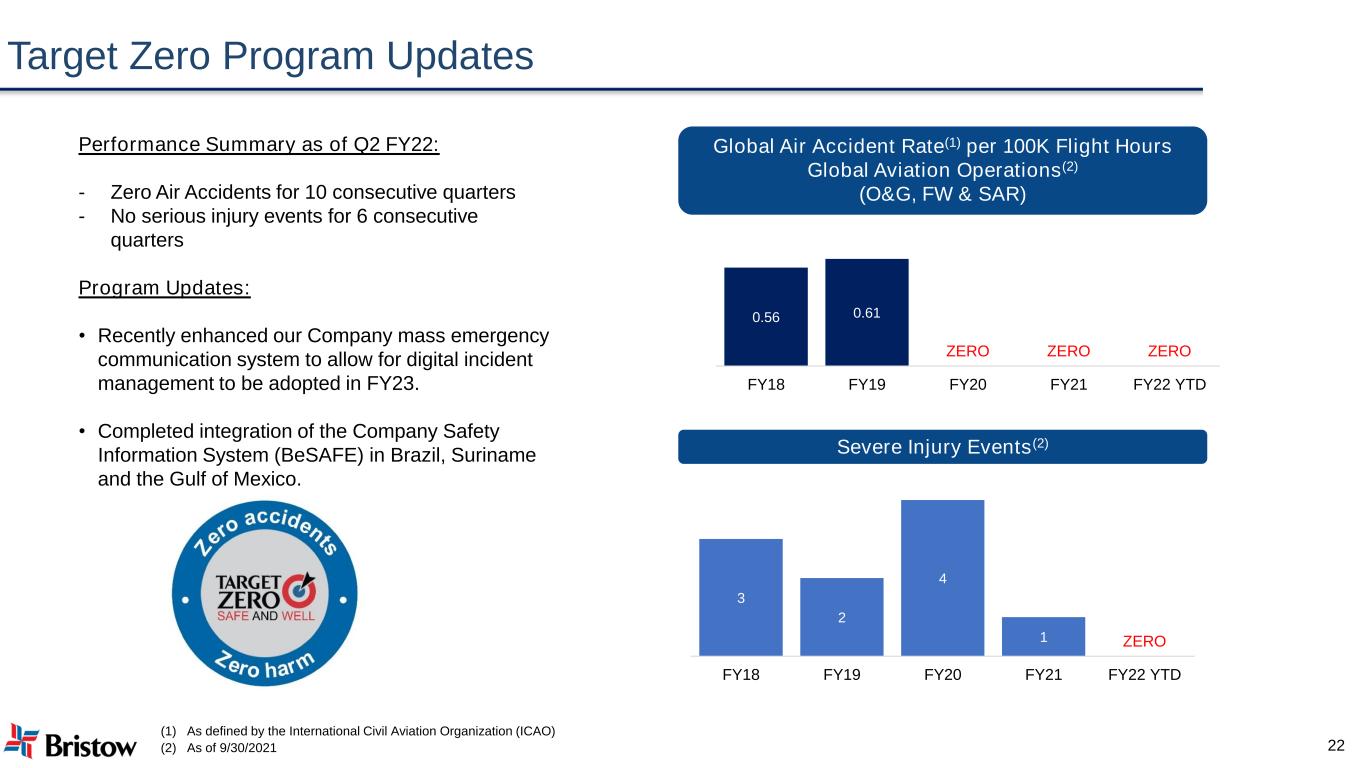

Target Zero Program Updates 22 Performance Summary as of Q2 FY22: - Zero Air Accidents for 10 consecutive quarters - No serious injury events for 6 consecutive quarters Program Updates: • Recently enhanced our Company mass emergency communication system to allow for digital incident management to be adopted in FY23. • Completed integration of the Company Safety Information System (BeSAFE) in Brazil, Suriname and the Gulf of Mexico. (1) As defined by the International Civil Aviation Organization (ICAO) (2) As of 9/30/2021 3 2 4 1 ZERO FY18 FY19 FY20 FY21 FY22 YTD 0.56 0.61 ZERO ZERO ZERO FY18 FY19 FY20 FY21 FY22 YTD Severe Injury Events(2) Global Air Accident Rate(1) per 100K Flight Hours Global Aviation Operations(2) (O&G, FW & SAR)

AOCs and Fleet 23 Trinidad 13 3 21 3 29 8 78 12 2 Bristow Group AOCs Dry Leasing # of Aircraft Bristow has 10 Air Operating Certificates globally, across both helicopter and fixed wing operations Note: As of 11/30/2021 16 44 1 1

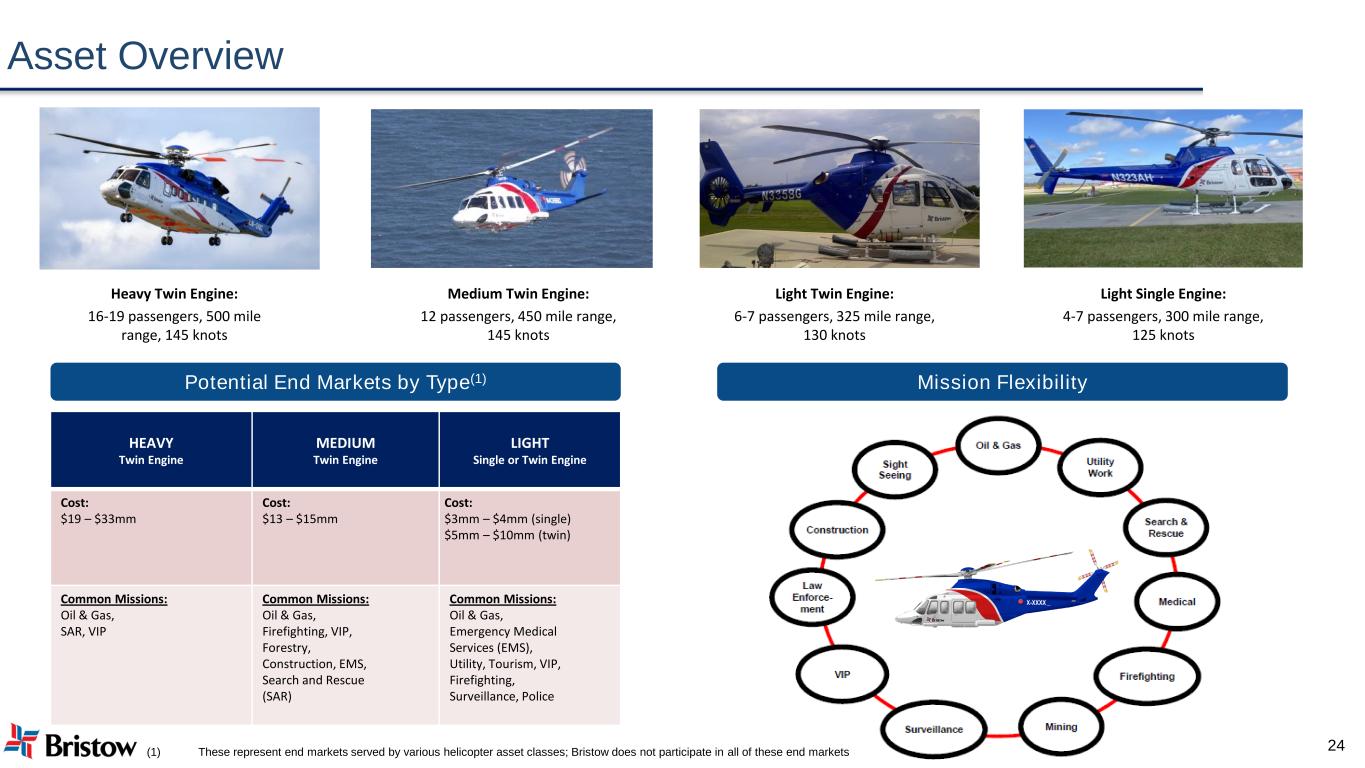

Asset Overview 24 Mission FlexibilityPotential End Markets by Type(1) HEAVY Twin Engine MEDIUM Twin Engine LIGHT Single or Twin Engine Cost: $19 – $33mm Cost: $13 – $15mm Cost: $3mm – $4mm (single) $5mm – $10mm (twin) Common Missions: Oil & Gas, SAR, VIP Common Missions: Oil & Gas, Firefighting, VIP, Forestry, Construction, EMS, Search and Rescue (SAR) Common Missions: Oil & Gas, Emergency Medical Services (EMS), Utility, Tourism, VIP, Firefighting, Surveillance, Police Light Single Engine: 4-7 passengers, 300 mile range, 125 knots Light Twin Engine: 6-7 passengers, 325 mile range, 130 knots Medium Twin Engine: 12 passengers, 450 mile range, 145 knots Heavy Twin Engine: 16-19 passengers, 500 mile range, 145 knots (1) These represent end markets served by various helicopter asset classes; Bristow does not participate in all of these end markets

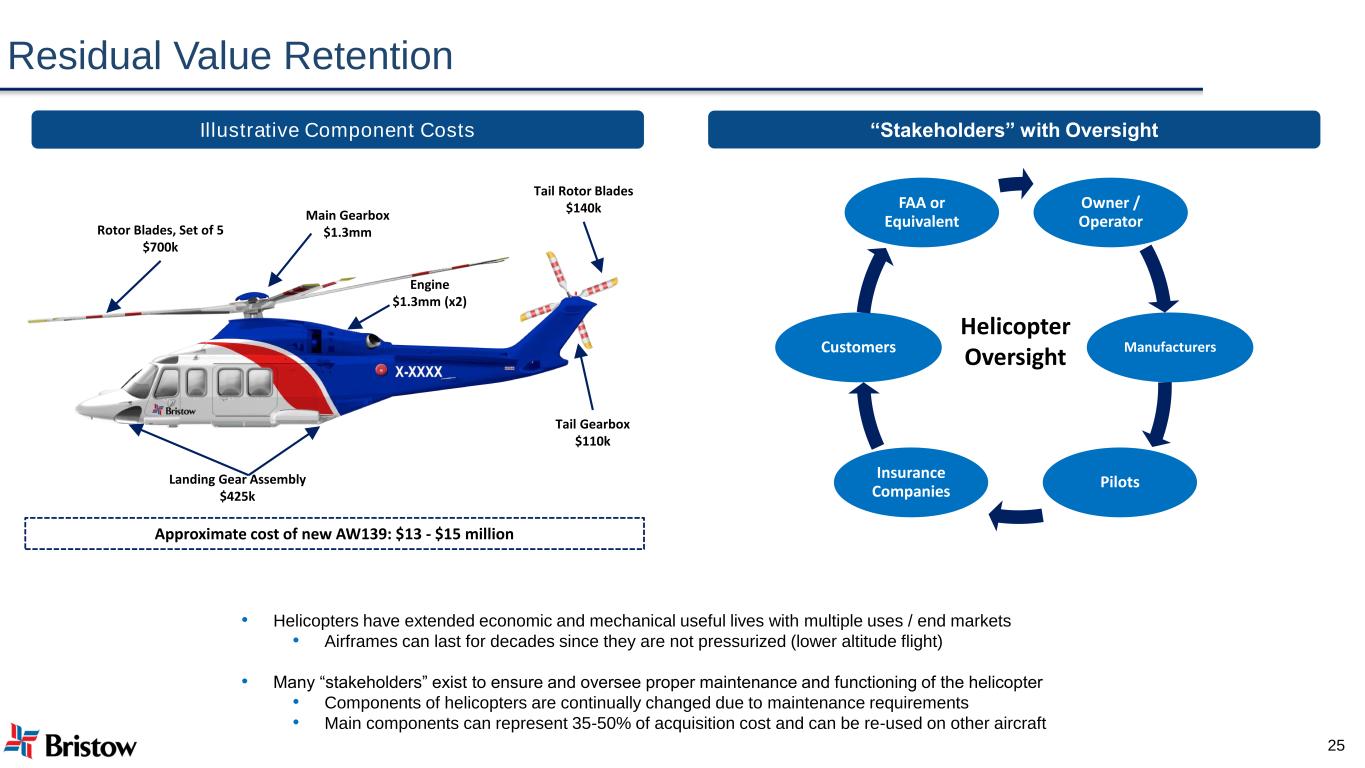

Residual Value Retention 25 “Stakeholders” with OversightIllustrative Component Costs • Helicopters have extended economic and mechanical useful lives with multiple uses / end markets • Airframes can last for decades since they are not pressurized (lower altitude flight) • Many “stakeholders” exist to ensure and oversee proper maintenance and functioning of the helicopter • Components of helicopters are continually changed due to maintenance requirements • Main components can represent 35-50% of acquisition cost and can be re-used on other aircraft Owner / Operator Manufacturers Pilots Insurance Companies Customers FAA or Equivalent Helicopter Oversight Rotor Blades, Set of 5 $700k Main Gearbox $1.3mm Tail Rotor Blades $140k Tail Gearbox $110k Landing Gear Assembly $425k Engine $1.3mm (x2) Approximate cost of new AW139: $13 - $15 million

