0001525221DEF 14AFALSEBristow Group Inc.00015252212023-01-012023-12-31iso4217:USD00015252212022-04-012022-12-3100015252212022-01-012022-12-3100015252212021-01-012021-12-3100015252212020-01-012020-03-310001525221ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310001525221ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001525221ecd:PeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-012023-12-310001525221ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-012023-12-310001525221ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310001525221ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310001525221ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001525221ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001525221ecd:PeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310001525221ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310001525221ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-01-012023-12-310001525221ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001525221ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-01-012023-12-310001525221ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001525221vtol:ChangeInPensionValueMemberecd:PeoMember2023-01-012023-12-310001525221vtol:ChangeInPensionValueMemberecd:NonPeoNeoMember2023-01-012023-12-310001525221ecd:PeoMembervtol:PensionAdjustmentsServiceCostAndPriorServiceCostMember2023-01-012023-12-310001525221vtol:PensionAdjustmentsServiceCostAndPriorServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-31000152522122023-01-012023-12-31000152522112023-01-012023-12-31000152522132023-01-012023-12-31000152522142023-01-012023-12-31000152522152023-01-012023-12-31

3151 Briarpark Driver

Suite 700

Houston, Texas 77042

Notice of 2024

Annual Meeting of Stockholders

And Proxy Statement

3151 Briarpark Drive

Suite 700

Houston, Texas 77042

April 22, 2024

Dear Fellow Stockholder:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders (the “Meeting”) of Bristow Group Inc. (the “Company”), which will be held exclusively via a live audio webcast at www.virtualshareholdermeeting.com/VTOL2024 on Wednesday, June 5, 2024, at 8:00 a.m. Central Daylight Time. All holders of record of the Company’s outstanding common stock at the close of business on April 8, 2024 will be entitled to vote at the Meeting.

At the Meeting, we will ask you (i) to elect nine directors to serve until the 2025 Annual Meeting of Stockholders; (ii) to approve, on an advisory basis, named executive officer compensation; (iii) to consider and vote upon a proposed amendment to the Company’s 2021 Equity Incentive Plan; and (iv) to ratify the appointment of KPMG LLP as the Company’s independent auditors for 2024.

Regardless of the number of shares of the Company’s common stock that you own, you are encouraged to read the accompanying Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2023 carefully. Please review the proxy card for instructions on how you can vote your shares of common stock over the Internet, by telephone, by mail or by attending the Meeting online at www.virtualshareholdermeeting.com/VTOL2024 using your 16-digit control number and voting your shares electronically on June 5, 2024. It is important that all holders of our common stock participate in the affairs of the Company. The prompt return of proxy cards will ensure the presence of a quorum.

We look forward to your participation in the Meeting.

Sincerely,

Christopher S. Bradshaw

President and Chief Executive Officer

| | | | | | | | | | | | | | |

| | 3151 Briarpark Drive | Suite 700 | Houston, Texas 77042 | |

| | | | |

Notice of 2024 Annual Meeting of Stockholders

DATE June 5, 2024

TIME 8:00 a.m. CDT

VIA WEBCAST www.virtualshareholder meeting.com/VTOL2024 | | TO OUR

STOCKHOLDERS | |

| April 22, 2024 | |

| | | |

| The 2024 Annual Meeting of Stockholders (the “Meeting”) of Bristow Group Inc. (the “Company”) will be held exclusively via a live audio webcast at www.virtualshareholdermeeting.com/VTOL2024 on Wednesday, June 5, 2024, at 8:00 a.m. Central Daylight Time for the following purposes: |

| | | |

| | | |

| 1. | To elect nine directors named in the accompanying Proxy Statement to serve until the 2025 Annual Meeting of Stockholders or until his or her successor is duly qualified and elected or until his or her earlier resignation or removal; | |

| | | |

| 2. | To hold an advisory vote to approve named executive officer compensation; | |

| | | |

| 3. | To consider and vote upon an amendment to the Company’s 2021 Equity Incentive Plan; | |

| | | |

| 4. | To ratify the appointment of KPMG LLP as the Company’s independent auditors for 2024; and | |

| | | |

| 5. | To transact such other business as may properly come before the Meeting and any adjournments or postponements thereof. | |

| | | |

| | | | |

| | Only holders of record of the Company’s common stock at the close of business on April 8, 2024 will be entitled to notice of and to vote at the Meeting. See the “Solicitation of Proxies, Voting and Revocation” section of the accompanying Proxy Statement for the place where the list of stockholders may be examined. We are furnishing proxy materials to our stockholders using the U.S. Securities and Exchange Commission (“SEC”) rule that allows companies to furnish their proxy materials over the Internet. As a result, on or about April 22, 2024, we are mailing to many of our stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) instead of a paper copy of the accompanying Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Annual Report”). The Notice contains instructions on how to access the accompanying Proxy Statement and our 2023 Annual Report over the Internet. The Notice also provides instructions on how you can request a |

| | | | | | | | | | | | | | |

FOR SPECIFIC INSTRUCTIONS Please refer to the section entitled “Questions and Answers About Voting Your Shares” beginning on page 1 | | copy of our proxy materials, including the accompanying Proxy Statement, our 2023 Annual Report and a form of our proxy card. We believe that posting these materials on the Internet enables us to provide stockholders with the information that they need more quickly, while lowering our costs of printing and delivery and reducing the environmental impact of the Meeting. All stockholders who do not receive a Notice, including the stockholders who have previously requested to receive paper copies of our proxy materials, will receive a paper copy of our proxy materials by mail. If you received our proxy materials via e-mail in accordance with your previous request, the e-mail contains voting instructions and links to the accompanying Proxy Statement and our 2023 Annual Report on the Internet. Only stockholders of record and beneficial owners will be able to virtually attend and vote their shares of the Company’s common stock electronically at the Meeting. Submitting a vote before the Meeting will not preclude you from voting your shares electronically at the Meeting should you decide to virtually attend. For specific instructions on how to participate in and vote your shares at the Meeting, please refer to the section entitled “Questions and Answers About Voting Your Shares” beginning on page 1 of the accompanying Proxy Statement. By order of our Board of Directors, Elizabeth Matthews Senior Vice President, General Counsel, Head of Government Affairs, and Corporate Secretary |

| | | | |

| | | YOUR VOTE IS VERY IMPORTANT! WE ENCOURAGE YOU TO VOTE AS SOON AS POSSIBLE. PLEASE VOTE BY PROXY OVER THE INTERNET, OR, IF YOU RECEIVED PAPER COPIES OF OUR PROXY MATERIALS BY MAIL, YOU CAN VOTE BY MAIL, TELEPHONE OR INTERNET BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD, WHETHER OR NOT YOU EXPECT TO VIRTUALLY ATTEND THE MEETING, SO THAT YOUR SHARES OF THE COMPANY’S COMMON STOCK MAY BE REPRESENTED AT THE MEETING IF YOU ARE UNABLE TO VIRTUALLY ATTEND AND VOTE ELECTRONICALLY. | |

| | | | |

PROXY STATEMENT SUMMARY

This summary highlights certain information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you may wish to consider prior to voting. Please review the entire Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2023 for more detailed information.

2024 Annual Meeting of Stockholders (the “Meeting”)

| | | | | | | | | | | | | | | | | |

| | | | | |

| Meeting Details DATE June 5, 2024 TIME 8:00 a.m. CDT VIA WEBCAST www.virtualshareholder meeting.com/VTOL2024 | | | VOTING ELIGIBILITY Only stockholders as of the close of business on April 8, 2024 (the “Record Date”) are eligible to vote at the Meeting or by proxy, and each such stockholder shall have one vote for each share of common stock held on the Record Date. |

| | | | |

| | | | |

| | | VOTING METHODS |

| | | BEFORE THE MEETING |

| | | | BY INTERNET Go to www.proxyvote.com for voting instructions or scan the QR code on your Important Notice Regarding the Availability of Proxy Materials or proxy card with your smartphone, then cast your vote electronically by 11:59 p.m. (Eastern Daylight Time) on June 4, 2024. |

| | | | BY TELEPHONE You may call 1-800-690-6903 on a touch-tone telephone and follow the instructions provided by the recorded message to vote your shares by telephone by 11:59 p.m. (Eastern Daylight Time) on June 4, 2024. |

| | | | BY MAIL You may promptly mail your completed and executed proxy card in the postage-paid envelope, which must be received by the Company on or prior to June 4, 2024. |

| | | DURING THE MEETING |

| | | | VIRTUAL MEETING Go to www.virtualshareholdermeeting.com/VTOL2024 and follow the posted instructions. You will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, your proxy card or the voting instructions that accompany your proxy materials. |

| | | | | |

Business of the Meeting

| | | | | | | | | | | |

| Proposals | Board Vote

Recommendation | See Page Number

for more information |

| | | |

1 | | FOR each nominee | |

2 | | FOR | |

| 3 | | FOR | |

| 4 | | FOR | |

| | | | | | | | |

| Bristow Group Inc. | i | 2024 Proxy Statement |

Our Director Nominees

You are being asked to vote on the election of these nine directors. Additional information about each director’s background, skills and experience can be found on pages 23 to 27 of this Proxy Statement. | | | | | | | | | | | | | | |

| Name | Age | Director Since | Independent | Committee Membership and Chairpersons |

| | | | |

| G. Mark Mickelson | 58 | 2020 | ü | Chairman of the Board of Directors |

| Christopher S. Bradshaw | 47 | 2015 | ü | |

| Lorin L. Brass | 70 | 2020 | ü | Compensation

Environmental, Social, and Governance |

| Wesley E. Kern | 57 | 2020 | ü | Compensation (Chair)

