Q2 FY23 Earnings Presentation and CY2023 Outlook November 3, 2022 Exhibit 99.2

2 Introduction Redeate (Red) Tilahun Senior Manager, Investor Relations and Financial Reporting 01 02 03 04 05 Operational Highlights Chris Bradshaw President and CEO Financial Review Jennifer Whalen SVP, Chief Financial Officer Concluding Remarks Chris Bradshaw President and CEO Questions & Answers Q2 FY23 Earnings Call & CY2023 Outlook

3 Cautionary Statement Regarding Forward-Looking Statements This presentation contains “forward-looking statements.” Forward-looking statements represent Bristow Group Inc.’s (the “Company”) current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words and, for the avoidance of doubt, include all statements herein regarding the Company's financial targets for Calendar Year 2023 and operational outlook. These statements are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, reflect management’s current views with respect to future events and therefore are subject to significant risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements. Forward-looking statements (including the Company's financial targets for Calendar Year 2023 and operational outlook) speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which the forward-looking statement is based that occur after the date hereof except as may be required by applicable law. Risks that may affect forward-looking statements include, but are not necessarily limited to, those relating to: public health crises, such as pandemics (COVID-19) and epidemics, and any related government policies and actions; any failure to effectively manage, and receive anticipated returns from, acquisitions, divestitures, investments, joint ventures and other portfolio actions; our inability to execute our business strategy for diversification efforts related to, government services, offshore wind, and advanced air mobility; our reliance on a limited number of customers and the reduction of our customer base as a result of consolidation and/or the energy transition; the possibility that we may be unable to maintain compliance with covenants in our financing agreements; global and regional changes in the demand, supply, prices or other market conditions affecting oil and gas, including changes resulting from a public health crisis or from the imposition or lifting of crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries (OPEC) and other producing countries; fluctuations in the demand for our services; the possibility that we may impair our long-lived assets and other assets, including inventory, property and equipment and investments in unconsolidated affiliates; the possibility of significant changes in foreign exchange rates and controls; potential effects of increased competition and the introduction of energy efficient alternative modes of transportation and solutions; the possibility that we may be unable to re-deploy our aircraft to regions with greater demand; the possibility of changes in tax and other laws and regulations and policies, including, without limitation, actions of governments that impact oil and gas operations or favor renewable energy projects; the possibility that we may be unable to dispose of older aircraft through sales into the aftermarket; general economic conditions, including the capital and credit markets; the possibility that segments of our fleet may be grounded for extended periods of time or indefinitely; the existence of operating risks inherent in our business, including the possibility of declining safety performance; the possibility of political instability, war or acts of terrorism in any of the countries where we operate; the possibility that reductions in spending on aviation services by governmental agencies could lead to modifications of our search and rescue (“SAR”) contract terms with governments, our contracts with the Bureau of Safety and Environmental Enforcement (“BSEE”) or delays in receiving payments under such contracts; the effectiveness of our environmental, social and governance initiatives; the impact of supply chain disruptions and inflation and our ability to recoup rising costs in the rates we charge to our customers; and our reliance on a limited number of helicopter manufacturers and suppliers. If one or more of the foregoing risks materialize, or if underlying assumptions prove incorrect, actual results may vary materially from those expected. You should not place undue reliance on our forward-looking statements because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our forward-looking statements are based on the information currently available to us and speak only as of the date hereof. New risks and uncertainties arise from time to time, and it is impossible for us to predict these matters or how they may affect us. We have included important factors in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2022 (the “Annual Report”) which we believe over time, could cause our actual results, performance or achievements to differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements. You should consider all risks and uncertainties disclosed in the Annual Report and in our filings with the United States Securities and Exchange Commission (the “SEC”), all of which are accessible on the SEC’s website at www.sec.gov.