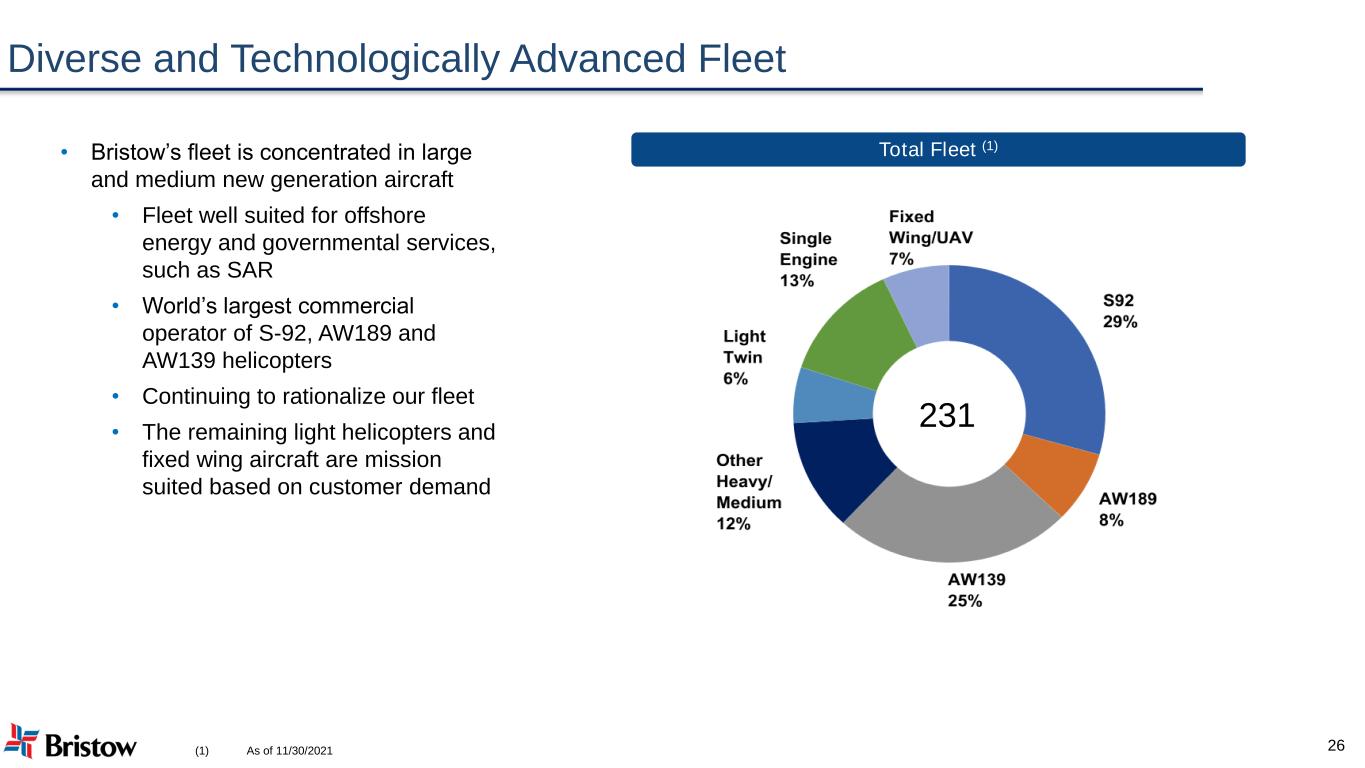

Diverse and Technologically Advanced Fleet 26 • Bristow’s fleet is concentrated in large and medium new generation aircraft • Fleet well suited for offshore energy and governmental services, such as SAR • World’s largest commercial operator of S-92, AW189 and AW139 helicopters • Continuing to rationalize our fleet • The remaining light helicopters and fixed wing aircraft are mission suited based on customer demand (1) As of 11/30/2021 Total Fleet (1) 231

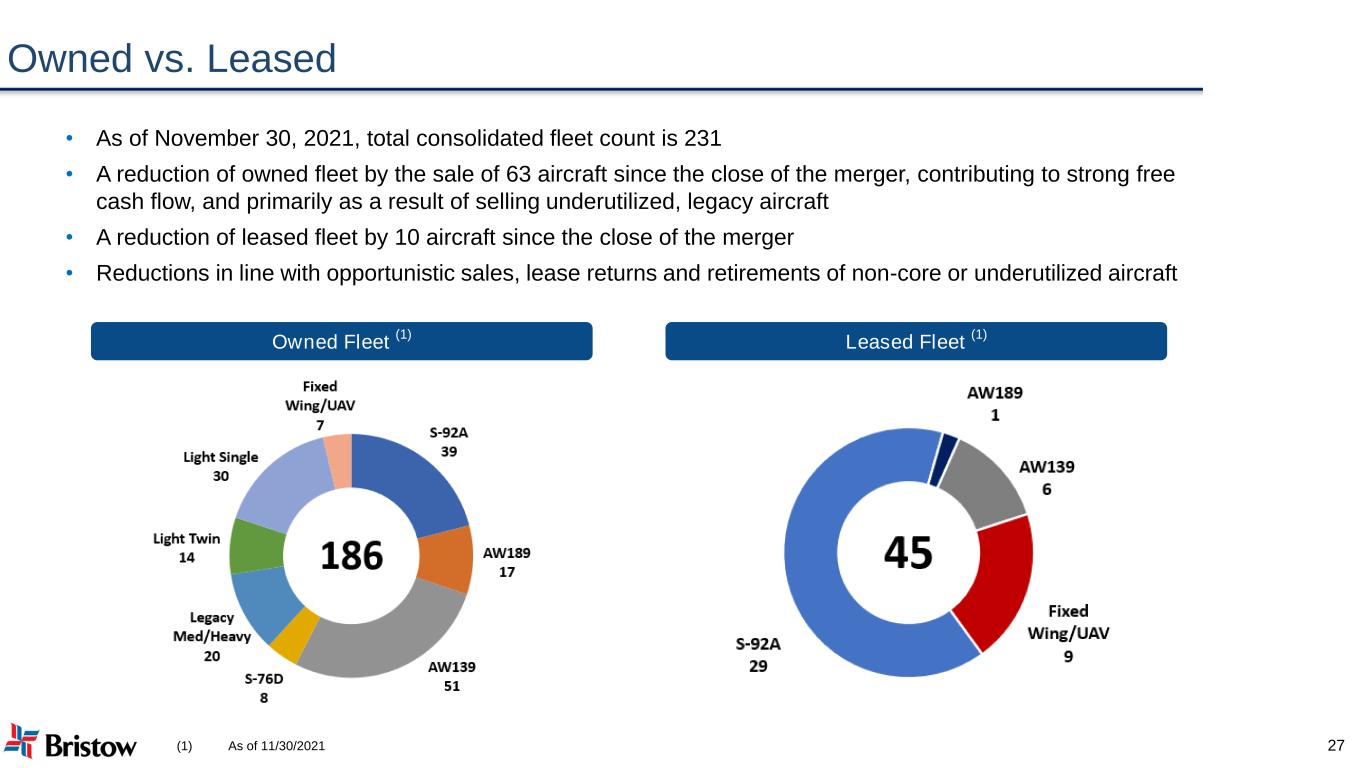

Owned vs. Leased 27 • As of November 30, 2021, total consolidated fleet count is 231 • A reduction of owned fleet by the sale of 63 aircraft since the close of the merger, contributing to strong free cash flow, and primarily as a result of selling underutilized, legacy aircraft • A reduction of leased fleet by 10 aircraft since the close of the merger • Reductions in line with opportunistic sales, lease returns and retirements of non-core or underutilized aircraft (1) As of 11/30/2021 Leased Fleet (1) Owned Fleet (1)

AppendixCommercial Overview

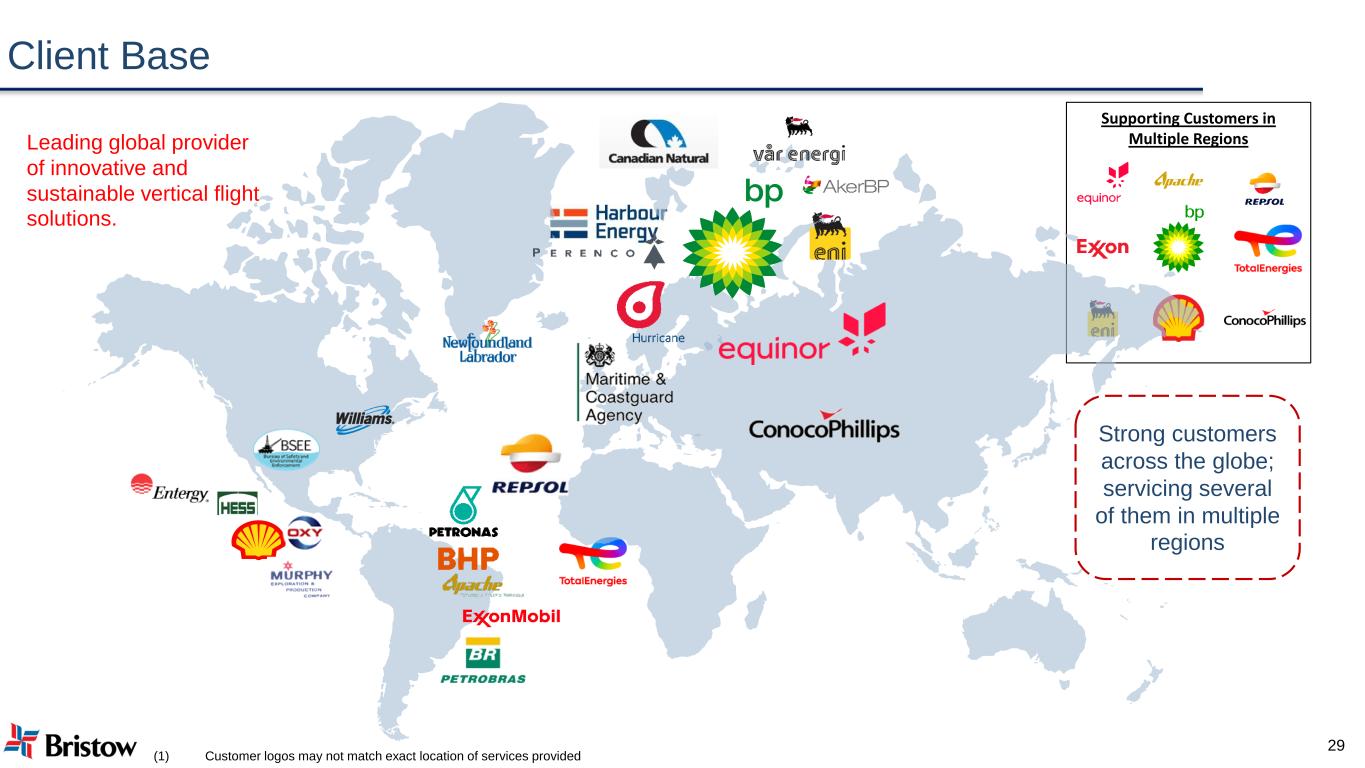

Supporting Customers in Multiple RegionsLeading global provider of innovative and sustainable vertical flight solutions. Client Base 29 (1) Customer logos may not match exact location of services provided Strong customers across the globe; servicing several of them in multiple regions

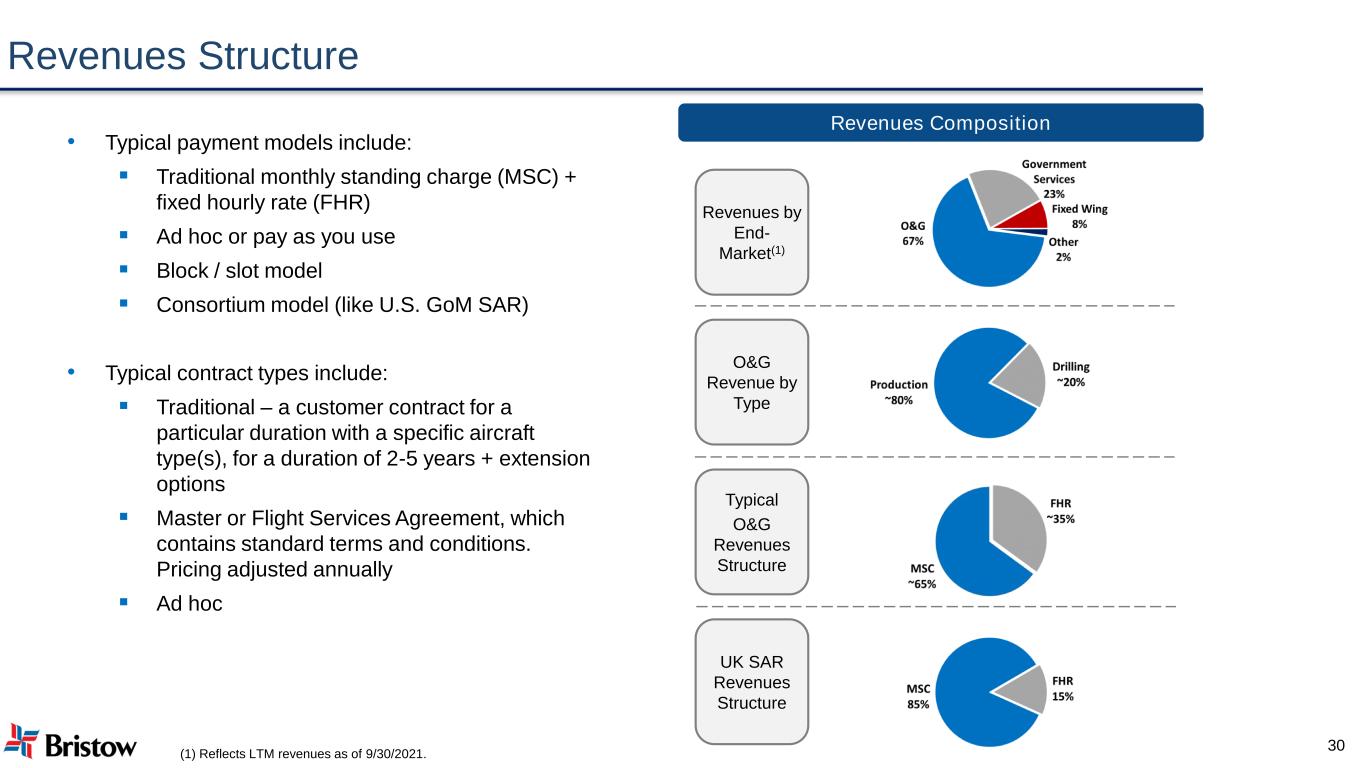

Revenues Structure 30 • Typical payment models include: ▪ Traditional monthly standing charge (MSC) + fixed hourly rate (FHR) ▪ Ad hoc or pay as you use ▪ Block / slot model ▪ Consortium model (like U.S. GoM SAR) • Typical contract types include: ▪ Traditional – a customer contract for a particular duration with a specific aircraft type(s), for a duration of 2-5 years + extension options ▪ Master or Flight Services Agreement, which contains standard terms and conditions. Pricing adjusted annually ▪ Ad hoc Revenues Composition Typical O&G Revenues Structure O&G Revenue by Type UK SAR Revenues Structure Revenues by End- Market(1) (1) Reflects LTM revenues as of 9/30/2021.

