Q4 and FY22 Earnings Presentation June 1, 2022 Exhibit 99.2

Q4 FY22 Earnings Call Agenda I. Introduction Crystal Gordon, SVP and General Counsel II. Operational Highlights Chris Bradshaw, President and CEO III. Financial Review Jennifer Whalen, SVP and CFO IV. Concluding Remarks Chris Bradshaw, President and CEO V. Questions & Answers 2

This presentation contains “forward-looking statements.” Forward-looking statements represent Bristow Group Inc.’s (the “Company”) current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, reflect management’s current views with respect to future events and therefore are subject to significant risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which the forward- looking statement is based that occur after the date hereof. Risks that may affect forward-looking statements include, but are not necessarily limited to, those relating to: public health crises, such as pandemics (COVID-19) and epidemics, and any related government policies and actions; any failure to effectively manage, and receive anticipated returns from, acquisitions, divestitures, investments, joint ventures and other portfolio actions; our inability to execute our business strategy for diversification efforts related to, government services, offshore wind, and advanced air mobility; our reliance on a limited number of customers and the reduction of our customers base as a result of consolidation and/or the energy transition; the possibility that we may be unable to maintain compliance with covenants in our financing agreements; global and regional changes in the demand, supply, prices or other market conditions affecting oil and gas, including changes resulting from a public health crisis or from the imposition or lifting of crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries (OPEC) and other producing countries; fluctuations in the demand for our services; the possibility that we may impair our long-lived assets and other assets, including inventory, property and equipment and investments in unconsolidated affiliates; the possibility of significant changes in foreign exchange rates and controls; potential effects of increased competition and the introduction of energy efficient alternative modes of transportation and solutions; the possibility that we may be unable to re-deploy our aircraft to regions with greater demand; the possibility of changes in tax and other laws and regulations and policies, including, without limitation, actions of the Biden Administration that impact oil and gas operations or favor renewable energy projects in the U.S.; the possibility that we may be unable to dispose of older aircraft through sales into the aftermarket; general economic conditions, including the capital and credit markets; the possibility that segments of our fleet may be grounded for extended periods of time or indefinitely; the existence of operating risks inherent in our business, including the possibility of declining safety performance; the possibility of political instability, war or acts of terrorism in any of the countries where we operate; the possibility that reductions in spending on aviation services by governmental agencies could lead to modifications of our search and rescue (“SAR”) contract terms with governments, our contracts with the Bureau of Safety and Environmental Enforcement (“BSEE”) or delays in receiving payments under such contracts; the effectiveness of our environmental, social and governance initiatives; the impact of supply chain disruptions and inflation and our ability to recoup rising costs in the rates we charge to our customers; and our reliance on a limited number of helicopter manufacturers and suppliers. If one or more of these risks materializes, or if underlying assumptions prove incorrect, actual results may vary materially from those expected. You should not place undue reliance on our forward-looking statements because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our forward-looking statements are based on the information currently available to us and speak only as of the date hereof. New risks and uncertainties arise from time to time, and it is impossible for us to predict these matters or how they may affect us. We have included important factors in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2022 (the “Annual Report”) which we believe over time, could cause our actual results, performance or achievements to differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements. You should consider all risks and uncertainties disclosed in the Annual Report and in our filings with the United States Securities and Exchange Commission (the “SEC”), all of which are accessible on the SEC’s website at www.sec.gov. Cautionary Statement Regarding Forward-Looking Statements 3

Non-GAAP In addition to financial results calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation includes certain non-GAAP measures including EBITDA, Adjusted EBITDA, Net Debt, Free Cash Flow and Adjusted Free Cash Flow. Each of these measures, detailed below, have limitations, and are provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our filings with the SEC and posted on our website. EBITDA and Adjusted EBITDA are presented as supplemental measures of the Company’s operating performance. EBITDA is defined as Earnings before Interest expense, Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for special items that occurred during the reporting period and noted in the applicable reconciliation. Management believes that the use of EBITDA and Adjusted EBITDA is meaningful to investors because it provides information with respect to our ability to meet our future debt service, capital expenditures and working capital requirements the financial performance of our assets without regard to financing methods, capital structure or historical cost basis. The GAAP measure most directly comparable to EBITDA and Adjusted EBITDA is net income. Since neither EBITDA nor Adjusted EBITDA is a recognized term under GAAP, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for discretionary use, as they do not take into account certain cash requirements, such as debt service requirements. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. Free Cash Flow represents the Company’s net cash provided by operating activities plus proceeds from disposition of property and equipment, less expenditures related to purchases of property and equipment. Adjusted Free Cash Flow is Free Cash Flow adjusted to exclude certain nonrecurring professional services fees, government grants related to the Company’s fixed wing services, other costs paid in relation to the merger between Era Group Inc. (“Era”) and Bristow Group Inc. (prior to such merger, “Old Bristow”) which was completed in June 2020 (the “Merger”), and the implementation of fresh-start accounting and the voluntary petitions filed by Old Bristow and certain of its subsidiaries on May 11, 2019, in the U.S. Bankruptcy Court for the Southern District of Texas, Houston Division seeking relief under Chapter 11 of Title 11 of the U.S. Code (the “Chapter 11 Cases”). Management believes that Free Cash Flow and Adjusted Free Cash Flow are meaningful to investors because they provide information with respect to our ability to generate cash from the business. The GAAP measure most directly comparable to Free Cash Flow and Adjusted Free Cash Flow is net cash provided by operating activities. Since neither Free Cash Flow nor Adjusted Free Cash Flow is a recognized term under GAAP, they should not be used as an indicator of, or an alternative to, net cash provided by operating activities. Investors should note numerous methods may exist for calculating a company's free cash flow. As a result, the method used by management to calculate Free Cash Flow and Adjusted Free Cash Flow may differ from the methods used by other companies to calculate their free cash flow. As such, they may not be comparable to other similarly titled measures used by other companies. The Company also uses Adjusted Free Cash Flow excluding Net Capex. “Net Capex” is defined as net (proceeds from)/purchases of property and equipment. Management uses Adjusted Free Cash Flow excluding Net Capex, and believes this information is meaningful to investors, as an analytical indicator to assess the Company’s liquidity and cash generating performance. The Company also presents Net Debt, which is a non-GAAP measure, defined as total principal balance on borrowings less unrestricted cash and cash equivalents. The GAAP measure most directly comparable to Net Debt is total debt. Since Net Debt is not a recognized term under GAAP, it should not be used as an indicator of, or an alternative to, total debt. Management uses net debt to determine the Company’s outstanding debt obligations that would not be readily satisfied by its cash and cash equivalents on hand. Management believes this metric is useful to investors in determining the Company’s leverage position since the Company has the ability to, and may decide to, use a portion of its cash and cash equivalents to reduce debt. A reconciliation of each of EBITDA, Adjusted EBITDA, Adjusted EBITDA excluding gains or losses on asset dispositions, Free Cash Flow, Adjusted Free Cash Flow, and net debt is included elsewhere in this presentation. Non-GAAP Financial Measures Reconciliation 4