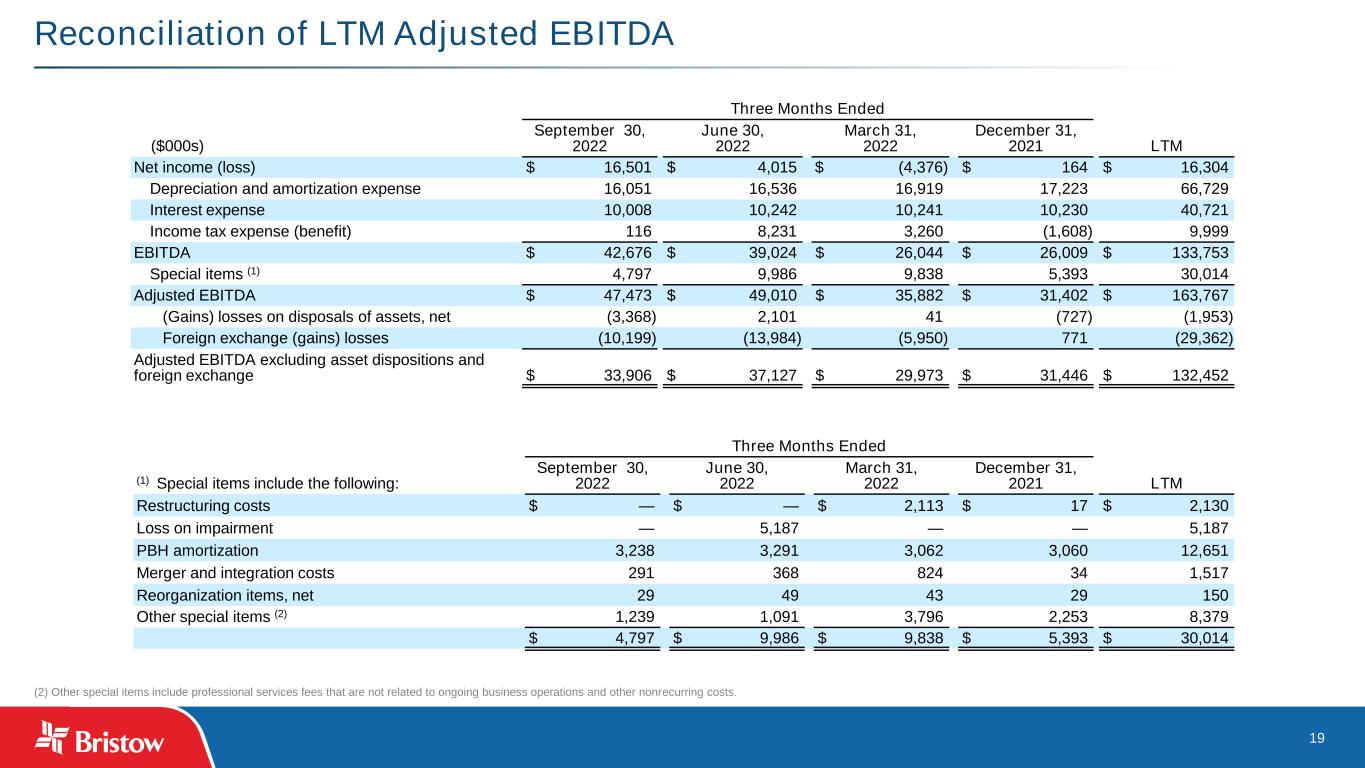

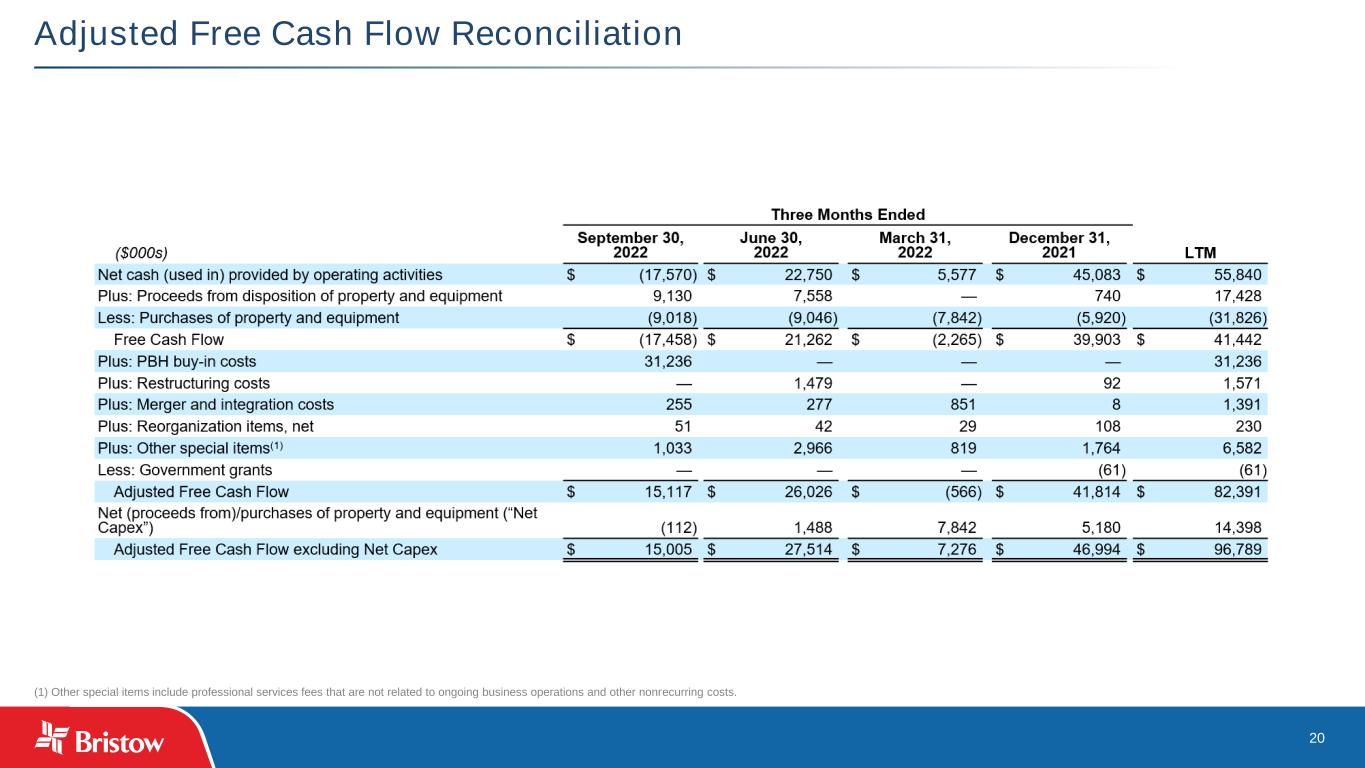

4 Non-GAAP Financial Measures Reconciliation Non-GAAP In addition to financial results calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation includes certain non-GAAP measures including EBITDA, Adjusted EBITDA, Net Debt, Free Cash Flow and Adjusted Free Cash Flow. Each of these measures, detailed below, have limitations, and are provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our filings with the SEC and posted on our website. EBITDA and Adjusted EBITDA are presented as supplemental measures of the Company’s operating performance. EBITDA is defined as Earnings before Interest expense, Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for special items that occurred during the reporting period and noted in the applicable reconciliation. Management believes that the use of EBITDA and Adjusted EBITDA is meaningful to investors because it provides information with respect to our ability to meet our future debt service, capital expenditures and working capital requirements the financial performance of our assets without regard to financing methods, capital structure or historical cost basis. The GAAP measure most directly comparable to EBITDA and Adjusted EBITDA is net income. Since neither EBITDA nor Adjusted EBITDA is a recognized term under GAAP, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of Free Cash Flow available for discretionary use, as they do not take into account certain cash requirements, such as debt service requirements. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. This presentation provides a reconciliation of net income (loss), the most directly comparable GAAP measure, to EBITDA and Adjusted EBITDA (in thousands, unaudited). The Company is unable to provide a reconciliation of forecasted Adjusted EBITDA for Calendar Year 2023 included in this presentation to projected net income (GAAP) for the same period because components of the calculation are inherently unpredictable. The inability to forecast certain components of the calculation would significantly affect the accuracy of the reconciliation. Additionally, the Company does not provide guidance on the items used to reconcile projected Adjusted EBITDA due to the uncertainty regarding timing and estimates of such items. Therefore, the Company cannot reconcile forecasted Adjusted EBITDA for Calendar Year 2023 to net income (GAAP) for the same period without unreasonable effort. Free Cash Flow represents the Company’s net cash provided by operating activities plus proceeds from disposition of property and equipment, less expenditures related to purchases of property and equipment. Adjusted Free Cash Flow is Free Cash Flow adjusted to exclude costs paid in relation to a PBH maintenance agreement buy-in, reorganization items, cost associated with recent mergers, acquisitions and ongoing integration efforts as well as other special items which include professional services fees that are not related to continuing business operations and other nonrecurring costs. Management believes that Free Cash Flow and Adjusted Free Cash Flow are meaningful to investors because they provide information with respect to our ability to generate cash from the business. The GAAP measure most directly comparable to Free Cash Flow and Adjusted Free Cash Flow is net cash provided by operating activities. Since neither Free Cash Flow nor Adjusted Free Cash Flow is a recognized term under GAAP, they should not be used as an indicator of, or an alternative to, net cash provided by operating activities. Investors should note numerous methods may exist for calculating a company's Free Cash Flow. As a result, the method used by management to calculate Free Cash Flow and Adjusted Free Cash Flow may differ from the methods used by other companies to calculate their Free Cash Flow. As such, they may not be comparable to other similarly titled measures used by other companies. The Company also uses Adjusted Free Cash Flow excluding Net Capex. “Net Capex” is defined as net (proceeds from)/purchases of property and equipment. Management uses Adjusted Free Cash Flow excluding Net Capex, and believes this information is meaningful to investors, as an analytical indicator to assess the Company’s liquidity and cash generating performance. The Company also presents Net Debt, which is a non-GAAP measure, defined as total principal balance on borrowings less unrestricted cash and cash equivalents. The GAAP measure most directly comparable to Net Debt is total debt. Since Net Debt is not a recognized term under GAAP, it should not be used as an indicator of, or an alternative to, total debt. Management uses Net Debt to determine the Company’s outstanding debt obligations that would not be readily satisfied by its cash and cash equivalents on hand. Management believes this metric is useful to investors in determining the Company’s leverage position since the Company has the ability to, and may decide to, use a portion of its cash and cash equivalents to reduce debt. A reconciliation of each of EBITDA, Adjusted EBITDA, Adjusted EBITDA excluding gains or losses on asset dispositions, Free Cash Flow, Adjusted Free Cash Flow, and Net Debt is included elsewhere in this presentation.

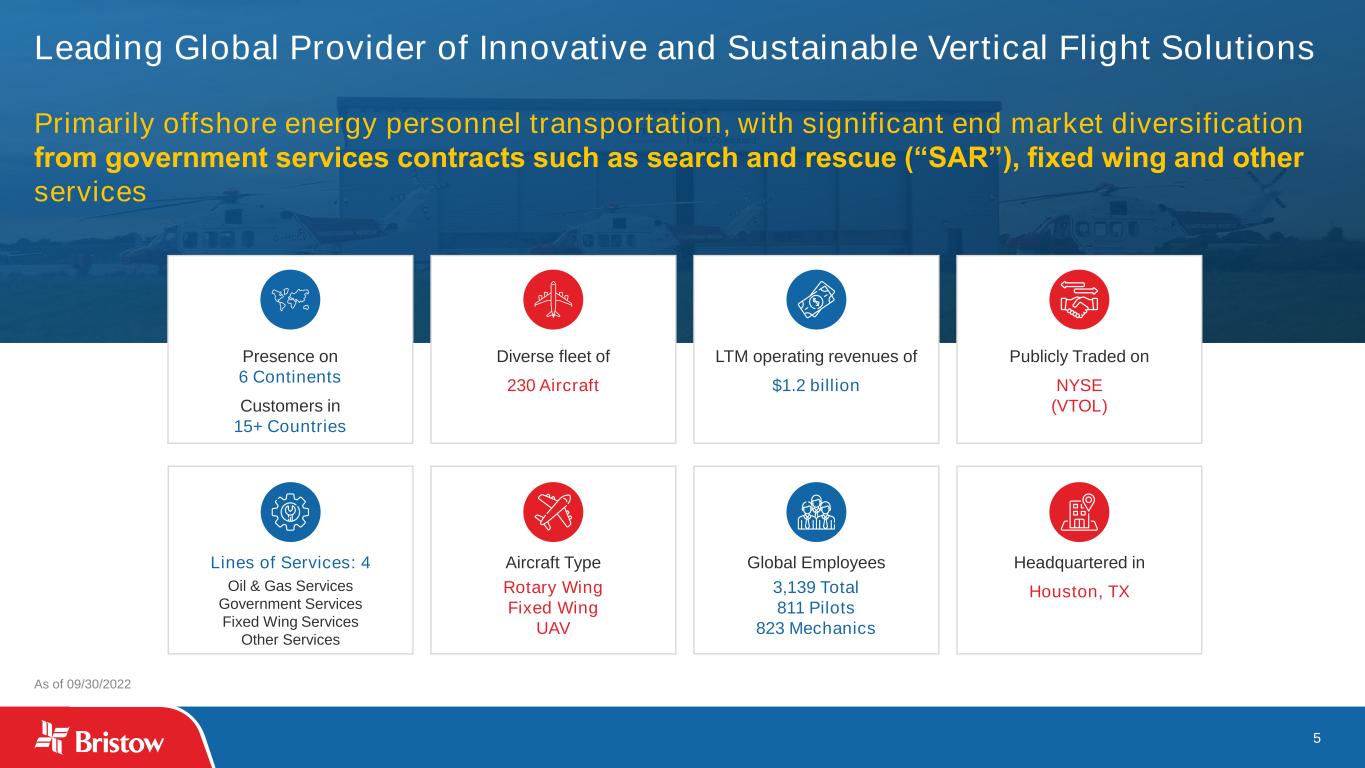

5 Leading Global Provider of Innovative and Sustainable Vertical Flight Solutions As of 09/30/2022 Primarily offshore energy personnel transportation, with significant end market diversification from government services contracts such as search and rescue (“SAR”), fixed wing and other services Global Employees 3,139 Total 811 Pilots 823 Mechanics Headquartered in Houston, TX Lines of Services: 4 Oil & Gas Services Government Services Fixed Wing Services Other Services Publicly Traded on NYSE (VTOL) Presence on 6 Continents Customers in 15+ Countries Diverse fleet of 230 Aircraft LTM operating revenues of $1.2 billion Aircraft Type Rotary Wing Fixed Wing UAV