Country/Client Incumbent Aircract Required Contract Start (CY) Duration Netherlands/ Coastguard 3x Heavy 2022 10 Years Dutch Antilles/ Coastguard 2x Medium 2022 10 Years Ireland/ Coast Guard 4x - 5x Super Medium 2023 10 Years MCA (UK SAR)/ Coastguard Up to 20 mixed fleet of Medium/Heavy 2024 10 Years+ Falklands/ UK Military 3x Heavy + 2x Super Medium 2026(1) 10 Years+ Government SAR Market Development 31 1) Existing contract has 2x 1-year options available Recently Awarded

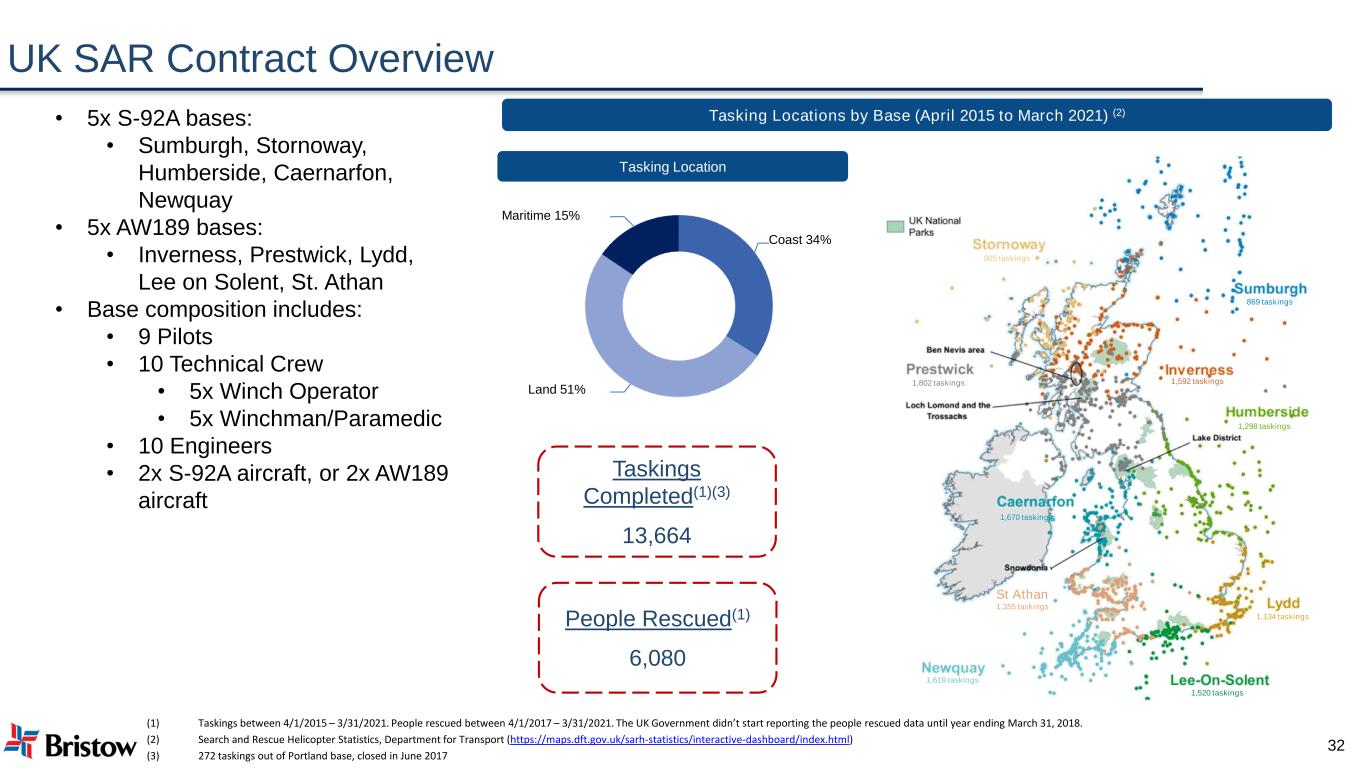

UK SAR Contract Overview 32 • 5x S-92A bases: • Sumburgh, Stornoway, Humberside, Caernarfon, Newquay • 5x AW189 bases: • Inverness, Prestwick, Lydd, Lee on Solent, St. Athan • Base composition includes: • 9 Pilots • 10 Technical Crew • 5x Winch Operator • 5x Winchman/Paramedic • 10 Engineers • 2x S-92A aircraft, or 2x AW189 aircraft (1) Taskings between 4/1/2015 – 3/31/2021. People rescued between 4/1/2017 – 3/31/2021. The UK Government didn’t start reporting the people rescued data until year ending March 31, 2018. (2) Search and Rescue Helicopter Statistics, Department for Transport (https://maps.dft.gov.uk/sarh-statistics/interactive-dashboard/index.html) (3) 272 taskings out of Portland base, closed in June 2017 Tasking Locations by Base (April 2015 to March 2021) (2) Maritime 15% Coast 34% Land 51% Tasking Location 1,670 taskings St Athan 1,355 taskings 1,802 taskings 805 taskings 869 taskings 1,592 taskings 1,298 taskings 1,134 taskings 1,520 taskings 1,619 taskings Taskings Completed(1)(3) 13,664 People Rescued(1) 6,080

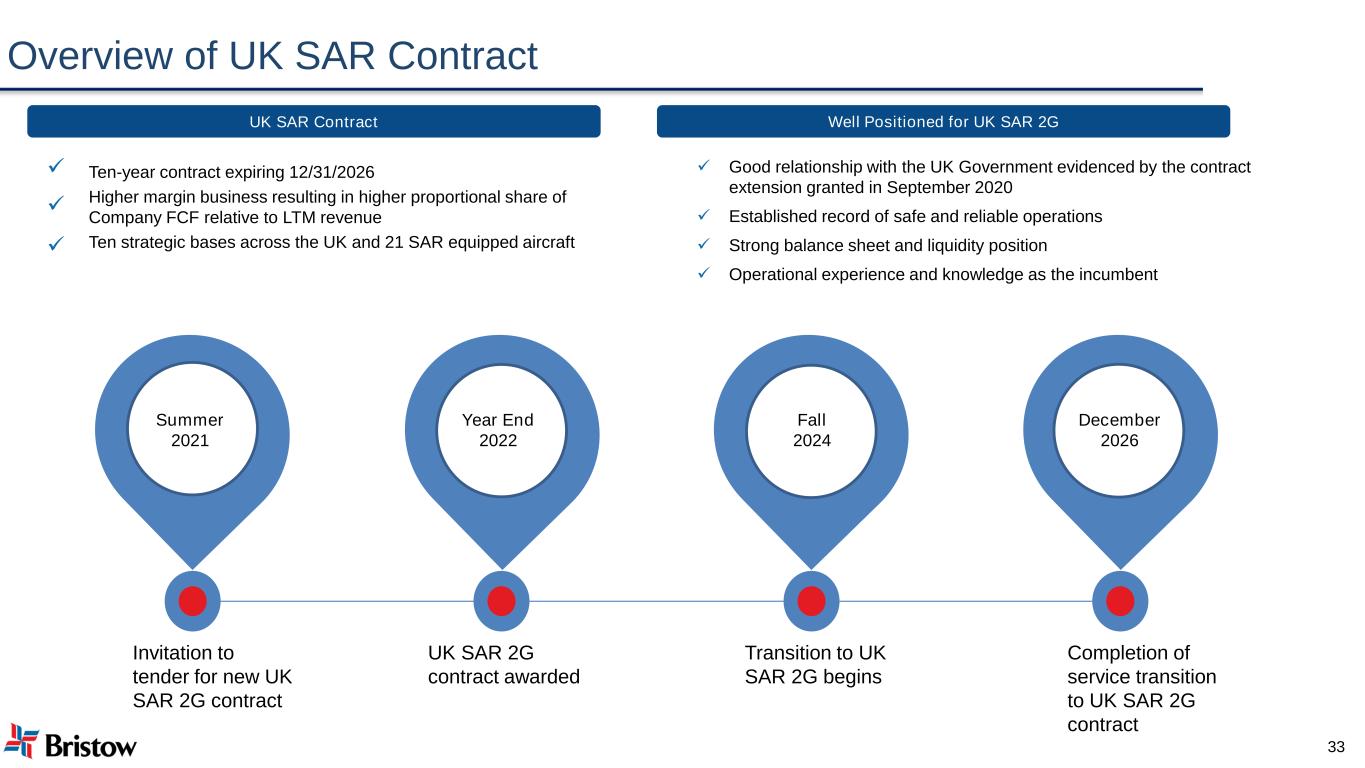

Overview of UK SAR Contract 33 Invitation to tender for new UK SAR 2G contract UK SAR 2G contract awarded Transition to UK SAR 2G begins Completion of service transition to UK SAR 2G contract UK SAR Contract Summer 2021 Year End 2022 Fall 2024 December 2026 ✓ • Ten-year contract expiring 12/31/2026 • Higher margin business resulting in higher proportional share of Company FCF relative to LTM revenue • Ten strategic bases across the UK and 21 SAR equipped aircraft ✓ ✓ ✓ ✓ Good relationship with the UK Government evidenced by the contract extension granted in September 2020 ✓ Established record of safe and reliable operations ✓ Strong balance sheet and liquidity position ✓ Operational experience and knowledge as the incumbent Well Positioned for UK SAR 2G

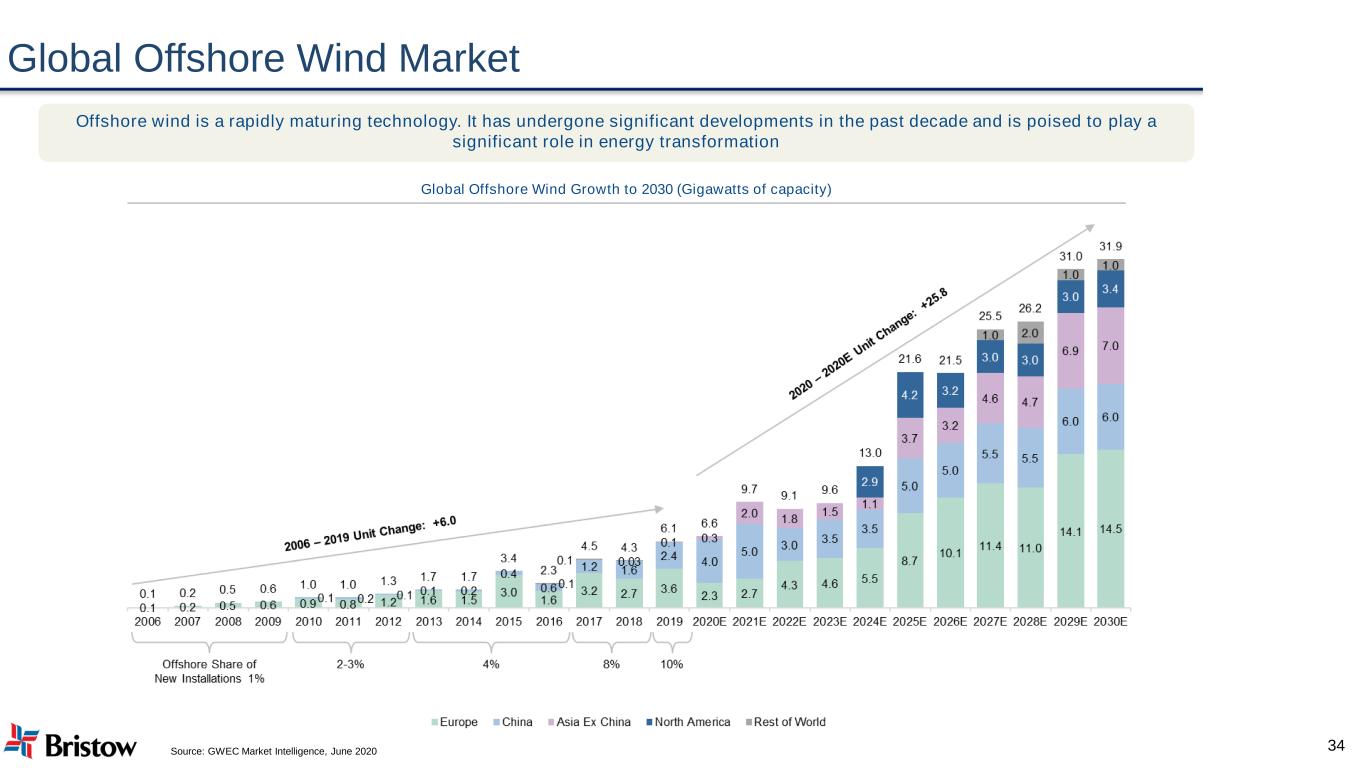

Global Offshore Wind Market 34 Global Offshore Wind Growth to 2030 (Gigawatts of capacity) Source: GWEC Market Intelligence, June 2020 Offshore wind is a rapidly maturing technology. It has undergone significant developments in the past decade and is poised to play a significant role in energy transformation