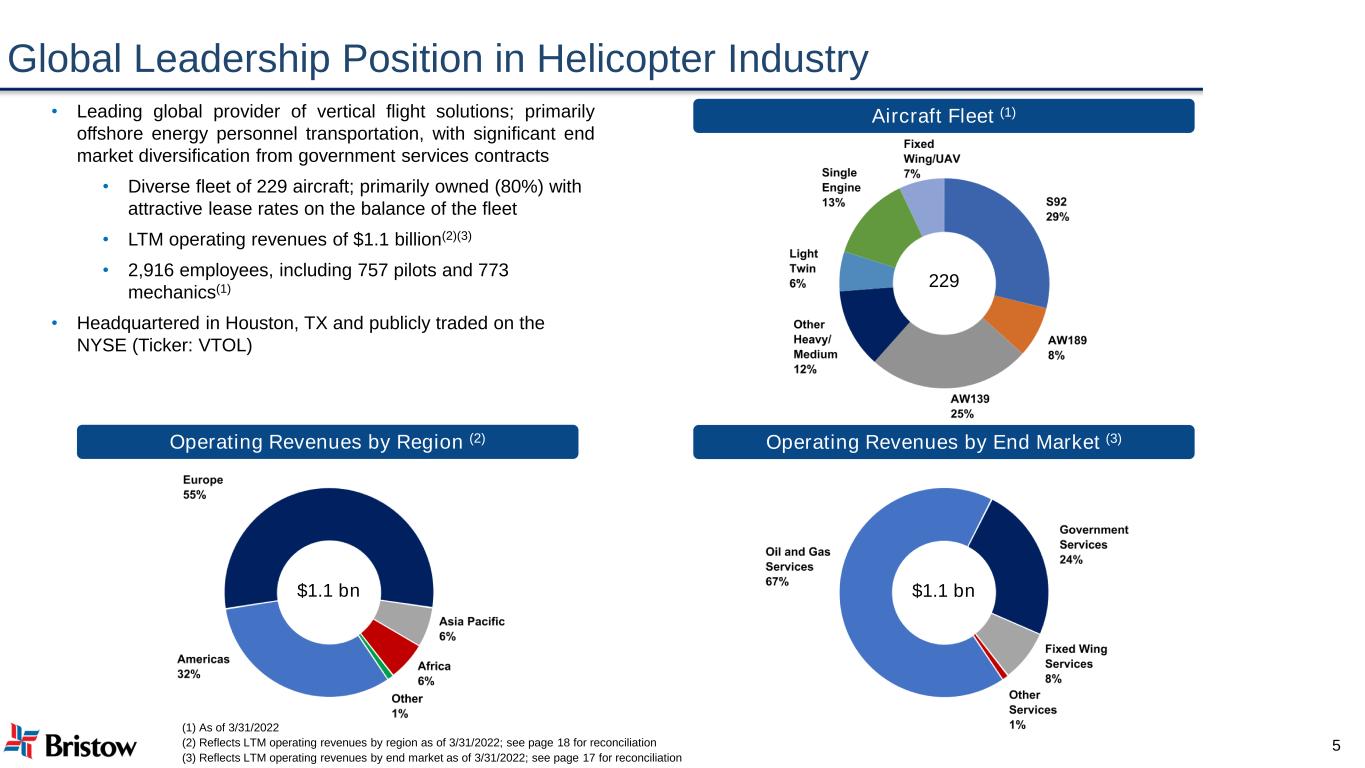

Global Leadership Position in Helicopter Industry Aircraft Fleet (1)• Leading global provider of vertical flight solutions; primarily offshore energy personnel transportation, with significant end market diversification from government services contracts • Diverse fleet of 229 aircraft; primarily owned (80%) with attractive lease rates on the balance of the fleet • LTM operating revenues of $1.1 billion(2)(3) • 2,916 employees, including 757 pilots and 773 mechanics(1) • Headquartered in Houston, TX and publicly traded on the NYSE (Ticker: VTOL) Operating Revenues by End Market (3) (1) As of 3/31/2022 (2) Reflects LTM operating revenues by region as of 3/31/2022; see page 18 for reconciliation (3) Reflects LTM operating revenues by end market as of 3/31/2022; see page 17 for reconciliation 229 $1.1 bn 5 Operating Revenues by Region (2) $1.1 bn

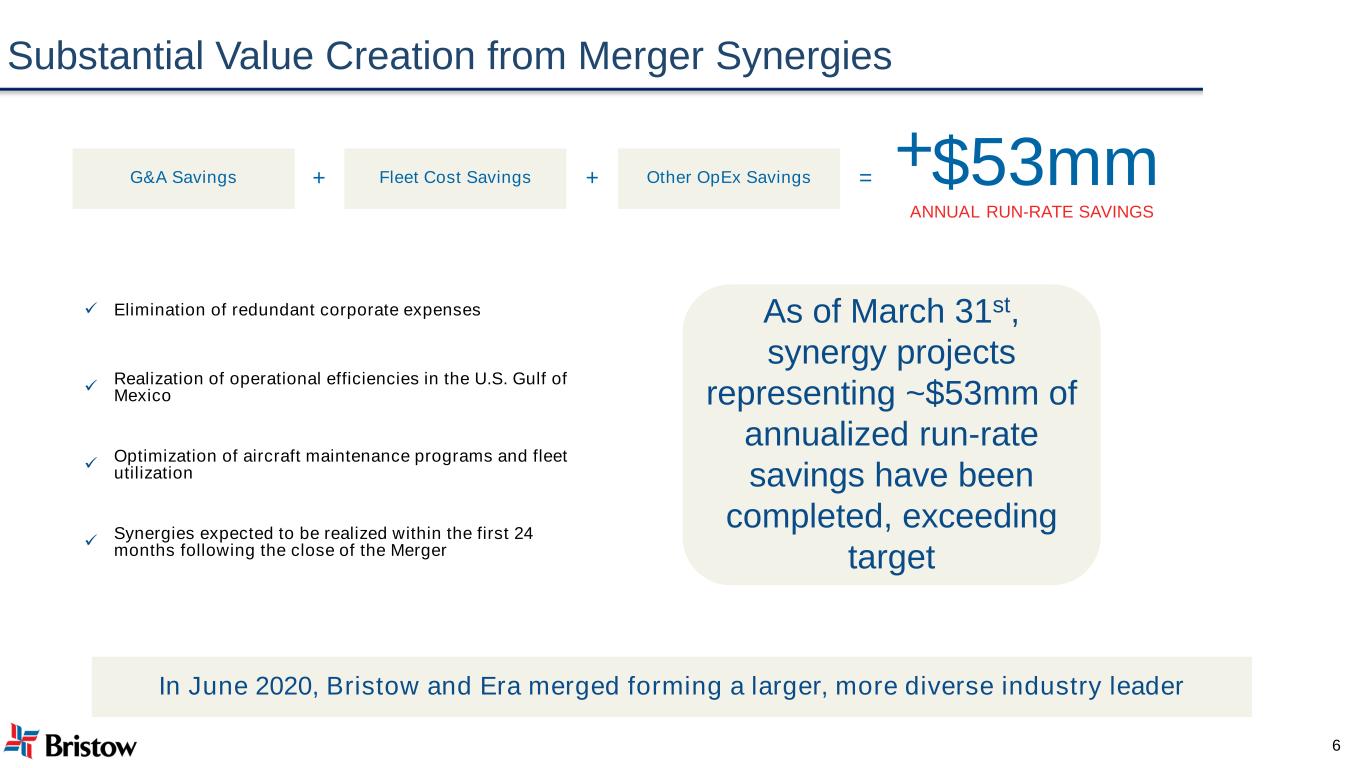

Substantial Value Creation from Merger Synergies As of March 31st, synergy projects representing ~$53mm of annualized run-rate savings have been completed, exceeding target ✓ Elimination of redundant corporate expenses ✓ Realization of operational efficiencies in the U.S. Gulf of Mexico ✓ Optimization of aircraft maintenance programs and fleet utilization ✓ Synergies expected to be realized within the first 24 months following the close of the Merger G&A Savings Fleet Cost Savings Other OpEx Savings 6 + + = +$53mm ANNUAL RUN-RATE SAVINGS In June 2020, Bristow and Era merged forming a larger, more diverse industry leader

