1 81249055 AMENDMENT AGREEMENT THIS AMENDMENT AGREEMENT is made and entered into as of 8 December 2021 AMONG:- (1) LOMBARD NORTH CENTRAL PLC as administrative agent for the Lenders (the "Agent"); (2) LOMBARD NORTH CENTRAL PLC as Security Trustee; (3) LOMBARD NORTH CENTRAL PLC as Lender; (4) BRISTOW U.S. LEASING LLC (the "Borrower"); (5) BRISTOW GROUP INC. (the "Guarantor"). WHEREAS:- (A) The parties to this Amendment Agreement (the "Parties") are party to a $109,890,000 (or GBP equivalent) term loan credit agreement dated as of 11 November 2016 as amended, restated, varied, supplemented, extended, modified or replaced from time to time prior to the date hereof (the "Agreement"). (B) The Borrower's obligations under the Agreement are guaranteed by the Guarantor. (C) The Parties have agreed to enter into this Amendment Agreement for the purposes of amending the Agreement such that, amongst other changes, it will be linked to SONIA rather than LIBOR (each as defined below). IT IS AGREED as follows:- 1. INTRODUCTION 1.1 Unless otherwise defined in this Amendment Agreement, words and expressions used in the Agreement shall bear the same meanings in this Amendment Agreement. 1.2 Any principles of construction set out in the Agreement shall have effect as if set out in full in this Amendment Agreement. 2. DESIGNATION This Amendment Agreement is a Loan Document, if that term is defined in the Agreement. 3. DEFINED TERMS 3.1 "Agreement" has the meaning given to that term in the Recitals to this Amendment Agreement. 3.2 "Amendments" means the amendments to the Agreement as set out in Clauses 5 and 6 below. 3.3 "Amendment Effective Date" means the first day of the first Interest Period starting after the occurrence of the Cessation Date (it being acknowleged that any interest due to be paid on the Amendment Effective Date shall be paid in accordance with the provisions of the Agreement as in effect immediately prior to the Amendment Effective Date). 3.4 "Cessation Date" has the meaning given to that term in Clause 6 below. 3.5 "Interest Period" has the meaning given to the term "Interest Period" or any other period by reference to which the interest payable for a period is calculated, in each case as defined or specified in the Agreement. 3.6 "Obligor" means each of the Borrower and the Guarantor. 4. CONSTRUCTION 4.1 The provisions of the Agreement, any other Loan Documents and other documents ancillary or related to the Agreement and/or the Loan Documents or any of them shall, save as amended by the terms of this Amendment Agreement, continue in full force and effect. 4.2 After the Amendment Effective Date, this Amendment Agreement shall be read and construed as one with the Agreement so that all references in the Agreement to "this Agreement", "hereunder", "herein" and similar expressions shall be references to the Agreement as amended or varied by this Amendment Agreement. Exhibit 10.2

2 4.3 If the Amendments and/or any other terms herein conflict with any terms of the Agreement, the Amendments and other terms herein shall prevail. 4.4 The Parties agree that the Amendments shall take effect notwithstanding any conditions in the Agreement that would otherwise apply to the making of such Amendments including, without limitation, a requirement for a notice period to have elapsed, or a consultation requirement. 