Advanced Air Mobility (AAM) Overview 35 • Electric vertical takeoff and landing (eVTOL) and short take-off and landing (eSTOL) aircraft are among several of the emerging technologies that are receiving increased prominence, with the potential to revolutionize air transportation • Significant investments in the space have occurred in recent months, with a handful encompassing multibillion dollar SPAC transactions • Bristow will lend its 70+ years of transport expertise in regulatory processes, operations and design to the advancement of eVTOL and eSTOL aircraft • We see early AAM adoption opportunities for Bristow within cargo and/or Regional Air Mobility missions. These opportunities remove or limit the need for new AAM specific infrastructure and build upon existing markets and regulatory framework • Uniquely positioned to take advantage of future AAM end markets • Bristow’s existing infrastructure can play a significant role in this developing industry • Disciplined management focused on opportunistic approach to AAM industry AAM estimated to be a $1tn industry by 2040 and $9tn by 2050(1) (1) Morgan Stanley Urban Air Mobility TAM 2021 Report

Potential AAM Opportunities 36 Passenger Focused Regional Air Mobility Complementary to and an accelerator for other emerging AAM operations Utilizes and builds upon existing infrastructure, regulatory landscape and funding mechanisms Focus on utilizing existing general aviation airports, potentially feeding into larger commercial airports Cargo Focused “Middle-Mile” Solution RAM aircraft and technology to support distribution center networks and cargo transport delivery Existing distribution center infrastructure could likely support RAM operations independently Industrial and/or rural area operation Offshore Energy Hub Network Cargo and passenger transport to shore-based energy hubs Enhance existing VTOL operations and markets Utilizes or builds upon existing energy infrastructure

Bristow’s Relevant Expertise 37Bristow has valuable expertise to help advance the development of AAM Passenger Management & Service Delivery Base operations worldwide delivering the safe, efficient movement of hundreds of thousands of passengers and over 100,000 flight hours annually Global Air Operations & Infrastructure 10 AOCs (plus various underlying certifications), customers in 15 countries and over 40 global bases Fleet Management and Maintenance Services 231 aircraft globally maintained by 765 in-house mechanics plus OEM / third party support programs Regulatory Certifications Extensive global experience, government relations contacts and well-established processes around vertical lift regulatory certifications (including initial type certification support) Supply Chain Management Global, efficient, well established supply chain practices supported by mutually beneficial relationships across the aviation supply chain Safety Management System Bristow’s Target Zero safety program underpins the Company’s culture and is a strong component of its reputation and brand amongst stakeholders Training Delivery Industry leading training programs and infrastructure, with certified in- house training teams supporting our pilots, engineers and other crew worldwide across multiple aircraft platforms Safety & Technical Services Innovations For 70+ years, Bristow has led the helicopter transportation industry on safety improvements and delivered benefits for the entire VTOL industry, including HUMS (Health Usage Monitoring System) and TCAS II (Traffic-alert Collision Avoidance System)

• Bristow and Vertical to cooperate on the certification, operational planning and potential purchase of eVTOL aircraft. Agreement includes: ▪ VA-X4 four-passenger, one pilot ▪ Expected speeds of up to 200 mph (174 knots) ▪ A range of more than 100 miles (161+ kilometers) ▪ Near silent when in flight with zero emissions and low cost per passenger mile • Companies will explore new markets: ▪ Commercial air taxi flights ▪ Various geographic locations ▪ Other specialized customers Select AAM Partnerships 38 Bristow and Vertical Aerospace Group Ltd • Bristow and Electra to cooperate on the technical development and certification, as well as marketing and future operations, of Electra's eSTOL aircraft. Agreement includes development of: ▪ Hybrid-electric, self charging aircraft ▪ Takes off in 300x100 ft and carries 5-7 passengers or 1,800 pounds of cargo ▪ Up to 500 nautical miles in all-weather conditions • Companies will explore new markets: ▪ Focus on “middle mile” logistics for large retail distribution chains ▪ Other specialized customers ▪ Bristow is also the principal launch operational customer with potential delivery of low-emission aircraft by 2026 Bristow and Electra.aero • Bristow and Eve to cooperate on development of operations, vehicle design, vertiport design, regulatory development for the operating environment and autonomous operation development to meet customer as well as eVTOL certification requirements. Agreement includes: ▪ Developing an Air Operator's Certificate (AOC) for Eve’s eVTOL aircraft ▪ Developing an Urban Air Mobility (UAM) operating model using Bristow's experience in safely transporting passengers and cargo worldwide ▪ Deliveries expected to start in 2026 • Companies will explore new markets in commercial air taxi flights, various geographic locations and other specialized customers Bristow and Eve Urban Air Mobility, LLC

AppendixFinancial Overview

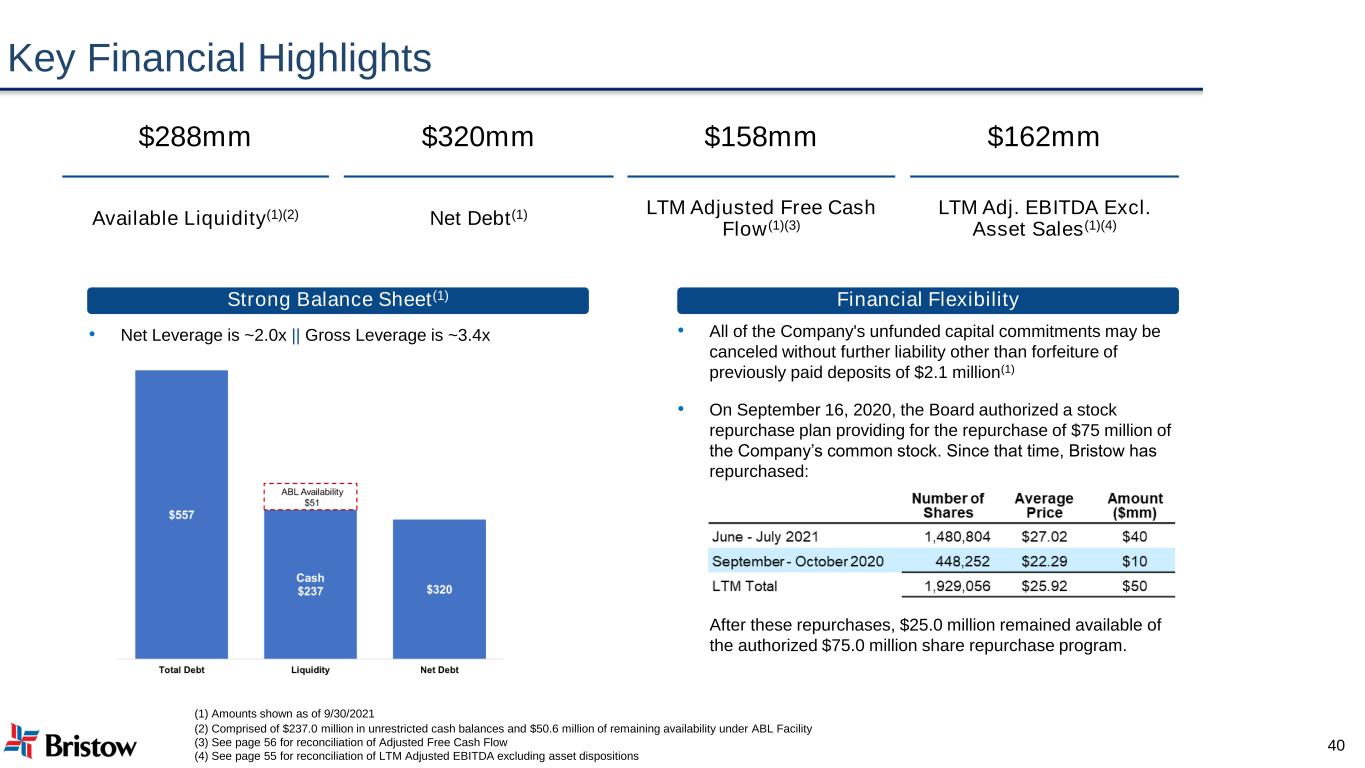

Key Financial Highlights (1) Amounts shown as of 9/30/2021 (2) Comprised of $237.0 million in unrestricted cash balances and $50.6 million of remaining availability under ABL Facility (3) See page 56 for reconciliation of Adjusted Free Cash Flow (4) See page 55 for reconciliation of LTM Adjusted EBITDA excluding asset dispositions 40 $288mm $320mm $158mm $162mm Available Liquidity(1)(2) Net Debt(1) LTM Adjusted Free Cash Flow(1)(3) LTM Adj. EBITDA Excl. Asset Sales(1)(4) • All of the Company's unfunded capital commitments may be canceled without further liability other than forfeiture of previously paid deposits of $2.1 million(1) • On September 16, 2020, the Board authorized a stock repurchase plan providing for the repurchase of $75 million of the Company’s common stock. Since that time, Bristow has repurchased: After these repurchases, $25.0 million remained available of the authorized $75.0 million share repurchase program. • Net Leverage is ~2.0x || Gross Leverage is ~3.4x Financial FlexibilityStrong Balance Sheet(1)

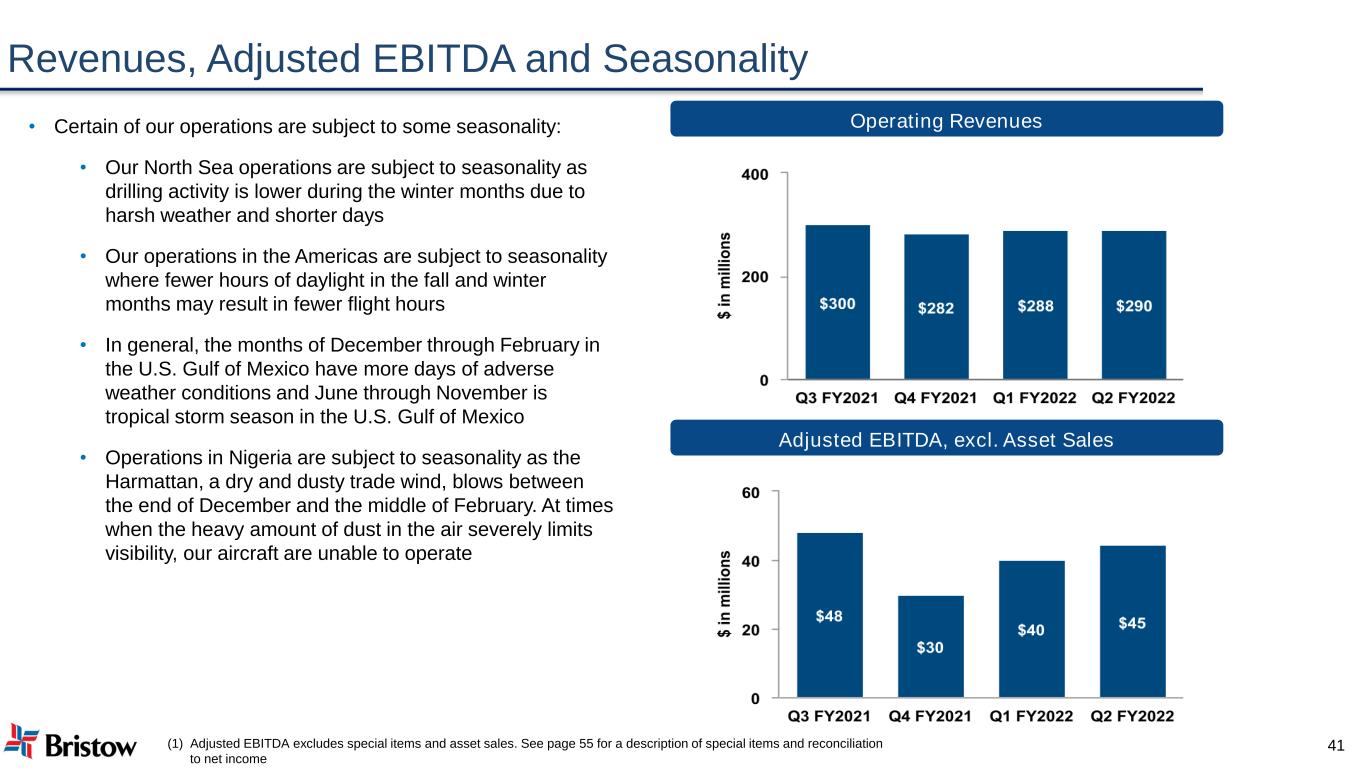

Revenues, Adjusted EBITDA and Seasonality • Certain of our operations are subject to some seasonality: • Our North Sea operations are subject to seasonality as drilling activity is lower during the winter months due to harsh weather and shorter days • Our operations in the Americas are subject to seasonality where fewer hours of daylight in the fall and winter months may result in fewer flight hours • In general, the months of December through February in the U.S. Gulf of Mexico have more days of adverse weather conditions and June through November is tropical storm season in the U.S. Gulf of Mexico • Operations in Nigeria are subject to seasonality as the Harmattan, a dry and dusty trade wind, blows between the end of December and the middle of February. At times when the heavy amount of dust in the air severely limits visibility, our aircraft are unable to operate Operating Revenue (1) Adjusted EBITDA excludes special items and asset sales. See page 55 for a description of special items and reconciliation to net income 41 Operating Revenues Adjusted EBITDA, excl. Asset Sales