Audit |

| Robert J. Manzo | 66 | 2020 | ü | Environmental, Social, and Governance (Chair)

Audit |

| General Maryanne Miller, Ret. | 65 | 2021 | ü | Compensation |

| Christopher Pucillo | 56 | 2020 | ü | Compensation

Environmental, Social, and Governance |

| Shefali Shah | 52 | 2023 | ü | Audit |

| Brian D. Truelove | 65 | 2020 | ü | Audit (Chair)

Environmental, Social, and Governance |

Advisory Approval of Named Executive Officer Compensation

In 2023, the Compensation Committee and the Board of Directors (our “Board”) maintained the compensation philosophy and design adopted following the merger involving Bristow Group Inc. and Era Group Inc. Underpinning the 2023 executive compensation program is a belief by the Compensation Committee that there must be a meaningful link between the compensation paid to our Named Executive Officers and our goal of long-term value creation for our stockholders.

The 2023 executive compensation program included: pay tied to performance through the use of performance-based stock units (which may be earned via performance against an absolute financial metric and relative total stockholder return); a 50% weighting of the financial metric in the short-term annual incentive program (the “STIP”); and a minimum financial metric threshold that must be achieved prior to the payment of any amounts under the individual strategic goals portion of the STIP.

| | | | | | | | |

| Bristow Group Inc. | ii | 2024 Proxy Statement |

Set forth below are other executive compensation best practices that guide the design of our executive compensation program.

| | | | | | | | |

ü WHAT WE DO | ü | Engage with large stockholders to discuss matters of interest. |

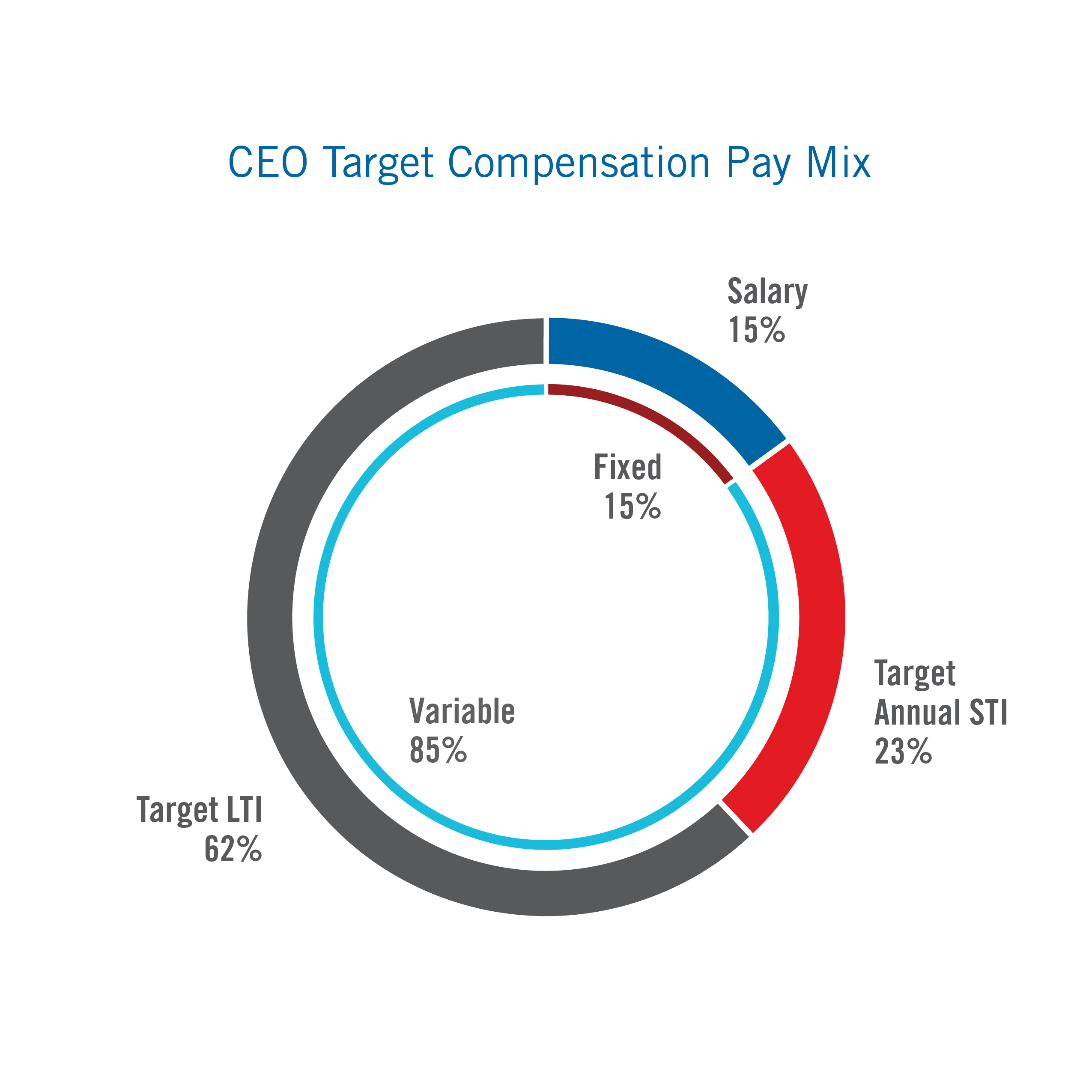

ü | Pay for performance. Place a heavy emphasis on variable pay with approximately 85% of our Chief Executive Officer’s target direct compensation contingent upon financial and operational performance and growth in long-term stockholder value. |

ü | Use performance-based long-term incentive award compensation through performance-based stock units for which value is contingent upon stock price, Company performance, and performance relative to the PHLX Oil Service Index (the “OSX Index”). |

ü | Review target compensation levels relative to an appropriate set of peers annually. |

ü | Reinforce the alignment of stockholders and our executives and directors by requiring significant levels of stock ownership. |

ü | Ensure accountability and manage risk through (i) a robust financial restatement clawback policy applicable to our executive officers in compliance with NYSE requirements and a supplemental policy for all employees in the event of a restatement as a result of employee misconduct, (ii) limits on maximum annual cash incentive award opportunities, and (iii) ongoing risk assessments of our program. |

ü | Use relative and absolute performance metrics to determine the payment of future performance awards under the Company’s long-term incentive awards. |

ü | Maintain a Compensation Committee composed entirely of independent directors who are advised by an independent compensation consultant. |

| | | | | | | | |

X WHAT WE DON’T DO | X | No employment agreements with any of our executive officers. |

| X | No pledging or hedging of our Company stock (unless cleared in advance by our Compliance Committee), and no repricing stock options. |

| X | No excise tax gross-ups. |

| X | No significant perquisites. |

| X | No guarantee of bonuses. |

Amendment to the Company’s 2021 Equity Incentive Plan

At the Meeting, our stockholders will be asked to approve an amendment (the “Amendment”) to the Company’s 2021 Equity Incentive Plan (the “LTIP”) to increase the number of shares that may be issued thereunder from 2,130,000 shares to 2,785,000 shares. Our Board approved the Amendment on April 17, 2024, subject to stockholder approval. We believe that the requested allocation is critical over the next year to ensure our ability to attract and retain key talent and to provide our executive leadership with competitive reward opportunities that are aligned with our stockholders’ interests.