5. AMENDMENTS TO THE AGREEMENT The following Amendments are made to the Agreement and will take effect from and including the Amendment Effective Date: - 5.1 Replacement of LIBOR 5.1.1 The calculation of interest under the Agreement by reference to, or as derived from, a LIBOR Reference is amended so that interest is instead calculated on a daily basis by reference to, and using the methodology set out for, the Sterling Relevant Reference Rate (as defined in Clause 6 below). 5.1.2 For the purposes of this Clause 5.1, "LIBOR Reference" means: (a) the LIBOR Rate (as defined in the Agreement); (b) the London interbank offered rate (whether or not administered by ICE Benchmark Administration Limited (“ICE BA”) or any predecessor (whether direct or indirect) of ICE BA); (c) the London interbank market; (d) any interbank offered rate; (e) the rate at which Sterling deposits of comparable amount to principal amount of the loan made by the Lenders to the Borrower and for the relevant Interest Period are offered by or to the Lenders; (f) the rate at which a financial institution or financial institutions lend to or, borrow from, or quote to lend to or borrow from, other financial institutions; (g) the Agent's or Lenders' fixing or other determination of the London interbank offered rate, or any wording of similar effect however expressed or defined (including any interpolated rate), and "LIBOR Rate" shall mean the rate of, or derived from, that LIBOR Reference. 5.1.3 The application (whether pursuant to an express or an implied term of the Agreement) of any zero floor, or other floor, to a LIBOR Reference, or to the aggregate of a LIBOR Reference and the applicable margin, shall continue to apply in the Agreement (as amended by this Amendment Agreement) with any LIBOR Reference in such context being a reference to the Sterling Relevant Reference Rate (as defined in Clause 6 below). 5.2 Break costs and early repayment charges 5.2.1 The Parties agree that Borrower shall not be obligated to make any indemnity payment pursuant to section 2.15 (Funding Indemnity and other Losses) of the Agreement as a result of the payment of any principal of a Term Loan on any day other than the last day of the Interest Period applicable thereto. 5.2.2 Clause 5.2.1 is subject to, and without prejudice to the provisions of section 2.8(c) (Optional Prepayments) of the Agreement. 5.3 Fallback provisions and cost of funds To the extent that the Agreement contains such provisions, provisions setting out how interest is calculated should the LIBOR Rate cease to be available, or cease to be available for the term of the relevant Interest Period, or that adequate and fair means do not exist to ascertain the LIBOR Rate, or that the fallback interest reference rate should be to the Lenders' cost of funds (or similar term) however defined or expressed, are deleted and the fallback interest reference rate (if applicable) shall instead be as provided for in the definition of "Daily Rate" (as set out in Clause 6 below). The Agent will notify you in writing if SONIA ceases to be available and tell you which rate the Lenders are using as an alternative.

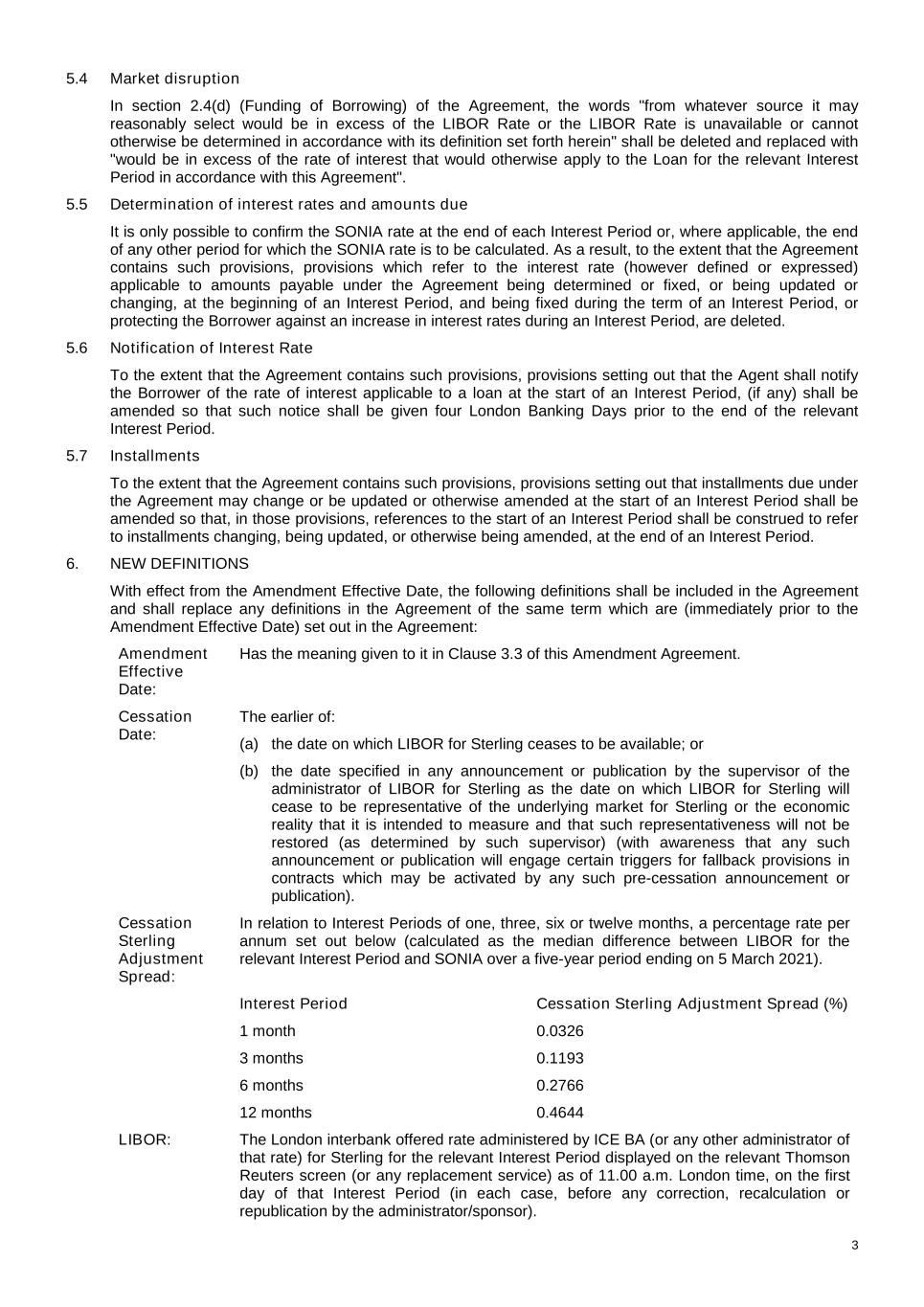