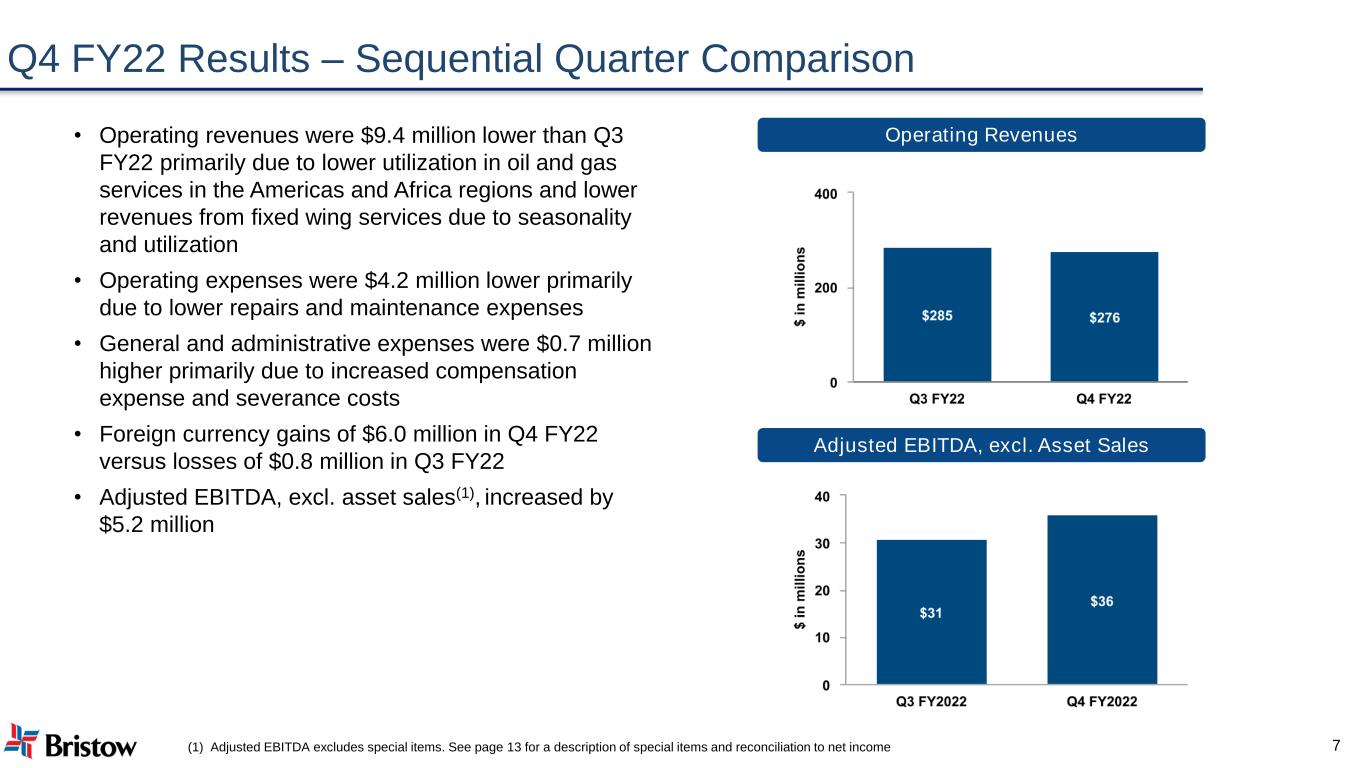

Q4 FY22 Results – Sequential Quarter Comparison • Operating revenues were $9.4 million lower than Q3 FY22 primarily due to lower utilization in oil and gas services in the Americas and Africa regions and lower revenues from fixed wing services due to seasonality and utilization • Operating expenses were $4.2 million lower primarily due to lower repairs and maintenance expenses • General and administrative expenses were $0.7 million higher primarily due to increased compensation expense and severance costs • Foreign currency gains of $6.0 million in Q4 FY22 versus losses of $0.8 million in Q3 FY22 • Adjusted EBITDA, excl. asset sales(1), increased by $5.2 million Operating Revenues Adjusted EBITDA, excl. Asset Sales (1) Adjusted EBITDA excludes special items. See page 13 for a description of special items and reconciliation to net income 7

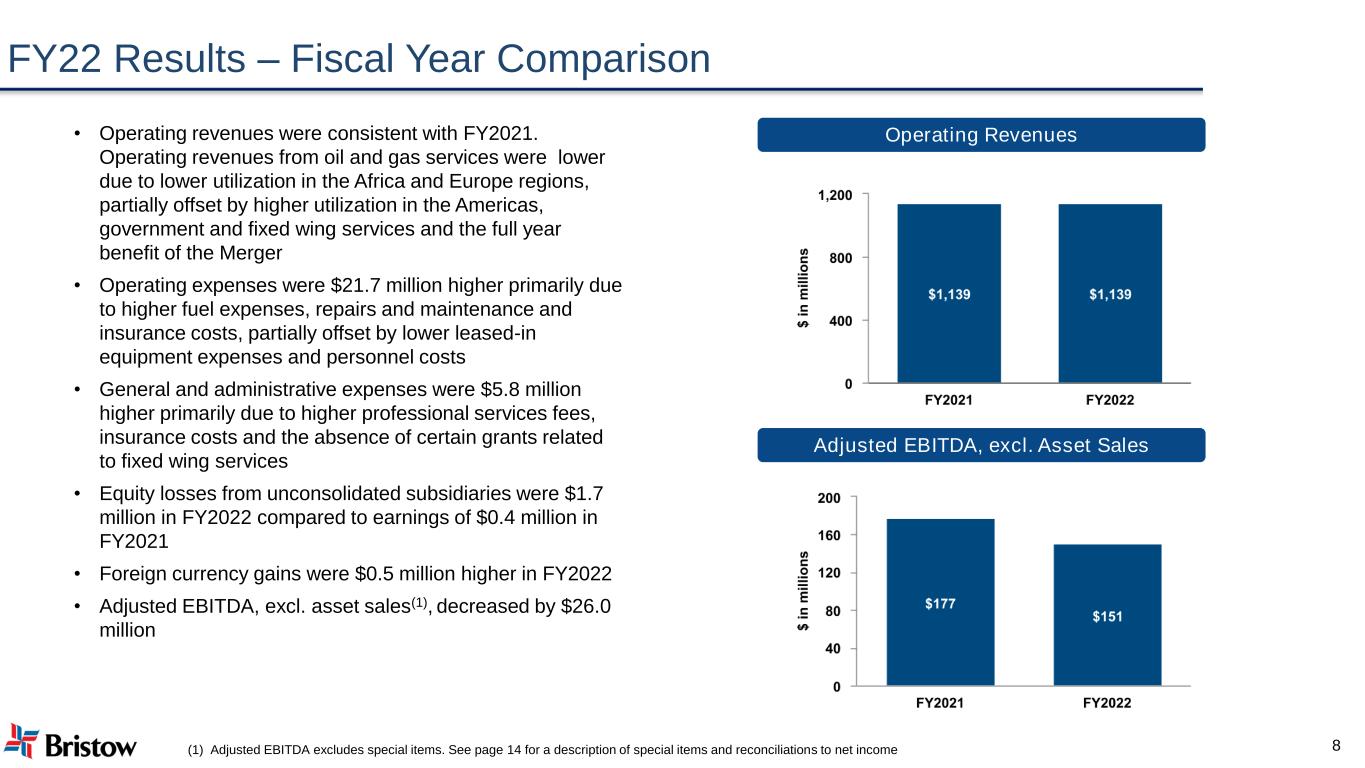

FY22 Results – Fiscal Year Comparison • Operating revenues were consistent with FY2021. Operating revenues from oil and gas services were lower due to lower utilization in the Africa and Europe regions, partially offset by higher utilization in the Americas, government and fixed wing services and the full year benefit of the Merger • Operating expenses were $21.7 million higher primarily due to higher fuel expenses, repairs and maintenance and insurance costs, partially offset by lower leased-in equipment expenses and personnel costs • General and administrative expenses were $5.8 million higher primarily due to higher professional services fees, insurance costs and the absence of certain grants related to fixed wing services • Equity losses from unconsolidated subsidiaries were $1.7 million in FY2022 compared to earnings of $0.4 million in FY2021 • Foreign currency gains were $0.5 million higher in FY2022 • Adjusted EBITDA, excl. asset sales(1), decreased by $26.0 million Operating Revenue Operating Revenues Adjusted EBITDA, excl. Asset Sales (1) Adjusted EBITDA excludes special items. See page 14 for a description of special items and reconciliations to net income 8