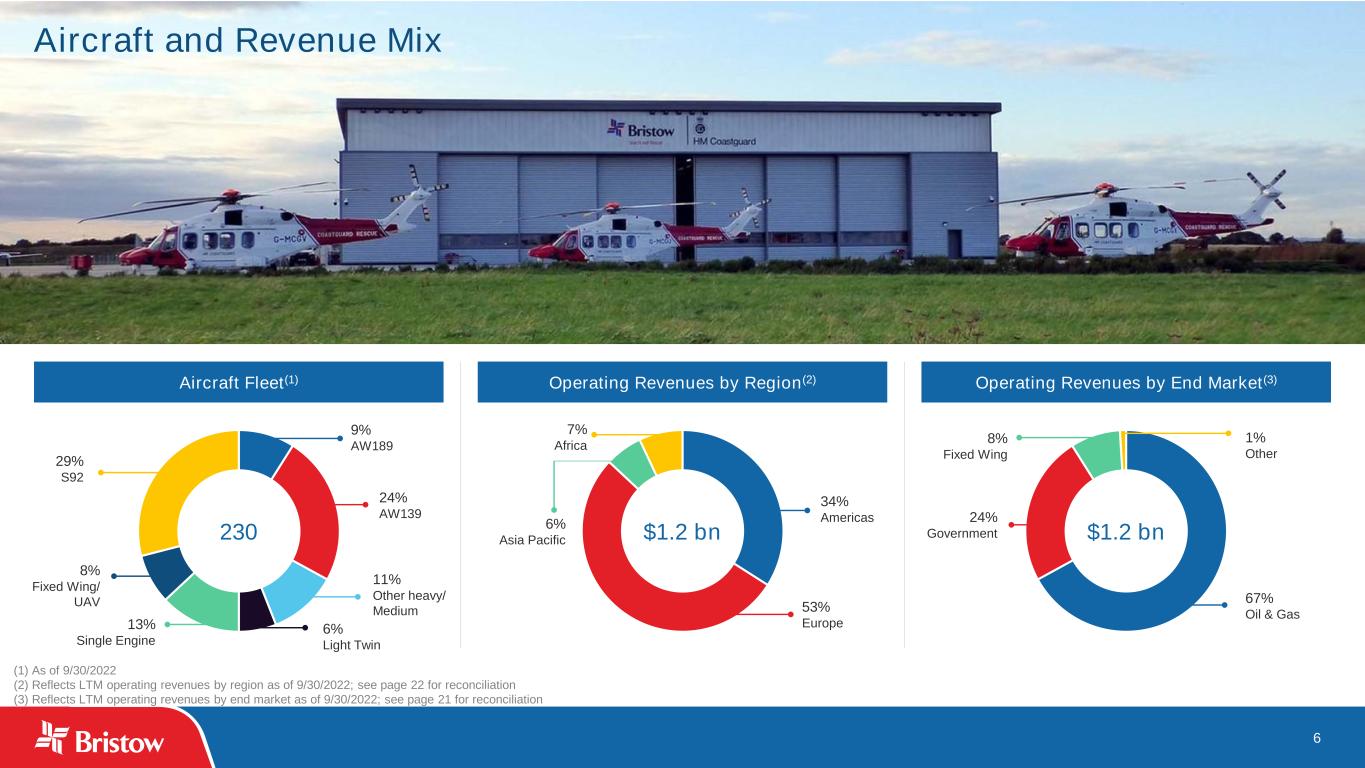

6 (1) As of 9/30/2022 (2) Reflects LTM operating revenues by region as of 9/30/2022; see page 22 for reconciliation (3) Reflects LTM operating revenues by end market as of 9/30/2022; see page 21 for reconciliation Operating Revenues by Region(2)Aircraft Fleet(1) Operating Revenues by End Market(3) 6% Light Twin 13% Single Engine 8% Fixed Wing/ UAV 29% S92 9% AW189 24% AW139 11% Other heavy/ Medium 34% Americas 53% Europe 6% Asia Pacific 7% Africa 1% Other 67% Oil & Gas 8% Fixed Wing 24% Government230 $1.2 bn $1.2 bn Aircraft and Revenue Mix

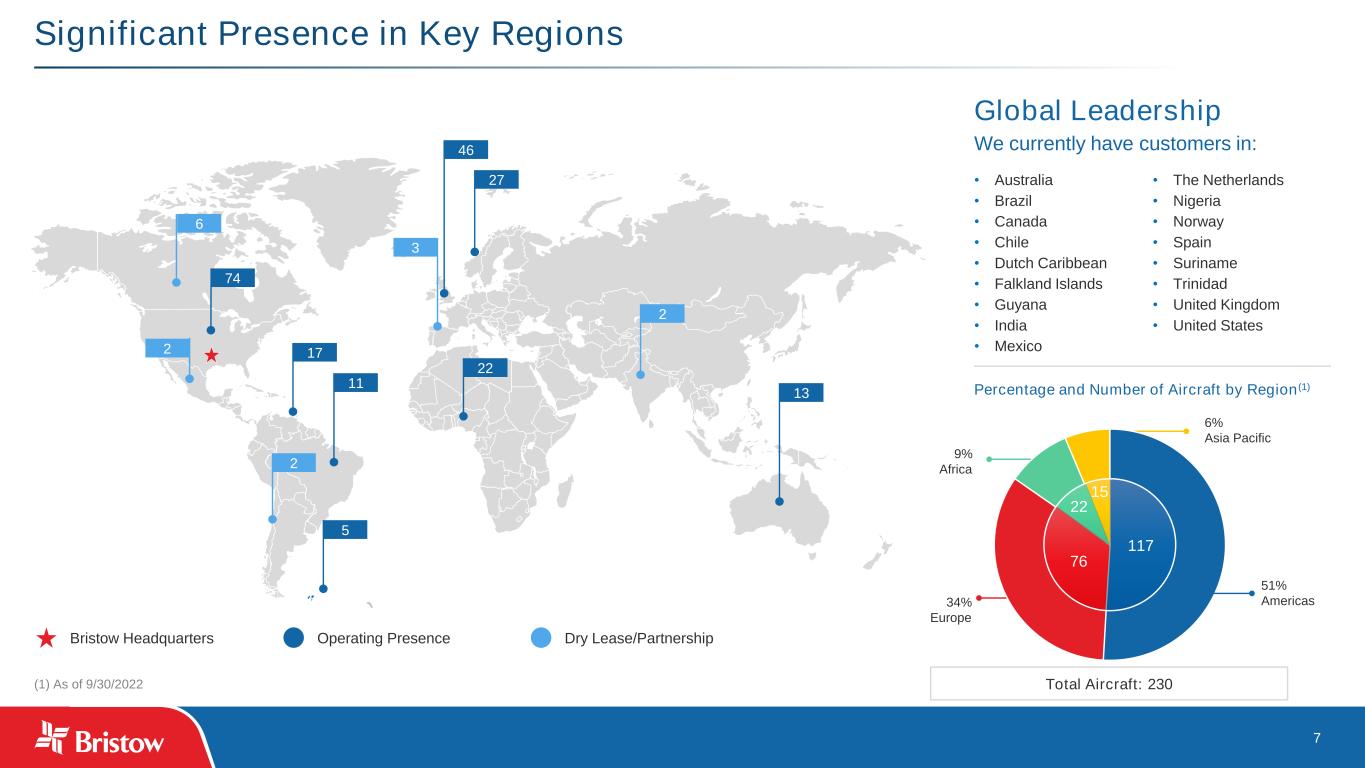

7 Significant Presence in Key Regions Global Leadership We currently have customers in: • Australia • Brazil • Canada • Chile • Dutch Caribbean • Falkland Islands • Guyana • India • Mexico • The Netherlands • Nigeria • Norway • Spain • Suriname • Trinidad • United Kingdom • United States Total Aircraft: 230 Bristow Headquarters Operating Presence Dry Lease/Partnership (1) As of 9/30/2022 17 11 2 27 46 22 3 2 74 6 2 13 Percentage and Number of Aircraft by Region(1) 51% Americas34% Europe 9% Africa 6% Asia Pacific 117 76 22 15 5

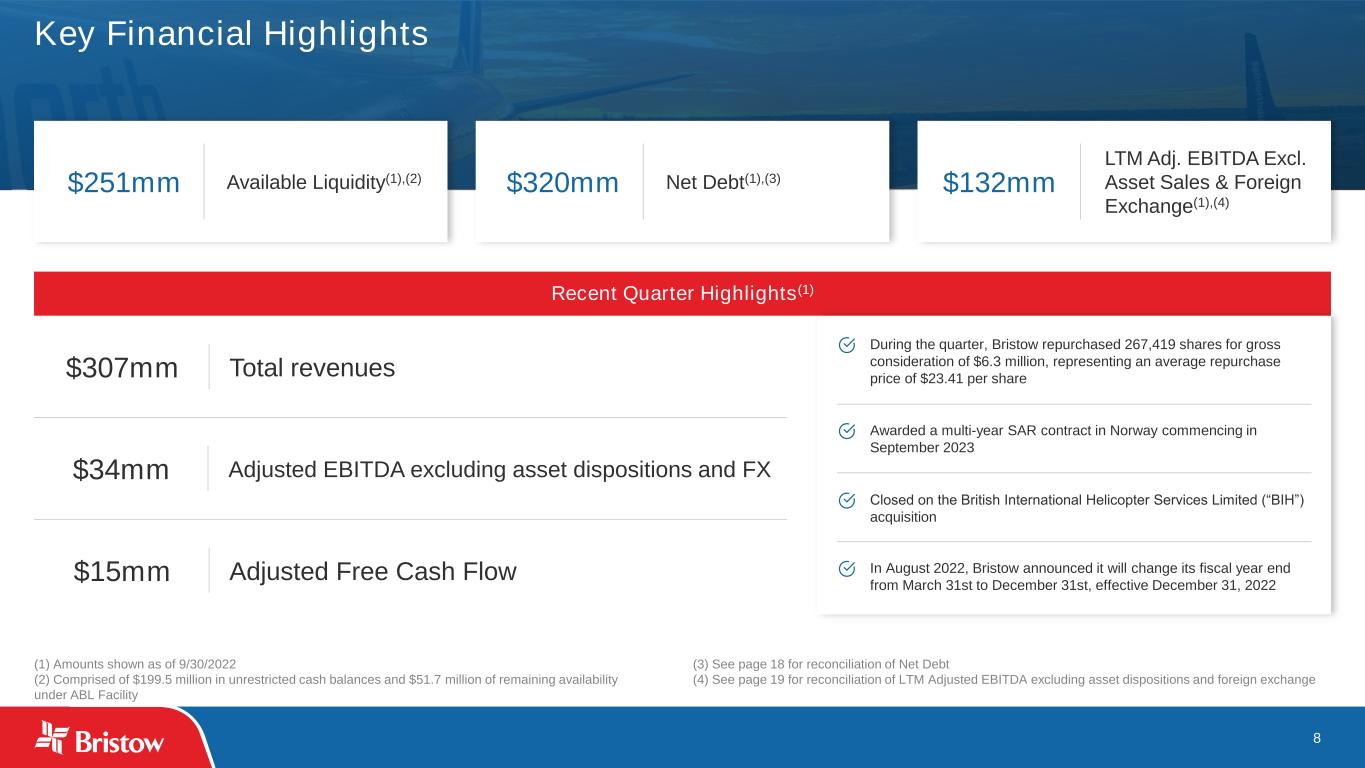

8 Key Financial Highlights (1) Amounts shown as of 9/30/2022 (2) Comprised of $199.5 million in unrestricted cash balances and $51.7 million of remaining availability under ABL Facility (3) See page 18 for reconciliation of Net Debt (4) See page 19 for reconciliation of LTM Adjusted EBITDA excluding asset dispositions and foreign exchange $251mm Available Liquidity(1),(2) $320mm Net Debt(1),(3) $132mm LTM Adj. EBITDA Excl. Asset Sales & Foreign Exchange(1),(4) Recent Quarter Highlights(1) $307mm Total revenues $34mm Adjusted EBITDA excluding asset dispositions and FX $15mm Adjusted Free Cash Flow During the quarter, Bristow repurchased 267,419 shares for gross consideration of $6.3 million, representing an average repurchase price of $23.41 per share Awarded a multi-year SAR contract in Norway commencing in September 2023 Closed on the British International Helicopter Services Limited (“BIH”) acquisition In August 2022, Bristow announced it will change its fiscal year end from March 31st to December 31st, effective December 31, 2022