3 5.4 Market disruption In section 2.4(d) (Funding of Borrowing) of the Agreement, the words "from whatever source it may reasonably select would be in excess of the LIBOR Rate or the LIBOR Rate is unavailable or cannot otherwise be determined in accordance with its definition set forth herein" shall be deleted and replaced with "would be in excess of the rate of interest that would otherwise apply to the Loan for the relevant Interest Period in accordance with this Agreement". 5.5 Determination of interest rates and amounts due It is only possible to confirm the SONIA rate at the end of each Interest Period or, where applicable, the end of any other period for which the SONIA rate is to be calculated. As a result, to the extent that the Agreement contains such provisions, provisions which refer to the interest rate (however defined or expressed) applicable to amounts payable under the Agreement being determined or fixed, or being updated or changing, at the beginning of an Interest Period, and being fixed during the term of an Interest Period, or protecting the Borrower against an increase in interest rates during an Interest Period, are deleted. 5.6 Notification of Interest Rate To the extent that the Agreement contains such provisions, provisions setting out that the Agent shall notify the Borrower of the rate of interest applicable to a loan at the start of an Interest Period, (if any) shall be amended so that such notice shall be given four London Banking Days prior to the end of the relevant Interest Period. 5.7 Installments To the extent that the Agreement contains such provisions, provisions setting out that installments due under the Agreement may change or be updated or otherwise amended at the start of an Interest Period shall be amended so that, in those provisions, references to the start of an Interest Period shall be construed to refer to installments changing, being updated, or otherwise being amended, at the end of an Interest Period. 6. NEW DEFINITIONS With effect from the Amendment Effective Date, the following definitions shall be included in the Agreement and shall replace any definitions in the Agreement of the same term which are (immediately prior to the Amendment Effective Date) set out in the Agreement: Amendment Effective Date: Has the meaning given to it in Clause 3.3 of this Amendment Agreement. Cessation Date: The earlier of: (a) the date on which LIBOR for Sterling ceases to be available; or (b) the date specified in any announcement or publication by the supervisor of the administrator of LIBOR for Sterling as the date on which LIBOR for Sterling will cease to be representative of the underlying market for Sterling or the economic reality that it is intended to measure and that such representativeness will not be restored (as determined by such supervisor) (with awareness that any such announcement or publication will engage certain triggers for fallback provisions in contracts which may be activated by any such pre-cessation announcement or publication). Cessation Sterling Adjustment Spread: In relation to Interest Periods of one, three, six or twelve months, a percentage rate per annum set out below (calculated as the median difference between LIBOR for the relevant Interest Period and SONIA over a five-year period ending on 5 March 2021). Interest Period Cessation Sterling Adjustment Spread (%) 1 month 0.0326 3 months 0.1193 6 months 0.2766 12 months 0.4644 LIBOR: The London interbank offered rate administered by ICE BA (or any other administrator of that rate) for Sterling for the relevant Interest Period displayed on the relevant Thomson Reuters screen (or any replacement service) as of 11.00 a.m. London time, on the first day of that Interest Period (in each case, before any correction, recalculation or republication by the administrator/sponsor).