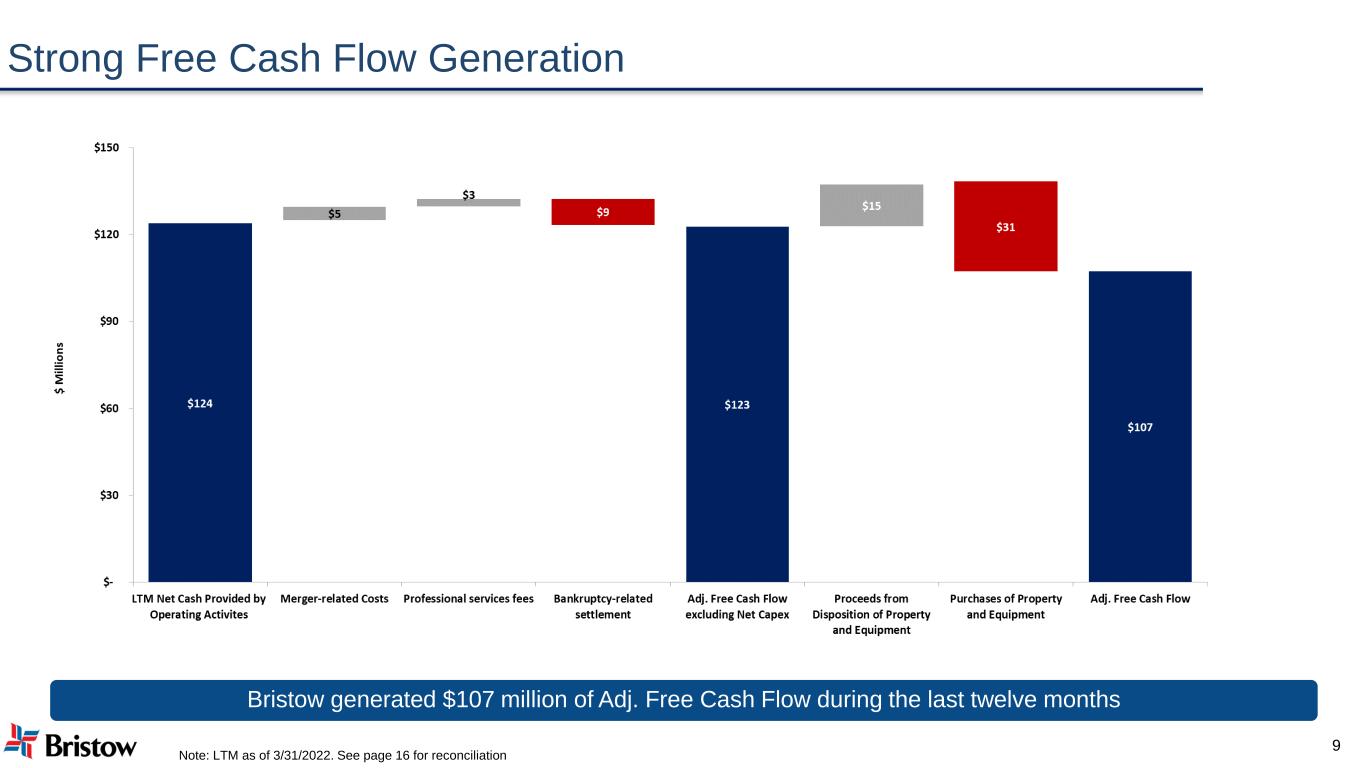

Strong Free Cash Flow Generation Bristow generated $107 million of Adj. Free Cash Flow during the last twelve months 9 Note: LTM as of 3/31/2022. See page 16 for reconciliation

10 11 Appendix Appendix ⮚ Fleet Overview ⮚ Balance Sheet and Liquidity Position ⮚ Reconciliation of LTM Adjusted EBITDA ⮚ Reconciliation of Annual Adjusted EBITDA ⮚ Reconciliation of Pro Forma FY21 ⮚ Reconciliation of Free Cash Flow ⮚ Operating Revenues and Flight Hours by Line of Service ⮚ LTM Operating Revenues

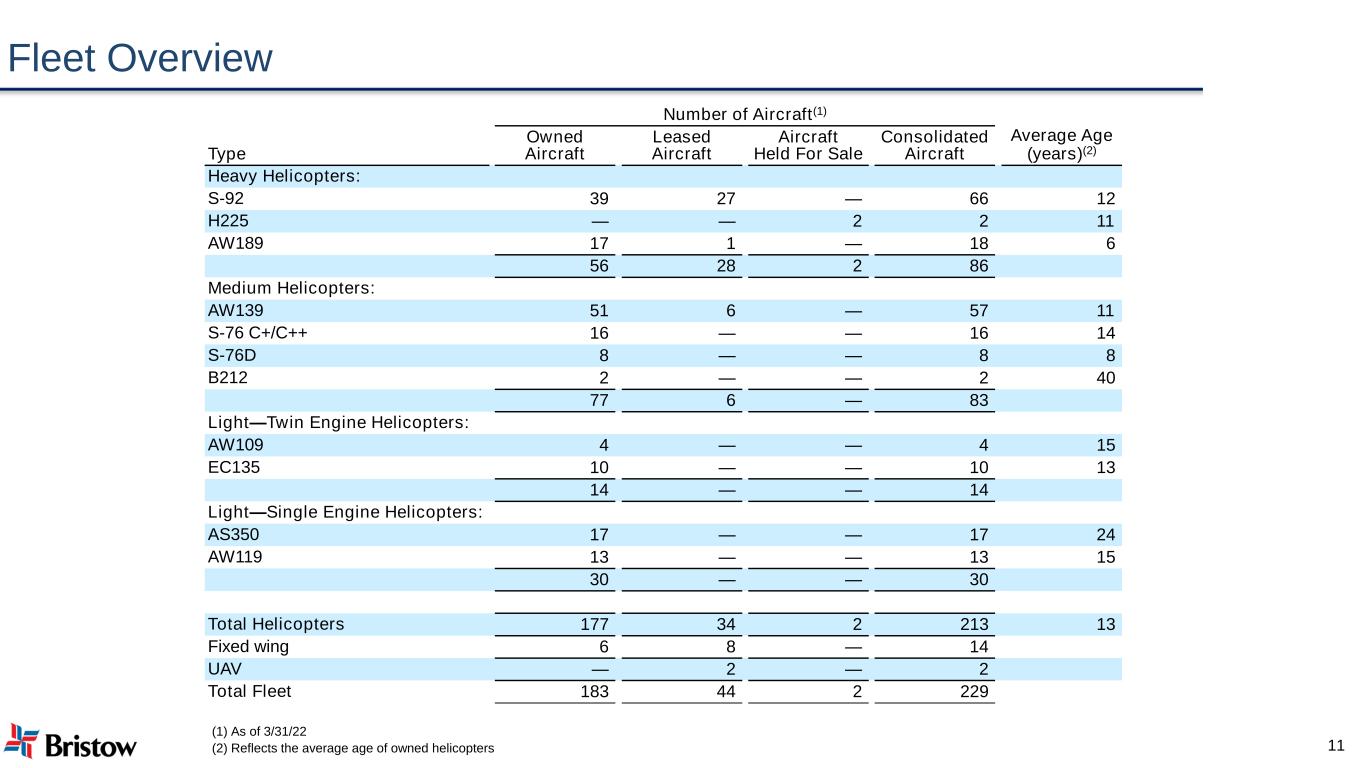

Fleet Overview Number of Aircraft(1) Type Owned Aircraft Leased Aircraft Aircraft Held For Sale Consolidated Aircraft Average Age (years)(2) Heavy Helicopters: S-92 39 27 — 66 12 H225 — — 2 2 11 AW189 17 1 — 18 6 56 28 2 86 Medium Helicopters: AW139 51 6 — 57 11 S-76 C+/C++ 16 — — 16 14 S-76D 8 — — 8 8 B212 2 — — 2 40 77 6 — 83 Light—Twin Engine Helicopters: AW109 4 — — 4 15 EC135 10 — — 10 13 14 — — 14 Light—Single Engine Helicopters: AS350 17 — — 17 24 AW119 13 — — 13 15 30 — — 30 Total Helicopters 177 34 2 213 13 Fixed wing 6 8 — 14 UAV — 2 — 2 Total Fleet 183 44 2 229 (1) As of 3/31/22 (2) Reflects the average age of owned helicopters 11