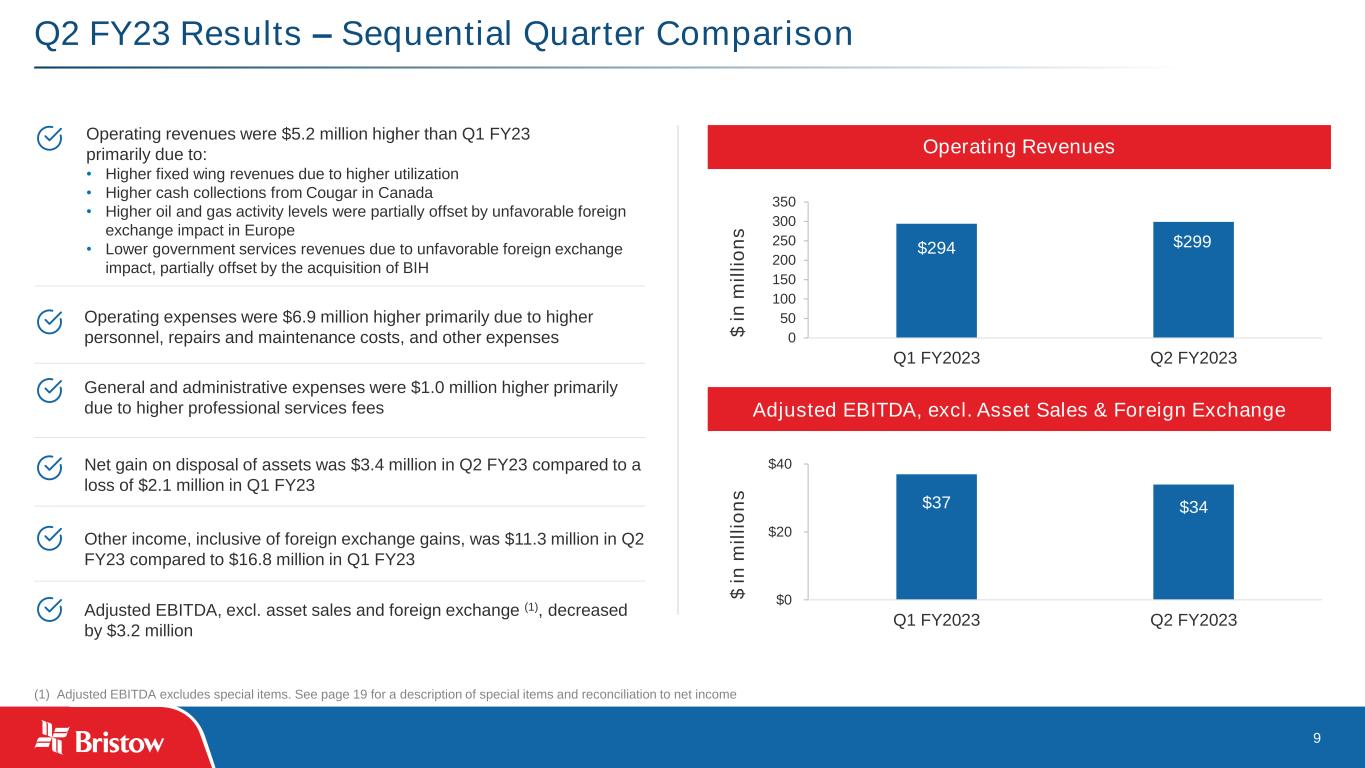

9 Q2 FY23 Results – Sequential Quarter Comparison Operating revenues were $5.2 million higher than Q1 FY23 primarily due to: • Higher fixed wing revenues due to higher utilization • Higher cash collections from Cougar in Canada • Higher oil and gas activity levels were partially offset by unfavorable foreign exchange impact in Europe • Lower government services revenues due to unfavorable foreign exchange impact, partially offset by the acquisition of BIH Operating expenses were $6.9 million higher primarily due to higher personnel, repairs and maintenance costs, and other expenses General and administrative expenses were $1.0 million higher primarily due to higher professional services fees Net gain on disposal of assets was $3.4 million in Q2 FY23 compared to a loss of $2.1 million in Q1 FY23 Other income, inclusive of foreign exchange gains, was $11.3 million in Q2 FY23 compared to $16.8 million in Q1 FY23 (1) Adjusted EBITDA excludes special items. See page 19 for a description of special items and reconciliation to net income $294 $299 0 50 100 150 200 250 300 350 Q1 FY2023 Q2 FY2023 $ i n m il li o n s Operating Revenues Adjusted EBITDA, excl. Asset Sales & Foreign Exchange $37 $34 $0 $20 $40 Q1 FY2023 Q2 FY2023 $ i n m il li o n s Adjusted EBITDA, excl. asset sales and foreign exchange (1), decreased by $3.2 million

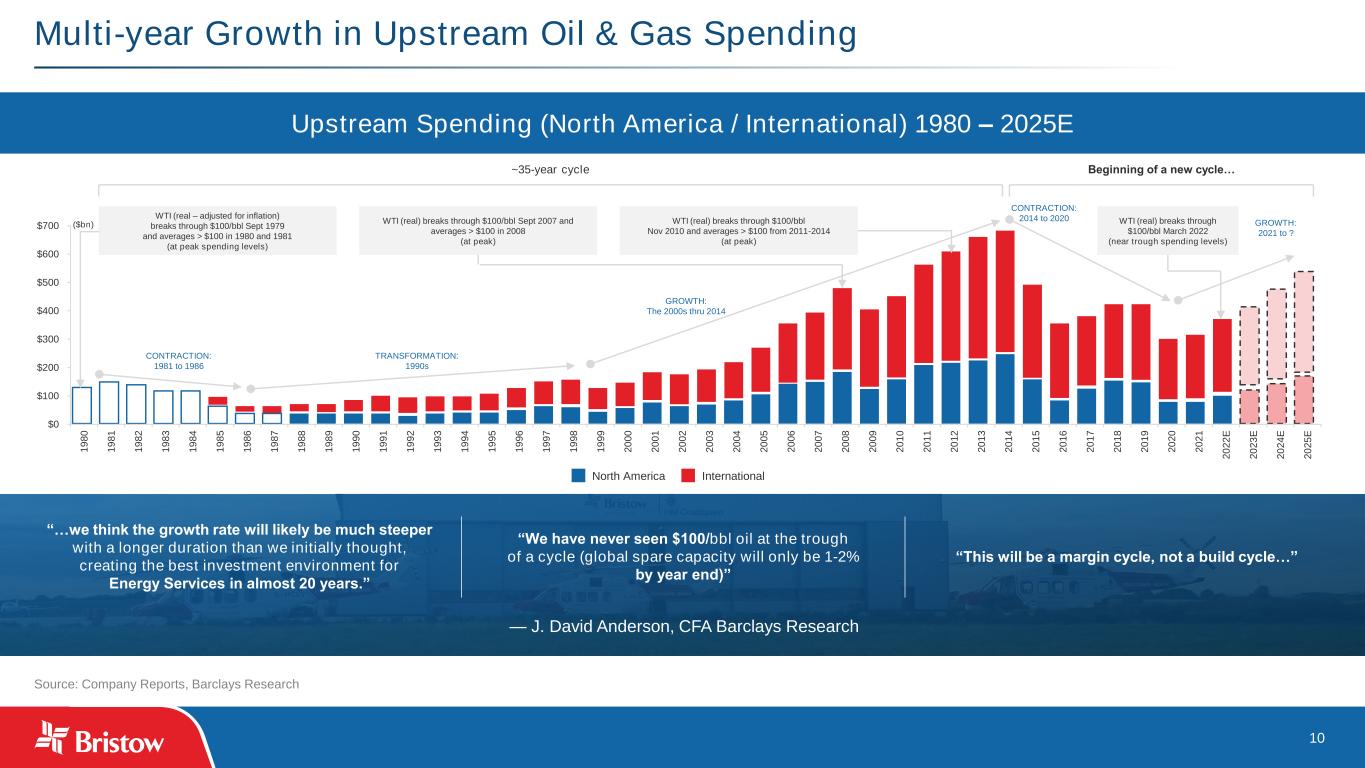

10 Multi-year Growth in Upstream Oil & Gas Spending Source: Company Reports, Barclays Research Upstream Spending (North America / International) 1980 – 2025E $0 $100 $200 $300 $400 $500 $600 $700 1 9 8 0 1 9 8 1 1 9 8 2 1 9 8 3 1 9 8 4 1 9 8 5 1 9 8 6 1 9 8 7 1 9 8 8 1 9 8 9 1 9 9 0 1 9 9 1 1 9 9 2 1 9 9 3 1 9 9 4 1 9 9 5 1 9 9 6 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 2 0 2 2 E 2 0 2 3 E 2 0 2 4 E 2 0 2 5 E ~35-year cycle Beginning of a new cycle… WTI (real – adjusted for inflation) breaks through $100/bbl Sept 1979 and averages > $100 in 1980 and 1981 (at peak spending levels) WTI (real) breaks through $100/bbl Sept 2007 and averages > $100 in 2008 (at peak) WTI (real) breaks through $100/bbl Nov 2010 and averages > $100 from 2011-2014 (at peak) WTI (real) breaks through $100/bbl March 2022 (near trough spending levels) CONTRACTION: 1981 to 1986 TRANSFORMATION: 1990s GROWTH: The 2000s thru 2014 CONTRACTION: 2014 to 2020 GROWTH: 2021 to ? ($bn) North America International “…we think the growth rate will likely be much steeper with a longer duration than we initially thought, creating the best investment environment for Energy Services in almost 20 years.” “We have never seen $100/bbl oil at the trough of a cycle (global spare capacity will only be 1-2% by year end)” “This will be a margin cycle, not a build cycle…” — J. David Anderson, CFA Barclays Research