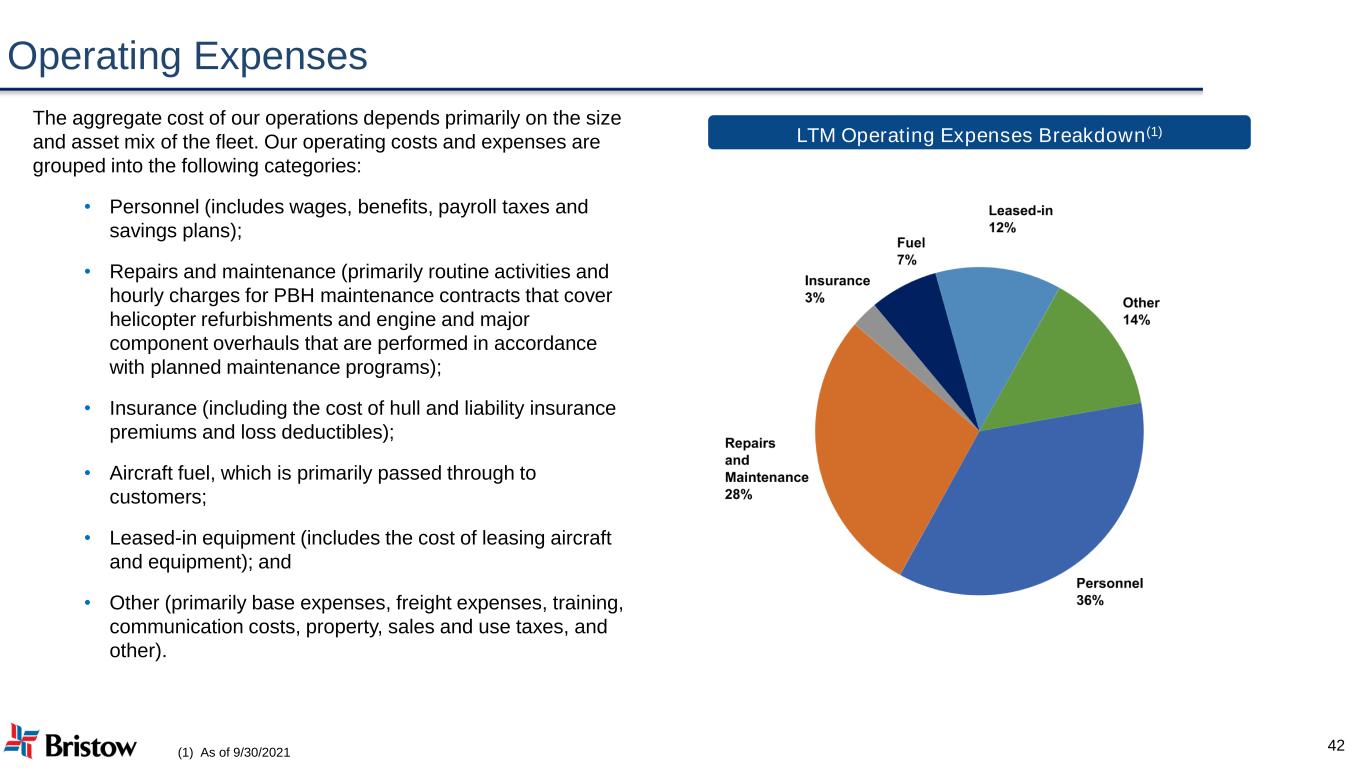

Operating Expenses 42 The aggregate cost of our operations depends primarily on the size and asset mix of the fleet. Our operating costs and expenses are grouped into the following categories: • Personnel (includes wages, benefits, payroll taxes and savings plans); • Repairs and maintenance (primarily routine activities and hourly charges for PBH maintenance contracts that cover helicopter refurbishments and engine and major component overhauls that are performed in accordance with planned maintenance programs); • Insurance (including the cost of hull and liability insurance premiums and loss deductibles); • Aircraft fuel, which is primarily passed through to customers; • Leased-in equipment (includes the cost of leasing aircraft and equipment); and • Other (primarily base expenses, freight expenses, training, communication costs, property, sales and use taxes, and other). LTM Operating Expenses Breakdown(1) (1) As of 9/30/2021

Annualized Run-Rate Synergies • Since the close of the merger on June 11, 2020, Bristow has completed ~$46 million of annualized run-rate synergy projects • Synergy savings have largely been driven by G&A savings through elimination of redundant corporate expenses and realization of operational efficiencies in the Gulf of Mexico • Remaining synergies in the pipeline primarily represent fleet cost savings • In addition to these numbers, there are non-merger related cost savings / operational efficiencies that provide upside Bristow expects to realize +$50 million of run-rate savings in the first 24 months following the close of the merger $46 +$50 Completed Synergies Fleet Cost Savings G&A Savings Other OpEx Savings Annual Run Rate $ m ill io n s Note: As of 9/30/2020 43

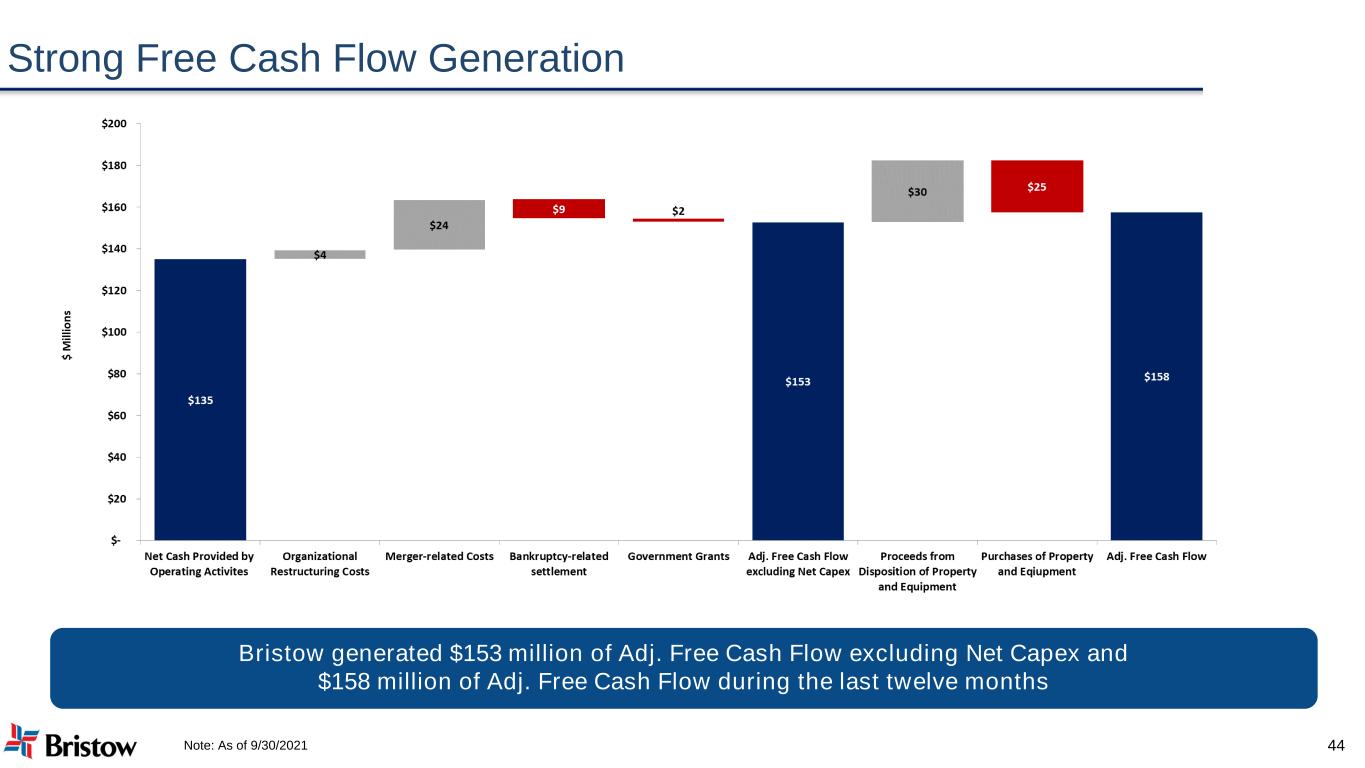

Strong Free Cash Flow Generation Bristow generated $153 million of Adj. Free Cash Flow excluding Net Capex and $158 million of Adj. Free Cash Flow during the last twelve months Note: As of 9/30/2021 44

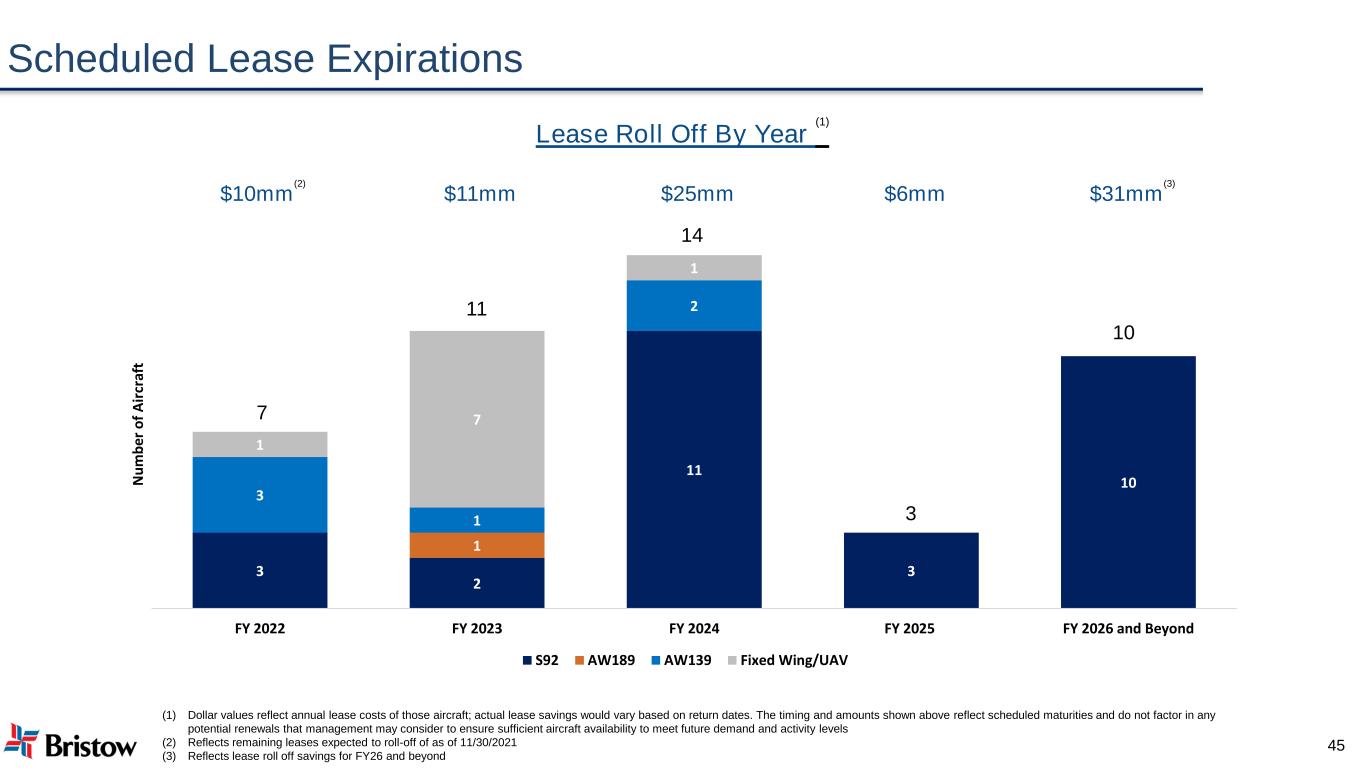

Scheduled Lease Expirations 45 (1) Dollar values reflect annual lease costs of those aircraft; actual lease savings would vary based on return dates. The timing and amounts shown above reflect scheduled maturities and do not factor in any potential renewals that management may consider to ensure sufficient aircraft availability to meet future demand and activity levels (2) Reflects remaining leases expected to roll-off of as of 11/30/2021 (3) Reflects lease roll off savings for FY26 and beyond Lease Roll Off By Year (1) 3 2 11 3 10 1 3 1 2 1 7 1 FY 2022 FY 2023 FY 2024 FY 2025 FY 2026 and Beyond N u m b er o f A ir cr af t S92 AW189 AW139 Fixed Wing/UAV 7 11 14 3 10 $10mm (2) $11mm $25mm $6mm $31mm (3)