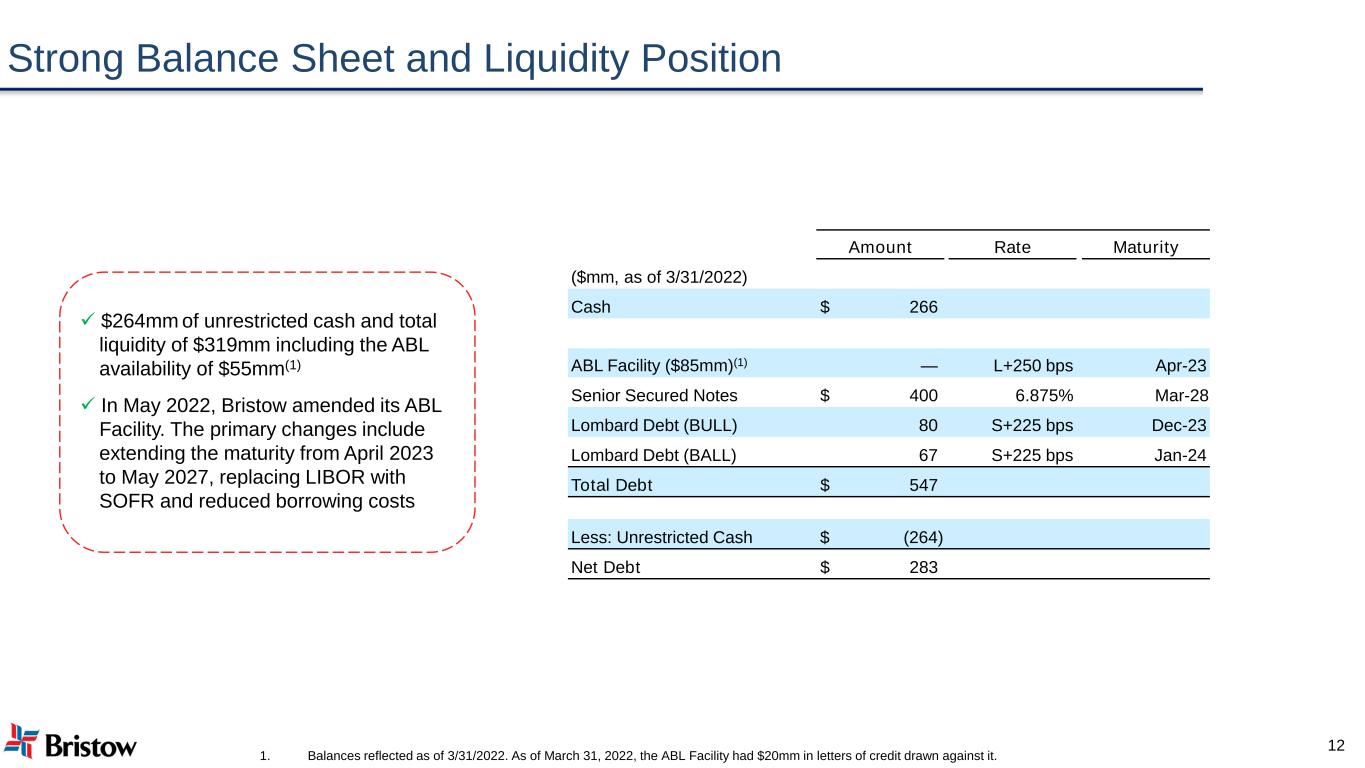

Strong Balance Sheet and Liquidity Position ✓ $264mm of unrestricted cash and total liquidity of $319mm including the ABL availability of $55mm(1) ✓ In May 2022, Bristow amended its ABL Facility. The primary changes include extending the maturity from April 2023 to May 2027, replacing LIBOR with SOFR and reduced borrowing costs 1. Balances reflected as of 3/31/2022. As of March 31, 2022, the ABL Facility had $20mm in letters of credit drawn against it. Amount Rate Maturity ($mm, as of 3/31/2022) Cash $ 266 ABL Facility ($85mm)(1) — L+250 bps Apr-23 Senior Secured Notes $ 400 6.875% Mar-28 Lombard Debt (BULL) 80 S+225 bps Dec-23 Lombard Debt (BALL) 67 S+225 bps Jan-24 Total Debt $ 547 Less: Unrestricted Cash $ (264) Net Debt $ 283 12

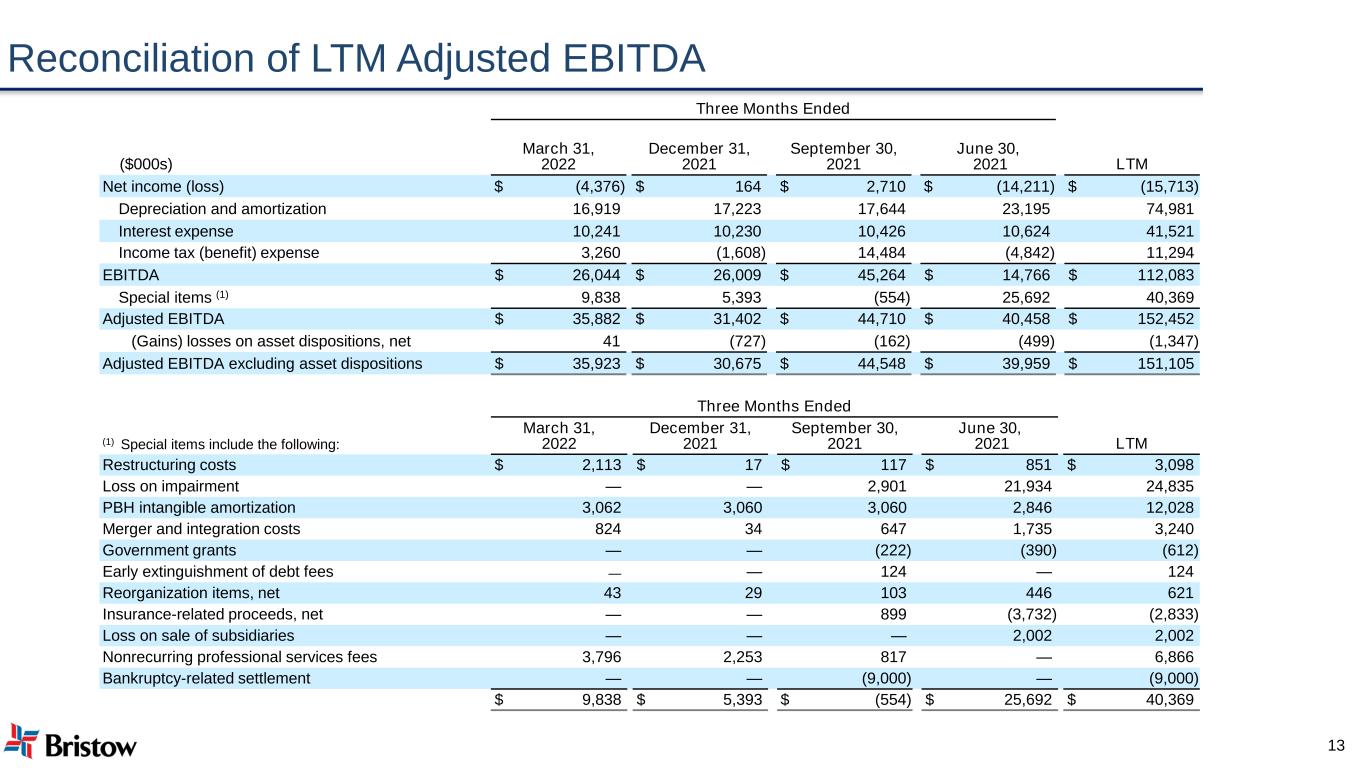

Reconciliation of LTM Adjusted EBITDA Three Months Ended ($000s) March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 LTM Net income (loss) $ (4,376) $ 164 $ 2,710 $ (14,211) $ (15,713) Depreciation and amortization 16,919 17,223 17,644 23,195 74,981 Interest expense 10,241 10,230 10,426 10,624 41,521 Income tax (benefit) expense 3,260 (1,608) 14,484 (4,842) 11,294 EBITDA $ 26,044 $ 26,009 $ 45,264 $ 14,766 $ 112,083 Special items (1) 9,838 5,393 (554) 25,692 40,369 Adjusted EBITDA $ 35,882 $ 31,402 $ 44,710 $ 40,458 $ 152,452 (Gains) losses on asset dispositions, net 41 (727) (162) (499) (1,347) Adjusted EBITDA excluding asset dispositions $ 35,923 $ 30,675 $ 44,548 $ 39,959 $ 151,105 13 Three Months Ended (1) Special items include the following: March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 LTM Restructuring costs $ 2,113 $ 17 $ 117 $ 851 $ 3,098 Loss on impairment — — 2,901 21,934 24,835 PBH intangible amortization 3,062 3,060 3,060 2,846 12,028 Merger and integration costs 824 34 647 1,735 3,240 Government grants — — (222) (390) (612) Early extinguishment of debt fees — — 124 — 124 Reorganization items, net 43 29 103 446 621 Insurance-related proceeds, net — — 899 (3,732) (2,833) Loss on sale of subsidiaries — — — 2,002 2,002 Nonrecurring professional services fees 3,796 2,253 817 — 6,866 Bankruptcy-related settlement — — (9,000) — (9,000) $ 9,838 $ 5,393 $ (554) $ 25,692 $ 40,369