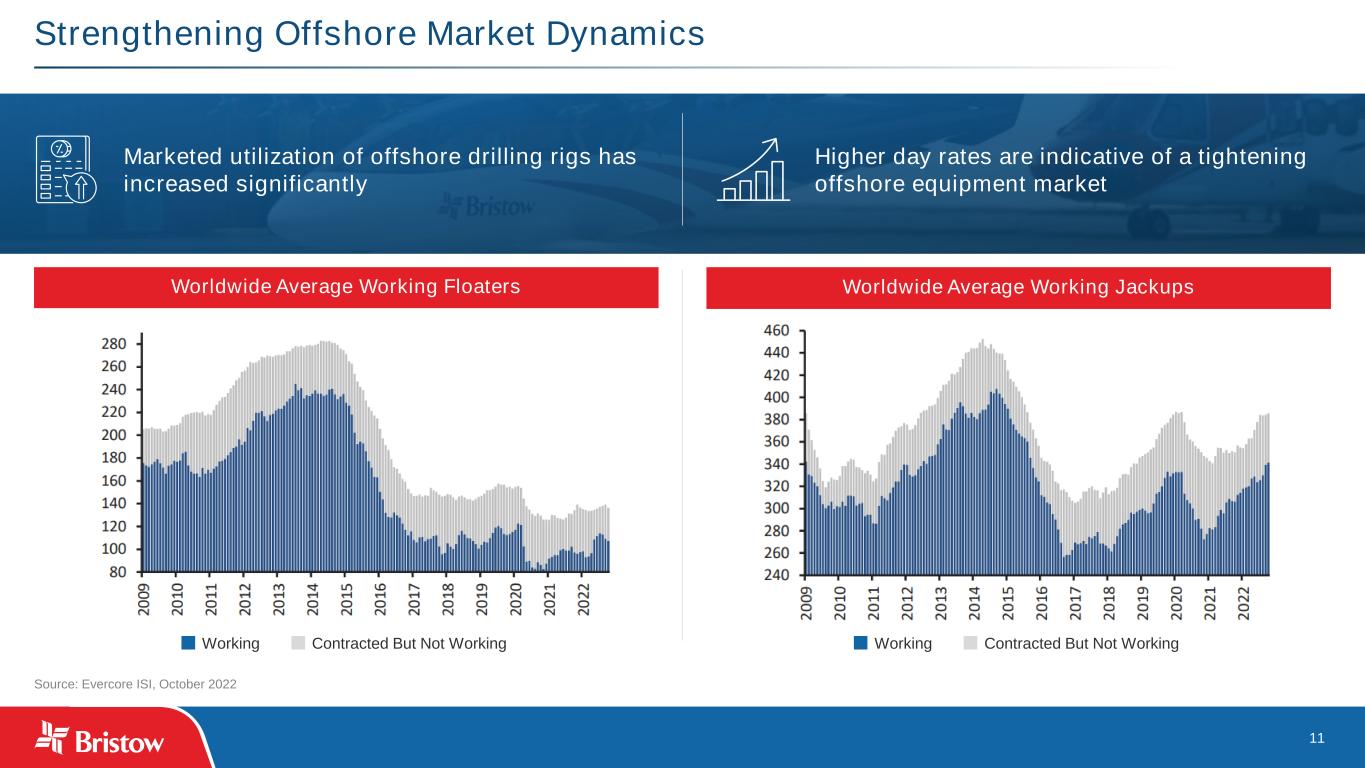

11 Strengthening Offshore Market Dynamics Source: Evercore ISI, October 2022 Worldwide Average Working Floaters Worldwide Average Working Jackups Higher day rates are indicative of a tightening offshore equipment market Marketed utilization of offshore drilling rigs has increased significantly Working Contracted But Not Working Working Contracted But Not Working

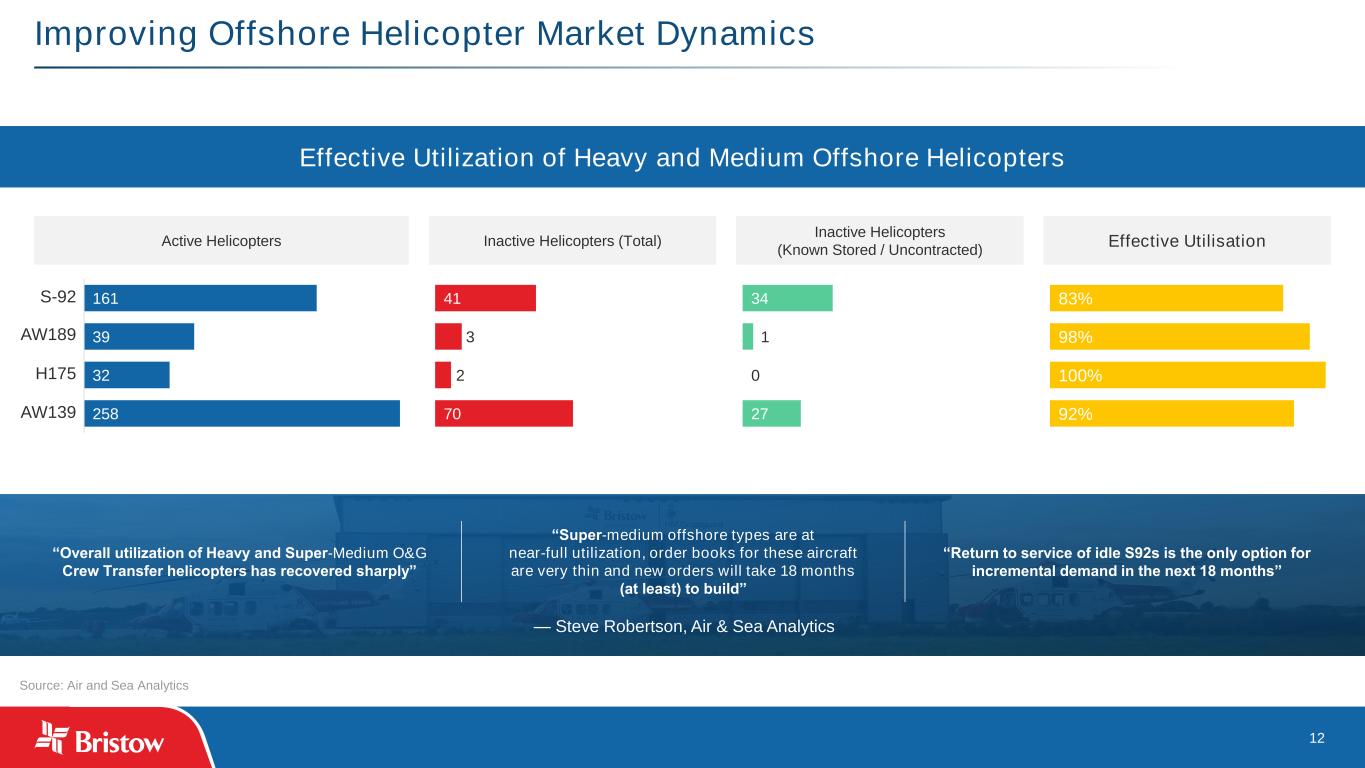

12 Improving Offshore Helicopter Market Dynamics Effective Utilization of Heavy and Medium Offshore Helicopters 258 32 39 161 70 2 3 41 27 0 1 34 92% 100% 98% 83% Active Helicopters Inactive Helicopters (Total) Inactive Helicopters (Known Stored / Uncontracted) Effective Utilisation “Overall utilization of Heavy and Super-Medium O&G Crew Transfer helicopters has recovered sharply” “Super-medium offshore types are at near-full utilization, order books for these aircraft are very thin and new orders will take 18 months (at least) to build” “Return to service of idle S92s is the only option for incremental demand in the next 18 months” — Steve Robertson, Air & Sea Analytics Source: Air and Sea Analytics S-92 AW189 H175 AW139