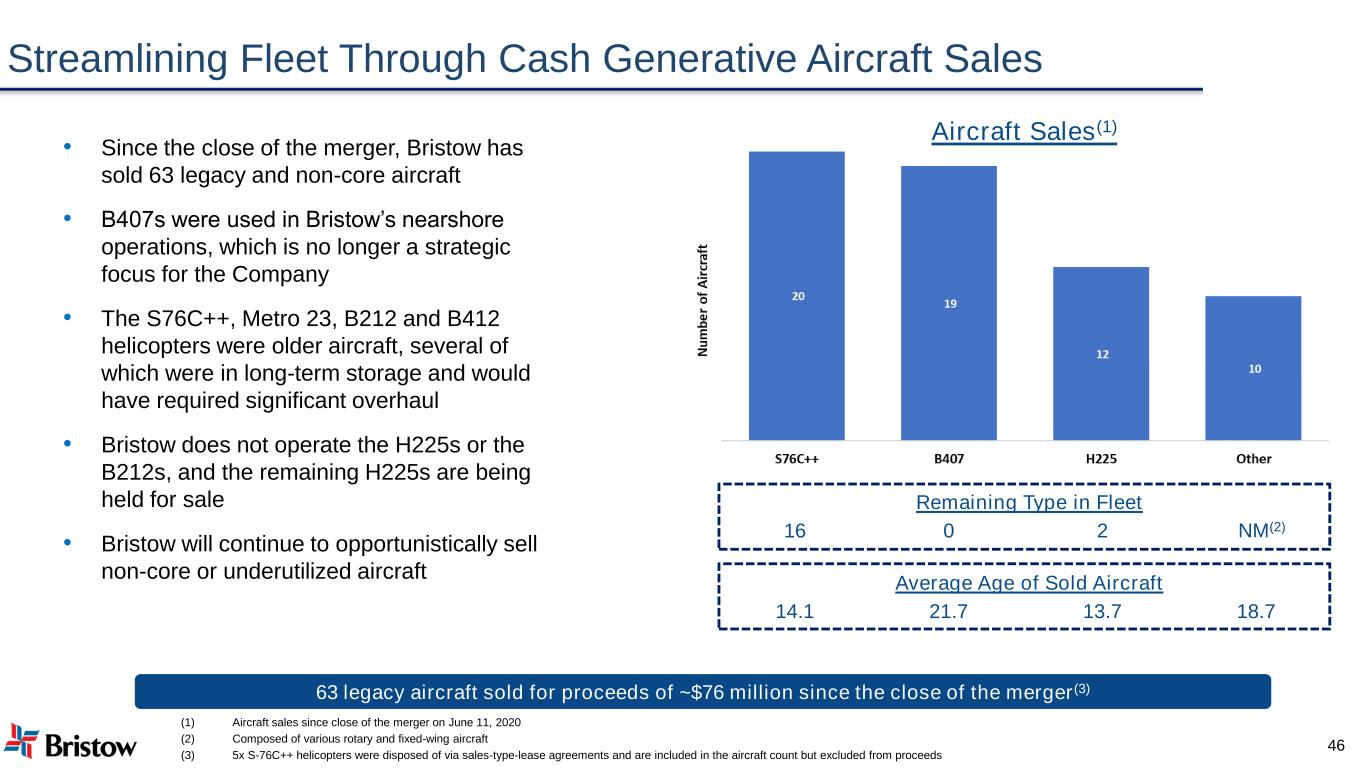

Streamlining Fleet Through Cash Generative Aircraft Sales 46 • Since the close of the merger, Bristow has sold 63 legacy and non-core aircraft • B407s were used in Bristow’s nearshore operations, which is no longer a strategic focus for the Company • The S76C++, Metro 23, B212 and B412 helicopters were older aircraft, several of which were in long-term storage and would have required significant overhaul • Bristow does not operate the H225s or the B212s, and the remaining H225s are being held for sale • Bristow will continue to opportunistically sell non-core or underutilized aircraft (1) Aircraft sales since close of the merger on June 11, 2020 (2) Composed of various rotary and fixed-wing aircraft (3) 5x S-76C++ helicopters were disposed of via sales-type-lease agreements and are included in the aircraft count but excluded from proceeds Aircraft Sales(1) 0 2 Remaining Type in Fleet 16 Average Age of Sold Aircraft 63 legacy aircraft sold for proceeds of ~$76 million since the close of the merger(3) 21.7 13.7 18.714.1 NM(2)

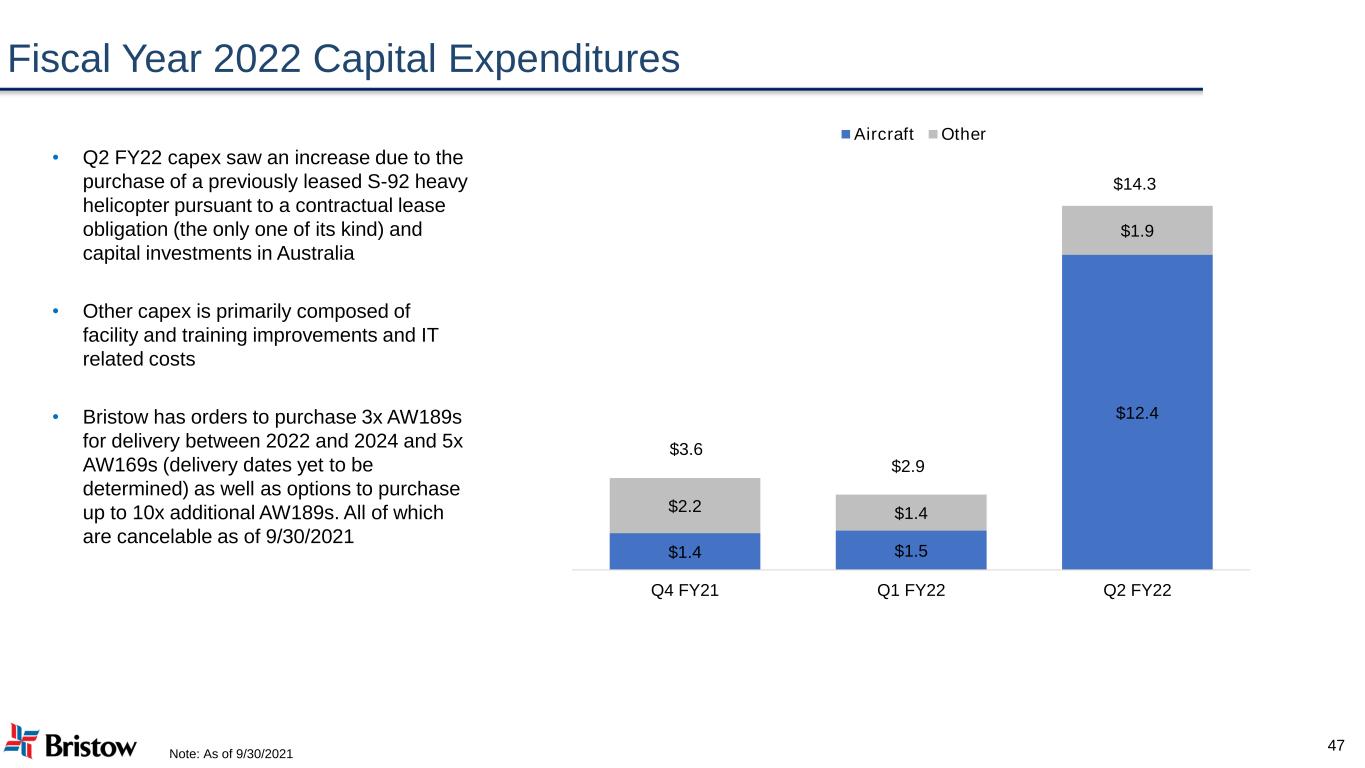

Fiscal Year 2022 Capital Expenditures 47 • Q2 FY22 capex saw an increase due to the purchase of a previously leased S-92 heavy helicopter pursuant to a contractual lease obligation (the only one of its kind) and capital investments in Australia • Other capex is primarily composed of facility and training improvements and IT related costs • Bristow has orders to purchase 3x AW189s for delivery between 2022 and 2024 and 5x AW169s (delivery dates yet to be determined) as well as options to purchase up to 10x additional AW189s. All of which are cancelable as of 9/30/2021 $1.4 $1.5 $12.4 $2.2 $1.4 $1.9 Q4 FY21 Q1 FY22 Q2 FY22 Aircraft Other $14.3 $2.9 $3.6 Note: As of 9/30/2021

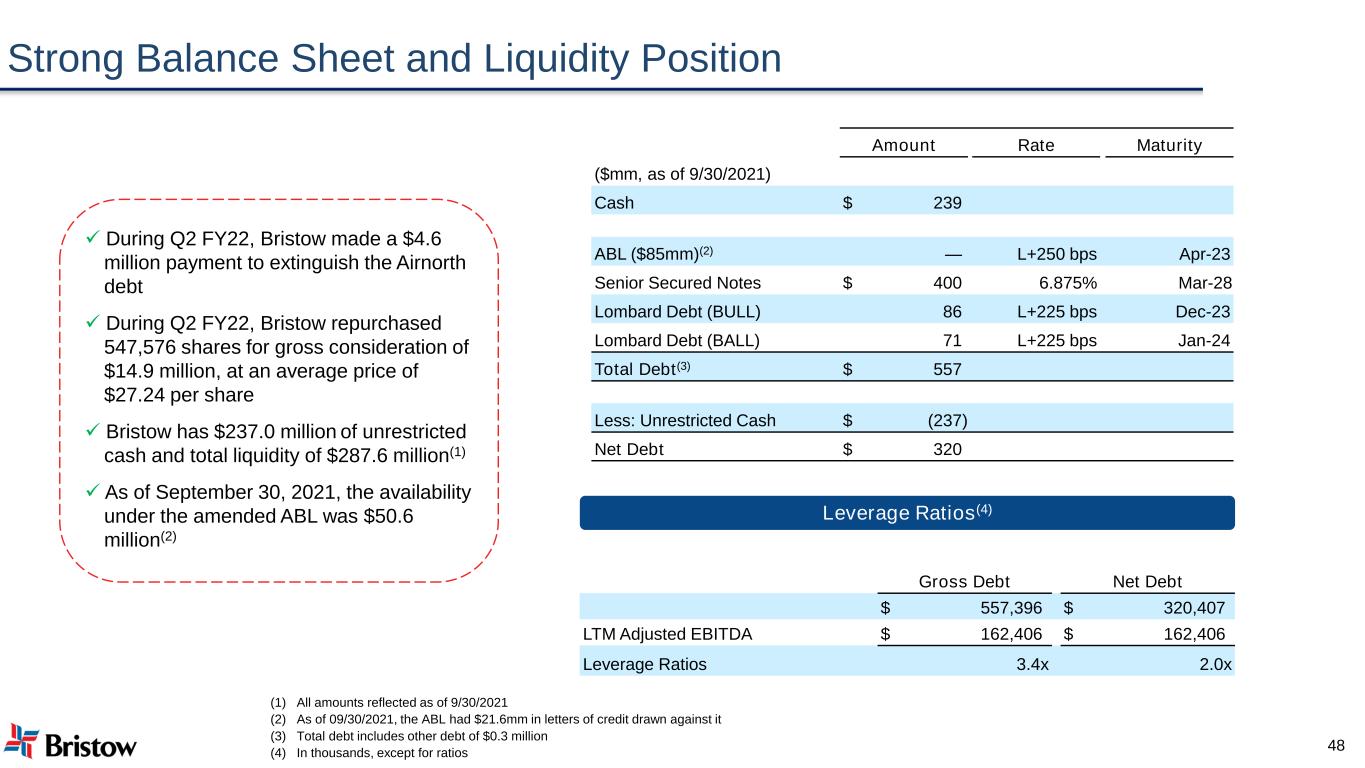

Strong Balance Sheet and Liquidity Position ✓ During Q2 FY22, Bristow made a $4.6 million payment to extinguish the Airnorth debt ✓ During Q2 FY22, Bristow repurchased 547,576 shares for gross consideration of $14.9 million, at an average price of $27.24 per share ✓ Bristow has $237.0 million of unrestricted cash and total liquidity of $287.6 million(1) ✓ As of September 30, 2021, the availability under the amended ABL was $50.6 million(2) (1) All amounts reflected as of 9/30/2021 (2) As of 09/30/2021, the ABL had $21.6mm in letters of credit drawn against it (3) Total debt includes other debt of $0.3 million (4) In thousands, except for ratios Amount Rate Maturity ($mm, as of 9/30/2021) Cash $ 239 ABL ($85mm)(2) — L+250 bps Apr-23 Senior Secured Notes $ 400 6.875% Mar-28 Lombard Debt (BULL) 86 L+225 bps Dec-23 Lombard Debt (BALL) 71 L+225 bps Jan-24 Total Debt(3) $ 557 Less: Unrestricted Cash $ (237) Net Debt $ 320 48 Gross Debt Net Debt $ 557,396 $ 320,407 LTM Adjusted EBITDA $ 162,406 $ 162,406 Leverage Ratios 3.4x 2.0x Leverage Ratios(4)