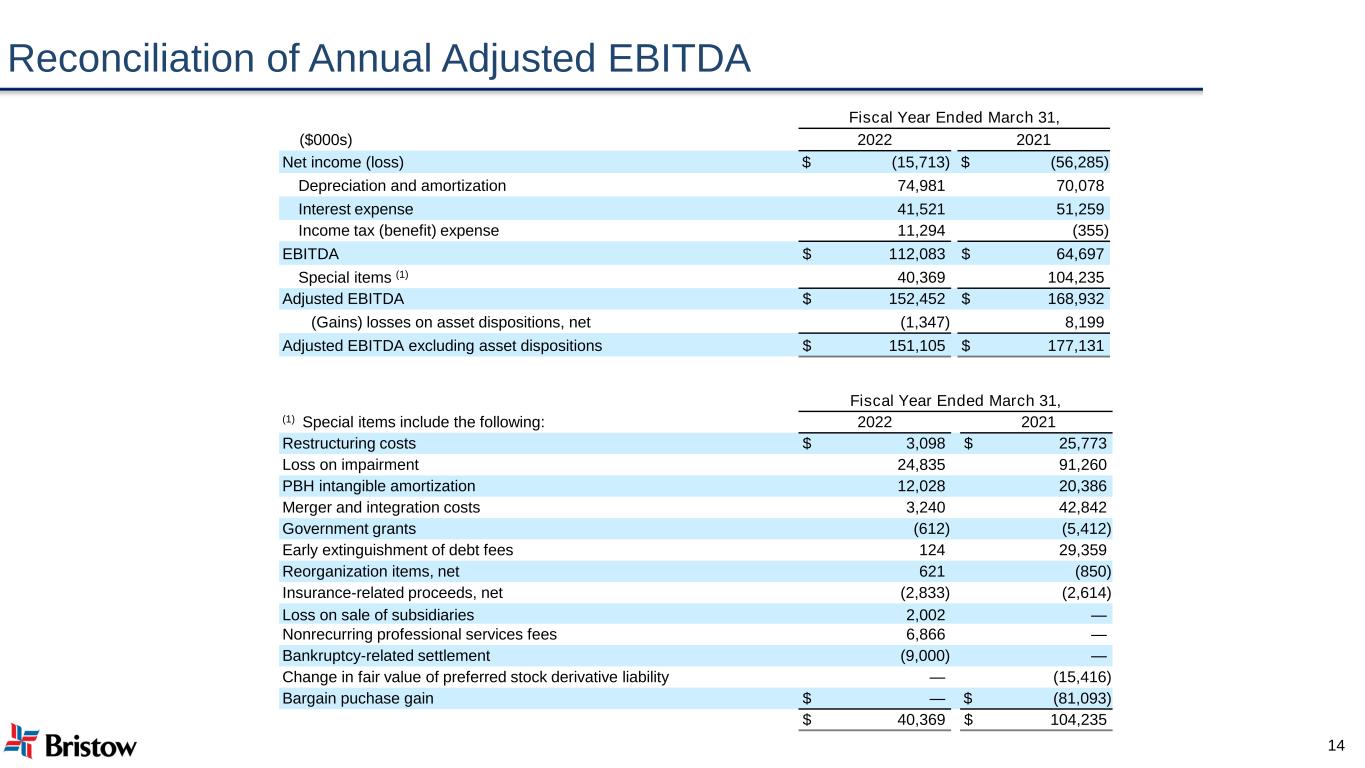

Reconciliation of Annual Adjusted EBITDA Fiscal Year Ended March 31, ($000s) 2022 2021 Net income (loss) $ (15,713) $ (56,285) Depreciation and amortization 74,981 70,078 Interest expense 41,521 51,259 Income tax (benefit) expense 11,294 (355) EBITDA $ 112,083 $ 64,697 Special items (1) 40,369 104,235 Adjusted EBITDA $ 152,452 $ 168,932 (Gains) losses on asset dispositions, net (1,347) 8,199 Adjusted EBITDA excluding asset dispositions $ 151,105 $ 177,131 14 Fiscal Year Ended March 31, (1) Special items include the following: 2022 2021 Restructuring costs $ 3,098 $ 25,773 Loss on impairment 24,835 91,260 PBH intangible amortization 12,028 20,386 Merger and integration costs 3,240 42,842 Government grants (612) (5,412) Early extinguishment of debt fees 124 29,359 Reorganization items, net 621 (850) Insurance-related proceeds, net (2,833) (2,614) Loss on sale of subsidiaries 2,002 — Nonrecurring professional services fees 6,866 — Bankruptcy-related settlement (9,000) — Change in fair value of preferred stock derivative liability — (15,416) Bargain puchase gain $ — $ (81,093) $ 40,369 $ 104,235