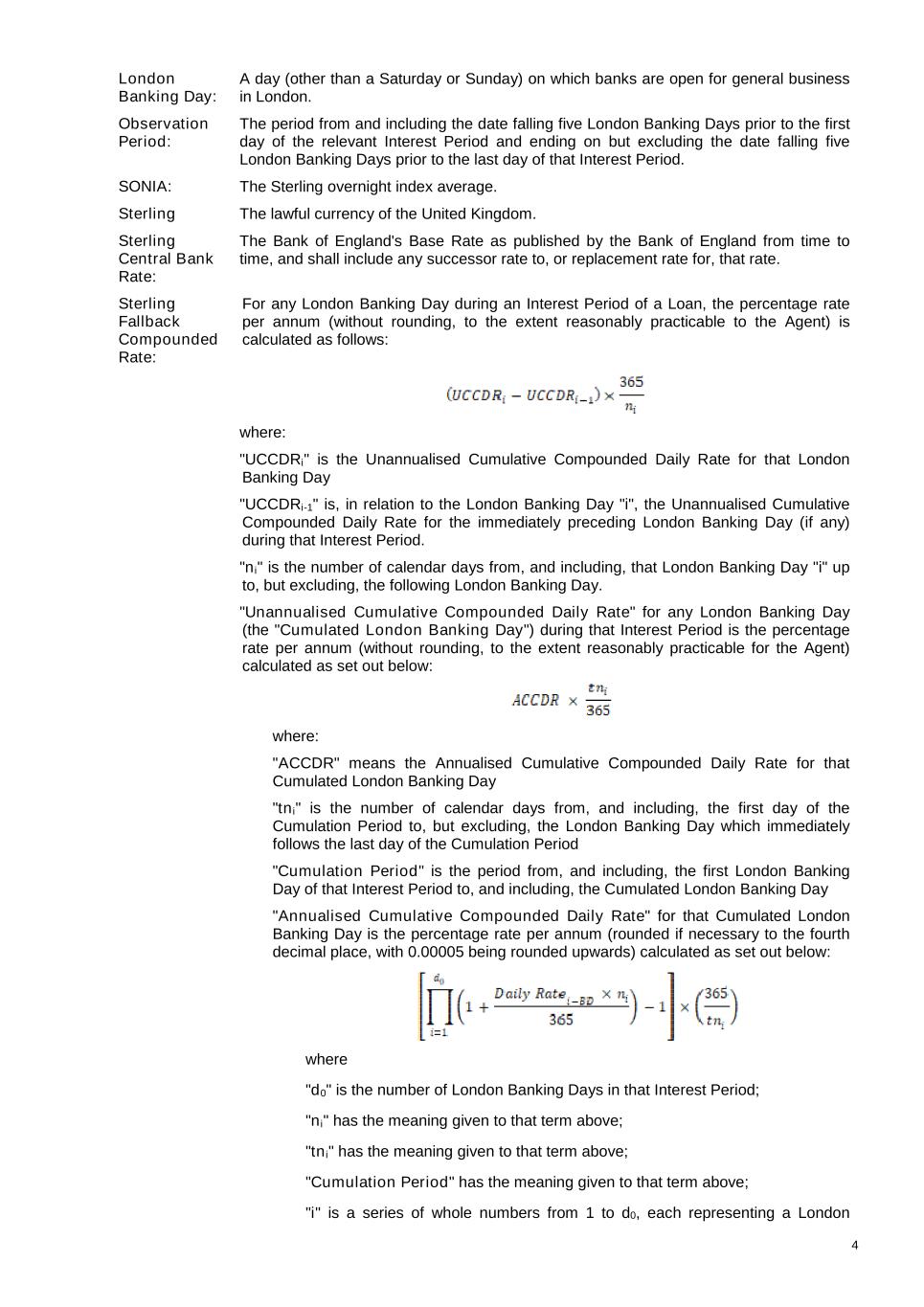

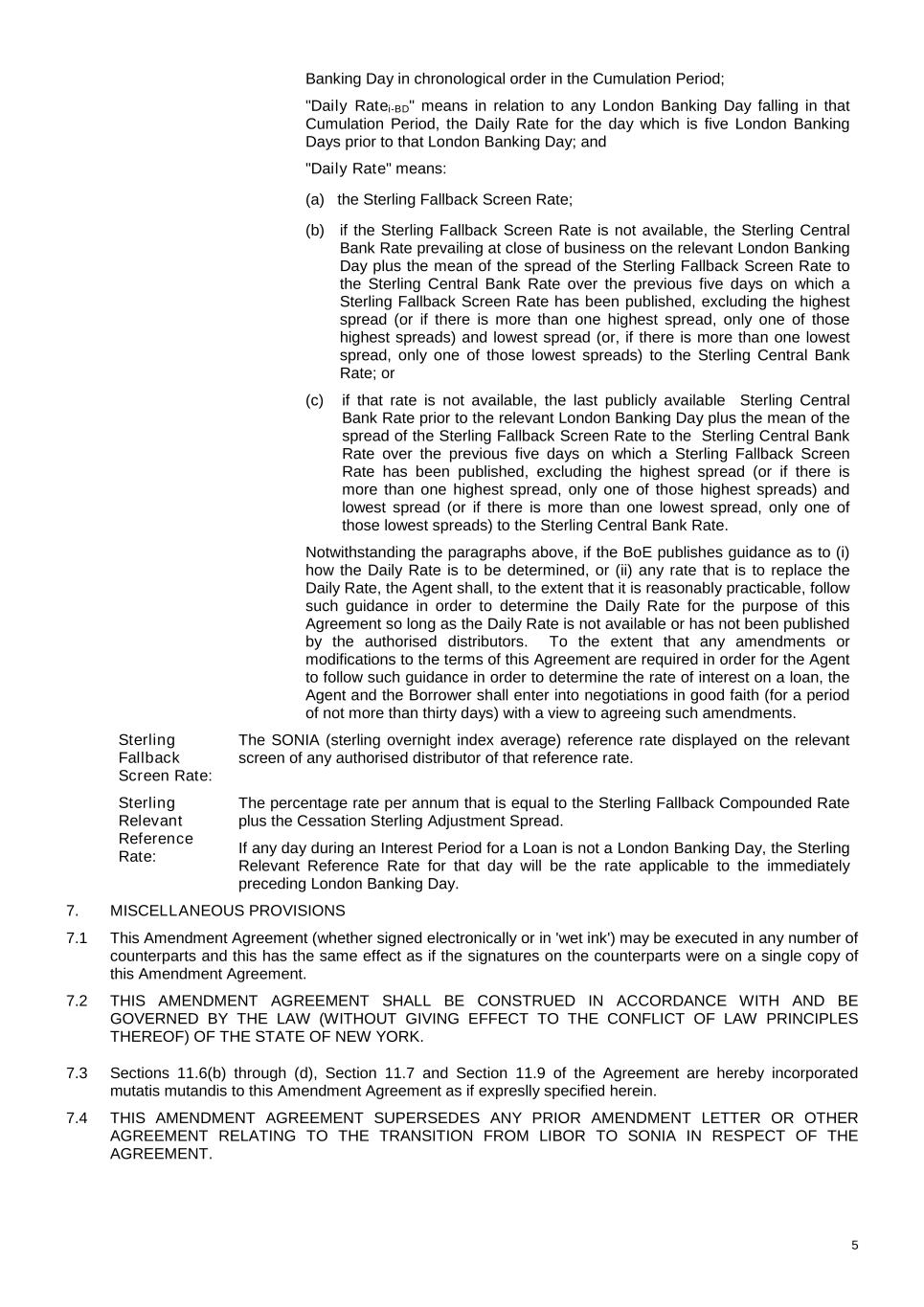

4 London Banking Day: A day (other than a Saturday or Sunday) on which banks are open for general business in London. Observation Period: The period from and including the date falling five London Banking Days prior to the first day of the relevant Interest Period and ending on but excluding the date falling five London Banking Days prior to the last day of that Interest Period. SONIA: The Sterling overnight index average. Sterling The lawful currency of the United Kingdom. Sterling Central Bank Rate: The Bank of England's Base Rate as published by the Bank of England from time to time, and shall include any successor rate to, or replacement rate for, that rate. Sterling Fallback Compounded Rate: For any London Banking Day during an Interest Period of a Loan, the percentage rate per annum (without rounding, to the extent reasonably practicable to the Agent) is calculated as follows: where: "UCCDRi" is the Unannualised Cumulative Compounded Daily Rate for that London Banking Day "UCCDRi-1" is, in relation to the London Banking Day "i", the Unannualised Cumulative Compounded Daily Rate for the immediately preceding London Banking Day (if any) during that Interest Period. "ni" is the number of calendar days from, and including, that London Banking Day "i" up to, but excluding, the following London Banking Day. "Unannualised Cumulative Compounded Daily Rate" for any London Banking Day (the "Cumulated London Banking Day") during that Interest Period is the percentage rate per annum (without rounding, to the extent reasonably practicable for the Agent) calculated as set out below: where: "ACCDR" means the Annualised Cumulative Compounded Daily Rate for that Cumulated London Banking Day "tni" is the number of calendar days from, and including, the first day of the Cumulation Period to, but excluding, the London Banking Day which immediately follows the last day of the Cumulation Period "Cumulation Period" is the period from, and including, the first London Banking Day of that Interest Period to, and