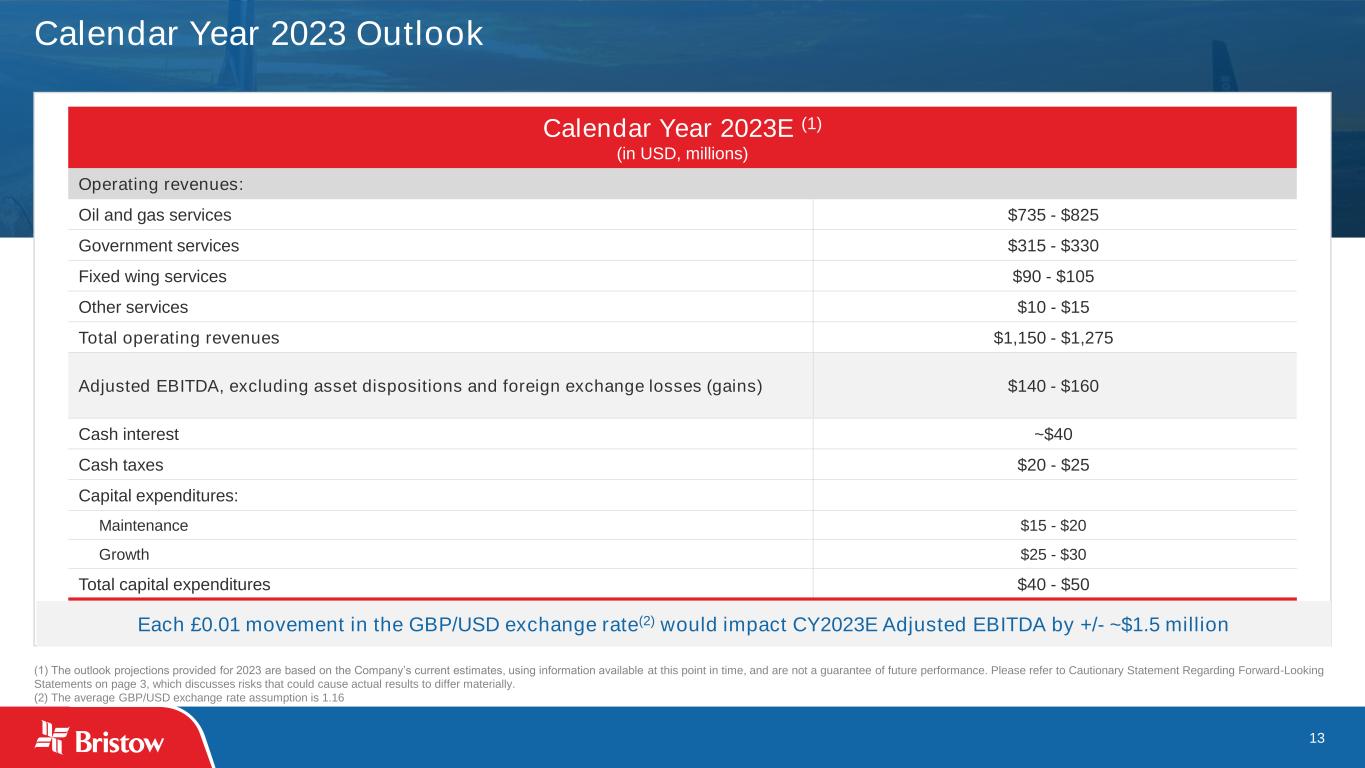

13 Calendar Year 2023 Outlook (1) The outlook projections provided for 2023 are based on the Company’s current estimates, using information available at this point in time, and are not a guarantee of future performance. Please refer to Cautionary Statement Regarding Forward-Looking Statements on page 3, which discusses risks that could cause actual results to differ materially. (2) The average GBP/USD exchange rate assumption is 1.16 Calendar Year 2023E (1) (in USD, millions) Operating revenues: Oil and gas services $735 - $825 Government services $315 - $330 Fixed wing services $90 - $105 Other services $10 - $15 Total operating revenues $1,150 - $1,275 Adjusted EBITDA, excluding asset dispositions and foreign exchange losses (gains) $140 - $160 Cash interest ~$40 Cash taxes $20 - $25 Capital expenditures: Maintenance $15 - $20 Growth $25 - $30 Total capital expenditures $40 - $50 Each £0.01 movement in the GBP/USD exchange rate(2) would impact CY2023E Adjusted EBITDA by +/- ~$1.5 million

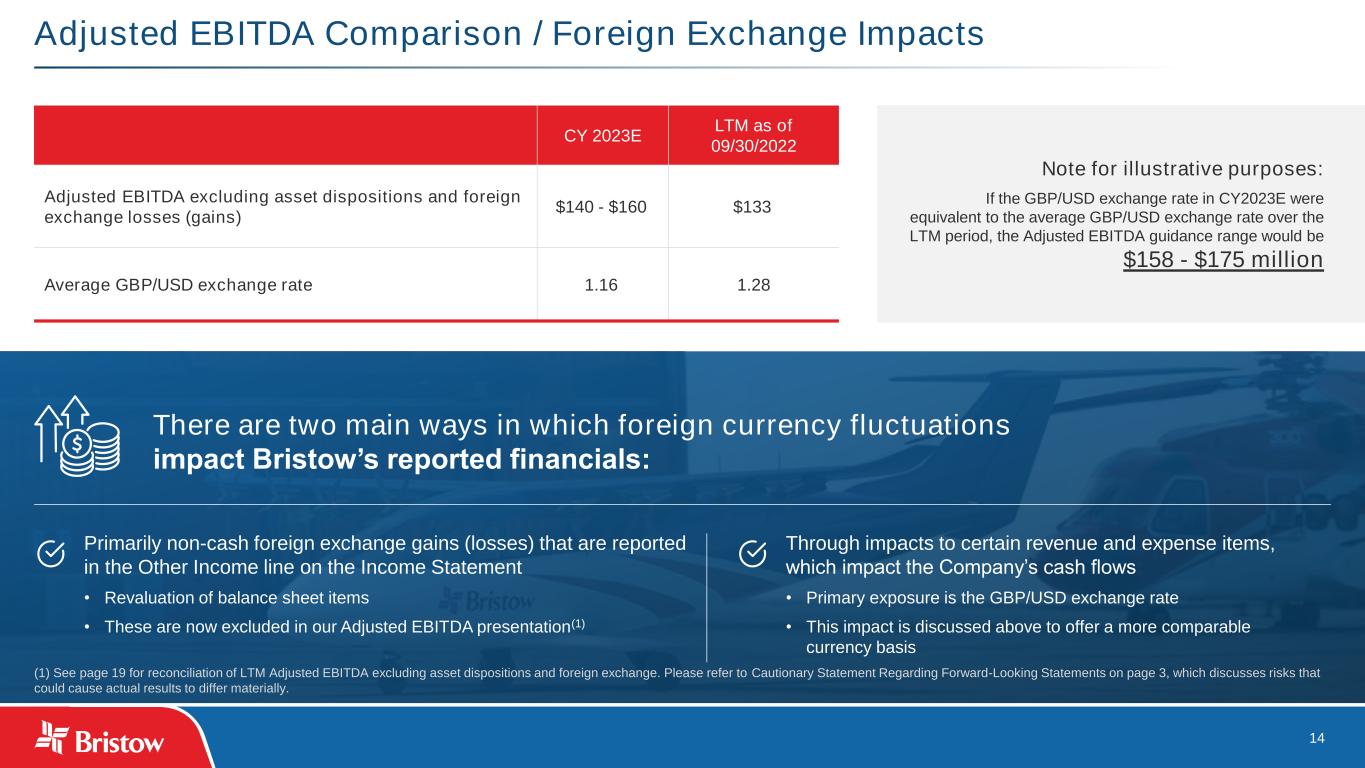

14 Adjusted EBITDA Comparison / Foreign Exchange Impacts (1) See page 19 for reconciliation of LTM Adjusted EBITDA excluding asset dispositions and foreign exchange. Please refer to Cautionary Statement Regarding Forward-Looking Statements on page 3, which discusses risks that could cause actual results to differ materially. CY 2023E LTM as of 09/30/2022 Adjusted EBITDA excluding asset dispositions and foreign exchange losses (gains) $140 - $160 $133 Average GBP/USD exchange rate 1.16 1.28 There are two main ways in which foreign currency fluctuations impact Bristow’s reported financials: Through impacts to certain revenue and expense items, which impact the Company’s cash flows • Primary exposure is the GBP/USD exchange rate • This impact is discussed above to offer a more comparable currency basis Primarily non-cash foreign exchange gains (losses) that are reported in the Other Income line on the Income Statement • Revaluation of balance sheet items • These are now excluded in our Adjusted EBITDA presentation(1) Note for illustrative purposes: If the GBP/USD exchange rate in CY2023E were equivalent to the average GBP/USD exchange rate over the LTM period, the Adjusted EBITDA guidance range would be $158 - $175 million