Our Independent Auditors

The Audit Committee of our Board has determined that the accounting firm of KPMG LLP (“KPMG”) is independent from the Company and appointed KPMG as the Company’s independent auditors for 2024. Our Board recommends a vote for the ratification of the appointment of KPMG, which conducted the examination of the Company’s financial statements for each of the past 21 years. KPMG’s total fees for the year ended December 31, 2023, the nine-month transition period ended December 31, 2022 (“TYE22”) and the fiscal year ended March 31, 2022, were $3.0 million, $5.2 million and $5.4 million, respectively, which included approximately $0.3 million (or 9.1%), $0.1 million (or 2.7%) and $0.4 million (or 6.5%) of non-audit services in 2023, TYE22 and the fiscal year ended March 31, 2022, respectively, that were authorized by the Audit Committee in compliance with our pre-approval policies and procedures.

| | | | | | | | |

| Bristow Group Inc. | iii | 2024 Proxy Statement |

TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PROPOSAL 3 – APPROVAL OF AN AMENDMENT TO THE COMPANY’S 2021 EQUITY INCENTIVE PLAN | |

| |

| |

| |

| |

Appendix B – Amendment No. 2 to Bristow Group Inc. 2021 Equity Incentive Plan | |

Appendix C-1 – Bristow Group Inc. 2021 Equity Incentive Plan | |

Appendix C-2 – Amendment No. 1 to Bristow Group Inc. 2021 Equity Incentive Plan | |

SOLICITATION OF PROXIES, VOTING AND REVOCATION

Information About this Proxy Statement and the Meeting

This Proxy Statement and the enclosed proxy card are being furnished to holders of record of common stock, $0.01 par value per share (“Common Stock”), of Bristow Group Inc., a Delaware corporation (the “Company” or “we”, “us” or “our”), in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”) for use at the 2024 Annual Meeting of Stockholders (the “Meeting”) to be held on Wednesday, June 5, 2024, and at any adjournment or postponements thereof. When the Company asks for your proxy, we must provide you with a proxy statement that contains certain information specified by law. This Proxy Statement and the enclosed proxy card were made available to our stockholders on or about April 22, 2024. All proxies in the form provided by the Company that are properly executed and returned to us prior to the Meeting will be voted at the Meeting, and any adjournments or postponements thereof, as specified by the stockholders in the proxy or, if not specified, as set forth in this Proxy Statement.

Unless the context indicates otherwise, the terms “we,” “our,” “ours,” “us” and the “Company” refer to Bristow Group Inc. and its consolidated subsidiaries. References herein to “Old Bristow” refer to the entity formerly known as Bristow Group Inc. and now known as Bristow Holdings U.S. Inc., together with its subsidiaries prior to the consummation of the merger between Era Group Inc. and Bristow Group Inc. on June 11, 2020 (the “Merger”). References herein to “Era” refer to the entity formerly known as Era Group Inc. and which was renamed to Bristow Group Inc. in connection with the consummation of the Merger.

Questions and Answers About Voting Your Shares

Why am I receiving these materials?

The Board is providing these materials to you in connection with the Board’s solicitation of proxies from our stockholders for the Meeting and any adjournments or postponements thereof. The Meeting will be online and will be a completely virtual meeting of stockholders. You may attend, vote and submit questions during the Meeting via live audio webcast on the Internet at www.virtualshareholdermeeting.com/VTOL2024, on Wednesday, June 5, 2024, at 8:00 a.m. Central Daylight Time. On or about April 22, 2024, we made available to our stockholders proxy materials or an Important Notice Regarding the Availability of Proxy Materials (which we refer to as a “Notice”), containing instructions on how to access our proxy materials, including this Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2023 (the “Annual Report”), and how to vote your shares.

What is the purpose of the Meeting?

At the Meeting, you and our other stockholders entitled to vote at the Meeting will be asked to consider and vote on the following proposals:

1To elect nine directors named in this Proxy Statement to serve until the 2025 Annual Meeting of Stockholders or until his or her successor is duly qualified and elected or until his or her earlier resignation or removal;

2To approve, on an advisory basis, named executive officer compensation;

3To consider and vote upon an amendment to the Company’s 2021 Equity Incentive Plan; and

4To ratify the appointment of KPMG LLP (“KPMG”) as the Company’s independent auditors for 2024.

| | | | | | | | |

| Bristow Group Inc. | 1 | 2024 Proxy Statement |

| | | | | | | | |

| SOLICITATION OF PROXIES, VOTING AND REVOCATION | | |

Will there be any other items of business on the agenda?

We do not expect that any other items of business will be considered because the deadlines for stockholder proposals and nominations have already passed. Nonetheless, in case there is an unforeseen need, the accompanying proxy gives discretionary authority to the persons named on the proxy with respect to any other matters that might be brought before the Meeting. Those persons intend to vote that proxy in accordance with their best judgment.

Who can attend the Meeting?

Only stockholders of record as of the close of business on April 8, 2024 (the “Record Date”) or the holders of their properly submitted valid proxies may attend the Meeting virtually at www.virtualshareholdermeeting.com/VTOL2024. A list of the Company’s stockholders entitled to vote at the Meeting will be available for review during ordinary business hours for ten days prior to the Meeting, and information on how to remotely access a list of stockholders entitled to vote at the Meeting in secure electronic format will be available online on the day of the Meeting.

How do I attend the Meeting?

The Meeting will be held solely by means of remote communication in a virtual meeting format only. If you are a stockholder of record as of the close of business on the Record Date, you will be able to virtually attend the Meeting, vote your shares and submit your questions online during the Meeting by visiting www.virtualshareholdermeeting.com/VTOL2024 and following the login instructions below. If you hold your shares in “street name” (a term that means the shares are held in the name of another party on behalf of its customer, the beneficial owner), you may gain access to the Meeting by following the instructions in the voting instruction card provided by your broker, bank or other nominee holder.

How do I access the audio webcast of the Meeting?

The Meeting will begin promptly at 8:00 a.m. (Central Daylight Time). The Company encourages you to access the Meeting prior to the start time. Online access to the audio webcast will open approximately thirty minutes prior to the start of the Meeting to allow time for you to log in and test your computer audio system, and you should allow ample time for the check-in procedures. To virtually attend the Meeting, log in at www.virtualshareholdermeeting.com/VTOL2024. It is important that you retain a copy of your unique 16-digit control number, which appears on your Notice, on your proxy card or on the instructions that accompanied your proxy materials, as such number will be required to gain access to and vote during the Meeting. In the event that you do not have a control number, please contact your broker, bank or other nominee holder as soon as possible so that you can be provided with the control number and gain access to the Meeting. If, for any reason, you are unable to locate your control number, you will still be able to virtually attend the Meeting as a guest by accessing www.virtualshareholdermeeting.com/VTOL2024 and following the guest login instructions; you will not, however, be able to vote or ask questions.

How do I submit a question at the Meeting?

As part of the Meeting, we will hold a live question and answer session, during which time we intend to answer questions submitted during the Meeting in accordance with the rules of conduct for the Meeting that are pertinent to the Company and meeting matters, as time permits. Questions and answers will be grouped by topic and substantially similar questions will be grouped and answered once. The rules of conduct for the Meeting will be posted on www.virtualshareholdermeeting.com/VTOL2024 before and during the Meeting. Only stockholders who log in using their unique 16-digit control number, which appears on your Notice, on your proxy card or on the instructions that accompanied your proxy materials, will be able to ask questions at the Meeting. Any questions pertinent to matters properly brought before the Meeting that cannot be answered during the Meeting may be raised after the Meeting by contacting Investor Relations at InvestorRelations@bristowgroup.com.

| | | | | | | | |

| Bristow Group Inc. | 2 | 2024 Proxy Statement |

| | | | | | | | |

| SOLICITATION OF PROXIES, VOTING AND REVOCATION | | |

Why are you holding a virtual meeting instead of a physical meeting?

The Meeting will be a completely virtual meeting of stockholders conducted exclusively by a live audio webcast. We believe that hosting a virtual meeting will provide a consistent experience to all stockholders regardless of location and enable more stockholders to attend and participate in the Meeting as stockholders can participate from any location around the world with Internet access. We will continue to assess the best approach to conduct meetings of stockholders going forward.

What constitutes a quorum?

The presence at the Meeting virtually or by proxy of the holders of a majority in voting power of the issued and outstanding shares of Common Stock entitled to vote at the Meeting is required to constitute a quorum for the transaction of business. Abstentions and broker non-votes (i.e., shares with respect to which a broker indicates that it does not have discretionary authority to vote on a matter) will be counted for purposes of determining whether a quorum is present at the Meeting.

Who is entitled to vote at the Meeting?

Subject to the limitations on voting by non-U.S. citizens described below, only holders of record of Common Stock at the close of business on the Record Date are entitled to notice of, and to vote at, the Meeting. Each stockholder is entitled to one vote for each share of Common Stock held. Shares of Common Stock represented virtually or by a properly submitted proxy will be voted at the Meeting. On the Record Date, 28,388,508 shares of Common Stock were outstanding and entitled to vote.

The Company’s Amended and Restated Bylaws (our “Bylaws”) provide that persons or entities that are not “citizens of the U.S.” (as defined in 49 U.S.C. § 40102(a)(1), as in effect on the date in question, or any successor statute or regulation, as interpreted by the U.S. Department of Transportation and any successor agency thereto in applicable precedent, including any agent, trustee or representative thereof) shall not collectively own or control more than 24.9% of the voting power of our outstanding capital stock (the “Permitted Foreign Ownership Percentage”) and that, if at any time persons that are not citizens of the U.S. nevertheless collectively own or control more than the Permitted Foreign Ownership Percentage, the voting rights of shares owned by stockholders who are not citizens of the U.S. shall automatically be reduced by such amount such that the total number of votes such holder shall be entitled to vote does not exceed the Permitted Foreign Ownership Percentage. Shares held by persons who are not citizens of the U.S. may lose their associated voting rights and be redeemed as a result of these provisions.