including, the Cumulated London Banking Day "Annualised Cumulative Compounded Daily Rate" for that Cumulated London Banking Day is the percentage rate per annum (rounded if necessary to the fourth decimal place, with 0.00005 being rounded upwards) calculated as set out below: where "d0" is the number of London Banking Days in that Interest Period; "ni" has the meaning given to that term above; "tni" has the meaning given to that term above; "Cumulation Period" has the meaning given to that term above; "i" is a series of whole numbers from 1 to d0, each representing a London

5 Banking Day in chronological order in the Cumulation Period; "Daily Ratei-BD" means in relation to any London Banking Day falling in that Cumulation Period, the Daily Rate for the day which is five London Banking Days prior to that London Banking Day; and "Daily Rate" means: (a) the Sterling Fallback Screen Rate; (b) if the Sterling Fallback Screen Rate is not available, the Sterling Central Bank Rate prevailing at close of business on the relevant London Banking Day plus the mean of the spread of the Sterling Fallback Screen Rate to the Sterling Central Bank Rate over the previous five days on which a Sterling Fallback Screen Rate has been published, excluding the highest spread (or if there is more than one highest spread, only one of those highest spreads) and lowest spread (or, if there is more than one lowest spread, only one of those lowest spreads) to the Sterling Central Bank Rate; or (c) if that rate is not available, the last publicly available Sterling Central Bank Rate prior to the relevant London Banking Day plus the mean of the spread of the Sterling Fallback Screen Rate to the Sterling Central Bank Rate over the previous five days on which a Sterling Fallback Screen Rate has been published, excluding the highest spread (or if there is more than one highest spread, only one of those highest spreads) and lowest spread (or if there is more than one lowest spread, only one of those lowest spreads) to the Sterling Central Bank Rate. Notwithstanding the paragraphs above, if the BoE publishes guidance as