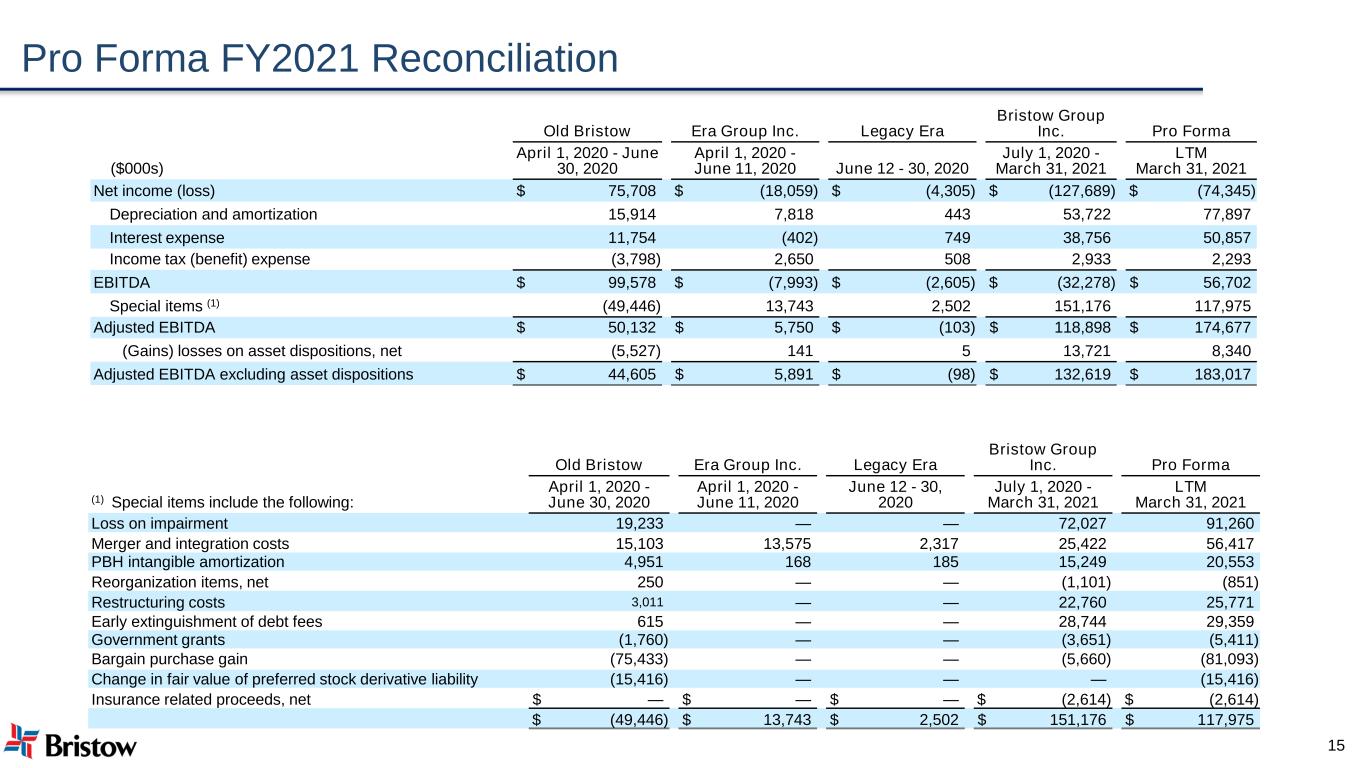

Pro Forma FY2021 Reconciliation Old Bristow Era Group Inc. Legacy Era Bristow Group Inc. Pro Forma ($000s) April 1, 2020 - June 30, 2020 April 1, 2020 - June 11, 2020 June 12 - 30, 2020 July 1, 2020 - March 31, 2021 LTM March 31, 2021 Net income (loss) $ 75,708 $ (18,059) $ (4,305) $ (127,689) $ (74,345) Depreciation and amortization 15,914 7,818 443 53,722 77,897 Interest expense 11,754 (402) 749 38,756 50,857 Income tax (benefit) expense (3,798) 2,650 508 2,933 2,293 EBITDA $ 99,578 $ (7,993) $ (2,605) $ (32,278) $ 56,702 Special items (1) (49,446) 13,743 2,502 151,176 117,975 Adjusted EBITDA $ 50,132 $ 5,750 $ (103) $ 118,898 $ 174,677 (Gains) losses on asset dispositions, net (5,527) 141 5 13,721 8,340 Adjusted EBITDA excluding asset dispositions $ 44,605 $ 5,891 $ (98) $ 132,619 $ 183,017 15 Old Bristow Era Group Inc. Legacy Era Bristow Group Inc. Pro Forma (1) Special items include the following: April 1, 2020 - June 30, 2020 April 1, 2020 - June 11, 2020 June 12 - 30, 2020 July 1, 2020 - March 31, 2021 LTM March 31, 2021 Loss on impairment 19,233 — — 72,027 91,260 Merger and integration costs 15,103 13,575 2,317 25,422 56,417 PBH intangible amortization 4,951 168 185 15,249 20,553 Reorganization items, net 250 — — (1,101) (851) Restructuring costs 3,011 — — 22,760 25,771 Early extinguishment of debt fees 615 — — 28,744 29,359 Government grants (1,760) — — (3,651) (5,411) Bargain purchase gain (75,433) — — (5,660) (81,093) Change in fair value of preferred stock derivative liability (15,416) — — — (15,416) Insurance related proceeds, net $ — $ — $ — $ (2,614) $ (2,614) $ (49,446) $ 13,743 $ 2,502 $ 151,176 $ 117,975

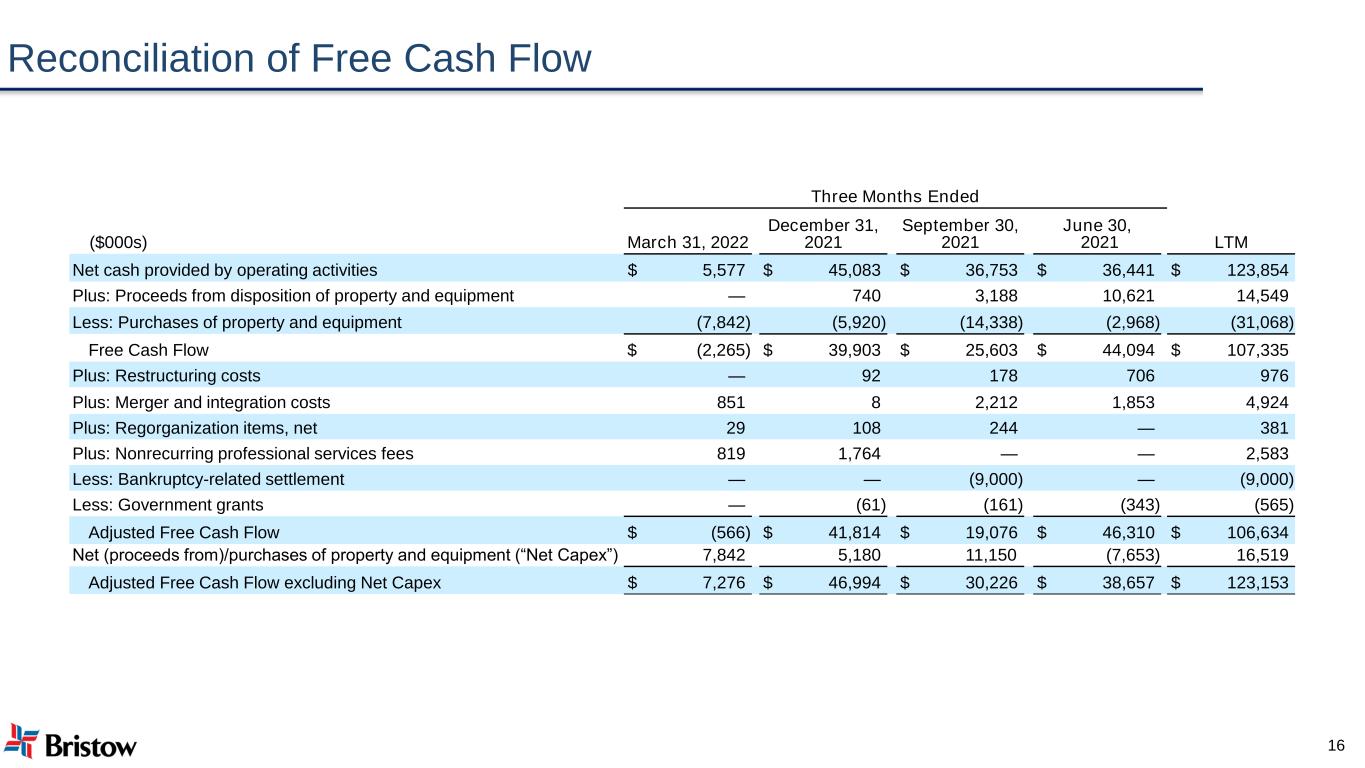

Reconciliation of Free Cash Flow Three Months Ended ($000s) March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 LTM Net cash provided by operating activities $ 5,577 $ 45,083 $ 36,753 $ 36,441 $ 123,854 Plus: Proceeds from disposition of property and equipment — 740 3,188 10,621 14,549 Less: Purchases of property and equipment (7,842) (5,920) (14,338) (2,968) (31,068) Free Cash Flow $ (2,265) $ 39,903 $ 25,603 $ 44,094 $ 107,335 Plus: Restructuring costs — 92 178 706 976 Plus: Merger and integration costs 851 8 2,212 1,853 4,924 Plus: Regorganization items, net 29 108 244 — 381 Plus: Nonrecurring professional services fees 819 1,764 — — 2,583 Less: Bankruptcy-related settlement — — (9,000) — (9,000) Less: Government grants — (61) (161) (343) (565) Adjusted Free Cash Flow $ (566) $ 41,814 $ 19,076 $ 46,310 $ 106,634 Net (proceeds from)/purchases of property and equipment (“Net Capex”) 7,842 5,180 11,150 (7,653) 16,519 Adjusted Free Cash Flow excluding Net Capex $ 7,276 $ 46,994 $ 30,226 $ 38,657 $ 123,153 16