Will other stockholders see my vote?

As a matter of policy, proxy cards, ballots and voting tabulations that identify individual stockholders are kept confidential by the Company. Such documents are made available only to the inspector of election and personnel associated with processing proxies and tabulating votes at the Meeting. The votes of individual stockholders will not be disclosed except as may be required by applicable law.

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name with the Company’s transfer agent, Equiniti Trust Company, LLC, then you are a stockholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank, or other nominee holder, then the broker, bank or other nominee holder is the stockholder of record with respect to those shares. However, you still are the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank, or other nominee holder how to vote their shares. Street name holders are also invited to virtually attend the Meeting. You may not vote your shares electronically at the Meeting unless you receive a valid proxy from your brokerage firm, bank, broker dealer or other nominee holder. Please refer to the voter instruction cards used by your bank, broker or other nominee holder for specific instructions on methods of voting, including using the Internet or by telephone.

| | | | | | | | |

| Bristow Group Inc. | 3 | 2024 Proxy Statement |

| | | | | | | | |

| SOLICITATION OF PROXIES, VOTING AND REVOCATION | | |

How many votes are required for the approval of each proposal?

Election of Directors: Directors are elected by a plurality of the votes of the shares of Common Stock present virtually or represented by proxy at the Meeting and voting on the matter. However, each nominee who is a current director of the Company is required to submit an irrevocable resignation as a director, which resignation would become effective upon (1) that person not receiving a majority of the votes cast in favor of his or her election in an uncontested election (i.e., the number of votes “for” such director’s election constitutes less than the number of votes “withheld” with respect to such director’s election) and (2) acceptance by the Board of that resignation in accordance with the policies and procedures adopted by the Board for such purpose. The Company’s stockholders do not have cumulative voting rights for the election of directors.

Votes Required to Adopt Other Proposals: The affirmative vote of the holders of a majority of shares of Common Stock present virtually or represented by proxy at the Meeting and voting on the subject matter is required for approval of all other proposals being submitted to stockholders for consideration.

How are abstentions and “broker non-votes” counted?

Withholding of authority to vote for a director nominee will have no effect on the election of directors (Proposal 1). For matters other than the election of directors, stockholders may vote in favor of or against the proposal, or may abstain from voting, and the affirmative vote of the holders of a majority of shares of Common Stock present virtually or by proxy and voting on the subject matter is required for approval of those matters. Abstentions will have no effect on approval, on an advisory basis, of the Company’s named executive officer compensation (Proposal 2), approval of an amendment to the Company’s 2021 Equity Incentive Plan (Proposal 3) and ratification of the appointment of KPMG as the Company’s independent auditors for 2024 (Proposal 4).

“Broker non-votes” will have no effect on any of the proposals. A “broker non-vote” occurs when a bank, broker or other holder of record holding shares in “street name” for a beneficial owner does not vote on a particular proposal because it does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. “Broker non-votes” may only be voted for routine matters. The only routine matter to be brought before the stockholders at the Meeting is the ratification of the appointment of KPMG as the Company’s independent auditors for 2024 (Proposal 4). If your shares are held in “street name” by a broker and you wish to vote on any non-routine business that may properly come before the Meeting, you should provide instructions to your broker. Under the rules of the New York Stock Exchange (the “NYSE”), if you do not provide your broker with instructions, your broker generally will have the authority to vote on routine matters. Broker non-votes will be counted for purposes of determining whether a quorum is present at the Meeting, but they are not counted for purposes of calculating the votes cast on particular matters at the Meeting.

How does the Board recommend that I vote?

The Board recommends that you vote:

•FOR the election of each nominee for director contained in this Proxy Statement (Proposal 1);

•FOR approval, on an advisory basis, of the Company’s named executive officer compensation (Proposal 2);

•FOR approval of an amendment to the Company’s 2021 Equity Incentive Plan (Proposal 3); and

•FOR ratification of the appointment of KPMG as the Company’s independent auditors for 2024 (Proposal 4).

Why did I receive a notice in the mail regarding Internet availability of the proxy materials instead of a paper copy of the proxy materials?

We are pleased to be distributing our proxy materials again to certain stockholders via the Internet under the “notice and access” approach permitted by the rules of the SEC. As a result, we are mailing to many of our stockholders a Notice about the Internet availability of the proxy materials instead of a full paper copy of the proxy materials. This approach conserves

| | | | | | | | |

| Bristow Group Inc. | 4 | 2024 Proxy Statement |

| | | | | | | | |

| SOLICITATION OF PROXIES, VOTING AND REVOCATION | | |

natural resources and reduces our costs of printing and distributing the proxy materials, while providing a convenient method of accessing the materials and voting. All stockholders receiving the Notice will have the ability to access the proxy materials over the Internet and may request to receive a paper copy of the proxy materials by mail. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be found in the Notice. In addition, the Notice contains instructions on how you may request to access proxy materials in printed form by mail or electronically on an ongoing basis.

How do I vote?

You may vote virtually at the Meeting online at www.virtualshareholdermeeting.com/VTOL2024 by using the 16-digit control number included with these proxy materials, or you may give us your proxy. We recommend that you vote by proxy even if you plan to virtually attend the Meeting. As described below, you can revoke your proxy or change your vote at the Meeting. You can vote by proxy over the telephone by calling a toll-free number, electronically by using the Internet or through the mail as described below. If you would like to vote by telephone or by using the Internet, please refer to the specific instructions set forth on the Notice, proxy card or voting instruction card. Stockholders are requested to vote in one of the following ways:

•by telephone by calling 1-800-690-6903 from any touch-tone phone and following the instructions (have your proxy card in hand when you call);

•by Internet before the Meeting by accessing www.proxyvote.com and following the on-screen instructions or scanning the QR code with your smartphone (you will need the 16-digit control number included with these proxy materials);

•during the Meeting at www.virtualshareholdermeeting.com/VTOL2024 (please see above under “How do I attend the Meeting?”); or

•by completing, dating, signing, and promptly returning the accompanying proxy card, in the enclosed postage-paid, pre-addressed envelope provided for such purpose. No postage is necessary if the proxy card is mailed in the United States.

If you hold your shares through a bank, broker or other nominee holder, such entity/person will give you separate instructions for voting your shares.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it means that you hold shares registered in more than one name or in different accounts. To ensure that all of your shares are voted, please vote by proxy by following the instructions provided in each proxy card. If some of your shares are held in “street name”, you should have received voting instructions with these materials from your broker, bank or other nominee holder. Please follow the voting instructions provided to ensure that your vote is counted.

Can I revoke or change my vote after I return my proxy card?

Yes. A stockholder who so desires may revoke his, her, or its proxy at any time before it is exercised at the Meeting by: (i) providing written notice to the Corporate Secretary of the Company; (ii) duly executing a proxy card bearing a date subsequent to that of a previously furnished proxy card; (iii) entering new instructions by Internet or telephone; or (iv) virtually attending the Meeting and voting. Virtual attendance at the Meeting will not in itself constitute a revocation of a previously furnished proxy, and stockholders who attend the Meeting virtually need not revoke their proxy (if previously furnished) to vote electronically. We encourage stockholders that plan to virtually attend the Meeting to vote by telephone or Internet or to submit a valid proxy card and vote their shares prior to the Meeting. If you hold your shares in “street name” and want to revoke your proxy, you will need to provide instructions to your broker, bank or other nominee holder.

| | | | | | | | |

| Bristow Group Inc. | 5 | 2024 Proxy Statement |

| | | | | | | | |

| SOLICITATION OF PROXIES, VOTING AND REVOCATION | | |

What happens if I do not make specific voting choices?

If you are a stockholder of record and you submit your proxy without specifying how you want to vote your shares, then the proxy holder will vote your shares in the manner recommended by the Board on all proposals. If you hold your shares in “street name” and you do not give instructions to your broker, bank or other nominee holder to vote your shares, under the rules that govern brokers, banks, and other nominee holders who are the stockholders of record of the shares held in “street name”, it generally has the discretion to vote uninstructed shares on routine matters but has no discretion to vote them on non-routine matters. The only “routine” matter expected to be brought before the stockholders at the Meeting is the ratification of the appointment of KPMG as the Company’s independent auditors for 2024 (Proposal 4). See “How are abstentions and ‘broker non-votes’ counted?” beginning on page 4. Where can I find the voting results of the Meeting?

The Company plans to announce preliminary voting results at the Meeting and to publish the final results in a Current Report on Form 8-K within four business days following the Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Meeting

Your Notice about the Internet availability of the proxy materials or proxy card will contain instructions on how to:

•View our proxy materials for the Meeting on the Internet; and

•Instruct us to send our future proxy materials to you electronically by e-mail.