to (i) how the Daily Rate is to be determined, or (ii) any rate that is to replace the Daily Rate, the Agent shall, to the extent that it is reasonably practicable, follow such guidance in order to determine the Daily Rate for the purpose of this Agreement so long as the Daily Rate is not available or has not been published by the authorised distributors. To the extent that any amendments or modifications to the terms of this Agreement are required in order for the Agent to follow such guidance in order to determine the rate of interest on a loan, the Agent and the Borrower shall enter into negotiations in good faith (for a period of not more than thirty days) with a view to agreeing such amendments. Sterling Fallback Screen Rate: The SONIA (sterling overnight index average) reference rate displayed on the relevant screen of any authorised distributor of that reference rate. Sterling Relevant Reference Rate: The percentage rate per annum that is equal to the Sterling Fallback Compounded Rate plus the Cessation Sterling Adjustment Spread. If any day during an Interest Period for a Loan is not a London Banking Day, the Sterling Relevant Reference Rate for that day will be the rate applicable to the immediately preceding London Banking Day. 7. MISCELLANEOUS PROVISIONS 7.1 This Amendment Agreement (whether signed electronically or in 'wet ink') may be executed in any number of counterparts and this has the same effect as if the signatures on the counterparts were on a single copy of this Amendment Agreement. 7.2 THIS AMENDMENT AGREEMENT SHALL BE CONSTRUED IN ACCORDANCE WITH AND BE GOVERNED BY THE LAW (WITHOUT GIVING EFFECT TO THE CONFLICT OF LAW PRINCIPLES THEREOF) OF THE STATE OF NEW YORK. 7.3 Sections 11.6(b) through (d), Section 11.7 and Section 11.9 of the Agreement are hereby incorporated mutatis mutandis to this Amendment Agreement as if expreslly specified herein. 7.4 THIS AMENDMENT AGREEMENT SUPERSEDES ANY PRIOR AMENDMENT LETTER OR OTHER AGREEMENT RELATING TO THE TRANSITION FROM LIBOR TO SONIA IN RESPECT OF THE AGREEMENT.