Appendix Conclusion

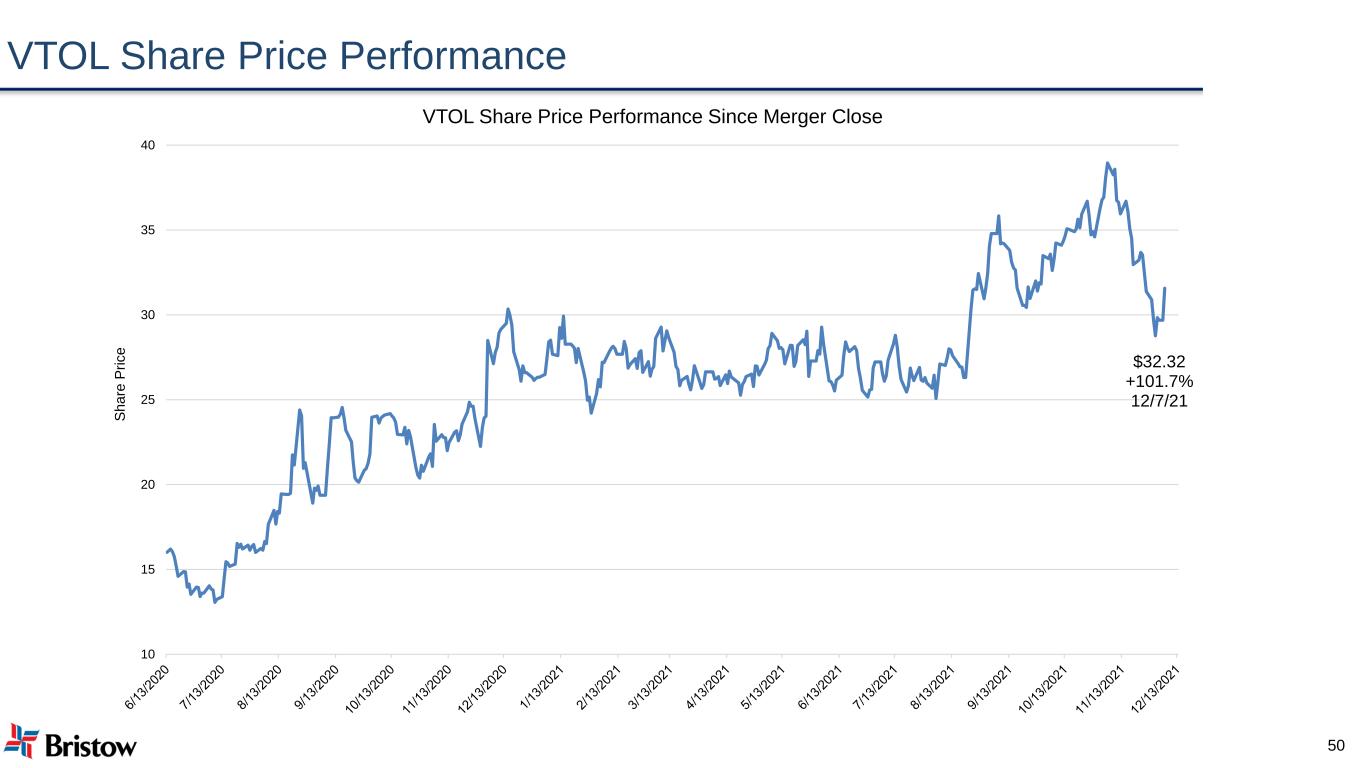

VTOL Share Price Performance 50 $32.32 +101.7% 12/7/21 10 15 20 25 30 35 40 S h a re P ri c e VTOL Share Price Performance Since Merger Close

Why Invest in Bristow Global Leader in Vertical Flight Solutions Well Positioned for Additional Strategic Opportunities Strong Balance Sheet with Robust Free Cash Flow Generation Meaningful Value Enhancement from Achievement of Cost Synergies Diverse Customer Base and End Markets 51

Appendix Q&A

53 11 Appendix Appendix ⮚ Fleet Overview ⮚ Balance Sheet and Liquidity Position ⮚ Reconciliation of LTM Adjusted EBITDA ⮚ Reconciliation of Free Cash Flow ⮚ Operating Revenues and Flight Hours by Line of Servic ⮚ LTM Operating Revenues Appendix

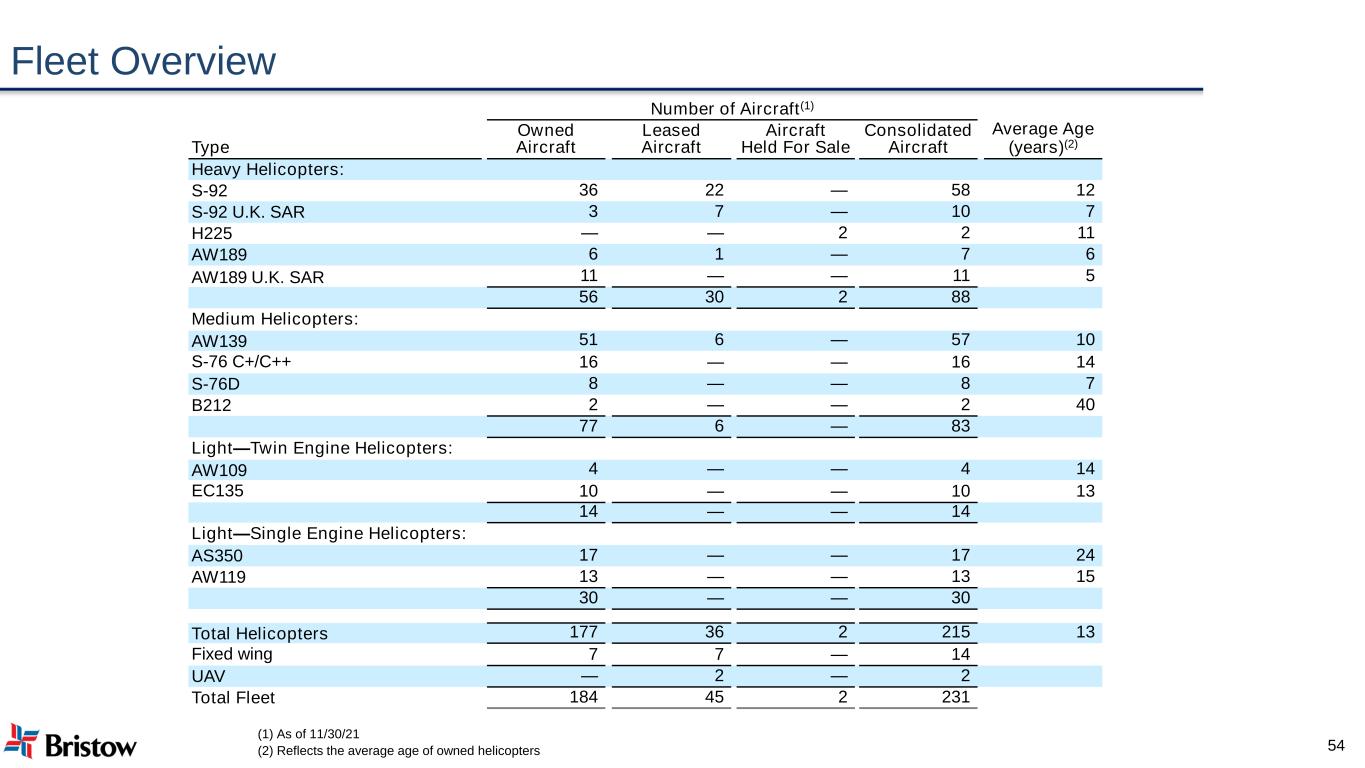

Number of Aircraft(1) Type Owned Aircraft Leased Aircraft Aircraft Held For Sale Consolidated Aircraft Average Age (years)(2) Heavy Helicopters: S-92 36 22 — 58 12 S-92 U.K. SAR 3 7 — 10 7 H225 — — 2 2 11 AW189 6 1 — 7 6 AW189 U.K. SAR 11 — — 11 5 56 30 2 88 Medium Helicopters: AW139 51 6 — 57 10 S-76 C+/C++ 16 — — 16 14 S-76D 8 — — 8 7 B212 2 — — 2 40 77 6 — 83 Light—Twin Engine Helicopters: AW109 4 — — 4 14 EC135 10 — — 10 13 14 — — 14 Light—Single Engine Helicopters: AS350 17 — — 17 24 AW119 13 — — 13 15 30 — — 30 Total Helicopters 177 36 2 215 13 Fixed wing 7 7 — 14 UAV — 2 — 2 Total Fleet 184 45 2 231 Fleet Overview (1) As of 11/30/21 (2) Reflects the average age of owned helicopters 54

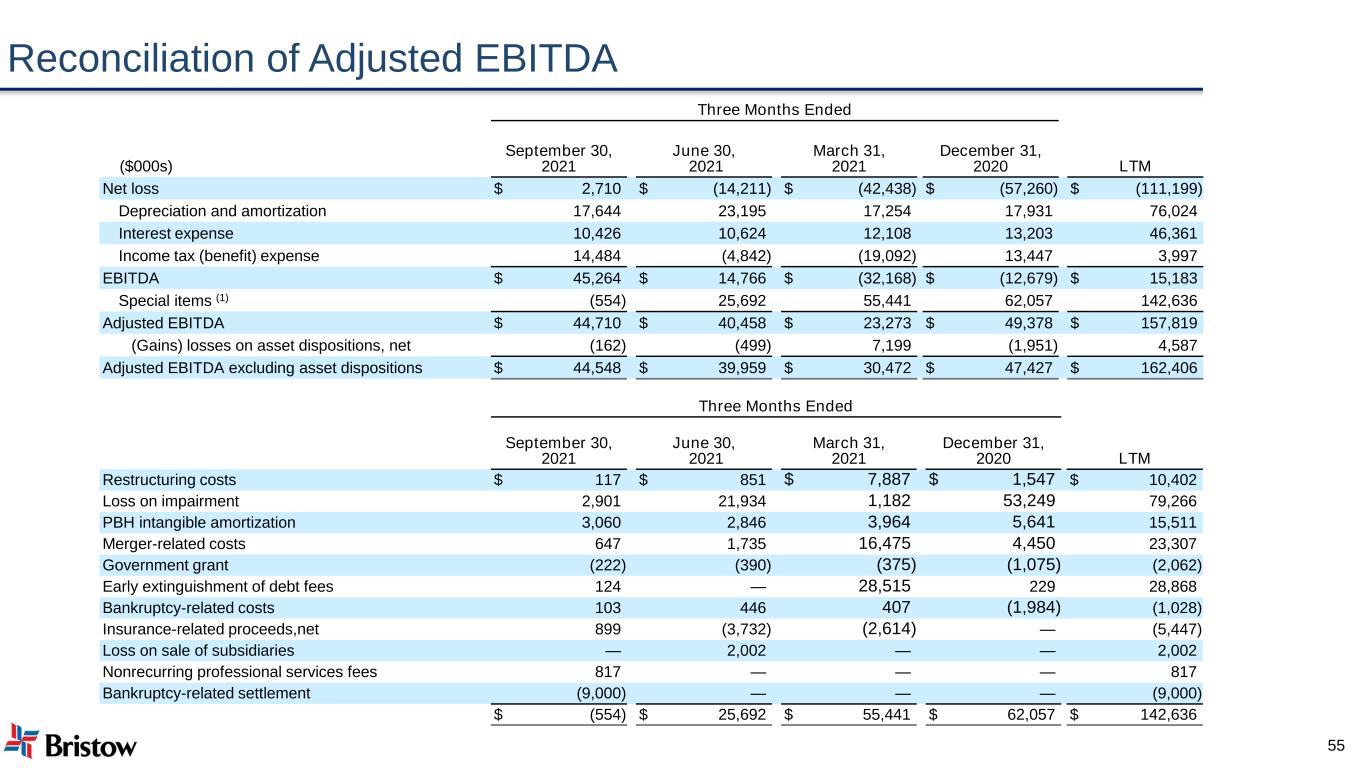

Reconciliation of Adjusted EBITDA Three Months Ended ($000s) September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 LTM Net loss $ 2,710 $ (14,211) $ (42,438) $ (57,260) $ (111,199) Depreciation and amortization 17,644 23,195 17,254 17,931 76,024 Interest expense 10,426 10,624 12,108 13,203 46,361 Income tax (benefit) expense 14,484 (4,842) (19,092) 13,447 3,997 EBITDA $ 45,264 $ 14,766 $ (32,168) $ (12,679) $ 15,183 Special items (1) (554) 25,692 55,441 62,057 142,636 Adjusted EBITDA $ 44,710 $ 40,458 $ 23,273 $ 49,378 $ 157,819 (Gains) losses on asset dispositions, net (162) (499) 7,199 (1,951) 4,587 Adjusted EBITDA excluding asset dispositions $ 44,548 $ 39,959 $ 30,472 $ 47,427 $ 162,406 55 Three Months Ended September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 LTM Restructuring costs $ 117 $ 851 $ 7,887 $ 1,547 $ 10,402 Loss on impairment 2,901 21,934 1,182 53,249 79,266 PBH intangible amortization 3,060 2,846 3,964 5,641 15,511 Merger-related costs 647 1,735 16,475 4,450 23,307 Government grant (222) (390) (375) (1,075) (2,062) Early extinguishment of debt fees 124 — 28,515 229 28,868 Bankruptcy-related costs 103 446 407 (1,984) (1,028) Insurance-related proceeds,net 899 (3,732) (2,614) — (5,447) Loss on sale of subsidiaries — 2,002 — — 2,002 Nonrecurring professional services fees 817 — — — 817 Bankruptcy-related settlement (9,000) — — — (9,000) $ (554) $ 25,692 $ 55,441 $ 62,057 $ 142,636