Our proxy materials and our Annual Report are also available on our website at www.bristowgroup.com. In addition, you may find information on how to obtain directions to virtually attend the Meeting and vote electronically by submitting a query via e-mail to InvestorRelations@bristowgroup.com.

Your Notice or proxy card will contain instructions on how you may request to access proxy materials electronically on an ongoing basis. Choosing to access your future proxy materials electronically will reduce the costs of printing and distributing our proxy materials. If you choose to access future proxy materials electronically, you will receive an e-mail with instructions containing a link to the website where our proxy materials are available and a link to the proxy voting website. Your election to access proxy materials by e-mail will remain in effect until terminated by you.

Solicitation and Solicitation Expenses

The Company will bear the costs of solicitation of proxies for the Meeting. In addition to solicitation by mail, directors, officers and regular employees of the Company may solicit proxies from stockholders by telephone, electronic or facsimile transmission, personal interview or other means.

The Company has requested brokers, banks and other nominee holders of voting Common Stock of the Company to forward proxy solicitation materials to their customers, and such brokers, banks and nominee holders will be reimbursed for their reasonable out-of-pocket expenses.

The Company has retained D.F. King & Co., Inc. to aid in the solicitation of proxies. The fees of D.F. King & Co., Inc. are $7,000 plus reimbursement of its reasonable out-of-pocket costs. If you have questions about the Meeting or need additional copies of this Proxy Statement or additional proxy cards, please contact the Company’s proxy solicitation agent as follows:

D.F. King & Co., Inc.

48 Wall Street, 22nd Floor

New York, NY 10005

Banks/Brokers: (212) 269-5550

Toll-free: (866) 796-7184

| | | | | | | | |

| Bristow Group Inc. | 6 | 2024 Proxy Statement |

CORPORATE GOVERNANCE

Environmental, Social, and Governance (“ESG”)

The Company’s vision is to lead the world in innovative and sustainable vertical flight solutions, and we are committed to leading responsibly. Along with our commitment to safe and reliable operations, we have a sustainability program that focuses on environmental responsibility through daily practices as further described in the following sections. The Environmental, Social, and Governance Committee of the Board (the “ESG Committee”) oversees our sustainability initiatives, which include, but are not limited to, developing a robust climate change risk management strategy aligned with the recommendations made by the Task Force on Climate Related Financial Disclosures (“TCFD”), increasing transparency for our stakeholders, and ensuring our social responsibility program continues to provide value for our employees and the communities in which we operate.

We published our inaugural sustainability report in 2022 and intend to continue to do so annually.

Environmental and Social Initiatives

The Company and its employees strive to play a positive role in the communities where we operate by conducting our operations in a way that respects the environment and surrounding communities. Additionally, through Bristow Uplift, our social responsibility program, we invest resources and partner with local communities, charities and non-profit organizations to develop, support and implement targeted and sustainable social responsibility initiatives with the goal of building strong community relationships that will have a positive impact on our communities and create long-term value for our business.

Environmental Initiatives

The Company was one of the first vertical lift operators in the U.K. to obtain International Organization for Standards (“ISO”) 14001 certification, which certifies that our U.K. operations have an environmental management system (“EMS”) in place that monitors, manages, and delivers continuous improvement at our bases of operations. Our Brazil operations are also certified with ISO 14001 and have continued the certification process that requires regular audits since 2018. In 2022, our corporate office obtained ISO 14001 certification. We aligned our enterprise-wide EMS with the IS0 14001 requirements, and the Company is strategically implementing this framework across our global operations. We also have undertaken proactive measures to lower aircraft emissions and reduce the environmental impact of our operations by monitoring operational practices to decrease our time running aircraft on the ground, utilizing a fleet of efficient and regularly maintained aircraft supported by current technologies, such as flight planning software for payload management, and by partnering with our customers to maximize seat utilization, thus reducing the number of flights required. We are actively developing a forward-looking strategy to improve the efficiency of our fleet and ensure alignment with customer contract terms. On the ground, we initiated the process of replacing inefficient, older support vehicles with electric vehicles (EVs) where feasible. Additionally, we encourage and assist our engine manufacturers, aircraft manufacturers, customers and other stakeholders to be early and leading adopters of sustainable aviation fuels (“SAF”) as we encourage wider availability of these alternative fuels by our fuel suppliers. We have successfully flown limited sets of SAF-powered flights for our energy and search and rescue (“SAR”) businesses in the North Sea. In addition, we have deepened our strategic relationships with multiple manufacturers to assist with the operationalization of electric vertical takeoff and landing, electric conventional takeoff and landing and short takeoff and landing aircraft, collectively known as Advanced Air Mobility (“AAM”). AAM is an emerging aviation system which utilizes aircraft that are primarily powered by hybrid and/or electric propulsion systems and is expected to support the reduction of operational emissions.

Bristow Uplift

We align our social investment initiatives with the five pillars of this program: Education, the Underserved, Health and Wellness, Diversity, and Sustainability. We also match certain employee donations to philanthropic organizations around the

| | | | | | | | |

| Bristow Group Inc. | 7 | 2024 Proxy Statement |

world. Through these efforts, we support building strong community relationships through the causes that are most important to our employees, ultimately creating long-term value for our business.

Human Rights

The Company has a zero-tolerance approach to all forms of modern slavery and human trafficking within our business and our supply chain. Our Chief Compliance Officer and our Director of Sustainability coordinate our overall strategy for human rights and have responsibility for our human rights risk management program, which is operationalized by our Regions, Segments and Functions. To further our commitment to human rights in 2023, we partnered with a third party to develop our Human Rights Framework that codifies our approach to five enablers that we identified to help us proactively address our human rights impact.

Our Human Rights Commitment outlines our promise to uphold the highest standards and principles of human rights, building on the Company’s existing modern slavery act statement. In 2023, the Company also established and adopted an internal Human Rights Policy, which stipulates our human rights expectations of employees, contractors, business partners, suppliers and other related parties. This policy was developed in alignment with international human rights standards and principles, including the UN Guiding Principles on Business and Human Rights and the OECD Guidance for Multinational Enterprises. In addition, we developed a new Supplier Commitment on Human Rights which requires key suppliers to adopt similar commitments and extend them to their supply chains.

Though the risk of human trafficking and slavery within our business is low given the nature of operations and customers, we utilize ongoing due diligence programs and training to identify, assess and manage any potential issues. Our employees are expected to immediately report violations of law, Company policies or our Code of Business Integrity to their managers or anonymously through our Ethics and Compliance Hotline (by telephone (888) 840-4147) or online (https://BristowGroup.TNWReports.com). Any employee or supplier found in violation of the standards outlined above is subject to discipline, up to and including termination and, if warranted, potential legal proceedings.

Safety, Industry Hazards and Insurance

The safety of our passengers and the maintenance of a safe working environment for our employees is our number one core value and highest operational priority. Aviation services are potentially hazardous and may result in incidents or accidents. Challenges to safe operations include unanticipated adverse weather conditions, fires, human factors, and mechanical failures that may result in death or injury to personnel, damage to equipment, and other environmental or property damage. We are also subject to regulation by the U.S. Occupational Safety and Health Administration (OSHA) and comparable state agencies, whose purpose is to protect the health and safety of workers. Failure to comply with these agencies’ requirements can lead to the imposition of penalties.

Technology and Standards

The Company’s fleet is configured with the latest safety equipment, including Traffic Collision Avoidance Systems (TCAS), Enhanced Ground Proximity Warning Systems (EGPWS) or Helicopter Terrain Awareness and Warning Systems (HTAWS), Automatic Dependent Surveillance-Broadcast (ADS-B), Helicopter Flight Data Monitoring Systems (HFDM), Health and Usage Monitoring Systems (“HUMS”), satellite communication and flight following systems, and forward facing tail cameras. The Company maintains a globally aligned safety information system called BeSAFE across our Offshore Energy and Government Services businesses.

Systems and Processes

Our safety, legal, and compliance departments oversee our adherence with government regulations, customer safety requirements and safety standards within our organization, the standardization of our base operating procedures and the proper training of our employees. A key to maintaining our strong safety record is developing and retaining highly qualified, experienced, and well-trained employees. We conduct extensive safety training on an ongoing basis and develop, implement, monitor, and continuously improve our safety management system to proactively manage risk and support the physical safety and mental wellness of our employees. Additionally, we have implemented supporting safety programs that

| | | | | | | | |

| Bristow Group Inc. | 8 | 2024 Proxy Statement |

include, among many other features, (i) transition and recurrent training using full-motion flight simulators and other flight training devices, (ii) an FAA-approved flight data monitoring program and (iii) HUMS, which automatically monitor and report on vibrations and other anomalies on key components of certain helicopters in our fleet.