6 8. CONSENT AND ACKNOWLEDGEMENT 8.1 By executing this Amendment Agreement the Guarantor acknowledges receipt of a copy of this Amendment Agreement and consents to the changes outlined herein. 8.2 Each Obligor: 8.2.1 confirms that the Parent Guaranty remains in full force and effect after giving effect to this Amendment Agreement and all documents ancillary or incidental thereto; and 8.2.2 agrees that the terms “Credit Agreement” as used in the Parent Guaranty shall mean the Agreement as amended and supplemented by this Amendment Agreement and as the same may be further amended, supplemented and/or novated from time to time. 8.3 The Borrower: 8.3.1 confirms that the Liens created by each Mortgage and each Lease Assignment remain in full force and effect after giving effect to this Amendment Agreement and all documents ancillary or incidental thereto; and 8.3.2 agrees that the terms “Credit Agreement” as used in any Mortgage or any Lease Assignment shall mean the Agreement as amended and supplemented by this Amendment Agreement and as the same may be further amended, supplemented and/or novated from time to time. 9. POWERS AND AUTHORITY By signing this Amendment Agreement, each Obligor confirms to the Finance Parties that it has the power to enter into and perform and where applicable, has taken all necessary action to authorise the entry into, performance and delivery of, this Amendment Agreement and the transactions contemplated by this Amendment Agreement.

7 IN WITNESS WHEREOF, the parties hereto have caused this Amendment Agreement to be duly executed by their respective authorized officers as of the day and year first above written. BRISTOW U.S. LEASING LLC By Name: Title: BRISTOW GROUP INC. By Name: Title: LOMBARD NORTH CENTRAL PLC as Administrative Agent and as a Lender By Name: Title: LOMBARD NORTH CENTRAL PLC as Security Trustee By Name: Title: Joseph Pitzinger Vice President and Treasurer Joseph Pitzinger Vice President, Treasurer and Corporate Development /s/ Joseph Pitzinger /s/ Joseph Pitzinger /s/ Janette Miller Janette Miller Director, Portfolio Management /s/ Janette Miller Janette Miller Director, Portfolio Management