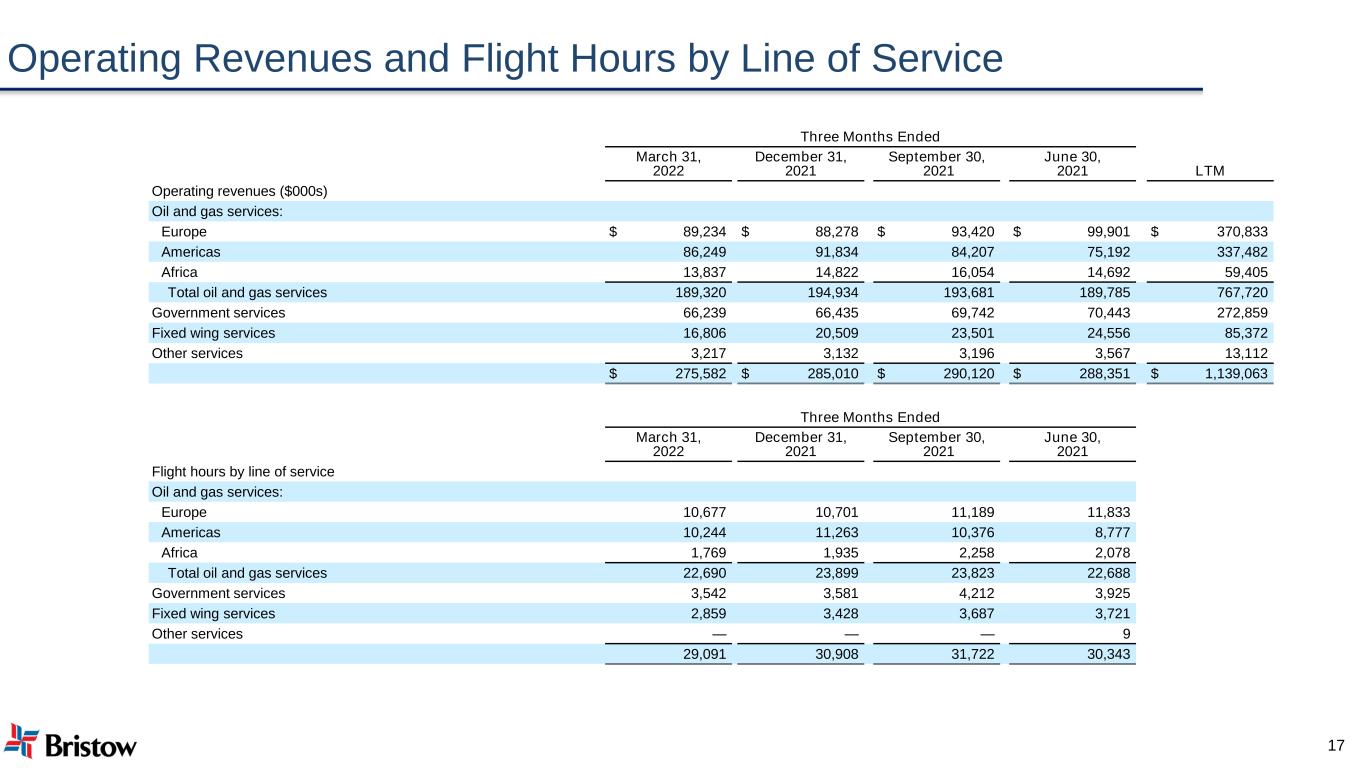

Operating Revenues and Flight Hours by Line of Service Three Months Ended March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 LTM Operating revenues ($000s) Oil and gas services: Europe $ 89,234 $ 88,278 $ 93,420 $ 99,901 $ 370,833 Americas 86,249 91,834 84,207 75,192 337,482 Africa 13,837 14,822 16,054 14,692 59,405 Total oil and gas services 189,320 194,934 193,681 189,785 767,720 Government services 66,239 66,435 69,742 70,443 272,859 Fixed wing services 16,806 20,509 23,501 24,556 85,372 Other services 3,217 3,132 3,196 3,567 13,112 $ 275,582 $ 285,010 $ 290,120 $ 288,351 $ 1,139,063 Three Months Ended March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 Flight hours by line of service Oil and gas services: Europe 10,677 10,701 11,189 11,833 Americas 10,244 11,263 10,376 8,777 Africa 1,769 1,935 2,258 2,078 Total oil and gas services 22,690 23,899 23,823 22,688 Government services 3,542 3,581 4,212 3,925 Fixed wing services 2,859 3,428 3,687 3,721 Other services — — — 9 29,091 30,908 31,722 30,343 17

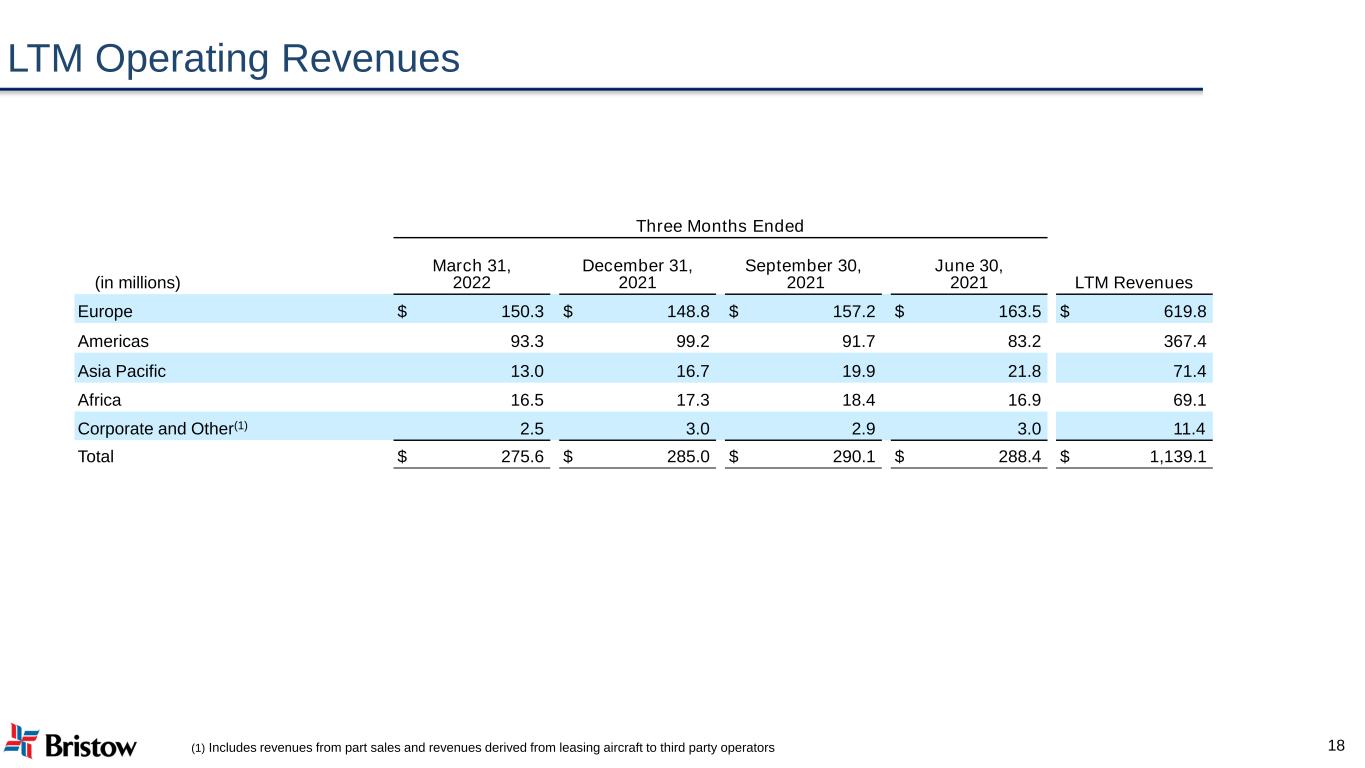

LTM Operating Revenues Three Months Ended (in millions) March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 LTM Revenues Europe $ 150.3 $ 148.8 $ 157.2 $ 163.5 $ 619.8 Americas 93.3 99.2 91.7 83.2 367.4 Asia Pacific 13.0 16.7 19.9 21.8 71.4 Africa 16.5 17.3 18.4 16.9 69.1 Corporate and Other(1) 2.5 3.0 2.9 3.0 11.4 Total $ 275.6 $ 285.0 $ 290.1 $ 288.4 $ 1,139.1 18(1) Includes revenues from part sales and revenues derived from leasing aircraft to third party operators