Culture

We have a strong safety culture committed to zero accidents and zero harm. Our safety culture and the implementation of our safety program, Target Zero, is modeled and owned by each employee and led by our President and Chief Executive Officer, who is responsible for setting the tone at the top. Under our Code of Business Integrity, all employees are empowered, and actively encouraged by management, to challenge unsafe acts and conditions, including by exercising his or her “STOP WORK” authority, and participate in safety improvements by the Company. This culture is further exemplified by our status as a founding member of HeliOffshore, an organization dedicated to collaboration across the offshore helicopter industry to improve safety around the world.

Human Capital Management

With over seven decades of operations, we are one of the largest and longest-serving helicopter operators in the world, with a reputation for operational excellence. Our employees are some of the most highly regarded experts in vertical flight solutions. We strive to prepare our employees for success through training, competitive benefits packages, and career development. Our success depends on our ability to attract and retain our pilots and mechanics. The competition for pilots and mechanics is competitive, and we compete with Part 121 air carriers and the emergency air medical industry to attract and retain such talent. We believe the best way to attract and retain top talent is to invest in our people through creating safe work environments, employee training and multi-level engagement to support their success. We seek qualified candidates who are aligned with our commitment to safety and other core values of integrity, passion, teamwork and progress. Our areas of focus for human capital management are:

Health and Safety

Safety is our number one core value and highest operational priority. Our pilots, maintenance technicians and support personnel are committed to our mission to provide safe, efficient and reliable aviation services. Our Safety Review Board (“SRB”) reviews the ongoing safety performance of the global organization and each individual air operator within the Company. The SRB provides for strategic allocation of resources to achieve safety performance goals. We continuously focus on our safety program, Target Zero, and are one of the founding members of HeliOffshore, an organization dedicated to collaboration across the offshore helicopter industry to improve safety around the world.

We believe in keeping everyone safe and well, which includes doing our part to safeguard our physical and mental well- being. We currently have global resources in place to support mental health including an employee well-being portal that provides information and support channels for navigating stress and access to counseling and mental health professionals for all our employees around the world.

Training and Development

We are committed to elevating our employees. All of our employees are required to take periodic trainings that promote the commitment to our core values: safety, integrity, passion, teamwork and progress. Our pilots and mechanics are required to take the latest trainings to ensure they are equipped to operate our aircraft with the best knowledge and experience. Our licensed professionals are afforded the opportunity for continuing education in their fields of expertise.

Diversity and Inclusion

We are committed to attracting and retaining high-performing employees through a diverse talent base and evaluating and promoting throughout our organization based on skills and performance. This is reinforced through our policy under our Code of Business Integrity to provide equal opportunity for everyone in recruiting, hiring, developing, promoting and compensating without regard to race, color, religion, sex (including pregnancy), sexual orientation, gender identity, ethnicity or national origin, citizenship, age, marital status, veteran status, genetic information or disability. Further, we have taken various steps to support our commitment to diversity including requiring all employees to undertake annual unconscious

| | | | | | | | |

| Bristow Group Inc. | 9 | 2024 Proxy Statement |

bias and inclusivity training and working to expand our diverse talent pool. Our workforce is represented by approximately 47 nationalities globally. Approximately 19% of our workforce are women, with 37% serving in management level roles and with half of our executive leadership team represented by women, and approximately 22% of our U.S. employees are veterans. In addition, our workforce includes racial and ethnic diversity across our global operations.

Compensation and Benefits

We offer competitive market-based compensation and benefits for the markets in which we operate. Competitive programs are critical to the well-being of our employees and their families, as well as retention and business continuity. Global benefit offerings include major medical, life, retirement/pension, employee well-being support akin to employee assistance programs in addition to local offerings that vary by country market.

As of December 31, 2023, we employed 3,298 individuals, including 830 pilots and 843 mechanics. We consider our relations with our employees to be good.

As of December 31, 2023, approximately 60% of our employees were covered by union or other collective bargaining agreements. Negotiations over annual salary or other labor matters could result in higher personnel or other costs or increased operational restrictions or disruptions. Furthermore, a failure to reach an agreement on certain key issues could result in strikes, lockouts or other work stoppages.