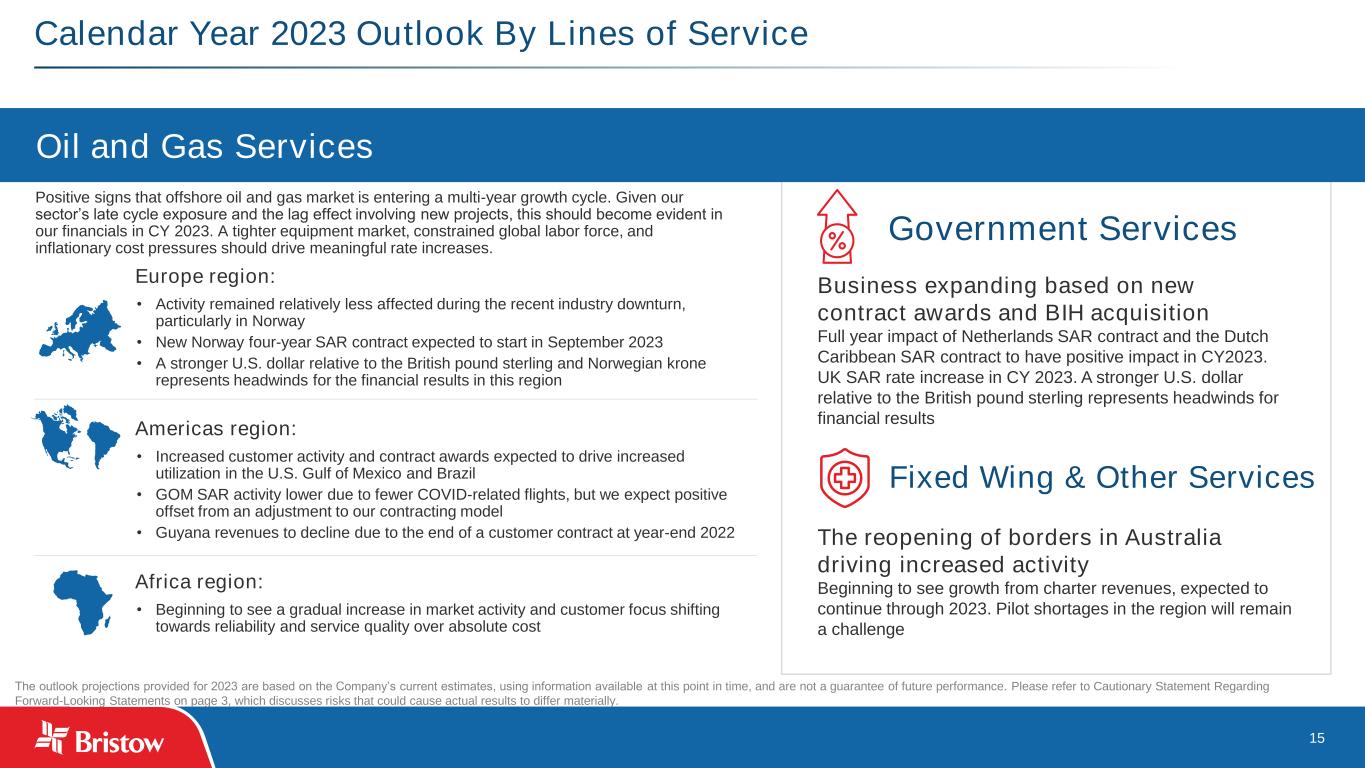

15 Oil and Gas Services Calendar Year 2023 Outlook By Lines of Service The outlook projections provided for 2023 are based on the Company’s current estimates, using information available at this point in time, and are not a guarantee of future performance. Please refer to Cautionary Statement Regarding Forward-Looking Statements on page 3, which discusses risks that could cause actual results to differ materially. Europe region: • Activity remained relatively less affected during the recent industry downturn, particularly in Norway • New Norway four-year SAR contract expected to start in September 2023 • A stronger U.S. dollar relative to the British pound sterling and Norwegian krone represents headwinds for the financial results in this region Oil and Gas Services Business expanding based on new contract awards and BIH acquisition Full year impact of Netherlands SAR contract and the Dutch Caribbean SAR contract to have positive impact in CY2023. UK SAR rate increase in CY 2023. A stronger U.S. dollar relative to the British pound sterling represents headwinds for financial results The reopening of borders in Australia driving increased activity Beginning to see growth from charter revenues, expected to continue through 2023. Pilot shortages in the region will remain a challenge Africa region: • Beginning to see a gradual increase in market activity and customer focus shifting towards reliability and service quality over absolute cost Americas region: • Increased customer activity and contract awards expected to drive increased utilization in the U.S. Gulf of Mexico and Brazil • GOM SAR activity lower due to fewer COVID-related flights, but we expect positive offset from an adjustment to our contracting model • Guyana revenues to decline due to the end of a customer contract at year-end 2022 Government Services Fixed Wing & Other Services Positive signs that offshore oil and gas market is entering a multi-year growth cycle. Given our sector’s late cycle exposure and the lag effect involving new projects, this should become evident in our financials in CY 2023. A tighter equipment market, constrained global labor force, and inflationary cost pressures should drive meaningful rate increases.

APPENDIX ⮚ Fleet Overview ⮚ Strong Balance Sheet and Liquidity Position ⮚ Reconciliation of LTM Adjusted EBITDA ⮚ Adjusted Free Cash Flow Reconciliation ⮚ Operating Revenues and Flight Hours by Line of Service ⮚ LTM Operating Revenues by Region

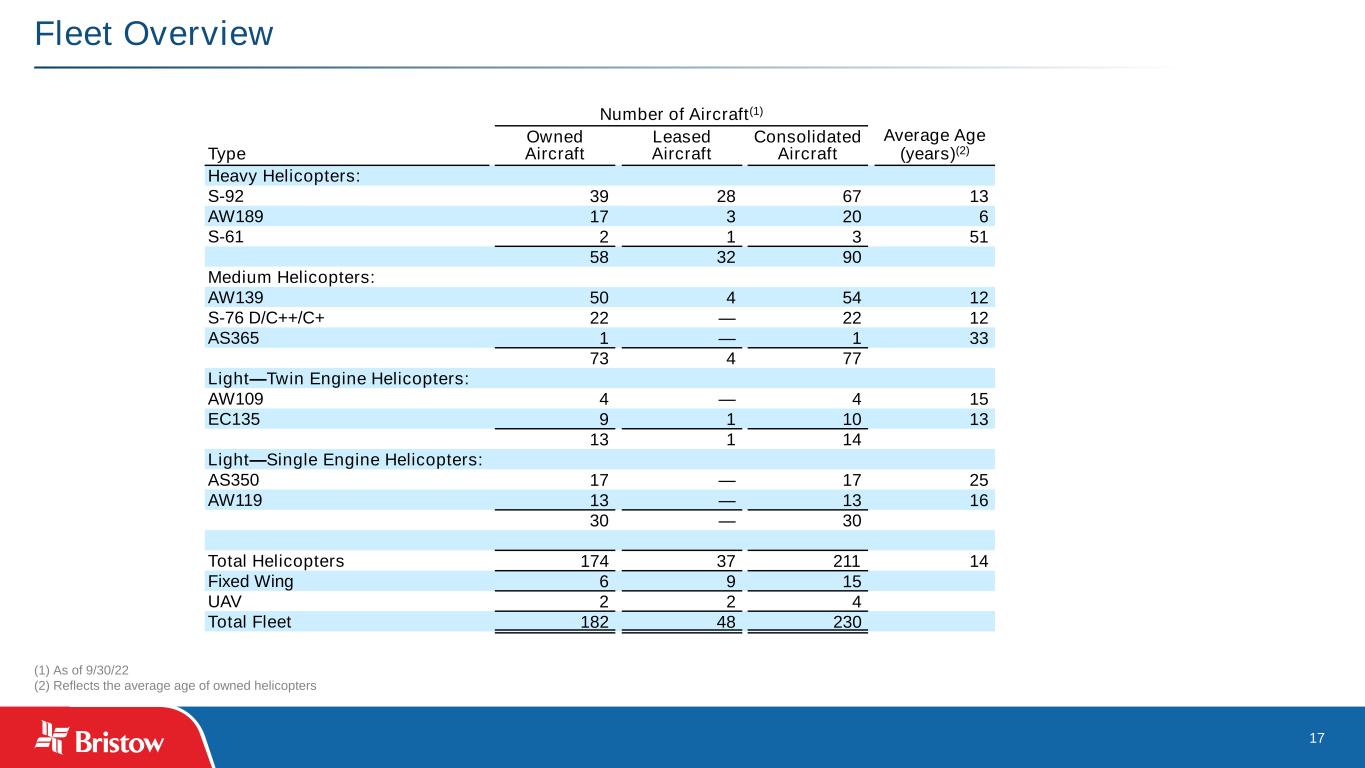

17 Fleet Overview (1) As of 9/30/22 (2) Reflects the average age of owned helicopters Number of Aircraft(1) Type Owned Aircraft Leased Aircraft Consolidated Aircraft Average Age (years)(2) Heavy Helicopters: S-92 39 28 67 13 AW189 17 3 20 6 S-61 2 1 3 51 58 32 90 Medium Helicopters: AW139 50 4 54 12 S-76 D/C++/C+ 22 — 22 12 AS365 1 — 1 33 73 4 77 Light—Twin Engine Helicopters: AW109 4 — 4 15 EC135 9 1 10 13 13 1 14 Light—Single Engine Helicopters: AS350 17 — 17 25 AW119 13 — 13 16 30 — 30 Total Helicopters 174 37 211 14 Fixed Wing 6 9 15 UAV 2 2 4 Total Fleet 182 48 230

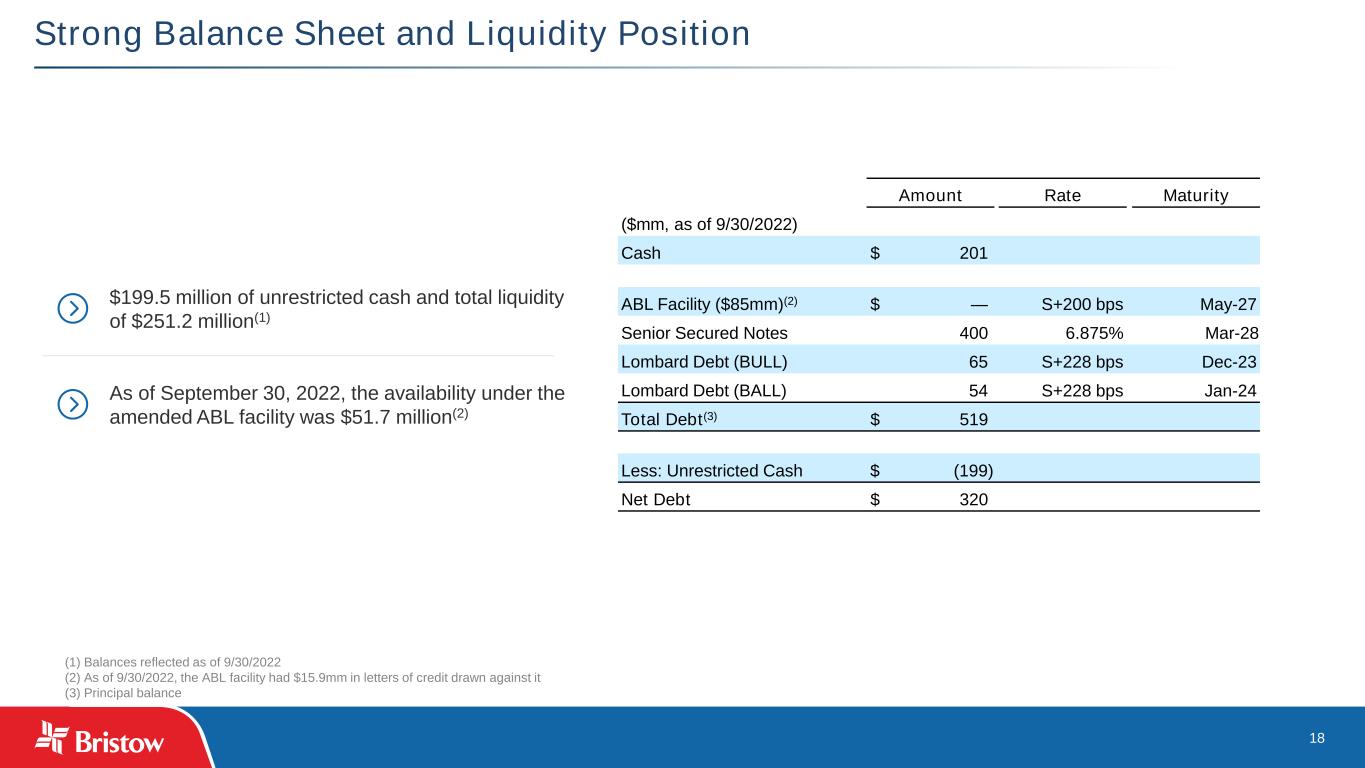

18 Strong Balance Sheet and Liquidity Position (1) Balances reflected as of 9/30/2022 (2) As of 9/30/2022, the ABL facility had $15.9mm in letters of credit drawn against it (3) Principal balance $199.5 million of unrestricted cash and total liquidity of $251.2 million(1) As of September 30, 2022, the availability under the amended ABL facility was $51.7 million(2) Amount Rate Maturity ($mm, as of 9/30/2022) Cash $ 201 ABL Facility ($85mm)(2) $ — S+200 bps May-27 Senior Secured Notes 400 6.875% Mar-28 Lombard Debt (BULL) 65 S+228 bps Dec-23 Lombard Debt (BALL) 54 S+228 bps Jan-24 Total Debt(3) $ 519 Less: Unrestricted Cash $ (199) Net Debt $ 320