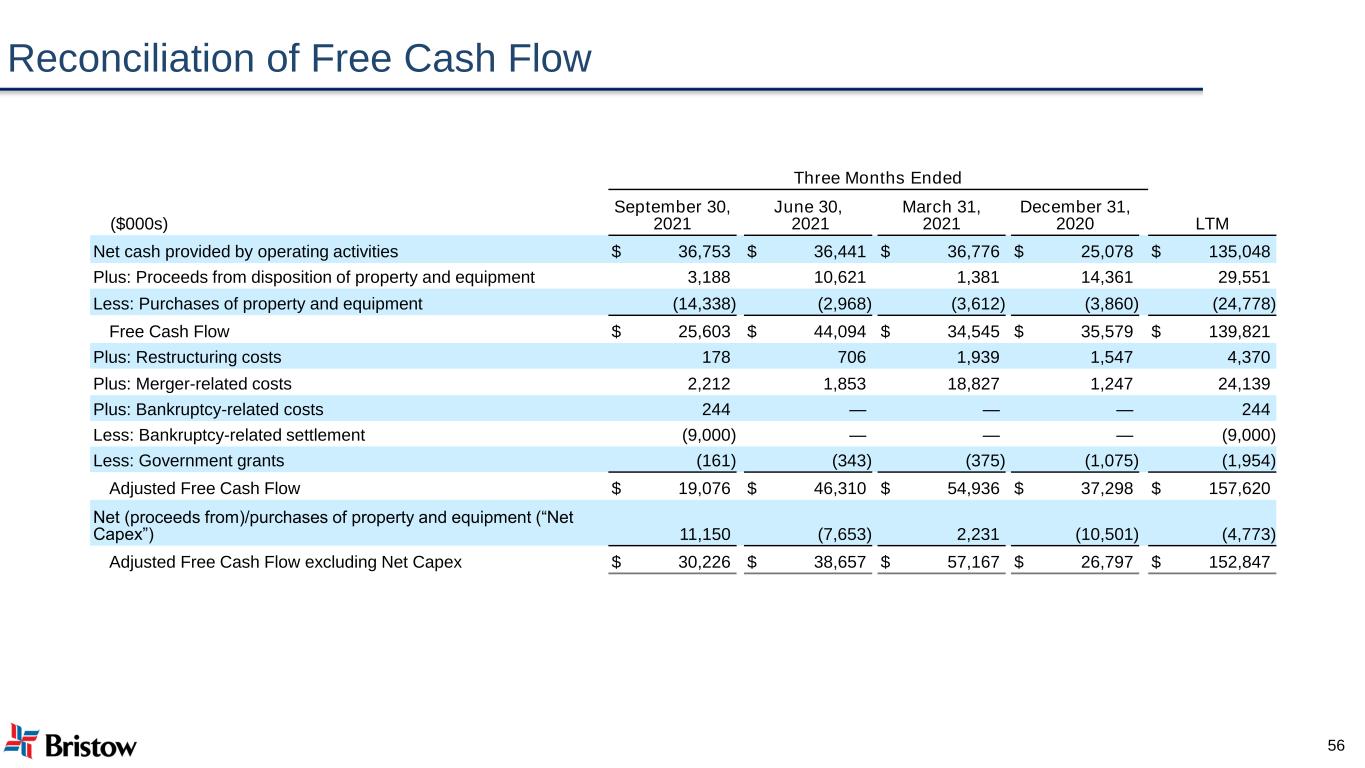

Reconciliation of Free Cash Flow Three Months Ended ($000s) September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 LTM Net cash provided by operating activities $ 36,753 $ 36,441 $ 36,776 $ 25,078 $ 135,048 Plus: Proceeds from disposition of property and equipment 3,188 10,621 1,381 14,361 29,551 Less: Purchases of property and equipment (14,338) (2,968) (3,612) (3,860) (24,778) Free Cash Flow $ 25,603 $ 44,094 $ 34,545 $ 35,579 $ 139,821 Plus: Restructuring costs 178 706 1,939 1,547 4,370 Plus: Merger-related costs 2,212 1,853 18,827 1,247 24,139 Plus: Bankruptcy-related costs 244 — — — 244 Less: Bankruptcy-related settlement (9,000) — — — (9,000) Less: Government grants (161) (343) (375) (1,075) (1,954) Adjusted Free Cash Flow $ 19,076 $ 46,310 $ 54,936 $ 37,298 $ 157,620 Net (proceeds from)/purchases of property and equipment (“Net Capex”) 11,150 (7,653) 2,231 (10,501) (4,773) Adjusted Free Cash Flow excluding Net Capex $ 30,226 $ 38,657 $ 57,167 $ 26,797 $ 152,847 56

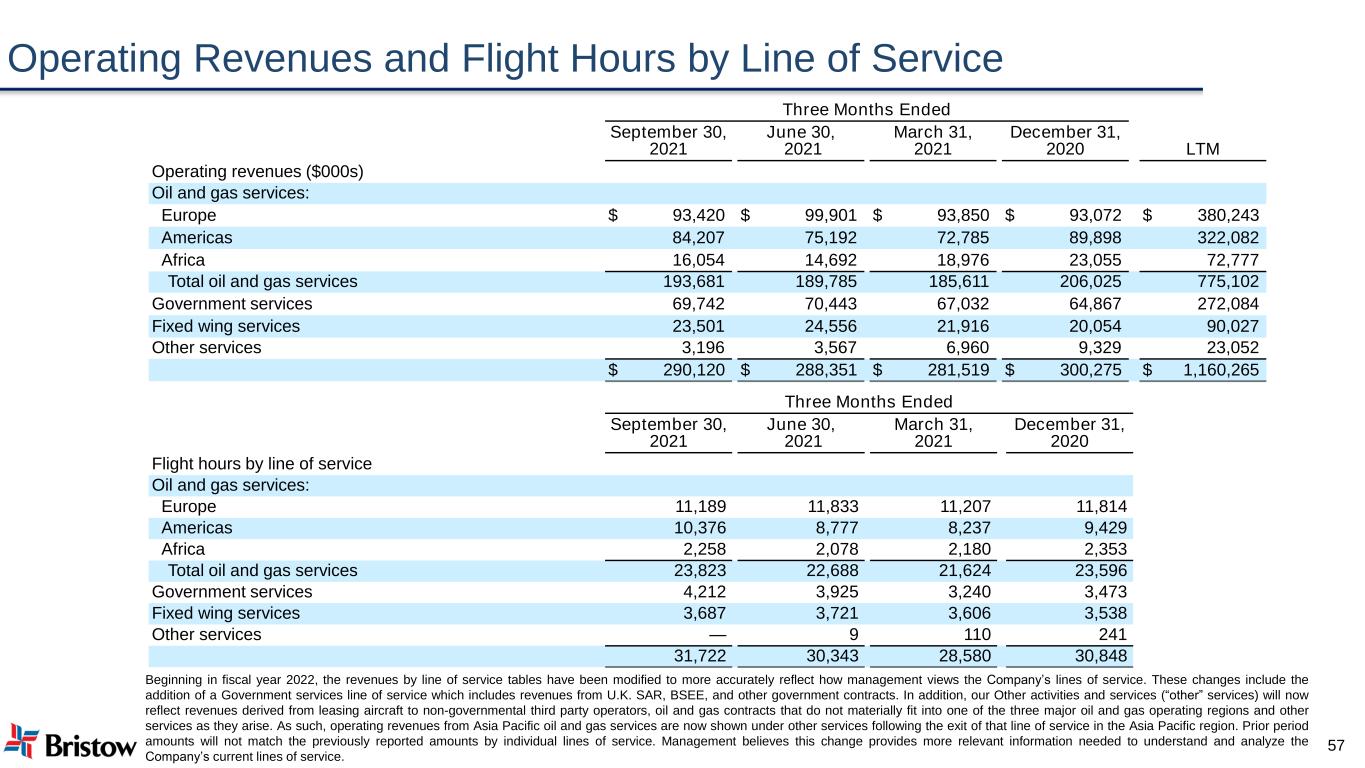

Operating Revenues and Flight Hours by Line of Service Three Months Ended September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 LTM Operating revenues ($000s) Oil and gas services: Europe $ 93,420 $ 99,901 $ 93,850 $ 93,072 $ 380,243 Americas 84,207 75,192 72,785 89,898 322,082 Africa 16,054 14,692 18,976 23,055 72,777 Total oil and gas services 193,681 189,785 185,611 206,025 775,102 Government services 69,742 70,443 67,032 64,867 272,084 Fixed wing services 23,501 24,556 21,916 20,054 90,027 Other services 3,196 3,567 6,960 9,329 23,052 $ 290,120 $ 288,351 $ 281,519 $ 300,275 $ 1,160,265 Three Months Ended September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 Flight hours by line of service Oil and gas services: Europe 11,189 11,833 11,207 11,814 Americas 10,376 8,777 8,237 9,429 Africa 2,258 2,078 2,180 2,353 Total oil and gas services 23,823 22,688 21,624 23,596 Government services 4,212 3,925 3,240 3,473 Fixed wing services 3,687 3,721 3,606 3,538 Other services — 9 110 241 31,722 30,343 28,580 30,848 Beginning in fiscal year 2022, the revenues by line of service tables have been modified to more accurately reflect how management views the Company’s lines of service. These changes include the addition of a Government services line of service which includes revenues from U.K. SAR, BSEE, and other government contracts. In addition, our Other activities and services (“other” services) will now reflect revenues derived from leasing aircraft to non-governmental third party operators, oil and gas contracts that do not materially fit into one of the three major oil and gas operating regions and other services as they arise. As such, operating revenues from Asia Pacific oil and gas services are now shown under other services following the exit of that line of service in the Asia Pacific region. Prior period amounts will not match the previously reported amounts by individual lines of service. Management believes this change provides more relevant information needed to understand and analyze the Company’s current lines of service. 57

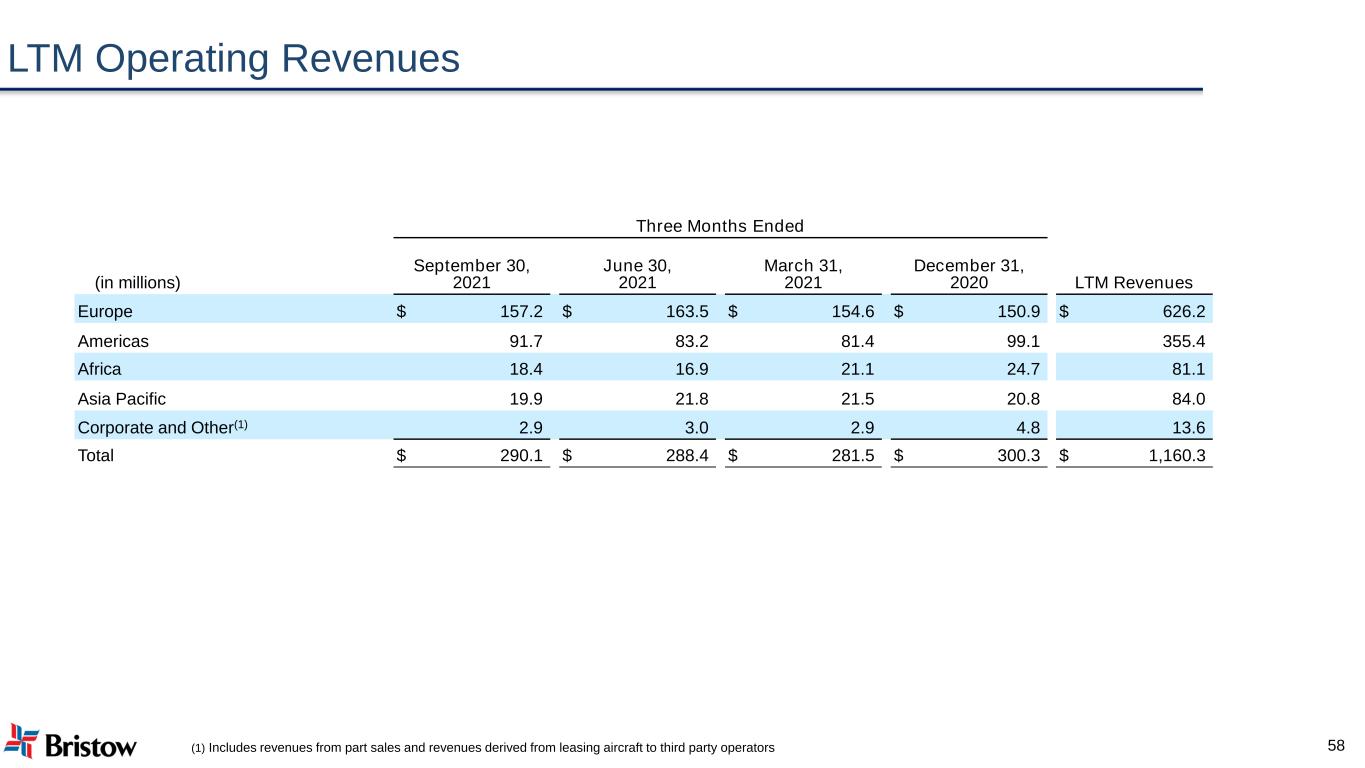

LTM Operating Revenues Three Months Ended (in millions) September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 LTM Revenues Europe $ 157.2 $ 163.5 $ 154.6 $ 150.9 $ 626.2 Americas 91.7 83.2 81.4 99.1 355.4 Africa 18.4 16.9 21.1 24.7 81.1 Asia Pacific 19.9 21.8 21.5 20.8 84.0 Corporate and Other(1) 2.9 3.0 2.9 4.8 13.6 Total $ 290.1 $ 288.4 $ 281.5 $ 300.3 $ 1,160.3 58(1) Includes revenues from part sales and revenues derived from leasing aircraft to third party operators

Appendix Bristow Group Inc. (NYSE: VTOL) 3151 Briarpark Drive Suite 700 Houston, TX 77042 InvestorRelations@bristowgroup.com www.bristowgroup.com/investors Contact Us