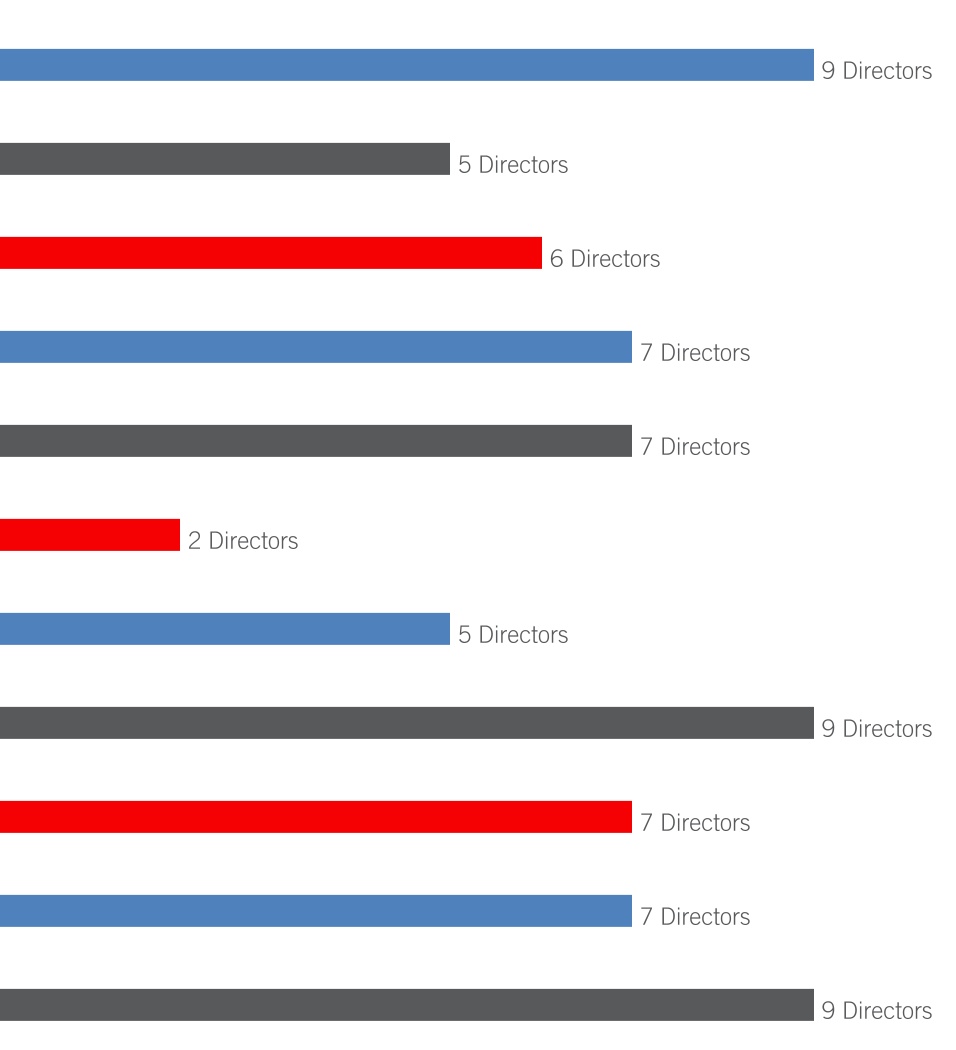

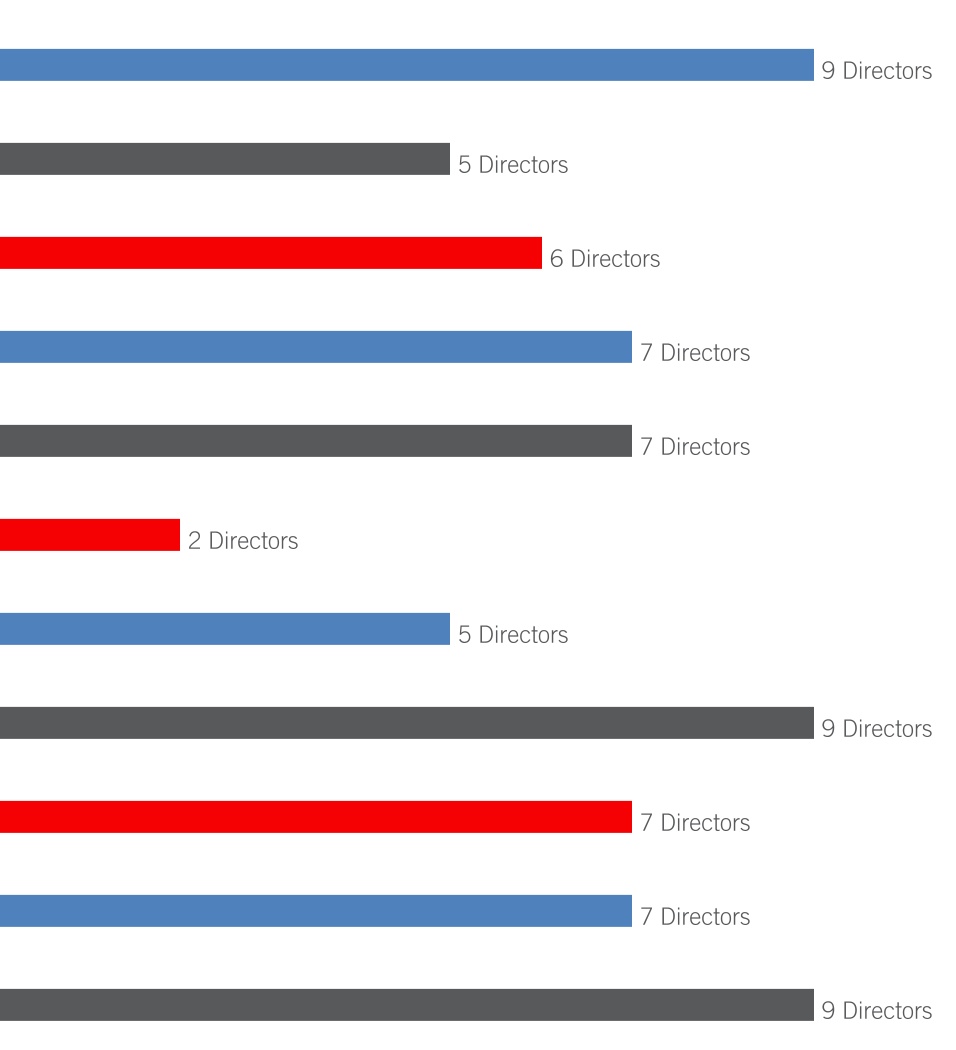

Board of Directors and Director Independence

The business and affairs of the Company are managed under the direction of the Board. Currently, the Company’s Board is comprised of nine directors. Our Bylaws provide that the Board will consist of not less than three and not more than fifteen directors. In connection with the recommendation of the ESG Committee, the Board has nominated all of the current directors for re-election at the Meeting.

Effective December 11, 2023, following review of Shefali Shah’s background, skills, expertise and qualifications for membership on the Board, the Board determined that Ms. Shah was qualified to serve on the Board, and appointed Ms. Shah to serve as a director.

During 2023, the Board held seven meetings. Except for Ms. Shah, who was appointed as a member of the Board effective December 11, 2023, each of the directors attended all meetings of the full Board and each of the committees on which he or she served. Although the Company does not have a formal policy requiring Board members to attend each Annual Meeting of Stockholders, it is encouraged, and all of the Board members then serving attended the 2023 Annual Meeting of Stockholders.

A majority of the Company’s current directors are independent, non-employee directors, and this will continue to be the case should all the director nominees be elected at the Meeting. The Board has made the affirmative determination that each of General Miller, Ret., Ms. Shah and Messrs. Brass, Kern, Manzo, Mickelson, Pucillo and Truelove are independent as such term is defined by the applicable rules and regulations of the NYSE. Additionally, each of these directors meets the categorical standards for independence established by the Board (the “Bristow Categorical Standards”). A copy of the Bristow Categorical Standards is available on the Company’s website at www.bristowgroup.com by clicking “Investors,” then “Governance” and then “Governance Documents” (entitled Director Independence Standards). The Company’s website and the information contained therein or connected thereto shall not be deemed to be incorporated into this Proxy Statement.

The schedule of Board meetings is made available to directors in advance along with the agenda for each meeting so that they may review and request changes. Directors also have access to management at all times and regularly communicate informally with management on an assortment of topics.

| | | | | | | | |

| Bristow Group Inc. | 10 | 2024 Proxy Statement |

Majority Voting

Our Bylaws provide that a director who fails to receive a majority of votes cast at an Annual Meeting of Stockholders must tender his or her resignation (assuming that the election is uncontested). Under our Bylaws, each nominee who is a current director is required to submit an irrevocable resignation, which resignation would become effective only upon (1) that person not receiving a majority of the votes cast in an uncontested election and (2) acceptance by the Board of that resignation in accordance with the policies and procedures adopted by the Board for such purpose. The Board, acting on the recommendation of the ESG Committee, is required to determine whether or not to accept the resignation not later than 90 days following certification of the stockholder vote, and the Board is required to accept the resignation absent a determination that a compelling reason exists for concluding that it is in the best interests of the Company for the person in question to remain as a director.

Board Leadership Structure

The Board believes that there is no single organizational model that would be most effective in all circumstances and that it is in the best interests of the Company and its stockholders for the Board to retain the authority to modify its leadership structure to best address the Company’s circumstances from time to time. The Board believes that the most effective leadership structure for the Company at the present time is to separate the positions of Chairman and Chief Executive Officer. Separating these positions allows the Chief Executive Officer to focus on the full-time job of running the Company’s business, while allowing the Non-Executive Chairman to lead the Board in its fundamental role of providing advice to, and maintaining independent oversight of, management. The Board believes this structure recognizes the time, effort and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as the Company’s Non-Executive Chairman, particularly as the Board’s oversight responsibilities continue to grow and demand more time and attention.

In addition to the role that the Non-Executive Chairman has with regard to the Board, the chair of each of the three wholly independent key committees of the Board (Audit Committee, Compensation Committee and ESG Committee) and each individual director is responsible for helping to ensure that meeting agendas are appropriate and that sufficient time and information are available to address issues the directors believe are significant and warrant their attention. Each director has the opportunity and ability to request agenda items, information and additional meetings of the Board or of the independent directors.

The Board has adopted significant processes designed to support the Board’s capacity for objective judgment, including executive sessions of the independent directors at Board meetings, independent evaluation of, and communication with, members of senior management, and annual self-evaluation of the Board, its committees, and its leadership. These and other critical governance processes are reflected in the Corporate Governance Guidelines and the various Committee Charters that are available on the Company’s website at www.bristowgroup.com. The Board has also provided mechanisms for stockholders to communicate in writing with the Non-Executive Chairman of the Board, with the non-employee and/or independent directors, and with the full Board on matters of significance. These processes are also outlined in the section of this Proxy Statement entitled “Communication with the Board or Independent Directors.”

Executive Sessions

The Company’s Corporate Governance Guidelines provide that the Company’s non-management directors shall meet periodically in executive session without any management participation. In addition, if any of the non-management directors are not independent under the applicable rules of the NYSE, then the independent directors will meet separately at least once per year without the presence of the non-independent director, and at other times as necessary. Mr. Mickelson, as Chairman, presides at these executive sessions. Committees of the Board may also meet in executive session without the presence of any non-independent director as deemed appropriate.

| | | | | | | | |

| Bristow Group Inc. | 11 | 2024 Proxy Statement |

Committees of the Board of Directors

The Board has established three standing committees: (i) Audit, (ii) Compensation and (iii) Environmental, Social, and Governance. Each of the committees operates under a written charter that has been posted on the Company’s website at www.bristowgroup.com by clicking “Investors,” then “Governance” and then “Governance Documents”. The website and the information contained therein or connected thereto shall not be deemed to be incorporated into this Proxy Statement. The charter of each committee is also available free of charge on request to our Corporate Secretary at 3151 Briarpark Drive, Suite 700, Houston, Texas 77042. The members and chairperson for each committee set forth below were the same at the end of 2023, except that Ms. Shah was appointed as a member of the Audit Committee effective February 21, 2024.

Board Committees

| | | | | | | | | | | |

| Independent Directors | Audit | Compensation | ESG |

| | | |

| Lorin L. Brass | | l | l |

| Wesley E. Kern | l | p | |

| Robert J. Manzo | l | | p |

| G. Mark Mickelson |

| |

|

| General Maryanne Miller, Ret. | | l | |

| Christopher Pucillo | | l | l |

| Shefali Shah | l | | |

| Brian D. Truelove | p« | | l |

| | | | | |

p | Committee Chair |

l | Committee Member |

« | Audit Committee Financial Expert |

| | | | | | | | |

| Bristow Group Inc. | 12 | 2024 Proxy Statement |

| | | | | | | | |

| COMMITTEES OF THE BOARD OF DIRECTORS | | |

Audit Committee

The Audit Committee met four times during 2023 and is currently comprised of Ms. Shah and Messrs. Kern, Manzo and Truelove. Mr. Truelove is the Chair of the Audit Committee, and he maintained frequent communication with the other members of the Audit Committee as well as the Company’s Non-Executive Chairman and Chief Executive Officer regarding matters relevant to the Audit Committee. The Board has determined that Mr. Truelove is an “audit committee financial expert” for purposes of the rules of the SEC and that each other member of the Audit Committee is financially literate as required under the NYSE standards. In addition, the Board determined that each member of the Audit Committee is independent, as defined by the rules of the NYSE, Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance with the Bristow Categorical Standards. The Audit Committee is expected to meet at least quarterly.