19 Reconciliation of LTM Adjusted EBITDA (2) Other special items include professional services fees that are not related to ongoing business operations and other nonrecurring costs. Three Months Ended (1) Special items include the following: September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 LTM Restructuring costs $ — $ — $ 2,113 $ 17 $ 2,130 Loss on impairment — 5,187 — — 5,187 PBH amortization 3,238 3,291 3,062 3,060 12,651 Merger and integration costs 291 368 824 34 1,517 Reorganization items, net 29 49 43 29 150 Other special items (2) 1,239 1,091 3,796 2,253 8,379 $ 4,797 $ 9,986 $ 9,838 $ 5,393 $ 30,014 Three Months Ended ($000s) September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 LTM Net income (loss) $ 16,501 $ 4,015 $ (4,376) $ 164 $ 16,304 Depreciation and amortization expense 16,051 16,536 16,919 17,223 66,729 Interest expense 10,008 10,242 10,241 10,230 40,721 Income tax expense (benefit) 116 8,231 3,260 (1,608) 9,999 EBITDA $ 42,676 $ 39,024 $ 26,044 $ 26,009 $ 133,753 Special items (1) 4,797 9,986 9,838 5,393 30,014 Adjusted EBITDA $ 47,473 $ 49,010 $ 35,882 $ 31,402 $ 163,767 (Gains) losses on disposals of assets, net (3,368) 2,101 41 (727) (1,953) Foreign exchange (gains) losses (10,199) (13,984) (5,950) 771 (29,362) Adjusted EBITDA excluding asset dispositions and foreign exchange $ 33,906 $ 37,127 $ 29,973 $ 31,446 $ 132,452

20 Adjusted Free Cash Flow Reconciliation (1) Other special items include professional services fees that are not related to ongoing business operations and other nonrecurring costs.

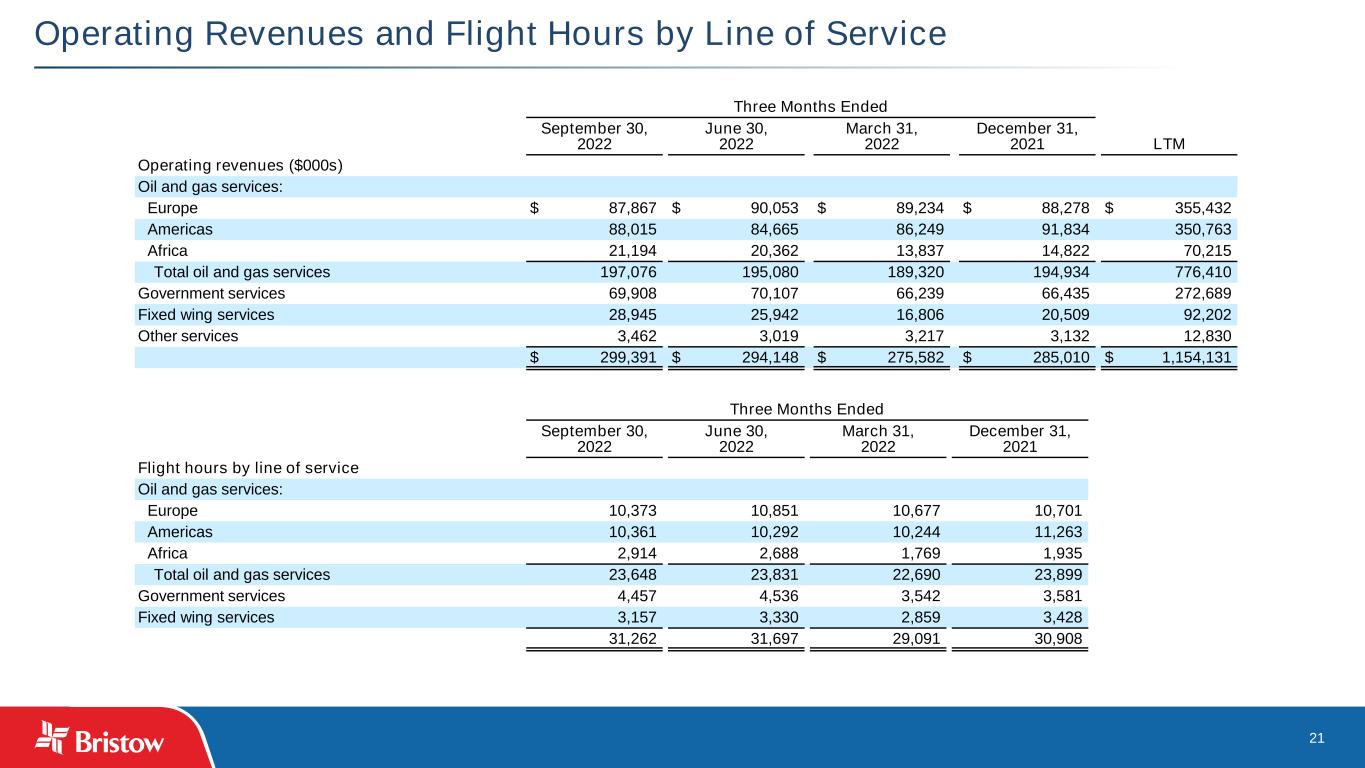

21 Operating Revenues and Flight Hours by Line of Service Three Months Ended September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 LTM Operating revenues ($000s) Oil and gas services: Europe $ 87,867 $ 90,053 $ 89,234 $ 88,278 $ 355,432 Americas 88,015 84,665 86,249 91,834 350,763 Africa 21,194 20,362 13,837 14,822 70,215 Total oil and gas services 197,076 195,080 189,320 194,934 776,410 Government services 69,908 70,107 66,239 66,435 272,689 Fixed wing services 28,945 25,942 16,806 20,509 92,202 Other services 3,462 3,019 3,217 3,132 12,830 $ 299,391 $ 294,148 $ 275,582 $ 285,010 $ 1,154,131 Three Months Ended September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 Flight hours by line of service Oil and gas services: Europe 10,373 10,851 10,677 10,701 Americas 10,361 10,292 10,244 11,263 Africa 2,914 2,688 1,769 1,935 Total oil and gas services 23,648 23,831 22,690 23,899 Government services 4,457 4,536 3,542 3,581 Fixed wing services 3,157 3,330 2,859 3,428 31,262 31,697 29,091 30,908

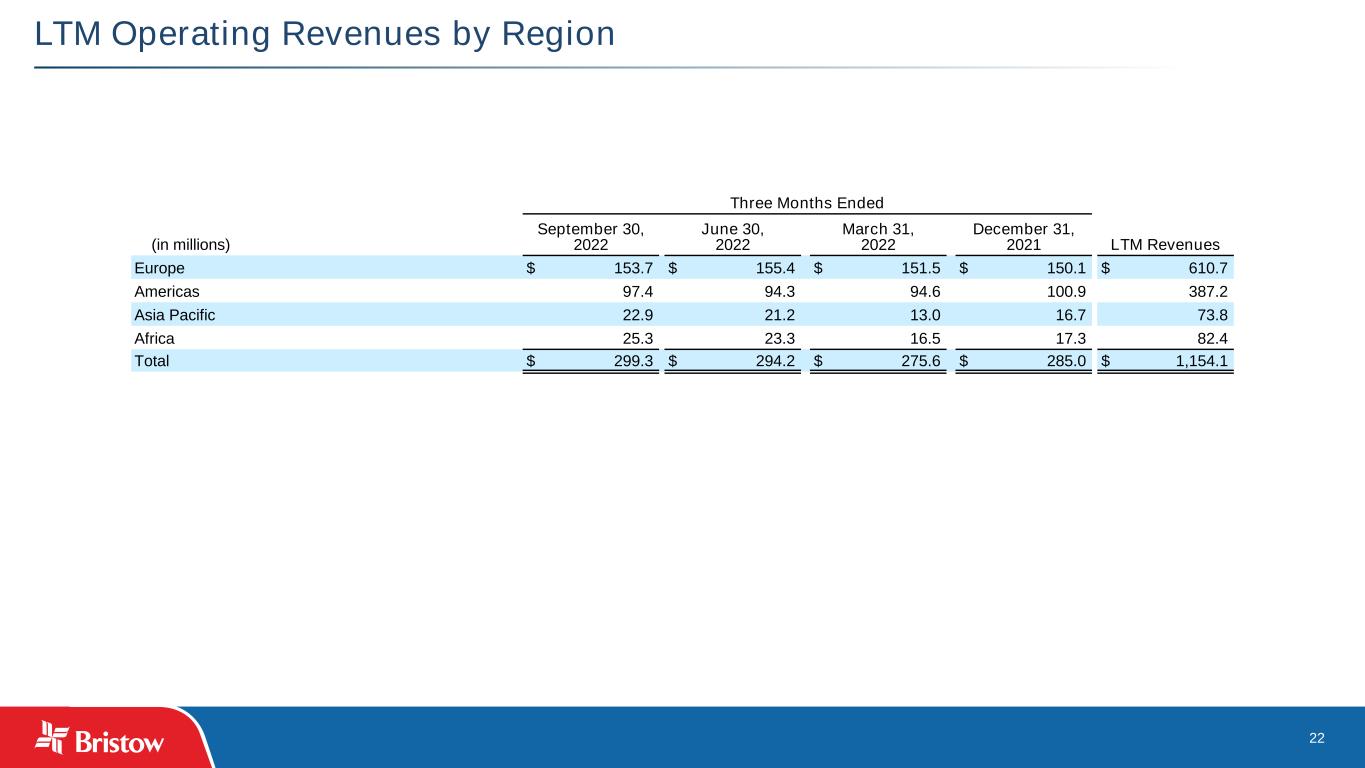

22 LTM Operating Revenues by Region Three Months Ended (in millions) September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 LTM Revenues Europe $ 153.7 $ 155.4 $ 151.5 $ 150.1 $ 610.7 Americas 97.4 94.3 94.6 100.9 387.2 Asia Pacific 22.9 21.2 13.0 16.7 73.8 Africa 25.3 23.3 16.5 17.3 82.4 Total $ 299.3 $ 294.2 $ 275.6 $ 285.0 $ 1,154.1