Committee Function. The Audit Committee assists the Board in fulfilling its responsibility to oversee, among other things:

•the conduct and integrity of management’s execution of the Company’s financial reporting to any governmental or regulatory body, the public or other users thereof;

•the qualifications, engagement, compensation, independence and performance of the Company’s independent auditors, its conduct of the annual audit and its engagement for any other services;

•the Company’s systems of internal accounting and financial and disclosure controls, the annual independent audit of the Company’s financial statements and the integrated audit of internal controls over financial reporting;

•risk management and controls, which includes assisting management with identifying and monitoring risks or exposures, assessing the steps management has taken to minimize such risks and overseeing the Company’s underlying guidelines and policies with respect to risk assessment and risk management;

•the Company’s ESG disclosures and the adequacy and effectiveness of internal controls related to such disclosures, and to coordinate with the ESG Committee with respect to such matters;

•the processes for handling complaints relating to accounting, internal accounting controls and auditing matters;

•the Company’s legal and regulatory compliance;

•review of certain material agreements that require approval of the Board pursuant to the Company’s Delegation of Authority, which is reviewed and approved annually by the Board;

•any code of business conduct and ethics applicable to directors and senior officers, including any waivers under such code; and

•the preparation of the audit committee report required by SEC rules to be included in the Company’s annual proxy statement.

The Audit Committee’s role is one of oversight. Management is responsible for preparing the Company’s financial statements, and the independent auditors are responsible for auditing those financial statements. Management and the independent auditors have more time, knowledge and detailed information about the Company than Audit Committee members. Consequently, in carrying out its oversight responsibilities, the Audit Committee will not provide any expert or special assurance as to the Company’s financial statements or any professional certification as to the independent auditors’ work.

| | | | | | | | |

| Bristow Group Inc. | 13 | 2024 Proxy Statement |

| | | | | | | | |

| COMMITTEES OF THE BOARD OF DIRECTORS | | |

Compensation Committee

The Compensation Committee is currently comprised of General Miller, Ret. and Messrs. Brass, Kern and Pucillo. Mr. Kern is the Chair of the Compensation Committee. The Compensation Committee met five times during 2023 and, in addition, the Chair of the Compensation Committee maintained frequent communication with the other members of the Compensation Committee as well as the Company’s Non-Executive Chairman and Chief Executive Officer regarding compensation matters. The Board has determined that each member of the Compensation Committee is independent, as defined by the rules of the NYSE, Section 10C-1 of the Exchange Act, and in accordance with the Bristow Categorical Standards. In addition, the members of the Compensation Committee qualify as “non-employee directors” for purposes of Rule 16b-3 under the Exchange Act.

Committee Function. The Compensation Committee, among other things:

•reviews and makes recommendations to the Board for approval of corporate goals and annual performance objectives relevant to executive compensation;

•reviews, together with the Company’s independent directors, and makes recommendations to the Board for approval of compensation for the Chief Executive Officer and other members of the executive leadership team;

•evaluates officer compensation plans, policies and programs;

•reviews and approves, together with the Company’s independent directors, benefit plans;

•approves, together with the Company’s independent directors, all grants of equity awards and administers the Company’s incentive plans;

•reviews and discusses with management the Company’s Compensation Discussion and Analysis and prepares a report on executive compensation to be included in the Company’s Annual Report on Form 10-K and proxy statement;

•determines stock ownership guidelines for the Chief Executive Officer and other officers at the Vice President level or higher and monitors compliance with such guidelines;

•reviews the Company’s incentive compensation arrangements to determine whether they encourage excessive risk-taking, reviews and discusses the relationship between risk management policies and practices and compensation, and evaluates compensation policies and practices that could mitigate any such risk;

•annually evaluates the independence of any advisors retained by the Compensation Committee; and

•reviews and recommends to the Board for approval the frequency with which the Company will conduct an advisory stockholder vote on executive compensation required by Section 14A of the Exchange Act.

The Chair of the Compensation Committee sets the agenda for meetings of the Compensation Committee. The meetings are attended by the Chief Executive Officer, the Chief Financial Officer, the Chief Administrative Officer and the General Counsel, if requested. The Compensation Committee meets at least annually with the Chief Executive Officer to discuss and review the performance criteria and compensation levels of members of the executive leadership team. At each meeting, the Compensation Committee has the opportunity to meet in executive session. The Chair of the Compensation Committee reports the Compensation Committee’s recommendations regarding compensation of members of the executive leadership team to the full Board. The Compensation Committee has the sole authority to retain, obtain the advice of and terminate any compensation consultants, independent legal counsel or other advisors to assist the Compensation Committee in its discharge of its duties and responsibilities, including the evaluation of executive officer compensation.

| | | | | | | | |

| Bristow Group Inc. | 14 | 2024 Proxy Statement |

| | | | | | | | |

| COMMITTEES OF THE BOARD OF DIRECTORS | | |

Compensation Committee Interlocks and Insider Participation. During 2023, no member of the Compensation Committee was, and no member of the Compensation Committee currently is, an officer or employee of the Company. During 2023, none of the Company’s executive officers served as a director or member of the compensation committee of any other entity whose executive officers serve on the Board or the Compensation Committee. During 2023, no member of the Compensation Committee had a relationship that must be described under the SEC rules relating to disclosure of related person transactions.

Environmental, Social, and Governance Committee

The ESG Committee met four times during 2023. The ESG Committee is currently comprised of Messrs. Brass, Manzo, Pucillo and Truelove. Mr. Manzo is the Chair of the ESG Committee. The Board has determined that each member of the ESG Committee is independent, as defined by the rules of the NYSE and in accordance with the Bristow Categorical Standards.

Committee Function. The ESG Committee assists the Board with, among other things:

•overseeing environmental and social responsibility matters as they pertain to the Company’s business and long-term strategy, and identifying and bringing to the attention of the full Board emerging ESG trends, human capital management, including a sustainable and diverse workforce, regulatory developments or public policy trends that affect the Company’s activities, stakeholders, reputation and corporate citizenship;

•reviewing periodically and receiving updates on the Company’s ESG programs and policies, and the Company’s progress and performance against sustainability goals and metrics;

•identifying, screening and reviewing individuals qualified to serve as directors, recommending to the Board candidates for election or re-election at the Company’s next annual meeting of stockholders and to fill vacancies on the Board;

•reviewing annually the Board’s committee structure, recommending to the Board directors to serve as members and chairpersons of each committee and recommending to the Board designation of audit committee financial experts;

•developing, recommending to the Board, and overseeing implementation of modifications, as appropriate, to the Company’s policies and procedures for identifying and reviewing candidates for the Board, including policies and procedures relating to candidates for the Board submitted for consideration by stockholders;

•reviewing the composition of the Board as a whole, including whether the Board reflects the appropriate balance of independence, sound judgment, business specialization, technical skills, diversity and other desired qualities;

•reviewing periodically the size of the Board and each committee and recommending any appropriate changes;

•developing and overseeing implementation of a Company orientation program for new directors and a continuing education program for current directors;

•monitoring the practices of the Board and the executive leadership team to ensure compliance with the Company’s Corporate Governance Guidelines and principles;

•reviewing and approving potential conflict of interest matters involving the directors, the Chief Executive Officer and other members of the executive leadership team;

•evaluating non-employee director compensation plans, policies and programs;

| | | | | | | | |

| Bristow Group Inc. | 15 | 2024 Proxy Statement |

| | | | | | | | |

| COMMITTEES OF THE BOARD OF DIRECTORS | | |

•overseeing the annual self-evaluation process of the Board based on objective criteria, including performance of the business, accomplishment of long-term strategic objectives and development of management, among other things; and

•reviewing on a regular basis, the overall corporate governance of the Company and recommending to the Board improvements when necessary.

The ESG Committee has the power to retain outside counsel, director search and recruitment consultants or other experts, and the ESG Committee will receive appropriate funding from the Company, as determined by the ESG Committee, to engage such advisors.

Sustainability. The ESG Committee works in cooperation with management to regularly assess the Company’s strategy, programs, and policies in light of the evolving public policy landscape with respect to sustainability-related matters. The ESG Committee’s oversight responsibilities include, among other things, (i) the Company’s ESG strategy, programs, and policies; (ii) strategic response to stakeholder expectations and concerns regarding sustainability and climate-related risks and opportunities; (iii) climate-related public policy trends and regulatory matters; (iv) the Company’s social responsibility programs and policies, including human capital management; and (v) input to the Company’s annual reporting and disclosure regarding sustainability.

Selection of Nominees for the Board of Directors. To fulfill its responsibility to recruit and recommend to the full Board nominees for election as directors, the ESG Committee reviews the composition of the full Board to determine the qualifications and areas of expertise needed to further enhance the composition of the Board and works with management in attracting candidates with those qualifications. In identifying new director candidates, the ESG Committee seeks advice and names of candidates from members of the ESG Committee, other members of the Board, members of management and other public and private sources. The ESG Committee, in formulating its recommendation of nominees for election as directors, considers each individual’s personal qualifications and how such personal qualifications effectively address the perceived then-current needs of the Board. Appropriate personal qualifications and criteria for membership on the Board include the following: